What is the Textile Auxiliaries Market Size?

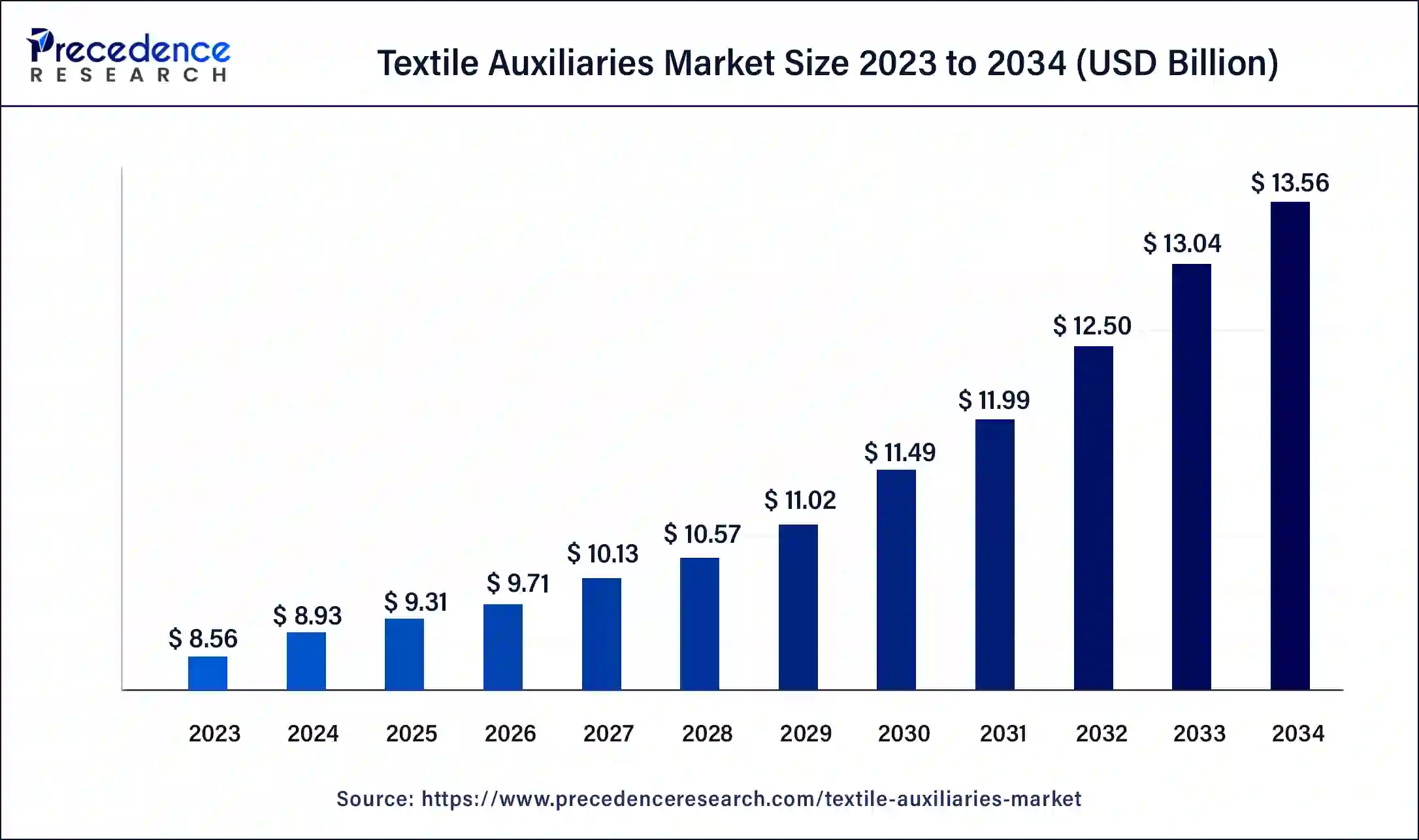

The global textile auxiliaries market size is valued at USD 9.31 billion in 2025 and is predicted to increase from USD 9.71 billion in 2026 to approximately USD 14.09 billion by 2035, expanding at a CAGR of 4.23% from 2026 to 2035.

Textile Auxiliaries Market Key Takeaways

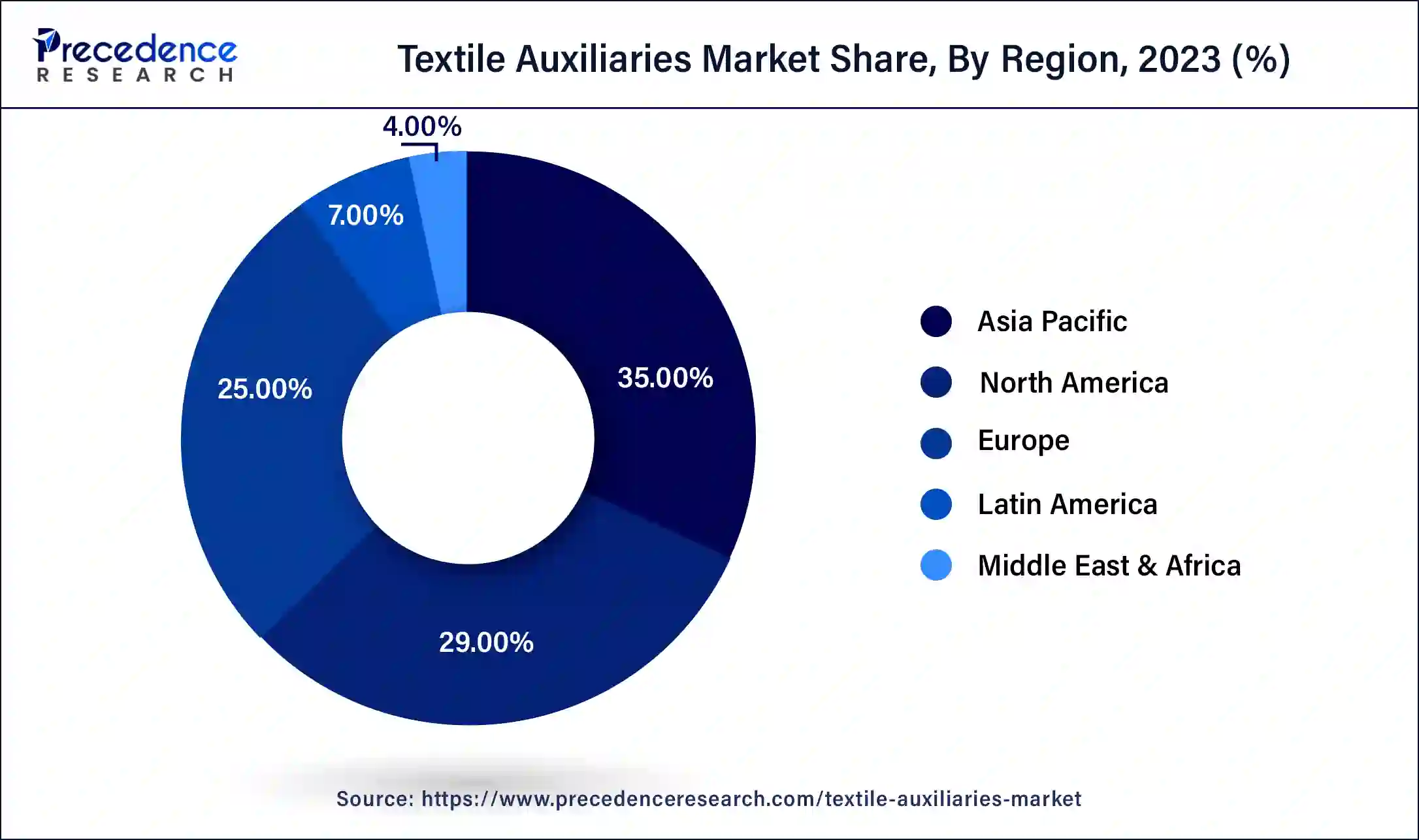

- Asia Pacific led the global market with the highest market share in 2024.

- By Type, the dyeing & printing agents segment has held the largest market share in 2024.

- By Application, the apparel segment captured the biggest revenue share in 2024.

What is the Textile Auxiliaries Market?

The usage of natural and environmentally safer textile auxiliaries is anticipated to boost market growth due to strict governmental regulations implemented on the practice of toxic chemicals in textiles. With textiles being progressively accepted for innumerable applications such as apparel, home furnishings, and others there has been an outbreak of activity in the bigger textile industry, and compliant growth in the textile auxiliaries market too. Apparel endures to be a foremost application segment in the textile auxiliaries marketplace on account of flourishing clothing commerce in both, established and emerging nations across the world.

One of the major influences propelling the market is the vigorous growth of the apparel market in emergent economies. Yet, pollution problems triggered by the finishing industry and textile dyeing are expected to confine the growth of the market to some extent.

How is AI contributing to the Textile Auxiliaries Market?

The expansion of AI has a positive impact on the textile auxiliaries' market through its formulation accuracy optimization, real-time fabric inspection improvement, and production process simplification. It also plays a role in predictive maintenance, automated equipment management with AI and robots, and integrated monitoring systems, making the workflow more efficient. AI-powered forecasting also helps in refining inventory and supply chain decisions, while sustainability tools cut down waste and help in the selection of eco-friendly auxiliaries.

Critical factors responsible for market growth are

- Intensifying applications of textile auxiliaries in the construction segment

- Upsurge in the disposable income of individuals across emerging countries

- Increasing acceptance of technical textiles across the globe

Market Outlook

- Industry Growth Overview: The growth is fortified by the increasing demand for durable textiles and the worldwide adoption of advanced auxiliary technologies.

- Sustainability Trends: The road to sustainability is paved with the growing demand for environmentally friendly formulations of auxiliaries that conform to regulatory and consumer expectations.

- Global Expansion: The expansion picks up speed internationally, thanks to the increasing production of and demand for specialty textile auxiliaries that support various applications.

- Major Investors: The major investors, like Archroma, Huntsman, Rossari, Croda, Solvay, Sarex Chemicals, have been successful in pushing the limits of innovation by coming up with the next generation of advanced chemical solutions that support performance, efficiency, and sustainability in the global textile market.

- Startup Ecosystem: Startups are actively involved in the development of new auxiliary modalities that focus on better material properties, more efficient production processes, and joint efforts toward realizing next-generation textile chemicals.

MarketScope

| Report Highlights | Details |

| Market Size in 2025 | USD 9.31 Billion |

| Market Size in 2026 | USD 9.71 Billion |

| Market Size by 2035 | USD 14.09Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.23% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Significant Market Trends

The Dyeing & Printing Agents Segment Captured Key Market Share in 2023

Different types of products involved in the global textile auxiliaries are pretreatment agents, finishing agents, dyeing & printing agents, knitting & weaving auxiliaries, and spin finishes. Among all, the dyeing & printing agents product segment garnered a significant market share in 2023 and it is predicted to mirror this trend throughout the forecast period. Dyeing auxiliaries are chemical articulated products that are most useful in dyeing and printing processes. These auxiliaries offer essential support to fabrics in dyeing and printing operations to accomplish the anticipated properties and textures.

Apparel Application is Projected to lead the Textile Auxiliaries Market Revenue

Depending on the application, the global textile auxiliaries market is classified into apparel, home furnishings, technical, and industrial textiles. The home furnishings segment has been further divided into furniture, carpets & rugs, and others. The apparel application segment comprises a large stake in the global textile auxiliaries market in 2022, and it is anticipated to develop even further throughout the estimated period. Apparel is widely used by a great number of customers around the world. Major usages comprise activewear and personal clothing including t-shirts, shirts, trousers, tops, blazers, sportswear, daily wear, and other garments.

Regional Insights

What is the Asia Pacific Textile Auxiliaries Market Size?

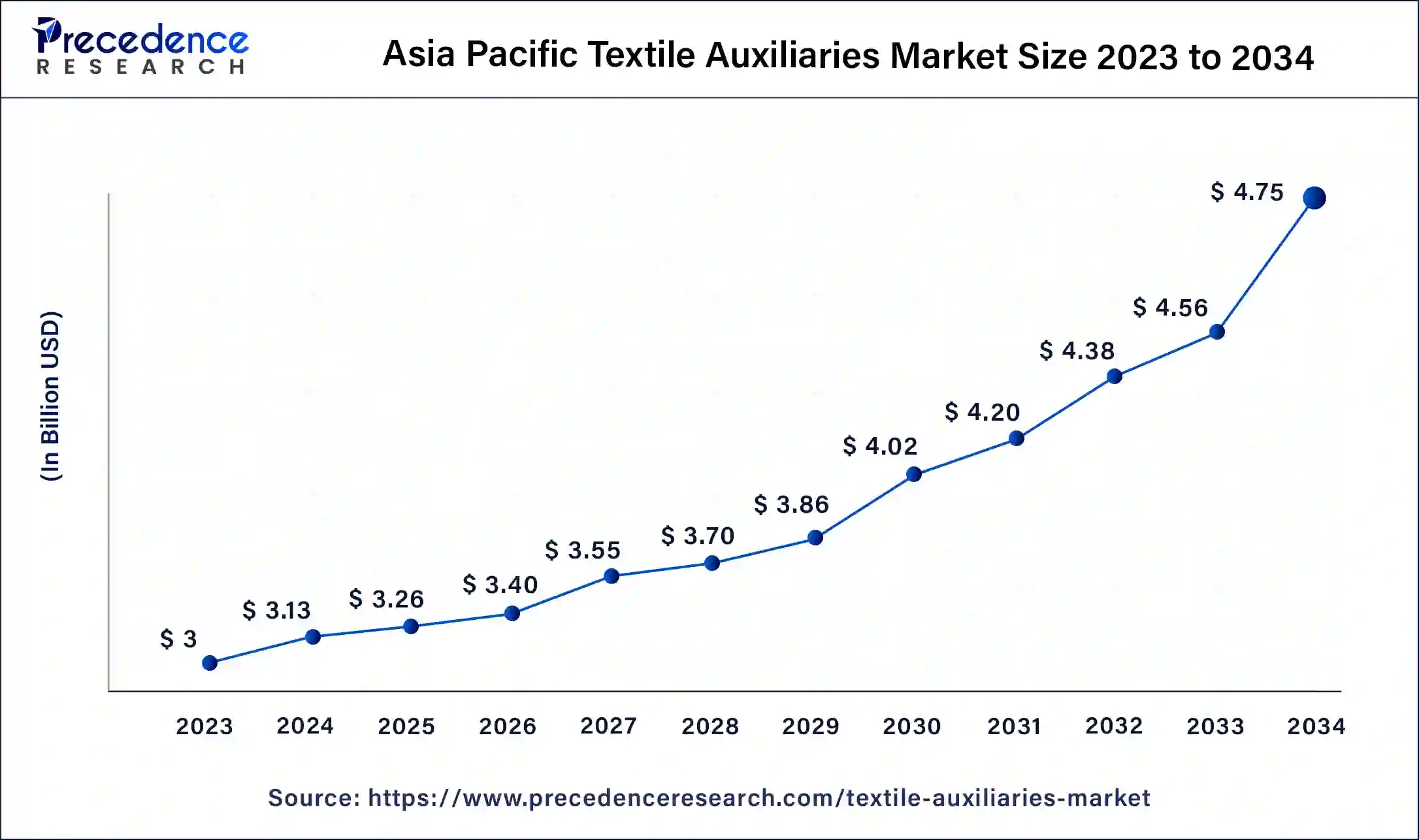

The Asia Pacific textile auxiliaries market size is valued at USD 3.26 billion in 2025 and is expected to reach USD 4.93 billion by 2035, growing at a CAGR of 4.25% from 2026 to 2035.

The research report covers crucial trends and predictions of textile auxiliaries products across several geographical regions such as North America, Asia-Pacific, Europe, Latin America, and the Middle East and Africa. Asia Pacific is anticipated to witness speedy growth in the global textile auxiliaries market in years to come due to the development of the textile sector in developing economies including India. As per, the India Brand Equity Foundation report on textiles and apparel, the Indian domestic textile sector grasped around USD 150 billion in 2017 from USD 137 billion in 2016. Furthermore, the Indian domestic textile sector is anticipated to reach about USD 223 billion by 2021. Consequently, the growth of the textile sector is anticipated to push demand for textile auxiliaries, which aids in refining the complete quality of the fabric, thus boosting the development of the textile auxiliaries market in the region.

The textile industry in China is the largest in the world in terms of exports and production. The Chinese textile industry is thriving with snowballing investments and government backing from the 13th 5-Year Plan. Venture in the country's textile industry has been swelling on account of inexpensive electricity rates, inferior raw cotton prices, and transportation subsidies.

How is Asia-Pacific performing in the Textile Auxiliaries Market?

The APAC region is at the forefront because of its strong manufacturing hubs, widespread industrial expansion, and, finally, reliable resources for the production of auxiliary materials. The region's position is strengthened by consumer demand and the continuous availability of advanced textile auxiliary solutions due to the metro-like character of supply networks, along with wide application diversity.

India Textile Auxiliaries Market Trends:

India has a textile industry that has its roots in the 3 main areas of strong domestic consumption, active governments' support, and a well-established cotton and technical textile base. The ups and downs in the industry are directly connected to the growth of production capacity and the changing demands of the industry. Thus, there is an increasing demand for a variety of auxiliary solutions that are performance-oriented and have different properties for various manufacturing processes.

What are the driving factors of the Textile Auxiliaries Market in Europe?

Europe's market is developed by the stricter environmental regulations, the emphasis on compliant formulations, and the mature textile landscape, which demands high-quality auxiliaries. The Region's textile ecosystem is growing rapidly due to the increasing innovation, sustainability initiatives, and demand for modern chemical solutions.

Germany Textile Auxiliaries Market Trends

Germany keeps on needing textile auxiliaries on account of its strong technical textile capabilities, high sustainability concerns, and driven performance chemical solution. Its high-tech production standards guarantee the constant incorporation of innovative, efficient, and eco-friendly auxiliary materials.

How is North America leading in the Textile Auxiliaries Market?

North America gets its advantage from technological progress, increasing attention to performance textiles, and the rise of sustainability-driven investments. The well-established manufacturing base and the constantly changing applications are the main factors behind the increased use of advanced auxiliaries that are specifically suited to functional, industrial, and specialized textile needs.

United States Textile Auxiliaries Market Trends

The United States is the major market for textiles, and thus, that drives the consumption of auxiliaries by the aforementioned high demand in automotive and industrial applications of technical textiles. The high-performance requirements in conjunction with the advanced processing technologies and the need for long-lasting materials consequently heat up the market for specialised, high-quality textile auxiliary products.

Value Chain Analysis

- Feedstock Procurement: Necessary raw materials and chemical inputs are purchased from trustworthy suppliers for production.

Key Players: Reliance Industries, Grasim Industries - Chemical Synthesis and Processing: Intermediate or final chemical products are obtained by converting raw materials through controlled reactions.

Key Players: Lanxess, Chevron Phillips Chemical Company, and Akzo Nobel - Compound Formulation and Blending: The performance of the desired auxiliaries is achieved by mixing the chemical components in precise proportions.

Key Players: Givaudan - Quality Testing and Certification: Finished materials are evaluated according to criteria, and the required compliance certifications are obtained.

Key Players: OEKO-TEX, GOTS (Global Organic Textile Standard), and AFIRM - Packaging and Labelling of Textile Auxiliaries: Final products are given protective packaging and proper identification labels.

Key Players: AFIRM Working Group

Recent Developments

- In October 2025, JAY Chemical Industries Pvt. Ltd. specializes in textile dyes and auxiliaries for six decades, focusing on sustainable solutions. They are expanding into Bangladesh, enhancing their global presence in the textile industry.(Source: https://www.textiletoday.com )

- In August 2025, Archroma launched CYCLANON XC-W e, enhancing color fastness and efficiency in cellulosic dyeing under challenging conditions. It reduces rinsing needs, conserves resources, and complies with MRSL and RSL standards, supporting sustainable practices.(Source:https://www.textileworld.com )

Textile Auxiliaries Market Companies

- Archroma: Market demand for textile auxiliary materials and solutions leads to the formulation of biodegradable repellents, chemical processes for high-performance and eco-friendly applications, and energy-saving washing agents among the textile auxiliary suppliers.

- Huntsman International LLC: The company offers extensive dye and chemical ranges that include water-saving colorants and superior non-fluorinated repellents, which are very efficient and help to maintain the quality of the processing operations of textiles.

- Solvay: Bleaching, dispersing, wetting, anti-foaming, and other such agents necessary for the complete processing of textiles are provided by Solvay, which supports the process efficiently with chemistry-based auxiliaries.

Other Major Key Players

- Dow Chemicals

- Evonik Industries AG

- ZSCHIMMER & SCHWARZ

- Fibro Chem LLC

- Fineotex Group,

- Camex Ltd

In order to better recognize the current status of acceptance of Textile Auxiliaries, and policies adopted by the foremost countries, Precedence Research predicted the future evolution of the Textile Auxiliaries market. This research study bids qualitative and quantitative insights into the Textile Auxiliaries market and an assessment of the market size and growth trend for potential market segments.

Segments Covered

By Type

- Dyeing & Printing Agents

- Pretreatment Agents

- Finishing Agents

- Spin Finish, Knitting & Weaving

By Application

- Technical Textiles

- Home Furnishings

- Apparel

- Industrial Textiles

By Geography

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- United Kingdom

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content