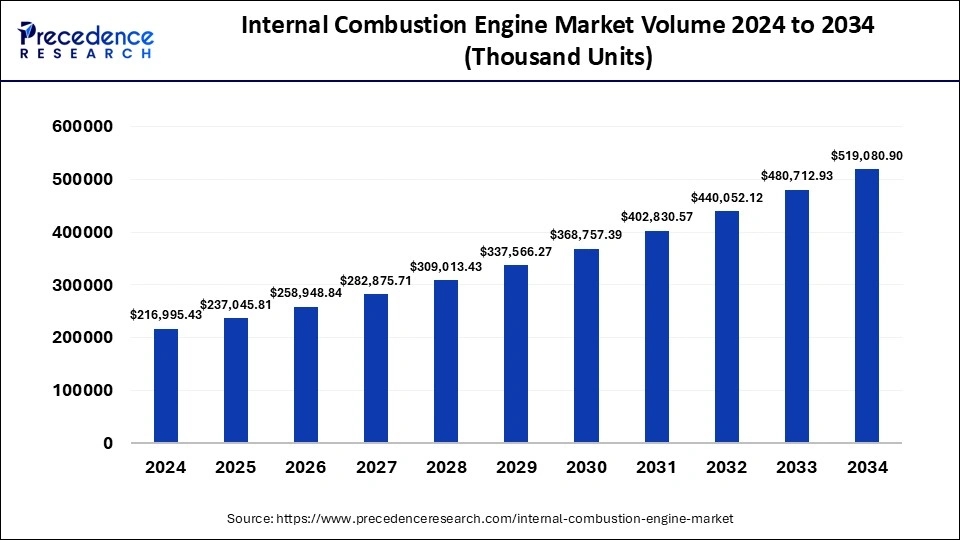

What is the Internal Combustion Engine Market Volume?

The global internal combustion engine market demand was estimated at 2,37,045.81 thousand units in 2025 and is predicted to increase from 2,58,948.84 thousand units in 2026 to approximately 5,58,977.43 thousand units by 2035, expanding at a CAGR of 8.96% from 2026 to 2035.

Internal Combustion Engine Market Key Takeaways

- The global internal combustion engine market was valued 2,37,045.81thousand units in 2025.

- It is projected to reach 5,58,977.43thousand units by 2035.

- The internal combustion engine market is expected to grow at a CAGR of 8.96% from 2026 to 2035.

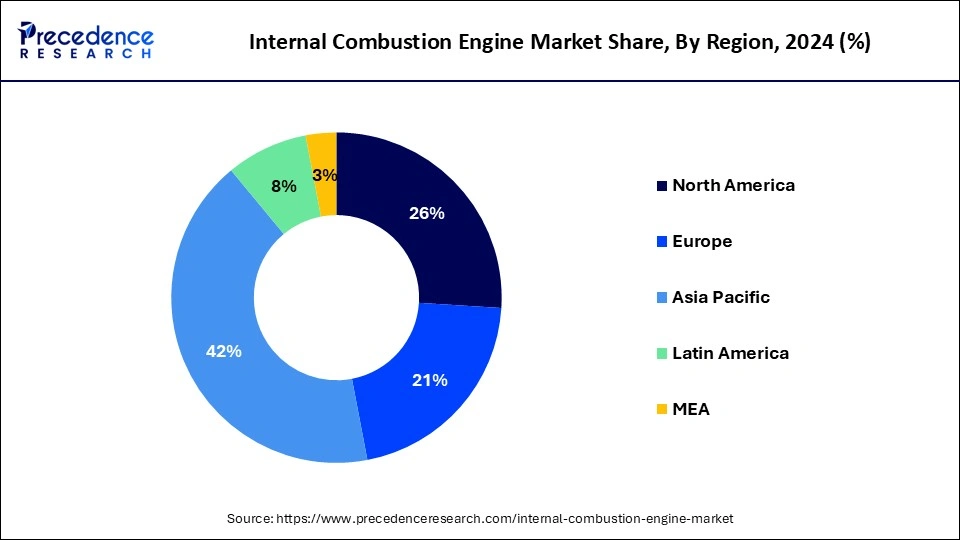

- Asia Pacific dominated the market with the largest revenue share of 42% in 2025.

- North America is anticipated to grow at a soldi CAGR of 8.92% during the forecast period.

- By fuel type, the petroleum segment accounted for the highest revenue share of 82% in 2025.

- By fuel type, the natural gas segment is expected to grow at a significant CAGR of 9.04% during the forecast period.

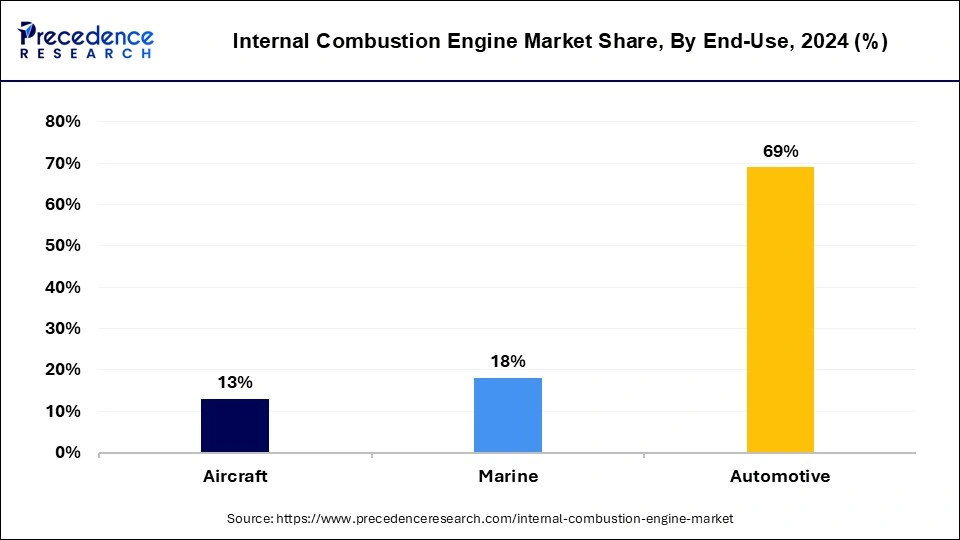

- By end-use, the automotive segment has held the largest revenue share of 69% of revenue share in 2025.

- By end-use, the aircraft segment is projected to expand at a remarkable CAGR of 8.52% during the forecast period.

Market Overview

Generally, combustion is the chemical process of releasing energy from a fuel and oxidizer mixture. An internal combustion engine is a heat engine that generates power for various applications, particularly in transportation. An internal combustion engine produces energy via burning oil, fuel, or petrol with air in a confined space, and then the hot gaseous fuel is created to power the movement of engine parts. In the era of modern transportation and industrial machinery, the internal combustion engine plays a crucial role in driving vehicles and machinery. Internal combustion Engines (ICE) have gained immense popularity across various sectors, such as aerospace, industrial, and automotive.

Artificial Intelligence: The Next Growth Catalyst in Internal Combustion Engines

AI is significantly impacting the internal combustion engine industry by shifting the focus from purely mechanical improvements to software-driven optimization, aiming to maximize efficiency and reduce emissions. AI-powered systems analyze high-frequency data from sensors in real-time to dynamically adjust parameters like fuel injection, ignition timing, and air-fuel ratios, leading to up to 10% in fuel savings and 18% in emission reductions.

Internal Combustion Engine Market Growth Factors

- The growing demand for low-emission engines owing to the increasing focus on lowering carbon emissions is expected to promote the internal combustion engine market expansion during the forecast period.

- The increasing industrialization, rising agricultural mechanization, and rapid growth of infrastructure development require robust equipment and machinery, powered by internal combustion engines are anticipated to contribute significantly to the global internal combustion engine market's revenue.

- The rising investment by the prominent automotive market players in research and development to increase the effectiveness and performance of their engines.

- The significant innovations in engine technology coupled with the rising adoption of cutting-edge technologies such as hybridization are likely to boost the growth of the internal combustion engine market.

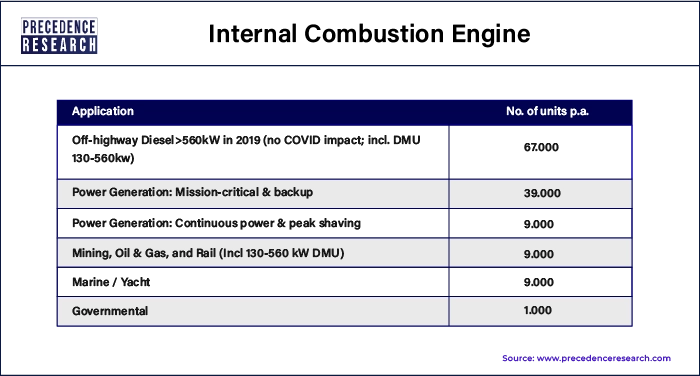

Internal Combustion Engine MarketSplit of Off-highway Units

Market Outlook

- Market Growth Overview: The internal combustion engine market is expected to grow significantly between 2025 and 2034, driven by the high-performance and efficiency demand, rising infrastructure limitations, and technology innovation.

- Sustainability Trends: Sustainability trends involve alternative and synthetic fuels, hybridization and efficiency upgrades, and hydrogen-powered ICE engines.

- Major Investors: Major investors in the market include Toyota Motor Corporation, Volkswagen Group, Ford Motor Company, General Motors, Honda Motor Co., Ltd., and Cummins Inc.

Market Scope

| Report Coverage | Details |

| Market Volume by 2035 | 5,58,977.43 Thousand Units |

| Market Volume in 2025 | 2,37,045.81Thousand Units |

| Growth Rate from 2026 to 2035 | CAGR of 8.96% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Fuel Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The rapid expansion of the automotive sector

The rapid expansion of the automotive sector globally is anticipated to propel the growth of the internal combustion engine market during the forecast period. An internal combustion engine (ICE) is a type of heat engine that converts the chemical energy of the fuel into mechanical energy. ICE is a common form of heat engine, and it is widely used in vehicles, trains, boats, ships, motorcycles, airplanes, and other industrial machines as the primary power source.

Several government initiatives to control emissions and fuel efficiency are encouraging the development of cleaner ICE engines for vehicles. Additionally, the rising consumer inclination towards diesel engines over gasoline engines due to their reliability, durability, and superior fuel economy for long distances is anticipated to propel the internal combustion engine market growth.

- In July 2024, Volkswagen, Europe's largest carmaker, unveiled its plan to manufacture combustion engine-powered cars by investing Thousand Unitss. USD 65 Thousand Units to keep combustion cars competitive.

Restraint

Rising environmental concerns

The rising environmental concerns are projected to hamper the growth of the global internal combustion engine market in the coming years. The surge in environmental awareness about the long-term ecological impacts of fossil fuels is likely to influence the consumer to shift towards greener alternatives. Fossil fuel has limited reserves, which increases the fuel prices.

The stringent emissions regulations compel manufacturers to invest in advanced emissions control technologies, which can be expensive and technically challenging. In addition, the increasing adoption of electric vehicles due to zero emission of fumes from electric vehicles is likely to limit the expansion of the internal combustion engine market.

Opportunity

Rising adoption of cutting-edge technologies

The increasing adoption of cutting-edge technologies is projected to offer lucrative growth opportunities for the growth of the internal combustion engine market in the coming years. Technological improvement offers evolution to the internal combustion engine design, making it more powerful and efficient while using less fuel. ICE plays an indispensable role in the automotive industry's evolution.

The introduction of advanced technology, such as low-temperature combustion engines, has gained immense popularity in the market. Therefore, the increasing investment in engine technology innovation creates a robust manufacturing base and is anticipated to contribute to the growth of the internal combustion engine market.

- In May 2024, Toyota announced its collaboration with Mazda and Subaru on new internal combustion engines. Next-gen engines are intended to provide better efficiency and performance and be compatible with alternative fuels. Each brand will focus on its own "signature" engine, with Toyota working on two four-cylinders, Mazda working on rotary systems, and Subaru doing a hybrid boxer.

Segment Insights

Fuel Type Insights

The petroleum segment accounted for the dominating share of the internal combustion engine market in 2025 and is expected to grow at the fastest rate during the forecast period. Petroleum-based fuels such as gasoline and diesel are the primary energy sources for internal combustion engines. Petroleum internal combustion engines make less vibration and noise. Petroleum fuels are highly used in the market. Diesel fuels are required in buses, trucks, and large industrial and agricultural machinery. Gasoline is heavily used in passenger cars and light commercial vehicles. There are several advantages offered by gasoline engines, such as being cheaper, lightweight, fewer emissions generation, and more efficient. Therefore, the increasing number of ICE-powered vehicles increases the demand for petroleum-based fuels.

The natural gas segment is expected to gain a significant share of the internal combustion engine market during the forecast period. Natural gas, such as Compressed Natural Gas (CNG), Liquefied Natural Gas (LNG), and others. Natural gas is gaining momentum owing to its lower emissions in comparison with conventional petroleum fuels, reduced environmental impact, and promoted sustainability. Thus, the rising number of natural gas vehicles, especially in regions with stringent government emission standards, is projected to make a substantial contribution to the segment's growth.

End-use Insights

The automotive segment held the largest share of the internal combustion engine market in 2025 and is expected to sustain its position throughout the forecast period. Automotive market players are highly investing in developing efficient ICE to improve fuel economy, reduce emissions, and boost performance. The primary focus of automotive manufacturers is to achieve high returns on manufacturing investments. Such factors are expected to boost the segment's growth during the forecast period.

- According to the data published by the Society of Indian Automobile Manufacturers (SIAM), the Auto industry produced a total of 2,59,31,867 vehicles, including passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles, from April 2022 to March 2023, compared to the previous year's 2,30,40,066 units from April 2021 to March 2022.

The aircraft segment is expected to grow significantly in the internal combustion engine market during the forecast period. The growth of the segment is attributed to the robust growth of the aviation industry worldwide. Aircraft used for defense, tourism, logistics, and others require high-performing internal combustion engines. The rising focus is on lightweight, compact design and various technological advancements, including multi-fuel capability that improves fuel mileage. Thereby driving the segment's growth.

Regional Insights

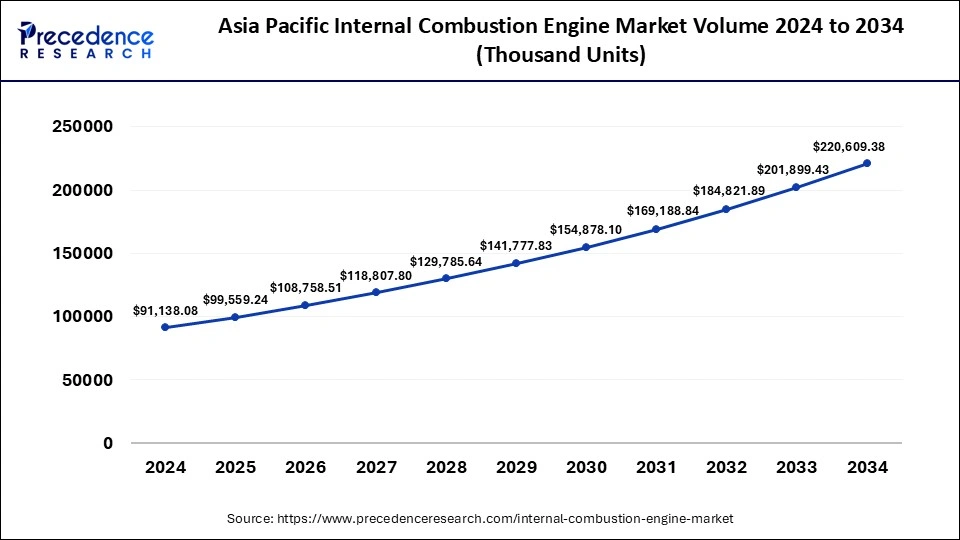

What is the Asia Pacific Internal Combustion Engine Market Volume?

The Asia Pacific internal combustion engine market volume was estimated at 99,229.24 Thousand Units in 2025 and is projected to reach 2,38,231.06 Thousand Units by 2035, registering a CAGR of 9.12% from 2026 to 2035.

Asia Pacific held the dominant share of the internal combustion engine market in 2025. The growth is attributed to the presence of major automotive manufacturers, increasing demand for both passenger andcommercial vehicles, rapid growth of the aviation industry, fast-paced industrialization, rising adoption of agricultural mechanization, increased vehicle production, and a growing demand for fuel-efficient engines. However, the lack of charging infrastructure for electric vehicles and the high cost of electric motors are anticipated to be key drivers of market growth in the region.

In addition, developing countries are significant contributors to the market, such as Japan, China, and India, due to the rising demand for ICEs from various automotive and non-automotive applications such as cars, motorcycles, aircraft, boats, diesel generators, lawnmowers, motorcycles, locomotives, ships, and airplanes is anticipated to propel the internal combustion engine market growth in the region during the forecast period.

- According to the China Association of Automobile Manufacturers (CAAM), in October 2023, vehicle production and sales volumes totaled 2.891 million units and 2.853 million units, up 11.2 percent and 13.8 percent y/y, respectively.

- In July 2024, Toyota unveiled a new and in-development internal combustion engine (ICE) that the company itself calls a “game-changer". These 1.5-litre and 2.0-litre four-cylinder engines are designed to be much more efficient than current offerings.

- According to the report published by the India Brand Equity Foundation (IBEF), In the first quarter of 2023-24, the total production of passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles was 6.01 million units.

North America is anticipated to grow notably in the internal combustion engine market during the forecast period. North America is home to prominent automobile manufacturers, including Caterpillar, AGCO Corporation, General Motors Company, Ford Motor Corporation, and others. The growth of the region is driven by the rising demand for hybrid electric vehicles, the rise in industrial activity, the rising focus on innovations in engine technology, the increasing demand for passenger and commercial vehicles, and the growing demand for effective and high-performance engines in industrial applications. Moreover, automotive companies are emphasizing redefining the design and volume of the ICE, making it smaller, lightweight, and more efficient to boost performance, bolstering the market growth. Thus, this is expected to propel the market growth in the region during the forecast period.

U.S. Internal Combustion Engine Market Trends

The U.S.'s dominance in hybridization and manufacturing is focusing on enhancing ICE performance through advanced technologies, including turbocharging, direct injection, and improved combustion techniques, while rising industrial and commercial demand fuels market growth. In commercial and industrial segments, ICEs continue to be widely used in construction equipment, generators, and off-highway applications, although alternative propulsion (eg, electrification, hydrogen) is emerging in niche areas.

How Did Europe Experience A Notable Growth in the Internal Combustion Engine Market?

Europe's high demand for industrial machinery, compressors, and pumps, coupled with strong manufacturing bases, a shift towards electrification, and petrol vehicle sales. The innovation in engine efficiency, lighter materials, and, more recently, hydrogen internal combustion engines for heavy-duty and infrastructure, and manufacturing, is leading to rising market growth.

Germany Internal Combustion Engine Market Trends

Germany is prioritizing PHEV growth and heavy-duty specialization over a rapid total phase-out. Innovation is now centered on Euro 7 compliance and CO2-neutral e-fuels, providing a vital regulatory bridge for manufacturers to operate. In commercial and industrial segments, ICEs continue to be used, but there is increasing exploration of low-carbon alternatives such as hydrogen and biofuels to reduce emissions in heavy-duty and off-highway applications.

Value Chain Analysis of the Internal Combustion Engine Market

- Raw Material Sourcing (Upstream)

This stage involves the procurement of essential materials like steel, aluminum, cast iron, and alloys necessary for engine blocks, pistons, and crankshafts.

Key Players: Rio Tinto, BHP - Components Manufacturing & Design

Component manufacturers design and produce critical engine parts such as cylinder heads, pistons, fuel injection systems, valves, and turbochargers.

Key Players: Bosch, Magna International, BorgWarner, Denso Corporation, Mahle GmbH, Cummins. - Engine Assembly & Systems Integration

This stage brings together the manufactured components to assemble the final engine, often incorporating advanced technology like electronic management systems and, increasingly, hybrid components.

Key Players: Toyota Motor Corporation, Volkswagen Group, Ford Motor Company, General Motors, Cummins Inc., Volvo Group, MAN Truck & Bus, Caterpillar.

Internal Combustion Engine Market Companies

- Volkswagen AG: The Volkswagen Group heavily invests in internal combustion engine (ICE) technology by developing advanced, efficient TSI petrol engines and, despite their electric transition, has committed significant billions to keeping their conventional engines competitive.

- Toyota Industries Corporation: Toyota Industries Corporation (TICO) manufactures and develops clean diesel and gasoline engines for Toyota vehicles worldwide, specializing in 2,000 cc to 4,500 cc engines for popular models like the Land Cruiser and RAV4.

- Robert Bosch GmbH: As a primary supplier to the automotive industry, Bosch drives the ICE market by developing advanced fuel injection systems and electronic engine management systems that improve combustion efficiency and lower emissions.

- Shanghai Diesel Engine Co., Ltd.: Shanghai Diesel Engine Co., Ltd. (SDEC) is a premier manufacturer in China of high-performance diesel and natural gas engines, catering to commercial vehicles, construction machinery, and marine applications.

- BMW: BMW contributes to the ICE market by manufacturing high-performance, refined petrol and diesel engines for its own vehicles and the MINI brand, focusing on balancing dynamic driving with fuel efficiency.

- Rolls-Royce: Rolls-Royce Motor Cars, operating as a subsidiary of BMW, contributes to the luxury segment of the ICE market by producing bespoke, high-performance V12 and V8 engines known for exceptional smoothness and power.

Other Major Key Players

- Navistar International Corporation

- MAN SE

- Kirloskar Oil Engines Ltd.

- Detroit Diesel

- Cummins

- Caterpillar Incorporated

- Ashok Leyland Ltd

- AB Volvo

- Mahindra & Mahindra Ltd.

- Renault Group

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- General Motors

- Ford Motor Company

- AGCO Corporation

Recent Developments

- In April 2025, Cummins Inc. launched the industry's first hydrogen internal combustion engine (H2-ICE) turbochargers, specifically designed for European heavy-duty on-highway applications. This advancement provides a critical technological link for decarbonizing long-haul freight. For more information, visit Cummins Inc.'s website.

(Source: https://www.cummins.com ) - In June 2023, Rolls-Royce opened an MTU combustion engine assembly plant for its MTU Series 2000 engines in Kluftern. The new structure features a 1.2MW solar photovoltaic system, e-charging columns to promote greener mobility, and smart building control to maximize energy efficiency.

- In June 2023, General Motors Co. announced its plan to invest USD 632 million in Fort Wayne Assembly to prepare the plant for production of the next-generation internal combustion engine (ICE) full-volume light-duty trucks. This investment will enable the company to strengthen its industry-leading full-volume truck business. Product details and timing related to GM's future trucks are not being released at this time.

- In February 2023, RIL announced India's first hydrogen combustion engine technology for heavy-duty vehicles. Reliance claims that it is a "unique and affordable" domestically developed technology solution that could change the course of green mobility in the future.

- In May 2024, Swedish auto manufacturer Volvo announced that it would start customer trials for trucks with hydrogen internal combustion engines in 2026, with a wider market launch planned for the end of the decade.

Segments Covered in the Report

By Fuel Type

- Petroleum

- Natural gas

By End-use

- Automotive

- Marine

- Aircraft

By Geography

- North America

- Europe

- Asia Pacific

- Latin America & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting