What is the Turboprop Engine Market Size?

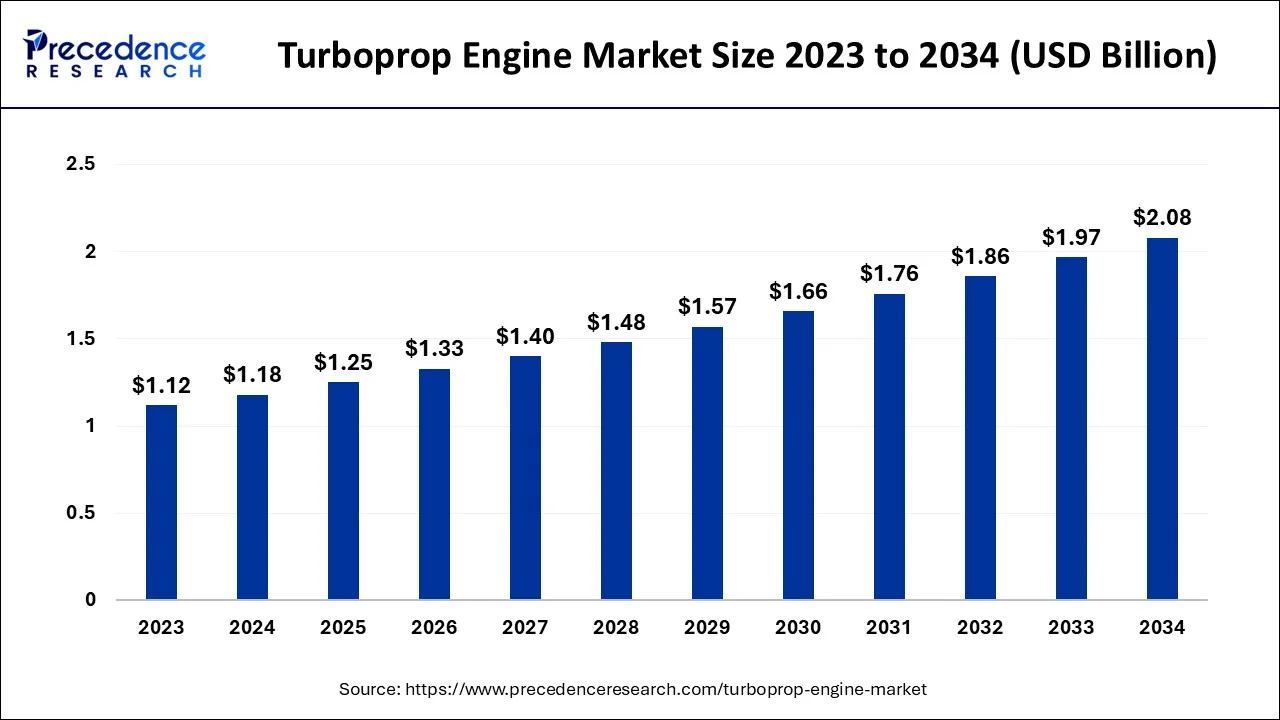

The global turboprop engine market size is valued at USD 1.25 billion in 2025 and is predicted to increase from USD 1.33 billion in 2026 to approximately USD 2.19 billion by 2035, expanding at a CAGR of 5.77% from 2026 to 2035.

Turboprop Engine Market Key Takeaways

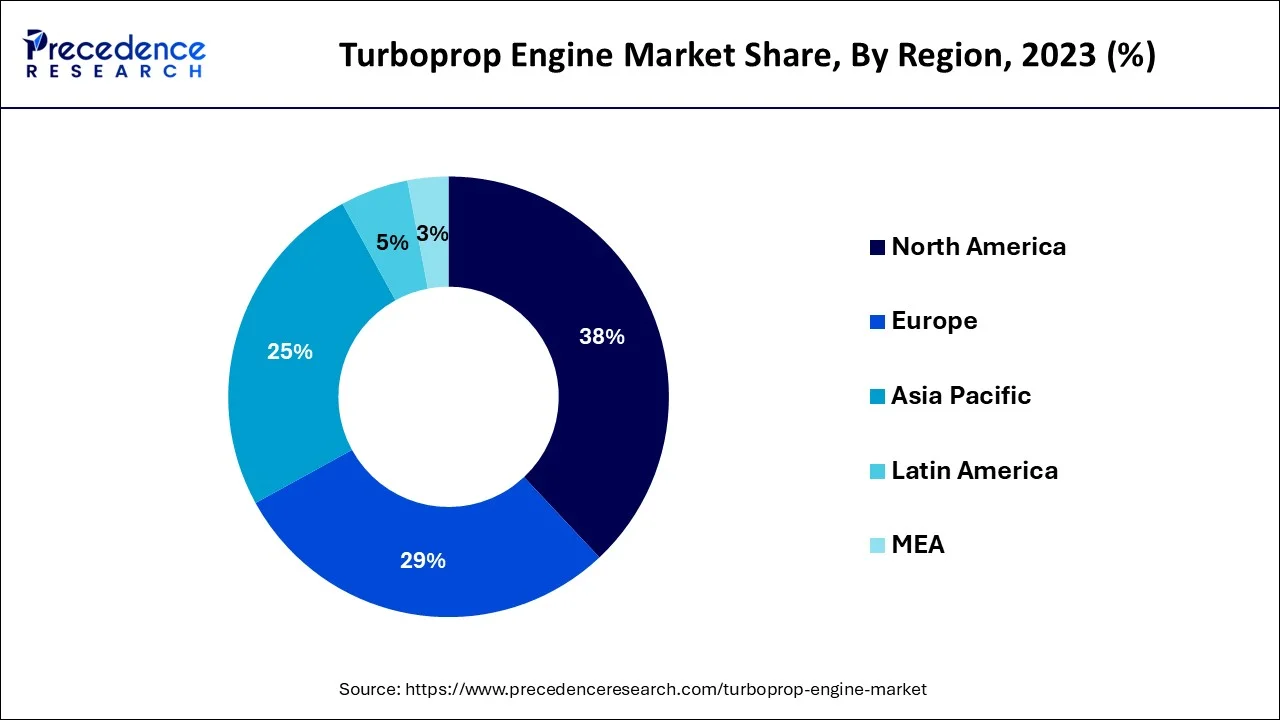

- North America holds the largest market share of 38% in 2025.

- By Type, the single shaft segment is expected to witness significant growth while being the dominating segment of the market.

- By Application, the general aviation segment is expected to hold the largest share of the market during the forecast period.

- By Technology, the electric/hybrid engine segment is expected to grow at the fastest rate during the forecast period.

- By Technology, the conventional engine segment will experience steady growth.

Artificial Intelligence: The Next Growth Catalyst in Turboprop Engines

Artificial intelligence is revolutionizing the turboprop engine market. Integrating AI features in turboprop engines enhances performance and efficiency. AI algorithms can predict engine behaviors, which helps to make better decisions. AI optimizes engine health and provides real-time data about performance and fuel consumption. It also optimizes fuel efficiency by monitoring engine settings. AI-driven turboprop engines are adjusted with propeller pitch and yaw for more efficiency.

Integrating AI features in the propulsion system helps maintain the engine's efficiency. Moreover, it enhances the engine's reliability by detecting defects and anomalies. AI-powered inspection systems not only monitor engine health but also provide requirement scheduling for maintenance before issues occur.

Strategic Overview of the Global Turboprop Engine Industry

A jet engine version that has been modified to power a propeller is known as a turboprop engine. In comparison to turbojet or turbofan-powered aircraft of the same size, turboprop-equipped aircraft are particularly efficient at lower flying speeds (less than Mach 0.6), burning less fuel per seat mile. They also require a lot less runway for takeoff and landing. Because of their reduced speed and cost-effectiveness while flying over relatively short distances, turboprops are the preferred engines for the majority of commuter aircraft.

The Pilatus PC-12, Alenia ATR 42, and Bombardier Dash 8 are a few examples of aircraft powered by turboprops. The gas generators of a turboprop engine, which uses the same principles as a turbojet to create energy, integrate a compressor, combustor, and turbine. The global turboprop engines market is being driven by several factors such as the growing aviation industry, increasing technological advancements, high fuel efficiency as compared to their counterparts, increasing demand from the military and defense, and growing collaboration between the key market players.

- According to the data given by IATA, global air traffic rose by 55.5% in February 2023 as compared to February 2022.

- According to the India Brand Equity Foundation, India has risen to become the third-largest domestic aviation market in the world. The country is expected to surpass the United Kingdom to occupy its position by 2024. In addition, Indian aviation has generated 4 million new employees while contributing 5% to the nation's GDP.

- As per International Civil Aviation Organization, over the next 20 years, there will be a 4.3% annual growth in the demand for air travel. By 2036, if this development trajectory is followed, 15.5 million direct employment and USD 1.5 trillion in GDP would be generated by the global aviation sector.

- According to the secondary analysis, the Pratt & Whitney PT6 is one of the most widely used turboprop engines. Since the PT6A engine family entered service in the 1960s, more than 41,000 have been built, totaling more than 335 million flight hours.

Market Outlook

- Market Growth Overview: The turboprop engine market is expected to grow significantly between 2025 and 2034, driven by fuel efficiency and sustainability, cargo and general aviation, and advancements in new engine designs.

- Sustainability Trends: Sustainability trends involve fueling efficiency, hybrid-electric propulsion, and greener choices for regional travel.

- Major Investors: Major investors in the market include Rolls-Royce plc, Pratt & Whitney, GE Aerospace, and Safran S.A.

- Startup Economy: The startup economy is focused on technological niches, partnership and collaboration, and targeting specific segments.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.25 Billion |

| Market Size by 2035 | USD 2.19 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.77% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Application, and By Technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

High fuel efficiency and growing adoption in military applications

Turboprop engines are known for their fuel efficiency, particularly at lower speeds and altitudes. With rising fuel costs and increasing environmental concerns, operators are looking for engines that offer better fuel economy. Turboprops provide an advantage in terms of lower fuel consumption compared to jet engines, making them attractive for airlines and operators seeking cost-effective solutions. In addition to this, these engines are extensively used in military aircraft for various missions such as transport, surveillance, and maritime patrol. The defense sector plays a significant role in driving the demand for turboprop engines. Military organizations worldwide invest in upgrading their aircraft fleets to enhance capabilities, fuel efficiency, and operational performance. Therefore, high fuel efficiency and the growing adoption of turboprop engines in military applications will propel the market growth in the coming years.

Restraint

Limited Speed

Limited speed and performance are major factors that hamper the turboprop engine market. Turboprop engines have limited speed compared to jet engines. Turboprop engine speed and performance are also not suitable for military applications. Due to the rising desire for high speed and performance, several aircraft manufacturers prefer jet engines over turboprop engines, leading to reduced adoption of turboprop engines.

Opportunity

Increasing emphasis on sustainable aviation across the globe

The aviation industry is increasingly focused on sustainability and reducing its environmental impact. Turboprop engines, compared to jet engines, generally produce lower carbon emissions and noise levels. This aligns with the industry's goals for decarbonization and environmentally friendly operations. For instance, IATA member airlines adopted a resolution pledging them to achieve net-zero carbon emissions from their operations by 2050 during the 77th IATA Annual General Meeting in Boston, USA, on October 2021. With this commitment, air travel will comply with the Paris Agreement goals to keep global warming well below 2C. The shift towards sustainable aviation creates an opportunity for turboprop engines to position themselves as a greener alternative, attracting environmentally conscious operators and customers.

Type Insights

Based on the type, the global turboprop engine market is segmented into single shaft and free turbine. The single shaft segment is expected to dominate the market over the forecast period owing to its properties such as efficiency, rapid response, reliability, and cost-effectiveness. Single-shaft turboprop engines can achieve high overall efficiency. With a direct mechanical connection between the gas generator and the propeller, no energy losses are associated with transferring power between separate turbine stages. The efficient power transmission allows for the effective conversion of fuel energy into propulsive power, resulting in improved fuel efficiency and lower operating costs.

Moreover, these engines offer a quick response to throttle inputs. The direct mechanical link between the engines and the propeller allows for rapid adjustments in propeller speed and, consequently, thrust. This responsiveness is particularly beneficial during the take-off and landing phases, where precise control and quick power changes are necessary. Therefore, the various advantages offered by single-shaft turboprop engines will further drive market growth.

Application Insights

The commercial aviation segment is expected to grow at a rapid pace in the coming years. This is mainly due to the rising demand for regional air travel. Commercial aviation focuses on reducing operational costs and environmental impact. However, turboprop engines are more fuel-efficient compared to turbojet engines, making them suitable for commercial aircraft. With the rising production of commercial aircraft, the demand for turboprop engines is rising, as these engines are suitable for short-haul flights.

Technology Insights

The conventional engine segment is projected to experience steady growth over the studied period. Conventional engines are cost-effective and do not require regular maintenance compared to electric engines, significantly reducing operational costs. Emerging technologies are helping to boost the performance of conventional engines. Conventional turboprop engines require lower initial investments, making them ideal for regional airlines.

Regional Insights

U.S. Turboprop Engine Market Size and Growth 2026 to 2035

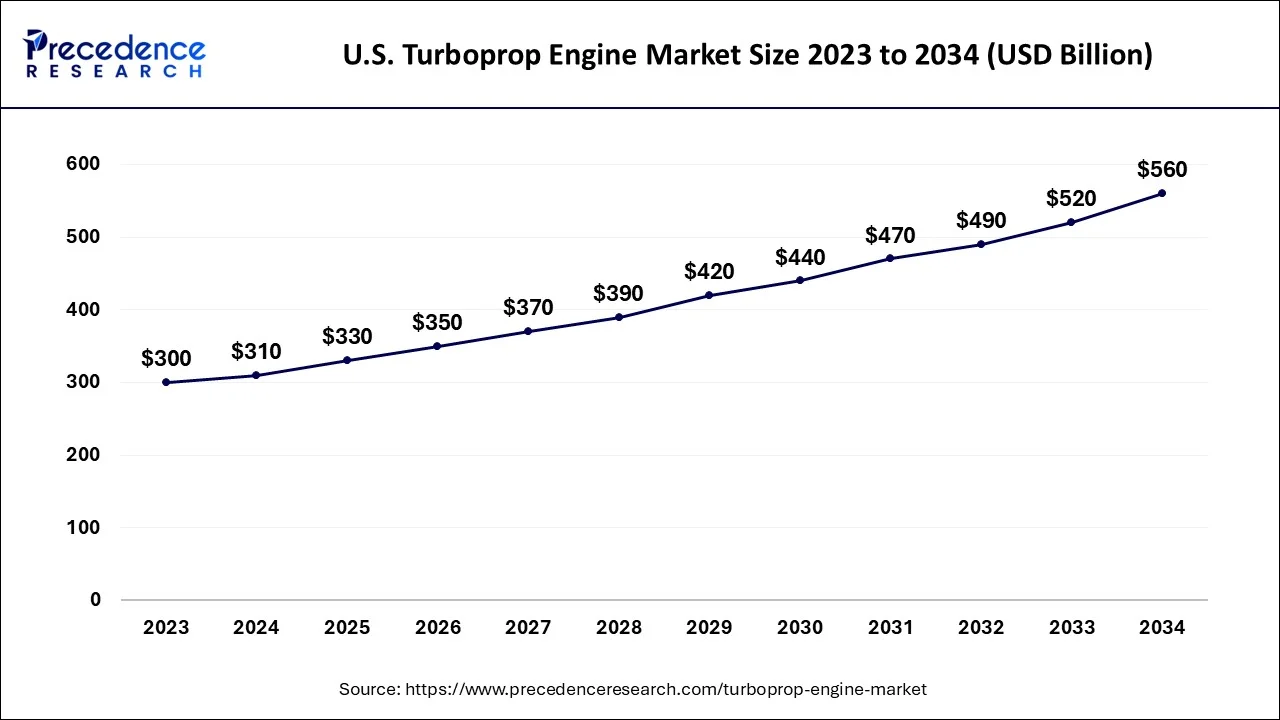

The U.S. turboprop engine market size is estimated at USD 330 million in 2025 and is expected to be worth around USD 600 million by 2035, growing at a CAGR of 6.16% between 2026 and 2035.

North America is expected to capture the largest revenue share of the turboprop engine market over the forecast period.The region is home to several major aircraft manufacturers, including Boeing, Bombardier, and Textron Aviation, which produce turboprop-powered aircraft. The market has witnessed steady growth over the years, driven by factors such as regional air travel demand, cargo operations, and specialized missions. The demand for regional air travel continues to grow in North America, driven by factors such as economic development, tourism, and connectivity. Turboprop-powered aircraft are well-suited for regional routes, short-haul flights, and serving smaller airports, making them a preferred choice for regional airlines.

U.S. Turboprop Engine Market Trends

The rising fuel prices in the U.S. make cost-effective turboprops attractive for short-haul routes, as well as steady demand for trainer and surveillance aircraft that utilize turboprops. Fuel efficiency and reduce costs, focusing on hybrid-electric propulsion, lower emissions, and quieter operations.

For instance, according to the Bureau of Transportation Statistics, in 2022, American Airlines transported 194 million more passengers than in 2021, an increase of 30% from year to year. U.S. airlines handled 853 million passengers (unadjusted) over the whole 2022 calendar year, up from 658 million in 2021 and 388 million in 2020. Additionally, advancements in technology, such as hybrid-electric propulsion and improvements in engine efficiency, could shape the future of the turboprop engine market in North America. Continued investments in research and development by engine manufacturers, along with evolving regulations and market dynamics, will influence the growth and direction of the market in the region.

Europe is expected to hold a significant market share over the forecast period. The regional growth is owing to the rise in the air traffic. For instance, according to the data given by Eurostat, in the EU, 373 million passengers were flying in total in 2021, a significant rise of 34.9% from the previous year. Except for Finland (-16.1%), all Member States had increases in 2021 compared to 2020. Croatia (+129.4%) saw the largest growth, followed by Cyprus (+104.8%) and Greece (+85.9%). 19 of the remaining EU members had increases of more than 20% during the same period. The four remaining Member States all had increases of at least 10%, with Ireland (+10.0%) having the lowest gain. Moreover, turboprop engines generally offer better fuel efficiency and lower emissions compared to jet engines. With an increasing emphasis on sustainability and environmental responsibility, turboprop-powered aircraft are preferred for certain operations, contributing to the growth of the turboprop engine market in Europe.

Germany Turboprop Engine Market Trends

Germany's EU green deal and national policies accelerate demand, growing need for connecting smaller cities, and strong requirements for intelligence, surveillance, reconnaissance, and trainer aircraft bolster military use.

How Did Asia Pacific Notably Grow in the Turboprop Engine Industry?

Asia Pacific's regions' rising air passenger traffic, increasing government initiatives, and investment in new small airports and regional networks are perfectly suited for turboprop demand. Improved regional connectivity, economic growth, and middle-class income fuel the market growth.

China Turboprop Engine Market Trend

China's vast geography and growing economy fuel demand for short-haul fights, benefiting efficient turboprops, increased defense spending drive demand, and rising government initiatives.

Value Chain Analysis of the Turboprop Engine Market

- Inbound Logistics/Raw Material Sourcing

This stage involves sourcing and managing the raw materials and components necessary for engine production, such as specialty alloys (titanium, aluminum) and advanced composites.

Key Players: Alcoa Corporation, VSMPO-AVISMA (titanium), and Hexcel Corporation - Operations/Manufacturing & Assembly

This stage focuses on the actual production, assembly, and testing of the turboprop engines and their complex components (compressors, turbines, combustion chambers).

Key Players: Pratt & Whitney Canada, General Electric (GE) Aerospace, and Rolls-Royce plc. - Outbound Logistics/Distribution

Once manufactured, engines are distributed to aircraft manufacturers (OEMs) and MRO providers globally.

Key Players: Textron Aviation and Pilatus Aircraft - Marketing & Sales

This activity involves promoting engine models and securing contracts with aircraft manufacturers, regional airlines, and defense agencies.

Key Players: Airbus SE, ATR, and De Havilland Aircraft of Canada Limited.

Top Companies in the Turboprop Engine Market & Their Offerings:

- Pratt & Whitney: The company is a dominant player, particularly through its Pratt & Whitney Canada (PWC) division, which produces the widely used PT6 engine family that powers a vast range of regional and general aviation aircraft.

- Rolls-Royce Plc: Rolls-Royce primarily serves the market with engines for large business jets and military aircraft, such as the M250 turboprop series. They focus on engine efficiency and maintenance programs like CorporateCare to provide cost-effective and reliable power solutions to operators.

- General Electric (GE): GE has recently entered the market with its Catalyst (Advanced Turboprop) engine, a modern clean-sheet design that incorporates advanced technologies like FADEC and additive manufacturing to offer high fuel efficiency.

- Honeywell International Inc.: Honeywell contributes by producing a range of turboprop propulsion systems and integrating advanced digital health monitoring systems to minimize downtime and maintenance costs.

- PBS AEROSPACE: PBS specializes in developing and manufacturing small turboprop engines, such as the PBS TP100, which are ideal for light aircraft, experimental planes, and unmanned aerial vehicles (UAVs).

- TurbAero: TurbAero is developing new, light turboprop engines that utilize innovative technologies like recuperative heating to offer fuel burn comparable to piston engines, aiming to provide a cost-effective alternative for the light aircraft and UAV markets.

- Heron Engines: Heron Engines focuses on making the turboprop experience available to a wider, more affordable market, particularly for experimental and recreational aviation.

Turboprop Engine Market Companies

- Pratt & Whitney

- Rolls-Royce Plc

- GENERAL ELECTRIC

- Honeywell International Inc.

- PBS AEROSPACE

- TurbAero

- Heron Engines

- Turbotech

- Textron Aviation Inc.

- SAFRAN

- IHI Corporation

- PILATUS AIRCRAFT LTD

- Varman Aviation Private Limited

Recent Developments

- In November 2024, Pratt & Whitney Canada will demonstrate hydrogen combustion technology on a PW127XT regional turboprop engine as part of a project supported by Canada's Initiative for Sustainable Aviation Technology (INSAT).

- In May 2024, Avio Aero signed a multi-year agreement with Aircraft Industries, a member of OMNIPOL Group, for developing up to 40 new H80 and H85 turboprop engines. This collaboration aims to power Aircraft Industries' L 410 UVP-E20 and the L 410 NG aircraft.

- In May 2024, Aeronautical Development Establishment (ADE), a premier laboratory of the Defence Research and Development Organisation (DRDO), announced a plan to begin testing advanced turboprop engine for UAVs.

Segments Covered in the Report

By Type

- Single Shaft

- Free Turbine

By Application

- Commercial Aviation

- Military Aviation

- General Aviation

By Technology

- Conventional Engine

- Electric/Hybrid Engine

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content