What is the Commercial Vehicles Market Size?

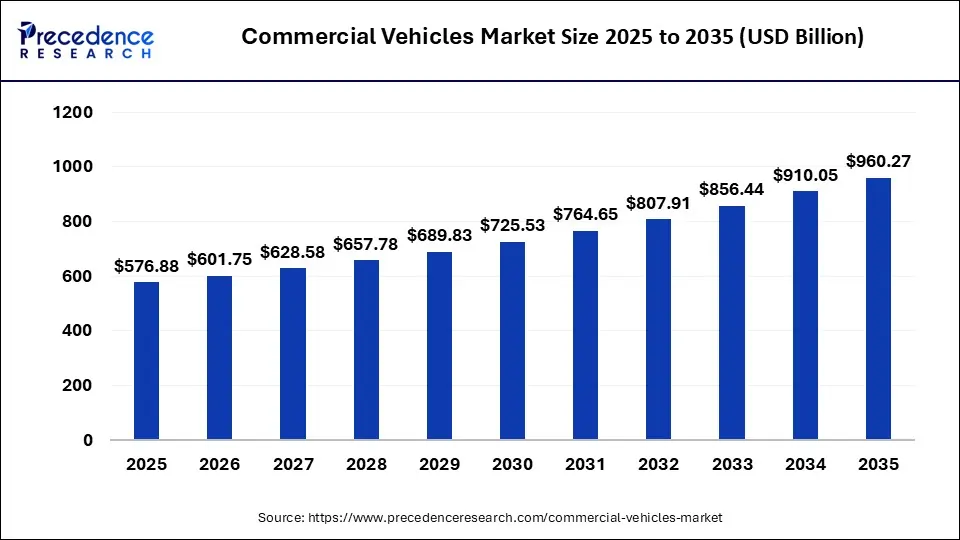

The global commercial vehicles market size accounted for USD 576.88 billion in 2025 and is predicted to increase from USD 601.75 billion in 2026 to approximately USD 960.27 billion by 2035, expanding at a CAGR of 5.23% from 2026 to 2035.

Market Highlights

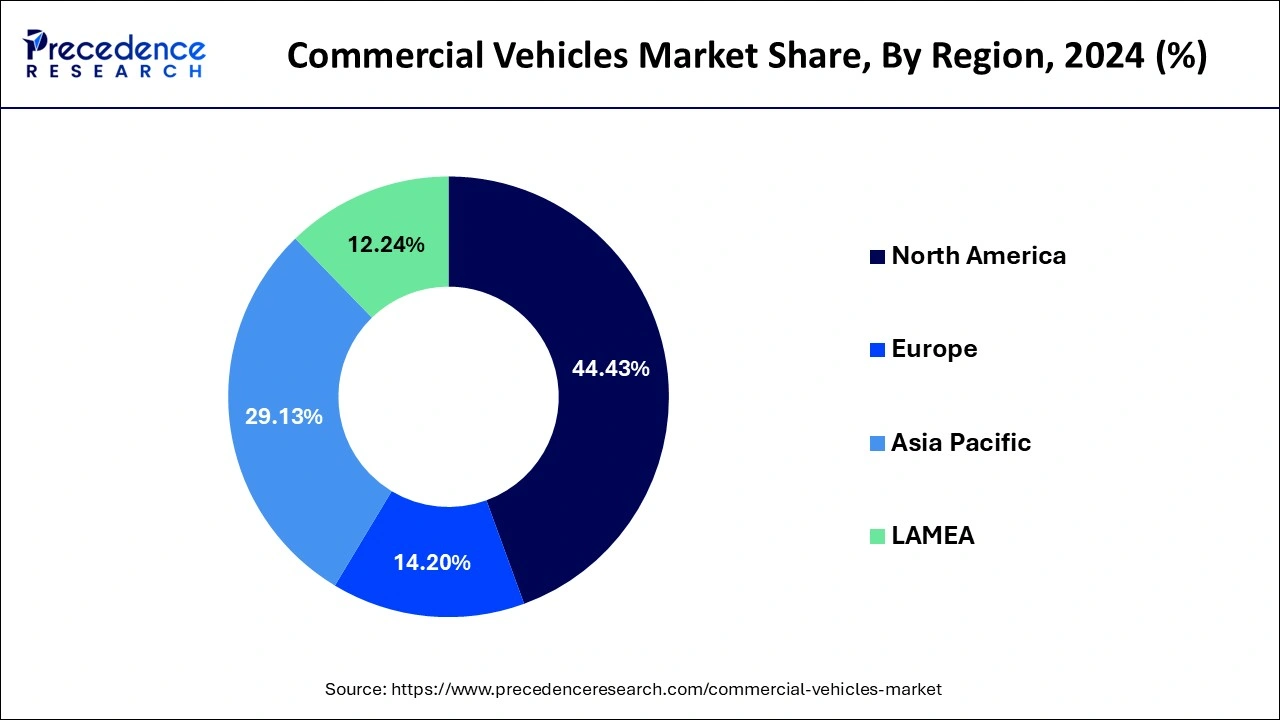

- North America has held highest revenue share in 2025.

- Asia-Pacific region is estimated to observe the fastest expansion during the forecast period.

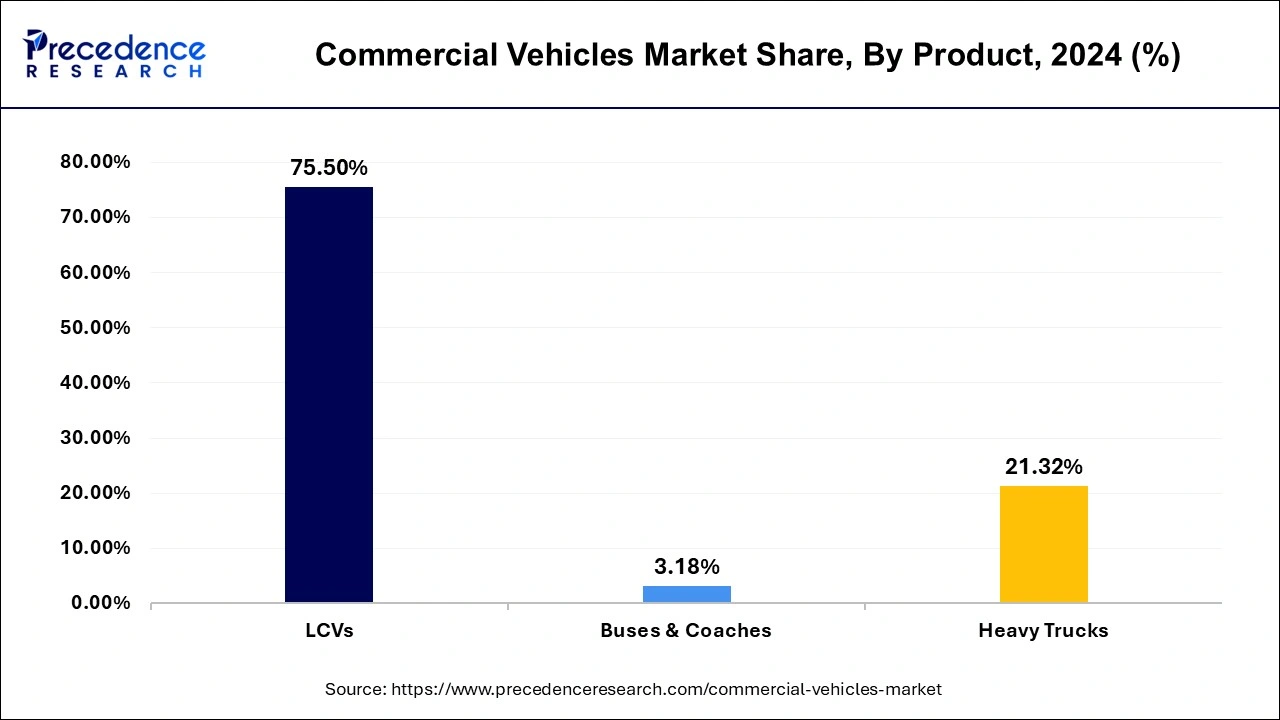

- By product, the light commercial vehicles segment captured the largest market share in 2025.

- By product, the heavy trucks product segment is expected to expand at the fastest CAGR of 5.7% between 2026 and 2035.

- By Propulsion Type, the IC engine has held highest revenue share in 2025.

- By Power Source, the diesel segment contributed the largest market share in 2025.

Market Overview

Commercial vehicle is a type of motor vehicle used purposely for the transportation of goods or merchandise. Commercial vehicle growth is mainly influenced by the increase in e-commerce business as well as increasing adoption of commercial vehicles for transportation. Apart from this, increasing industrialization, adoption of e-mobility in commercial sectors, and infrastructure development that supports the advancement & development in automotive industry also triggers the market growth for commercial vehicles.

Commercial vehicle is a type of motor vehicle used for the transportation of goods, materials, and people. It is used across various industries including transportation & logistics, mining & construction, manufacturing industries, agriculture, and many others. Main products covered under the commercial vehicle market are light commercial vehicles, buses & coaches, and heavy trucks. Industrial growth and rising penetration of electric-powered vehicles in commercial vehicles are some of the prime factors that trigger the market pace of commercial vehicles during the forecast period.

What is the Role of AI in the Commercial Vehicles Market?

Artificial intelligence (AI) in automotive industries driving the growth of the commercial vehicles market with measurable outcomes through scalable operations, safer vehicles, and smarter systems. Its ability to transform processes from predictive maintenance to supply chain optimization which improve customer satisfaction, scalability, and customer satisfaction. AI-based innovations are improving in-car functionality and user experiences.

The benefits of AI in automotive industry include navigation and traffic intelligence, fatigue monitoring, stress reduction, autonomous driving, improved driver experience, fleet utilization & monitoring, fuel efficiency & emission control, predictive maintenance and improved safety. It allows autonomous driving capabilities, real-time traffic management, and predictive maintenance. AI streamline logistic operations, reduces congestion, and minimizes accidents. In addition, AI reroutes vehicles to avoid congested areas.

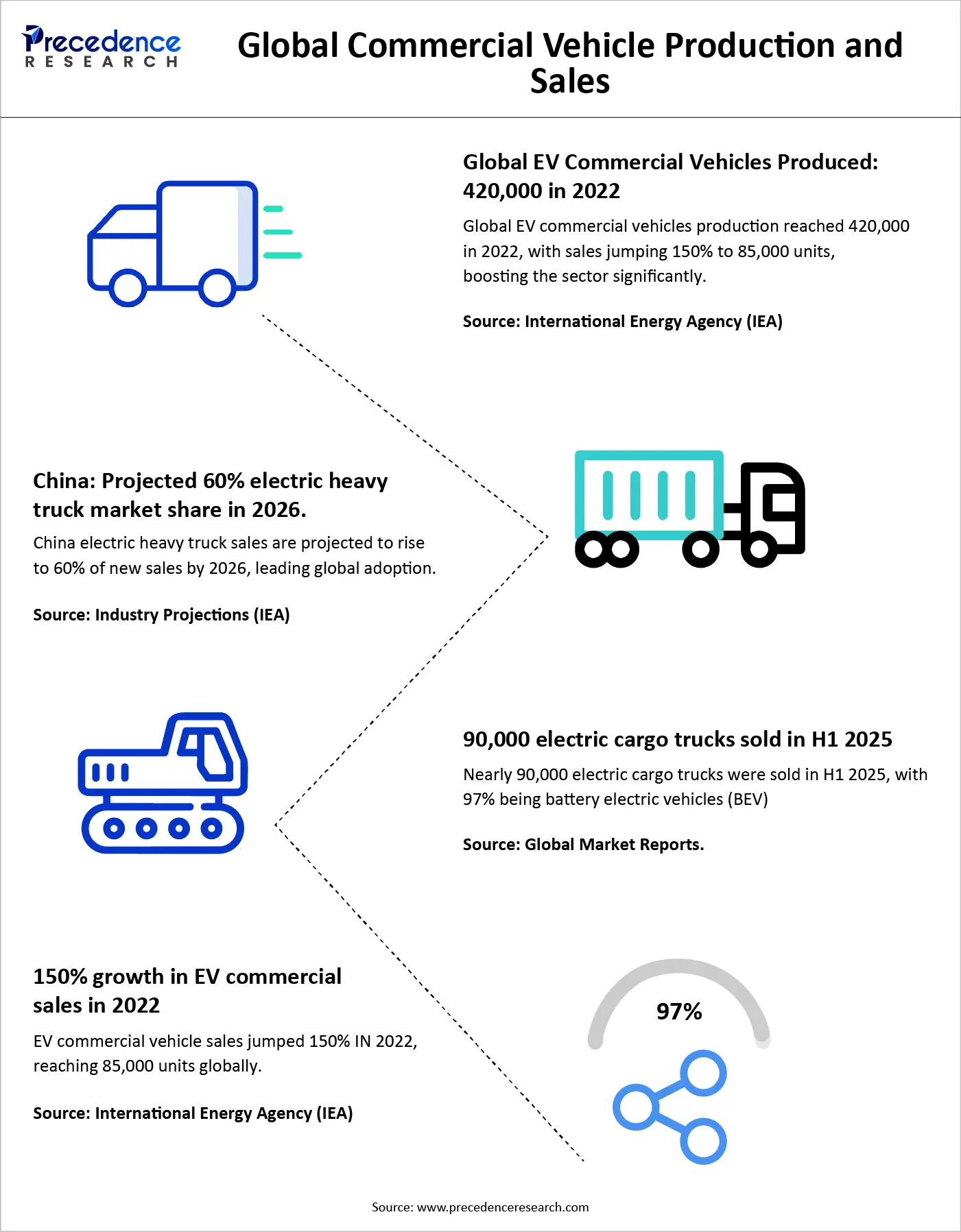

Electric Commercial Vehicles Growth Accelerates Global Transport Transition

Electric commercial vehicles are rapidly reshaping the global transportation ecosystem, reflecting strong policy support, fleet electrification targets, and technological advancements. Approximately 420,000 electric commercial vehicles were produced worldwide in 2022, marking a significant shift toward sustainable mobility. EV commercial vehicle sales surged nearly 150% in 2022, reaching around 85,000 units, demonstrating accelerating fleet adoption. Momentum continued into 2025, with nearly 90,000 electric cargo trucks sold in the first half alone, dominated by a 97% battery electric vehicle share. Notably, China's electric heavy truck sales are projected to account for nearly 60% of new sales by 2026, signaling transformative market expansion.

Market Trends

- Development of specialty commercial vehicles

- Increasing disposable income

- Strict governmental regulations

- Rising infrastructure projects

- Growth of logistics and e-commerce sector

Commercial Vehicles Market Growth Factors

Although the market experiences sluggish growth in the recent past, it predicted to recover the overall sales performance in commercial vehicles, especially in the developing countries. Digitization along with the rising infrastructure spending anticipated to boosts the commercial vehicles market growth in the coming years. Initially the market development was closely related to the growth of global economy; however, this interrelation is crumbling rapidly. Demand for specific transport solutions by consumers, integration of telematics services, and rising popularity of shared mobility are some of the major trends that are shaping the commercial vehicle market growth. Further, governments across several nations have implemented various policies and regulations for effectively managing the size of goods that can be carried in a commercial vehicle. For instance, the Federal Motor Carrier Safety Administration (FMCSA) in the United States was established to prevent fatalities and injuries related to commercial vehicles. In wake of same, the body has regulated the maximum size of goods that can be carried in these vehicles. In in turn, is expected to flourish the sale of commercial vehicles in the near future.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 576.88 Billion |

| Market Size in 2026 | USD 601.75 Billion |

| Market Size by 2035 | USD 960.27 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.23% |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, End User, Propulsion Type, Power Source, Region |

Market Dynamics

Driver

Technological advancements in vehicles

Technological advancements in vehicles benefits include supply chain optimization, predictive automobile technology, improved customer experience, connected mobile apps or digital keys, improved driver experience, voice commands, personalized user experience, personalization, environmental gains, driver assistance, cost savings, automatic emergency breaking, assisted parking, data-driven decisions, cost savings, increased operational efficiency, automatic doors, and AI in automobiles.

Restraint

Supply chain disruptions:

Disadvantages of supply chain disruptions in commercial vehicles include decreased customer satisfaction, increased transportation costs, inefficient routine, delivery delays, are all factors may lead to increase costs and reduce customer satisfaction. Supply chain disruption can disrupt the flow of goods and services within a company's supply chain. There are internal and external risks to supply chain including operational, cybersecurity, demand, supply, environmental, geopolitical, and financial.

Opportunity

Advances in autonomous driving

One of the most significant benefits of autonomous cars is their potential to make our roads safer. Human error is a leading cause of accidents with factors including fatigue, distracted driving, and impaired judgement contributing to a large number of collisions. Advances in autonomous driving in vehicles to detect and respond to the surrounding environment, providing new opportunities for safety and mobility. It helps to improve traffic flow and increase road capacity.

Segments Insights

Product Insights

Light commercial vehicles (LCVs) segment held a dominant presence in the commercial vehicles market in 2025.

- In March 2025, the launch of new electrical light commercial vehicle, the JEM TEZ, alongside the inauguration of advanced manufacturing plant in Pithampur, Indore was launched by Jupiter Electric Mobility (JEM), the electric vehicle division of the Jupiter Group.

Heavy trucks segment is expected to grow at the fastest rate in the market during the forecast period of 2026 to 2035.

- In July 2025, a scheme incentivize electric trucks (e-trucks) under the PM E-DRIVE Scheme was launched by Heavy Industries Minister H.D. Kumaraswamy. This is the first time that the government has launched support for electric trucks to help the country's transition to clean and sustainable freight mobility.

However, the heavy trucks segment is expected to account for the highest growth over the next decade owing to heavy investments of OEMs in the market, rising demand for powerful automobiles with higher Power Sources of carrying to manage weights and strong suspension systems, increasing need for fuel-efficient trucks, and the strict regulations and laws in relation with carbon footprint and emissions.

Commercial Vehicle Market Revenue, By Product, 2023 to 2025 (USD Billion)

| By Product | 2023 | 2023 | 2025 |

| LCVs | 402.1 | 418.0 | 434.9 |

| Buses & Coaches | 16.9 | 17.6 | 18.4 |

| Heavy Truck | 112.8 | 118.0 | 123.6 |

Propulsion Type Insights

The IC engine segment is led the commercial vehicles market.

- In December 2024, the first hydrogen internal combustion engine (H2-ICE) test facility in Chakan, Pune was launched by HORIBA India. The new center will be used to analyze hydrogen fuel internal combustion engine vehicles to promote development in energy saving and reduction of emissions.

The electric vehicle segment set to experience the fastest rate of the market growth from 2026 to 2035.

- In July 2025, Gen-2 Lithium-Ion Battery Packs for commercial electric vehicles was launched by Neuron Energy. These battery packs are designed for electric two wheelers, three wheelers, and light commercial vehicles.

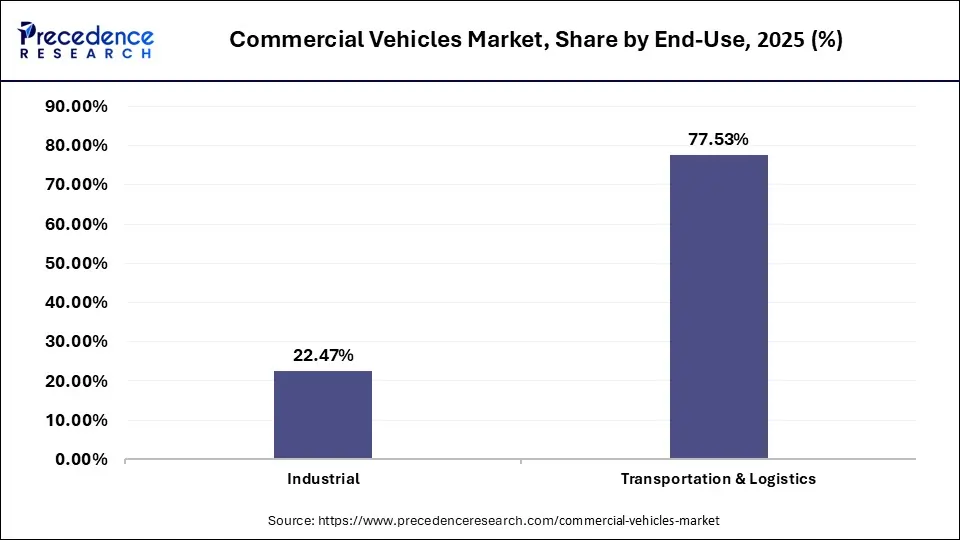

End-use Insights

The transportation segment accounted for a considerable share of the commercial vehicles market in 2025.

- In July 2023, Lloyd's of London Backed Physical Damage Program for Commercial Auto was launched by Reliable Transportation Association (RTA). RTA is a premier managing general agent and Lloyd's of London coverholder, reshaping how commercial auto insurance works for fleets and owner operators in the transportation industry.

The logistics segment is projected to experience the highest growth rate in the market between 2026 and 2035.

- In July 2025, the Pro Plus Trucks for Smarter LMD Logistics was launched by Eicher Trucks and Buses, a division of VE Commercial Vehicles (VECV). This line underlines Eicher's dedication to transforming the logistics sector with high-performance, connected, and sustainable transport solutions tailored for India's fast evolving supply chains.

Power Source Insights

The diesel segment regThe diesel segment registered its dominance over the commercial vehicles market in 2025.

- In March 2025, to launch a co-branded Genuine Diesel Exhaust Fluid (DEF) designed to improve the efficiency and compliance of BS6 commercial vehicles, Hindustan Petroleum Corporation Ltd. (HPCL) collaborated with Tata Motors.

The fuel cell vehicle segment is anticipated to grow with the highest CAGR in the market during the studied years.

- In April 2025, the New XCIENT Heavy-Duty Fuel Cell Truck at ACT Expo 2025 in Anaheim California was launched by Hyundai Motor.

Commercial Vehicle Market Revenue, By Power Source, 2023 to 2025 (USD Billion)

| By Power Source | 2022 | 2024 | 2025 |

| Gasoline | 90.0 | 92.7 | 95.5 |

| Diesel | 282.9 | 290.5 | 298.6 |

| HEV / PHEV | 39.1 | 42.2 | 45.6 |

| Battery Electric Vehicle (BEV) | 73.5 | 79.1 | 85.1 |

| Fuel Cell Vehicle | 12.6 | 13.6 | 14.8 |

| LPG & Natural Gas | 33.7 | 35.6 | 37.3 |

Regional Insights

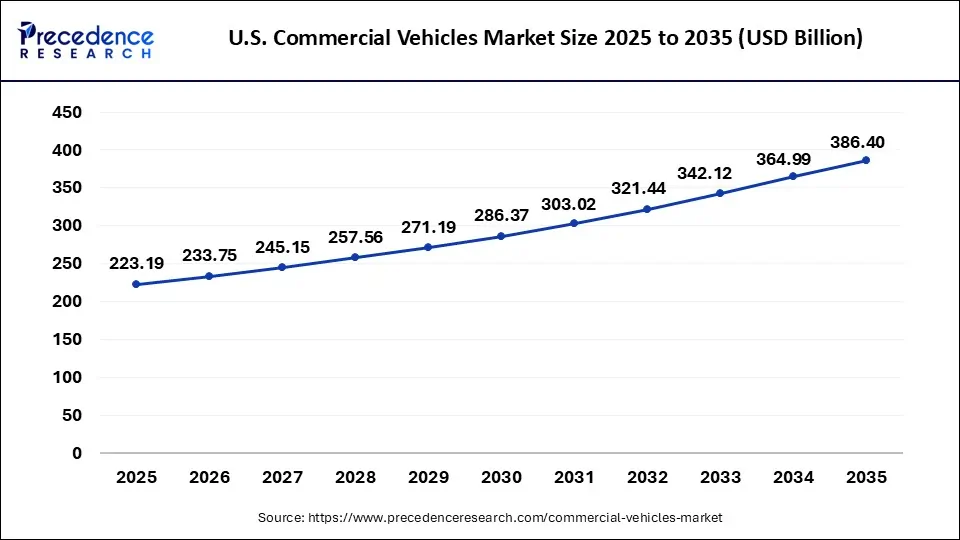

U.S. Commercial Vehicles Market Size and Growth 2025 to 2035

The U.S. commercial vehicles market size was evaluated at USD 223.19 billion in 2025 and is projected to be worth around USD 386.40 billion by 2035, growing at a CAGR of 5.64% from 2026 to 2035.

North America captured the maximum market value share in the global commercial vehicles market and is anticipated to grow at a considerable rate during the forecast period. The U.S. commercial vehicles market size is expected to be worth around USD 408.44 billion by 2035 and is growing at a compound annual growth rate (CAGR) of 5.30% from 2026 to 2035.

North America emerged as the market leader in the global commercial vehicles market owing to the high adoption rate of commercial vehicles in the U.S. Industrial growth, infrastructure development, and government regulations related to maximum loading capacity for commercial vehicles are some of the major factors that propel the market growth in North America.

Significant development in the industrial sector along with stringent government norms pertaining to load carrying capacity of commercial vehicles is the prime factor that triggers the growth of the region. Further, the rising penetration of electric vehicles and battery-powered vehicles as well as government initiatives to promote the adoption of these vehicles to curb carbon emission expected to propel the demand for commercial vehicles in the coming years.

Maximum Share Captured by North America.The rising demand for the long distance operation from fleet management in North America is significantly boosting the growth of the commercial vehicles market. Furthermore, the growing developments in the industrial sector and the strict regulations of the government pertaining to the load carrying capacity of the commercial vehicles have led to the growth of the market. The presence of unified supply network in North America and establishment of a strong connection between manufacturers and consumers via multiple transportation mediums such as maritime transport, air transport, truck transport, and rail transport are driving the growth of the North America commercial vehicles market. The easy availability of various financing options in North America is further boostingthe market growth. The aggressive investments in the infrastructural development in North America, presence of leading automotive manufacturers in the region, and favorable government support are the most prominent factors that has significantly driven the growth of the North America commercial vehicles market in the past years. Moreover, the demand for the light commercial vehicles is growing rapidly owing to the rising penetration of the online cab services and car rental services in North America.

Besides this, the Asia Pacific registered the highest growth rate over the analysis period. The attractive growth of the region is mainly because of escalating growth in industrial sector, highest adoption rate of electric vehicles in the region, and high yearly investment for infrastructure development.

This is attributed to the increasing road infrastructure along with rising manufacturing facilities due to cost-effective raw materials and labor, particularly in the developing countries such as India and China. In addition, the region is highly promising for the growth of smart mobility solutions owing to favorable policies by governments in the region expected to accelerate the market growth prominently.

Asia Pacific Forecast the Strongest Growth Rate during the Forecast Year (2025-2034). Asia Pacific is expected to witness the fastest growth rate during the forecast period. Asia Pacific is witnessing rapid industrialization, rapid urbanization, presence of huge population, and aggressive investments by the government in the development of sophisticated infrastructure. The presence of huge industries in the region has significantly boosted the demand for the commercial vehicles in this region for transportation of goods to the domestic and international regions. Furthermore, China is one of the largest producer and consumer of electric vehicles across the globe.

The rising government initiatives to eliminate carbon emission from vehicles have significantly boosted the demand for the electric commercial vehicles in the region. The growing popularity of the car rental services in this region is expected to fuel the demand for the commercial vehicles during the forecast period. The countries like India, China, and South Korea are heavily investing in the adoption of sustainable public transport solutions in order to move closer towards achieving zero emission economy, which is a prominent factor boosting the growth of the commercial vehicles market in Asia Pacific.

Commercial Vehicles Market Companies

- Bosch Rexroth AG

- Ashok Leyland

- Daimler

- Toyota Motor Corporation

- Volkswagen AG

- Mahindra and Mahindra

- VOLVO

- TATA Motors

- General Motors

- Golden Dragon

Recent Developments

- In June 2025, a new milestone in cargo mobility with the launch of all-new Tata Ace Pro, India's most affordable 4-wheel mini truck starting at ? 3.99 lakh delivering exceptional efficiency, unmatched versatility, and superior value was introduced by Tata Motors, India's largest commercial vehicle manufacturer.

- In July 2025, the launch of Coretura AB, In July 2025, the launch of Coretura AB, their joint venture aimed at transforming the commercial vehicle industry through a new software-defined vehicle platform and establishing a new industry standard was announced by Volvo Group and Daimler Truck

Segments Covered in the Report

By Product

- Light Commercial Vehicles (LCVs)

- Buses & Coaches

- Heavy Trucks

By End-use

- Industrial

- Transportation

- Others

By Propulsion Type

- IC Engine

- Electric Vehicle

By Power Source

- Gasoline

- Diesel

- HEV / PHEV

- Battery Electric Vehicle (BEV)

- Fuel Cell Vehicle

- LPG & Natural Gas

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting