What is the U.S. Commercial Vehicles Market Size?

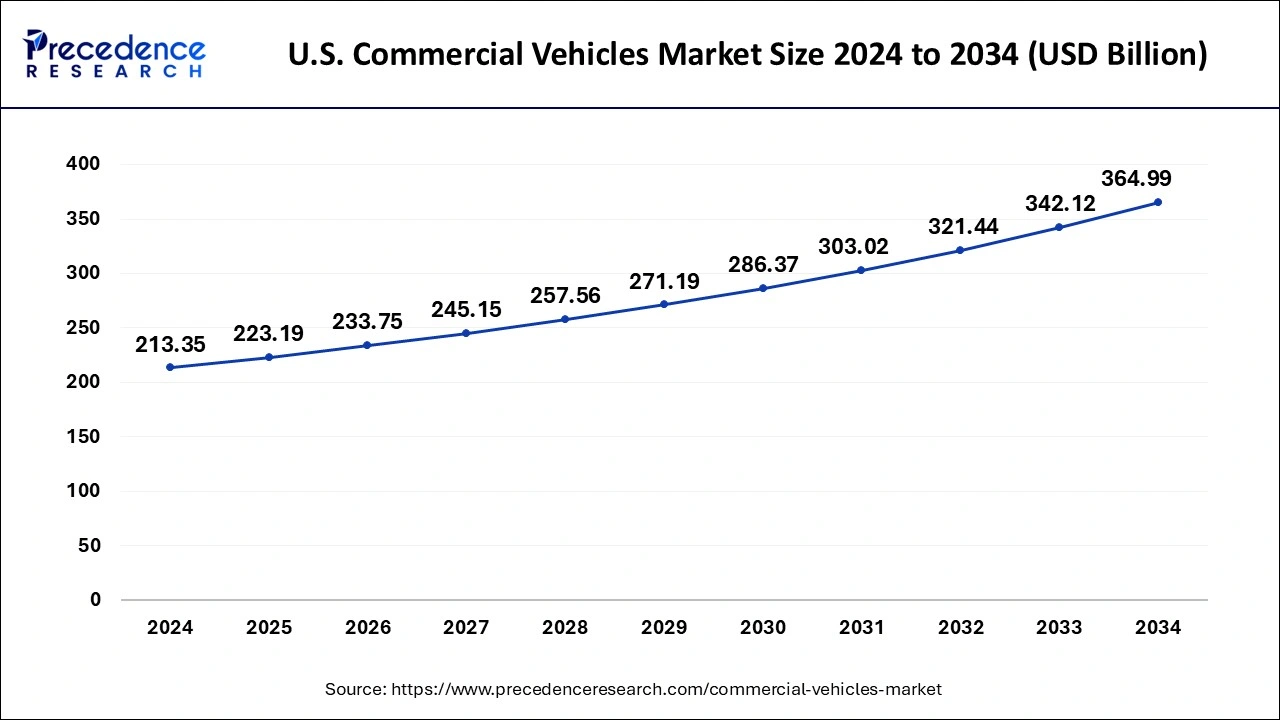

The U.S.commercial vehicles market size is calculated at USD 223.19 billion in 2025 and is predicted to increase from USD 233.75 billion in 2026 to approximately USD 364.99 billion by 2034, expanding at a CAGR of 6.80% from 2025 to 2034.

Market Highlights

- By product, the light commercial vehicles (LCVs) segment held the dominating share of the market in 2024.

- By end-use, the logistics segment estimated for the largest market share in 2024.

- By end-use, the passenger transportation segment is expected to grow at a significant rate during the forecast period.

- By propulsion type, the electric vehicle segment held the largest share of the market in 2024.

- By power source, the battery electric vehicle (BEV) segment is expected to hold a significant market share over the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 66.75 Billion

- Market Size in 2026: USD 69.80 Billion

- Forecasted Market Size by 2034: USD 106.02 Billion

- CAGR (2025-2034): 5.17%

Commercial Vehicles Accelerate with Surging E-Commerce Sales

Vehicles used for business or commerce as opposed to personal mobility are referred to as commercial vehicles. Usually, these vehicles are built and outfitted to carry out certain duties or to transport cargo, people, or equipment in exchange for money. In many different sectors and industries, commercial vehicles are essential to the movement of products and services. Depending on their intended purpose, they frequently have particular configurations and are subject to various rules and licensing requirements.

- According to the data published by OBERLO, U.S. e-commerce sales are estimated to be around USD 1.04 trillion in 2024, an increase of 8.5% in 2024.

Sales of 6476 units were reported by VE Commercial Vehicles Ltd. (a joint venture between the Volvo Group and Eicher Motors) in August 2023, up from 5003 units in August 2022, signifying an increase of 29.40%. This comprises 237 units under the Volvo brand and 6239 units under the Eicher brand.

Market Outlook

- Industry Growth Offerings: The U.S. commercial vehicle industry offers a range of products, including light, medium, and heavy-duty trucks, vans, and buses. Solutions focus on fuel efficiency, safety, telematics, modular designs, and customization to meet diverse business and fleet needs.

- Global Expansion: The U.S. commercial vehicle market is expanding globally through exports, strategic partnerships, and joint ventures. Manufacturers are targeting emerging markets, enhancing technology transfer, and leveraging brand reputation to increase international sales of trucks, vans, and fleet solutions.

- Startup ecosystem: The U.S. commercial vehicle startup ecosystem is growing with companies focusing on electric trucks, autonomous driving, fleet management software, and sustainable logistics solutions. Innovation hubs, venture funding, and collaboration with established manufacturers are driving rapid development in the sector.

U.S. Commercial Vehicles MarketGrowth Factors

- The rise of e-commerce has dramatically increased the demand for efficient last-mile delivery services. Delivery vans and trucks are crucial for transporting goods from distribution centers to end consumers, driving the demand for commercial vehicles.

- The integration of advanced technologies, such as telematics, autonomous driving capabilities, and connectivity, is influencing the US commercial vehicle market. Fleet operators seek vehicles with improved safety features, efficiency, and connectivity, contributing to the growth of the market.

Major Key Trends in U.S. Commercial Vehicles Market

- Electrification of Commercial Fleets: Due to environmental policies and progress in battery technology, there is a notable transition towards electric commercial vehicles, aiming to lower emissions and operating expenses for fleets.

- Integration of Advanced Technologies: Commercial vehicles are increasingly adopting advanced driver-assistance systems (ADAS), telematics, and connectivity features to improve safety, operational efficiency, and fleet management capabilities.

- Growth in E-commerce and Last-Mile Delivery: The rise in e-commerce has heightened the demand for light commercial vehicles, especially vans, to streamline effective last-mile delivery services in urban and suburban settings.

- Infrastructure Development and Urbanization: Continued infrastructure initiatives and urban growth are driving the demand for heavy-duty trucks and construction vehicles, necessary for transporting materials and equipment.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 223.19 Billion |

| Market Size in 2026 | USD 69.80 Billion |

| Market Size by 2034 | USD 364.99 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.80% |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End-use, Propulsion Type, and Power Source |

Market Dynamics

Drivers

Growth of online delivery services for groceries and perishable commodities

The rise of the US commercial vehicles market is being driven by the proliferation of online grocery and perishable product delivery. The need for reliable and efficient delivery services has grown as more people buy groceries and perishable goods online. Due to their ability to deliver these delicate items in a fast and secure manner, commercial trucks are essential to satisfying this demand.

Specialized trucks with temperature control systems are needed for the perishable goods segment to preserve the freshness and quality of items while they are being transported. Commercial trucks with refrigeration units that are built for cold chain logistics make it possible to deliver goods like dairy, prescription drugs, and fresh fruit.

The necessity for adaptable and well-equipped commercial trucks that can handle a range of load sizes, navigate urban surroundings, and meet strict delivery deadlines is increased by this growing trend. As a result, the commercial vehicle industry in the United States is expanding since these vehicles are essential to the smooth and effective delivery of groceries and perishable goods to customers' doorsteps.

Restraint

Short range of electric commercial vehicles

Modern electric cars have small-capacity batteries that can only go so far between charges. The cost and performance of electric vehicles are directly impacted by the quality and lifespan of batteries. Lead-acid, nickel-cadmium, nickel-metal hydride, and lithium-ion batteries are now used to power electric cars.

Lithium-ion batteries are gradually taking the place of lead-acid, nickel-cadmium, and nickel-metal hydride batteries in electric cars due to their longer lifespan. However, the capacity of lithium-ion batteries is not high enough to power commercial vehicles. It is difficult for batteries to generate their full power at low temperatures due to a severe decline in their charging-discharging performance. Thus, this is expected to hinder the US commercial vehicles market during the forecast period.

Opportunity

Increasing the use of fleet management and telematics systems

The U.S. commercial vehicles market is being stimulated by the increasing integration of fleet management and telematics technologies. Fleet managers may now get real-time information on driver behavior, vehicle performance, location tracking, and maintenance requirements through these technologies. Fleet productivity is increased, downtime is decreased, and operational efficiency is optimized using this kind of data-driven knowledge. Because they enable preventative maintenance, optimize routes, and monitor driver behavior, telematics, and fleet management systems are essential for supporting safety protocols. Adopting these solutions is essential as companies place a greater emphasis on safety and regulatory compliance.

Additionally, the industry is being driven by the combination of telematics and the growing need for environmentally friendly transportation. Telematics helps businesses run more efficiently and sustainably by streamlining operations, cutting fuel use, and lowering carbon emissions. The U.S. commercial vehicle market is changing as a result of the integration of telematics and fleet management systems, which provide eco-friendly, safer, and more efficient operations. As a result, it addresses changing industry demands and maximizes vehicle performance, which propels the expansion of the U.S. commercial vehicles market.

Segments Insights

Product Insights

The light commercial vehicles (LCVs) segment held the largest share of the U.S. commercial vehicles market in 2024.For the transportation of both passengers and products,light commercial vehiclesare seen to be an affordable choice. LCVs help reduce emissions and have several tax advantages. These cars may also be customized to carry both passengers and cargo, making them extremely dynamic. They are also reasonably priced, which could help the segment's expansion.

The buses & coaches segment is expected to grow at a rapid rate over the forecast period. The segment's expansion may be ascribed to the tourist and healthcare sectors' growing usage of buses and coaches. Because they are the most economical form of transportation, buses and coaches are in high demand and sell well. The increasing usage of electric buses to reduce vehicle emissions in both developed and developing nations is encouraging the expansion of the buses and coaches segment of the US commercial vehicles market.

End-use Insights

The logistics segment held the largest share of the U.S. commercial vehicles market in 2024. Commercial vehicles, such as trucks and vans, are the backbone of transporting goods from manufacturing facilities to distribution centers and ultimately to retailers or directly to consumers. The logistics industry heavily relies on a well-functioning fleet of commercial vehicles to ensure timely and efficient delivery. In addition, logistics companies invest in comprehensive fleet management systems to monitor and optimize the use of their commercial vehicle fleets. These systems often include technologies such as GPS tracking, fuel management, maintenance scheduling, and route optimization to enhance operational efficiency.

The passenger transportation segment is expected to grow at a significant rate over the forecast period. It is expected that the demand for commercial automobiles will rise as more people use public transit. In terms of both time and expense, many find that using public transportation which is frequently well-developed in metropolitan areas is more efficient than driving to work. A key driver of the passenger transportation industry is the availability and affordability of personal transportation, as well as the growing overall cost of personal car ownership. Thus, driving the segment growth.

Propulsion Type Insights

The electric vehicle segment dominated the U.S. commercial vehicles market in 2024.The segment expansion is attributed to the rising launches of commercial electric vehicles by the key market players in the U.S.

- In April 2023, under the new brand name RIZON, the Daimler Truck Group introduced a range of electric vehicles to the US market. Public introductions of the RIZON brand and its lineup of vehicles will take place at the Advanced Clean Transportation (ACT) Expo in Anaheim, California. The first trucks offered under the RIZON brand will be the e18L, e16L, and e16M model versions.

Power Source Insights

The battery electric vehicle (BEV) segment is expected to hold a significant market share over the forecast period. The BEV segment is expected to grow significantly during the forecast period. BEVs are considered more environmentally friendly compared to traditional internal combustion engine vehicles. The commercial sector's adoption of BEVs aligns with the growing emphasis on sustainability, reducing greenhouse gas emissions, and addressing climate change concerns. Thereby, driving the segment expansion.

State-wise Insights

The well-established oil & gas industry drives Texas market growth

Texas is a major contributor to the U.S. commercial vehicle market. The presence of vast infrastructure networks of rail lines, roads, seaports, and highways helps in the market growth. The presence of a vast number of trucking and logistics drivers in the area increases demand for commercial vehicles. The well-established automotive manufacturing industry drives the market growth. The strong presence of the oil & gas industry increases demand for commercial vehicles for transportation, contributing to overall market growth.

Business hub surging demand for U.S. commercial vehicles in California

California is a key contributor to the U.S. commercial vehicles market. The growing demand for logistics & transportation and business hubs for various industries like technology, manufacturing, and agriculture increases demand for commercial vehicles. The presence of the Port of Long Beach and the Port of Los Angeles increases demand for commercial vehicles. The growing demand for zero-emission commercial vehicles and the increasing demand for public vehicles like buses drive the overall market growth.

Value Chain Analysis

1.Raw Material Sourcing

- Raw material sourcing for U.S. commercial vehicles involves obtaining essential materials such as steel, aluminum, plastics, and rubber.

- These materials are processed into vehicle components and assembled into final products.

- The supply chain is global and complex, requiring coordination across multiple suppliers and regions.

Key players: ArcelorMittal, aluminum producers such as Alcoa, and automotive component manufacturers, including Bosch and Continental.

2.Component Manufacturing

- Component manufacturing for U.S. commercial vehicles covers a broad spectrum of parts, from traditional components to advanced, emerging technologies.

- The process involves both large multinational suppliers and specialized manufacturers.

Key players: ZF Friedrichshafen AG (drivetrain and chassis systems), Cummins Inc. (engines and powertrains), Bosch (electrical and electronic systems), Continental (tires and braking systems), and Denso (automotive electronics).

Vehicle Assembly and Integration

- Vehicle assembly for U.S. commercial vehicles uses advanced assembly lines with automation, modular designs, and flexible platforms.

- These methods allow the production of a wide range of vehicles, from light-duty trucks to heavy-duty trucks.

- Emphasis is on efficiency, scalability, and customization to meet diverse market needs.

Key players: Ford Motor Company, Daimler Trucks North America, PACCAR Inc., Navistar International, and Volvo Group.

U.S. Commercial Vehicles Market Companies

- Ford Motor Company: Offers light and medium-duty trucks, vans, and chassis with advanced safety and fuel-efficient technologies for commercial use.

- Hino Motors, Ltd.: Delivers medium and heavy-duty trucks emphasizing reliability, low emissions, and operational efficiency.

- GM motors: Provides commercial vans, trucks, and fleet solutions with connectivity and durability features.

- Paccar Inc: Manufactures heavy-duty trucks under Kenworth, Peterbilt, and DAF brands, focusing on performance and reliability.

- Volvo Group: Supplies medium and heavy-duty trucks with innovative safety, telematics, and fuel-efficient solutions.

Other Major Key Players

- Daimler Trucks North America

- ZF Friedrichshafen AG

- Navistar International Transportation Corporation

- Toyota motor corporation

- ISUZU COMMERCIAL TRUCKS

Recent Developments

- In April 2025, Coulomb Solutions launched the Super Long Life commercial vehicle battery for U.S. trucks, trains, buses, and many more vehicles. The battery comes with a 15-year warranty and consists of a large 900000-mile. The battery has an energy density of 270Wh/Kg and a specific energy of 175Wh/kg. The battery is designed by a Chinese battery manufacturer, CATL, and is used in last-mile delivery vehicles & commercial vehicles .

- In January 2025, ZM trucks to launch a manufacturing plant in Fontana, California. The company focuses on manufacturing 100000 zero-emission commercial vehicles annually at the new 210000 square foot plants. The facility will assemble airport ground service equipment, commercial trucks, and terminal tractors. The facility creates new job opportunities and production starting in first half of 2025 .

- In May 2024, Hyundai Motor launched the NorCAL ZERO project to bring zero-emission freight transportation in the U.S. The project aims to reduce 24000 metric tons of carbon emissions. The company is utilizing hydrogen fuel cell technology to reduce carbon emissions in California's Central Valley and San Francisco Bay Area .

- In August 2023, BYD | RIDE provided the City of Burlington in North Carolina with two K7M 30-foot battery-electric buses designed for the Link Transit Fleet, which serves local passengers. These 30-foot buses can hold up to 22 passengers and come with the safest batteries in the industry, ensuring a smooth, quiet, and environmentally-friendly experience throughout the city.

- In June 2023, General Motors Co. purchased ALGOLiON Ltd., a battery software startup based in Israel, for an undisclosed sum. The software leverages data streams from electric vehicle battery management systems to detect irregularities in battery performance, ensuring effective vehicle health management and enabling early identification of potential battery hazards, such as thermal runaway incidents.

- In May 2023, Scania announced plans to transform its bus and coach operations to offer customers competitive and sustainable mobility solutions while ensuring profitable growth in a shifting market landscape.

- In July 2023, presenting its most recent eMobility kit, Z.F.'s Commercial Vehicle Solutions (CVS) business demonstrated its dedication to the complete electric mobility of the future.

- In February 2022, BYD unveiled a new all-electric Type A school bus in the United States. The battery-powered bus is available in three different lengths: 26.7 feet (8.1 meters), 24.5 feet (7.45 meters), and 22.9 feet (7 meters), making it suitable for routes with fewer students.

Segments Covered in the Report

By Product

- Light Commercial Vehicles (LCVs)

- Buses & Coaches

- Heavy Trucks

By End-use

- Mining & Construction

- Industrial

- Passenger Transportation

- Logistics

- Others

By Propulsion Type

- IC Engine

- Electric Vehicle

By Power Source

- Gasoline

- Diesel

- HEV/PHEV

- Battery Electric Vehicle (BEV)

- Fuel Cell Vehicle

- LPG & Natural Gas

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting