What is the U.S. Commercial Vehicle Roadside Assistance Market Size?

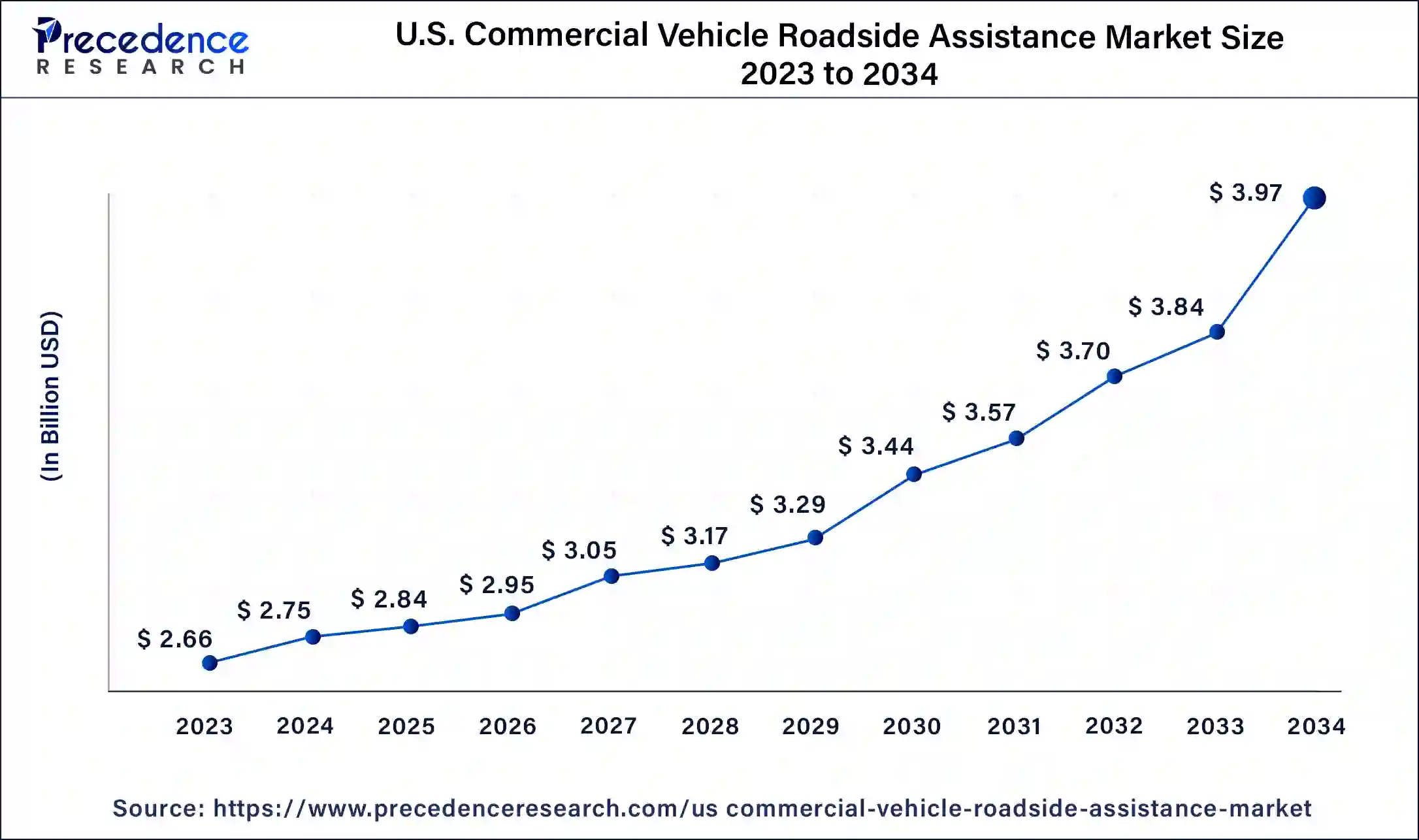

The U.S. commercial vehicle roadside assistance market size is accounted at USD 2.84 billion in 2025 and predicted to increase from USD 2.95 billion in 2026 to approximately USD 4.10 billion by 2035, representing a CAGR of 3.74% from 2026 to 2035. The market is driven by customer preferences for fuel-efficient and safe vehicles, e-commerce sector growth, and infrastructure development.

U.S. Commercial Vehicle Roadside Assistance Market Key Takeaways

- By service, the towing segment contributed the largest market share of 33.49% of market share in 2025.

- By service, the tire replacement segment is estimated to grow fastest during the forecast period.

- By provider, the auto manufacturer segment generated the biggest market share of 50.10% in 2025.

- By provider, the motor insurance segment is projected to expand rapidly over the coming years.

- By vehicles, the light commercial vehicles segment accounted for the highest market share of 69.84% in 2025.

- By vehicles, the heavy commercial vehicles segment is estimated to grow at the fastest rate during the forecast period.

Market Overview

The U.S. commercial vehicle roadside assistance market involves offering 24/7 roadside assistance services to commercial vehicles. Commercial vehicles like trucks transport goods and logistics from one destination to another. These vehicles need timely intervention and repair in case of breakdowns. Roadside assistance plays a vital role by offering a rapid-response solution and minimizing downtime by addressing mechanical issues on the spot. It ensures the protection of the vehicle and goods so that they reach the destination on time. Some roadside services provided include a flat battery to resolve issues in a battery, spare keys, flat tire, towing facilities, minor repairs, fuel assistance, load shifts, transfer, etc. For commercial vehicles, roadside assistance is an essential strategic requirement. In 2022, there were 1.85 million new commercial registrations in the US, a 4% rise from the previous year, 2021. The number of operating vehicles increased further, reaching 30.1 million commercial vehicles by 2022.

How is AI Changing the U.S. Commercial Vehicle Roadside Assistance Market?

Technological advancements like artificial intelligence are a boon to roadside assistance services. It enables service providers to deliver faster and more efficient services to customers. One of the widespread applications of AI is the use of mobile apps and software to connect service providers whenever needed.

Another advancement is automated customer recognition via biometrics, ensuring greater safety and security. In case of emergencies, AI can feature voice assistants for immediate services. Additionally, it can estimate the cost of repair and accelerate the repair process. Furthermore, AI can enable real-time data collection through road infrastructure that simplifies incident management and improves traffic and travel times, which can significantly reduce road accidents.

- In September 2023, AAA, in collaboration with Apple, announced a novel satellite-powered roadside assistance feature in iPhone 14 and 15, exclusively for U.S. customers, offering two years of emergency SOS and roadside assistance access for free upon activation.

Major Trends

- Digital and App-Based Platforms: Companies are increasingly adopting mobile apps and online platforms to provide real-time service requests, tracking, and faster response times.

- Predictive Maintenance Integration: Fleet operators are leveraging AI and telematics to predict vehicle breakdowns, reducing emergency calls and improving service efficiency.

- Expanded Service Offerings: Roadside assistance providers are broadening services beyond towing, including on-site repairs, tire changes, fuel delivery, and battery support to meet diverse commercial vehicle needs.

Market Outlook

- Industry Growth Overview: The U.S. commercial vehicle roadside assistance market is growing due to the rising number of commercial vehicles, increasing logistics and fleet operations, and demand for quick breakdown solutions. Technological advancements such as GPS-enabled assistance, mobile apps, and predictive maintenance services are further driving market expansion.

- Major Investors: Major investors in the market include Agero, GEICO, Urgent.ly, Roadside Masters, Honk Technologies, Bridgestone, ARI Fleet, and Fleet Complete. These investors contribute by funding infrastructure, expanding service networks, and integrating advanced technologies to enhance response times and service efficiency.

- Startup Ecosystem: Emerging companies are contributing to the market by introducing innovative digital platforms, app-based on-demand assistance, and AI-powered predictive maintenance solutions. These startups improve accessibility, reduce downtime for commercial vehicles, and push established players to adopt more tech-driven, customer-focused services.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 4.10 Billion |

| Market Size in 2025 | USD 2.84 Billion |

| Market Size in 2026 | USD 2.95 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 3.74% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service, Provider, Vehicle |

Market Dynamics

Drivers

Rising road accidents

Commercial vehicles require emergency roadside services in case of a major breakdown or an accident. The rising number of road accidents in the US demand roadside assistance services for commercial vehicles. According to a Forbes report, approximately 5,930,496 car accidents were reported in 2022. In the majority of cases, commercial vehicles need to be towed from the accident site to help the driver transport the vehicle to a garage and to reduce traffic, allowing way for other vehicles. Other services include tire replacement, fuel delivery, and locksmith service. Additionally, several car insurance policies, including roadside assistance policies, facilitate demand in the U.S. commercial vehicle roadside assistance market.

Restraint

The major limitation in the U.S. commercial vehicle roadside assistance market is the cost of the service. The high cost of roadside assistance depends on the provider and the coverage offered by different companies. Some companies may provide limited services like towing to a certain distance. Additionally, calling a roadside service could be difficult in areas with limited mobile networks. Another huge risk is the accidents of road assistance workers by either car passing while they work or hitting a car from behind.

Opportunity

Rise in the Use of Electric Vehicles

The advancements in technology favor the use of electric vehicles (EVs) for commercial purposes. According to Cox Automotive, nearly 577,000 electric vehicles were sold in the US in the first half of 2023. EVs offer several advantages as they are efficient and cost-effective. Even though EVs do not require petrol or diesel, they are machines and are prone to breakdown. The common issues that need to be resolved in an EV through roadside assistance include dead battery. The lithium-ion battery can sometimes need to be changed as it may be degraded after long-term use. Other problems encountered in an EV include brake problems, flat tires, and lock and key assistance.

- In May 2024, Mullen Automotive, Inc., an electric vehicle manufacturer and Pritchard EV, joined with Mobile Road Service Solutions (MRSS) to introduce the Mullen ONE, Class 1 EV cargo van roadside assistance vehicle upfit.

US Commercial Roadside Assistance Market Revenue, By Service 2019-2030

| By Service | 2020 | 2021 | 2022 | 2023 |

| Tyre Replacement | 410 | 440 | 460 | 470 |

| Towing | 780 | 840 | 860 | 890 |

| Jump Start/Pull Start | 290 | 320 | 330 | 340 |

| Fuel Delivery | 130 | 140 | 140 | 150 |

| Lockout/ Replacement Key Services | 170 | 180 | 190 | 190 |

| Battery Assistance | 190 | 210 | 210 | 220 |

| Winch | 080 | 090 | 090 | 090 |

| DPF Regen/ Computer Assisted Regen | 110 | 120 | 120 | 130 |

| DPF Regen/ Computer Assisted Regen | 170 | 180 | 180 | 180 |

Service Insights

The towing segment dominated the U.S. commercial vehicle roadside assistance market in 2025. Towing assists a driver in transporting a vehicle from one place to another in case of a breakdown or accident. The vehicle needs to be loaded onto the tow truck in cases of engine failure or collision damage using specialized equipment like winches or cranes. The towed vehicle is transported either to an auto repair shop or any other location specified by the driver. Hence, towing services help drivers safely remove their vehicles from crowded roads and highways, thereby decreasing the likelihood of more accidents or traffic disruptions.

- In March 2023, EasyMile, a global leader in autonomous driving solutions, presented its “TractEasy” driverless tow tractor at an event in Chicago. The TractEasy has a load capacity of 14 tons and is deployed at several sites around the world. It uses advanced technologies like real-time processing, centimeter-precise localization, and wide-range perception to handle objects.

The tyre replacement segment is estimated to grow at the fastest rate in the U.S. commercial vehicle roadside assistance market during the forecast period. The tires in commercial vehicles need to be checked frequently for wear and tear and to avoid overuse. The Department of Transportation (DOT) issues several guidelines and safety regulations for commercial vehicles' tires.

According to the Commercial Vehicle Safety Alliance (CVSA), tire issues are the second most common issue in commercial vehicles. The tire flat or audible leak violation is the most common violation every year. The road assistance service helps the driver by replacing the tires according to their requirements. Continental AG, a German tire manufacturer, predicted that commercial vehicle replacement tire sales in North America will rise between 2% and 4% year-over-year in 2024.

Provider Insights

The auto manufacturer segment held a dominant presence in the U.S. commercial vehicle roadside assistance market in 2025. Auto manufacturers provide after-sales services like warranties facilitating their demand. Many auto manufacturers also provide roadside assistance services for their commercial vehicles. These services are either free of cost or at a very reasonable rate for the predetermined period. The service period and cost depend on different manufacturers. Auto manufacturers like BMW, Ford, Tesla, Mercedes-Benz, etc provide roadside assistance. The roadside assistance includes tire replacement, jump-start, locksmith services, fuel requirements, and towing. Some companies also offer reimbursement policies to enable owners to reconfigure their travel plans.

The motor insurance segment is projected to expand at the fastest rate in the U.S. commercial vehicle roadside assistance market over the coming years. Roadside assistance is an add-on feature that can be included in a car insurance policy. Additionally, some insurance companies provide roadside assistance as a standalone option without adding it to the car insurance policy. It provides access to emergency services in the event of a breakdown or other mishap. The high costs of roadside assistance services can limit the affordability of the owners. According to Forbes, companies like Erie, Geico, Good Sam, and Nationwide offer the best insurance plans for roadside assistance.

Vehicle Insights

The light commercial vehicles segment held the largest share of the U.S. commercial vehicle roadside assistance market in 2023. Alternative fuel vehicles and electric and hybrid powertrains are examples of light commercial vehicles. The demand for light commercial vehicles is increasing due to the growing e-commerce sector for last-mile delivery.

The heavy commercial vehicles segment is estimated to grow at the fastest rate in the U.S. commercial vehicle roadside assistance market during the forecast period. Heavy vehicles require roadside assistance services like towing, winching, battery jump-start, fuel and fluid delivery, locksmith service, and flat tire service. Heavy commercial vehicles are primarily used for the transportation of goods from one place to another.

- In May 2023, Progressive Insurance introduced a heavy truck roadside assistance policy as an optional coverage. The policy will cover up to $500 in labor at the site of disablement and up to $5,000 in towing to the nearest qualified repair facility for the insured vehicle and attached trailer.

U.S. Commercial Vehicle Roadside Assistance Market Companies

- Trimble Transportation

- Love's Travel Stops & Country Stores

- TravelCenters of America

- FleetNet America

- Pilot Travel Centers, LLC

- TTS Road Service

- Samsara

- Agile Fleet Commander

- Fiix

- Fleetio

New Advancements

- In August 2024, HONK Technologies, a roadside assistance software company, launched its new and innovative service plans with three levels of service: HONK Core, HONK Enhanced, and HONK Enterprise, and a suite of AI-driven digital tools. The newly designed websites simplify decision-making for customers.

- In March 2024, Miovision, an ITS firm, acquired TTS, a pioneer in V2X services. The acquisition will add a new dimension to Miovision's array of solutions by scaling its critical services. The motive is to save lives, reduce energy consumption, and increase productivity.

- In June 2024, Trucker Path announced the launch of RoadsideMASTERS.com, an emergency roadside assistance program. The new website was designed to offer 24/7 emergency assistance, skilled repairs, and minimizing downtime and expenses.

- In August 2024, TravelCenters of America, in collaboration with the California Energy Commission, developed a new charging hub for electric trucks in Ontario, Canada. The hub features four chargers with 400 kW each and a one-megawatt charger. The nation's first publically accessible charging station for medium- and heavy-duty trucks provides DC ultra-fast charging for up to five trucks simultaneously.

- In January 2024, Fleetio announced a collaboration with BeyondTrucks, a multi-tenant SaaS transportation management system provider, to enable customers with real-time asset information, resulting in better decision-making. The fleet managers will have opportunities to improve the cost efficiency of fleets by determining the scheduled maintenance.

Segments Covered in the Report

By Service

- Towing

- Tyre Replacement

- Jump Start/Pull Start

- Fuel Delivery

- Lockout/Replacement Key Services

- Battery Assistance

- Winch

- DPF Regen/Computer Assisted Regen

- Others

By Provider

- Auto Manufacturer

- Motor Insurance

- Automotive Clubs

- Independent Warranty

- Others

By Vehicle

- Light Commercial Vehicles

- Heavy Commercial Vehicles

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting