U.S. Automotive Aftermarket Size and Forecast 2025 to 2034

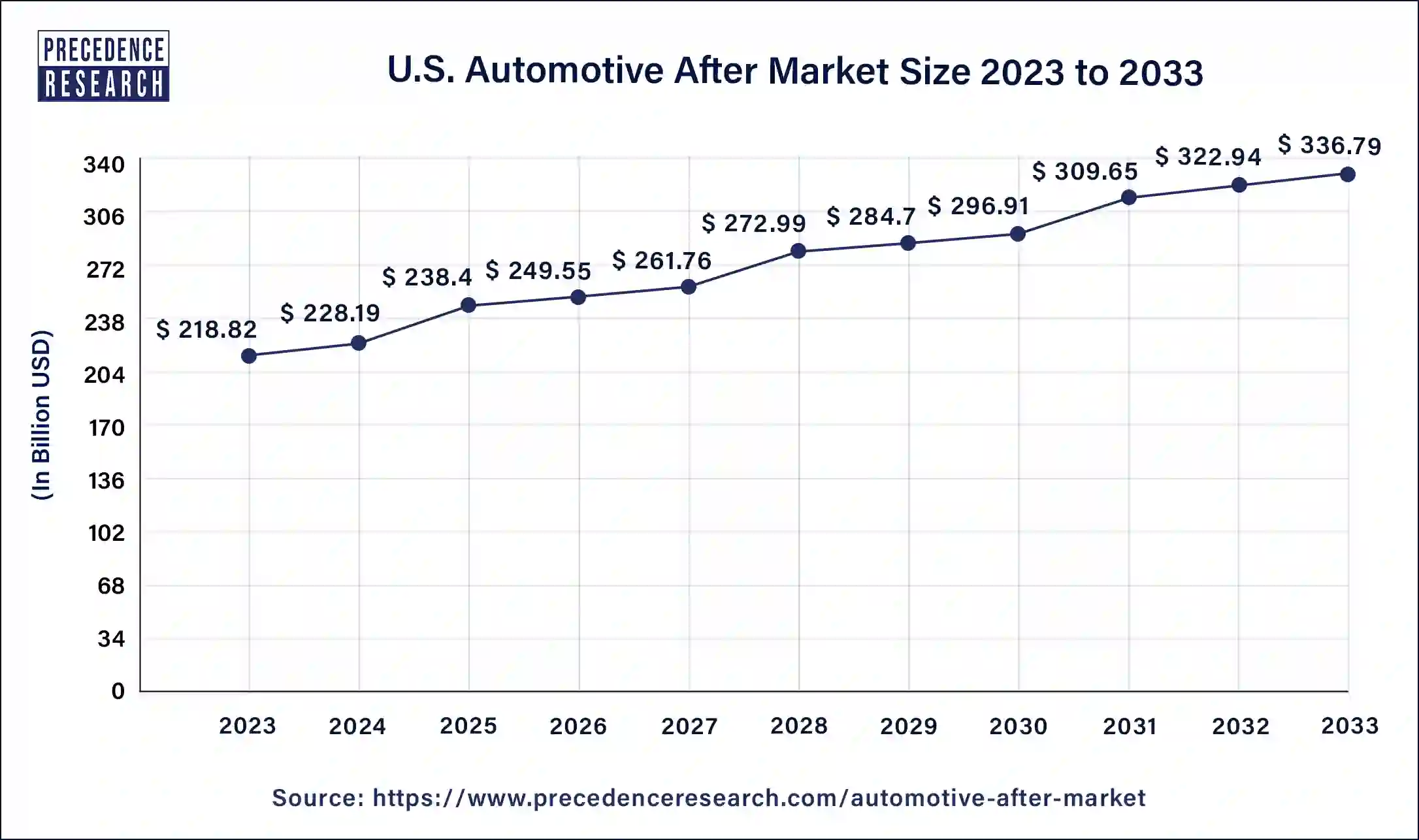

The USautomotive aftermarket size reached USD 228.19 billion in 2024 and is estimated to surpass around USD 350.64 billion by 2034, growing at a CAGR of 4.39% from 2025 to 2034.

U.S. Automotive Aftermarket Key Takeaways

- By replacement part type, the hard parts segment held a dominant presence in the market in 2024.

- By replacement part type, the electrical components segment accounted for considerable growth in the U.S. automotive aftermarket market over the forecast period.

- By service channel, the DIFM (Do-It-For-Me) segment held the major market share in 2024.

- By service channel, the online/offline retailers segment is projected to grow at a CAGR between 2025 and 2034.

- By vehicle type, the passenger vehicles segment registered its dominance in the U.S. automotive aftermarket market in 2024.

- By vehicle type, the light commercial vehicles (LCVs) segment is expected to grow significantly during the forecast period.

- By propulsion type, the Internal Combustion Engine (ICE) segment accounted for the dominating share in 2024.

- By propulsion type, the electric vehicle segment is expected to witness a significant share during the forecast period.

Market Overview

The expanding electric vehicle (EV) population necessitates specialized infrastructure, services, and parts for software updates, charging systems, and battery maintenance. Sensor-equipped and telematics-equipped vehicles produce data, which makes individualized service recommendations and predictive maintenance possible. Online sales are growing because they are convenient and have competitive prices.

Possibilities for aftermarket manufacturers to create training materials, diagnostic tools, and repair kits tailored to EVs. With flexible delivery options and individualized product recommendations, they improved online shopping experiences. More reasonably priced, refurbished, and recycled parts are available.

Subscription-based programs provide flexible and convenient car care and maintenance options. Creating software, diagnostic tools, and maintenance kits tailored to electric vehicles. Preventive repairs and customized service recommendations are provided via data-driven maintenance platforms.

U.S. Automotive Aftermarket Growth Factors

- As EV use increases, the need for specialized parts, charging infrastructure, and software updates increases.

- The need for cybersecurity solutions, remote diagnostics, and data-driven services is being pushed by increased connectivity.

- Online platforms encourage the growth of online parts and service bookings because they provide convenience and price transparency; the emergence of online platforms create a significant growth factor for the US automotive aftermarket.

- New aftermarket software upgrades, customization, and sensor maintenance opportunities will arise as autonomous vehicles (AVs) gain traction.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 350.64 Billion |

| Market Size in 2025 | USD 238.4 Billion |

| Market Size in 2024 | USD 228.19 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.39% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Replacement Part Type, Service Channel, Vehicle Type, Propulsion Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa |

Market Dynamics

Drivers

- The increasing complexity of modern vehicles

Modern cars have sophisticated parts, intricate electronic systems, and cutting-edge technologies. Many customers and even some vehicle repair companies may require additional knowledge and abilities to maintain and repair this complexity. Therefore, the need for aftermarket services to handle these complications is rising. Modern automobiles last longer because of advancements in engineering and manufacturing despite their increasing complexity. The need for aftermarket services is further increased because automobiles require regular maintenance and repairs as they age. Thereby, the rising complexity of modern vehicles is observed to act as a driver for the

- Shifting consumer preferences

These preferences consider several variables, such as evolving lifestyles, economic concerns, environmental concerns, and technological improvements. Customers are looking for more customized and environmentally friendly transportation options, so aftermarket goods and services are in high demand. For example, the growing demand for EV charging stations and associated accessories results from the increasing popularity of electric vehicles (EVs). Similarly, the demand for personalization and customization has driven the market for aftermarket components like linked automobile technologies, performance increases, and cosmetic modifications.

Furthermore, as automobiles grow increasingly intricate and advanced, buyers want aftermarket systems that provide connection, safety, and convenience features. The development of aftermarket items like sophisticated navigation systems, collision avoidance systems, and smartphone integration has been fueled by this trend.

Restraint

Rise of electric vehicles (EVs)

In contrast to conventional internal combustion engine vehicles, electric vehicles have fewer moving parts. This means that parts like spark plugs, belts, and filters frequently changed in conventional cars are either absent in EVs or require less regular maintenance. This decline in part demand directly impacts the merchants and aftermarket suppliers who depend on selling these components. The aftermarket for parts intended for conventional vehicles is well-established, but the one for electric car parts is still growing. Because of this, it can be difficult for aftermarket companies to find and carry parts designed specifically for electric vehicles while competing with OEMs that can control most of the supply chain.

Opportunities

- Embracing the electrification wave

Aftermarket electric car parts (EVs) will become increasingly in demand as more EVs are driven on public roads. This covers EV-specific accessories, batteries, electric drivetrain parts, and charging stations. The number of EVs on the road will increase demand for infrastructure related to charging. The aftermarket sector may utilize this by offering cutting-edge charging options for homes, businesses, and public areas.

- Subscription-based services & circular economy

For aftermarket businesses, subscription models offer a reliable source of income, facilitating more stable and effective financial planning. Aftermarket companies can boost client relationships and increase lifetime value and loyalty by providing subscription-based services like maintenance, repairs, and part replacements. By renovating and remanufacturing used parts rather than creating brand-new ones, adopting circular economy concepts can assist aftermarket businesses in cutting waste and lessening their environmental effect. Remanufacturing and refurbishing items can result in cost savings for organizations and consumers as they are often less expensive than manufacturing new ones.

Replacement Part Type

The hard parts segment held a dominant presence in the market in 2024, owing to the rising age and mileage of vehicles, and the increasing expansion of e-commerce platforms for parts distribution. The hard parts generally include the Engine Parts, Transmission Parts, Brake Systems, Suspension and Steering, Driveline Components, Exhaust Systems, and others. Moreover, the rising demand for replacement parts and maintenance services drives the segment's growth.

On the other hand, the electrical components segment accounted for considerable growth in the U.S. automotive aftermarket market over the forecast period. The electrical components generally include starters & alternators, ignition systems, sensors (O2, MAP, TPS), ECUs & control modules, and others. The increased mileage often results in wear and tear on electrical systems is expected to spur the demand for aftermarket parts. The rising vehicle age and increasing adoption of electric vehicles create demand for aftermarket electrical components, particularly batteries and other related parts.

Application Insights

The DIFM (Do it for Me) segment dominated the US automotive aftermarket in 2024. Due to their increased complexity, modern cars need specific tools, equipment, and knowledge to be maintained and repaired. Many car owners rely on specialists to complete these activities because they need more time or expertise. When opposed to do-it-yourself projects, professional service centers usually provide greater quality repairs. For the peace of mind of their clients, they frequently offer warranties on their work, have access to OEM (Original Equipment Manufacturer) parts, and employ skilled technicians.

The DIY (Do it Yourself) segment is the fastest growing in the US automotive aftermarket during the forecast period. With the wealth of internet DIY guides and resources, many customers are increasingly confident handling simple auto maintenance and repairs. Due to the growth of internet merchants specializing in automotive tools and parts, it is now simpler for customers to obtain the necessary supplies to undertake do-it-yourself maintenance. In addition, many physical stores currently have a wide range of tools and vehicle parts for do-it-yourself enthusiasts.

Service Channel Insights

The DIFM (Do-It-For-Me) segment held the largest market share in 2024, driven by the increasing preference for professional services among consumers. As vehicles age over the years, they require more maintenance and repairs. Consumers are increasingly opting for professional services (DIFM, Do-It-For-Me) for vehicle maintenance and repairs over DIY (Do-It-Yourself) methods.

On the other hand, the online/offline retailers' segment is projected to grow at a CAGR between 2025 and 2034. The growth of the segment is driven by the robust presence of offline retailers and online platforms such as Amazon, AutoZone, eBay, and other specialized automotive portals. Online retail is gaining popularity, offering convenience and accessibility for a wider product selection. The growth of online retailers has made it easier for consumers to access and purchase aftermarket parts at discounted prices and other value-added prices. Offline retailers provide a hands-on shopping experience to customers and build trust through providing professional services.

Vehicle Type Insights

The passenger vehicles segment registered its dominance in the U.S. automotive aftermarket market in 2024. The segment is experiencing immense growth with the rising popularity of vehicle customization, particularly among younger individuals, which increases the demand for various performance parts, accessories, and cosmetic modification systems. The surge in the number of passenger vehicles on the road in the U.S., along with the increasing average age of vehicles, fuels the growth of the segment. As the prices of passenger vehicles rise, consumers are increasingly preferring to keep their vehicles for a longer span, leading to increased demand for repairs and maintenance in the aftermarket.

On the other hand, the light commercial vehicles (LCVs) segment is expected to grow significantly during the forecast period. The segment's growth is driven by the rising adoption of light commercial vehicles (LCVs) along with the increasing need for vehicle maintenance and repairs in the aftermarket. Moreover, the expansion of e-commerce offers convenience to vehicle owners to maintain and repair their existing LCVs.

Propulsion Type Insights

The Internal Combustion Engine (ICE) segment accounted for the dominating share in 2024, owing to the rising demand for ICE vehicles along with the increasing need for vehicle maintenance and repairs. Internal Combustion Engine (ICE) vehicles continue to be a crucial part of the automotive industry, which spurs the demand for aftermarket parts and services. Moreover, the constant improvements in engine technology are significantly enhancing both performance and fuel efficiency, which extends the lifespan of ICE vehicles.

On the other hand, the electric vehicle segment is expected to witness a significant share during the forecast period, owing to the growing adoption of electric vehicles in the country. The surge in the number of EVs on the road is a primary driver, boosting the demand for specialized auto parts and services. With the rising age of EV batteries, which creates a significant need for battery maintenance, repair, and replacement services. Supportive government Incentives and policies are encouraging the purchase of EVs among consumers.

Recent Developments

- In April 2022, 3M declared that it had purchased the technological assets of LeanTec, a US and Canadian supplier of digital inventory management solutions to the automobile aftermarket industry. The acquisition shows 3M's dedication to its "connected Bodyshop," one of its active online operations that combines material product platforms with data collection and analysis to capitalize on new market trends and demands.

U.S. Automotive Aftermarket Companies

- p.A.

- 3M Company

- Continental AG

- Robert Bosch GmbH

- Federal-Mogul Corporation

- Denso Corporation

Segments Covered in the Report

By Replacement Part Type

- Hard Parts (Wear-and-Tear)

- Engine Parts

- Transmission Parts

- Brake Systems

- Suspension and Steering

- Driveline Components

- Exhaust Systems

- Soft Parts / Consumables

- Filters (Oil, Air, Fuel, Cabin)

- Batteries

- Tires

- Wiper Blades

- Spark Plugs

- Fluids and Lubricants (Coolants, Brake Fluid, Motor Oil)

- Accessories and Appearance

- Interior Accessories (Floor Mats, Seat Covers)

- Exterior Accessories (Body Kits, Covers, Chrome Parts)

- Infotainment Systems

- Lighting (LEDs, Headlamps, Fog Lamps)

- Electrical Components

- Starters & Alternators

- Ignition Systems

- Sensors (O2, MAP, TPS)

- ECUs & Control Modules

By Service Channel

- DIY (Do-It-Yourself)

- DIFM (Do-It-For-Me)

- Independent Garages

- Branded Franchise Workshops (e.g., Midas, Meineke)

- OEM-authorized Service Centers

- Online/Offline Retailers

- Auto Parts Stores (e.g., AutoZone, NAPA)

- E-commerce Platforms (e.g., Amazon, RockAuto)

By Vehicle Type (US$/Units)

- Passenger Vehicles

- Hatchbacks

- Sedans

- SUVs

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Trucks

- Buses

- Two-Wheelers (in regions like Asia-Pacific)

- Off-Highway Vehicles (Agriculture, Construction)

By Propulsion Type

- Internal Combustion Engine (ICE)

- Electric Vehicle

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting