What is the Light Commercial Vehicles Market Size?

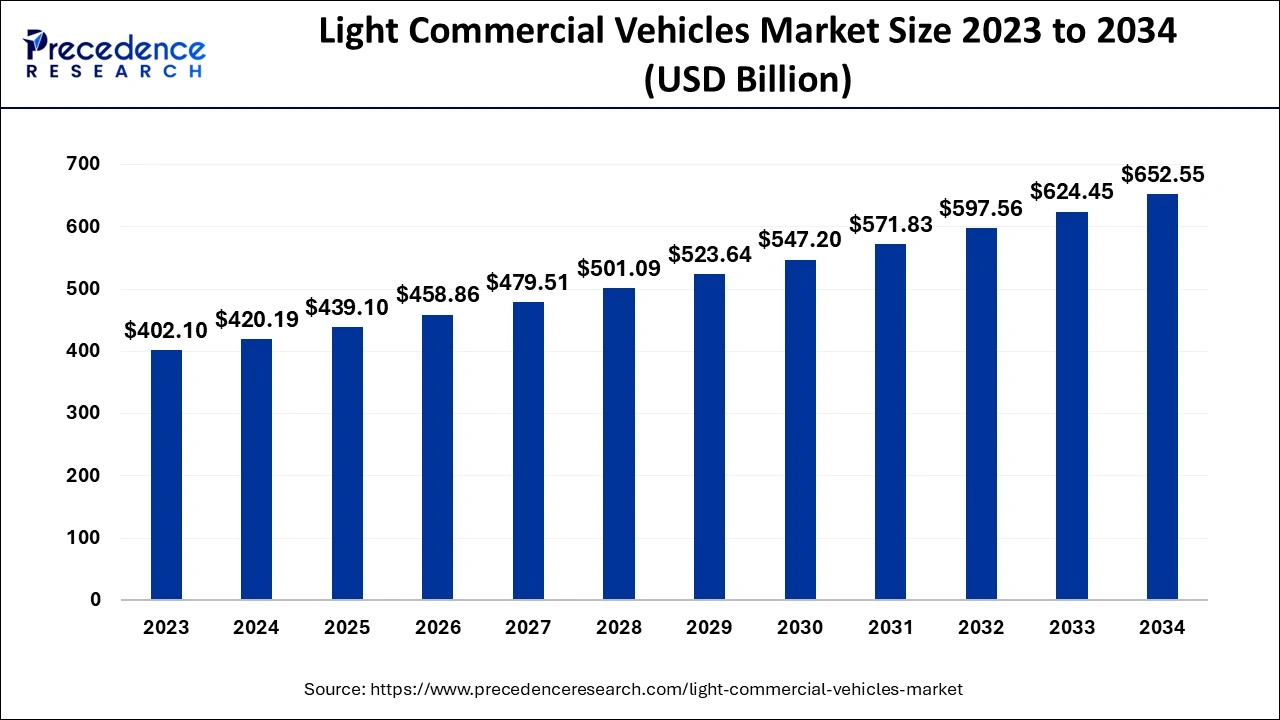

The global light commercial vehicles market size is calculated at USD 439.10 billion in 2025 and is predicted to increase from USD 458.86 billion in 2026 to approximately USD 679.84 billion by 2035, expanding at a CAGR of 4.43% from 2026 to 2035.

Light Commercial Vehicles Market Key Takeaways

- In terms of revenue, the market is valued at $439.10 billion in 2025.

- It is projected to reach $679.84 billion by 2035.

- The market is expected to grow at a CAGR of 4.43% from 2026 to 2035.

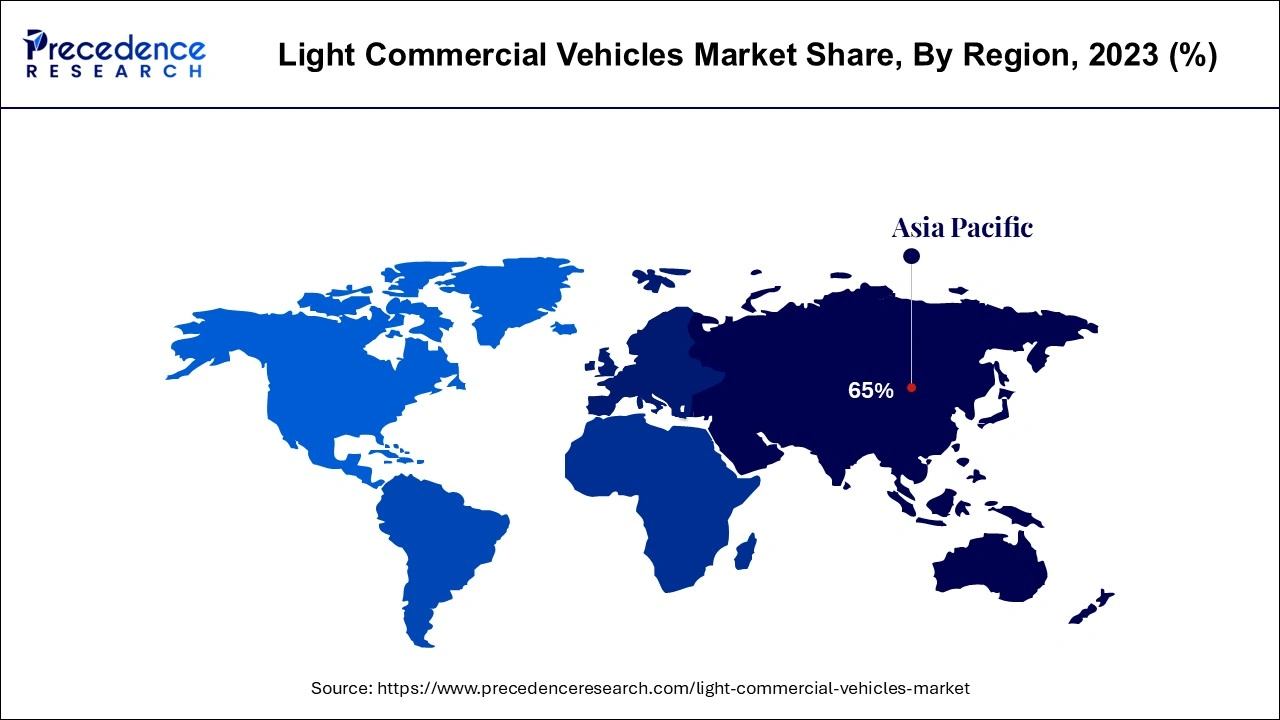

- Asia Pacific dominated the light commercial vehicles market with the largest market share of 65% in 2025.

- North America is projected to host the fastest-growing market in the coming years.

- By vehicle, the vans segment held a dominant presence in the market in 2025.

- By vehicle, the pickup trucks segment is expected to grow at the fastest rate in the market during the forecast period of 2026 to 2035.

- By gross weight, the 6000-9000 lbs segment accounted for a considerable share of the market in 2025.

- By gross weight, the 9000-12000 segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By fuel, in 2025, the gasoline segment led the global market.

- By fuel, the electric segment is projected to expand rapidly in the market in the coming years.

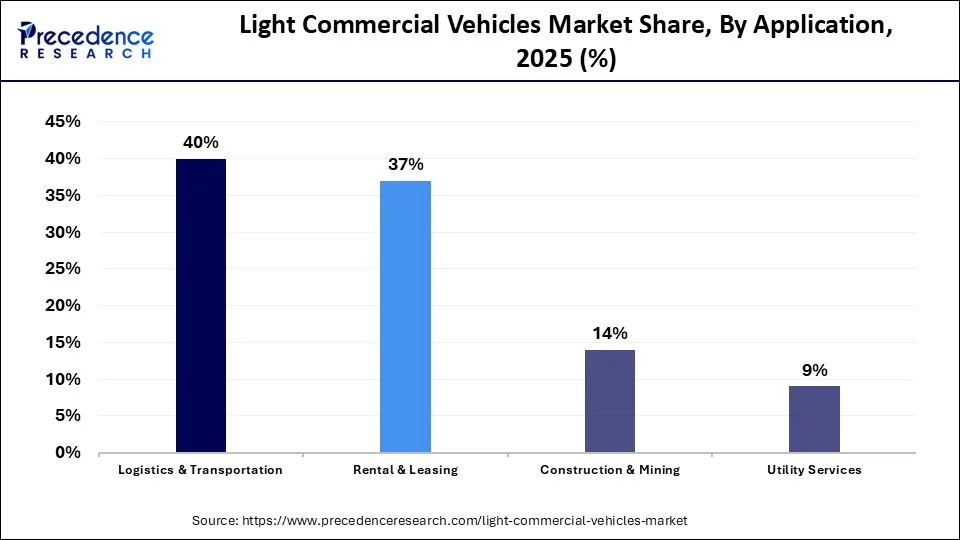

- By application, the logistics and transportation segment recorded more than 40% of the market share in 2025.

- By application, the construction & mining segment is projected to grow at the fastest rate in the market in the future years.

Market Overview

The greater need for effective solutions for the realization of logistics contributes to boosting the light commercial vehicles market. This demand is mainly driven by the advancement of electronic commerce, which requires the timely delivery of products to customers. The increased use of e-commerce for purchases delivery fleets must be expanded; light commercial vehicles, specifically vans and pickup trucks, are particularly useful owing to their ease of maneuvering in a city. In addition, advancements in typical technologies such as telematics and route optimization software further facilitate operational effectiveness by keeping track of machinery conditions and consumption. Furthermore, companies are sifting towards new and efficient solutions due to the constantly developing economy.

- The adoption of such technologies is believed to decrease operational costs by 15% to 20%, as estimated by the International Council on Clean Transportation.

Impact of Artificial Intelligence on Light Commercial Vehicles Market

In the light commercial vehicles market, artificial intelligence (AI) advances intelligent technologies, such as autonomous driving, predictive maintenance, or fleet management. Self-driving car technologies amplify the existing advanced technology driving aids, including auto-steering, distance control, and collision avoidance, to increase road safety. Utilizing big data and machine learning, predictive maintenance applications foresee when maintenance is required for a vehicle, thus avoiding large chaotic downtimes. Moreover, the AI facilitates the development of immediate real-time constraints on routes and fuel by analyzing traffic and weather patterns and fuel consumption, reducing operation expenses.

Light Commercial Vehicles Market Growth Factors

- Rising e-commerce demand: The continuous growth of online shopping necessitates efficient logistics, driving the need for more light commercial vehicles to handle deliveries.

- Urbanization trends: Increasing urban populations lead to higher demand for transportation solutions that can navigate congested city environments.

- Regulatory support for green vehicles: Government incentives for electric and low-emission vehicles encourage manufacturers and consumers to shift towards greener options.

- Technological advancements: Innovations in vehicle design and telematics enhance operational efficiency, attracting more businesses to invest in light commercial vehicles.

- Cost-effectiveness of fleet operations: Businesses are increasingly recognizing the cost benefits associated with operating light commercial vehicle fleets, leading to higher purchase rates.

- Growing small and medium enterprises (SMEs): The rise of SMEs in logistics and service sectors increases demand for versatile light commercial vehicles that can adapt to various operational needs.

- Increased last-mile delivery services: The surge in demand for last-mile delivery services, particularly in urban areas, fuels the need for smaller, agile vehicles capable of navigating tight spaces.

Market Outlook

- Market Growth Overview: The light commercial vehicles market is expected to grow significantly between 2025 and 2034, driven by the rapid e-commerce boom and last-mile delivery, expanding urbanization and infrastructure, and fueling efficiency and technology.

- Sustainability Trends: Sustainability trends involve exploring smart and eco-friendly materials, growing trends toward electrification, and rising digitalization and connectivity.

- Major Investors: Major investors in the market include Ford Motor Company, Daimler Truck Holding AG, Toyota Motor Corp, Volkswagen AG, and Ashok Leyland.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 679.84 Billion |

| Market Size in 2025 | USD 439.10 Billion |

| Market Size in 2026 | USD 458.86 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.43% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Vehicle, Gross Weight, Fuel, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Dynamics

Drivers

Growing demand across various industries

Growing demand for e-commerce and last-mile delivery solutions is anticipated to drive substantial growth in the light commercial vehicles market. The fast growth of online retailing in the B2C segment is exerting pressure on logistics providers and retailers to reinforce fleets with LCVs, especially vans and small truck varieties, as the traffic constraint that big vehicles encounter, there is an increasing tendency toward developing in-house fleets or concentrating on partners with third-party applications and experimenting with technologies, including electric vehicles and autonomous delivery. Companies such as Hello Fresh recently launched an EV fleet across 19 major U.S. metropolitan areas, and such examples signify that the industry is now moving towards environment-friendly or sustainable models supported by consumer policy and policies. These developments are expected to drive additional LCV demand to support growing logistics in e-commerce.

- In 2024, Dollar General increased private delivery capacity to more than 2000 tractors and planned to deliver half of the incoming distribution independently. This strategy saves huge sums of money and also increases straight-through transportation efficiency by avoiding third-party carriers.

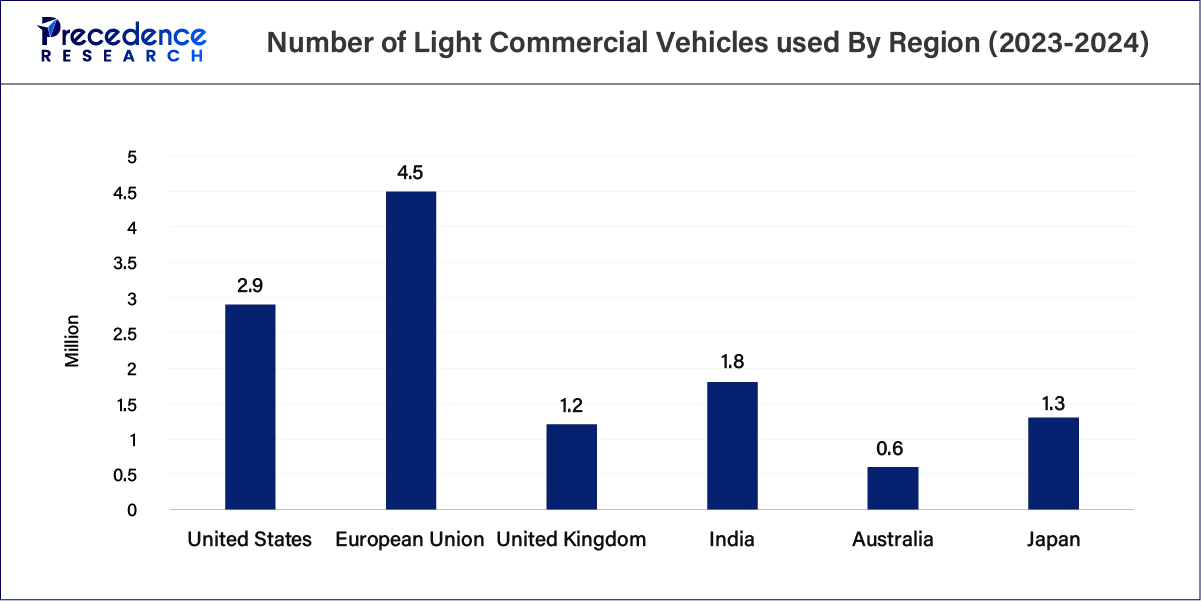

Estimated number of Light Commercial Vehicles used by Region (2023-2024)

Restraint

High initial costs for electric vehicles

High initial costs associated with electric light commercial vehicles (e-LCVs) are expected to restrain the light commercial vehicles market growth, particularly as companies weigh the expenses of fleet electrification. The initial establishment costs of such equipment may be recuperated by operational cost savings in the future. Many small to mid-sized logistics service providers and fleet owners are often financially constrained to acquire such equipment. This cost barrier affects manufacturers who incorporate sophisticated technologies, such as fully autonomous driving and improved battery power, which increase the cost of production even more. Moreover, the high cost of e-LCVs is expected to dampen companies' adoption of them.

Opportunity

High investments in technological advancements

Rising investments in autonomous driving, telematics, and vehicle-to-everything (V2X) communication are creating immense opportunities for the players competing in the light commercial vehicles market. As investment in autonomous driving, telematics, and V2X communication technologies increases, the opportunities for cars utilizing these advanced technologies emerge. The demand for autonomous LCVs to support last-mile delivery services is believed to be capable of improving logistics functionality and drastically cutting labor costs. Improved telematics help fleet owners manage fleet conditions, track trips in real-time, and address fuel consumption requirements, representing the shift to efficiency and automation in the industry.

Segment Insights

Vehicle Insights

The vans segment held a dominant presence in the light commercial vehicles market in 2025 due to its versatility and indispensable use in growing logistics, such as e-commerce. With the growing need for effective last-mile deliveries in recent years, companies have sought to increase the number of vans in their fleets. The integration of advanced telematics and connectivity features in vans is expected to enhance operational efficiency.

- ACEA found that the sales of electric vans rose by 27%, and the upward trend demonstrated the movement towards sustainable means of transport.

The pickup trucks segment is expected to grow at the fastest rate in the light commercial vehicles market during the forecast period of 2026 to 2035. Since they were classified as everyday cars, most pickup trucks are used for both private and business purposes. Furthermore, the increasing consumer preference for outdoor activities and the increasing popularity of off-road vehicles are driving this trend.

- The U.S. Department of Transportation noted that there was a 10% increase in sales of pickup trucks in 2025 where over 3 million units were sold within the United States market.

Gross Weight Insights

The 6000-9000 lbs segment accounted for a considerable share of the light commercial vehicles market in 2025. This weight range comprises different types of vehicles, including commercial vans and light-duty trucks that are used in different operational sectors. This is a result of the increasing need for efficient delivery solutions, especially within cities, which puts fleet operators under pressure to adopt vehicles within this wagon width. Furthermore, the improvements in fuel consumption and emission requirements have contributed to the popularity of these vehicles.

- The analysis of the dynamics of the registrations of such vehicles in 2025 shows that their growth comprised 8%, based on the data of the Federal Highway Administration (FHWA).

The 9000-12000 segment is anticipated to grow with the highest CAGR in the light commercial vehicles market during the studied years, owing to the growing requirements of industries that cater to construction and logistics, among others, that need greater payload capacity. This segment includes medium-duty trucks mostly used in regional haulage and commercial uses. Additionally, the increased regulations towards using large commercial vehicles for personal freight transport are expected to boost this segment.

- As reported by the American Trucking Association, the need for trucks of this weight class is expected to increase by 5% per annum up through 2026.

Fuel Insights

The gasoline segment led the global light commercial vehicles market, owing to the higher availability and low initial cost as compared to the diesel and electric segments. New gasoline vehicles are generally cheaper to buy and lighter than diesel options, making them efficient for short-haul transport. This segment has been able to harness the latest technologies in emissions regulations to further improve fuel efficiencies and performance levels that were needed despite the enhanced emissions regulations. Furthermore, more refueling stations make gasoline vehicles more desirable for fleet holders.

- As claimed by the EPA, enhanced technology of gasoline engines is set to decrease emissions by 15% in 2025.

The electric segment is projected to expand rapidly in the light commercial vehicles market in the coming years, owing to their growing range and fuel efficiency. Electric engines offer superior torque and fuel efficiency and are employed in tasks related to carrier and construction industries. These engines are now being used extensively in different commercial and other applications, as their ability to handle heavily laden tasks well. The available technologies to reduce emission levels are also helping to reduce the environmental impact of diesel automobiles.

Application Insights

The logistics & transportation segment dominated the global light commercial vehicles market in 2025 due to the growth in e-commerce and the need for improving delivery performance. Logistics firms are now assuming tremendous risks for a purposeful scaling of light commercial vehicle fleets to meet Consumers' speed expectations. Additionally, the increased adoption of last-mile delivery services is also helping drive the uptake of application-enabled, flexible vehicles that move through complex and congested cityscape landscapes, improving operations.

- The data from the U.S. Census Bureau show e-commerce sales hit USD 1 trillion in 2022.

The construction & mining segment is projected to grow at the fastest rate in the light commercial vehicles market in the future years, owing to the rise in infrastructure projects and mining activities. Furthermore, the inclination towards green construction methodologies is prompting the use of electric light commercial vehicles.

- As per the U.S. Bureau of Economic Analysis, construction spending rose at 7.4% in 2025 to signify the recovery of this sector and, therefore, the corresponding usage of light trucks and vans for construction.

Regional Insights

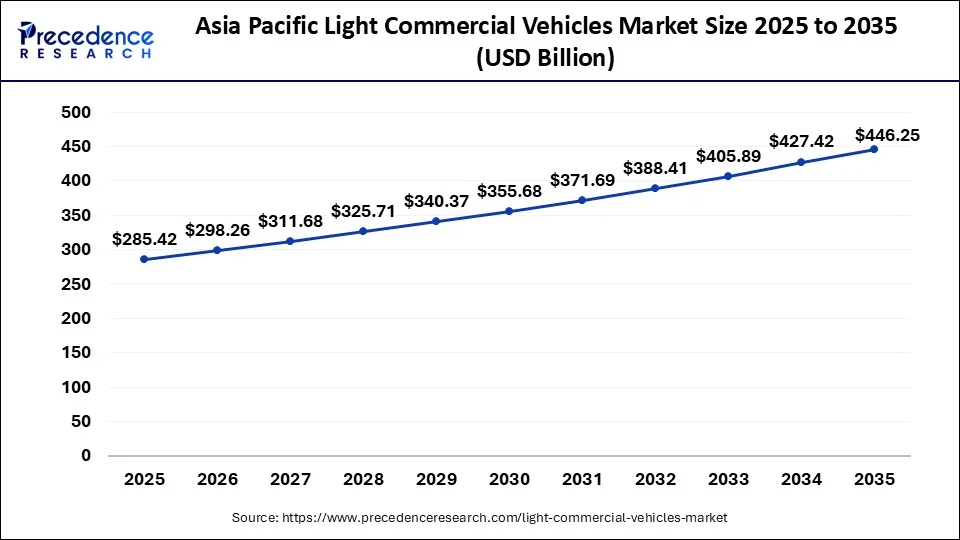

What is the Asia Pacific Light Commercial Vehicles Market Size?

The Asia Pacific light commercial vehicles market size is exhibited at USD 285.42 billion in 2025 and is predicted to be worth around USD 446.25 billion by 2035, growing at a CAGR of 4.57% from 2026 to 2035.

Asia Pacific dominated the light commercial vehicles market in 2025 due to allied factors, such as the fast pace of globalization and the increase in business opportunities in Asian countries, including China and India. The Asia Pacific market is expected to maintain its market leadership as the result of growing infrastructural investments and growing consumer demand for goods and services. This increases the prospects of light commercial vehicles meant for delivery and transportation. Moreover, the rising middle-income population base and the continuing expansion of e-commerce channels are expected to create a high demand for light commercial vehicles suitable for both cities and townships.

China Light Commercial Vehicles Market Trends

China's surge in e-commerce, manufacturers are integrating advanced fleet management and autonomous features to optimize last-mile logistics and reduce operational costs. The market has shifted toward multi-functional, high-efficiency vehicles that serve both as versatile business tools and sustainable personal transport.

North America is projected to host the fastest-growing light commercial vehicles market in the coming years, owing to the revival in the construction and transportation industry. The Bipartisan Infrastructure Law will enhance America's infrastructure by likely providing light commercial vehicles that are used in construction and logistics. Furthermore, the manufacturers' interest in investing in technology to improve the functionality of these vehicles further facilitates the market in this region.

- The U.S. Federal Highway Administration states that in 2025, the Biden-Harris Administration will allocate USD 62 billion to states from the Bipartisan Infrastructure Law to enhance America's infrastructure.

U.S. Light Commercial Vehicles Market Trends

The U.S.'s manufacturers are prioritizing agile, high-tech van designs that integrate advanced connectivity and navigation to maximize operational efficiency in increasingly congested cities. While the pickup segment continues to lead in heavy-duty versatility, there is a distinct shift toward hybrid and luxury-spec models that bridge the gap between commercial utility and personal use.

How Did Europe Experience A Notable Growth in the Light Commercial Vehicless Market?

Europe's strategic pivot toward battery-electric vans to navigate tightening urban emission zones and the relentless demands of the e-commerce boom. The integration of advanced telematics and modular designs allows small businesses to maximize fleet efficiency while leveraging the multi-purpose versatility of modern pickup segments.

Germany Light Commercial Vehicles Market Trends

Germany's e-commerce boom and stringent Euro 7 emission standards. While diesel remains a legacy baseline, the rapid adoption of LFP batteries and telematics-driven route optimization is significantly lowering the total cost of ownership for last-mile delivery fleets. Electrification is a major trend, with electric and hybrid light commercial vans gaining traction thanks to environmental regulations, government incentives, and corporate fleet decarbonization strategies.

Value Chain Analysis of the Light Commercial Vehicles Market

- Inbound Logistics & Raw Materials (Upstream):This stage focuses on sourcing raw materials like steel, aluminum, rubber, and glass, along with key components such as engines, transmission systems, and electronics.

Key Players: Tata Steel, LG Energy Solution, Panasonic, Robert Bosch GmbH, Denso Corporation, and Cummins Inc. - Manufacturing and Assembly (Midstream):This stage involves transforming raw materials into finished products through stamping, painting, and powertrain integration.

Key Players: Ford Motor Company, Tata Motors, Toyota Motor Corporation, Renault Group, Mahindra & Mahindra Ltd., Hyundai Motor Company, Isuzu Motors Ltd., Volkswagen AG. - Outbound Logistics & Distribution:This stage covers the storage, transportation, and delivery of finished LCVs to dealerships, fleet customers, or end-users.

Light Commercial Vehicles Market Companies

- Daimler AG:Daimler contributes significantly to the light commercial vehicle (LCV) market through its Mercedes-Benz Vans division, which produces iconic, versatile, and high-quality vehicles like the Sprinter and Vito.

- Ford Motor Company: Ford dominates the North American LCV market, holding a leading position for decades, primarily driven by the Transit van lineup and its various commercial truck offerings.

- General Motors (GM): General Motors sustains a strong presence in the LCV sector through its specialized Chevrolet and GMC brands, producing popular, durable vehicles like the Chevrolet Express and GMC Savana vans.

- Hyundai Motor Company: Hyundai has established itself as a rising player in the LCV market by focusing on innovative, eco-friendly technologies, including the development of dedicated global electric LCV platforms.

- Mitsubishi Motor Corporation (Mitsubishi Fuso): As part of the Daimler Truck group, Mitsubishi Fuso Truck and Bus Corporation is a key contributor to the light commercial vehicle market, renowned for its reliable and versatile Canter light-duty trucks.

Other Major Key Players

- Nissan Motor Company Ltd

- PACCAR Inc.

- Renault Trucks

- Volkswagen AG

- Volvo Group

Recent updates on light commercial vehicles

Electrification leads the next wavy of LCV innovation

- On 5 March 2025 Ford Motor Company officially launched the E-Transit Custom in global markets, expanding its EV offerings for last-mile logistics. The model features a 236-mile range, faster charging, and advanced telematics to support real-time fleet optimization. This marks a strategic shift toward full electrification in the light commercial segment.

- On 12 March 2025 The all-electric delivery van RCV700 designed for urban use and featuring modular cargo zones and AI-enhanced driver assistance was introduced by Rivian. Bulk orders from major logistics companies like FedEx and Amazon indicate strong business-to-business demand for sustainable LCVs.

Connected tech and autonomous features reshape fleet management

- On 2 April 2025, several OEMs, including Mercedes-Benz and Isuzu, incorporated next-gen telematics and V2X (vehicle-to-everything) communication into their LCV product lines. These features allow for predictive maintenance, driver behavior monitoring, and route optimization, leading to cost savings and reduced downtime.

- On 9 April 2025, A beta test of Autonomous Delivery Mode which will allow for low-speed geo-fenced self-driving operation in distribution centers and industrial parks was announced by Tesla for its upcoming LCV platforms Tesla is now deployment of semi autonomous LCVs.

Recent Developments

- On 29 January 2025, Flexis announced the receipt of letters of intent for 15,000 electric vans from 10 European transport and distribution companies, including Colis Prive, Hived and DB Schenker. This move underscores the growing demand for electric vans in Europe, driven by urban delivery needs for emissions regulations.

- On 11 March 2025, Renault announced a reduction of 300 jobs at its vans factory in Sandouville, France due to a slowdown in the European commercial vehicle market amidst economic uncertainty. This decision reflects the challenges faced by manufacturers in adapting to fluctuating demand.

- On 4 September 2024, Prodrive and Astheimer design announced a partnership to produce 10,000 electric delivery quadricycles in the UK by 2030, targeting the last mile delivery market. Their joint venture, ELM Mobility, aims to provide small, energy efficient vehicles priced at 25,000 each, focusing on lightweight design and ease of loading.

- In February 2024, Iveco announced plans for a new battery-electric commercial vehicle developed in collaboration with Hyundai. This vehicle will be based on Hyundai's global electric vehicle architecture. This model aims to cater to urban and suburban logistics in Europe, reinforcing the partnership between the two companies in the electric vehicle segment.

- In June 2024, Ford introduced the E-Transit Courier. This all-electric model is designed for small business owners and urban drivers, offering advanced technology and capabilities. It is part of Ford's broader strategy to electrify its vehicle lineup, including the all-new Ford Transit and the F-150 Lightning, with plans to build out the electric vehicle infrastructure to support these models.

- In May 2024, Volkswagen Commercial Vehicles revealed its latest model, the ID. Buzz Cargo, on May 10, 2024. This electric van aims to meet the growing demand for sustainable delivery solutions and is expected to offer enhanced cargo capacity and efficiency. The ID. Buzz Cargo is part of Volkswagen's commitment to transitioning to electric mobility within its commercial vehicle range.

Segments Covered in the Report

By Vehicle

- Pickup Trucks

- Light-Duty Trucks

- Vans

By Gross Weight

- 9000-12000 Lbs

- 6000-9000 Lbs

- 12000-14000 Lbs

By Fuel

- Diesel

- Gasoline

- Electric

By Application

- Construction And Mining

- Utility Services

- Logistics And Transportation

- Rental And Leasing

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting