What is the Light Electric Vehicles Market Size?

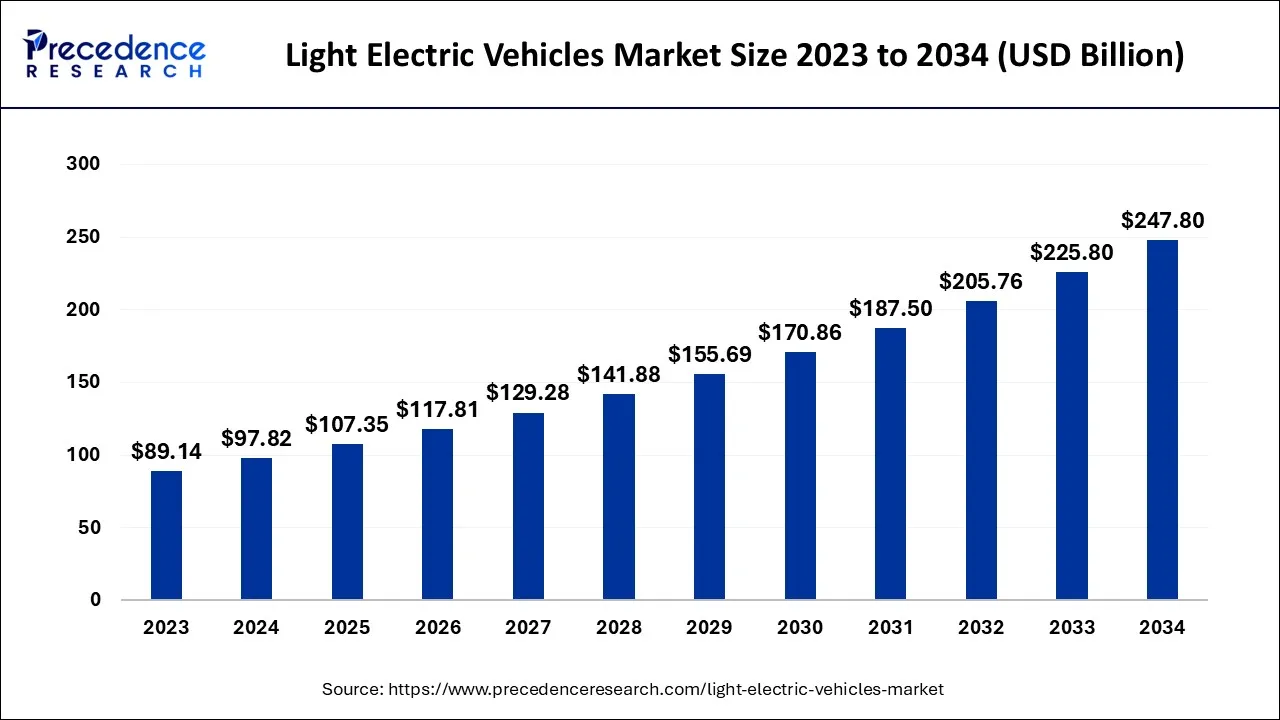

The global light electric vehicles market size is calculated at USD 107.35 billion in 2025 and is predicted to increase from USD 117.81 billion in 2026 to approximately USD 268.49 billion by 2035, expanding at a CAGR of 9.60% from 2026 to 2035.

Light Electric Vehicles Market Key Takeaways

- North America region dominates the global market.

- By Vehicle Category, the 2-wheeler segment captured the largest revenue share in 2025.

- By Application, the commercial segment is predicted to generate the maximum market share in 2025.

- By Power Output, the 6–9 kW segment is expected to capture the largest market share in 2025.

- By Component, the battery pack segment is projected to record the highest market share in 2025.

- By Vehicle Type, the e-bike segment is expected to account for the biggest market share in 2025.

Strategic Overview of the Global Light Electric Vehicles Industry

The light electric vehicles (LEVs) market refers to the segment of the electric vehicle industry that includes electric bicycles, electric scooters, electric motorcycles, and other similar forms of transportation. These vehicles are typically smaller and lighter than traditional automobiles, and electric motors and rechargeable batteries power them. The global LEVs market has been growing in recent years due to increasing demand for sustainable and low-emission transportation options, advancements in battery technology and the availability of government incentives for purchasing electric vehicles. The market includes consumer and commercial applications and is anticipated to increase.

Furthermore, The global light electric vehicles market is anticipated to grow considerably in the coming years due to the growing demand for low-emission transportation and sustainable options. As concerns about air pollution and climate change have grown, consumers and governments alike have become more interested in electric vehicles to reduce greenhouse gas emissions and improve air quality.

The growth of the LEVs market is another factor contributing to the increasing availability of government incentives for purchasing electric vehicles. Many countries and municipalities have implemented policies to encourage the adoption of electric vehicles, such as tax incentives, rebates, and subsidies. These policies have helped to make LEVs more affordable for consumers and encouraged manufacturers to invest in developing new products. In addition, advancements in battery technology have made LEVs more practical and reliable than ever. Lithium-ion batteries, in particular, have become more efficient and affordable, allowing LEVs to travel longer distances on a single charge and reducing the overall cost of ownership.

However, a limited range and safety concerns are anticipated to impede the market growth. Despite advancements in battery technology, most LEVs still have a limited range compared to traditional gasoline-powered vehicles. This can be a significant barrier for consumers who need to travel long distances or live in areas with limited charging infrastructure. While the number of charging stations for electric vehicles is growing, there is still a significant lack of charging infrastructure in many parts of the world. This can limit the market's potential, especially in areas where people do not have access to a private charging station.

The COVID-19 pandemic have accelerated the adoption of digital transformation technologies. It has also increased demand for LEVs as consumers have sought safe and sustainable transportation forms. Also, the pandemic has disrupted the global supply chain, causing shortages of components and delaying the production and delivery of LEVs. This has led to increased prices for some models and delays in shipments. In addition, the economic uncertainty caused by the pandemic has led some consumers to delay purchasing decisions, which has slowed growth in the market.

Artificial Intelligence: The Next Growth Catalyst in Light Electric Vehicles

Artificial Intelligence (AI) is fundamentally transforming the light electric vehicle (LEV) industry by shifting the focus from basic hardware to software-defined mobility. Machine learning algorithms are now standard for predictive battery management, where AI analyzes real-time discharge patterns to extend battery life by up to 25% and prevent thermal runaway before it occurs. The integration of AI-driven computer vision and edge computing has enabled advanced rider-assistance systems (ARAS) on e-bikes and scooters, providing active collision warnings and lane-departure alerts.

Light Electric Vehicles Market Growth Factors

The increasing demand for fewer greenhouse gas emissions and air pollutants than traditional vehicles, making them an attractive option for environmentally-conscious consumers, propelled the market demand. The various factors are helping to drive the market are sustainable transportation options, government regulations, and convenient & affordable mode of transportation

Market Outlook

- Market Growth Overview: The light electric vehicles market is expected to grow significantly between 2025 and 2034, driven by the logistics & e-commerce expansion, urbanization & micro mobility, and technological innovation.

- Sustainability Trends: Sustainability trends involve the implementation of battery passports, the rise of the second-life battery economy, and the transition to cobalt-free LPF chemistries.

- Major Investors:Major investors in the market include Honda & Sony, Amazon Climate Pledge Fund, Bosch Ventures, and TPG Rise Fund.

- Startup Economy:The startup economy is focused on autonomous last-mile delivery, battery-as-a-service, AI-native & diagnostics.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 107.35 Billion |

| Market Size in 2026 | USD 117.81 Billion |

| Market Size by 2035 | USD 268.49 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.60% |

| Largest Market | North America |

| Base year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Vehicle Category, Application, Power Output, Component, Vehicle Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Key Market Drivers

Growing government incentives to brighten the market prospect:

Government incentives are critical in driving demand for Light Electric Vehicles (LEVs) market. These incentives take many forms, including tax credits, rebates, grants, and subsidies, and they are designed to make LEVs more affordable and accessible to consumers. Many governments offer financial incentives to encourage consumers to purchase LEVs. Some countries offer tax credits or rebates to purchase electric bicycles or scooters. This can make these vehicles more affordable and competitive with traditional gasoline-powered vehicles. For instance, in 2019, the French government introduced a tax credit of up to €500 to purchase an electric bicycle or scooter. The credit can be claimed by individuals or businesses and applies to purchases made after 1 January 2018. Similarly, in 2020, California introduced a $10 million e-bike incentive program, which provides rebates of up to $1,000 to purchase an electric bicycle. The program aims to reduce air pollution and traffic congestion in the state.

Furthermore, governments also provide incentives to build electric vehicle charging infrastructure, including LEVs. These incentives include grants, tax credits, or subsidies to companies or individuals installing charging stations. By promoting the development of a robust charging infrastructure, governments can help to increase the convenience and appeal of LEVs. Moreover, governments can also provide regulatory incentives to encourage the adoption of LEVs. For instance, some cities have implemented policies to promote electric bicycles and scooters, such as dedicated bike lanes or reduced parking fees for LEVs. These policies can help to make LEVs a more attractive and convenient transportation option.

Advancements in Battery Technology:

As the primary power source for these vehicles, batteries play a critical role in determining their performance, range, and overall value to consumers. As battery technology has improved, producing batteries that can store more energy and last longer between charges has become possible. This has made LEVs more practical for commuting, running errands, and other everyday activities. In addition to longer ranges, advancements in battery technology have also improved the overall performance of LEVs. For instance, newer batteries are lighter and more efficient, leading to better acceleration, handling, and braking. This has helped to make LEVs more fun and engaging to ride.

Furthermore, advancements in battery technology have steered to the emergence of new LEVs categories. For example, electric scooters and bicycles have become increasingly popular as battery technology has improved. Additionally, new categories of LEVs, such as electric skateboards and hoverboards, have emerged thanks to advancements in battery technology.

Key market challenges

The limited range of the light electric vehicle is causing hindrances to the market:

Advancements in battery technology have significantly improved, and LEVs typically have a shorter range than traditional gasoline-powered vehicles. This can limit the appeal of LEVs for consumers who need to travel long distances or are concerned about running out of power while on the road. The limited range of LEVs can also be a barrier to entry for consumers considering these vehicles. For instance, electric bicycles and scooters may not be practical for commuters traveling long distances to work or living in areas with limited charging infrastructure. In addition, consumers who frequently take longer trips may be hesitant to purchase LEVs due to concerns about range anxiety. Another factor that can contribute to the limited range of LEVs is their size and weight. Smaller LEVs, such as electric bicycles and scooters, may have smaller batteries than larger vehicles, which can limit their range. Additionally, the weight of the vehicle and the rider can impact the vehicle's overall range, as more energy is required to move a heavier load.

Key Market Opportunities

Increase in urban mobility

With the rapid growth of urbanization and the increase in traffic congestion, LEVs can provide a convenient and sustainable alternative to traditional modes of transportation such as cars and buses. They can help reduce traffic congestion and pollution while also improving accessibility for people who may not have access to public transportation. LEVs are easy to operate, affordable, and require low maintenance which in turn increases the demand and creates huge growth opportunities for the market players. Additionally, they offer flexibility in terms of parking, as they can be easily stored and charged in small spaces. This makes them ideal for short commutes, running errands, and other daily activities. LEVs represent a promising opportunity for urban mobility as they have the potential to improve transportation efficiency, reduce carbon emissions, and enhance the quality of life for people in urban areas.

Growing demand for efficient last-mile delivery e-commerce solutions

with the rise of online shopping, there has been an increasing demand for faster and more efficient last-mile delivery. With the rise of online shopping, there has been an increasing demand for faster and more efficient last-mile delivery. LEVs, particularly electric bicycles and electric scooters are becoming popular among delivery companies as they offer a cost-effective and environmentally friendly solution for last-mile delivery. They are particularly well-suited for urban areas where traffic congestion and limited parking can be a challenge for larger vehicles. Additionally, LEVs can also offer faster and more flexible delivery times compared to traditional delivery vehicles, as they can navigate through narrow streets and avoid traffic jams. They are also easier to park and can be charged quickly, which makes them ideal for delivery operations that require multiple stops. Due to these reasons, the light electric vehicles market is projected to grow exponentially over the forecast period.

LEV's increasing popularity among tourists

As the demand for sustainable tourism grows, we can expect to see a further increase in the popularity of LEVs among tourists. This presents a significant opportunity for companies that specialize in the development and distribution of LEVs, as well as for cities and tourism boards that want to promote eco-friendly and sustainable tourism practices. In addition, tourists often need to navigate urban areas and tourist attractions, which can be difficult and expensive with traditional modes of transportation. LEVs, such as electric bicycles and electric scooters, offer a more convenient and eco-friendly solution for tourists to explore their surroundings. Furthermore, many cities around the world are implementing bike-sharing and scooter-sharing programs, allowing tourists to rent LEVs for short periods of time. These programs provide an affordable and accessible way for tourists to explore the city, without having to worry about parking or navigating public transportation. Hence, the rising popularity of electric vehicles is expected to create huge growth opportunities over the forecast period.

LEVs can be used for fleet management in various industries

Delivery companies can use electric bicycles and electric scooters for last-mile delivery, reducing their carbon footprint and improving efficiency in urban areas where traffic congestion and limited parking can be a challenge for larger vehicles. Similarly, LEVs can be used in the hospitality and tourism industries for tasks such as maintenance, room service, and guest transportation. Electric golf carts, electric bicycles, and electric auto-rickshaws are all examples of LEVs that are commonly used in these industries. In addition, LEVs are also suitable for campus and corporate fleets, where employees or students need to travel short distances within the premises.

Furthermore, LEVs can be used for rental services in various industries, such as tourism, recreation, and mobility. Electric bicycles, electric scooters, and electric cars can be rented out for short periods of time, providing a convenient and eco-friendly alternative to traditional car rental services. The use of LEVs in fleet management presents a significant opportunity for businesses to reduce their carbon footprint and operating costs, while also improving efficiency and customer satisfaction.

Segment Insights

Vehicle Category Insights

The 2-wheelers account for most of the market because they are more agile and maneuverable than three-wheelers, making them ideal for navigating crowded urban areas. They are also more affordable and energy-efficient than traditional vehicles, creating them an attractive option for cost-conscious consumers. The primary growth factor creating extensive growth opportunities is the increasing demand for eco-friendly transportation options. The rising concern for environmental issues and increasing fuel prices are pushing consumers towards more sustainable options.

Additionally, the ease of maneuvering through heavy traffic and low maintenance cost is attracting more consumers towards 2-wheelers. The availability of government subsidies and incentives for electric 2-wheelers is also driving the growth of this segment. Furthermore, 3-wheelers, such as e-trikes and e-cargo bikes, are less common than two-wheelers but offer unique advantages for certain use cases. E-trikes are popular among seniors and individuals with mobility issues who need stable and reliable transportation.

Application Insights

The commercial segment accounts for most of the market. Commercial light electric vehicles are ideal for urban areas where traditional delivery vehicles, such as vans and trucks, are impractical due to traffic congestion and parking limitations. They offer a more efficient and cost-effective alternative to traditional delivery vehicles. They are also eco-friendly, which is increasingly important for industries looking to decrease their carbon footprint.

The commercial application of LEVs is driven by several factors, including cost savings, environmental concerns, government incentives, and convenience and efficiency. These factors are making LEVs an attractive option for businesses looking to reduce costs, improve their environmental impact, and increase efficiency.

Power Output Insights

The 6–9 kW accounting for most of the market. These vehicles are designed for personal and commercial use and are ideal for longer-distance commutes. They offer more power and speed than vehicles in the less than 6 kW segment, and they are increasingly popular among consumers looking for a more powerful and faster mode of transportation.

The primary driving factor for the growth of this segment is the increasing demand for eco-friendly and cost-effective transportation options for medium-distance travel, especially in urban areas.

Component Insights

The light electric vehicles market is divided into the battery pack, electric motor (propulsion motor), motor controller, inverters, power controller, E-brake booster, and power electronics, with the battery pack accounting for most of the market because the battery pack is a critical component of any light electric vehicle. It stores the electrical energy required to power the vehicle's electric motor, and its performance determines the range and performance of the vehicle. Battery packs are available in various chemistries, including lithium-ion, lead-acid, and nickel-metal hydride.

Vehicle Type Insights

On the basis of vehicle type, the e-bike accounting for most of the market. E-bikes are ideal for short-distance commutes and are popular among urban commuters, college students, and older adults. They come in various styles, including mountain, road, and city, and are powered by an electric motor that provides pedal assistance. The primary driving factors for the growth of the e-bikes segment include increasing concerns about air pollution and traffic congestion, rising fuel prices, and the need for affordable and eco-friendly personal transportation options. E-bikes are energy-efficient and eco-friendly, offering a more affordable and convenient alternative to traditional bicycles.

Regional Insights

How Does North America Dominate the Light Electric Vehicles Market?

North America dominates the market, primarily driven by the growing demand for eco-friendly transportation solutions. The United States and Canada are the key providers to market growth in this region. The increasing government support in the form of subsidies and tax incentives for electric vehicles is also expected to drive market growth. The demand for electric scooters and bicycles is also increasing in this region, such as in urban areas traffic congestion is a vital issue. Key players such as Tesla, General Motors, and Ford are expected to drive market growth in this region.

U.S. Light Electric Vehicles Market Trends

U.S. transition toward software-defined mobility and commercial logistics, despite high volatility caused by the expiration of federal tax credits. Manufacturers are shifting toward domestic battery production and next-generation solid-state technology to mitigate supply chain risks and address consumer range anxiety.

Why is Europe Considered a Significant Market?

Europe is a significant market for light electric vehicles, with Germany, the United Kingdom, and France being the major contributors to the market's growth. The increasing demand for sustainable transportation solutions drives the growth in this market. The favorable government policies, such as tax incentives, subsidies, and regulatory norms promoting the adoption of electric vehicles, are driving market growth in this region. The growing focus on decreasing carbon emissions is also expected to drive market growth. The demand for electric bicycles and scooters is also increasing in this region, especially in urban areas.

Germany Light Electric Vehicles Market Trend

Germany's focus has shifted from volume sales to high-value innovations, with e-bikes now outselling conventional bicycles despite nearing market saturation. Growth is increasingly driven by the rapid electrification of logistics fleets, supported by corporate leasing models and new infrastructure at major distribution centers.

What Makes Asia Pacific the Fastest-Growing Region in the Light Electric Vehicles Market?

The region in Asia-Pacific is anticipated to have the greatest CAGR. This growth is primarily driven by the increasing demand for affordable, eco-friendly transportation solutions. China is the largest market for light electric vehicles in this region, accounting for a significant market share. The increasing government support in the form of subsidies and tax incentives for electric vehicles is driving market growth in this region. The increasing urbanization and rising disposable income levels of consumers are also expected to drive market growth. The demand for electric bicycles and scooters is particularly high in this region, especially in densely populated urban areas with limited parking space.

India Light Electric Vehicles Market Trend

The affordable electric two- and three-wheelers in urban settings. This rapid expansion is strongly supported by government programs like PM E-DRIVE and FAME II, which have significantly increased public charging infrastructure. Localized manufacturing efforts are reducing reliance on imports, while innovations in battery swapping address cost and range anxieties for fleet operators.

Why Is the MEA Light Electric Vehicles Market Gaining Momentum?

The Middle East & Africa (MEA) light electric vehicles market is growing due to rising environmental awareness, favorable government policies, and increasing urbanization. In the UAE, Saudi Arabia, and South Africa, governments are implementing incentives, pilot projects, and regulations to promote the use of electric vehicles, particularly two- and three-wheelers and light commercial vehicles. Investments in charging infrastructure, smart cities, and the integration of renewable energy also contribute to market development. South Africa is becoming a regional hub, and domestic manufacturers and overseas EV actors are increasingly engaged.

How is the Opportunistic Rise of Latin America in the Light Electric Vehicles Market?

Latin America is experiencing an opportunistic rise in the market due to urbanization, rising fuel prices, and growing demand for green transportation systems. Countries such as Brazil, Mexico, Colombia, and Chile are heavily promoting electric mobility through tax incentives and urban clean-air programs. Electric vehicles, particularly e-bikes, electric scooters, and electric three-wheelers, are also gaining popularity as a means of last-mile delivery and personal transit in urban centers with congestion. The growing momentum and activity of e-commerce and shared mobility services are also boosting the need for cost-effective and energy-efficient LEVs.

Value Chain Analysis of the Light Electric Vehicles Market

Raw Material Sourcing & Battery Chemicals: This foundational stage involves the mining and processing of lithium, cobalt, nickel, and graphite required for high-density battery cells.

- Key Players: Albemarle Corporation, Ganfeng Lithium, SQM, and Glencore.

Component Manufacturing & Power Electronics: Companies at this stage produce the specialized hardware that defines LEV performance, including high-torque mid-drive motors, motor controllers, and integrated power units.

- Key Players: Bosch eBike Systems, Shimano, Brose, Delta Electronics, and Valeo.

Battery Pack Assembly & BMS Development: This stage involves the integration of individual cells into sophisticated battery packs equipped with AI-driven Battery Management Systems (BMS).

- Key Players: Panasonic Energy, CATL, LG Energy Solution, Samsung SDI, and BYD.

Vehicle Assembly & OEM Production: Original Equipment Manufacturers (OEMs) design and assemble the final LEV, ranging from personal e-scooters to commercial last-mile delivery vans.

- Key Players: Tesla (Semi/Light Trucking), Ola Electric, Rivian, Giant Bicycles, and Niu Technologies.

Distribution, Charging & Aftermarket Services: The final stage manages the sale of vehicles and the deployment of infrastructure, such as battery-swapping stations and specialized LEV fast-chargers.

- Key Players: ChargePoint, Gogoro (Battery Swapping), Specialized, JobRad (Leasing/Aftermarket), and Blink Charging.

Top Companies in the Light Electric Vehicles Market & Their Offerings

- Accelerated Systems Inc.: Accelerated Systems Inc. develops advanced AC and DC motor controllers and complete powertrain systems optimized for light electric vehicles such as e-bikes and outdoor equipment.

- Addax Motors:Addax Motors specializes in the design and manufacture of 100% electric, compact utility vans specifically engineered for urban logistics and last-mile delivery. Their modular chassis design allows municipalities and delivery fleets to customize cargo space while benefiting from zero-emission operation in restricted city zones.

- Aisin Corporation:Aisin contributes to the LEV market through the development of compact e-Axles and high-precision motor components that integrate drive systems into a single, efficient package.

- Alke:Alke is a leading manufacturer of high-performance electric utility vehicles capable of heavy-duty tasks in extreme environments, such as industrial sites and airports.

- American Landmaster:American Landmaster produces electric Utility Task Vehicles (UTVs) that bridge the gap between recreational use and rugged agricultural work. By integrating quiet, powerful electric drivetrains into their Landmaster EV line, they provide landowners and farmers with a durable, low-maintenance alternative to gas-powered off-road vehicles.

- Ari Motors:Ari Motors offers a diverse range of small-footprint electric vehicles, including electric scooters, vans, and platform trucks, designed for agile urban maneuverability. They cater to European small businesses and craftspeople by providing affordable, compact EV options that are easy to park and navigate through dense city centers.

- Auro Robotics (Ridecell):Auro Robotics, now integrated into the Ridecell ecosystem, specializes in developing autonomous driving software and sensor integration for low-speed light electric vehicles.

- Auto Rennen India:Auto Rennen India focuses on the design and manufacturing of electric two-wheelers and high-performance components tailored for the Indian subcontinent's unique terrain. They contribute to the region's electrification by offering cost-effective, durable electric motorcycles that reduce reliance on fossil-fuel-powered commuting.

- Balkancar Record:Balkancar Record is a major European manufacturer of electric forklifts and industrial platform trucks used in warehousing and heavy logistics. Their long-standing expertise in electric material handling equipment supports the decarbonization of indoor industrial operations and large-scale manufacturing facilities.

- BMW AG:BMW contributes to the LEV market through its "BMW Motorrad" division, producing premium electric scooters like the CE 04 that redefine urban personal mobility. They leverage their high-end automotive battery technology to create high-performance, digitally-integrated light vehicles that set standards for design and connectivity.

- BorgWarner Inc.:BorgWarner provides critical propulsion components, including high-voltage silicon carbide (SiC) inverters and integrated drive modules (iDM), for a wide array of light electric vehicles. Their power electronics are essential for increasing the energy efficiency and thermal management of modern electric delivery vans and high-speed e-motorcycles.

- BYD Auto Co. Ltd.:BYD is a global titan in the LEV space, providing both finished electric commercial vans and the high-density "Blade Battery" technology that powers them. As a vertically integrated manufacturer, they control the entire value chain from raw materials to final vehicle assembly, driving down the cost of electrification for global fleets.

- CFMoto:CFMoto is rapidly expanding into the electric segment with its "ZEEHO" brand, focusing on high-tech electric scooters and lightweight off-road motorcycles. Their vehicles integrate advanced connectivity features and futuristic designs to appeal to a younger, tech-savvy generation of urban commuters.

- Club Car Inc.:Club Car is a global leader in small-wheel electric vehicles, ranging from golf carts to commercial utility vehicles used in hospitality and facility management.

- Columbia Vehicle Group Inc.:Columbia Vehicle Group produces a comprehensive line of pure-electric utility vehicles designed for moving people and goods in commercial and industrial settings.

- Continental AG:Continental AG provides specialized tires, sensors, and brake systems optimized for the unique weight and torque profiles of light electric vehicles.

- Crystalyte Motors:Crystalyte Motors is a pioneer in high-power hub motors used extensively in the high-performance e-bike and DIY electric vehicle communities.

Recent Developments in Light Electric Vehicles

- In January 2025, Vayve Mobility, EV maker, unveiled India's first solar-powered EV, EVA, at Bharat Mobility Global Expo 2025. These vehicles are starting at Rs. 3.25 lakh. (Source: youtube.com)

- In October 2024, Kinetic Green launched a limited-edition package for its Safar Smart electric passenger car, offering both lead-acid and lithium-ion battery packs to meet the needs of a wide range of customers. The model is designed to be flexible, with ample seating and cargo space to accommodate passenger transportation and light commercial workloads. (Source: drivespark.com)

- In December 2019,Chinese electric vehicle manufacturer Niu Technologies partnered with the Thai government to launch electric scooters and bicycles in Thailand.

- In June 2020, Swedish e-bike company, Cake, announced the launch of a new electric motorcycle model, the Kalk INK, designed for off-road use.

- In September 2020, Chinese electric vehicle manufacturer, Xpeng, announced its entry into the electric scooter market by launching a new model, the Xpeng E300 Plus.

- In October 2021, Indian electric scooter startup, Ola Electric, launched its first electric scooter model, the Ola S1, which offers a range of up to 121 km on a single charge.

- In January 2022, the Japanese automaker, Toyota, announced a partnership with the electric scooter-sharing company, Dott, to launch a new line of electric scooters in Europe.

Segments Covered in the Report

By Vehicle Category

- 2-wheelers

- 3-wheelers

- 4-wheelers

By Application

- Personal Mobility

- Shared Mobility

- Recreation & Sports

- Commercial

By Power Output

- Less than 6 kW

- 6–9 kW

- 9–15 kW

By Component

- Battery pack

- Electric motor (Propulsion Motor)

- Motor controller

- Inverters

- Power Controller

- E-brake booster

- Power Electronics

By Vehicle Type

- e-ATV/UTV

- e-bike

- e-scooter

- e-motorcycle

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting