What is Electric Scooters Market Size?

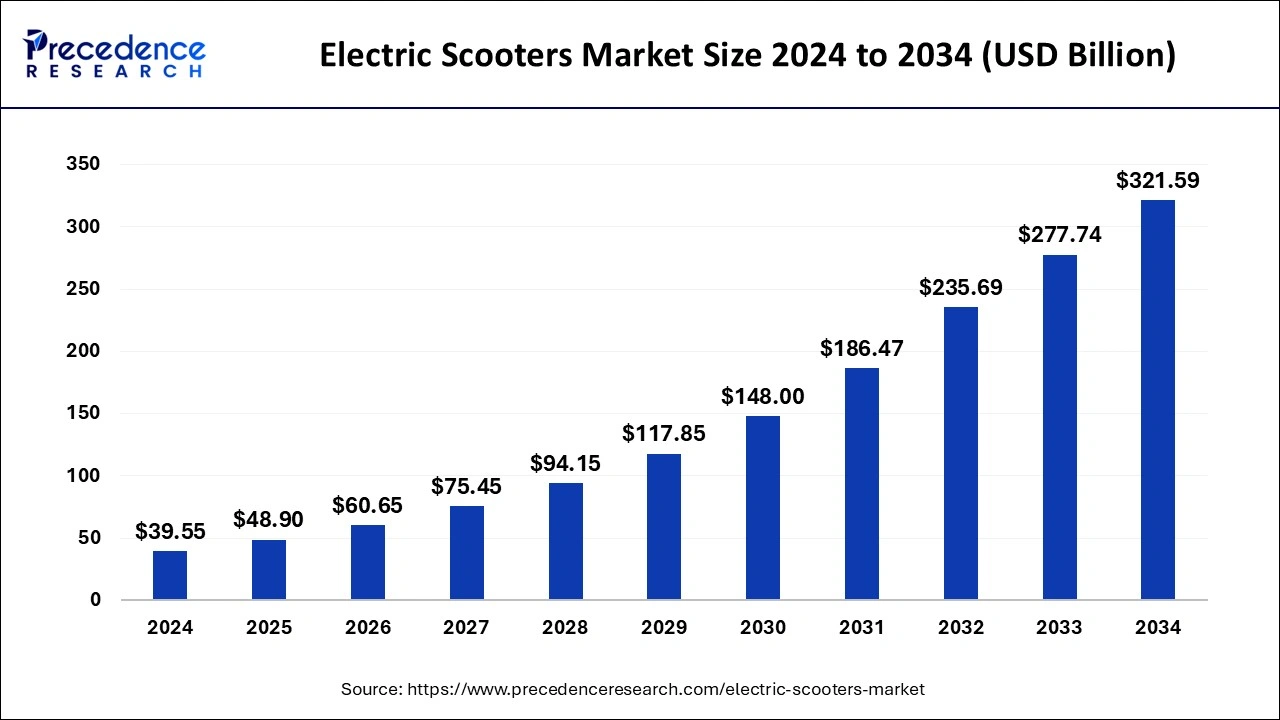

The global electric scooters market size is accounted at USD 48.90 billion in 2025 and predicted to increase from USD 60.65 billion in 2026 to approximately USD 364.24 billion by 2035, expanding at a CAGR of 22.24% from 2026 to 2035. The global electric scooters market is anticipated to be driven by increasing electric scooter sharing services owing to their cost-effective urban commute for end-user across all the developed and developing economies across the globe.

Market Highlights

- North America electric scooters market is anticipated to grow at a registered CAGR of 23.92% from 2026 to 2035

- By product, the folding electric scooter segment is projected to experience the highest growth rate in the market between 2026 to 2035

- By drive type, the hub motor segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By drive type, the belt drive segment dominated the market in 2025.

- By end use, the commercial segment is predicted to witness significant growth in the market over the forecast period.

- By end use, the personal segment accounted for a considerable share of the market in 2025.

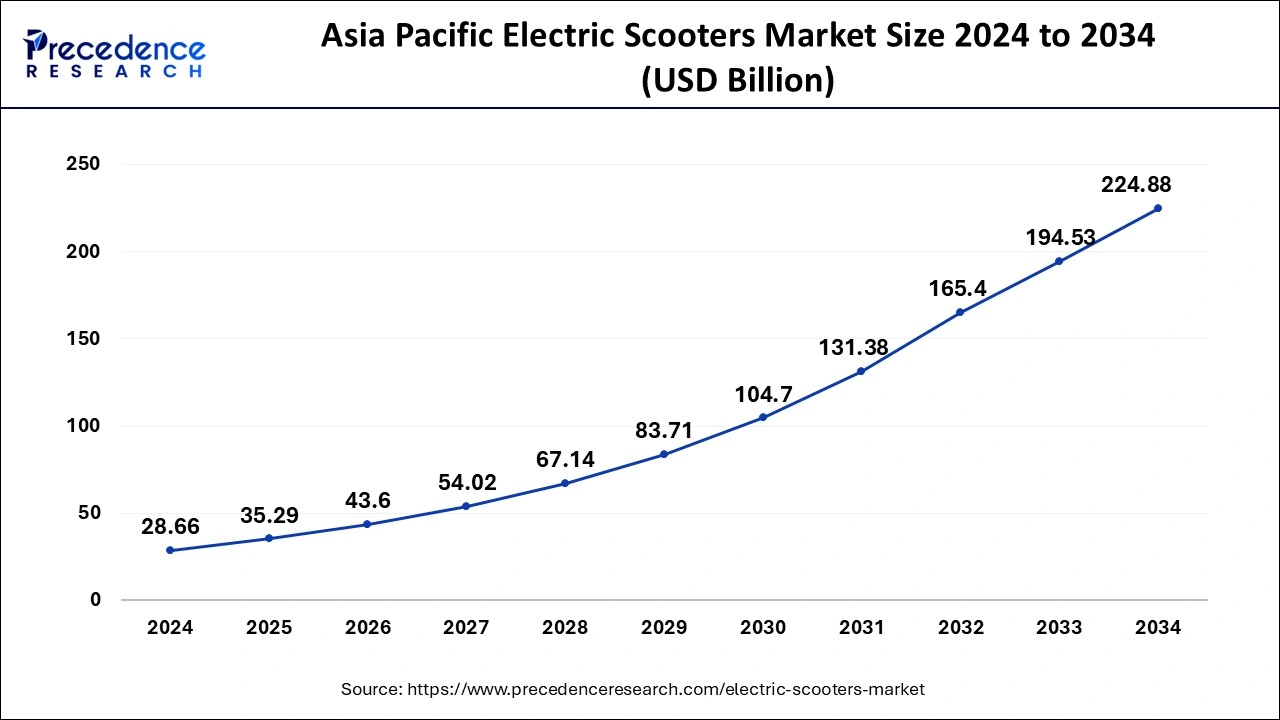

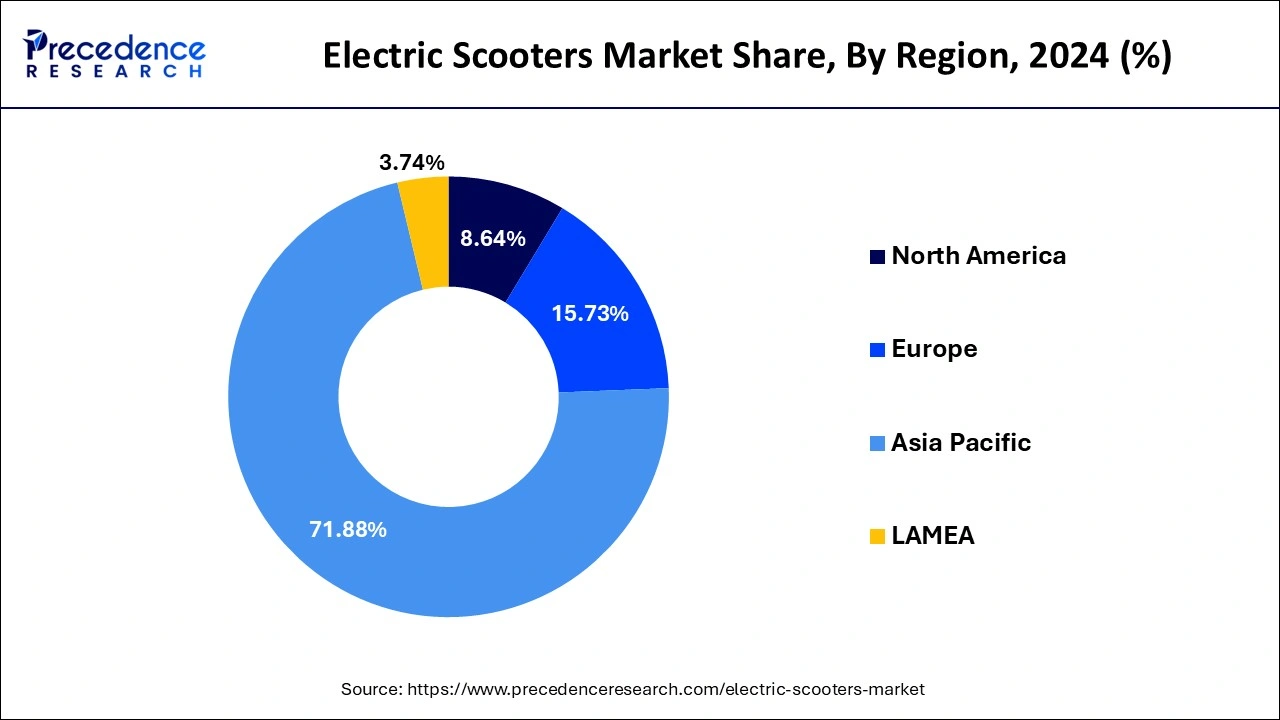

- By region, the Asia Pacific region is projected to expand rapidly in the market in the coming years.

How has AI benefited the Market?

Electric scooters are at the center of a mad rush in applyingartificial intelligence to fleet management, safety, and user experience. Real-time monitoring entails efficient tracking and dynamic rebalancing, whereas predictive maintenance precludes downtime. Demand forecasting and dynamic pricing work in tandem to provide the best placement and revenue maximization for the scooters. Anomalies get detected by AI, which then sends out alerts to emergency services and adjusts the route suggestions.

Beyond affecting maintenance scheduling and energy management optimality, AI also lowers emissions-favoring green-minded operations. Industry-wise, AI churns out patterns that allow businesses to steer decisions based on analyzing rider behaviors and trends in the market. To sum up, AI brings necessary enhancements in the areas of operational excellence, safety, user satisfaction, and green footprint.

Market Overview

The global electric scooters market is expected to grow between 2026 and 2035 due to urbanization growth, rising fuel prices, and the increasing use of low-emission personal mobility worldwide. The Asian-Pacific and European markets enjoy particularly high demand, and e-scooters are becoming more popular among commuters. The International Energy Agency (IEA) projects that global e-scooter sales will reach over 70 million units annually by 2030, with strong adoption in India, China, Germany, and France.

Powering Ahead: Key Growth Drivers Shaping the Electric Scooters Market

- Rising Integration of AI and Motion Tracking: Advancements in artificial intelligence and sensor technologies are fueling the evolution of immersive, data-driven fitness experiences.

- Growing Popularity of Connected Home Gyms: Increasing adoption of smart workout equipment and subscription-based platforms is boosting demand for interactive fitness ecosystems.

- Expansion of Gamified Fitness Experiences: The incorporation of gaming elements, leaderboards, and virtual challenges is driving user engagement and retention across all age groups.

- Surging Demand for Remote Wellness Solutions: Work-from-home trends and digital health awareness are propelling the uptake of interactive fitness apps and virtual coaching programs.

- Rapid Growth of AR and VR Fitness Platforms: The integration of augmented and virtual reality is transforming workouts into fully interactive, immersive experiences, attracting tech-savvy consumers.

Policy and Sustainability Trends:

Governments are promoting e-scooters as a key sustainable transportation option. Policies like the Fit for 55 plan in the European Union, India's FAME II policy, and China's New Energy Vehicle (NEV) initiative have significantly boosted adoption through tax credits and direct purchasing incentives. Major manufacturers like Yadea, NIU Technologies, and Ola Electric are beginning to produce with eco-friendly materials, implement battery recycling, and adopt carbon-neutral manufacturing practices to support global decarbonization.

Technological Advancements:

Rapid innovation in battery technology, vehicle connectivity, and smart mobility platforms is fueling the next wave of growth. With advances such as solid-state batteries and ultra-fast charging networks, supported by Panasonic, LG Energy Solution, and Bosch eBike Systems, the performance standards and economics of ownership are likely to be reshaped by 2030.

International Growth and Investments:

Major producers and distributors of e-scooters are expanding their production and distribution channels across Europe, Southeast Asia, and Latin America to meet the rising demand and capitalize on favorable policies. Ola Electric is constructing one of the largest EV manufacturing plants in India, while Yadea and NIU Technologies continue to expand into Europe and North America.

Tech startups:

The startup ecosystem worldwide is gaining momentum, driven by urban needs, environmental concerns, and venture capital funding. Innovators like River Mobility (India) and Horwin Global (China/Austria) are launching high-performance models designed for both private ownership and ride-hailing. This evolving mobility landscape continues to develop with the integration of battery-as-a-service, app-based analytics, and government-supported infrastructure investments fueling the trend.

Electric Scooters Market Growth Factors

Rising demand for fuel-efficient vehicles across the globe coupled with increasing concern for alarming rise in the global pollution are some of the major factors that drives the market growth of electric scooters over the upcoming years. As a result, governments of various regions have issued stringent emission norms to curb the rate of rising rate of carbon in the environment. For instance, Environmental Protection Agency (EPA) of USA proposed a rule in order to revise the existing national Greenhouse Gas (GHG) emission standards for light trucks and passenger cars.

Similarly, European Commission has also proposed strict measure on the passenger vehicle emission. This is majorly due to 70% out of the total emission is from transport sector and passenger cars are the major contributor among road transports in the rise the GHG gas.

Furthermore, rapid urbanization along with rising population density particularly in the developing nations contribute prominently for the significant rise in demand for electric scooters in these regions. Moreover, it is an affordable and environment-friendly mode of commutation that again propels the market growth during the forecast time frame.

Urban mobility trend such as shared bikes, electric scooters, and dockless bikes have gained significant momentum in the past few years. Electric scooters reduce the overall travelling time as well as is more convenient for short and long-distance commutation. Hence, the preference for electric scooters are rising rapidly even greater compared to electric cars during the upcoming years.

However, sudden outbreak of coronavirus in the year 2020 has impacted the automotive sales badly along with several other industries owing to disruption in the supply chain structure across the globe. Nonetheless, diversity in the e-scooter models and on-going research on electric scooters for improving its performance propels the market growth for electric scooters over the forthcoming period.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 48.90 Billion |

| Market Size in 2026 | USD 60.65 Billion |

| Market Size by 2035 | USD 364.24 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 22.24% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Voltage, Battery, Product, and region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEAN |

Market Dymaics

Drivers

Increasing adoption for electric scooters sharing service

The growing adoption of electric scooter sharing services in countries like France, Germany, the U.S., and Spain, among others, has spurred the demand for electric scooters. The companies such as Bird Rides, Inc., Lime, Spin, Uber Technologies Inc., emmy-sharing, Cooltra Motos SL, Scooty, and Razor USA LLC offering electric scooter sharing services are procuring electric scooters mainly from the manufacturers like Ninebot-Segway, Gogoro, Inc., and Xiaomi. The penetration of electric scooter sharing service is witnessing an exponential adoption rate since 2016. Currently, more than 90 cities and various universities across the globe use electric scooter sharing service, with around 95 percent of the scooters having an electric drivetrain. The growth of the electric scooter market is attributed to the increasing adoption of scooters as the preferred mode of transportation, especially from the time when electric scooters entered this market space.

Moreover, electric scooters have become a cost-effective urban commute for an end-user. Its sleek design and easy handling capability help commuters avoid traffic congestion and simultaneously reduce carbon emissions. Therefore, the above-mentioned factors are some of the key drivers behind the escalating adoption of electric scooters. Since the electric scooter sharing industry is currently undergoing rapid development and is in a transition phase; therefore, the electric scooters sharing operators are also expanding their presence to both untapped and competitive markets.

Restraints

Range anxiety amongst the consumers posing a challenge for the adoption of electric scooters

Many potential buyers are concerned about the distance or range covered in a single charge of the electric scooter. Thus, electric scooter owners are a bit reluctant towards purchasing these scooters due to the fact that an electric scooter might not have the necessary range to take them to their desired destination. The driving distance or range of electric scooters on a single charge is shorter than the distance covered by the normal scooters on a full-tank of traditional fuel. This problem is severely linked to the lack of charging infrastructure across many countries.

The normal scooters can be refueled at petrol stations, such regularized infrastructure (charging station) is not yet available for electric scooters, thus hindering the market growth. But these obstacles are slowly fading with increasing investments in the charging infrastructure across the globe. For instance, in 2017, HM Treasury from the Government of the U.K. announced the establishment of the Charging Infrastructure Investment Fund (CIIF). It includes a EUR 200 million investment from the government, and the same amount needs to be contributed by the private sector. Several such investments are taking place across the globe and are expected to eliminate the range anxiety amongst the consumers over the next five years.

Opportunity

The rise of battery swapping infrastructure, particularly in Southeast Asia, is poised to dramatically accelerate e-scooter adoption. Companies such as Oyika in Thailand are building out extensive Battery-as-a-Service (BaaS) models, enabling users to exchange depleted batteries for fully charged ones quickly and conveniently. This model reduces downtime and lowers the entry cost barrier for consumers, making electrified two-wheelers more accessible and user-friendly, especially in densely populated urban regions.

Electric scooters are emerging as a linchpin in the transformation toward smarter, greener cities. Urban planners envision seamless integration of e-scooters into multimodal transportation networks complete with dedicated lanes, geofencing, real-time traffic management, and adaptive regulations that respond to usage data. Meanwhile, brands like Vmoto are partnering with delivery platforms to pilot battery swap services in major European cities, combining micro mobility with commercial use cases to unlock new growth pathways.

Connected and IoT-Enabled Scooters

With the soaring growth of connected and IoT-enabled scooters, the electric scooter space is certainly able to take a great advantage of it. The additional features are capable of real-time GPS tracking, remote diagnostics, and ensuring enhanced security, thereby creating user-friendly options for fleet user convenience and very efficient options on the management side. IoT integration essentially allows the scooters and the management platform to communicate effectively for predictive maintenance and resource re-allocation. Given that consumers want increasingly smarter and connected mobility solutions, having products that are IoT-enabled would provide tremendous differentiation and would lead to far greater user engagement and new services, thereby increasing the universe for smart mobility and data platforms.

Electric Scooters Market Segment Insights

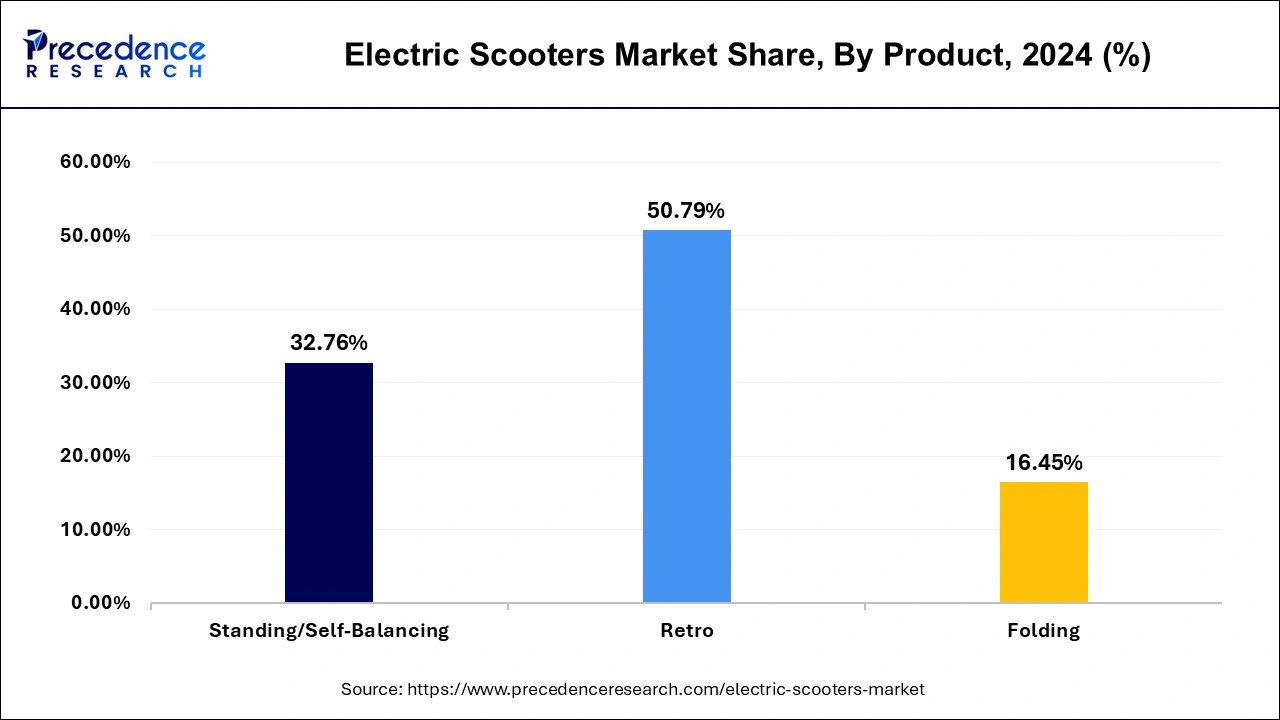

The electric scooter market by product type includes categories such as folding, retro, and self-balancing scooters. Among these, the folding electric scooters segment is projected to experience the highest growth rate in the market between 2025 and 2034. This growth is driven by increasing urban congestion, the demand for portable and space-saving personal mobility solutions, and rising adoption among commuters for first and last-mile connectivity. Folding scooters are particularly favoured for their lightweight design, ease of storage, and compatibility with public transportation systems. On the other side, folding e-scooter type exhibit accelerating growth of nearly 16.45% during the forecast period. Increasing penetration of next-generation technologies such as big data and Internet of Things (IoT) and rising need for product differentiation have triggered the demand for folding electric scooters. However, higher degree of convenience and control of standing/self-balancing electric scooters in residential and commercial application basically for the amalgamation of daily activities likely to prosper its demand over the forecast period. Electric Scooters Revenue, By Product, 2022-2024 (USD Million)

The 36V segment was valued at USD 24,119.55 million in 2024 and it is expected to reach at a CAGR of 22.80% from 2026 and 2035. The greater than 48V segment was valued at USD 2,786.07 million in 2024, registering at a CAGR of 24.60% from 2025 and 2034. The deployment of additional voltage levels i.e., scooters with voltage greater than 48V offer several advantages. These systems facilitate the realization to reduce carbon dioxide emissions at acceptable cost levels. Furthermore, these voltage systems offer features such as air conditioning compressors, turbochargers, and so on that are difficult to implement in 12V or 24V systems. The need to reduce carbon footprints is estimated to proliferate the growth of high voltage electric scooters.

In terms of drive type, electric scooters are typically classified into belt drive, chain drive, and hub motor systems. The hub motor segment is anticipated to grow with the highest CAGR in the market during the studied years. Hub motors offer better efficiency, less maintenance, and a quieter ride compared to chain and belt drivers, making them increasingly popular for both personal and shared mobility applications. However, by drive type, the belt drive segment dominated the market in 2025. Belt drivers are known for their smoother performance, better durability, and relatively low noise levels. They are especially common mid to high-end electric scooter models, contributing to their strong market position.

Based on end use, the market is divided into personal and commercial segments. The personal segment accounted for a considerable share 9of the market in 2024. Growing consumer preference for environmentally friendly transport options, rising fuel costs, and the need for convenient short-distance commuting have propelled personal electric scooter adoption, particularly in urban areas. Looking ahead, the commercial segment is predicted to witness significant growth in the market over the forecast period. With the rapid expansion of the gig economy, food delivery, courier services, and ride-sharing platforms, electric scooters are being increasingly deployed for short-range commercial transportation due to their cost-effectiveness, low emissions, and operational efficiency.Product Insights

Product

2022

2023

2024

Standing/Self-Balancing

8,817.32

10,862.95

12,955.07

Retro

13,254.04

16,151.36

20,088.80

Folding

4,031.65

5,069.04

6,506.64

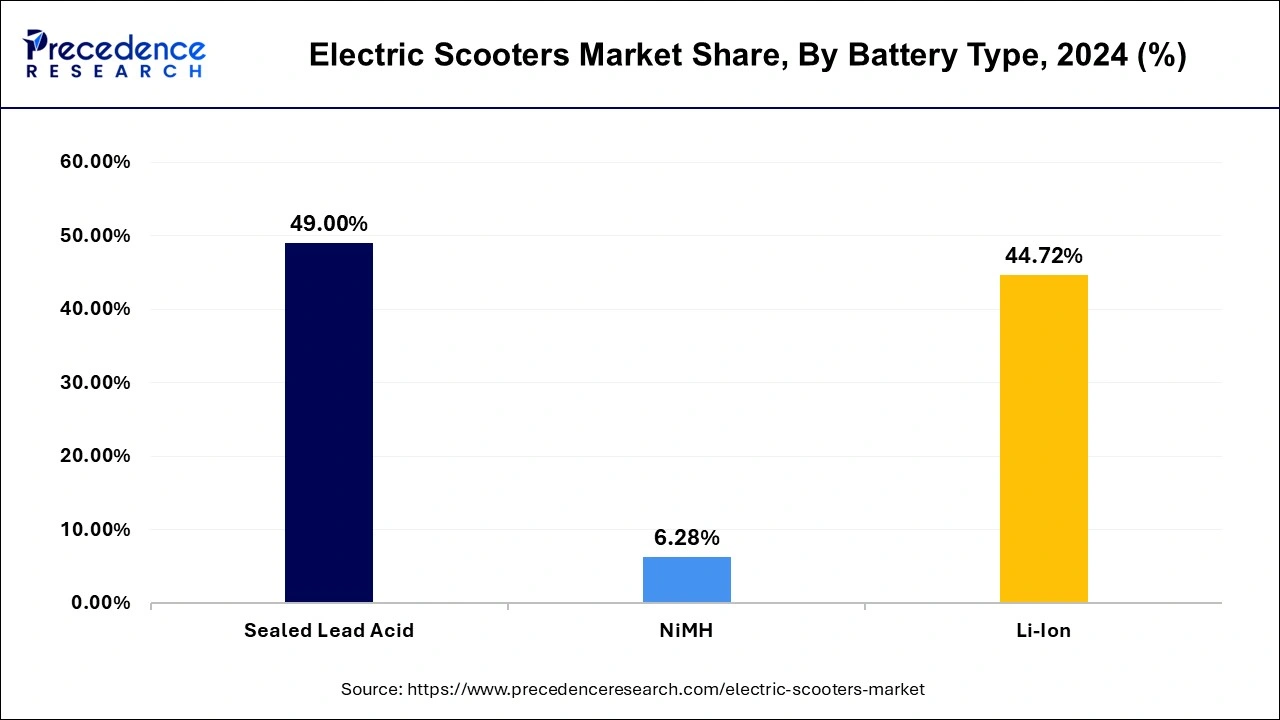

Battery Type Insights

Drive Type Insights

End use Insights

Electric Scooters Market Regional Insights

The Asia Pacific electric scooters market size is exhibited at USD 35.29 billion in 2025 and is projected to be worth around USD 254.41 billion by 2035, growing at a CAGR of 21.84% from 2026 to 2035. The Asia Pacific region is the front-runner in the global electric scooters market, accounting for a revenue share of approximately 71.88% in the year 2024 and predicted to witness significant growth over the upcoming years. This is primarily attributed to the increasing concentration of electric scooter manufacturers in Japan, China, and Taiwan that acquire significant share in electric scooters market across the world.

The North America anticipated to witness the fastest growth of approximately 8.64% over the upcoming time frame owing to increasing investment from government bodies in theelectric vehicle charging infrastructure coupled with research support for high-density batteries.

The U.S. market has been dominated by the shared electric scooter fleet segment over the past year, with increased adoption in metropolitan areas such as Los Angeles, Austin, and Washington, D.C., along with a surge in commuter demand for sustainable first- and last-mile transportation. Grants from the federal and state levels, provided through the Infrastructure Investment and Jobs Act (IIJA), are expected to improve charging infrastructure and connectivity, enhancing the scalability of the future fleet.

In Europe, the electric scooters market is witnessing growing traction, particularly in urban areas where regulatory support and infrastructure for micro-mobility are advancing rapidly. Countries like Germany and France have implemented clear policies regarding electric scooter usage, helping drive adoption. Additionally, shared mobility services have gained strong momentum, with operators like Bolt expanding their fleets across numerous European cities. Emerging market entrants, including Indian manufacturers such as Hero MotoCorp, are preparing to introduce their electric scooter brands in key European countries like the UK, France, and Spain. Despite this activity, the region lacks clearly defined data on country-level market size, segmentation by drive type or end use, and forecasted growth trends, presenting an opportunity for deeper regional analysis. Germany Electric Scooters Market Analysis In Germany, shared fleet operations are growing, supported by a strong urban mobility policy and rapid expansion among operators in Berlin, Munich, and Hamburg. The emphasis on sustainable transportation, safety standards regulation, and integration with the public transport system has increased the use of shared scooters in cities. Incentives from the German Klimaschutzprogramm 2030 are likely to boost consumer interest in private e-mobility options.

The market in India is characterized by mass-market, low-speed electric scooters last year, driven by aggressive pricing, local manufacturing volumes, and strong government support through the FAME II (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) program. The states of Maharashtra, Tamil Nadu, and Gujarat emerged as production hubs, supported by favorable policies, EV subsidies, and local component sourcing. The growth of domestic OEMs, including Ola Electric, Ather Energy, TVS Motor, and Bajaj Auto, is likely to foster innovation and boost export potential.

Rising urbanization and the need to travel short distances in large cities like São Paulo, Rio de Janeiro, and Curitiba have increased the importance of imported, low-cost shared and personal scooters to lead the Brazilian market in 2024. The development of local manufacturing and reductions in import duties on battery components are expected to make these scooters more affordable and help the ecosystem mature.

United Arab Emirates Electric Scooters Market Analysis Pilot shared scooter schemes were widespread in Dubai, Abu Dhabi, and Sharjah, contributing to the UAE market, supported by smart-city initiatives in the UAE Vision 2031. The integration of smart infrastructure into the Roads and Transport Authority (RTA) system could likely enhance operational efficiency and safety. South Africa Electric Scooters Market Analysis In 2024, the South African market was primarily driven by imported entry-level scooters, mainly used by urban commuters and small-scale delivery operators. The focus on cost-effectiveness and growing awareness of the financial benefits of e-mobility contributed to a steady adoption trend in the country. Additionally, improvements in electricity reliability and the integration of renewable energy sources will further enhance market sustainability and resilience.

Electric Scooters Market Value Chain Analysis

- Raw Material Procurement:

This stage involves sourcing key materials for battery production, such as lithium, nickel, cobalt, and rare earth elements, as well as aluminum and steel for frames and chassis. Asia-Pacific, particularly China, Indonesia, and Australia, dominates the global supply chain for these raw materials, giving the region a strategic advantage in cost and availability. - Battery and Component Manufacturing:

Battery production remains the most value-intensive segment in the chain, accounting for nearly 35–40% of the total scooter cost. Key suppliers include CATL, LG Energy Solution, and Panasonic. In addition to batteries, tier-1 suppliers also manufacture electronic control units (ECUs), motors, braking systems, and IoT modules, with increasing localization in India, Taiwan, and Vietnam to reduce import dependency. - Vehicle Assembly and Integration:

At this stage, OEMs such as Yadea, NIU Technologies, Hero Electric, and Ola Electric integrate batteries, drivetrains, and digital systems into the final vehicle. The focus is shifting toward smart connectivity, modular design, and lightweight materials to enhance performance and reduce energy consumption. Automation and lean production practices are improving cost efficiency and scalability. - Distribution and Retail Networks:

The market operates through a hybrid sales model that combines traditional dealerships, e-commerce platforms, and subscription-based mobility services. Companies are expanding direct-to-consumer (D2C) and online retail channels, while global brands increasingly partner with logistics firms to streamline exports and aftersales support. - End-User Services and Aftermarket Ecosystem:

Post-sale services, including battery swapping, charging infrastructure, maintenance, software upgrades, and fleet analytics, are emerging as key revenue drivers. Service platforms such as Gogoro Network and Ather Grid are leading this transformation by offering integrated energy management and subscription-based maintenance models. - Circular Economy and Recycling Initiatives:

With rising emphasis on sustainability, the industry is adopting closed-loop recycling systems for lithium-ion batteries and materials recovery. Companies like Redwood Materials and Attero Recycling are partnering with OEMs to develop efficient end-of-life battery management, reducing raw material dependence and environmental footprint.

Key Companies & Market Share Insights

Leading players in the global electric scooters market are largely focused on research & development activity along with product level strategies in order to expand their market reach across the globe. Industry participants adopt various strategies in different regions depending in the consumer preference and nature. For instance, in Taiwan Gogoro Inc. introduced swappable battery electric scooters that has revolutionized the market. In addition, several Asian vendors are affiliating with the company to integrate the swappable battery technology in their e-scooters.

- JIANGSU XINRI E-VEHICLE CO., LTD. is a China-based company engaged in the production of electric vehicles. The company is engaged in the manufacture and sale of electric scooters and motorcycles. The company is investing significantly in the R&D activities for development of technologically advanced electric vehicles, as well. It has three main production units in Wuxi, Tianjin, and Xiangyang in China.

- Gogoro, Inc. is a Taiwan-based company involved in the manufacturing of electric scooters as well as battery swapping products. It is focused on integrating the latest innovations in its Energy Network in order to enhance mobility and connectivity. The company adopted partnership and product launch as its key strategy to maintain its foothold in the market. The company also focuses on innovations to stay aligned with the transitioning phase of the electric scooters market. For instance, the company launched Gogoro 2 Smartscooter with battery swapping, smart connectivity, and high-performance for a wide customer base across the globe.

- Yadea Technology Group Co., Ltd. is a China-based manufacturer of electric bikes, electric scooters, electric tricycles, and other special vehicles. Recently, it set up four production units in Guangzhou, Tianjin, Ningbo, and Wuxi provinces. The company exports its electric scooter model to 66 countries, including the U.S., and Germany, to name a few.

- In the electric scooters market, the market leaders comprise the China- and Taiwan-based scooter players including Gogoro, Inc., Yadea Technology Group Co. Ltd., NIU International, and Jiangsu Xinri E-Vehicle. These players generate revenue by selling their products either through their local and international distribution channels or through the OEM channel across the globe. To enter into the premium electric scooter segment, Niu International has differentiated itself by integrating a number of advanced connected features to enrich the riding experience.

- The increasing popularity of electric scooter sharing services and the growing awareness about ecofriendly vehicles are some of the major factors that are opening growth opportunities for other electric scooter manufacturers. In addition, the electric scooter sharing start-ups are collaborating with top manufacturers in the market to expand their customer base and enhance their product offerings in the market.

Charging Ahead: Inside the Global Trade, Policy, and Tech Forces Driving Electric Scooters

- China remains the world's largest producer and exporter of electric scooters, accounting for nearly 65–70% of global production in 2024, with export volumes exceeding 15 million units valued at approximately USD 6–7 billion, according to China Customs and MIIT data.

- India has rapidly emerged as the second-largest producer, driven by companies like Ola Electric, Ather Energy, Hero MotoCorp, and TVS Motor, with exports exceeding USD 1.2 billion in FY24, primarily to Southeast Asia, Latin America, and Africa.

- Germany and the Netherlands are key European exporters, focusing on premium e-scooters and urban mobility fleets, with Germany's export share valued at around USD 800–900 million in 2024.

- The U.S. imported over 1.5 million e-scooters in 2024, valued at USD 900 million, mainly from China and Taiwan, as reported by the U.S. International Trade Commission (USITC).

- France and Italy have seen rapid growth in imports due to national e-mobility incentives, with import values reaching EUR 650–700 million combined, supported by European Commission DG MOVE data.

- European Union continues to lead with its Fit for 55 and Green Deal frameworks, under which several countries (France, Germany, Spain, and Italy) offer purchase subsidies up to €900 per e-scooter, backed by data from European Commission DG MOVE.

- India's FAME II scheme (Faster Adoption and Manufacturing of Electric Vehicles) provides incentives of INR 15,000 per kWh, supporting the sale of over 1.3 million e-scooters since its inception, as per the Ministry of Heavy Industries.

- Globally, more than 3.8 million public charging points were installed by mid-2024, with Asia-Pacific accounting for nearly 65%, according to the International Energy Agency (IEA) Global EV Outlook 2024.

- Europe's Horizon Europe Program has allocated €310 million toward urban micromobility R&D projects under the EU Mission on Climate-Neutral Cities initiative

Electric Scooters Market Companies

- Gogoro Inc.

- AllCell Technologies LLC

- BMW Motorrad International

- BOXX Corp.

- Green Energy Motors Corp.

- Honda Motor Co. Ltd.

- Greenwit Technologies Inc.

- Jiangsu Xinri E-Vehicle Co., Ltd.

- Mahindra GenZe

- KTM AG

- Peugeot Scooters

- Terra Motors Corporation

- Suzuki Motor Corporation

- Vmoto Limited

- Yamaha Motor Company Limited

- Yadea Technology Group Co. Ltd.

- Xiaomi

- Bird

- Ninebot Limited

- Lime

- Spin

Recent Developments

- In August 2025, Zelo Electric launched the Knight+, an affordable electric scooter priced at Rs 59,990, offering a range of features. (Source:https://timesofindia.indiatimes.com)

- In July 2025, the Kinetic DX electric scooter in India is priced at Rs 1.11 lakh (ex-showroom) and Rs 1.17 lakh (ex-showroom), with bookings limited to 35,000 units via the Kinetic EV website. Delivery starts in September 2025. (Source: https://www.ndtv.com)

- In June 2025, China announced it is increasingly embracing sodium-ion battery technology in its electric scooter industry. A major manufacturer, Yadea, has already launched multiple models powered by sodium-ion chemistry and is rapidly expanding related infrastructure with plans for thousands of fast charging and battery swap stations. Analysts predict a growing share of electric scooters will adopt sodium-ion power, driven by cost advantages and sustainability benefits, even as traditional lithium-ion maintains dominance. (Source: https://www.techradar.com)

- In August 2025, Hero MotoCorp unveiled its new electric model, the Vida VX2, introducing a Battery as a Service (BaaS) option to reduce upfront costs and enhance affordability for consumers. In India, Ather Energy demonstrated strong operational performance with a significant improvement in revenue and reduced quarterly losses, while also catching investor attention. However, performance pressures persist, with Bajaj Auto announcing it will only meet about half to two-thirds of its planned deliveries for the current quarter, citing a shortage of critical rare earth magnets, underscoring ongoing supply chain vulnerabilities.

(Source: https://auto.economictimes.indiatimes.com)

Electric Scooters Market Segments Covered in the Report

By Product Type

- Standing/Self-Balancing

- Retro

- Folding

By Battery Type

- NiMH

- Sealed Lead Acid

- Li-ion

By Voltage Type

- 24V

- 36V

- 48V

- Greater than 48V

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content