Lithium Market Size and Forecast 2025 to 2034

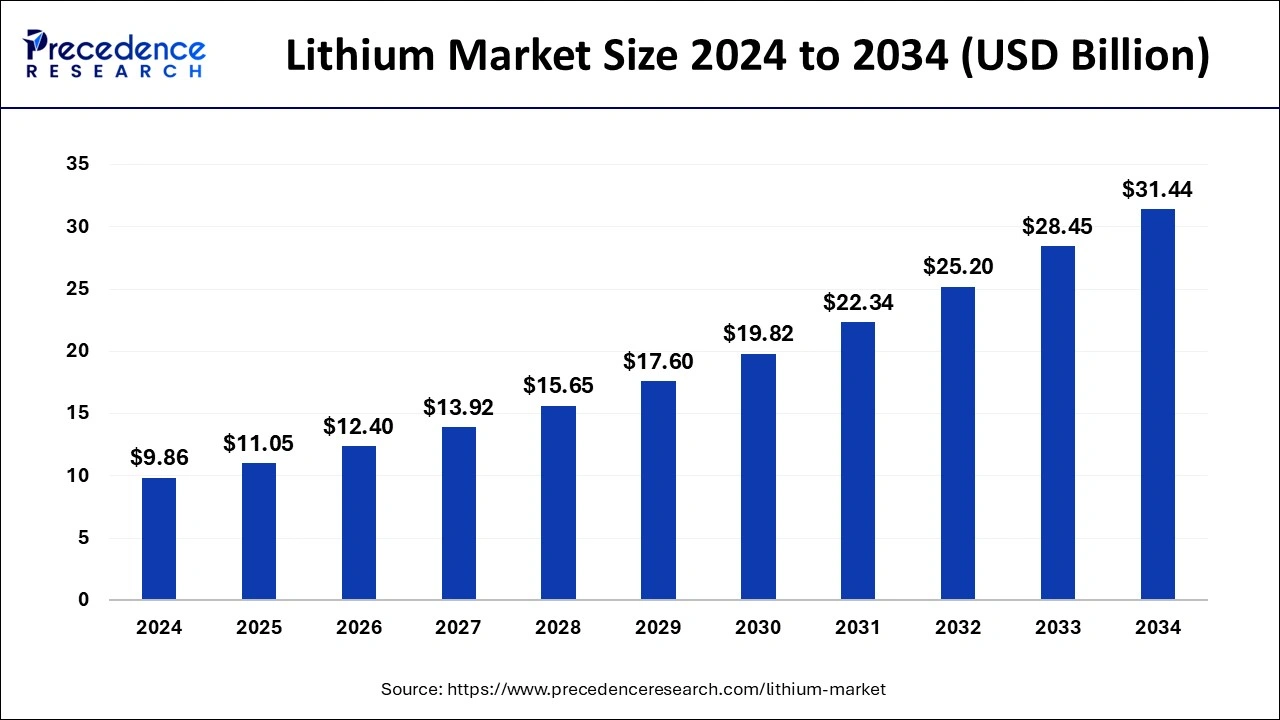

The global lithium market size was estimated at USD 9.86 billion in 2024 and is predicted to increase from USD 11.05 billion in 2025 to approximately USD 31.44 billion by 2034, expanding at a CAGR of 12.30% from 2025 to 2034.

Lithium MarketKey Takeaways

- In terms of revenue, the lithium market is valued at $11.05 billion in 2025.

- It is projected to reach $31.44 billion by 2034.

- The lithium market is expected to grow at a CAGR of 12.30% from 2025 to 2034.

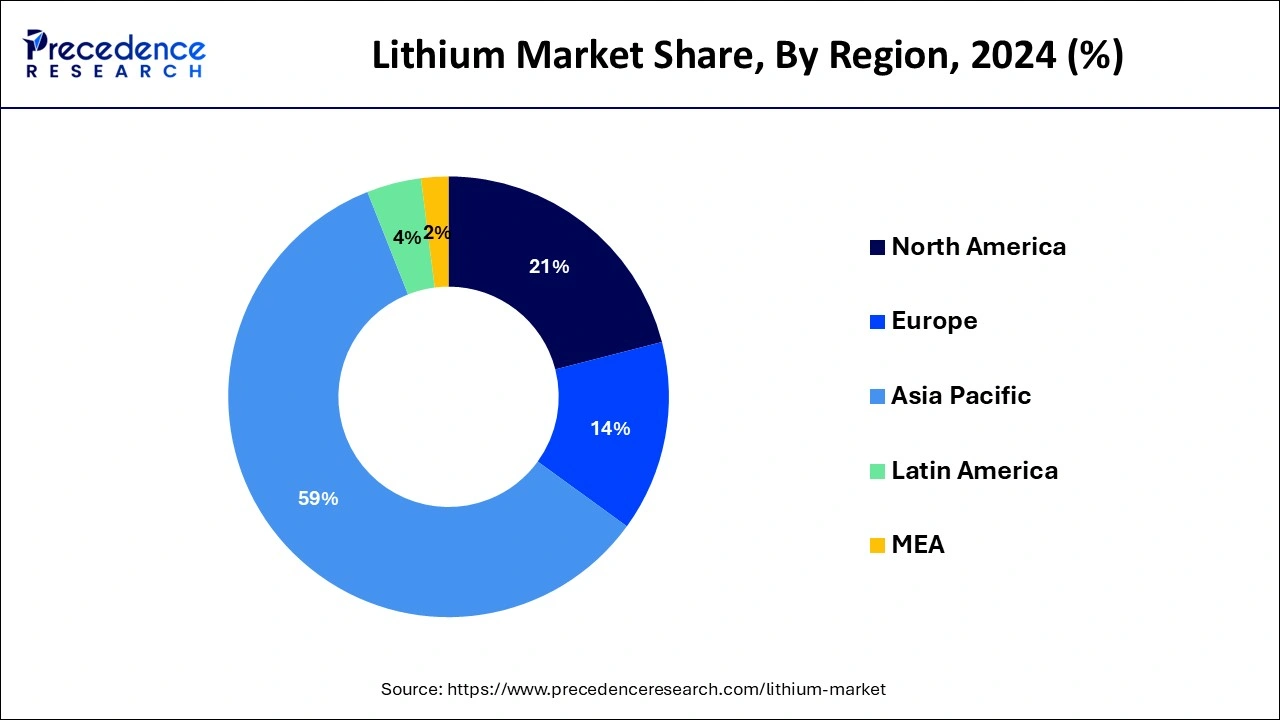

- Asia-Pacific contributed 59% of market share in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

- By product, the carbonate segment has held the largest market share of 55% in 2024.

- By product, the hydroxide segment is anticipated to grow at a remarkable CAGR of 13.3% between 2025 and 2034.

- By application, the automotive segment generated over 41% of market share in 2024.

- By application, the consumer electronics segment is expected to expand at the fastest CAGR over the projected period.

Asia PacificLithium Market Size and Growth 2025 to 2034

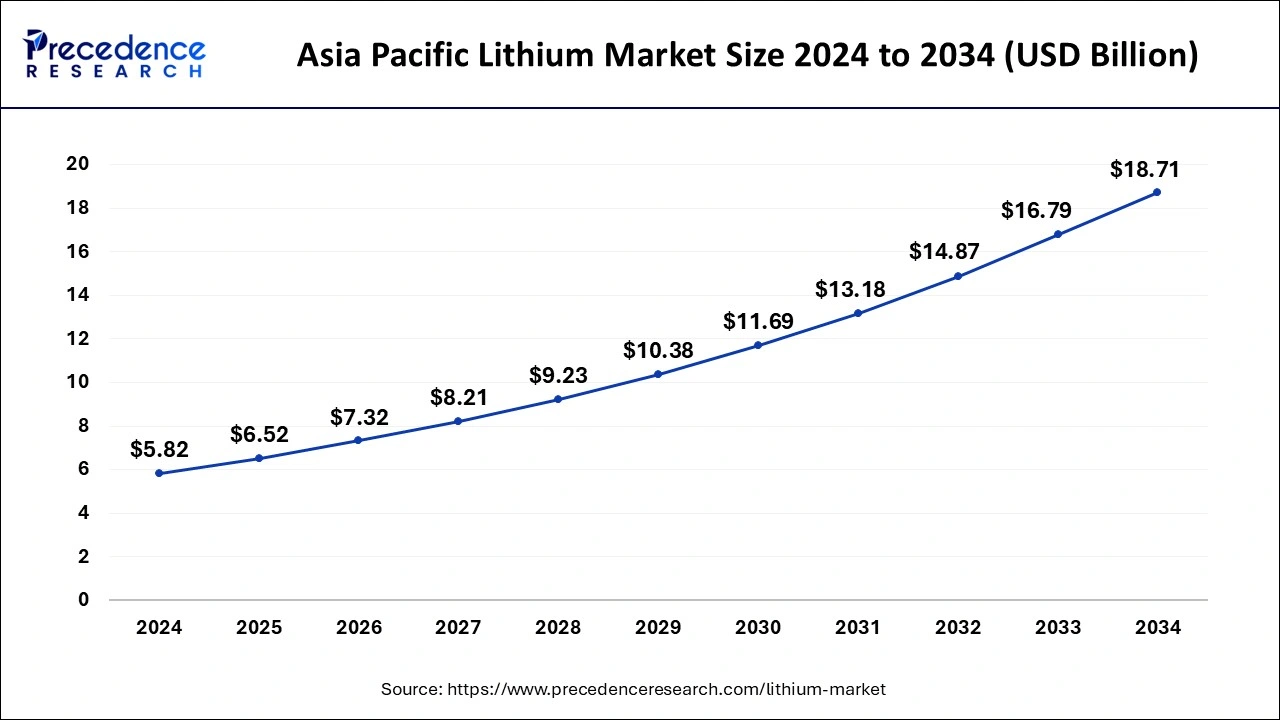

The Asia Pacific lithium market size was valued at USD 5.82 billion in 2024 and is anticipated to reach around USD 18.71 billion by 2034, poised to grow at a CAGR of 12.39% from 2025 to 2034.

Asia-Pacific held the largest market share of 59% in 2024 in the lithium market due to robust demand for electric vehicles (EVs) and consumer electronics. Countries like China lead in EV adoption, driving the need for lithium-ion batteries. The region's economic growth, technological advancements, and government initiatives supporting clean energy contribute to the dominance. Additionally, key lithium producers and manufacturers are concentrated in Asia-Pacific, establishing it as a central hub for the lithium supply chain. These factors collectively position the region as a powerhouse in driving the growth and development of the lithium market.

- In April 2025, lithium prices have been lowest lowest in over three years due to an oversupplied market and escalating trade tensions. S&P Global reported in the latest quarter lithium report, lithium carbonate prices fell by 5.4% to 70,000 yuan per tonne in China by April 16, 2025. It is the lowest price in China since January 2021.

- The lithium carbonate shipped price to Asia dropped 5.3% to $9,000 per tonne, the weakest since February 2021, according to Platts data. Source: carboncredits.com

North America is poised for rapid growth in the lithium market due to the increasing demand for electric vehicles (EVs) and renewable energy initiatives. The region's commitment to sustainability and the push for clean transportation has fueled a surge in EV adoption. Additionally, investments in energy storage projects and advancements in battery technology further contribute to the growing demand for lithium. With a focus on reducing dependence on fossil fuels, North America stands as a key player in driving the expansion of the lithium market in the coming years.

The U.S. is a major player in the regional market, growth driven by rising government focus toward fostering countries' mineral production capabilities. The US is stepping forward to reduce dependence on foreign sources, resulting in a boost to lithium production in the country.

- In March 2025, President Donald Trump signed an executive order to accelerate mineral production by enhancing funding, streamlining permits, and expanding federal land access.

- In April 2025, the US launched a critical minerals investigation, resorted to the US tariffs. The tariffs are expected to incentivize local mining and refining of lithium and cobalt

Meanwhile, Europe is experiencing notable growth in the lithium market due to a strong push toward electric mobility and renewable energy. With stringent environmental regulations and increasing adoption of electric vehicles, the demand for lithium-ion batteries has surged. Governments are promoting sustainable energy solutions, fostering investments in lithium production and battery technologies. The European Union's commitment to carbon neutrality and the expansion of electric vehicle infrastructure contribute to the region's dynamic growth in the lithium market.

Market Overview

The lithium market revolves around the offering of a chemical element known for its lightweight and highly reactive properties. It is a crucial component in rechargeable batteries, playing a vital role in various electronic devices like smartphones, laptops, and electric vehicles. Due to its ability to efficiently store and release electrical energy, lithium-ion batteries have become the preferred choice for powering modern technology. Moreover, lithium has garnered significant attention in the renewable energy sector, where it is essential for storing energy generated by solar panels and wind turbines. As the demand for electric vehicles and clean energy solutions continues to rise, the importance of lithium in powering our digital and sustainable future becomes increasingly evident.

Lithium Market Data and Statistics

- In 2021, China experienced a remarkable surge in electric vehicle (EV) sales, with over 3.3 million units sold, reflecting a substantial 169% increase compared to the previous year, as reported by the China Passenger Car Association (CPCA).

- Notably, CATL, a prominent Chinese battery manufacturer, commands a significant share, surpassing 30%, of the global EV battery market. Darton Commodities, specializing in cobalt supply, estimated that Chinese refineries contributed approximately 85% of the world's cobalt tailored for battery use, a crucial mineral enhancing the stability of lithium-ion batteries.

- According to the National Blueprint for Lithium Batteries, China is poised to achieve an impressive 1,811 gigawatt-hours (GWh) of lithium cell production by 2025.

- Adding to this trend, data from the Korea Automotive Technology Institute (KAII) indicates a substantial 96% surge in electric vehicle sales in South Korea, reaching 71,006 units during the initial nine months of 2021.

Lithium MarketGrowth Factors

- The surge in the global adoption of electric vehicles is a key driver for the lithium market. As countries and consumers increasingly prioritize clean energy and sustainability, the demand for lithium-ion batteries in EVs continues to grow significantly.

- Lithium-ion batteries play a crucial role in energy storage systems, supporting the integration of renewable energy sources like solar and wind. The transition to clean and sustainable energy contributes to the growth of the lithium market.

- Ongoing technological advancements and improvements in battery efficiency drive the demand for lithium. As research and development efforts lead to more efficient and cost-effective lithium-ion batteries, their applications expand across various industries.

- Government initiatives promoting the use of electric vehicles and clean energy often stimulate the lithium market. Subsidies, incentives, and regulations favoring the adoption of lithium-ion batteries contribute to market growth globally.

- The ubiquitous use of lithium-ion batteries in consumer electronics, such as smartphones, laptops, and wearable devices, maintains a consistent demand for lithium. The lightweight and high energy density properties of lithium make it ideal for powering portable gadgets.

- The increasing pace of industrialization and urbanization worldwide fuels the demand for lithium in various applications. From powering industrial machinery to providing backup energy for smart cities, lithium's versatility makes it a critical component in diverse sectors.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 12.30% |

| Market Size in 2025 | USD 11.05 Billion |

| Market Size by 2034 | USD 31.44 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Surge in electric vehicle (EV) demand

- In 2021, China, the world's largest EV market, sold over 3.3 million units, marking a remarkable 169% increase from the previous year (China Passenger Car Association).

The surge in electric vehicle (EV) demand has significantly bolstered the lithium market, a key component in rechargeable batteries. As more people globally embrace the shift towards cleaner and sustainable transportation, the demand for EVs has skyrocketed. Lithium-ion batteries, powered by lithium, are the preferred energy storage solution for electric vehicles due to their lightweight nature and high energy density.

The rise in EV adoption is not only driven by environmental concerns but also by advancements in battery technology, making electric cars more practical and affordable. This growing demand for electric vehicles directly translates to an increased need for lithium, as it remains a critical element in the production of batteries that power these environmentally friendly vehicles. As the automotive industry continues to prioritize electric mobility, the lithium market is witnessing a surge in demand, playing a pivotal role in shaping the future of clean and sustainable transportation.

Restraint

Cobalt dependency in battery chemistry

Cobalt dependency in battery chemistry serves as a significant restraint on the demand for the lithium market. Lithium-ion batteries, while pivotal for powering electric vehicles and electronic devices, often rely on cobalt to enhance stability and performance. However, cobalt extraction poses ethical concerns, including issues related to child labor and unsafe mining practices, leading to increased scrutiny and calls for sustainable alternatives.

The fluctuating supply and rising prices of cobalt further contribute to the restraint, as the lithium market is vulnerable to disruptions in the cobalt supply chain. Industry stakeholders are actively seeking ways to reduce or eliminate cobalt in battery formulations to address these challenges. Efforts to develop cobalt-free battery technologies and explore alternative chemistries are crucial for ensuring the sustainability and resilience of the lithium market in the face of cobalt-related constraints.

Opportunity

Energy storage systems

Energy Storage Systems (ESS) represent a significant opportunity for the lithium market. As the world increasingly relies on renewable energy sources like solar and wind, the need for efficient energy storage becomes paramount. Lithium-ion batteries, being lightweight and offering high energy density, emerge as a key solution for storing excess energy generated by renewables. This surge in demand for ESS not only enhances the market for lithium but also positions it at the forefront of supporting grid stability and promoting the growth of sustainable energy.

Moreover, the versatility of lithium-ion batteries extends beyond electric vehicles, finding extensive use in grid-scale energy storage projects. These projects aim to store excess energy during periods of low demand and release it when demand is high, providing a reliable and flexible solution for managing energy grids. As the global focus on clean energy intensifies, the expanding role of lithium in energy storage systems presents a strategic opportunity for market players to contribute to a more sustainable and resilient energy infrastructure.

Product Insights

The carbonate segment held the highest market share of 55% in 2024. In the lithium market, the carbonate segment refers to lithium carbonate, a key chemical compound derived from lithium ore. Lithium carbonate is a crucial component in the production of lithium-ion batteries used in various applications, including electric vehicles and consumer electronics. A notable trend in this segment involves increasing demand driven by the growing electric vehicle market, renewable energy storage systems, and technological advancements in battery chemistry. The carbonate segment's prominence highlights its pivotal role in meeting the rising global demand for sustainable energy solutions.

The hydroxide segment is anticipated to witness rapid growth at a significant CAGR of 13.3% during the projected period. In the lithium market, the hydroxide segment refers to lithium hydroxide, a compound derived from lithium-bearing materials. Lithium hydroxide is a key component in the production of high-performance lithium-ion batteries, commonly used in electric vehicles and portable electronics. The trend in the hydroxide segment involves a growing preference for lithium hydroxide over lithium carbonate due to its suitability for advanced battery chemistries. Manufacturers and researchers are increasingly focusing on optimizing lithium hydroxide production processes to meet the rising demand for advanced energy storage solutions.

Application Insights

The automotive segment has held 41% market share in 2024. The automotive segment in the lithium market primarily involves the use of lithium-ion batteries to power electric vehicles (EVs). This application has witnessed remarkable growth due to the global shift toward clean transportation. The trend is driven by increased consumer awareness of environmental sustainability, government incentives for EV adoption, and advancements in battery technology. As automakers focus on expanding their electric vehicle portfolios, the demand for lithium in the automotive sector is expected to continue its upward trajectory, solidifying its role as a key driver in the lithium market.

The consumer electronics segment is anticipated to witness rapid growth over the projected period. The consumer electronics segment in the lithium market encompasses the use of lithium-ion batteries in devices such as smartphones, laptops, and wearable gadgets. These batteries offer lightweight and high-energy-density solutions, making them ideal for portable electronics. Trends in this segment include the demand for longer-lasting batteries, rapid charging capabilities, and a focus on eco-friendly battery technologies. As consumers increasingly rely on electronic devices, innovations in lithium-ion batteries continue to shape the consumer electronics market, emphasizing sustainability, efficiency, and improved user experiences.

Lithium Market Companies

- Albemarle Corporation

- SQM (Sociedad Química y Minera de Chile)

- Tianqi Lithium Corporation

- Ganfeng Lithium

- FMC Corporation

- Livent Corporation

- Jiangxi Ganfeng Lithium Co., Ltd.

- Lithium Americas Corp.

- Galaxy Resources Limited

- Orocobre Limited

- Pilbara Minerals Limited

- Nemaska Lithium Inc.

- Critical Elements Lithium Corporation

- Altura Mining Limited

- Mineral Resources Limited

Recent Developments

- On May 7, 2025, a leading North American supplier of lithium products critical to the U.S. electric vehicle supply chain, Piedmont Lithium Inc., will release its first quarter 2025 results after the Nasdaq close. Source: businesswire.com

- On May 9, 2025, SOFAR launched two new solutions, called PowerIn and PowerMagic Mini for C&I Energy Systems, Intersolar Europe 2025, designed for expanding footprint in the C&I PV and energy storage market. The launch was presented over two consecutive days, reflecting the company's current commitment to innovation in Europe's fast-evolving clean energy sector. Source: solarquarter.com

- In April 2025, a prominent player in India's lithium battery sector, Maxvolt Energy Industries Limited, launched the Smart Lithium Inverter Series, the latest innovation at Ride Asia 2025, held at Pragati Maidan, New Delhi. Source: themachinemaker.com

- In November of 2023, ExxonMobil initiated the drilling process for its inaugural lithium well in Arkansas, a region rich in lithium deposits. The company's objective is to commence lithium production by 2027 and, by 2030, achieve the capacity to supply lithium for the manufacturing of batteries for more than one million electric vehicles annually.

- Around the same time in September 2023, Gotion High-tech Co Ltd., a prominent Chinese battery manufacturer, unveiled plans to construct a lithium battery manufacturing facility in Manteno, Illinois, U.S., with a substantial investment totaling USD 2 billion.

- Additionally, in September 2023, the Office of the Assistant Secretary for Industrial Base Policy inked an agreement with Albemarle, focusing on the latter's expansion endeavors in lithium mining and production. This agreement, facilitated through the Manufacturing Capability Expansion and Investment Prioritization (MCEIP) office, carries a value of USD 90 million. Albemarle's strategic plan involves reopening its Kings Mountain, N.C. mine between 2025 and 2030, contributing to the augmentation of domestic lithium production.

Segments Covered in the Report

By Product

- Carbonates

- Hydroxide

- Others

By Application

- Automotive

- Consumer Electronics

- Grid Storage

- Glass & Ceramics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting