What is the Lithium Hydroxide Market Size?

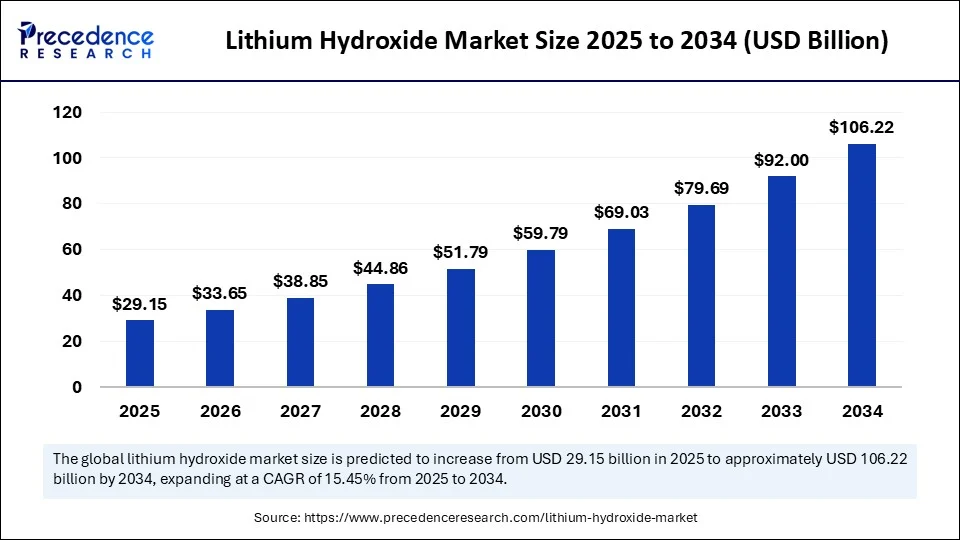

The global lithium hydroxide market size is accounted at USD 29.15 billion in 2025 and predicted to increase from USD 33.65 billion in 2026 to approximately USD 106.22 billion by 2034, expanding at a CAGR of 15.45% from 2025 to 2034. The growth of the market is driven by the surge in electric vehicle production, renewable energy adoption, and advancements in battery technology.

Lithium Hydroxide Market Key Takeaways

- In terms of revenue, the global lithium hydroxide market was valued at USD 25.25 billion in 2024.

- It is projected to reach USD 106.22 billion by 2034.

- The market is expected to grow at a CAGR of 15.45% from 2025 to 2034.

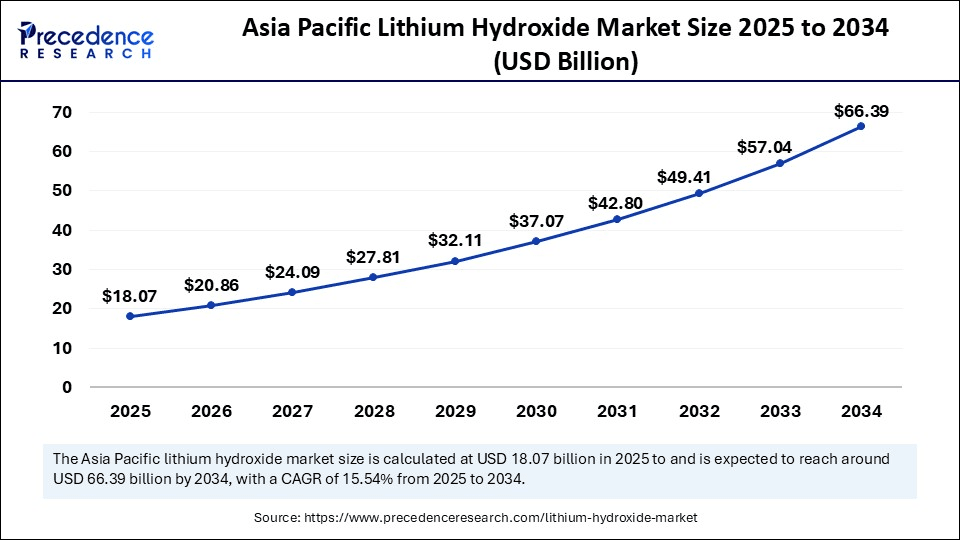

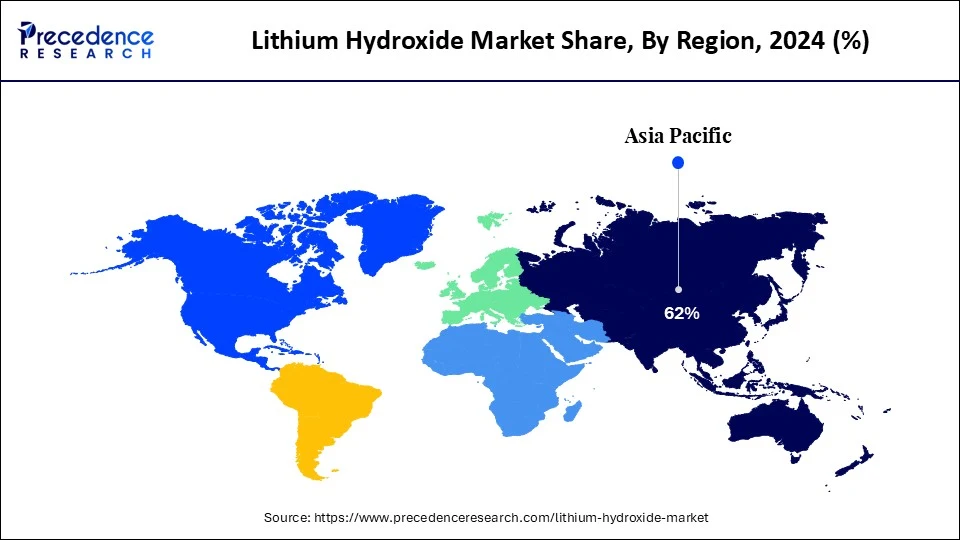

- Asia Pacific dominated the global lithium hydroxide market with the largest market share of 62% in 2024.

- North America is anticipated to witness the fastest growth during the forecasted years.

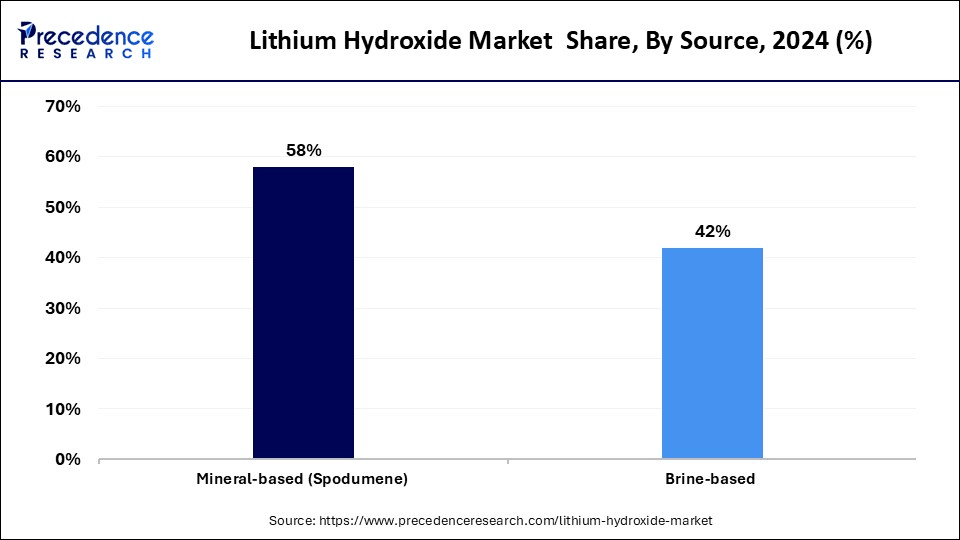

- By source, the mineral-based (spodumene) segment captured the biggest market share of 58% in 2024.

- By source, the brine-based segment is anticipated to show considerable growth over the forecast period.

- By grade, the battery grade segment contributed the highest market share of 72% in 2024.

- By grade, the technical grade segment is anticipated to show considerable growth over the forecast period.

- By application, the batteries segment led the market, under which the EV batteries sub-segment held a 65% share in 2024.

- By application, the energy storage systems sub-segment is anticipated to show considerable growth over the forecast period.

- By end-use industry, the automotive segment held the largest market share of 64% in 2024.

- By end-use industry, the energy and utilities segment is anticipated to show considerable growth over the forecast period.

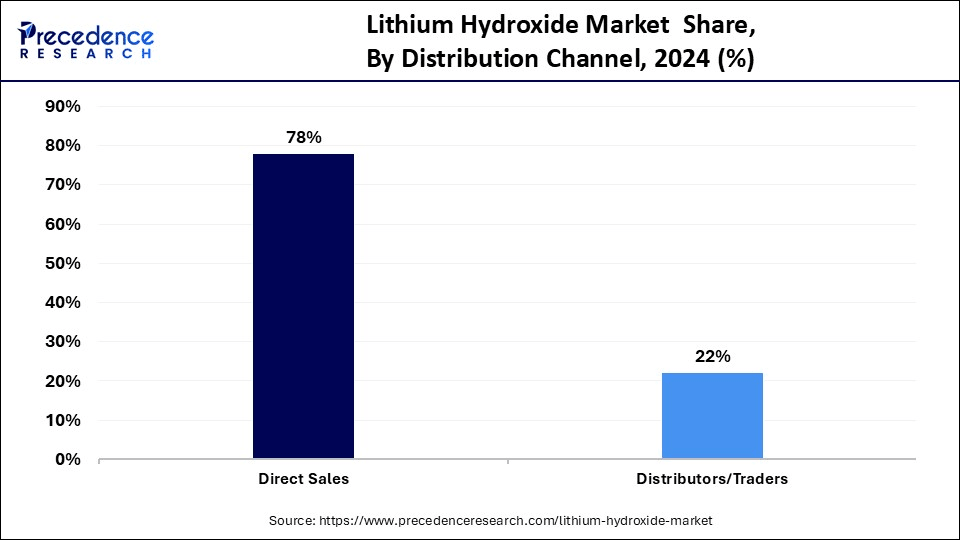

- By distribution channel, the direct sales segment generated the major market share of 78% in 2024.

- By distribution channel, the distributors/traders segment is anticipated to show significant growth over the forecast period.

Artificial Intelligence: The Next Growth Catalyst in Lithium Hydroxide

Artificial intelligence is revolutionizing the lithium hydroxide market by optimizing supply chain processes. AI aids in resource extraction, demand forecasting, and battery manufacturing. In mining, AI systems maximize efficiency by mapping geological data to locate high-value lithium deposits, saving time and reducing costs. In production, AI enhances battery design and efficiency modeling, optimizing cathode material composition to leverage lithium hydroxide for increased energy density.

Strategic Overview of the Global Lithium Hydroxide Industry

The lithium hydroxide market refers to the global industry focused on the production, distribution, and utilization of lithium hydroxide (LiOH), an inorganic compound primarily used in lithium-ion battery cathode manufacturing, especially for electric vehicles (EVs) and energy storage systems (ESS). Lithium hydroxide offers greater energy density and thermal stability than lithium carbonate, making it the preferred choice for high-nickel NMC (nickel-manganese-cobalt) and NCA (nickel-cobalt-aluminum) battery chemistries. The market spans upstream extraction (from spodumene or brine), chemical conversion, and downstream applications across automotive, electronics, and industrial sectors.

The market is witnessing rapid growth, primarily fueled by the rising production of electric vehicles and the development of renewable energy systems. Lithium hydroxide is a crucial component in high-nickel lithium-ion batteries, offering improved energy density and a longer lifespan compared to lithium carbonate, the standard in advanced battery tech. Global decarbonization efforts, environmental policies, and increased investments in clean energy further support the market growth.

What Factors Are Fueling the Growth of the Lithium Hydroxide Market?

- Rising Electric Car Production: High-nickel lithium-ion batteries, essential for quality and durable electric vehicle batteries, rely on lithium hydroxide. The increasing demand for EVs and car manufacturers' sustainability goals are driving up lithium hydroxide consumption globally.

- Government Policies and Investment: Government subsidies, regulations, and infrastructure development are promoting clean energy and electric transportation. These policies, particularly those related to lithium-ion battery production, indirectly boost the demand for lithium hydroxide.

- Renewable Energy Storage Growth: The global trend toward reliance on renewable energy sources, such as solar and wind, has significantly increased the demand for efficient energy storage solutions. Lithium-ion batteries that incorporate lithium hydroxide enable the storage of high capacities and contribute to grid stabilization.

Market Outlook

- Market Growth Overview: The Lithium Hydroxide market is expected to grow significantly between 2025 and 2034, driven by surging demand for electric vehicle (EV) batteries and high-energy cathodes. The global shift towards high-purity, battery-grade LiOH and increasing investment in sustainable production methods like Direct Lithium Extraction (DLE).

- Sustainability Trends: Sustainability trends involve the development of sustainable production methods, the integration of battery recycling for a circular economy, and ESG factors driving investment and strategy.

- Major Investors: Major investors in the market include Hyundai Motor Group, Tesla, General Motors, Ganfeng Lithium, and BYD.

- Startup Economy: The startup economy is focused on sustainable extraction technologies, recycling and circular economy, and processing and refining innovation.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 106.22 Billion |

| Market Size in 2025 | USD 29.15 Billion |

| Market Size in 2026 | USD 33.65 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.45% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Grade, Application, End-Use Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand for Power Tools

The rising demand for cordless power tools in the construction and manufacturing industries is likely to drive the growth of the lithium hydroxide market. These tools leverage the benefits of lithium-ion batteries, such as enhanced energy density and mobility. North America and Europe are leading this trend, driven by skilled labor shortages and production goals that encourage contractors to adopt high-efficiency cordless tools. Cordless platforms are also favored in Building Information Modeling (BIM) and smart construction processes involving mobile technology integration.

Restraint

High Production Costs

The high cost of manufacturing lithium hydroxide, especially the one that is of battery grade, is a major factor restraining the growth of the lithium hydroxide market. The automotive and energy storage industries' high specifications necessitate stringent impurity control and costly crystallization, making lithium hydroxide manufacturing complex and expensive. The associated increased costs from these capital-intensive processes are significant for both start-up investments and ongoing operations. This investment complexity and high cost act as a barrier to new entrants and delay the commissioning of new facilities.

Opportunity

Increasing Investments in Lithium Mining & Refining

Rising investments in lithium mining and refining create immense opportunities in the lithium hydroxide market. The fast-paced rise in the adoption of electric vehicles and clean energy technologies has created a new surge of demand for lithium hydroxide that has prompted governments, institutional investors, and big mining companies to invest heavily in enhancing their capacity to extract and process the material. North America and Europe are also expanding their investments to establish their national chains of lithium supply to reduce their dependence on Chinese processing plants and enhance their energy security. Such endeavors include government subsidizing, supply chain alliances, and government policies to support domestic production.

Source Insights

Why Did the Mineral-Based (Spodumene) Segment Lead the Lithium Hydroxide Market?

The mineral-based (spodumene) segment led the market while holding a 58% share in 2024. Spodumene, a lithium aluminum silicate mineral, is the most popular for lithium hydroxide production, thanks to its lithium concentration and a stable supply chain. The extraction process involves high-temperature roasting to transform spodumene into a more reactive form, followed by acid leaching or other chemical treatments to extract the lithium compounds. The benefit of Spodumene-based production is that the process is shorter, taking less time, and the purity output is better than brine sources. Moreover, lithium-producing countries like Australia have vast spodumene reserves and established supply chain infrastructure, supporting segmental growth.

The brine-based segment is expected to grow at a significant CAGR over the forecast period. Brine extraction uses lithium-enriched brine pumped from underground reservoirs or salt flats, such as in the Lithium Triangle (Chile, Argentina, Bolivia), and concentrates it in solar salt evaporation ponds. Lithium is typically recovered as lithium carbonate after concentration, which can then be chemically converted to lithium hydroxide. Brine-based methods tend to consume less energy and have competitively low operating costs, making them desirable for long-term viability and profitability. With global demand for lithium hydroxide rising, especially for EVs and grid storage, diversifying supply sources is crucial to stabilize prices in the lithium value chain.

Grade Insights

How Does the Battery Grade Segment Contribute the Most Revenue in 2024?

The battery grade segment held a 72% share of the market in 2024, driven by the increased demand for electric vehicle batteries and energy storage systems. These applications require high-purity lithium hydroxide to support advanced lithium-ion battery chemistries, particularly high-nickel cathodes. Major manufacturers have invested heavily in these technologies, recognizing the stringent quality requirements for batteries. The higher prices of battery-grade lithium hydroxide reflect its high value and the complexity of achieving such purity levels. With increasing EV adoption, the market share of battery-grade lithium hydroxide is expected to be sustained due to its critical role in providing energy-intensive and high-power battery technology.

The technical grade segment is expected to grow at the fastest CAGR in the upcoming period, driven by its widespread use in industrial applications and expanding consumption in emerging economies. It is crucial in the production of lubricating greases, ceramics, glass, and chemical synthetics. Technical-grade lithium hydroxide is also suitable in industries where cost-effectiveness is prioritized over high purity, making it appealing in cost-sensitive markets. With growing industrial use and the proliferation of downstream applications, the technical grade segment is expected to increase.

Application Insights

What Made Batteries the Dominant Segment in the Lithium Hydroxide Market in 2024?

The batteries segment dominated the market, under which the EV batteries segment held the largest share of 65% in 2024. This is mainly due to the surge in global EV manufacturing, driven by decarbonization needs, government subsidies, and the consumer trend towards environmentally friendly mobility, is notable. High-performing lithium-ion batteries, such as the cathode in EVs, particularly high-nickel ones like NCA (nickel-cobalt-aluminum) and NCM (nickel-cobalt-manganese), depend on lithium hydroxide. These battery chemistries require lithium hydroxide due to its energy density performance, thermal stability, and battery life, which are crucial performance factors for EV manufacturers. It also aids in increasing vehicle range and safety, important aspects influencing EV adoption.

The energy storage systems sib-segment is expected to grow at a significant CAGR over the forecast period, driven by the increasing implementation of mega-renewable schemes and distributed power systems. Grid-balancing technologies are in demand as countries expand their solar and wind capacity. Extended-duration storage applications increasingly specify lithium-ion batteries with nickel-rich cathodes due to their high energy density and long cycle life. These applications offer energy resilience and load-shifting capacity, further broadening the lithium hydroxide use case beyond electric mobility. Due to the increasing adoption of energy storage systems by utilities, businesses, and municipalities, the battery chemistry utilizing lithium hydroxide is expected to experience higher and more rapid demand.

End-Use Industry Insights

Why Did the Automotive Segment Contribute the Most Revenue in 2024?

The automotive segment held a 64% share of the market in 2024. This is primarily due to the surge in electric vehicle production, driven by stricter emissions standards and a growing consumer interest in environmentally friendly transportation options. With the rapid rise in EV unit sales and advancements in battery capacity, automakers are increasingly incorporating lithium hydroxide into their long-term electrification strategies. Battery-grade lithium hydroxide is essential for achieving high cathode performance in high-nickel lithium-ion batteries, which offer high energy density and long ranges. The EV boom is on the rise, and the automotive industry currently stands as the largest consumer of lithium hydroxide.

The energy & utilities segment is likely to grow at the fastest rate over the projection period because of the increasing demand for large-scale energy storage solutions and integration of renewable energy. Lithium hydroxide is a critical component in the production of high-performance lithium-ion batteries, used in both the cathode and electrolyte. These batteries are also utilized in grid-scale energy storage to stabilize the power grid, address the intermittency of renewable energy sources, and facilitate peak shaving and load balancing initiatives. As the world focuses on energy and utilities decarbonization, ongoing electrification, and grid modernization, the energy & utilities segment is poised to become a significant driver of the lithium hydroxide market.

Distribution Channel Insights

Why Does the Direct Sales Segment Lead the Lithium Hydroxide Market?

The direct sales segment led the market while holding a 78% share in 2024. Direct sales enable lithium hydroxide producers to establish long-term strategic partnerships with end-users, including automotive OEMs and battery manufacturers. These direct relationships ensure a secure supply chain, improved coordination of quality demands, and enhanced price negotiations. This model is widely adopted by major manufacturers like Albemarle, SQM, and Livent, enabling them to collaborate closely with their clients on product customization, delivery, and research cooperation.

The distributors/traders segment is expected to grow at a significant CAGR over the forecast period due to several key advantages. They offer logistical flexibility, enabling efficient delivery across various regions. This segment provides access to regional markets, which can be challenging for manufacturers to reach directly. Distributors also specialize in smaller volume packaging, catering to diverse customer needs. The increasing globalization and diversification of the supply chain further amplify their significance. Ultimately, distributors and traders offer scalable, region-based solutions, driving the expansion of the market.

Regional Insights

Asia Pacific Lithium Hydroxide Market Size and Growth 2025 to 2034

The Asia Pacific lithium hydroxide market size is evaluated at USD 18.07 billion in 2025 and is projected to be worth around USD 66.39 billion by 2034, growing at a CAGR of 15.54% from 2025 to 2034.

Asia Pacific: China Lithium Hydroxide Market Trends

Asia Pacific dominated the global market with the highest market share of 62% in 2024. The region's dominance stems from the high demand for high-performance batteries, driven by rapid industrialization, the booming sale of electric vehicles, and substantial investments in renewable energy infrastructure. The well-developed supply chain and technological advancements in Asia Pacific ensure efficient sourcing, processing, and distribution of lithium hydroxide, solidifying its market-leading position. Japan and South Korea have a competitive edge due to their long-standing expertise in material sciences, which fosters innovation in battery compositions.

China is a major contributor to the market in Asia Pacific, serving as a major producer and consumer. Chinese companies like Ganfeng Lithium and Tianqi Lithium control a substantial portion of the world's refining capacity, with many having vertically integrated operations. Furthermore, China is the world's largest producer of EVs, boosting the demand for batteries. This significantly creates the need for high-purity lithium hydroxide.

North America: U.S. Lithium Hydroxide Market Trends

North America is expected to grow at the highest CAGR over the forecast period, driven by the growth in electric vehicle development and renewable energy sources. The electrification of the automotive industry is accelerating due to favorable policies, government subsidies, and emission reduction targets. These trends have fueled demand for high-purity lithium hydroxide, essential for advanced lithium-ion batteries like those in EVs. Furthermore, advancements in battery design, materials science, and collaboration between government and companies will enhance the region's competitiveness.

The U.S. is a major player in the lithium hydroxide market in North America. National programs like the Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law provide incentives for local lithium mining, refining, and battery fabrication, reducing import dependence. The U.S. also sees growing downstream demand for EVs and energy storage systems, expanding the consumer base. The country's focus on clean energy and electrification is expected to significantly boost the lithium hydroxide market.

Europe: U.K. Lithium Hydroxide Market Trends

The European market is expected to grow at a notable rate in the coming years, backed by the region's commitment to environmental sustainability and the clean energy shift. The European Union's Green Deal and other climate policies aim to reduce carbon emissions and accelerate electromobility, driving investments in lithium-ion battery production and EV infrastructure. Additionally, Europe boasts major automotive and battery manufacturers that are focusing on establishing local supply chains to reduce reliance on battery material suppliers, which support market growth.

The UK is a leading player in the lithium hydroxide market in Europe because of its clean energy goals and ambition to lead in EV and battery innovation. The UK's focus on EVs and stationary storage will be crucial in supporting regional lithium hydroxide supply and development. The expansion of regional refining and production capacities is also supported by joint ventures, public-private partnerships, and specific funding within the EU's Battery Alliance.

Value Chain Analysis of the Lithium Hydroxide Market

- Raw Material Extraction (Mining and Brine Operations)

This initial stage involves extracting lithium from hard rock mines (spodumene) or brine deposits.

Key Players: Albemarle Corporation, SQM (Sociedad Química y Minera), Ganfeng Lithium Group Co., Ltd., Tianqi Lithium Corporation. - Lithium Processing & Refining

Concentrated lithium ore or brine is processed and refined through chemical conversion processes to produce battery-grade lithium hydroxide (LiOH) monohydrate.

Key Players: Albemarle Corporation, Ganfeng Lithium Group Co., Ltd., Tianqi Lithium Corporation, SQM (Sociedad Química y Minera), Livent Corporation. - Cathode Material Manufacturing

Refined lithium hydroxide is used as a key precursor chemical in the production of high-nickel content cathode materials, such as NMC (Nickel Manganese Cobalt) and NCA (Nickel Cobalt Aluminum) used in electric vehicle batteries.

Key Players: BASF SE, Umicore S.A., POSCO Chemical Co., Ltd., Ecopro BM Co., Ltd., Sumitomo Metal Mining Co., Ltd. - Battery Cell Manufacturing & EV Integration

The manufactured cathode material is then assembled with anodes, electrolytes, and separators into complete battery cells, which are integrated into battery packs for electric vehicles.

Key Players: Tesla, Inc., BYD Company Limited, Contemporary Amperex Technology Co., Ltd. (CATL), LG Energy Solution.

Top Companies in the Lithium Hydroxide Market & Their Offerings:

- Albemarle Corporation: Albemarle is a major global producer of lithium, contributing significantly to the market through both brine and hard-rock operations and extensive processing facilities.

- Ganfeng Lithium Co., Ltd: Ganfeng is one of the world's largest lithium producers and a key player across the entire value chain, from resource extraction to lithium hydroxide production and battery recycling.

- Tianqi Lithium Corporation: Tianqi is a leading global lithium company with major stakes in resource mines (like Greenbushes in Australia) and downstream processing facilities for lithium hydroxide production. They contribute to the market as a significant supplier of high-quality LiOH for the electric mobility sector.

- SQM (Sociedad Química y Minera de Chile): SQM is a major producer of lithium from brine operations in Chile, supplying lithium carbonate and also converting it into lithium hydroxide for the battery market. They contribute to the market by providing a significant volume of high-purity lithium products essential for energy storage solutions.

- Livent Corporation: Livent is a pure-play lithium technology company specializing in the production of performance lithium compounds, including high-purity lithium hydroxide. They contribute to the market by focusing on specialized lithium chemical production that meets the demanding specifications of battery manufacturers.

- Mineral Resources Limited: Mineral Resources is a diversified mining company with significant lithium operations in Australia, primarily focused on extracting hard-rock lithium (spodumene).

- Pilbara Minerals Limited: Pilbara Minerals operates the world's largest independent hard-rock lithium operation, supplying spodumene concentrate to global customers for further processing into lithium chemicals like LiOH.

- Yahua Group: Yahua is a Chinese chemical company with a significant presence in the lithium industry, specializing in the production of lithium hydroxide and carbonate.

- Sichuan Energy Investment Development Co., Ltd.: This company is involved in energy development, including investments in lithium resources and processing facilities within China.

- Allkem Limited (formerly Orocobre): Allkem is a global lithium producer with both brine operations and hard-rock projects that feed into the production of lithium chemicals, including LiOH. They contribute to the market by ensuring a diversified and sustainable supply of lithium products.

- Chengxin Lithium Group: Chengxin is a Chinese company focused on the production of lithium products, including lithium hydroxide, for the battery industry. They contribute to the market by expanding domestic supply chains and meeting the growing demand for battery-grade materials in China.

- AMG Lithium: AMG Lithium is a part of AMG Advanced Metallurgical Group, focusing on the production of battery-grade lithium hydroxide with a planned facility in Germany, contributing to the European domestic supply. They contribute to the market by establishing a regional supply chain that reduces reliance on overseas production.

- Nemaska Lithium: Nemaska Lithium is a Canadian company developing a unique process to produce lithium hydroxide directly from spodumene concentrate, focusing on sustainable production methods.

- IGO Limited: IGO is an Australian resources company with interests in lithium mining and processing, aiming to be a sustainable supplier of battery-grade materials. They contribute to the market by ensuring the supply of raw materials essential for the global clean energy transition.

- Piedmont Lithium: Piedmont is an emerging lithium producer in the U.S. and globally, working to develop integrated lithium operations, including plans for a merchant lithium hydroxide plant. They contribute to the market by aiming to establish a localized, sustainable supply chain in North America.

- European Lithium Ltd.: This company is developing lithium projects within Europe to support the continent's electric vehicle battery supply chain and reduce reliance on international imports. They contribute to the market by providing a potential domestic source of lithium hydroxide for the European battery industry.

- Lithium Americas Corp.: Lithium Americas is developing major lithium projects in North and South America (brine and clay resources), aiming to become a key supplier to the EV market. They contribute by establishing significant new sources of lithium production to meet increasing demand.

- Bacanora Lithium: Bacanora focused on developing the Sonora Lithium Project in Mexico, which was eventually acquired by Ganfeng Lithium. Its contribution was in proving up a significant lithium resource for future market supply.

- Xinjiang TBEA Group: While primarily focused on other industries like energy, TBEA is involved in some mineral processing and potentially related lithium operations in China.

CNGR Advanced Material Co., Ltd.: CNGR is a leading Chinese producer of battery precursor materials (like NMC and NCA precursors), which are downstream from lithium hydroxide production.

Lithium Hydroxide Market Companies

- Albemarle Corporation

- Ganfeng Lithium Co., Ltd

- Tianqi Lithium Corporation

- SQM (Sociedad Química y Minera de Chile)

- Livent Corporation

- Mineral Resources Limited

- Pilbara Minerals Limited

- Yahua Group

- Sichuan Energy Investment Development Co., Ltd.

- Allkem Limited (formerly Orocobre)

- Chengxin Lithium Group

- AMG Lithium

- Nemaska Lithium

- IGO Limited

- Piedmont Lithium

- European Lithium Ltd.

- Lithium Americas Corp.

- Bacanora Lithium

- Xinjiang TBEA Group

- CNGR Advanced Material Co., Ltd.

Recent Developments

- In January 2024, Hyundai Motor Group signed a 4-year deal with Ganfeng Lithium Group to obtain battery-grade lithium hydroxide produced in Argentina to go into their electric vehicles. The alliance is likely to make the market for lithium hydroxide robust by encouraging demand and stability of the supply chain. (Source: https://www.greencarcongress.com)

- In January 2024, a merger between Livent and Allkem created Arcadium Lithium, a global lithium-chemicals manufacturing leader with technology to produce more lithium hydroxide in various regions. The supply chain is likely to be fortified by this move and enhance the lithium hydroxide market. (Source: https://ir.arcadiumlithium.com)

- In May 2023, Nemaska Lithium agreed to a deal with Ford to provide it with lithium hydroxide produced through the company's manufacturing facility in Bécancour. In this collaboration, Nemaska Lithium would be able to provide 13000 tons of lithium hydroxide to Ford to make electric vehicle batteries.(Source: https://www.greencarcongress.com)

Segments Covered in the Report

By Source

- Mineral-based (Spodumene)

- Brine-based

By Grade

- Battery Grade

- Technical Grade

- Industrial Grade

By Application

- Batteries

- EV Batteries

- Consumer Electronics Batteries

- Energy Storage Systems (ESS)

- Lubricating Greases

- Glass and Ceramics

- Air Treatment (CO? Scrubbers)

- Others (Metallurgy, Polymers)

By End-Use Industry

- Automotive

- Consumer Electronics

- Industrial

- Aerospace and Defense

- Energy & Utilities

By Distribution Channel

- Direct Sales

- Distributors/Traders

By Region

- Asia-Pacific (APAC)

- North America

- Europe

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting