What is the Lithium Sulfides Market Size?

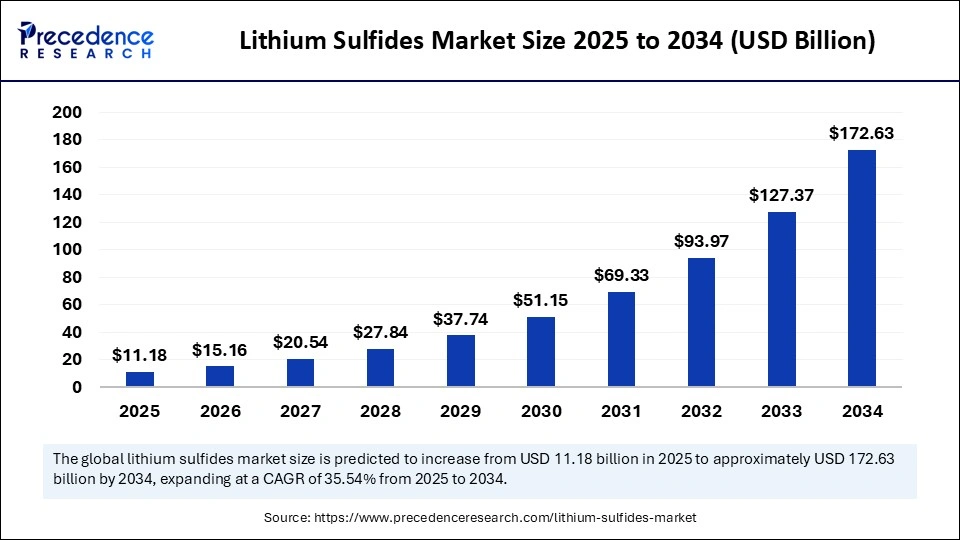

The global lithium sulfides market size accounted for USD 8.25 billion in 2024 and is predicted to increase from USD 11.18 billion in 2025 to approximately USD 172.63 billion by 2034, expanding at a CAGR of 35.54% from 2025 to 2034. The increasing demand for electric vehicles (EVs), rising need for grid storage integration, growing focus on sustainability, and surging investments in renewable energy sources are expected to propel the growth of the global lithium sulfides market over the forecast period. Additionally, the market is rapidly expanding in various regions, particularly the Asia Pacific, fuelled by a supportive regulatory environment and the rising production of electric vehicles (EVs) and portable electronics.

Market Highlights

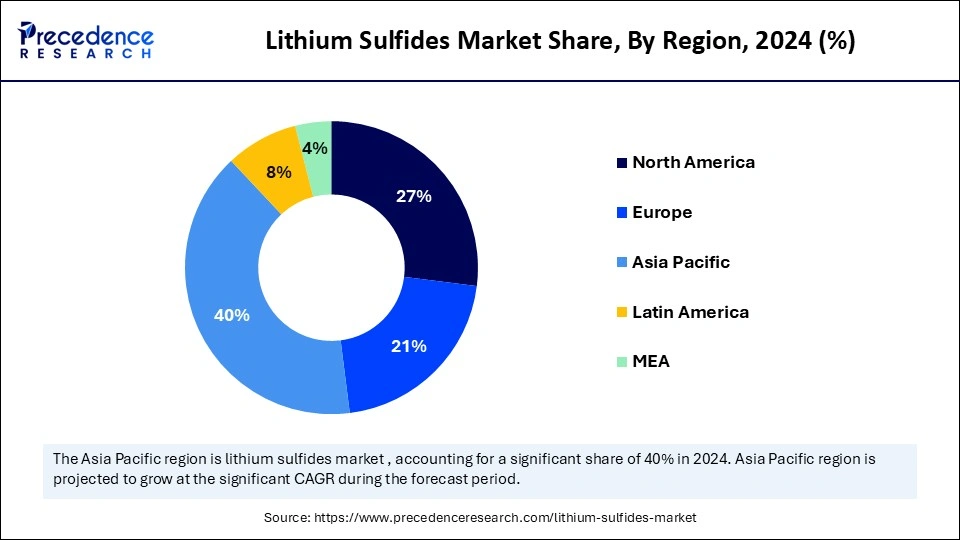

- Asia Pacific dominated the lithium sulfides market with the largest market share of 40% in 2024.

- North America is anticipated to grow at the fastest CAGR during the forecast period.

- By form, the powder form segment led the market in 2024.

- By form, the crystalline segment is expected to witness a significant share during the forecast period.

- By application, the solid-state battery electrolytes segment contributed the highest revenue share and is expected to further grow at the fastest CAGR.

- By end-use industry, the automotive (EV batteries) segment captured the biggest market share in 2024.

- By end-use industry, the energy storage systems (grid-scale & residential) segment is expected to grow significantly during the forecast period.

- By distribution channel, the direct sales to the battery OEMs segment generated the major market share in 2024.

- By distribution channel, the specialty chemical distributors segment is expected to witness remarkable growth during the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 8.25 Billion

- Market Size in 2025: USD 11.18 Billion

- Forecasted Market Size by 2034: USD 172.63 Billion

- CAGR (2025-2034): 35.54%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Market Overview

The lithium sulfides market refers to the production, commercialization, and use of lithium sulfide (Li?S) materials, mainly applied in next-generation solid-state batteries, specialty cathode and anode precursors, and advanced energy storage systems. Lithium sulfides serve as key solid electrolytes, offering high ionic conductivity and compatibility with lithium metal anodes, enabling safer and higher-density energy storage compared to conventional liquid electrolytes. Beyond energy storage, they are used in catalysts, chemical intermediates, and specialty electronics.

How Does Artificial Intelligence Integration Improve the Lithium Sulfides Market?

In the evolving technological landscape, Artificial intelligence emerges as a transformative force. It holds great potential for growth in the lithium sulfides market by optimizing manufacturing processes, enhancing operational efficiency, improving battery reliability, and reducing wastage. AI technologies are being increasingly integrated into lithium sulphide production processes, assisting in battery design, predictive maintenance, and manufacturing optimization of lithium sulfur batteries. AI is significantly improving battery performance, longevity, and safety while driving innovation. By leveraging Machine Learning (ML) algorithms, it is possible to accurately predict key performance indicators in the solid-state battery management system. Artificial intelligence (AI) serves as an accelerator for solid-state battery development by allowing material screening and accurate performance prediction. AI-driven solutions can identify any potential performance decline and optimize charging strategies to extend battery lifespan.

What Are the Latest Trends in the Lithium Sulfides Market?

- The rising research and development initiatives to improve the performance of lithium-sulfur batteries and the increasing focus on sustainable battery solutions are expected to promote the growth of the lithium sulfides market during the forecast period.

- The stringent emission standards and supportive government policies to promote electric transportation are expected to significantly contribute to the overall growth of the lithium sulfides market during the forecast period.

- The rising awareness of climate change and the push to reduce carbon emissions are significantly creating demand for lithium sulfides, which is driving the market expansion during the forecast period.

- The rapid advancements in solid-state batteries and lithium-sulfur batteries are anticipated to propel the expansion of the lithium sulfides market in the coming years.

- The rising shift towards renewable energy storage sources and increasing investments in sulfide-based solid electrolytes are expected to accelerate the market's revenue during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 8.25 Billion |

| Market Size in 2025 | USD 11.18 Billion |

| Market Size by 2034 | USD 172.63 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 35.54% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Form, Application, End-Use Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Adoption of Electric Vehicles

The rising adoption of electric vehicles (EVs) is expected to boost the growth of the lithium sulfides market during the forecast period. As the world is shifting toward electric mobility, lithium-sulfur batteries are gaining immense popularity, owing to their superior theoretical energy density. Lithium sulfide is a crucial component in next-generation batteries, such as lithium-sulfur (Li-S) and all-solid-state lithium batteries. Lithium sulfide (Li2S) benefits significantly from the rising global push for clean and sustainable energy solutions in the automotive sector. Lithium-sulfur (Li-S) batteries offer a theoretically superior energy density and significantly lighter weight compared to traditional lithium-ion batteries, which makes them a well-suited and promising technology for applications like electric vehicles (EVs) and portable electronics. Therefore, the global transition to EVs creates substantial demand for Lithium-sulfur (Li-S) batteries, which use abundant sulfur that could lower costs and accelerate EV adoption.

- According to the Global EV Outlook 2025 published by the International Energy Agency (IEA), A total of 17.3 million electric cars were produced worldwide in 2024, nearly one-quarter more than in 2023, largely as a result of increased production in China, which reached 12.4 million electric cars. China remains the world's electric car manufacturing hub, accounting for more than 70% of global production in 2024. In 2024, Chinese OEMs accounted for more than 80% of domestic production, up from roughly two-thirds in 2021.(Source: https://www.iea.org)

Restraint

Technical challenges

The technical issues are anticipated to hamper the market's growth. Lithium-sulfur batteries often face technical challenges associated with poor cycling stability and limited lifespan. Additionally, a significant upfront capital investment is necessary to establish production facilities, which can often serve as a substantial barrier to entry for new companies in the market due to budget constraints. Such factors are likely to limit the expansion of the lithium sulfides market during the forecast period.

Opportunity

How Is the Growing Need for High-Energy-Density Energy Storage Systems Impacting the Market's Growth?

The rising need for advanced, reliable, and high-energy-density energy storage systems is projected to offer lucrative growth opportunities to the lithium sulfides market during the forecast period. Lithium sulfur batteries (LiSB) are considered promising for renewable energy storage, owing to their high theoretical energy density, lower cost, and environmental benefits. Solid-state batteries are next-generation energy storage devices that offer enhanced energy, improved safety, and greater environmental adaptability. The advanced energy storage systems, particularly batteries, are essential for aligning with climate change targets and enhancing energy security. Moreover, grid-scale energy storage plays a critical role in managing the intermittency of wind and solar power. High-energy-density and low-cost lithium-sulfur (Li-S) is ideal for the large-scale stationary applications.

- In June 2025, Huawei stepped up its ambitions in advanced energy storage with a patent for a sulfide-based solid-state battery that offers driving ranges of up to 3,000 kilometres and ultra-fast charging in just five minutes. The development signals a significant push by the tech giant to stake a claim in the fast-evolving solid-state battery landscape.(Source: https://carnewschina.com)

Segment Insights

Form Insights

Which Segment Is Dominating the Market by Form in the Lithium Sulfides Market?

The powder form segment dominated the global Lithium sulfides market in 2024, owing to the increasing use in advanced battery technologies, such as lithium-sulfur batteries and solid-state batteries. Lithium sulfide powder is widely used in the production of phosphors for fluorescent lamps, LED lighting, display screens, and other applications. Moreover, high-purity powders are used in research and development (R&D) for creating new materials, especially for solar energy and fuel cells. On the other hand, the crystalline segment is expected to witness remarkable growth during the forecast period. The growth of the segment is driven by the increasing use of high-purity crystalline lithium sulfide (Li?S) as a cathode material in next-generation and high-performance Li-S batteries that offer superior energy density compared to conventional lithium-ion batteries.

End-Use Industry Insights

What Has Led the Automotive (EV Batteries) to Dominate the Lithium Sulfides Market?

The automotive (EV batteries) segment accounted for the largest market share of the global lithium sulfides market in 2024. The increasing demand for high-capacity energy storage in electric vehicles mainly drives the growth of the segment. The favorable regulatory environments and stringent emission standards have led to an increasing adoption of high-energy-density lithium-sulfur (Li-S) battery technologies, which offer a significantly lower carbon footprint and increased energy storage for electric vehicles. Moreover, attractive government policies, including tax credits, grants, and subsidies, are making electric vehicles more accessible, increasing the demand for lithium-sulfur (Li-S) batteries. Such factors are driving the growth of the segment during the forecast period.

On the other hand, the energy storage systems (grid-scale & residential) segment is anticipated to grow at a CAGR during the forecast period, owing to the rising demand for high-energy-density batteries and energy storage solutions. Lithium-sulfur (Li-S) batteries are an emerging technology for sustainable energy storage systems. Lithium sulfide is increasingly gaining prominence for both grid-scale and residential energy storage. The Li-S batteries offer a theoretical energy density that is up to five times higher than that of traditional lithium-ion batteries, making them well-suited for grid-scale and residential units. Sulfur is abundant and less expensive, which makes Li-S batteries a more affordable option for large-scale deployment.

Application Insights

What Causes the Solid-State Battery Electrolytes Segment to Dominate the Lithium Sulfides Market?

The solid-state battery electrolytes segment held a dominant position in the lithium sulfides market in 2024 and is expected to continue growing at the fastest CAGR. The segment includes all-solid lithium metal batteries and hybrid solid-liquid electrolyte systems. Lithium sulfide is a crucial component in sulfide-based solid electrolytes. The segment growth is attributed to the increasing adoption of electric vehicles (EVs), the growing demand for advanced energy storage solutions, and rapid advancements in solid-state batteries. Sulfide Solid Electrolytes (SSEs) are inorganic materials that are widely used as solid-state electrolytes in batteries.

Sulfide solid electrolytes (SSEs) offer excellent ionic conductivity and mechanical stability, making them well-suited for high-energy-density all-solid-state batteries (ASSBs). The solid-state battery sector is experiencing significant R&D activities, with research focused on cost-effective production and purification methods for lithium sulfide to accelerate the adoption of these high-performance batteries. Moreover, the transition towards sustainable energy sources and surging investments in R&D into improving the performance and longevity of Li-S batteries are expected to boost the segment's expansion in the coming years.

Distribution Channel Insights

How Did the Direct Sales to the Battery OEMs Segment Dominate the Lithium Sulfides Market in 2024?

The direct sales to the battery OEMs segment held the majority of the market share in 2024. Direct sales to the battery Original Equipment Manufacturers (OEMs) play a crucial role as a significant distribution channel in the lithium sulfides market. Direct sales to battery OEMs provide wide access to a broad market. Manufacturers are increasingly seeking to secure supply and co-develop next-generation batteries for electric vehicles (EVs) and energy storage solutions. Producers of lithium sulfide can directly influence the quality and availability of their material for critical battery applications, work closely with Original Equipment Manufacturers (OEMs) to meet any specific technical and customized requirements.

On the other hand, the specialty chemical distributors segment is projected to grow at a CAGR between 2025 and 2034. Specialty chemical distributors play an integral role as a distribution channel in the lithium sulfides market, leveraging their technical expertise and logistics networks to connect manufacturers with end-users. Specialty chemical distributors ensure that lithium sulfide reaches manufacturers and researchers on time. Specialty chemical distributors also provide valuable technical support, assisting customers with product formulation, selection, and ensuring regulatory compliance.

Regional Insights

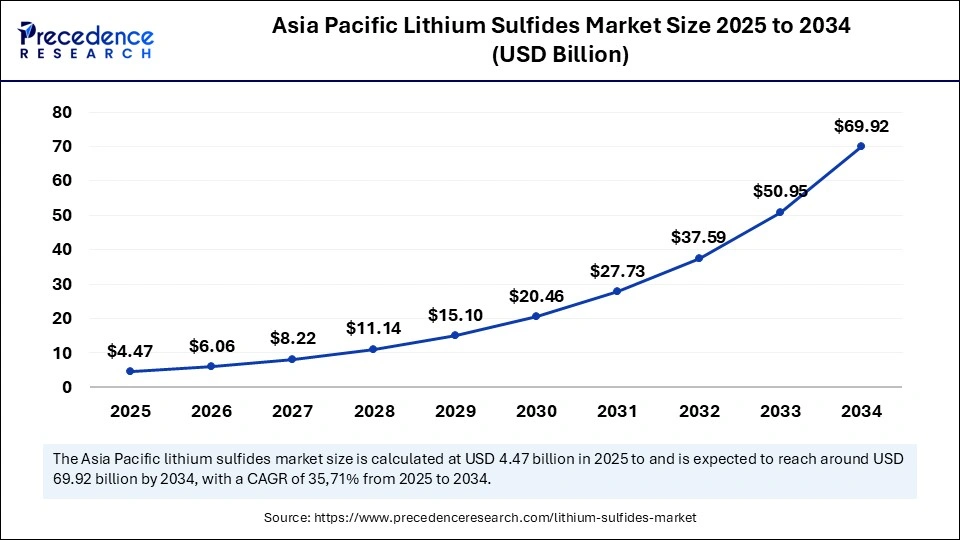

Asia Pacific Lithium Sulfides Market Size and Growth 2025 to 2034

The Asia Pacific lithium sulfides market size was evaluated at USD 3.30 billion in 2024 and is projected to be worth around USD 69.92 billion by 2034, growing at a CAGR of 35.71% from 2025 to 2034

Asia Pacific Is Dominating the Market With the Majority of the Market Share

Asia Pacific dominated the lithium sulfides market and holds largest market share of 40% in 2024. The region's rapid growth is driven by the abundant availability of lithium sulfides, increasing need for cost-effective and efficient power sources, growing demand for higher-density energy storage systems, and increasing investment in research and development of next-generation battery technologies like lithium-sulfur. Lithium-sulfur batteries are gaining immense popularity in aerospace applications and grid energy storage systems, owing to their excellent potential for high energy density, making them attractive for aircraft. The regional market for lithium sulfides is fuelled by the large-scale production base of electric vehicles (EVs) and consumer electronics such as smartphones, laptops, tablets, small drones, and other portable consumer electronics, including smartphones. The market is witnessing a shift toward more advanced battery technology and cost-effective manufacturing processes, with lithium-sulfur batteries consuming less energy during production compared to conventional lithium batteries.

The continuous advancements in lithium-sulfur (Li-S) battery technology are significantly enhancing battery longevity, performance, and safety, creating market growth opportunities in the region. Li-S batteries are a promising technology for extending the range of electric vehicles (EVs) and improving the battery life of consumer electronic devices. Additionally, the stringent emissions targets and the expansion of renewable energy storage systems are anticipated to propel the market's expansion in the region. Governments in the region are implementing attractive policies and initiatives, including tax benefits, grants, subsidies, and stricter emission regulations for non-electric vehicles, bolstering the growth of the lithium sulfides market in the coming years.

- In September 2024, A group led by scientists from the University of Electronic Science and Technology of China created a lithium-sulfur (Li-S) battery that reportedly offers exceptional stability and safety capabilities. Conversion-type transition-metal sulfides (MSx) are promising cathodes for lithium-ion batteries (LIBs) due to their low cost, easy availability, and high energy density.(Source: https://www.ess-news.com)

Lithium sulfides market trends in China and India

China and India are the major contributors to the lithium sulfides market in 2024, driven by the rising adoption of consumer electronics & electric vehicles (EVs), increasing environmental concerns, the rapid expansion of renewable energy storage systems, and supportive government regulations. China leads the regional market's growth owing to its large-scale EV production. The country's most extensive electric vehicles and consumer electronics manufacturing units are expected to drive the market's growth during the forecast period.

- According to the article published by the IBEF in February 2025 on the Electric Vehicle Industry Report, sales of electric vehicles (EVs) in India experienced an exponential rise in January 2025, with a 19.4% month-over-month (MoM) and 17.1% year-over-year (YOY) growth, reaching 169,931 units. In 2023, electric vehicle sales in India saw a significant increase of 49.25%, reaching 1.52 million units. Indian automakers are likely to launch nearly a dozen new EVs in 2025, focusing on premium models, as India's EV sales rose 20%, with a 30% target by 2030. (Source: https://www.ibef.org)

- According to data published by the IBEF, India's domestic electronics production has nearly doubled from USD 48 billion in FY17 to USD 101 billion in FY23, driven largely by mobile phones, which account for 43% of the total production. India's electronics sector has seen significant growth, reaching USD 155 billion in FY23, with production nearly doubling from USD 48 billion in FY17 to USD 101 billion in FY23, driven largely by mobile phones. This growth has been facilitated by government initiatives such as ‘Make in India' and PLI schemes. As of 2023, the mobile phone market contributed to over 43% of the nation's total electronics production with an annual cost of about USD 17 billion.(Source: https://www.ibef.org)

North America Is Expected to Grow at the Fastest Rate in the Market

North America is expected to grow at the fastest rate in the market during the forecast period. The fastest growth of the region is mainly fuelled by the strong presence of key industry players and research institutions, growing demand for consumer electronics products, increasing shifts toward electric transportation, focus on sustainable battery solutions, and rising innovations in battery technology. The increasing investments in sulfide-based solid electrolytes and growing adoption of advanced energy storage systems have significantly increased the demand for lithium sulfides in the region. Moreover, the surge in emissions targets and supportive government initiatives promoting to promote green energy storage are expected to boost the market's expansion in these countries. These factors are expected to accelerate the regional market's growth during the forecast period.

- In June 2025, Standard Lithium (SLI) announced the successful production of battery-quality lithium sulfide as part of a collaboration with Telescope Innovations. Standard Lithium's President stated that development of new IP and technology with their research partner, Telescope Innovations, exemplifies their approach to becoming the leading new lithium company in North America. (Source: https://finance.yahoo.com)

Lithium Sulfides Market Companies

- Nippon Chemical Industrial Co., Ltd.

- Mitsui Mining & Smelting Co., Ltd.

- NEI Corporation

- Solid Power, Inc.

- QuantumScape Corporation

- NGK Insulators Ltd.

- Samsung SDI Co., Ltd.

- Hitachi Chemical (Showa Denko Materials)

- Sumitomo Chemical Co., Ltd.

- LG Energy Solution

- CATL (Contemporary Amperex Technology)

- TDK Corporation (including Amperex Technology)

- Umicore

- Toray Industries, Inc.

- BASF SE (Battery Materials Division)

- Targray Technology International

- Stella Chemifa Corporation

- Ohara Inc.

- Ilika plc

- Murata Manufacturing Co., Ltd.

Recent Developments

- In March 2025, Idemitsu, a Japanese mineral oil company, intends to build a lithium sulfide production plant in Chiba, near Tokyo. According to the company, the plant is expected to produce approximately 1,000 tons of lithium sulfide per year, commencing in June 2027. The precursor is needed for electrolytes that will be used in future solid-state batteries. The total investment is equivalent to approximately 143 million US dollars, of which the Japanese government may provide up to 48 million dollars in subsidies.(Source: https://battery-news.de)

- In June 2025, Standard Lithium Ltd., a leading near-commercial lithium company, is pleased to announce the successful production of battery-quality lithium sulfide as part of a collaboration with Telescope Innovations. Standard Lithium has been working with its research and development partner, Telescope Innovations, to develop new and novel conversion technologies to make next-generation battery materials.(Source: https://www.globenewswire.com)

Segmentation Covered in the Report

By Form

- Powder form

- Granules

- Crystalline

- Solution-based / slurry form

By Application

- Solid-state battery electrolytes

- All-solid lithium metal batteries

- Hybrid solid-liquid electrolyte systems

- Cathode/anode materials precursor

- Catalysts & chemical intermediates

- Photonics and specialty electronics

- Research and laboratory use

By End-Use Industry

- Automotive (EV batteries)

- Consumer electronics

- Energy storage systems (grid-scale & residential)

- Aerospace & defense (lightweight energy storage)

- Industrial chemicals & specialty manufacturing

- Academic & research institutions

By Distribution Channel

- Direct sales to battery OEMs

- Specialty chemical distributors

- Online / laboratory supply portals

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting