What is Sulfur Market Size?

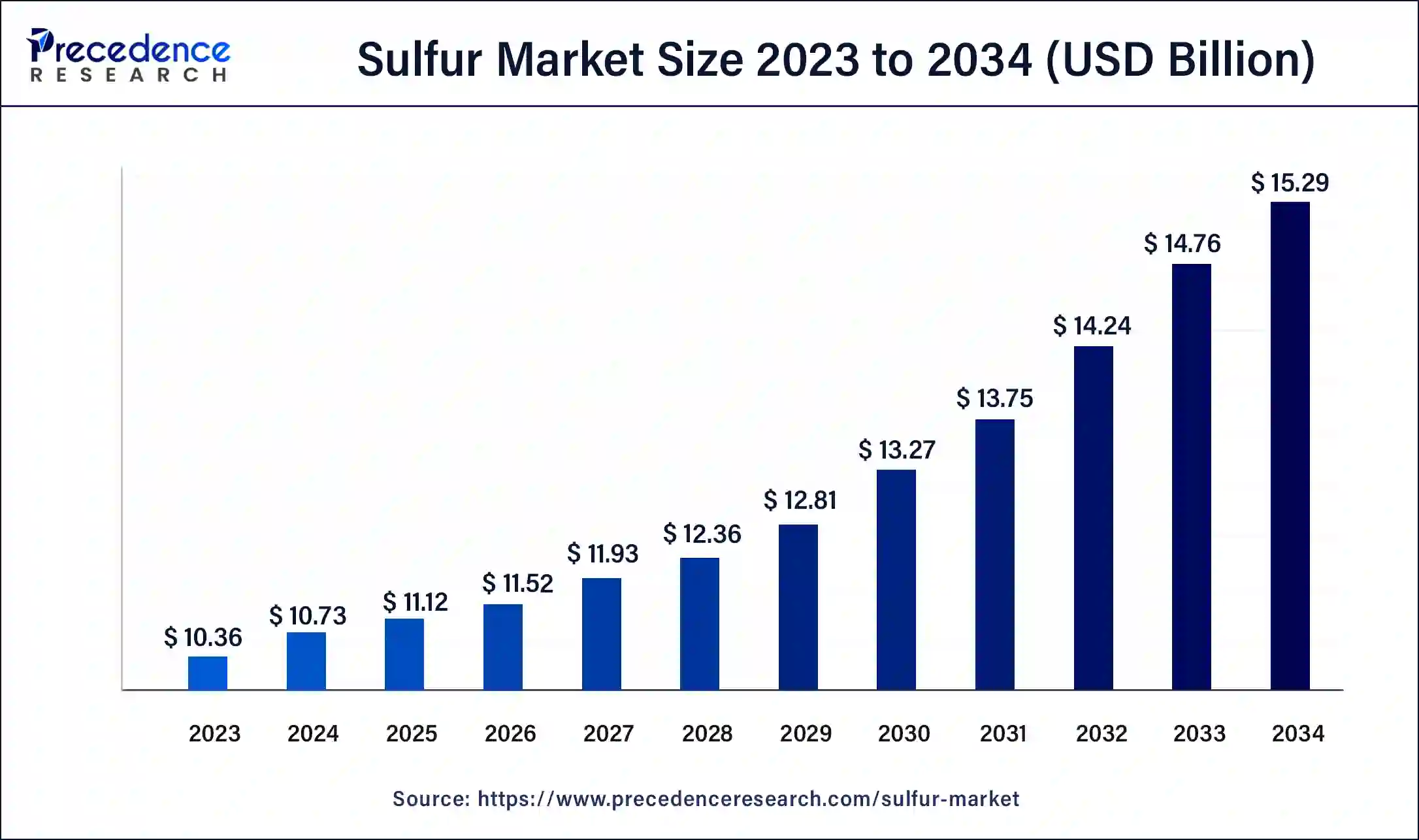

The global sulfur market size is calculated at USD 11.12 billion in 2025 and is expected to be worth around USD 15.29 billion by 2034, at a CAGR of 3.6% from 2025 to 2034.

Market Highlights

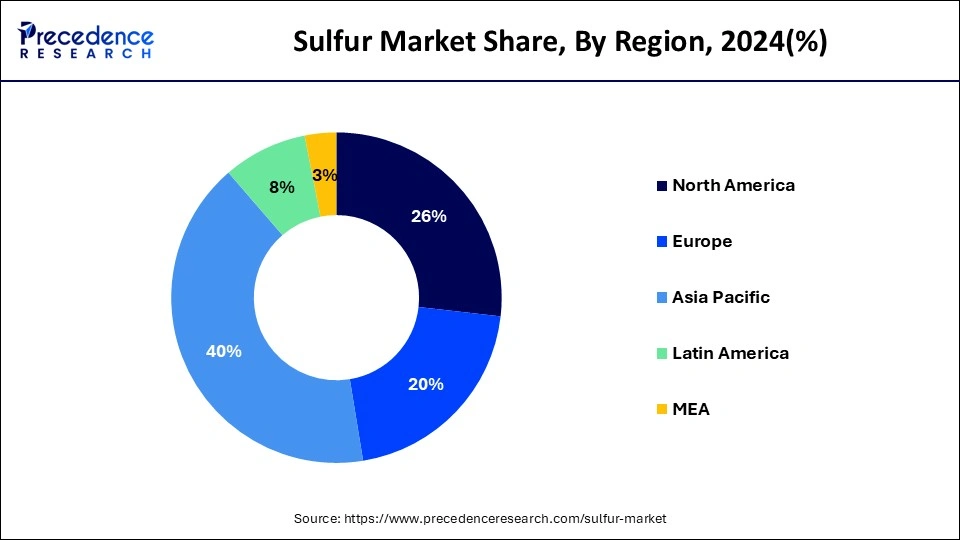

- Asia Pacific led the global market with the biggest market share in 2024

- North America is estimated to expand at the fastest CAGR from 2025 to 2034.

- By End-use Industry, the chemical processing segment has held the largest revenue share in 2024.

Market Size and Forecast

- Market Size in 2025: USD 11.12 Billion

- Market Size in 2026: USD 11.52 Billion

- Forecasted Market Size by 2034: USD 15.29 Billion

- CAGR (2025-2034): 3.6%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

How Sulfur Market Evolving?

Emerging applications of sulfur are estimated to create gainful growth prospects for the major companies functioning in the global sulfur market. Sulfur are multifunctional in nature and used in its elemental form the production of range of end-use products like match sticks, fungicides, insecticides, detergents, batteries, and black gunpowder in both developed as well as emerging economies. Sulfur possesses great resistance to the heat and electricity along with ideal chemical properties. Commercial sectors including fertilizer, rubber, and pharmaceutical are widely ad optioning sulfur to get competitive edge in the global market. Also, emerging countries across the globe are focusing on increasing sulfur production in order to cater the increasing global demand of the sulfur. This trend is expected to continue and will enhance growth of the global industry in the near future.

- On May 1, 2025, according to the IMO reports, the Mediterranean Sea officially became an Emission Control Area (Med SOx ECA) under MARPOL Annex VI. The sulfur content in fuel oil for ships operating in the area is now limited to 0.1%, an effort to significantly reduce air pollution and deliver major benefits to both human health and the marine environment.

Sulfur Market Growth Factors

- Increasing adoption of the sulfur in agriculture industry for the manufacturing of fertilizers

- Growing demand for the sulfur based chemical elements in the commercial industries including pharmaceutical, chemical, and rubber industry.

- Capacity addition and strategic partnerships by the major players operating in the target industry.

Market Outlook

- Sustainability Trends: Sustainability trends in the sulfur market focus on eco-friendly recovery methods, recycling byproducts from petroleum and natural gas, and reducing emissions. Companies are investing in green technologies and circular economy practices to minimize environmental impact.

- Global Expansion:Global expansion in the sulfur market is driven by rising demand from fertilizers, chemicals, and pharmaceuticals. Companies are investing in new production facilities, strategic partnerships, and exports to emerging markets in Asia-Pacific, Latin America, and the Middle East.

- Major investors: Major investors in the sulfur market include Royal Dutch Shell, Chemtrade Logistics, Gulf Sulphur Services, Mereafe Resources, and Enersul Limited Partnership. They focus on expanding production capacity, sustainable recovery methods, and global distribution to meet growing industrial and agricultural demand.

Market Trends

- Agricultural Practices: The increased use of sulfur, including ammonium sulfate and sulfur-coated ureas, as fertilizers for agricultural practices to promote healthiness and enhance crop yield is supporting the market growth.

- Pharmaceutical and Personal Care Products: The demand for sulfur in pharmaceutical and personal care products has increased, contributing to market growth.

- Mining Industry:The use of sulfur is high in mining explosives, driving influence on the innovation and development of sulfur elements.

- Technological Advancements: The Adoption of advanced liquid fertilizer technologies like nanoparticle formulations has increased to enhance crop yields and reduce carbon footprints.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 11.12 Billion |

| Market Size in 2026 | USD 11.52 Billion |

| Market Size by 2034 | USD 15.29 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 3.6% |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | End-use Industry, and Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Segment Insights

End-use Industry Insights

On the basis of end-use industry segment the global market is segregated into chemical processing, metal manufacturing, rubber processing, and others. The chemical processing end-use industry segment is expected to dominate in terms of revenue over the forecast time frame. The growth is attributed to the growing demand for sulfur form the chemical processing industries across the globe for various end-use applications. These factors are primarily responsible for the greater market share of chemical processing in the end-use industry segment of the sulfur Market. Fertilizer segment will expand at a significant CAGR during the forecast time-frame. Increasing adoption of sulfur based fertilizers from the Asian countries is expected to fuel growth of the segment in the near future. Further growth increasing production of the fertilizers in order to cater the agricultural demand of the end users worldwide is expected drive growth of the segment in the next 10 years.

Regional Insights

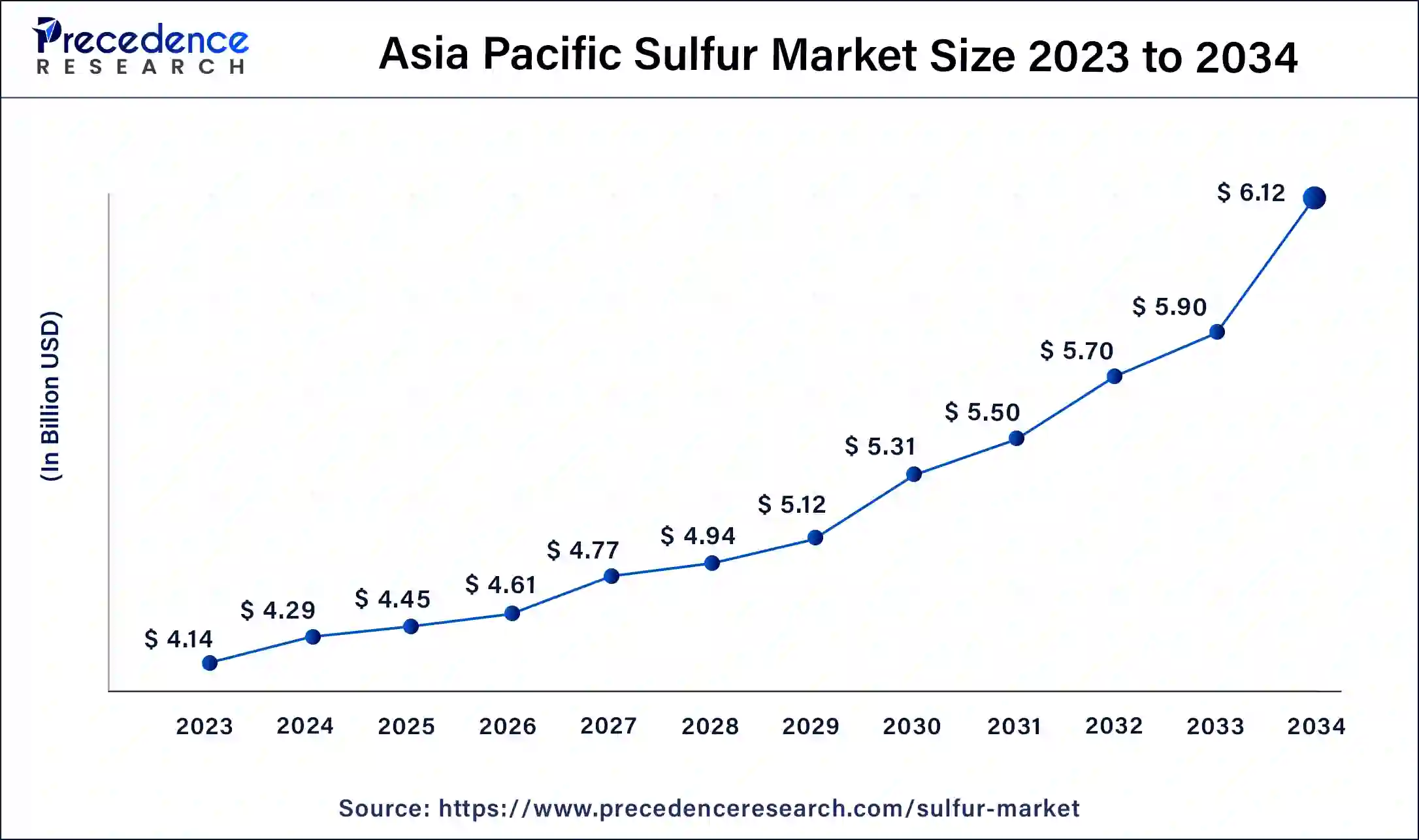

Asia Pacific Sulfur Market Size and Growth 2025 to 2034

The Asia Pacific sulfur market size is estimated at USD 4.45 billion in 2024 and is predicted to be worth around USD 6.12 billion by 2034, at a CAGR of 3.80% from 2025 to 2034.

China: Soars Amid Industrial Growth and Rising Demand

China's sulfur market is growing due to the country's rapid industrialization and expanding chemical, fertilizer, and pharmaceutical sectors. Rising demand for elemental sulfur in manufacturing fungicides, detergents, batteries, and rubber products further drives growth. Additionally, government initiatives to boost domestic production and meet increasing global and local demand, coupled with advancements in sulfur extraction and processing technologies, are strengthening China's position as a key player in the global sulfur market.

Technological Advances Drive U.S.

The U.S. sulfur market is growing due to increasing demand from the fertilizer, chemical, and pharmaceutical industries. Elemental sulfur is widely used in producing fertilizers, fungicides, detergents, and batteries, supporting agricultural and industrial growth. Additionally, advancements in sulfur recovery from petroleum and natural gas processing, along with investments in sustainable and efficient production technologies, are driving market expansion. Growing focus on meeting domestic demand while supporting exports further strengthens the U.S. sulfur market.

Europe Accelerates with Eco-Friendly Production and Industrial Demand

The European sulfur market is growing due to strong demand from the fertilizer, chemical, and pharmaceutical sectors. Elemental sulfur is widely used in producing fertilizers, chemicals, and industrial products, supporting agricultural and manufacturing activities. Additionally, strict environmental regulations encourage sulfur recovery from industrial processes, boosting supply. Investments in advanced production technologies, sustainable practices, and increasing industrial output across developed European countries are further driving market growth, positioning the region as a significant player in the global sulfur market.

Germany: Rising Demand Boosts the Market Growth

Germany's sulfur market is expanding due to strong demand from the chemical, fertilizer, and pharmaceutical industries. The adoption of advanced sulfur recovery technologies, combined with strict environmental regulations and a focus on sustainable production, is driving efficient supply and supporting the country's leading position in the European sulfur market.

Top Vendors and their Offerings

- Royal Dutch Shell PLC- Shell produces and supplies elemental sulfur as a byproduct of refining and natural gas processing, supporting chemical, fertilizer, and industrial applications globally.

- GULF Sulphur Services- Specializes in sulfur trading, storage, and logistics, offering high-quality sulfur products to industrial and agricultural sectors.

- Mereafe Resources-Engaged in sulfur production and distribution, focusing on supplying raw sulfur and derivatives for fertilizers and chemical manufacturing.

- Enersul Limited Partnership- Provides elemental sulfur and related products, emphasizing sustainable recovery processes from petroleum and gas operations.

- Chemtrade Logistics- Supplies sulfur and sulfur-based chemicals, with integrated logistics solutions to support industrial, agricultural, and chemical applications worldwide.

Recent Developments

- In April 2025, the Sulphur World Symposium 2025 took place in Florence, Italy. The event convenes industry leaders, experts, and stakeholders from the sulfur and sulfuric acid value chain to examine the latest trends, innovations, and challenges shaping the industry.

- In April 2025, Researchers at Washington State University demonstrated a way to use corn protein to improve the performance of lithium-sulfur batteries by creating a protective barrier made from a combination of corn protein and a common plastic. This helps to enhance the battery's performance and lifespan, potentially paving the way for wider use in electric vehicles, renewable energy storage, and other applications, significantly.

- In April 2024, ADNOC Gas initiated a desulphurization project to reduce sulphur content in LNG production to below 1 mg/cu m by 2025-26. This initiative aligns with global efforts to minimize emissions and improve environmental performance.

- In 2019, NOCO Incorporated and Marathon Petroleum Corporation has entered into the agreement in order to acquire the 9,00,000 barrels capacity light weight and asphalt terminal and retail stores of the NOCO.

- In 2019, Abu Dhabi National Oil Company has announced to expand its capacity up to 3 to 4 million barrels of oil per day in order to respond to the existing market condition. This huge investment is expected to increase production of the sulfur and will serve the increasing demand of sulfur from the European, Asian, and Middle East and African countries across the globe.

Segments Covered in the Report

By End-use Industry

- Fertilizer

- Chemical Processing

- Metal Manufacturing

- Rubber Processing

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting