What is the Rubber Market Size?

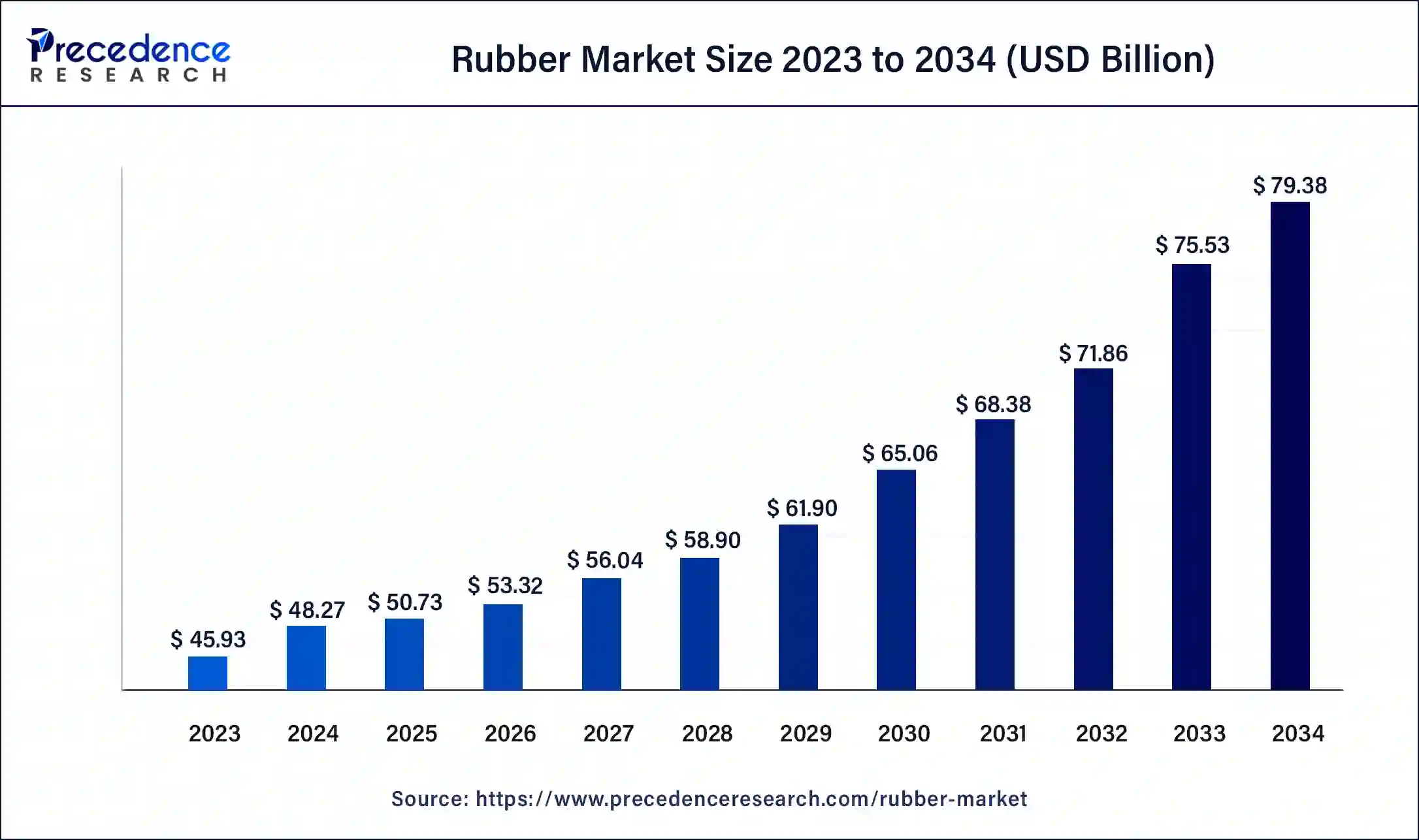

The global rubber market size was estimated at USD 48.27 billion in 2025 and is predicted to increase from USD 50.73 billion in 2026 to approximately USD 79.38 billion by 2034, expanding at a CAGR of 5.10% from 2025 to 2034.

Market Highlights

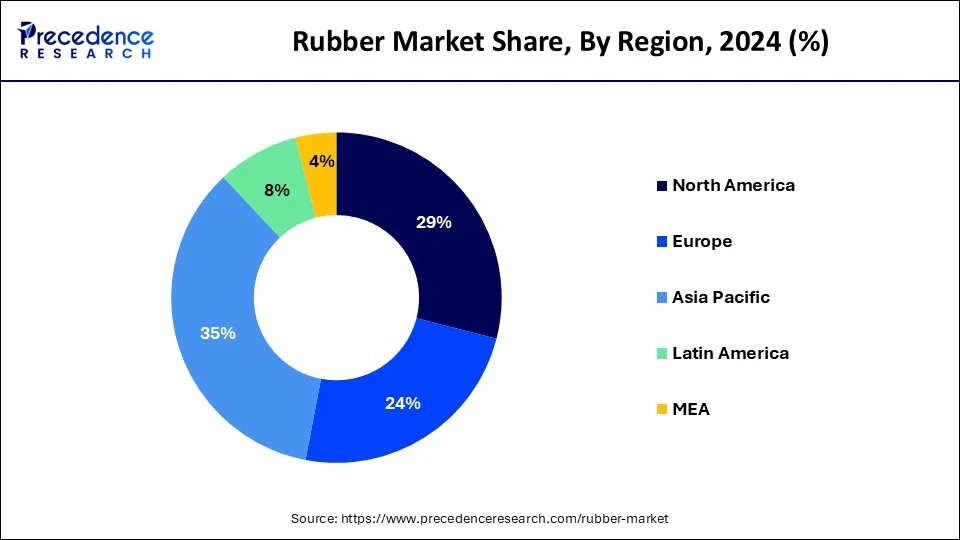

- Asia Pacific dominated the global market with the largest market share of 35% in 2024.

- North America is estimated to expand at the fastest CAGR between 2025 and 2034.

- By type, the natural segment is expected to hold the largest market share in 2024.

- By type, the synthetic segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By application, the tire segment captured the biggest market share in 2024.

- By application, the industrial goods segment is expected to expand at the fastest CAGR over the projected period.

Market Size and Forecast

- Market Size in 2025: USD 48.27 Billion

- Market Size in 2026: USD 50.73 Billion

- Forecasted Market Size by 2034: USD 79.38 Billion

- CAGR (2025-2034): 5.10%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Market Overview

Rubber, derived from the latex sap of rubber trees, undergoes vulcanization, a process involving the addition of sulfur to enhance its properties. This results in a versatile and durable material with widespread applications across various industries.

Its primary role lies in tire manufacturing, providing vehicles with essential traction and ensuring a comfortable driving experience. Beyond the automotive sector, rubber finds extensive use in everyday items like footwear, conveyor belts, hoses, and seals. Its unique combination of elasticity, impermeability, and resilience renders it indispensable in fields such as construction and consumer goods.

Additionally, advancements in synthetic rubber production have broadened its applications, offering alternatives to natural rubber and meeting specific industrial requirements. In essence, rubber's diverse properties significantly contribute to the functionality and efficiency of a wide array of products that impact our daily lives.

Rubber Market Growth Factors

- Automotive Industry Expansion: The growing automotive sector drives demand for rubber in tire manufacturing, a key growth factor for the rubber market.

- Infrastructure Development: Increasing infrastructure projects worldwide boost the demand for rubber in construction applications like seals, hoses, and gaskets.

- Rising Population: The global population surge contributes to increased consumption of rubber-based products, from footwear to consumer goods.

- Technological Advancements: Innovations in rubber processing and manufacturing technologies enhance production efficiency, positively impacting market growth.

- Economic Growth: Improving economic conditions in emerging markets lead to higher disposable incomes, fueling demand for rubber-based products.

- Sustainable Practices: Growing awareness of environmental concerns promotes the use of sustainable and eco-friendly rubber production methods.

- Advancements in Synthetic Rubber: Technological breakthroughs in synthetic rubber development offer alternatives and expand the overall market.

- Increased Industrialization: Rapid industrialization in developing regions results in elevated demand for rubber in various industrial applications.

- Changing Consumer Lifestyles: Evolving consumer preferences and lifestyles drive demand for rubber-based products, such as athletic footwear and recreational gear.

- Government Initiatives: Supportive government policies and initiatives encourage the growth of the rubber industry, fostering a conducive business environment.

- Globalization of Trade: Increased international trade facilitates the movement of rubber products globally, fostering market expansion.

- Innovation in Product Design: Ongoing product innovation, such as high-performance rubber compounds, opens new market opportunities.

- Stringent Safety Regulations: Strict safety regulations mandate the use of high-quality rubber components, driving market growth.

- Expansion of Aviation Industry: The burgeoning aviation sector boosts demand for rubber in aircraft components, from tires to seals.

- Medical Industry Requirements: Growing healthcare needs drive demand for rubber in medical devices and equipment.

- E-commerce Boom: The rise of e-commerce amplifies the demand for rubber in packaging materials and logistics solutions.

- Natural Disaster Preparedness: Increasing focus on disaster preparedness fuels demand for rubber in emergency response and protective equipment.

- Energy Sector Development: Expansion in the energy sector leads to increased use of rubber in oil and gas exploration and production.

- Growing Consumer Electronics Market: The expanding electronics industry drives demand for rubber in electronic components and accessories.

- Climate Change Resilience: Rubber's resilience and weather-resistant properties make it a crucial material in climate-resilient infrastructure projects.

Technological Advancement

Technological advancements in the rubber market feature refined properties like durability and heat resistance, and polymerization techniques for synthetic rubber. Regarding the environmental concern, the sustainable techniques used are the practice of bio-based rubber and the approach recyclable process. With the support of AI and data exchange, the accurate utilization reduces waste, helps environmental growth. Technology boosts the growth of the rubber market with the appropriate sustainable use of it.

The popular nanotechnology in the rubber market is used for the development and reliability of the rubber quality. The new rubber type consists of additional rubber materials for applications such as medical devices supporting the healthcare sector by producing mechanical properties, and in construction by developing the raw materials for waterproofing and sealing. Automation and smart production include efficiency, automated factories, and smart production methods. The manufacturing of silicon rubber can accelerate the production process compared to the manual process.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 48.27 Billion |

| Market Size in 2026 | USD 50.73 Billion |

| Market Size by 2034 | USD 79.38 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.10% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Automotive industry growth and infrastructure development

The robust growth of the automotive industry and ongoing infrastructure development globally significantly contribute to the surge in demand for the rubber market. As the automotive sector expands, the primary driver for this market, there is an escalating need for rubber in tire manufacturing, given its indispensable role in ensuring optimal vehicle performance and safety. The increasing production and sales of automobiles worldwide amplifies the demand for high-quality rubber compounds.

Simultaneously, infrastructure development projects, ranging from construction to transportation, propel the demand for rubber-based products such as seals, gaskets, and hoses. Rubber's versatility and durability make it a preferred material in various construction applications, further stimulating market growth. The infrastructure boom creates a domino effect, necessitating a consistent and substantial supply of rubber for diverse applications, reinforcing its pivotal position in meeting the demands of both the automotive and construction sectors.

Restraint

Fluctuating raw material prices

Fluctuating raw material prices serve as a significant restraint on the growth of the rubber market. The rubber industry is highly dependent on the prices of key raw materials, particularly natural rubber and synthetic rubber feedstocks. Rapid and unpredictable fluctuations in these prices can create challenges for manufacturers in terms of production planning, cost management, and profit margins. The volatility in raw material prices is often influenced by factors such as weather conditions affecting rubber tree plantations, geopolitical events, and global economic uncertainties. These fluctuations complicate the forecasting process for businesses within the rubber industry, making it challenging to maintain stable pricing for end-products.

Moreover, sudden spikes in raw material costs can lead to increased production expenses, potentially impacting the competitiveness of rubber products in the market. Managing these uncertainties requires strategic planning, risk mitigation measures, and a proactive approach to adapt to the dynamic nature of raw material pricing in the rubber industry.

Opportunity

Green initiatives

Green initiatives are generating significant opportunities for the rubber market as environmental consciousness drives a shift toward sustainable practices. The demand for eco-friendly and biodegradable rubber products has surged, opening avenues for innovation in manufacturing processes and materials. Companies investing in research and development to create rubber formulations with reduced environmental impact are poised to capitalize on this growing market segment.

Moreover, adherence to green initiatives enhances corporate reputation and meets the preferences of environmentally conscious consumers. This trend aligns with a broader movement toward circular economy practices, encouraging the recycling and repurposing of rubber products. Additionally, sustainable rubber cultivation methods, such as agroforestry and responsible land management, are gaining traction. Embracing green initiatives not only addresses environmental concerns but also positions the rubber industry to tap into expanding markets seeking ethically and environmentally responsible products, thereby fostering long-term growth and competitiveness.

Segments Insights

Type Insights

In 2024, the natural segment had the highest market share based on type. The natural rubber segment in the rubber market refers to rubber derived from the latex sap of rubber trees, primarily Hevea brasiliensis. This type of rubber is characterized by its organic origin and is a crucial component in various industries, particularly tire manufacturing.

Trends in the natural rubber segment include a focus on sustainable and responsible sourcing practices, as well as efforts to address environmental concerns associated with deforestation. Additionally, advancements in natural rubber processing technologies aim to enhance efficiency and product performance, meeting the demand for high-quality, eco-friendly rubber products.

The synthetic segment is anticipated to expand at a significant CAGR of 5.2% during the projected period. The synthetic rubber segment in the rubber market comprises artificially produced elastomers, offering properties similar to natural rubber. Key synthetic rubber types include styrene butadiene rubber (SBR), polybutadiene rubber (BR), and nitrile rubber (NBR). Trends in the synthetic rubber sector involve a growing demand for specialty elastomers with enhanced performance characteristics. Increasing applications in automotive tires, industrial goods, and consumer products drive the demand for high-performance synthetic rubber variants, contributing to the segment's continued expansion and technological advancements within the rubber industry.

Application Insights

According to the application, the tire segment has held a 34% revenue share in 2024. The tire segment in the rubber market pertains to the production of vehicle tires, representing a pivotal application. Fueled by the flourishing automotive industry, there is a notable demand for advanced, environmentally friendly tires. Current trends within this segment include a heightened interest in sustainable tire solutions, exemplified by the creation of fuel-efficient and low-rolling-resistance tires. Furthermore, there is a noticeable shift toward smart tire technologies, integrating sensors for real-time monitoring, enhancing safety, and optimizing performance in the automotive realm.

The industrial goods segment is anticipated to expand fastest over the projected period. The industrial goods segment in the rubber market encompasses a broad range of applications, including seals, gaskets, hoses, conveyor belts, and other components used in industrial machinery. As industries seek durability and performance, high-quality rubber products become essential for effective operations. Trends in this segment include a growing demand for customized rubber solutions tailored to specific industrial needs, along with a heightened emphasis on incorporating sustainable and eco-friendly rubber materials in manufacturing processes to align with global environmental standards and regulations.

Regional Insights

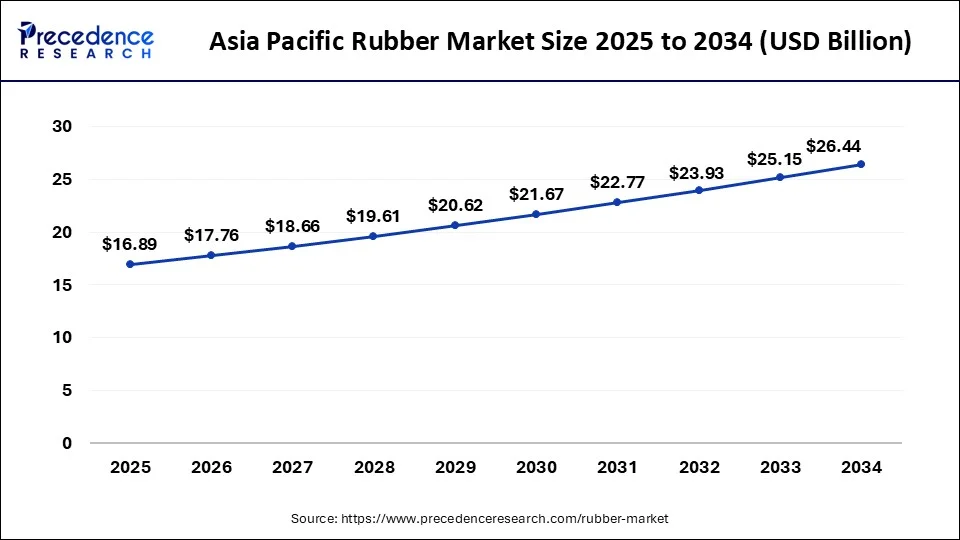

Asia Pacific Rubber Market Size and Growth 2025 to 2034

The Asia Pacific rubber market size was estimated at USD 17.76 billion in 2025 and is predicted to be worth around USD 28.18 billion by 2034, at a CAGR of 5.23% from 2025 to 2034.

Asia Pacific is dominating the rubber market. With the largest share in the global tire manufacturing and heavy investment in rubber plantations, mostly in Southeast Asia, the region secures its first position in the rubber market. The high production and consumption rate of rubber through several businesses makes this region the leader in the rubber market globally.

Asia-Pacific dominates the rubber market due to robust economic growth, particularly in countries like China and India. The region's thriving automotive and manufacturing sectors drive significant demand for rubber products, especially in tire manufacturing. Additionally, the presence of key natural rubber-producing countries in Southeast Asia, coupled with a vast consumer population, further solidifies Asia-Pacific's prominent position in the global rubber market. The region's strategic importance in the supply chain, coupled with industrialization and infrastructure development, contributes to its major growth in the overall rubber industry.

North America holds a significant share of the rubber market due to its thriving automotive and manufacturing sectors, driving robust demand for rubber products. The region's advanced technological infrastructure fosters innovation and product development in the rubber industry. Additionally, stringent safety and quality regulations contribute to the prominence of high-performance rubber components. A well-established supply chain and a growing emphasis on sustainability further bolster North America's dominance in the global rubber market.

Rubber Market Companies

- Bridgestone Corporation

- Michelin

- Goodyear Tire and Rubber Company

- Continental AG

- Sumitomo Rubber Industries, Ltd.

- Pirelli & C. S.p.A.

- Hankook Tire

- Apollo Tyres Ltd.

- Yokohama Rubber Company

- Cooper Tire & Rubber Company

- Kumho Tire

- Toyo Tire Corporation

- Zhongce Rubber Group Co., Ltd. (ZC Rubber)

- Linglong Tire

- MRF Limited

Recent Developments

- In April 2025, Tariff turbulence cast a shadow over the rubber plantations of Kerala. With the U.S. tariff suspension on the Indian rubber industry, prices are affected with a certain drop in the rate.

- In April 2025, Indonesia came forward in forest monitoring to meet the EU deforestation law, to which the rubber industry will face a transitional change.

Segments Covered in the Report

By Type

- Natural

- Synthetic

By Application

- Industrial Goods

- Footwear

- Non-Tire Automotive

- Tire

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting