Butadiene Market Size and Forecast 2025 to 2034

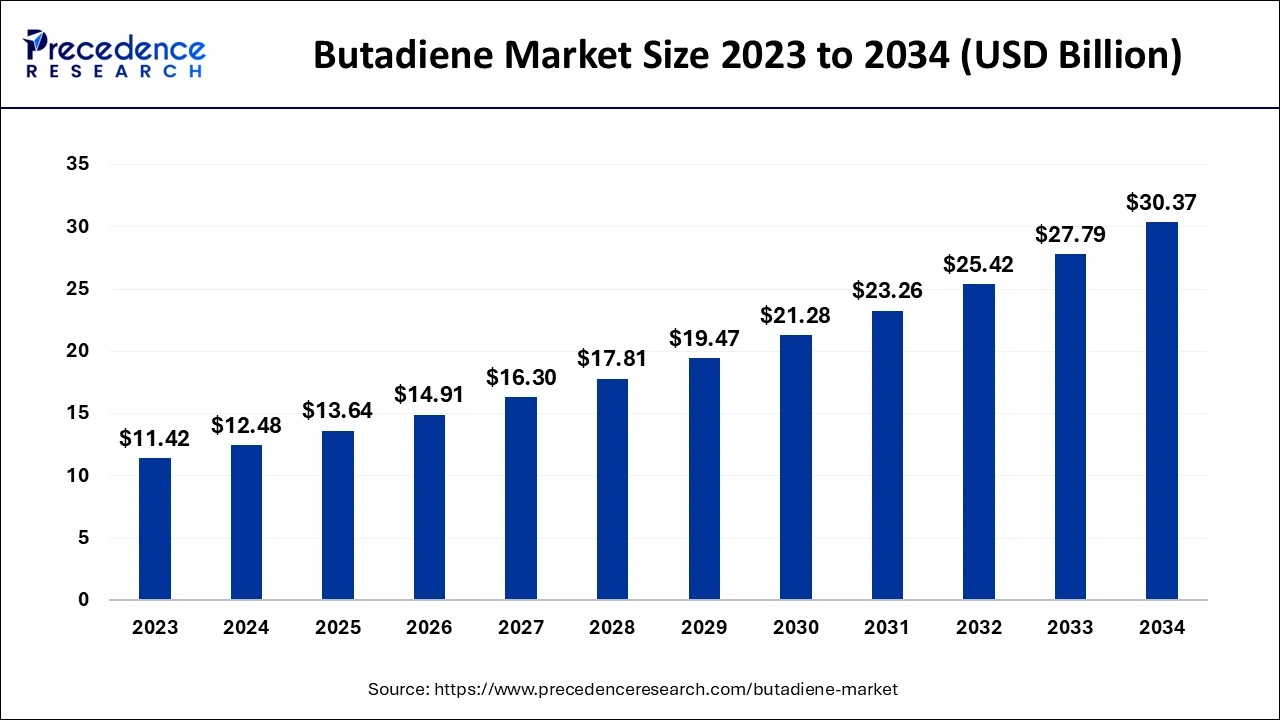

The global butadiene market size was estimated at USD 12.48 billion in 2024 and is anticipated to reach around USD 30.37 billion by 2034, expanding at a CAGR of 9.30 % from 2025 to 2034.

Butadiene Market Key Takeaways

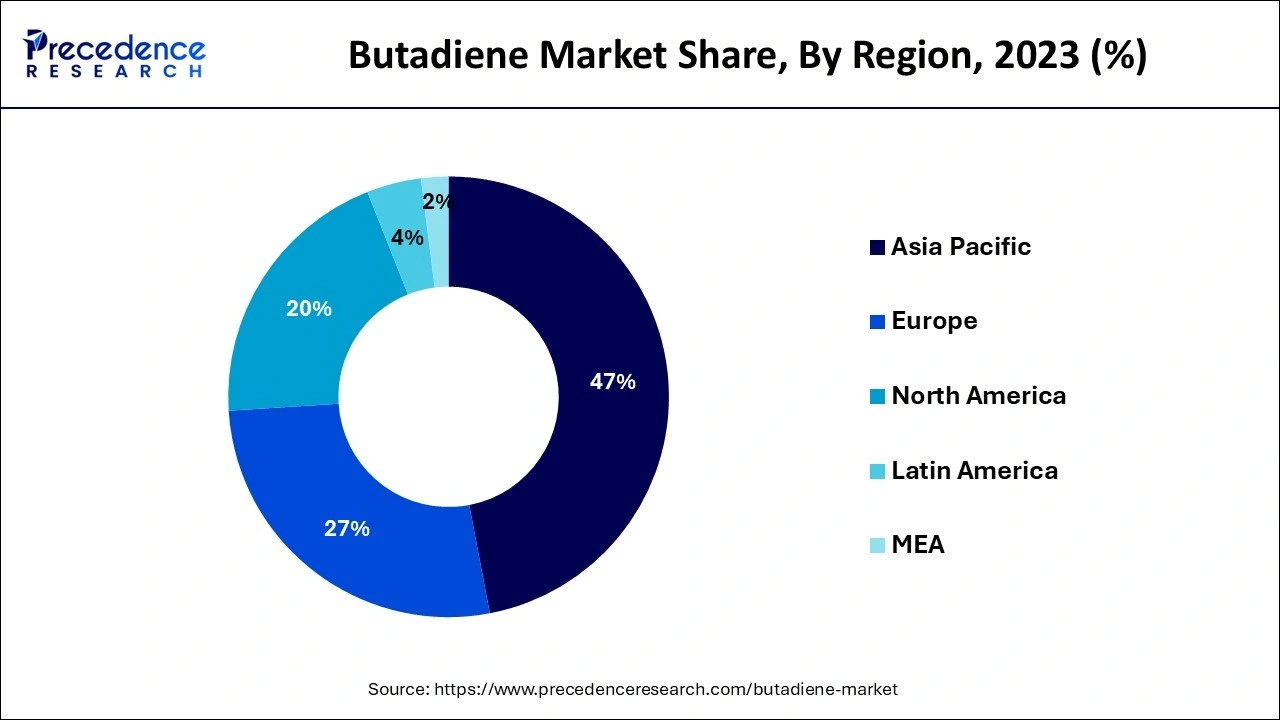

- Asia Pacific was accounted for 47% revenue share in 2024.

- By product, the acrylonitrile butadiene rubber segment 31% revenue share in 2024.

- By production process, the n-butane dehydrogenation category dominated the market in 2024.

AI in the Market

Artificial Intelligence is revolutionizing this market while increasing production efficiencies and assuring safe operations. AI-powered decision-making systems have essentially optimized chemical processing by intelligently assessing and manipulating the influencers. They advise on parameter settings to minimize energy consumption. For real-time monitoring, ensuring quality assurance, applying simulations of chemical interactions to R&D activities, or setting up systems for predictive maintenance to guarantee safety and compliance, AI has an expanding role. AI provides real-time insights into raw material consumption, inventory, and logistics, thus improving supply chain management. Accordingly, this fosters an environment where R&D, sustainability, and operational excellence come to the fore, making butadiene a much more competitive, efficient, and leaner market from the environmental standpoint.

Asia Pacific Butadiene Market Size and Growth 2025 to 2034

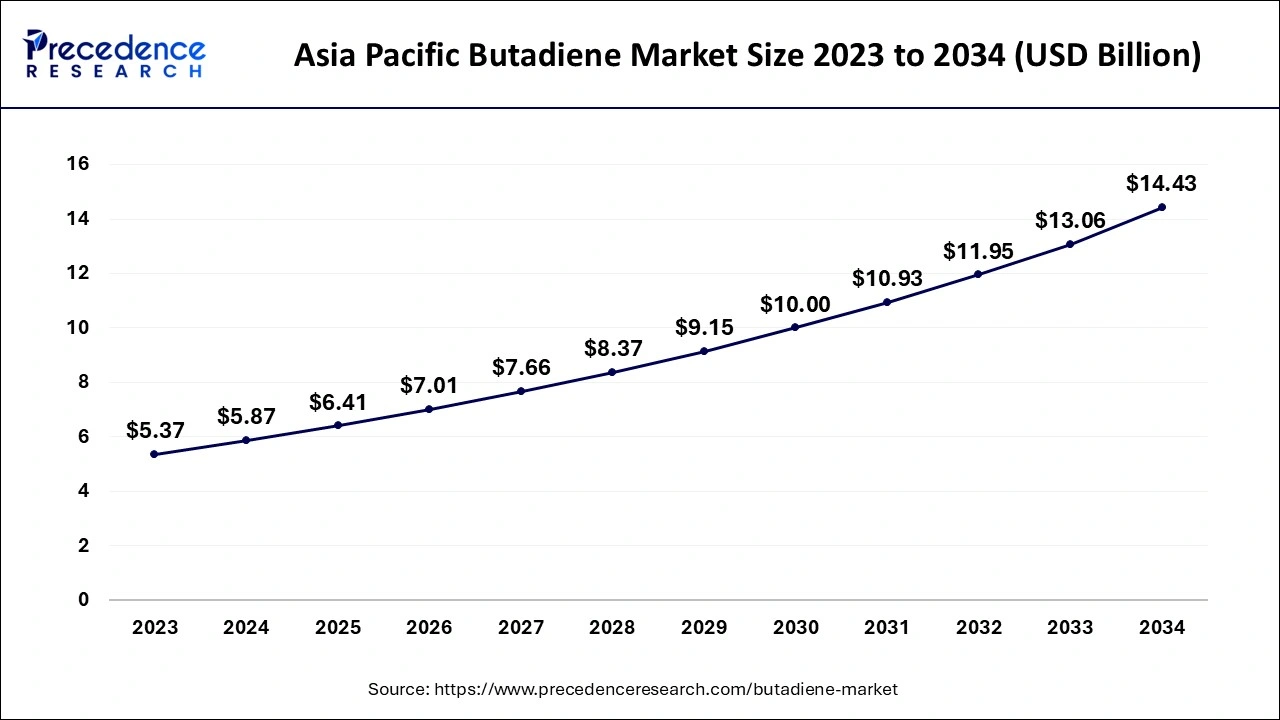

The Asia Pacific butadiene market size was evaluated at USD 5.87 billion in 2024 and is predicted to be worth around USD 14.43 billion by 2034, rising at a CAGR of 9.41% from 2025 to 2034.

On the basis of geography, Asia-Pacific region accounted for the majority revenue share in 2024. Asia-Pacific currently has a dominant position in the butadiene market and is anticipated to expand at the highest rate during the forecast period as a result of the region's rapid industrialization and increased demand for butadiene in automotive and rubber applications. The fastest-growing market in the region is China, which consumes the most butadiene, followed by India and other South-East Asian nations. This is due to rising car manufacturing. Sales and production of commercial vehicles, which represent an important growth of 91 percent and 73.8 percent over March, respectively, reached 5,01,000 and 4,68,000 units in April 2021, according to the China Association of Automobile Manufacturers (CAAM). This creates lucrative opportunities for butadiene market participants. Additionally, the textile industry's expanding usage of butadiene derivatives in the manufacture of shoes, gloves, and belts is promoting regional market expansion.

A major percentage of the market in 2023 was in North America. In well-established businesses like paints and coatings and the polymer industry, the need for butadiene derivatives is rising. The United States is the dominant nation in the region due to the presence of important critical companies like Exxon, Dow, and TPC Group.

North America is the fastest growing market for the butadiene market with a significant CAGR during the forecast period, spurred by increased automotive production, greater demand for synthetic rubber, and investments in petrochemical infrastructure. The region is supported by a well-established refining and cracking capacity, especially in the U.S., which ensures a reliable supply of raw materials. Furthermore, improvements in shale gas exploration have reduced feedstock costs, leading to increased butadiene production. Growth in the construction and consumer goods sectors also drives the demand for butadiene-based polymers, further promoting market growth.

United States

The United States is at the forefront of butadiene growth in North America, because of its strong refining infrastructure, availability of low-cost feedstocks from shale gas, and large-scale automotive manufacturing. The country's plans for capacity expansion and technological advancements in production and recovery processes support a stable supply. High demand for tires, polymers, and adhesives further strengthens the country's position as a key player in the region's butadiene market.

Moreover, Europe is predicted to have significant increase throughout the projection period as a result of the widespread use of butadiene and its derivatives in the manufacturing of auto parts such wheel covers, dashboard trims, tires, and other components. Germany is the top-ranking nation due to its rising automobile exports.

Europe is observed to grow at a considerable growth rate in the upcoming period due to strong demand from the automotive and packaging industries. The increasing focus on sustainability and bio-based alternatives is fostering innovation in methods of producing butadiene. Regulatory pressure to cut emissions is leading to the creation of cleaner technologies. Additionally, the presence of major automotive manufacturers and strong infrastructure in countries like Germany and France ensures a steady demand for butadiene derivatives such as SBR and ABS.

Germany

Germany is a crucial player in Europe's butadiene market, bolstered by its strong automotive and chemical sectors. The nation's solid industrial base requires synthetic rubber and plastic derivatives, driving butadiene consumption. Moreover, Germany's dedication to sustainable practices encourages research into alternative production technologies. With leading chemical companies based here, Germany remains a vital center for innovation and demand in the European butadiene value chain.

Market Overview

The demand for synthetic rubbers, which in turn affects the butadiene market, is significantly influenced by the automotive industry, while the supply is dependent on the ethylene industry because it is a key component needed for the steam cracking process. As a result, the butadiene industry is significantly impacted by the supply-demand tensions in other markets. The development of eco-friendly techniques for producing polymer emulsions, the rise in demand for water-based solvents and coatings, as well as the expansion of industrial sectors like autos and consumer durables, are some of the drivers driving the worldwide market.

Butadiene Market Growth Factors

- The tire, footwear, and consumer goods industries are the main demand drivers for synthetic rubber.

- Increasing markets for acrylonitrile butadiene styrene in automotive, electronics, and industrial uses further promote its market growth.

- Polybutadiene is essential for tire production, providing increased durability and improved performance; thus increasing demand.

- With a broader scope in automobile parts, plastics, and other industrial materials, the outlook for the market is strengthening.

- Shift toward advanced, lightweight, durable, and adaptable materials lends growth to the sector of butadiene derivatives.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 |

USD 12.48 Billion |

| Market Size in 2025 |

USD 13.64 Billion |

| Market Size by 2034 |

USD 30.37 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.30% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Production Process, End-User, and Geography |

Market Dynamics

Key Market Challenges

Acute and chronic effects on health

Due to the dangerous carcinogenic properties of shale oil and its acute and long-term effects, production has been reduced. Acute low exposures may irritate the lungs, nose, throat, and eyes. Skin exposure can also result in frostbite. Acute high exposures may harm the central nervous system or result in symptoms including headaches, nausea, dizziness, fainting, distorted vision, vertigo, general exhaustion, low blood pressure, and headaches. There is debate concerning the long-term consequences of exposure to butadiene. Numerous epidemiological studies on humans have revealed an upsurge in cancer and cardiovascular illnesses.

Key Market Opportunities

- Development of bio-based butadiene - Numerous market possibilities are anticipated as a result of the increasing demand for nylon 66 resin in important end-use sectors like automotive and electronics and manufacturers' focus on the development of bio-based manufacturing processes for butadiene. Many researchers are working on the same and governments are supporting their nations to adopt bio-based alternatives.

Value Chain Analysis

- Raw Material Procurement

Feedstock procurement of butadiene means the strategic process of sourcing the raw materials, chiefly crude C4 stream from petroleum refining, for its industrial-making purpose.

Players: BASF SE, LyondellBasell, ExxonMobil

- Chemical Synthesis and Processing

Butadiene chemical synthesis and processing involve numerous industrial methods, mainly steam cracking of hydrocarbons, wherein butadiene is formed as a co-product along with ethylene.

Players: ExxonMobil, Shell, and LyondellBasell

- Compound Formulation and Blending

Compound formulation and blending of butadiene refer to producing materials by mixing butadiene polymers with additives and other rubbers to improve physical and mechanical properties.

Players: Styrene Butadiene Rubber (SBR), Butadiene Rubber (BR)

- Quality Testing and Certification

Testing for the quality of the substance butadiene is an important step in fairly ensuring the purity and quality of the chemical for a variety of industrial applications, for example, the production of synthetic rubbers and plastics.

Players: Bureau of Indian Standards (BIS), SGS, Bureau Veritas

- Packaging and Labelling

With reference to butadiene, packaging means containing the chemical as a liquefied gas under pressure in steel vessels, and labeling involves some sort of display on the containers with specific hazard warnings and regulatory information.

Key players: SABIC and Zeon Corporation

Product Insights

On the basis of product, the styrene butadiene rubber (SBR) segment has had largest market share in 2024 in terms of revenue. Styrene Butadiene Rubber (SBR), which is derived from butadiene and combined with rubber from natural sources to manufacture tires, is the primary component. Tires' performance-enhancing aspects, such as rolling resistance, wear, and traction, are provided by the physical and chemical properties of these rubber polymers. In industrial applications, SBR rubber often replaces natural rubber directly. Some of its advantages include excellent aging qualities, crack endurance, and abrasion resistance. Styrene-butadiene also exhibits high water and compression set resistance. A synthetic copolymer called SBR was first developed to replace natural rubber in tires. SBR is created by combining BD with styrene. Together with natural rubber, it currently accounts for 90% of all rubber consumed globally. In conditions involving water, hydraulic fluids, or alcohol, SBR is widely used. SBR can therefore be found, for example, in tires, tubes, compressors, and conveyor belt coverings.

The category with the quickest growth is anticipated to be Styrene-butadiene (SB) latex during the forecast period. Styrene-butadiene (SB) latex is a common type of emulsified polymer used in a variety of commercial and industrial applications. Because it is made of two distinct monomers, styrene and butadiene, SB latex is classified as a polymerization. While styrene is produced when benzene and ethylene mix, butadiene is a byproduct of the production of ethylene. Styrene-butadiene latex is used to create transparent, glossy, and luminescent paper coverings and products including coated canvas and white chipboard, as well as data capture papers like pneumatically paper and infrared paper that are used in brochures, journals, and SB latex. Additionally, SB latex is used in the back coats of tufted carpets. SB latex is a popular solution for adhesives in various sectors, including the flooring industry.

End-User Insights

On the basis of end-user, the automobile segment is expected to have the largest market share in the coming years period.

Butadiene is used to make the majority of synthetic rubbers and elastomers, including polybutadiene rubber (PBR), nitrile rubber (NR), styrene-butadiene rubber (SBR), and polychloroprene (Neoprene). These are subsequently used to produce a range of goods and raw materials. When butadiene-based rubber is used as the starting material, the main component of acrylonitrile-butadiene-styrene (ABS) resin, which has several applications, is utilized to manufacture plastics. Polybutadiene is often used in tire manufacture.

The production of polybutadiene is believed to account for over 70% of all tires produced worldwide. It is mostly used in tires as a sidewall to lessen strain caused by continual bending when running. Hence, the application of butadiene in the automotive segment is expected to increase in the projected period.

Butadiene Market Top Companies

- China Petroleum & Chemical Corporation

- Royal Dutch Shell Plc

- Borealis AG.

- Versalis S.p.A.

- Eni S.p.A.

- Evonik Industries AG

- Ineos Group AG

- LANXESS

- LG Chem

- LyondellBasell Industries Holdings B.V.

- Nizhnekamskneftekhim.

- Repsol

- SABIC

- The Dow Chemical Company

- TPC Group

- Formosa Plastics Corporation

- ZEON Corporation.

- Shanghai Petrochemical

Recent Developments

-

In December 2024, Polestar and MBA Polymers UK partnered to boost the UK's circular economy for electric vehicles by incorporating post-consumer plastics into luxury vehicle interiors.

https://www.recyclingtoday.com/news/mba-polymers-uk-polestar-partner-to-improve-plastics-circularity-in-electric-vehicles/ -

In November 2024, Bridgestone plans to invest over $9 million in federal funds to construct a plant in Akron for innovative tire production research.

https://signalakron.org/bridgestone-to-build-pilot-butadiene-plant-in-akron/

Segments Covered in the Report

By Product Type

- Butadiene Rubber

- Styrene Butadiene Rubber

- Acrylonitrile Butadiene Rubber

- Nitrile Butadiene Rubber

- Styrene Butadiene Latex

- Hexamethylenediamine

By Production Process

- C4 hydrocarbon extraction

- n-butane dehydrogenation

- From ethanol

- From butenes

By End-User

- Automobile Industries

- Chemical

- Plastics and Polymers

- Building & Construction

- Consumer Products Industries

- Healthcare

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting