What is the Acrylonitrile Butadiene Styrene Market Size?

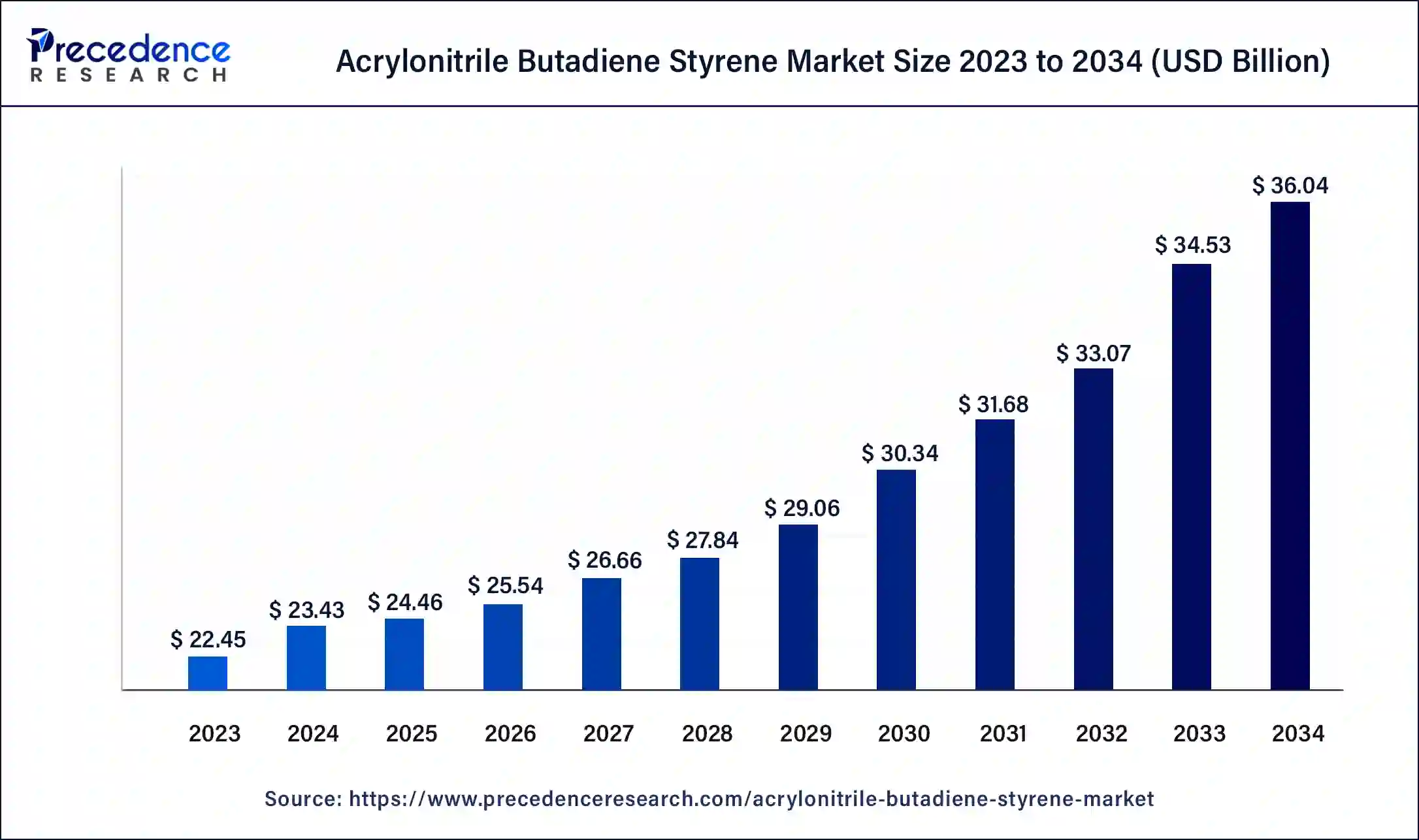

The global acrylonitrile butadiene styrene market size is accounted at USD 24.46 billion in 2025 and predicted to increase from USD 25.54 billion in 2026 to approximately USD 36.04 billion by 2035, expanding at a CAGR of 4.4% from 2026 to 2035.

Acrylonitrile Butadiene Styrene Market Key Takeaways

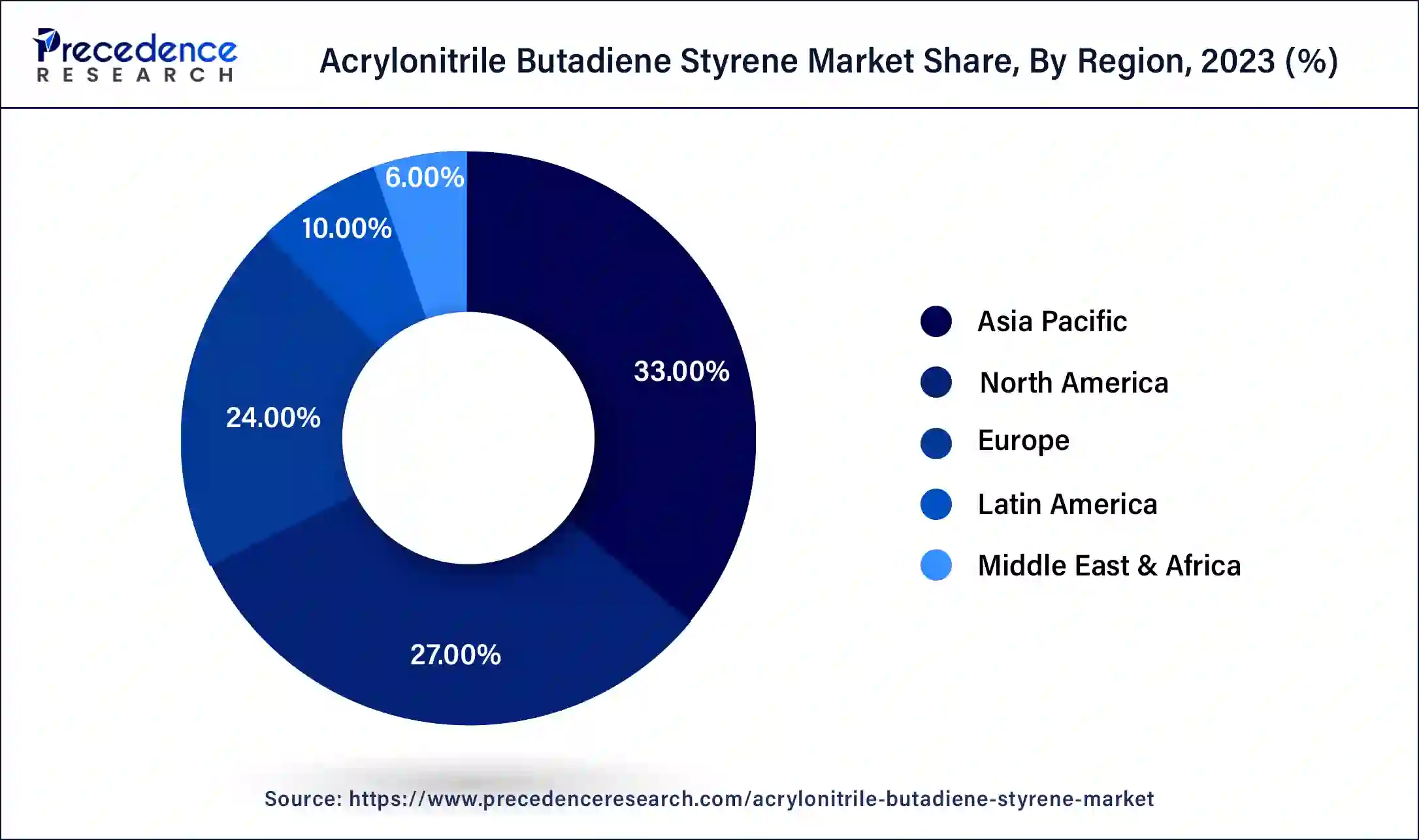

- Asia Pacific contributed more than 33% of revenue share in 2025.

- North America is estimated to expand the fastest CAGR between 2026 and 2035.

- By type, the opaque segment has held the largest market share of 40% in 2025.

- By type, the transparent segment is anticipated to grow at a remarkable CAGR of 4.8% between 2026 and 2035.

- By application, the appliances segment generated over 25% of revenue share in 2025.

- By application, the automotive segment is expected to expand at the fastest CAGR over the projected period.

What is Acrylonitrile Butadiene Styrene?

Acrylonitrile butadiene styrene (ABS) is a versatile thermoplastic polymer composed of three key monomers such as acrylonitrile, butadiene, and styrene. This combination results in a material renowned for its exceptional strength, toughness, and resistance to impact. ABS finds widespread use across industries, including automotive, electronics, and consumer goods. ABS stands out due to its impressive mechanical properties, making it a preferred choice for applications demanding durability and resilience to physical stress. Its capacity to be molded into intricate shapes without compromising structural integrity makes it a popular material in manufacturing.

Furthermore, ABS showcases commendable chemical resistance, making it capable of withstanding exposure to various substances. Whether in the form of 3D printing filaments, automotive parts, or household appliances, ABS remains a favored material, providing a harmonious blend of mechanical robustness and processing versatility for a diverse array of products.

Acrylonitrile Butadiene Styrene Market Growth Factors

- The growing automotive industry's reliance on lightweight and durable materials is propelling the demand for ABS in-vehicle components.

- The expanding popularity of 3D printing applications is boosting the demand for ABS filaments due to their versatility and ease of use in additive manufacturing.

- The surge in consumer electronics, particularly in gadgets and appliances, is driving the need for ABS in manufacturing casings and structural components.

- The global focus on infrastructure development is creating a demand for ABS in construction-related applications, such as pipes and fittings.

- The medical industry's increasing reliance on ABS for manufacturing lightweight and sterile medical devices is contributing to market growth.

- ABS's impact resistance and versatility are making it increasingly popular in the packaging industry for manufacturing durable and protective containers.

- The rise in renewable energy projects, such as wind turbines and solar panels, is fueling the demand for ABS in components that require both strength and durability.

- ABS's ability to meet stringent aerospace requirements is leading to its increased usage in the production of aircraft interior components.

- As urbanization accelerates, the demand for ABS in various urban infrastructure applications like pipes, fittings, and construction materials is on the rise.

- The surge in e-commerce activities is boosting the use of ABS in packaging materials to ensure the safe transportation of goods.

- ABS's electrical insulation properties make it a preferred choice for the manufacturing of electrical connectors and housings.

- Industries' emphasis on lightweight materials to enhance fuel efficiency in transportation is fueling the demand for ABS in automotive and aerospace applications.

- The rising middle-class population worldwide is driving the demand for durable and affordable consumer goods, positively impacting the ABS market.

- Ongoing developments in processing technologies for ABS are improving its efficiency and reducing production costs, fostering market growth.

- Increasing regulations for automotive safety standards are promoting the use of ABS in vehicles due to its impact resistance.

- The growing focus on sustainable practices is driving the adoption of recyclable ABS materials, aligning with environmentally conscious manufacturing processes.

- ABS's suitability for rapid prototyping in product development processes is fueling its demand in research and development activities across different sectors.

Acrylonitrile Butadiene Styrene Market Outlook

- Industry Growth Overview:

The acrylonitrile butadiene styrene market is experiencing significant growth as rising demand for ABS (Acrylonitrile-Butadiene-Styrene) and SAN (Styrene-Acrylonitrile) are versatile engineering thermoplastics that have substituted major traditional materials of construction, such as wood, glass, metal, and rubber, in applications. - Global Expansion:

The acrylonitrile butadiene styrene market is experiencing significant global expansion, driven by ABS is majorly used in appliances and electronics, and electrical apparatus. Asia Pacific dominates the market due to the occurrence of strong automotive organizations and a robust electronics industry. - Major investors:

The major investors in the acrylonitrile butadiene styrene market are significantly large chemical conglomerates that dominate by capacity expansions, partnerships, and research into sustainable alternatives. - Global Expansion:Emerging demand for lightweight materials in electric vehicles, construction, and a rise in emphasis on sustainability and recycling initiatives are supporting the comprehensive growth.

- Major Investors: Companies, including LG Chem, CHIMEI Corporation, and INEOS Styrolution, are actively engaged in new product development and capacity expansions.

- Startup Ecosystem: ReNew Polymers, a U.K. recycler actively establishing a solvent-based depolymerization process for post-consumer ASA (acrylonitrile styrene acrylate, a related polymer) blends.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 24.46 Billion |

| Market Size in 2026 | USD 25.54 Billion |

| Market Size by 2035 | USD 36.04 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.4% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

3D Printing applications and medical industry requirements

The surge in 3D printing applications and the evolving requirements of the medical industry significantly contribute to the heightened demand for acrylonitrile butadiene styrene (ABS) in the market. In the realm of 3D printing, ABS's versatility and ease of use make it a preferred material for producing durable prototypes, intricate designs, and functional components.

The ability of ABS to maintain structural integrity while being molded into complex shapes aligns well with the intricate requirements of additive manufacturing, fueling its adoption in various industries, including automotive, aerospace, and consumer goods. Within the medical industry, ABS plays a crucial role in meeting the demand for lightweight, sterile, and durable medical devices.

Its use in manufacturing components like housings, connectors, and equipment enclosures underscores ABS's compliance with stringent regulatory standards while offering the necessary mechanical properties required in medical applications. The combination of ABS's versatility in 3D printing and its suitability for medical devices positions it as a sought-after material, driving sustained market growth in these key sectors.

Restraint

Limited heat resistance

Limited heat resistance poses a significant restraint on the growth of the acrylonitrile butadiene styrenes market. While ABS exhibits excellent mechanical properties, its relatively lower heat resistance compared to some other engineering plastics restricts its application in environments with elevated temperatures. In industries such as automotive and electronics, where exposure to heat is common, alternative materials with higher heat resistance may be preferred.

This limitation hinders the broader adoption of ABS in high-temperature applications, impacting its market share in segments where heat stability is a critical consideration. Manufacturers and industries seeking materials for applications involving elevated temperatures may explore alternatives with superior thermal performance, leading to a challenge for ABS in capturing certain market segments and influencing the overall growth trajectory of the ABS market.

Opportunity

Rising demand in the automotive industry

The rising demand in the automotive industry is a significant catalyst for opportunities within the acrylonitrile butadiene styrenes market. As the automotive sector increasingly prioritizes fuel efficiency and sustainability, ABS emerges as a favored material due to its lightweight nature and excellent mechanical properties. The demand for ABS is propelled by its application in manufacturing various automotive components, including interior trims, dashboards, and exterior body parts.

Additionally, the trend toward electric vehicles, where weight reduction is crucial for enhancing battery efficiency, further underscores ABS's relevance. Manufacturers have the opportunity to collaborate with automotive companies to develop innovative solutions, leveraging ABS to meet the industry's evolving needs and contribute to advancements in vehicle design, performance, and environmental impact, thus solidifying ABS's position as a key material in the automotive sector.

SWOT Analysis - Acrylonitrile Butadiene Styrene Market

Drivers:

- ABS plastic is a broadly used thermoplastic polymer its versatility, durability, and simplicity of processing.

- ABS plastic is simple to extrude, mold, and shape, enabling manufacturers to create multifaceted designs with precision. It is broadly used in injection molding, 3D printing, and CNC machining.

- ABS withstands exposure to chemicals, oils, and heat, making it standard for industrial and automotive components that face strict environments.

Restraints:

- The material is prone to degradation when exposed to sunlight and UV radiation. It can become stiff and discolored over time, restrictive its outdoor uses.

- ABS plastic is classified as a combustible material and has a comparatively low resistance to fire.

Opportunity:

- Acrylonitrile imparts chemical resistance, and butadiene offers durability and impact resistance. Styrene contributes to processability and rigidity.

- Recent technology advances, the ABS manufacturing process arecontinuing to emerge, with a focus on improved performance and sustainability.

Threat:

- ABS has a major coefficient of thermal expansion compared to other engineering plastics.

Segment Insights

Type Insights

The opaque segment had the highest market share of 40% in 2024. The opaque segment in the acrylonitrile butadiene styrenes market refers to ABS materials that are not transparent or translucent, exhibiting solid and non-transparent characteristics. Opaque ABS finds extensive use in various industries, particularly in applications where visual clarity is not a primary requirement. This segment has witnessed a growing demand, driven by its suitability for automotive interiors, electronic housings, and consumer goods. The trend towards utilizing opaque ABS for its robustness and versatile molding capabilities underscores its significance in addressing diverse industrial needs and market preferences.

The transparent segment is anticipated to expand at a significant CAGR of 4.8% during the projected period. The transparent segment in the acrylonitrile butadiene styrenes market refers to a specialized category of ABS characterized by its clarity and translucency. Transparent ABS is widely used in applications where a combination of strength and see-through properties is desired, such as in consumer electronics, automotive interiors, and medical devices. Recent trends indicate a growing demand for transparent ABS in product design, particularly in the consumer goods sector, where aesthetics and visibility of internal components play a crucial role in the overall appeal and functionality of the end product.

Application Insights

According to the application, the appliances segment held a 25% revenue share in 2024. In the acrylonitrile butadiene styrenes market, the appliances segment refers to the use of ABS in manufacturing various household appliances such as washing machine parts, refrigerator components, and small kitchen appliances. ABS is preferred in this segment due to its impact resistance, durability, and versatility in molding intricate designs. The trend in the appliances segment involves a growing demand for aesthetically pleasing and durable products, where ABS's ability to provide both structural integrity and a smooth, customizable surface contributes to its prominence in appliance manufacturing.

The automotive segment is anticipated to expand fastest over the projected period. In the acrylonitrile butadiene styrenes market, the automotive segment encompasses the use of ABS in manufacturing various components for vehicles, such as interior trims, dashboards, and exterior body parts. The automotive sector's trend towards lightweight materials to improve fuel efficiency aligns with ABS's properties, making it a preferred choice. As the automotive industry continues to evolve, the ABS market is witnessing a surge in demand driven by the growing need for durable and lightweight solutions in vehicle design and manufacturing.

Regional Insights

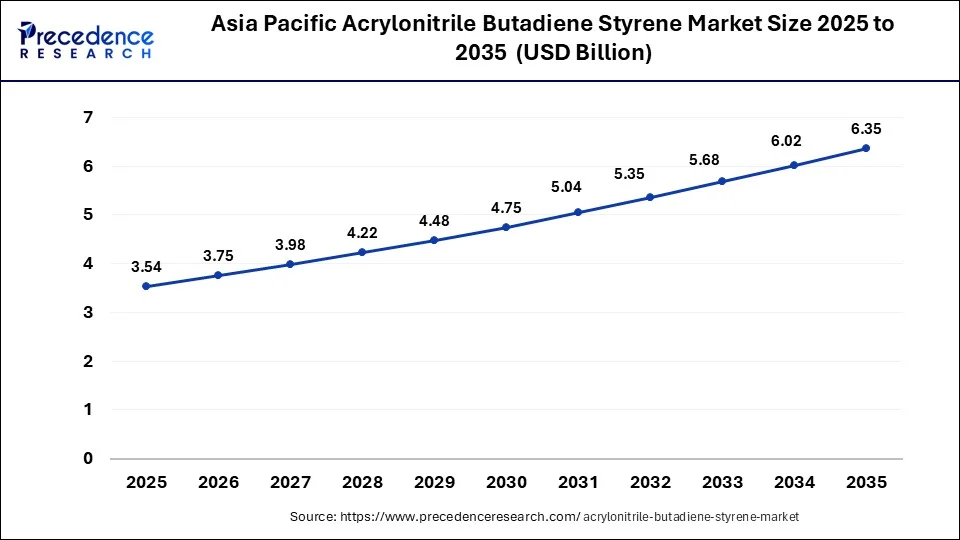

Asia Pacific Acrylonitrile Butadiene Styrene Market Size and Growth 2026 to 2035

The Asia Pacific acrylonitrile butadiene styrene market size is estimated at USD 8.07 billion in 2025 and is predicted to be worth around USD 11.89 billion by 2035, at a CAGR of 4.6% from 2026 to 2035.

Asia Pacific: Increased manufacturing activities

Asia Pacific has held the largest revenue share of 33% in 2025. Asia Pacific commands a major share in the acrylonitrile butadiene styrenes market due to robust industrialization, increased manufacturing activities, and a booming automotive sector. The region's economic growth has propelled demand for ABS in diverse applications, including automotive components, consumer goods, and construction materials. Additionally, a large population base and rising middle-class consumers contribute to the high demand for durable and affordable goods, further fueling the ABS market in Asia Pacific. The region's strategic position as a manufacturing hub and its expanding markets make it a key player in the global ABS industry.

India Acrylonitrile Butadiene Styrene Market Trends

In India, rising urbanization, growing disposable spending, and the increasing popularity of smart devices and household appliances are driving the demand for ABS. India's automakers use ABS in dashboards, door panels, seat backs, pillar trim, center consoles, and exterior body parts like mirror housings and grilles.

Expansion of Production Capacity: China Market Analysis

A substantial growth of the Chinese market is mainly influenced by the continuous efforts in the progression of production capacity. Whereas, the CHIMEI Corporation is boosting its ABS production capacity at its Zhangzhou plant to a projected 600,000 tons per year by 2025. Also, the Formosa Chemicals & Fibre Corporation has a large-scale plan to foster its total ABS production capacity to 7.43 million tonnes per annum by 2030.

North America: Robust industrialization

North America is estimated to observe the fastest expansion. North America holds a major growth in the acrylonitrilebutadiene styrenes market due to robust demand from key industries. The region benefits from a thriving automotive sector, where ABS is extensively used for manufacturing lightweight and durable components. Additionally, the well-established 3D printing industry contributes to the increased demand for ABS filaments. The region's focus on technological advancements, stringent safety standards, and a strong presence of key market players further solidify North America's significant share in the ABS market.

Empowerment of the Automotive Industry: U.S. Market Analysis

In the coming era, the US market will have the highest expansion, with rising emphasis on lightweighting for EVs, where reinforcing of ABS grades is substituting metal components in electric vehicles to enhance fuel effectiveness and extend driving range, led by the U.S. government's goals to lower vehicle weight.

U.S. Acrylonitrile Butadiene Styrene Market Trends

In the U.S., lightweight materials provide massive potential for growing vehicle efficiency. A 10% decrease in vehicle weight outputs in a 6%-8% drive economy enhancement, which drives demand for acrylonitrile butadiene styrene. This material is applied in electronic housings, auto parts, customer products, pipe fittings, and LEGO toys. Growing infrastructure and housing enhancement fuel demand for ABS in piping and fittings.

Europe: Increasing healthcare professionals

Europe is experiencing significant growth in the market, as ABS provides good heat resistance, enduring temperatures up to around 200°F (93°C). ABS remains the best choice for thermoforming machines as it's a balance of impact

Europe is experiencing a notable growth in the acrylonitrile butadiene styrene market due to a rise in the execution of sustainability and the circular economy. However, INEOS Styrolution is testing the production of ABS from recycled feedstock at its Antwerp, Belgium, site, as part of the "LIFE ABSolutely Circular" project to demonstrate the advantages of more sophisticated recycling technologies.

The UK Acrylonitrile Butadiene Styrene Market Trends

In the UK, ABS is broadly used for interior components like dash boards, instrument panels, door panels, and center consoles. ABS provides a high-quality surface finish, impact resistance, and outstanding customization choices.

Acrylonitrile Butadiene Styrene Market: Value Chain Analysis

- Feedstock Procurement

Inclusion of sourcing of acrylonitrile, butadiene, and styrene, with supply chain management, risk prevention, and an understanding of market dynamics, assists the market development.

Key Players: LG Chem, INEOS, CHIMEI Corporation, etc. - Waste Management and Recycling

This mainly comprises mechanical recycling, like grinding and melting ABS waste into new products, and chemical recycling, which breaks the polymer down into its base monomers for reuse.

Key Players: MBA Polymers, Nitya Plastic, Antony Waste Handling Cell, etc. - Regulatory Compliance and Safety Monitoring

The market emphasizes mandatory quality control orders and safety monitoring, particularly in food contact applications and manufacturing environments.

Key Players: SGS, BIS, ABC Group, Chola MS Risk Services Ltd., etc.

Top Companies and Their Contributions to the Market

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

LG Chem |

London |

Diversified business portfolio |

In June 2025, LG Chem is expanding PFAS-Free flame-retardant materials beyond a single product into a broad range of engineering plastics. Starting with PC/ABS, the company is advancing flame-retardant technologies for other materials like PC and PBT. |

|

INEOS Styrolution |

Germany |

Excellent dimensional stability |

In December 2024, INEOS Styrolution signed a definitive agreement to sell its acrylonitrile butadiene styrene (ABS) and styrene acrylonitrile (SAN) production site. |

|

SABIC |

Saudi Arabia |

Diverse and extensive product portfolio |

In February 2025, SABIC launched its novel LNP ELCRES CXL polycarbonate (PC) copolymer resins, intended to provide exceptional chemical resistance. |

|

BASF SE |

Germany |

Strong innovation and R&D network |

In December 2025, BASF, San Fang Chemical Industrial Co., Ltd., and Nichetech Advanced Materials Co., Ltd. signed a Memorandum of Understanding (MoU) to cooperatively develop sustainable services for the footwear industry. |

|

Covestro |

Germany |

Commitment to sustainability and circularity |

In January 2025, Covestro LLC announced that, effective April 1, 2024, Amco Polymers will no longer be a distributor of Covestro polycarbonate products. |

Other Major Key Players

- Chi Mei Corporation

- Trinseo

- Formosa Chemicals & Fibre Corp.

- Asahi Kasei Corporation

- Toray Industries, Inc.

- Kumho Petrochemical Co., Ltd.

- Teijin Limited

- LOTTE Chemical CORPORATION

- Ravago

- Mitsubishi Chemical Corporation

Recent Developments

- In January 2024, Platts launched novel European recycled acrylonitrile butadiene styrene spot assessments. R-ABS black pellets are recycled injection-grade acrylonitrile butadiene styrene pellets made with 100% recycled material. The new assessments are listed under symbols, including recycled ABS Black Pellets DDP NEW Eur/mt CRABSo1 and Recycled ABS Light Grey Pellets DDP NEW Eur/mt CRABS62. (Source: https://www.spglobal.com )

- In February 2025, India's Supreme Petrochem Ltd (SPL) expected to commission the first phase of its 70,000 tonne/year acrylonitrile butadiene styrene (ABS) plant in Nagothane. By the end of March 2025, Mechanical completion of the first phase of our mass ABS project. (Source: https://www.icis.com )

- In June 2021, Nexeo Plastics and Covestro jointly introduced the Polycarbonate/ABS 3D printing filament, Addigy FPB 2684 3D, available through Nexeo Plastics' distribution platform. This launch signifies a strategic move to expand their 3D printing product range, showcasing a commitment to investing in innovative solutions.

- In January 2021, INEOS Styrolution initiated the "LIFE ABSolutely Circular" project, constructing a demonstration plant in Antwerp, Belgium, to test the production of ABS plastic from recycled feedstock. This effort underscores a commitment to exploring advanced recycling technologies, aiming to demonstrate both environmental and economic advantages in closing the loop of plastic recycling.

Segments Covered in the Report

By Type

- Opaque

- Transparent

- Colored

By Application

- Appliances

- Electrical and Electronics

- Automotive

- Consumer Goods

- Construction

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content