What is Styrene Market Size?

The global styrene market size is estimated at USD 63.70 billion in 2025 and is anticipated to reach around USD 108.35 billion by 2034, expanding at a CAGR of 6.09% from 2025 to 2034. The introduction of innovative technologies with sustainable applications for styrene use, rising demand for styrene-based products owing to its vast applications in several industries and the growing awareness towards recycling plastic waste with support and initiatives from various industries as well as governments across the globe is driving the growth of the styrene market.

Market Highlights

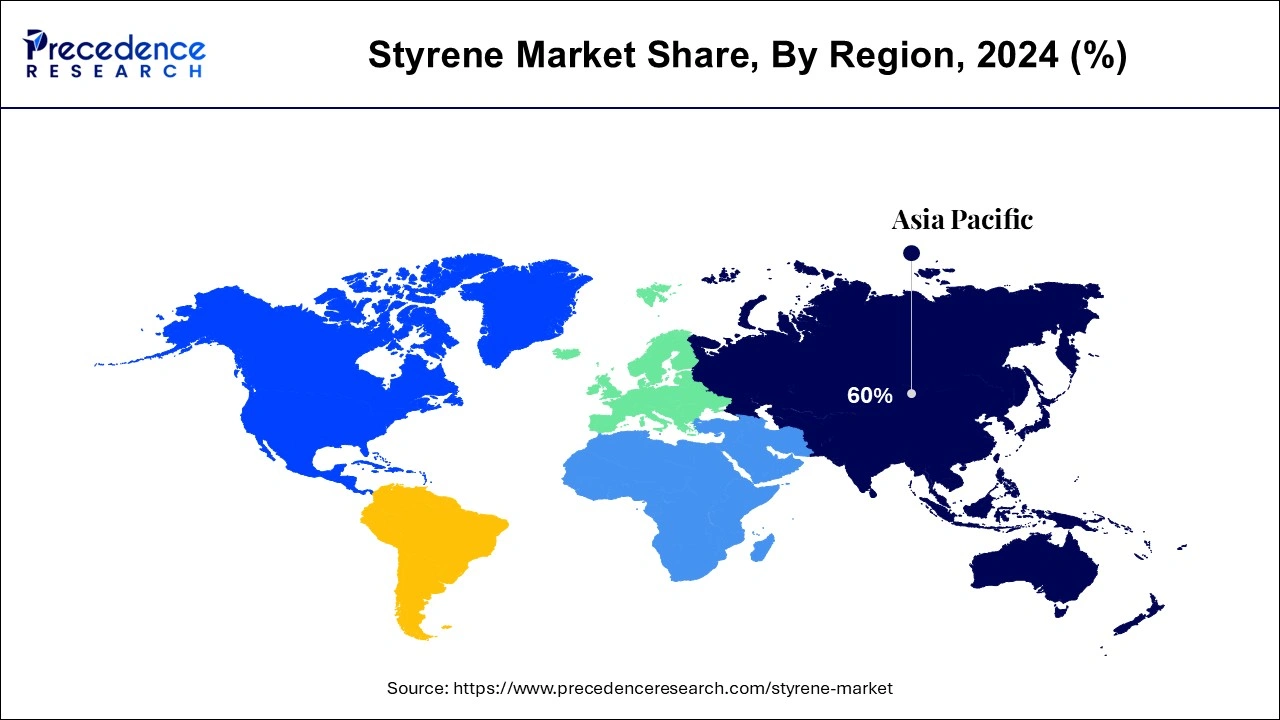

- Asia Pacific led the styrene market and generated the highest market share of 60% in 2024.

- North America is projected to grow at a notable CAGR during the forecast period.

- By product type, the polystyrene segment has held a significant share in 2024.

Market Overview

Styrene, an industrial chemical is used widely for many applications such as packaging, construction, electronics, automotive, paints and in medical field. The versatility in polymerization, convenient processing, resistance against aging and abrasion, low temperature properties, ozone resistance and the potential to be moulded into lightweight, rigid and transparent plastic products with sublime thermal and electrical insulating properties makes it a highly a valuable and ideal material for different applications.

The increasing demand for high performance and eco-friendly styrene based-products in various industrial applications, development of advanced polymerization techniques, rising focus on creating recyclable products for mitigating plastics waste, ongoing research and innovations on producing bio-based styrene and incorporation of nanomaterials for enhancing the properties of styrene-based polymers is boosting the growth of the styrene market.

Furthermore, the high demand for polystyrene which is a flexible material used in production of various appliances (ovens, microwaves, freezers), packaging applications and other products is driving the styrene market growth. Additionally, the rising focus on creating recyclable polystyrene and initiatives taken by global organizations for recycling plastic waste are developing opportunities for manufacturers for adopting sustainable methods in styrene production. For instance, in October 2024, the data summary provided by the Global EPS Sustainability Alliance (GESA) confirms that 72 countries committed for varying levels of recycling expanded polystyrene (EPS) Transport Packaging in 2023 have achieved recycling rates above 30%.

Influence of Artificial Intelligence (AI) on Styrene Market

The integration of artificial intelligence in styrene applications is helping in optimizing production processes by analysing real-time data from manufacturing equipment's, in predictive maintenance and for maximizing efficiency, product quality and yield by adjusting product parameters while minimizing wastage. Furthermore, AI can assist in resource management, development of new applications for styrene polymers based on performance characteristics and designing of new products through advanced data analysis thereby streamlining the processes for styrene manufacturing.

Styrene Market Growth Factors

- Rising demand from end-use industries

- Strong economic growth in various regions

- Advancements in styrene manufacturing processes and technologies

- Involvement of manufacturers and research institutions in development of new applications for styrene

- Deployment of advanced innovative recycling technologies

- Market need for environment friendly versions with easy processing and lightweight products derived from styrene

- Increased usage of transparent and durable packaging materials in food and consumer goods industries

- Improved durability and performance of polymer-modified bitumen is increasing the demand in construction, home-roofing and other applications

Styrene Market Outlook

- Industry Growth Overview: The styrene industry is expected to experience robust growth between 2025 and 2034, driven by rising demand for downstream polymers like polystyrene, ABS, and SBR across packaging, automotive, electronics, construction, and consumer goods. Expansion is further supported by new applications in 3D printing, insulation, and electronics encapsulation, along with government policies promoting local production and investment in chemical parks.

- Sustainability Trends: Environmental awareness and stricter regulations are driving the styrene industry toward greener operations and circular economy practices. Leading players like INEOS Styrolution, Trinseo, and LyondellBasell are investing in recyclable polystyrene and low-emission production processes to meet rising sustainability standards, particularly in the EU and North America.

- Global Expansion: Major styrene producers are expanding strategically in high-demand regions and areas with favorable regulations. Companies like LG Chem, Shell, and Chevron Phillips Chemical are investing in new production units, technology upgrades, and joint ventures, while local partnerships help secure feedstock and reduce logistics costs, particularly in Asia-Pacific, the Middle East, and Latin America, where industrial growth, automotive manufacturing, and infrastructure spending are rising.

- Major Investors: Private equity firms and strategic investors are increasingly drawn to the styrene industry due to steady demand, high production volumes, and opportunities in value-added downstream products. Their investments focus on expanding production plants, modernizing technology, acquiring specialty polymer compounding units, and fostering innovations in recycled and bio-based styrene through strategic alliances with chemical producers.

- Startup Ecosystem: The startup ecosystem in the market is still emerging, focusing on sustainable polymerization, chemical recycling, and specialty additives. Startups such as Elevate Chemicals (USA) and other European and Asian innovators are developing bio-styrene, waste-to-styrene conversion, and advanced compounding for automotive, packaging, and electronics, attracting venture capital and shaping the future of sustainable, high-performance styrene production.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 63.70 Billion |

| Market Size in 2026 | USD 67.67 Billion |

| Market Size by 2034 | USD 108.35 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.09% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product Type and By End User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

The increased popularity of recycled styrene

Polystyrene manufacturing and use worldwide are increasing annually due to various applications and a wide range of services across multiple industries. The discharge of this polystyrene into the environment has prompted environmentalists and researchers to demand the recycling of polystyrene to lessen the high burden of plastics in the environment. Furthermore, recycled polystyrene can be employed in insulating plates, light switches, and foam packaging. There is overall increased popularity in recycling styrene.

For instance, the French “Climate and Resilience” law sanctioned for banning styrenic polymers and copolymers by 2025. However, in September 2024 the prohibition was postponed to 2030. The extension was in accordance with the European Union's packaging and packaging waste directive (PPWR) which allows manufacturers for developing recycling channels meeting recyclability standards which will effective in by recyclable packaging in 2030 and will be implemented on an industrial scale by 2035. Also until then, the compliant styrenic packaging materials will not face prohibition.

Restraints

Increase in health concerns

Styrene consumption is hazardous to human health. Little amounts are discovered in urban air when people consume food packaged in polystyrene, use laser printers, and breathe cigarette smoke. Moreover, the use of styrene can have adverse effects on health. Styrene consumption can harm the respiratory and central nervous systems, causing fatigue, depression, nausea, and narcosis. Furthermore, styrene is poisonous to animals, and animal studies reveal that they are more susceptible to styrene and experience more damage.

The International Agency for Research on Cancer (IARC) has declared that styrene is a potential carcinogen that can cause cancer with prolonged exposure.

Opportunities

Increase in the end user

The styrene market has various uses across all industries. Even so, styrene is most commonly used in huge industries like automotive, construction, and packaging. It is a suitable replacement because it is light in weight and cost-effective, especially in food packaging. The automobile sector and new future automotive parts are currently popular, and such elements are commonly used in making auto parts. Furthermore, the preference for simple alternatives to complex components is becoming a trend in nearly every industry segment.

The tyre market, for example, is massive, and the use of styrene as rubber in the tyre makes the market opportunistic. The heat tolerance property of styrene is fundamental in the construction business and is used as a practical implementation substitute. Furthermore, the use of styrene and its derivatives in the electronics sector is increasing as there is an overall increase in demand for electronics.

For instance, in October 2024, Ineos Styrolution, a German-based materials maker declared the permanent shutdown of its styrene monomer production site in Ontario, Canada due to regulatory concerns regarding benzene emissions and operational challenges.

Segment Insights

Product Type Insights

The styrene market is projected to grow because of rising demand for its packaging applications. The surge in demand for packaged foods is primarily attributed to the food industry. Because of its chemical stability, resistance to bacteria, and superior heat insulation, expanded polystyrene is usually employed, not just in the food packaging business but also in the use of consumer electronics as a result of rapid urbanization, technological developments, and value pricing rates.

Furthermore, several companies are now exploring better recycling technologies for polystyrene to reduce health risks and the use of polystyrene in food contact. For example, the styrene company INEOS Styrolution announced today the release of mechanically recycled polystyrene in EMEA. This includes the development of a new Styrolution PS ECO 440 with the help of TOMRA's high-quality NIR sorting technology, which delivers pure polystyrene.

The automotive industry has witnessed a growth in the number of uses for acrylonitrile butadiene styrene. Dashboards, centre console, seats, bumpers, interior trim, and lighting all use acrylonitrile butadiene styrene. Moreover, the healthcare industry is expected to increase because of its outstanding characteristics, such as performance qualities and adaptability. Acrylonitrile butadiene styrene manufactures medical devices and items such as masks, ventilator valves, gloves, shoes, and patient gowns.

End User Type Insights

Packaging is an essential factor in practically every industry. It is significant since it concerns consumer product safety. The kind of container used determines the product's safety. Plastic packaging is widely used in various industries nowadays because of its high durability, superior features, high-quality material, and low cost. The applications are widespread in many sectors, although it is high in the packaging industry.

Because of the significant demand from the plastic packaging industry, the styrene market is rapidly growing. Styrene is used in the plastic packaging industry for various food packaging, such as glasses, plates, disposable containers, and insulation. In addition, the plastic packaging business employs styrene in the pharmaceutical and medical industries to make medical devices and packaging.

Automobile Industry is the largest market and is anticipated to increase in the future years due to demand in electric demand for new features in autos and a growing market for premium vehicles. Styrene is widely used in the manufacture of tyres. It is widely used because to its durability, quality, and low cost. The styrene sector is growing because to increased demand for automobile body parts, vehicle rubber tyres, and energy-efficient building insulation. Furthermore, the use of styrene in automotive creates tensions in raw material availability and cost, allowing for shifting demand patterns in the tyre business and technical advancements in the ever-changing automotive space.

Styrene-based products help decrease greenhouse gas emissions by providing energy-efficient insulation in architecture and construction, as well as improved fuel efficiency through the strength and weight-reduction of automobile components. Expanded polystyrene has shown to be a viable alternative material. Because expanded polystyrene is recyclable and inexpensive, it is commonly employed in the construction industry.

Regional Insights

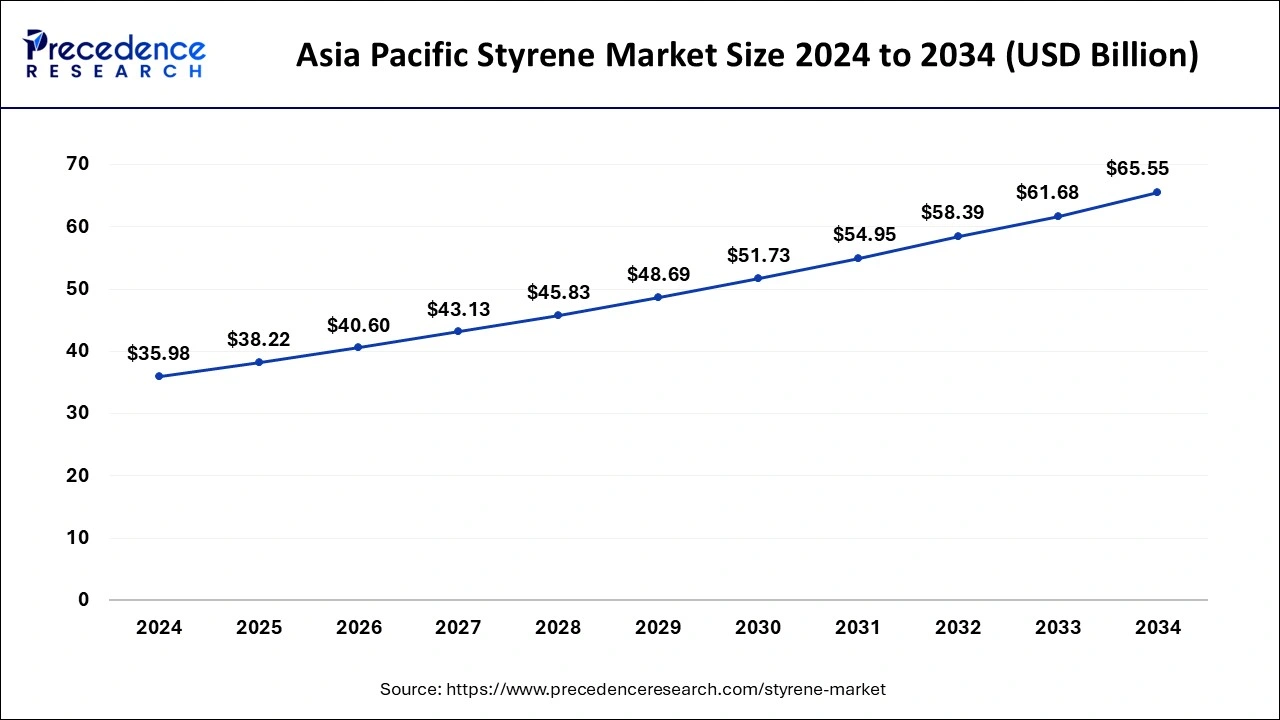

Asia Pacific Styrene Market Size and Growth 2025 to 2034

The Asia Pacific styrene market size is evaluated at USD 38.22 billion in 2025 and is predicted to be worth around USD 65.55 billion by 2034, rising at a CAGR of 6.18% from 2025 to 2034.

Asia Pacific led the styrene market and generated the highest market share of 60% in 2024., followed by North America and Europe. This expansion can be attributed to an increase in the use of packaging throughout the region. The growth is also attributed to the rise of the disposable culture. Furthermore, demand in significant application categories such as buildings, construction, and the automobile industry is increasing. According to a recent analysis, the styrene market inventory in China grew beginning in January 2023. Also, China is amongst the key packaging industry around the globe. Moreover, styrene is in high demand due to the rising demand for synthetic and processed rubber in Asia-Pacific.

China Styrene Market Analysis

China's styrene market is projected to grow rapidly, driven by urbanisation, industrialisation, and rising demand from the electronics, automotive, and consumer goods sectors. Government support for manufacturing and infrastructure development, along with investments in capacity expansion and technological upgrades, is further enhancing supply efficiency and market growth.

What Makes North America the Fastest-Growing Region in the Styrene Market?

The North American market will likely expand during the forecast period due to increased demand in the region's automotive and packaging industries. This demand is seen because styrene, as a monomer, is used in various other industrial sectors as a product. For example, the expanded polystyrene market is growing significantly in North America, particularly in the United States, due to increased expenditures on research and development and implementation in the construction industry.

U.S. Styrene Market Analysis

The U.S. styrene market is expected to grow steadily due to increased manufacturing activity and rising demand in the automotive and packaging sectors. Growth in infrastructure development and modernization of industries is also likely to boost the consumption of styrene-based materials. Well-developed logistics networks and steady availability of petrochemical feedstocks will support production. Additionally, improvements in recycling infrastructure and sustainability initiatives are projected to further drive market growth.

How is the Opportunistic Rise of Europe in the Styrene Market?

Europe is experiencing significant growth in the market, driven by high demand from the packaging and construction sectors. Investments in specialty applications and advanced manufacturing are expected to increase market value. Modernization in industries in Germany, France, and Italy also helps sustain consumption levels. The logistics networks and technological expertise already established in the region are likely to stabilize the market situation.

Germany Styrene Market Analysis

Germany's styrene market is expected to grow due to strong demand from packaging, construction, and industrial sectors. Environmental laws promoting the use of recycled materials and chemicals are likely to encourage adoption. Market growth will probably be supported by industrial modernization and innovations in polymer processing. Stable supply chains and advanced technological capabilities should also help maintain stability in the market.

What Potentiates the Growth of the Styrene Market in Latin America?

The market in Latin American is growing due to rising demand for styrene from the packaging and construction industries in Brazil, Mexico, and other areas. The market is expected to expand due to industrial modernization and the localization of supply chains. Growth is also projected to rise with increased regional exports. Economic recovery and infrastructure development are anticipated to sustain long-term demand.

Brazil Styrene Market Analysis

Brazil's styrene market is expected to grow due to increasing demand in packaging and construction sectors. The growth is also supported by industrial modernization and supply chain localization. The rise in consumer goods and motor vehicle production is also expected to boost material consumption.

How Big is the Opportunity for the Styrene Market in the Middle East and Africa?

The Middle East and Africa present significant opportunities for the growth of the styrene market, as the construction, packaging, and industrial sectors expand in Gulf countries and North Africa. Investments in industrial parks and foreign direct investment enhance production capacity. Demand is fueled by increasing urbanization and infrastructure development. The widespread availability of petrochemical feedstocks is expected to support regional market growth.

Saudi Arabia Styrene Market Analysis

Saudi Arabia's styrene market is expected to expand due to growth in construction, packaging, and industrial sectors, along with rising demand from automotive, electronics, and consumer goods industries. Investments in industrial parks and foreign direct investment are likely to bolster production capacity and support market development.

Styrene Market – Value Chain Analysis

- Raw Material Sourcing

Styrene production begins with sourcing primary feedstocks such as ethylbenzene, benzene, and other petrochemical derivatives. The availability, price volatility, and purity of these raw materials directly impact styrene production and cost structures.

Key Players: ExxonMobil, Shell, Chevron Phillips Chemical, INEOS - Styrene Monomer Production

Raw materials are processed through catalytic dehydrogenation or other chemical routes to produce styrene monomer, the core product. High efficiency and yield control are crucial at this stage.

Key Players: LyondellBasell, Trinseo, Nova Chemicals - Styrene Derivatives & Polymers Manufacturing

Styrene is further polymerized or copolymerized to produce polystyrene, ABS (Acrylonitrile Butadiene Styrene), SBR (Styrene-Butadiene Rubber), and other specialty styrenic polymers used across industries.

Key Players: LG Chem, Kraton Corporation, Dynasol Group - Formulation & Specialty Applications

Polymers and styrene-based derivatives are blended, compounded, or formulated for specific applications, including automotive parts, construction materials, packaging, and consumer products.

Key Players: BASF, Dow, Solvay, Elevate Chemicals - Distribution & End-Use Industries

Finished styrene products and derivatives are distributed to downstream industries for end-use applications such as packaging, electronics, automotive, insulation, and consumer goods. Logistics, regional demand, and regulatory compliance are key factors.

Key Players: Global distributors, industrial suppliers, specialty chemical distributors

Key Players in Styrene Market and their Offerings

- Chevron Phillips Chemical Company LLC (U.S.): A major petrochemical producer supplying styrene, polymers, and performance chemicals for packaging, automotive, and construction sectors.

- Alpek SAB DE CV (Mexico): A leading Latin American manufacturer of styrene, PET, and other polymers, serving industrial and consumer applications.

- Ineos Group AG: Global petrochemical giant producing styrene and high-performance plastics with a strong focus on industrial derivatives.

- Nova Chemicals Corporation (Canada): Specializes in styrene, polystyrene, and related polymers for packaging, electronics, and consumer goods markets.

- Shell plc: Major energy and chemical company producing styrene and intermediates for industrial and specialty applications worldwide.

- LG Chem Ltd (South Korea): Diversified chemical manufacturer offering styrene-based polymers and advanced materials for automotive and electronics sectors.

- Dynasol Group (Spain): Focused on synthetic rubbers and styrene-butadiene solutions for tires, adhesives, and industrial applications.

- Kraton Corporation (U.S.): Supplies styrene-based polymers and specialty elastomers used in adhesives, coatings, and consumer products.

- Trinseo: Provides styrene and latex solutions for construction, automotive, and packaging industries.

Latest Announcements

- In November 2024, Nathalie Morin, President and CEO of Polystyvert commenced a course of strategic meetings in Europe with partners and investors for boosting company's growth strategy. Nathalie said that, “Polystyvert is in an active commercialization phase. Our dissolution technology is the most advanced on the market. There are great opportunities for partners who want to be sustainability leaders in their industry, or investors looking for mature solutions. We have a portfolio of patented applications in the innovative recycling of plastic waste, ready for deployment today, and with strong short-term growth potential.”

- In August 2024, United Felts announced the re-launch of its patent pending EnviroCure felt which is an advancement in Cured-In-Place-Pipe (CIPP) technology. Mike Vellano, President and CEO of Vortex Companies, the parent company of United Felts said that, "With EnviroCure felt, we are giving the industry a sustainable lining option that addresses the crucial issue of styrene emissions while ensuring our products stand the test of time. This innovation is part of our commitment to supporting the maintenance of aging infrastructure with solutions that are both effective and conscious to evolving asset owner requirements."

Recent Developments

- In November 2025, Trinseo announced the availability of polystyrene (PS), ABS, and SAN resins made from chemically recycled styrene monomer (rSM) sourced from a new recycling facility by partner Indaver in Antwerp, Belgium. The plant, operational since August 2025, focuses on recovering styrene from post-consumer polystyrene packaging waste.

- In September 2025, the first truckloads of recycled styrene monomers arrived at INEOS Styrolution's Antwerp site, supplied by Indaver from its depolymerization facility, the first dedicated to polystyrene recycling in Europe.

- In May 2025, Denka Company Limited launched its D-NODE brand to promote the recycling and remanufacturing of styrene materials as part of its commitment to sustainability.

- January 2022, INEOS Styrolution initiated a 50,000-ton ABS production in France that will simultaneously increase the product collection of INEOS.

- In January 2021, China Petroleum and Chemical Corporation announced the signing of the agreement in forming a joint venture. This venture will be operated by Ningbo ZRCC LyondellBasell

- In August 2022, Technip Energies and Agilyx announced the launch of the TruStyrenyx brand for the chemical recycling of polystyrene.

- Orthex group moves towards more sustainable raw materials in cooperation with INEOS Styrolution and BASF.

- FPCO and DIC explore collaboration in the practical implementation of a closed-loop recycling system for polystyrene that utilises chemical recycling.

- In July 2024, INEOS Styrolution, a global leader in styrenics, announced that POGS, a leading innovator in developing audio solutions for young listeners has selected the high performance Novodur grades ECO version for new range of headphones for children. The material available in several sustainable ECO versions which contain 30%, 50% or 70% contributions of post-consumer mechanical recycled acrylonitrile-butadiene-styrene (ABS).

- In May 2024, Bridgestone Americas, Inc., the U.S.-based subsidiary of Bridgestone Corporation, a global leader in tires and rubber, demonstrated the use of sustainable materials in motorsports at the 108th Running of the Indianapolis 500. The race tyres in this year's race included bio-styrene and butadiene monomers which were certified by the International Sustainability and Carbon Certification (ISCC).

Segments Covered in the Report

By Product Type

- Polystyrene

- Styrene Butadiene Rubber

- Acrylonitrile Butadiene Styrene

By End User

- Packaging Industry

- Automotive Industry

- Construction Industry

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting