What is Acrylonitrile Styrene Acrylate Market Size?

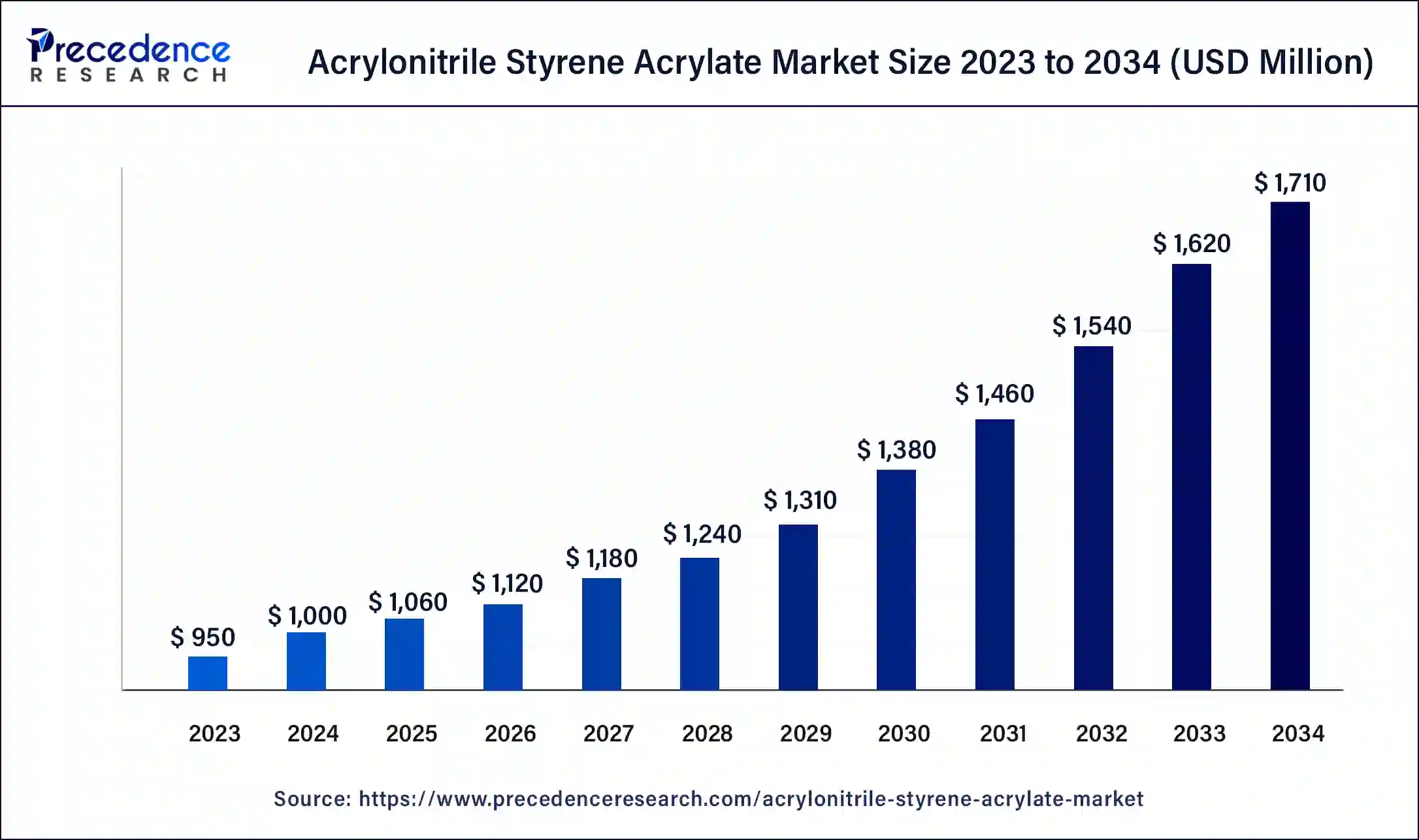

The global acrylonitrile styrene acrylate market size accounted for USD 1,060 billion in 2025 and is anticipated to reach around USD 1,793.33 billion by 2035, expanding at a CAGR of 5.4% from 2026 to 2035

Market Highlights

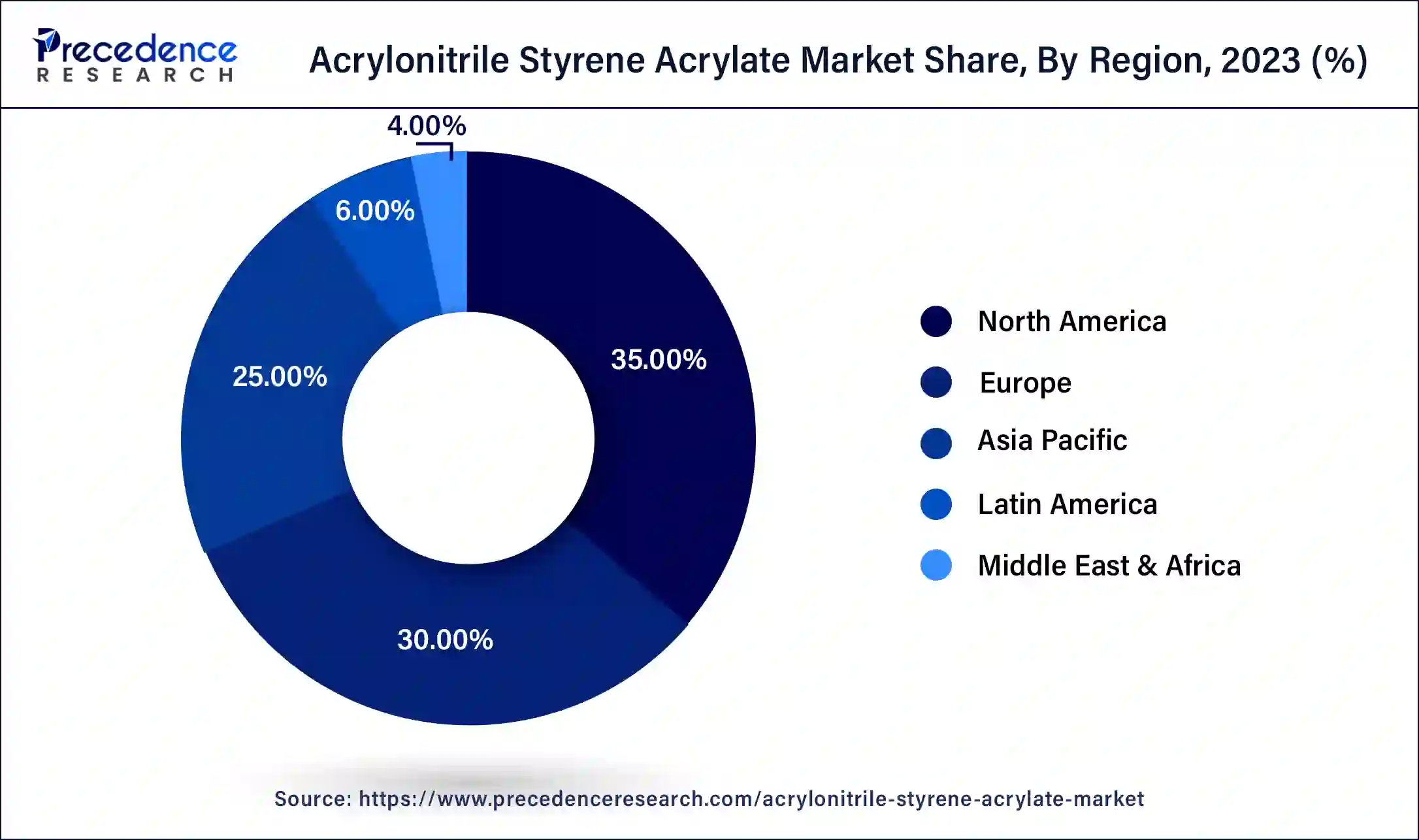

- Asia Pacific contributed more than 35% of revenue share in 2025.

- North America is estimated to expand the fastest CAGR between2026 to 2035

- By application, the plastics segment has held the largest market share of 42% in 2025.

- By application, the fabrics segment is anticipated to grow at a remarkable CAGR of 6.2% between 2026 to 2035

- By end user, the consumer electronic and home appliances segment generated over 35% of revenue share in 2025.

- By end user, the automotive segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

Acrylonitrile styrene acrylate (ASA) is a robust thermoplastic blend recognized for its outstanding durability and resilience against weathering. It is composed of three essential building blocks, acrylonitrile, styrene, and acrylate—each contributing distinct quality. The acrylonitrile component enhances resistance to chemicals, styrene imparts rigidity and ease of processing, while acrylate ensures resistance to UV radiation. ASA stands out for its remarkable ability to withstand prolonged exposure to sunlight without deteriorating, making it a preferred choice for outdoor applications and automotive components.

Common uses include crafting durable automotive trims, resilient outdoor signage, and reliable construction materials. ASA's versatility, coupled with its capacity to maintain color stability and mechanical integrity in challenging environments, positions it as a valuable material for manufacturers seeking enduring and aesthetically pleasing solutions for outdoor use.

Acrylonitrile Styrene Acrylate Market Growth Factors

- Growing use of Acrylonitrile Styrene Acrylate (ASA) in automotive exterior components due to its durability and UV resistance.

- Surge in construction projects, especially in outdoor applications, boosts the demand for ASA in materials like roofing and cladding.

- Growing need for UV-resistant materials in outdoor signage and displays contributes to the market growth of ASA.

- Shift towards ASA in consumer goods manufacturing, driven by the desire for weather-resistant and long-lasting products.

- Ongoing developments in processing technologies enhance the efficiency and cost-effectiveness of producing ASA, driving market growth.

- Rising awareness regarding the damaging effects of UV radiation fuels the demand for ASA in various applications requiring UV protection.

- Rise in demand for durable and weather-resistant outdoor furniture supports the expansion of the ASA market.

- ASA's suitability for outdoor applications in the renewable energy sector, such as solar panel components, contributes to market growth.

- Global urbanization trends and infrastructure development projects drive the need for durable construction materials, benefiting the ASA market.

- ASA's adoption as a substitute for traditional materials in outdoor applications due to its superior properties fuels market expansion.

- Rising consumer emphasis on aesthetically pleasing products, particularly in outdoor settings, boosts the demand for ASA.

- ASA's recyclability and potential for eco-friendly manufacturing align with the global focus on sustainable and green materials.

- The rise in the production of recreational vehicles, where ASA is used for exterior components, contributes to market growth.

- ASA's resistance to water and weathering makes it a preferred choice for outdoor applications in the pool and spa industry.

- Increasing use of ASA in marine applications due to its resistance to saltwater and environmental elements.

- Integration of ASA into additive manufacturing processes for prototyping and production purposes propels market growth.

- Collaborative efforts between manufacturers and end-users to develop innovative ASA applications stimulate market expansion.

- Growing construction and manufacturing activities in emerging economies contribute to the increased demand for ASA.

- Supportive regulations promoting the use of sustainable materials in various applications positively impact the ASA market.

- Ongoing research and development leading to improved formulations and properties of ASA drive market growth through technological innovation.

Market Outlook

- Industry Growth Overview: The acrylonitrile styrene acrylate market is experiencing significant growth as demand for durable, weather-resistant plastics in construction, automotive, and consumer electronics.

- Global Expansion: The market is experiencing significant global expansion, driven by it is use for general prototyping in 3D printing, where its UV resistance and mechanical characteristics make it an outstanding material for use in attached filament fabrication printers. North America is dominant in the market, with strong end-use demand in vigorous automotive, electronics, and construction fields.

- Major investors: The major players and investors in the acrylonitrile styrene acrylate (ASA) market are significantly large, worldwide chemical and polymer production companies that invest in manufacturing facilities, research, and development.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1,060 Billion |

| Market Size in 2026 | USD 1,120 Billion |

| Market Size by 2035 | USD 1,793.33Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.4% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Weather resistance and versatility

The robust weather resistance and remarkable versatility of acrylonitrile styrene acrylate (ASA) play pivotal roles in surging market demand. ASA's exceptional ability to withstand harsh weather conditions, including prolonged exposure to UV radiation, positions it as an ideal choice for outdoor applications. This weather resilience is particularly crucial in the automotive sector, where ASA is increasingly favored for exterior components, ensuring long-lasting and aesthetically pleasing surfaces even in challenging environmental conditions.

The versatility of ASA further contributes to heightened market demand, as it can be easily processed using various manufacturing techniques such as extrusion and injection molding. This adaptability enables its use across diverse industries, ranging from construction to signage, allowing manufacturers to create a wide array of durable products. The combination of weather resistance and versatility makes ASA a go-to material for applications where durability, color stability, and performance in outdoor settings are paramount, propelling its sustained growth in the market.

Restraint

Limited heat resistance

The limited heat resistance of acrylonitrile styrene acrylate (ASA) poses a notable constraint on its market growth. While ASA excels in weather resistance and durability, its relatively lower heat resistance compared to some alternative materials can restrict its adoption in applications subjected to elevated temperatures. Industries requiring components to withstand high thermal loads, such as automotive under-the-hood parts or certain industrial settings, may prefer materials with superior heat resistance.

This limitation hinders the expansion of ASA into sectors where exposure to elevated temperatures is a critical consideration. Manufacturers and end-users seeking materials for applications with stringent heat requirements may opt for alternatives like high-temperature engineering plastics. Addressing this restraint may involve research and development efforts to enhance ASA's heat-resistant properties or strategic market positioning in applications where its existing strengths outweigh the demand for elevated thermal performance.

Opportunity

Increasing demand for sustainable solutions

The increasing demand for sustainable solutions is a significant catalyst for opportunities in the acrylonitrile styrene acrylates market. ASA's recyclability and eco-friendly attributes align with the global shift toward sustainability, creating avenues for growth. As industries and consumers prioritize environmentally responsible materials, ASA stands poised to meet these demands, offering a durable and weather-resistant alternative with a lower environmental impact. Positioning ASA as a sustainable choice opens doors to new markets and applications, especially in industries emphasizing green practices.

Manufacturers can leverage this trend by promoting ASA's recyclability and communicating its environmental benefits to attract environmentally conscious consumers. With sustainability becoming a key driver of purchasing decisions, the ASA market has the opportunity to expand its reach across diverse sectors seeking durable, performance-oriented materials with a reduced ecological footprint.

Segment Insights

Application Insights

In 2025, the plastics segment had the highest market share of 42% based on the type. In the plastics segment of the Acrylonitrile Styrene Acrylate (ASA) market, the material finds extensive application in various industries. ASA's excellent weather resistance and durability make it a preferred choice for manufacturing automotive exterior components, construction materials, and outdoor signage. Recent trends indicate a growing demand for ASA in 3D printing processes, where its compatibility and versatility offer unique opportunities for prototyping and customized plastic applications. This highlights ASA's evolving role beyond traditional uses, driven by its distinctive properties in the dynamic plastics market.

The fabrics segment is anticipated to expand at a significant CAGR of 6.2% during the projected period. In the acrylonitrile styrene acrylates market, the fabrics segment refers to the application of ASA in outdoor textiles and materials. ASA's weather resistance and durability make it an ideal choice for outdoor fabrics, including awnings, canopies, and upholstery. The trend in this segment involves the increasing adoption of ASA for manufacturing fabrics that can withstand harsh weather conditions, providing longevity and color stability. ASA's versatility in textile applications is contributing to a growing demand for durable and weather-resistant outdoor fabrics in various industries, from furniture to recreational equipment.

End User Insights

According to the end user, the consumer electronic and home appliances segment has held a 35% revenue share in 2025. In the acrylonitrile styrene acrylates market, the consumer electronics and home appliances segment pertains to the utilization of ASA in manufacturing casings and components for devices such as smartphones, laptops, and household appliances. A notable trend in this segment is the increasing demand for ASA due to its durable and aesthetically pleasing properties, meeting consumer preferences for sleek, resilient products. ASA's resistance to weathering and UV radiation enhances the longevity of electronic and appliance exteriors, contributing to the material's growing adoption in this sector.

The automotive segment is anticipated to expand fastest over the projected period. In the acrylonitrile styrene acrylates market, the automotive segment refers to the utilization of ASA in manufacturing exterior components and trims for vehicles. This includes applications such as automotive grilles, mirror housings, and exterior panels. A notable trend in this segment is the increasing preference for ASA due to its exceptional weather resistance, UV stability, and durability. As automakers prioritize lightweight, aesthetically pleasing materials that can withstand harsh environmental conditions, ASA emerges as a preferred choice for enhancing the longevity and visual appeal of automotive exteriors.

Regional Insights

Asia Pacific Acrylonitrile Styrene Acrylate Market Size and Growth 2026 to 2035

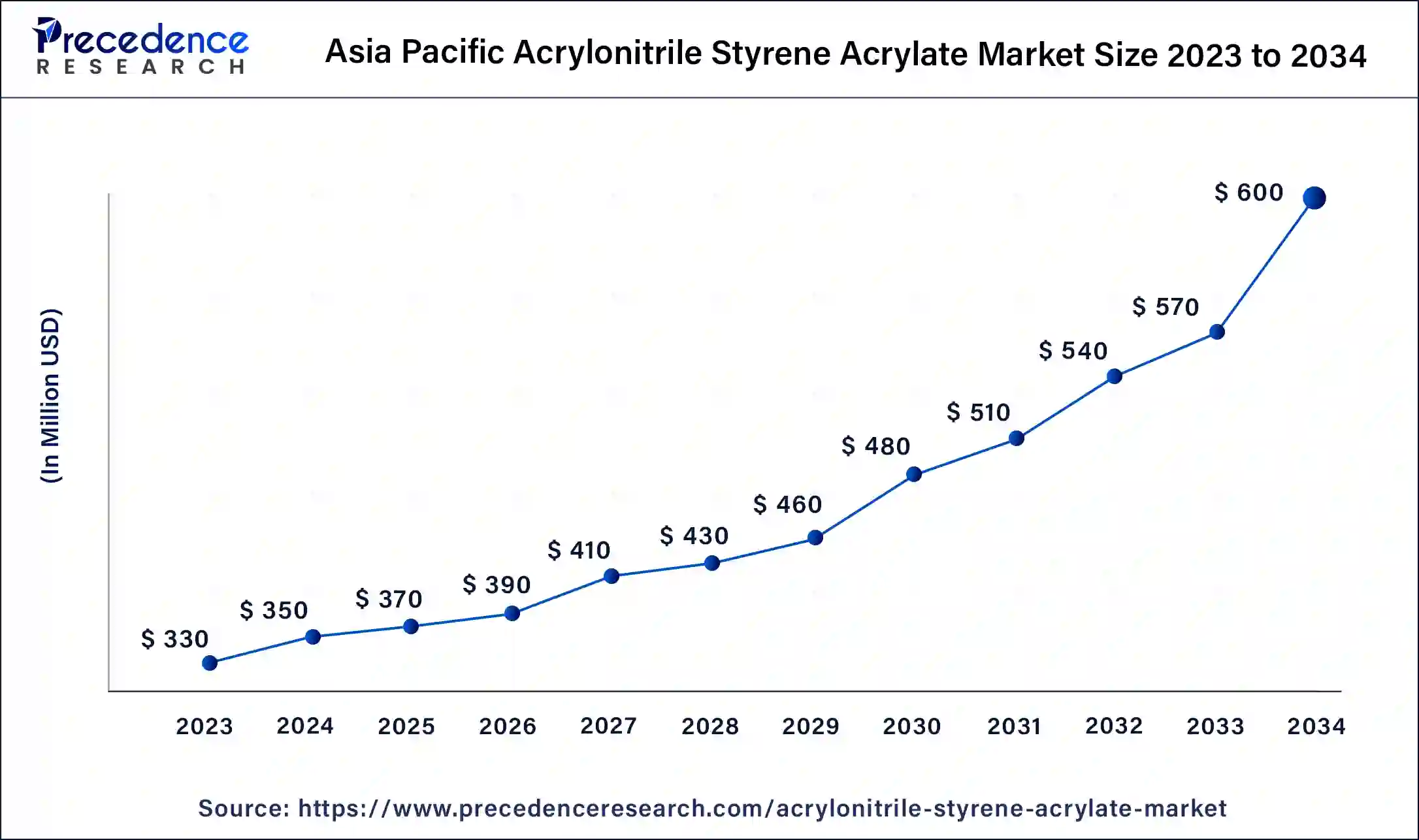

The Asia Pacific acrylonitrile styrene acrylate market size is valued at USD 370 million in 2025 and is expected to reach USD 630 million by 2035, poised to grow at a CAGR of 5.47% from 2026 to 2035

Asia Pacific: Growing acrylonitrile styrene acrylate

Asia-Pacific has held the largest revenue share 35% in 2025. Asia-Pacific holds a major share in the acrylonitrile styrene acrylates market due to rapid industrialization, infrastructure development, and robust automotive production in the region. The demand for durable and weather-resistant materials in construction and automotive applications drives the adoption of ASA. Additionally, the growing awareness of sustainable solutions aligns with ASA's eco-friendly attributes. With a burgeoning consumer goods market and a focus on advanced materials, Asia-Pacific remains a key player in the global ASA market, experiencing significant growth in various end-use industries.

India Acrylonitrile Styrene Acrylate Market Trends

India's growing automotive and construction demand, which is increasing acrylonitrile styrene acrylate. Quick urbanization, infrastructure projects, and manufacturing expansion are growing the demand for ASA in durable products such as roofing, siding, and automotive exteriors. Rapid advancement of smart city initiatives drives high demand for ASA in durable building materials, such as roofing sheets and window frames, which withstand the harsh tropical environment.

North America: Increasing construction activities

North America is estimated to observe the fastest expansion. North America holds significant growth in the acrylonitrile styrene acrylates market due to a robust demand from industries like automotive, construction, and consumer goods. The region benefits from a mature automotive sector, where ASA is extensively used for durable and weather-resistant exterior components. Additionally, increased construction activities and a growing emphasis on sustainable materials further contribute to the dominance of North America in the ASA market. The region's established industrial infrastructure and focus on innovative applications position it as a key player in driving overall market growth.

U.S. Acrylonitrile Styrene Acrylate Market Trends

In the U.S., increasing demand for long-lasting, weather-resistant materials for window profiles, siding, and outdoor furniture, reducing maintenance costs. The U.S. automotive sector is shifting toward lightweight and durable materials for exterior parts like grilles, mirror housings, and roof rails. Growth is fueled by a rebound in housing projects and a focus on sustainable building practices.

Europe: Increasing lightweight material

Europe is experiencing significant growth in the market, as the EU products guideline is allowed to support delivering on ambitious climate goals and aim to lower raw material use and enhance the recycling rates and results. Growing trend for lightweight, durable, and aesthetically stable plastics for exterior car parts such as grilles and mirror housings is growing acrylonitrile styrene acrylate use.

The UK Acrylonitrile Styrene Acrylate Market Trends

In the UK, increasing demand for acrylonitrile styrene acrylate from the sectors such as construction, automotive, and electronics requiring lightweight, durable materials, alongside increased medical care demand for SAN (Styrene Acrylonitrile) in healthcare devices, has been increased by government initiatives helping domestic manufacturing and an attention on hygiene and packaging.

Top Comapnies in the Acrylonitrile Styrene Acrylate Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

INEOS Styrolution |

India |

Diverse and specialized product portfolio |

INEOS Styrolution's Luran S XA SPF60 provides excellent weather resistance, UV stabilisation, and improved deep black appearance for automotive exterior uses. |

|

LG Chem |

South Korea |

Technological leadership in battery materials |

LG Chem showcased actual components made with High Gloss ASA, drawing strong interest from visitors. |

|

Chi Mei Corporation |

Taiwan |

Advance research and development (R&D) |

Chi Mei Corp. is the world's leading supplier of plastic and rubber materials. Chi Mei's products are broadly applied in the manufacture of nearly countless customer goods. |

|

Trinseo |

Pennsylvania |

Technology and innovation |

Trinseo's styrene acrylonitrile (SAN) monomer polymers are strong, transparent engineering thermoplastics. They provide a unique combination of clarity, processing ease, and affordability for industrial and commercial lighting applications. |

|

SABIC |

Saudi Arabia |

Innovation and technology |

GELOY resin developed for usage outdoors, GELOY resin delivers improved UV resistance, advanced heat and impact performance compared to standard ASA, and excellent processability. |

Acrylonitrile Styrene Acrylate Market Companies

- KKPC (Kumho Petrochemical)

- Formosa Plastics Corporation

- Shandong Novista Chemicals Co., Ltd.

- Techno Polymer Co., Ltd.

- LOTTE Chemical Corporation

- Asahi Kasei Corporation

- Supreme Petrochem Ltd.

- Nantong Xingchen Synthetic Material Co., Ltd.

- Dow Inc.

- Ravago Group

Recent Developments

- In 2022,Saudi Basic Industries Corporation (SABIC) acquired DSM Engineering Plastics for $5.5 billion. This acquisition gave SABIC access to DSM's strong portfolio of ASA products and technologies.

- In 2023, Asahi Kasei Corporation announced that it would merge its acrylic resin business with the ASA business of Mitsubishi Chemical Corporation. The new company, Asahi Kasei Asacryl Co., Ltd., is expected to be launched in April 2024. This merger will create one of the world's largest ASA producers.

Segments Covered in the Report

By Application

- Adhesives & Sealants

- Plastics

- Paints & Coatings

- Fabrics

By End User

- Automotive

- Consumer Electronic and Home Appliances

- Sports and Leisure

- Building and Construction

- Packaging

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting