What is the Acrylate Market Size?

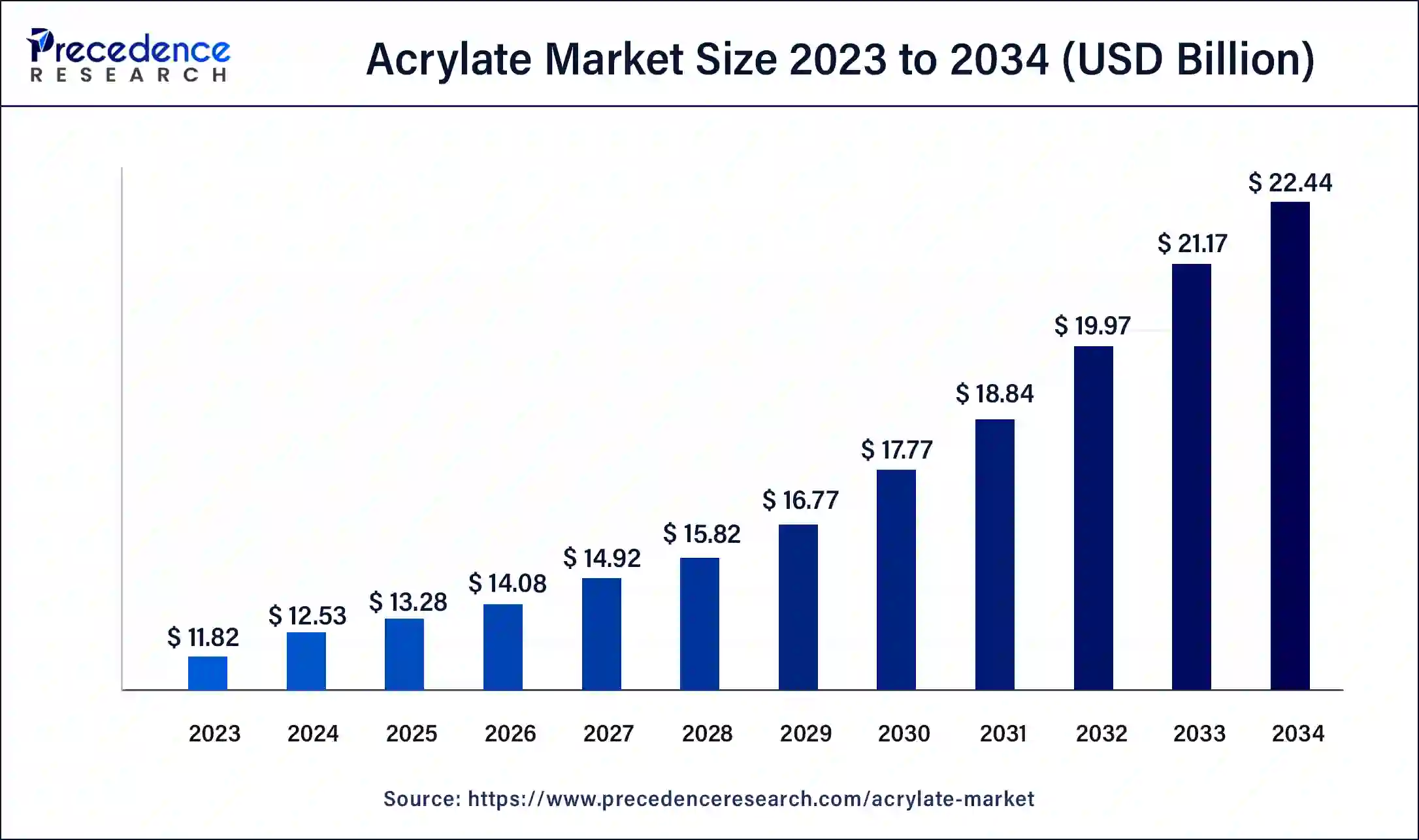

The global acrylate market size is calculated at USD 13.28 billion in 2025 and is predicted to increase from USD 14.08 billion in 2026 to approximately USD 23.66 billion by 2035, expanding at a CAGR of 5.95% from 2026 to 2035.

Acrylate Market Key Takeaways

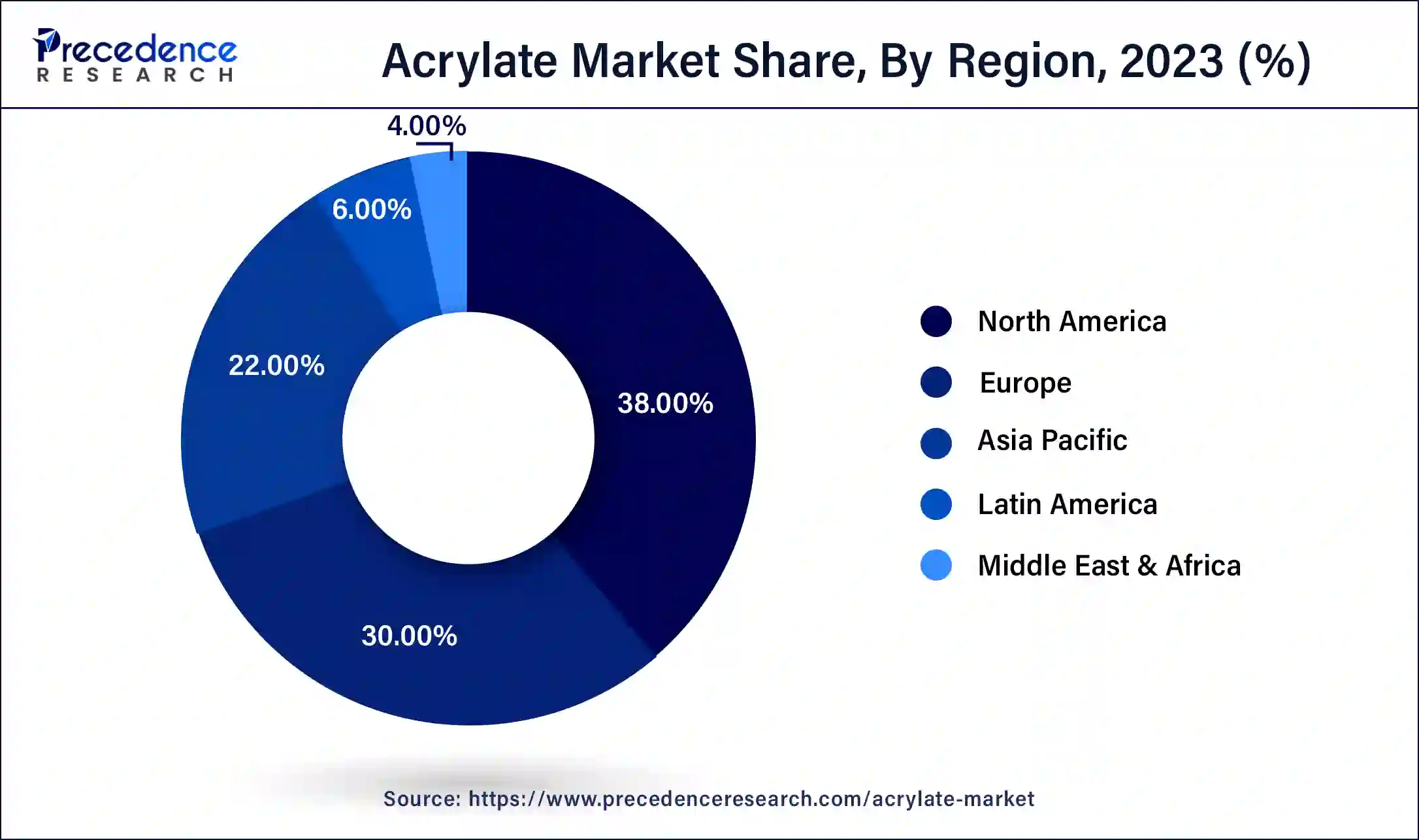

- The North America region contributed more than 38% of revenue share in 2025.

- Asia Pacific is estimated to expand the fastest CAGR between 2026 and 2035.

- By product type, the methyl acrylate segment has held the largest market share of 32% in 2025.

- By product type, the butyl acrylate segment is anticipated to grow at a remarkable CAGR of 7.5% between 2026 and 2035.

- By grade, the standard grade segment generated over 34% of revenue share in 2025.

- By grade, the chemical grade segment is expected to expand at the fastest CAGR over the projected period.

- By application, the adhesives & sealants segment generated over 25% of revenue share in 2025.

- By application, the personal care products segment is expected to expand at the fastest CAGR over the projected period.

- By end use, the construction imaging segment generated over 35% of revenue share in 2023.

- By end use, the paints & coatings segment is expected to expand at the fastest CAGR over the projected period.

What is Acrylate?

Acrylates are a family of chemical compounds originating from acrylic acid. These compounds feature a distinctive structure with a vinyl group (carbon-carbon double bond) and a carbonyl group (carbon-oxygen double bond). Acrylates find extensive use in manufacturing polymers, adhesives, and coatings due to their special chemical characteristics.

A notable member of the acrylate family is methyl acrylate, a crucial building block for polymethyl acrylate, a type of acrylic resin widely employed for its exceptional adhesion, transparency, and resistance to weathering. Acrylate polymers offer versatility in tailoring material properties, making them indispensable across various industries, including medical devices and automotive coatings.

Acrylate Market Growth Factors

- The acrylate market is experiencing growth due to rising demand in the construction industry, where these compounds are utilized in adhesives, sealants, and coatings for enhanced durability.

- Growth is fueled by the automotive sector's increased use of acrylate-based materials, such as acrylic polymers, in manufacturing lightweight components for improved fuel efficiency.

- The acrylate market is benefiting from innovations in medical device manufacturing, where acrylate polymers are employed for their biocompatibility and versatility.

- As sustainability gains importance, acrylates are finding favor for their potential in environmentally friendly formulations, contributing to the market's growth.

- Ongoing research and development efforts are introducing novel applications of acrylates, expanding their utility in industries like electronics, textiles, and packaging.

- The market is witnessing an upswing with the increasing adoption of UV-curable acrylates in printing, coatings, and adhesive applications, driven by their quick curing and low environmental impact.

- The growth of e-commerce is boosting demand for acrylate-based packaging materials, as these offer excellent adhesion and protective properties for shipping and handling.

- With a growing emphasis on reducing volatile organic compounds (VOCs), water-based acrylate formulations are gaining traction, driving market growth.

- The market is benefiting from increased disposable income, leading to higher consumer spending on goods and services where acrylates are commonly used, such as textiles and personal care products.

- Urbanization and infrastructure development are contributing to the demand for acrylate-based products in paints, coatings, and sealants for construction applications.

- The medical adhesive sector is witnessing growth due to the use of acrylate-based adhesives in wound care products and surgical applications.

- Acrylates are increasingly utilized in electronics manufacturing for their thermal stability and dielectric properties, supporting growth in the market.

- The market is witnessing a rise in demand as companies across industries adopt sustainable packaging solutions, where acrylates play a role in creating eco-friendly materials.

- Government investments in infrastructure projects globally are boosting the acrylate market, especially in regions with robust construction activities.

- The construction sector's emphasis on energy-efficient buildings is driving the use of acrylates in coatings and sealants that contribute to insulation and reduce energy consumption.

- The cosmetic industry's expanding use of acrylate polymers in hair styling products, nail enhancements, and skincare formulations is propelling market growth.

- Acrylates are utilized in the production of wind turbine components, and the growth of the wind energy sector is positively impacting the acrylate market.

- The industrial coatings sector is a key driver for the acrylate market, with increased applications in machinery, equipment, and infrastructure for protective and aesthetic purposes.

Market Outlook

- Industry Growth Overview:

The acrylate market is experiencing significant growth, driven by demand for high-performance, environmentally friendly services in coatings, paints, construction, and adhesives. Increasing urbanization and infrastructure projects drive demand for acrylate additives in cement. - Global Expansion:

The acrylate market is experiencing significant global expansion, driven by rising demand for lightweight materials and developments in coating processes. North America dominates the market due to growing urbanization and natural formulations. - Major investors:

The major investors in the acrylate market are significant, worldwide chemical manufacturing companies that invest heavily in production capacity, research, and development. It includes BASF SE, Arkema S.A., Nippon Shokubai Co., Ltd., and LG Chem Ltd.

Acrylate Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 5.95% |

| Market Size in 2025 | USD 13.28Billion |

| Market Size in 2026 | USD 14.08 Billion |

| Market Size by 2035 | USD 23.66Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Grade, Application, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing medical imaging demand and prevalence of chronic diseases

The rise in medical device manufacturing and the growth of the construction industry synergistically contribute to a substantial surge in demand for the acrylate market. In the medical sector, acrylate polymers are increasingly sought after for their biocompatibility and versatility, playing a vital role in the production of adhesives and materials used in medical devices. Their ability to adhere securely, coupled with resistance to various environmental conditions, positions acrylates as key components in the development of advanced and reliable medical equipment.

Simultaneously, the construction industry's expansion significantly bolsters the acrylate market. Acrylates are integral in construction materials such as adhesives, sealants, and coatings, enhancing durability and performance. With the construction sector experiencing robust growth globally, the demand for acrylate-based solutions continues to rise, driven by their versatility, adhesive properties, and capacity to meet the evolving requirements of modern construction practices.

As both industries advance, the acrylate market stands to benefit from their continued reliance on these versatile compounds, showcasing the interconnectedness of technological progress and market dynamics.

Restraint

Environmental and health concerns

Environmental and health concerns pose significant restraints on the acrylate market growth. Certain acrylate compounds can contribute to air pollution through volatile organic compound (VOC) emissions during production and application processes. This has led to heightened regulatory scrutiny and the implementation of stringent guidelines, impacting the formulation and usage of acrylate-based products. Additionally, some acrylates have been associated with potential health risks, leading to concerns among consumers and regulatory bodies.

As sustainability becomes a focal point across industries, the environmental impact of acrylate polymers, which may have limited biodegradability, presents challenges. Increased awareness of these issues has prompted a shift towards eco-friendly alternatives. Addressing these environmental and health concerns necessitates innovation in the development of greener formulations and production processes within the acrylate market, ensuring compliance with regulations and meeting the growing demand for environmentally responsible solutions.

Opportunity

UV-curable technologies

UV-curable technologies are creating exciting opportunities in the acrylate market. These technologies involve the rapid curing of UV-curable acrylates when exposed to ultraviolet light, offering quick and eco-friendly processes. Industries such as coatings, adhesives, and 3D printing benefit from this technology due to its ability to provide high-performance coatings with excellent adhesion and scratch resistance. The growing demand for sustainable and efficient solutions is propelling the adoption of UV-curable acrylates, particularly in the packaging, automotive, and electronics sectors.

As the emphasis on eco-friendly practices increases, UV-curable technologies present opportunities for the acrylate market to provide innovative, energy-efficient, and fast-curing solutions, meeting the evolving needs of modern industries while minimizing environmental impact.

SWOT Analysis - Acrylate Market

Drivers:

- Acrylate offers outstanding adhesion, weather resistance, and UV stability.

- Acrylate monomers are one of the most significant and versatile groups of monomers in the development of coatings.

- They serve as the foundation for the polymers, which optimize paints, coatings, adhesives, and sealants, and can be found in a broad range of productions as a result.

Restraints:

Fluctuating raw material costs and environmental challenges pose significant hurdles.

The manufacturing and disposal of acrylate oligomers increase concerns related to toxicity and biodegradability.

Opportunity:

- Epoxy adhesives are predictable for high bonding strength and chemical resistance, and silicone adhesives are chosen for their superior performance in dangerous environments.

- Smart textiles work for health monitoring, guaranteeing the comfort of the patient and health data. It is the evolved extension of early advanced materials, an interdisciplinary area that uses conductive polymers, carbon-based nanomaterials, and hybrid composites, produced by printing, weaving, and embedding, among other processes.

Threat:

- Acrylic is simply deformed at high temperatures, which restricts its use in some high-temperature surroundings.

- Acrylic is prone to corrosion in acid and alkali environments, which will lead to a poor appearance and low performance.

Segment Insights

Product Type Insights

The methyl acrylate segment had the highest market share of 32% in 2025. Methyl acrylate is a key segment in the acrylate market, representing a chemical compound derived from acrylic acid. It is widely utilized as a monomer in the production of polymethyl acrylate, a versatile acrylic resin with applications in adhesives, coatings, and textiles.

A notable trend in the methyl acrylate segment is its increasing demand for adhesives and sealants, driven by the construction and automotive industries. Its excellent adhesion properties and suitability for various surfaces contribute to the segment's growth, aligning with the market's focus on performance-driven applications in diverse sectors.

The butyl acrylate segment is anticipated to expand at a significant CAGR of 7.5% during the projected period. A notable trend in the butyl acrylate segment is its increasing adoption in water-based formulations, aligning with the industry's shift towards environmentally friendly products. Additionally, the demand for butyl acrylate is influenced by the construction and automotive sectors, where it finds applications in coatings and adhesives, reflecting the market's responsiveness to evolving industry needs for durable and sustainable solutions.

Grade Insights

According to the grade, the standard grade segment has held 34% revenue share in 2023. In the acrylate market, the standard grade segment refers to acrylate products meeting industry-standard specifications. These acrylates are characterized by their balanced performance, cost-effectiveness, and versatility, making them widely utilized in various applications.

Trends indicate a sustained demand for standard-grade acrylates, particularly in construction, adhesives, and coatings, where consistent quality and reliability are paramount. The segment's growth is driven by its ability to cater to a broad range of industries, providing essential characteristics without the premium costs associated with specialized or high-performance grades.

The chemical grade segment is anticipated to expand fastest over the projected period. In the acrylate market, the chemical grade segment pertains to acrylates produced with high purity and adherence to stringent chemical standards. This grade is essential for applications in industries like pharmaceuticals, electronics, and specialty chemicals. The increasing demand for precision and quality in these sectors is driving a trend toward the use of high-grade acrylates. As industries prioritize stringent chemical specifications, the chemical grade segment is witnessing growth, ensuring the reliable and consistent performance of acrylate-based products in applications requiring the highest levels of purity and quality.

Application Insights

According to the application, the adhesives & sealants segment has held a 25% revenue share in 2023.In the acrylate market, the adhesives and sealants segment encompasses products formulated from acrylate compounds, serving as bonding agents and protective sealants. A notable trend in this segment is the increasing demand for environmentally friendly formulations, driving research into low-VOC and sustainable adhesives.

Acrylate-based adhesives and sealants are favored for their versatility, providing strong and durable bonds in various industries, from construction to automotive. This trend aligns with the broader market shift towards eco-friendly solutions, emphasizing the pivotal role of acrylates in adhesive and sealant applications.

The personal care products segment is anticipated to expand fastest over the projected period. The personal care products segment in the acrylate market refers to the utilization of acrylate polymers in formulations such as hair styling gels, nail enhancements, and skincare products. These acrylate-based solutions offer benefits such as enhanced adhesion, film-forming properties, and resistance to environmental factors. A notable trend in this segment includes a growing demand for acrylate polymers with improved flexibility and compatibility with diverse cosmetic ingredients, facilitating the formulation of innovative and long-lasting personal care products to meet evolving consumer preferences.

End Use Insights

According to the end use, the construction has held a 35% revenue share in 2023. In the acrylate market, the construction segment refers to the utilization of acrylates in various construction materials, including adhesives, sealants, and coatings. A significant trend in this segment involves the increasing demand for acrylate-based products in construction due to their ability to enhance durability and performance. As the construction industry continues to grow globally, acrylates play a pivotal role in addressing the evolving needs of modern construction practices, contributing to the sector's development through their versatile applications in adhesive and coating formulations.

The paints & coatings segment is anticipated to expand fastest over the projected period. The paints and coatings segment in the acrylate market encompasses the use of acrylate polymers in formulating paints, varnishes, and protective coatings. Noteworthy trends include the rising demand for environmentally friendly water-based formulations, driven by regulatory pressures and consumer preferences.

Additionally, the development of high-performance acrylate coatings, offering enhanced durability and weather resistance, is gaining prominence in industries like construction and automotive. The paints and coatings sector continues to be a key driver for acrylate market growth, with a focus on sustainability and performance driving innovation in formulations.

Regional Insights

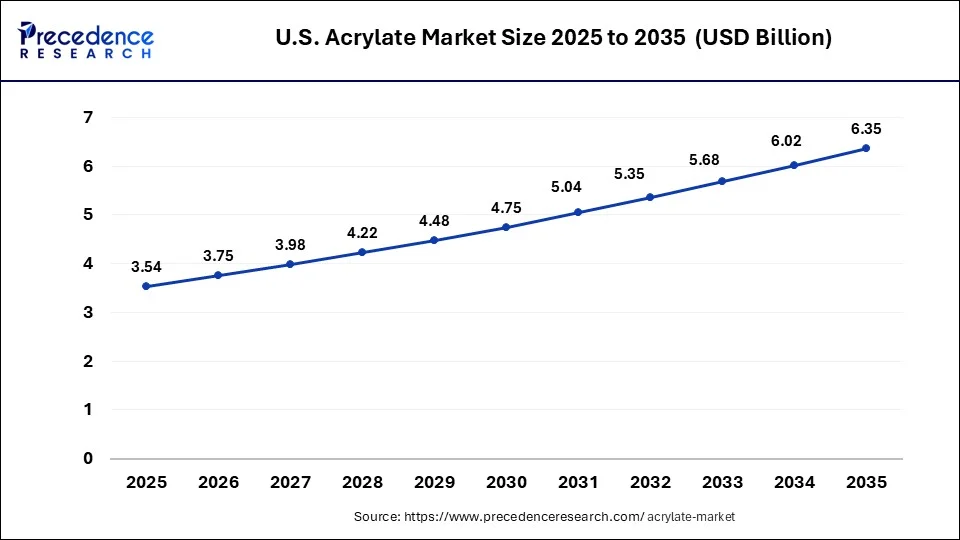

U.S. Acrylate Market Size and Growth 2026 To 2035

The U.S. acrylate market size was valued at USD 3.54 billion in 2025 and is predicted to surpass around USD 6.35 billion by 2035, growing at a CAGR of 6.02% from 2026 to 2035.

North America: Growing research and development

North America has held the largest revenue share 38% in 2023. North America commands a significant share of the acrylate market due to a robust demand across diverse industries such as construction, automotive, and healthcare. The region's well-established infrastructure, technological advancements, and a strong focus on innovation contribute to its leadership in acrylate consumption. Additionally, stringent environmental regulations have spurred the adoption of eco-friendly acrylate formulations. The presence of key market players and a high level of industrialization further solidify North America's position as a major contributor to the thriving acrylate market.

U.S. Acrylate Market Trends

In the U.S., chemical manufacturers spend heavily in research and development, making innovative products that solve evolving problems. USA chemicals produced domestically provide significant environmental benefits through lower transportation emissions, energy-based manufacturing processes, and sustainable raw material sourcing strategies, which collectively reduce environmental impacts.

Asia Pacific: Robust industrialization

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific dominates the acrylate market due to robust industrialization, construction activities, and a flourishing automotive sector. The region's economic growth fuels increased demand for acrylate-based products in paints, coatings, adhesives, andtextiles. Moreover, the rising population and urbanization drive construction projects, further propelling the acrylate market. Asia Pacific's strategic position as a manufacturing hub, combined with strong consumer demand, positions it as a key player in the global acrylate market, with continued growth expected in various end-use industries.

China Acrylate Market Trends

China's coatings factories have developed significantly in the global paint sector, driven by economic advancement, urbanization. Rapid infrastructure development and rising real estate markets drive demand for durable, high-performance paints and coatings. Attached functionalized textiles play a significant role in developing stain-resistant textiles via surface modification processes that present hydrophobic or oleophobic functional groups in the textile surface.

Europe: Increasing healthcare professionals

Europe is experiencing significant growth in the market, as the rising awareness of individual hygiene. The construction and automotive sector in Europe is based significantly on acrylic-based adhesives and sealants because of their excellent bonding properties, durability, and resistance to weather conditions. The European Union's strict regulations on emissions and sustainability are raising the demand for bio-based acrylic acid and environmentally friendly manufacturing processes, which drives the growth of the market.

The UK Acrylate Market Trends

In the UK, the Green Claims Directive (GCD) was a proposed EU law goal at curbing major challenges by safeguarding companies back up their environmental claims with science. UK construction product producers, this push for credible claims brings them into line with other carbon-related guidelines and initiatives, which drives the growth of the market.

Acrylate Market Companies

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Germany |

Strong innovation and R&D |

In June 2025, BASF completed the transition to bio-based Ethyl Acrylate (EA) for its Rheovis range manufactured at Ludwigshafen and Bradford sites. |

|

|

United States |

Diverse product portfolio |

In May 2025, Dow opened in a novel tab that has received more Edison Awards than any other company. Ten Dow innovations were recognized with one gold, four silver, and five bronze Edison Awards in 2025. |

|

|

Arkema S.A. |

France |

Talented workforce and strong values |

In September 2025, Arkema, a global leader in specialty materials, and Catalyxx, an innovator in bio-based chemicals, announced a strategic partnership. This collaboration aims to develop a new value chain for low-carbon, bio-based acrylic resins by leveraging breakthrough proprietary technology. |

|

Evonik Industries AG |

Germany |

World leaders in specialty chemicals |

In January 2025, Evonik launched Smart Effects, a novel entity counting 3,500 employees worldwide, born from the strategic merger of its Silica and Silanes business lines that will be part of advanced technologies in the novel company organization. |

|

Mitsubishi Chemical Corporation |

Japan |

Advanced innovation through R&D |

In September 2025, Mitsubishi Chemical Corporation and Honda Motor jointly developed PMMA recycled material for the door visors of the new N-ONE e-mini-electric vehicle. |

Other Major Key Players

- Nippon Shokubai Co., Ltd.

- Sartomer (a part of Arkema)

- H.B. Fuller Company

- Toagosei Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- LG Chem

- DIC Corporation

- Hitachi Chemical Co., Ltd.

- Formosa Plastics Corporation

- Kuraray Co., Ltd.

Recent Developments

- In December 2025, Mitsui Chemicals, Idemitsu Kosan, and Sumitomo Chemical concluded a definitive agreement for the business integration of Sumitomo Chemical's PP and LLDPE. The companies have announced a joint venture agreement for Business Integration. (Source: https://www.sumitomo-chem.co.jp )

- In September 2025, Synthomer, a leading supplier of high-performance, highly specialised polymers and ingredients, and Lummus Technology, a provider of process technologies and value-based energy services, announced the launch of a novel partnership to license Synthomer's exclusive acrylic acid esters technology. This partnership combines Synthomer's deep operational expertise and technological know-how in acrylic acid esters with Lummu's global licensing capabilities. (Source: https://www.prnewswire.com )

- In November 2022, Arkema S.A. took a significant stride in sustainable development by introducing a range of bio-attributed acrylic monomers using the mass balance approach. This move aligns with the company's commitment to environmentally friendly practices, particularly in its coating solutions segment.

- In May 2022, Evonik established a strategic distribution partnership with Vimal Intertrade and Nordmann to cater to the emerging Indian and surrounding markets. This collaboration enhances Evonik's market presence and distribution network, positioning the company to better serve the evolving needs of these growing markets.

Segments Covered in the Report

By Product Type

- Methyl acrylate

- Ethyl acrylate

- Butyl acrylate

- 2-ethylhexyl acrylate

- Others

By Grade

- Standard grade

- Technical grade

- Chemical grade

- Pharmaceutical grade

By Application

- Adhesives & sealants

- Paints & coatings

- Textiles

- Plastics

- Paper & paperboard

- Personal care products

- Others

By End Use

- Construction

- Automotive

- Packaging

- Textile

- Paints & coatings

- Adhesives & sealants

- Personal care

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content