What is Paints and Coatings Market Size?

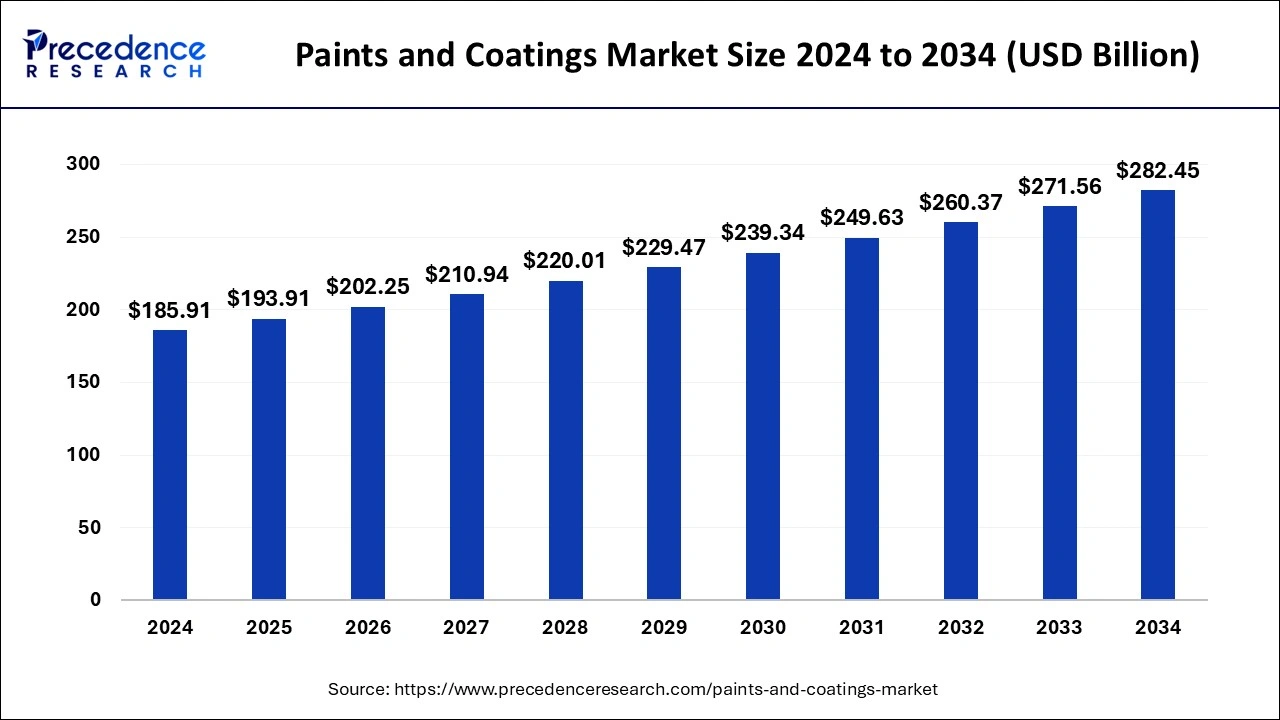

The global paints and coatings market size was accounted at USD 193.91 billion in 2025 and predicted to increase from USD 202.25 billion in 2026 to approximately USD 293.54 billion by 2035, representing a CAGR of 4.23% from 2026 to 2035. The paints and coating market is growing due to growing industrialization, which requires paints and coating for infrastructure, equipment, devices, machinery, etc.

Paints and Coatings Market Key Takeaways

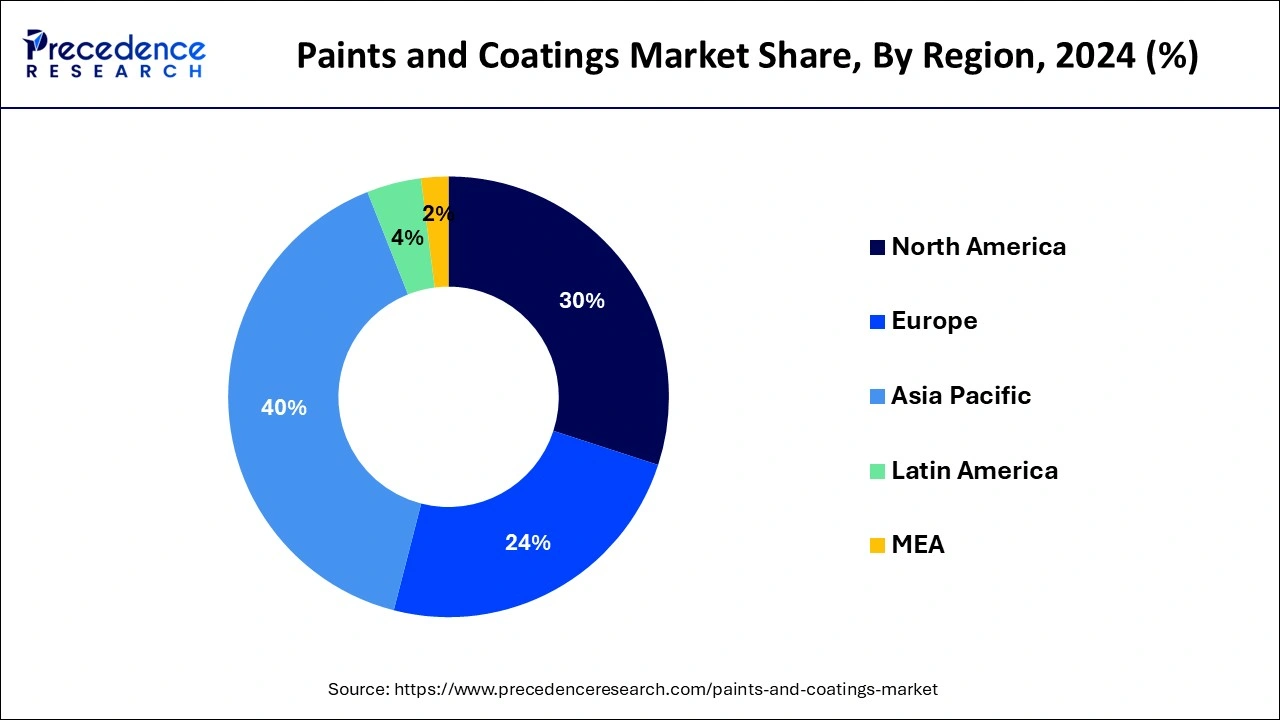

- Asia Pacific region held a revenue share of around 40% in 2025.

- By product, the waterborne segment accounted market share of around 39.4% in 2025.

- By material, the acrylic segment hit the highest market share of over 45% in 2025. However, the polyurethane segment is growing at a CAGR of 5.8% from 2026 to 2035.

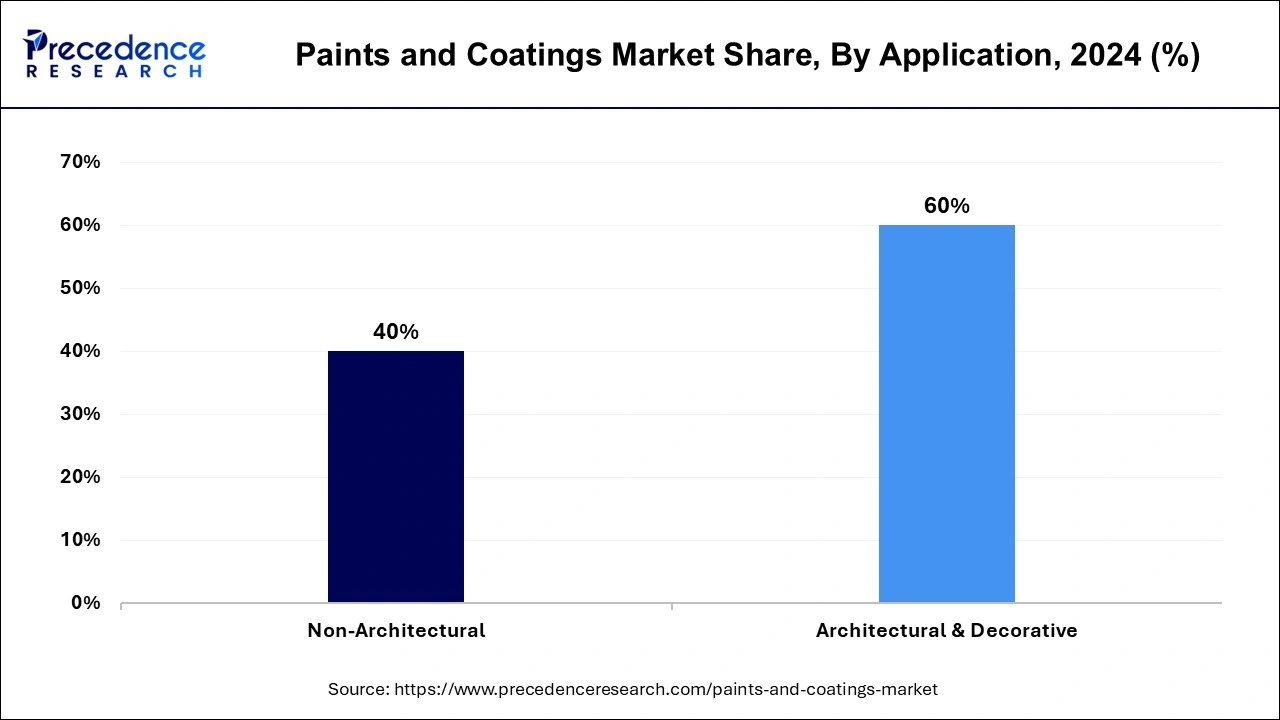

- By application, the architectural and decorative segment hit more than 60% market share in 2025.

Colours Of Opportunity: The Paints and Coatings Market Overview

Rising demand for paints & coatings in automotive, construction, and general industries anticipated to boost the overall market growth. The Asia Pacific region registered high rate of automotive production in the recent past because of surge in disposable income and rising demand for personal transportation is likely to augment the market for paints and coatings over the coming years. Further, rapid industrialization and urbanization particularly in the developing countries, for example China, India, and Southeast Asia estimated to fuel the demand for paints & coatings across various applications.

Apart from these factors, paints and coatings are estimated to register high demand from the architectural industry. Within the architectural industry, paints and coatings are largely used in residential construction because of increasing construction output, rising urbanization, and population expansion. Furthermore, various ambitious programs introduced by the governments of the developing countries in the Asia Pacific region are anticipated to act as a significant factor that pushes the residential construction activities within the region.

Painting with Intelligence: AI transforming the Paints and Coatings

By altering research, development, and production procedures, artificial intelligence and machine learning are redefining the paints and coatings sector. AI is essential to the development of innovative coatings with enhanced adhesion, wear resistance, and corrosion resistance. AI is assisting in the development of novel chemical compositions by facilitating in-depth investigation into material characteristics. Paint formulas may be precisely adjusted based on chemical composition thanks to the use of machine learning algorithms to model data. The R&D process is streamlined by this data-driven approach, which also guarantees that goods fulfill industry standards and particular performance requirements. Additionally, AI and ML evaluate variables like paint toxicity, price swings driven by the market, environmental effects, and the feasibility of substitute materials, offering insights that support well-informed decision-making and product formulation improvement.

Paints and Coatings Market Growth Factors

- The rapid expansion of the construction industry: The primary purposes of paints and coatings are to adorn and preserve buildings and infrastructure. Exterior and interior paints, sealants, primers, stains, and varnishes are examples of these architectural advancements. Architectural paints come in a variety of textures, ranging from semi-gloss to uniform, and allow for odorless paints with increased abrasion resistance. The market's growth will probably be aided by an increase in building activity and government investment in a number of public infrastructure projects.

- Focus on sustainability: There is a huge need for coatings products to be developed sustainably due to strict environmental restrictions. In order to satisfy consumer demand, paint producers are introducing and developing sustainable paint technologies. These businesses are also adhering to REACH's regulations to lower their carbon footprint and volatile organic compounds (VOCs), which will help them create bio-based technologies and achieve recyclability.

- Rising urbanization: Increased urbanization and infrastructural development, particularly in emerging nations, are driving the global market for paints and coatings. The usage of long-lasting, aesthetically pleasing, and protective paints and coatings has expanded as a result of rising demand in the commercial, industrial, and residential sectors.

- Rise in the automotive industry: The demand for paints and coatings has also grown dramatically as a result of the global paints and coatings market's rise. High-performance coatings that provide superior protection and aesthetics are becoming more and more necessary as the number of cars produced globally rises.

- In May 2024, PPG Industries unveiled its plan to invest USD 300 million to boost its manufacturing capabilities in North America, aimed at meeting the rising demand for paints and coatings in the automotive sector. This investment includes the construction of a new manufacturing facility in Tennessee.

Painting the Future: Paints and Coatings Market Outlook

- Industry Growth Overview: The increased urbanization and infrastructure development are contributing to the industrial growth in the market, where growing environmental regulations are increasing the use of water-based products.

- Sustainability Trends: The sustainability trends of paints and coatings involve the development and use of water-based low or zero-VOC formulations to enhance the indoor air quality and stringent environmental regulations

- Major Investors: Large corporate entities, specialized private equity firms, and institutional asset managers are the major investors in the paint and coating industry. BlackRock, Inc., Akzo Nobel N.V., and the Vanguard Group, Inc. are some of the major investors in the market.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 193.91 Billion |

| Market Size in 2026 | USD 202.25 Billion |

| Market Size by 2035 | USD 293.54 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.23% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material Type, Product Type, Application Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

RAW MATERIAL TRENDS

Raw material trends are one of the major factors affecting the paints and coatings market as the market is raw material intensive. The costs of raw materials are very significant for paint and coating manufacturers as 50% of the costs are associated to the raw materials. The raw materials required for manufacturing paints and coatings include pigments, solvents, additives, and resins. Resins such as acrylic, epoxy, polyurethane, alkyd, and polyesters are majorly used in the production of paints and coatings. These resins are derived from acrylate, methacrylate, bisphenol-A, epichlorohydrin, phenols; Isocyanate, polyol; isophthalic acid, phthalic anhydride, maleic anhydride, and glycols such as propylene glycol, Di-ethylene glycol, and mono-ethylene glycol. Pigment and additives is a substance that is responsible for the color change and to enhance the properties of paints and coatings.

These raw materials are derived from crude oil, therefore, the price volatility of crude oil is expected to have a significant impact on the prices of its by-products such as solvents and resins, thereby, impacting the prices of paints and coatings. For instance, in April 2018, PPG Industries, Inc. announced to increase the global prices of its protective and marine coatings to mitigate the increasing operational costs and the cost of raw materials such as epoxy resins, titanium dioxide, zinc powders, and solvents.

In the past few years, raw materials have seen an extreme fluctuation in prices owing to the political instability in oil-producing nations such as Iraq, Saudi Arabia, and other countries of the Middle East. Furthermore, the social unrest in Iran, Venezuela, Iraq, and Libya has adversely affected the crude oil supply in the recent past. Factors such as natural disasters, various demand & supply aspects, and seasonal variations are expected to negatively impact the crude oil prices.

The overall growth rate of the industry depends on high potential regions, such as Asia Pacific, wherein industrial output is above the global average. The considerable rise in consumerism is driven by the exponential growth of end-use industries such as construction, automotive, aerospace, marine, and oil & gas. Factors such as economic growth, rising population, and increased disposable incomes, especially in India and China, are significantly contributing to the growth of end-use industries in the region.

Segment Insights

Product Insights

The waterborne segment dominated the global market accounting largest market share in the year 2025. Rising spending in the construction industry along with the shifting consumer preference for environment-friendly products expected to influence the growth of the segment over the analysis period. Water-based paints & coatings are largely used in poorly and confined ventilated spaces. Water-based coatings dry faster compared to solvent-based products owing to the fast evaporation of water content from the coating layer.

However, the solvent-borne coatings segment estimated to register slower growth rate compared to other types of products because of stringent government regulations for the products having high Volatile Organic Compounds (VOC) content. Moreover, increasing application of solvent-based coatings for architectural and industrial purposes due to less time taken to dry as well as better functionality in humid and open environment projected to propel the growth of the segment over the upcoming period.

Application Insights

The architectural & decorative segment has captured a major market share in 2025. This is mainly attributed to the increasing construction activities along with the significant development of road and rail infrastructure across various developed as well as developing countries, such as the U.K., India, the U.S., Germany, China, and European countries predicted to drive the demand for paints & coatings in the architectural & decorative segment during the analysis period.

Regional Insights

Asia Pacific Paints and Coatings Market Size and Growth 2026 to 2035

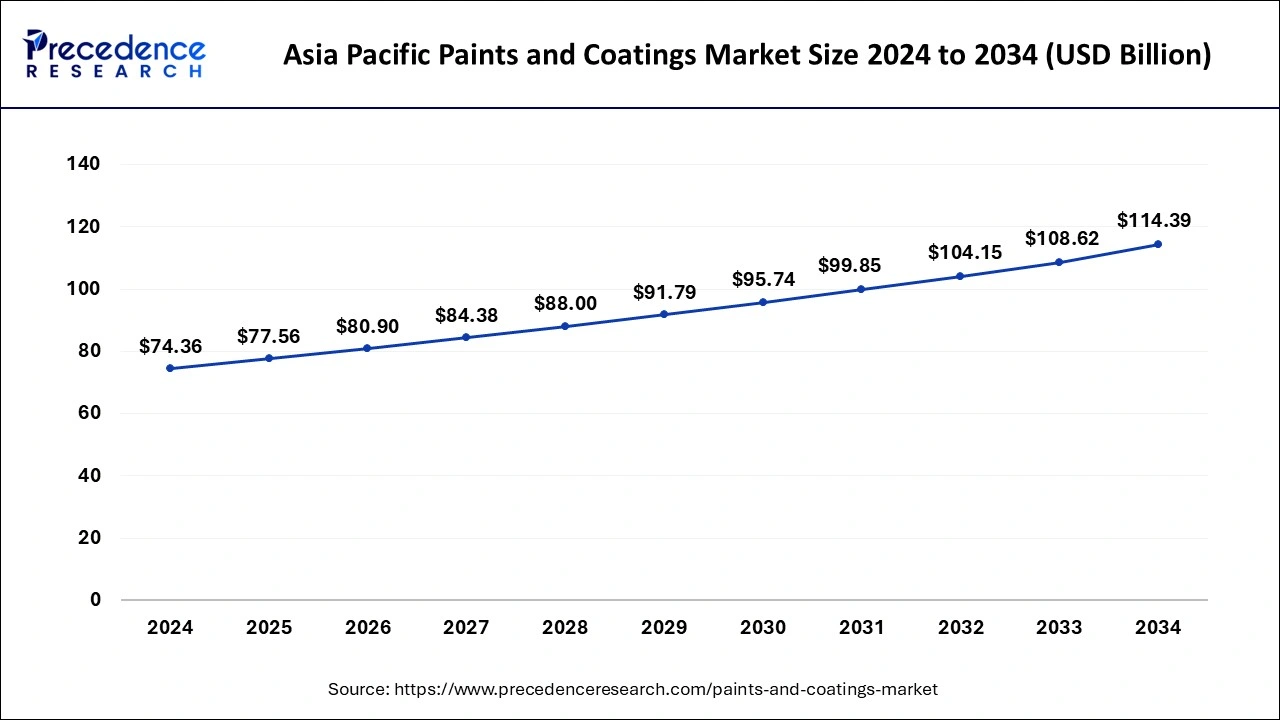

The Asia Pacific paints and coatings market size was exhibited at USD 77.56 billion in 2025 and is projected to be worth around USD 119.29 billion by 2035, growing at a CAGR of 4.40% from 2026 to 2035.

The Asia Pacific covered the major part of the global revenue and accounted highest share in the year 2024. Increasing construction activities coupled with the rising demand from the automotive industry particularly in the emerging countries, for example India, China, Korea, and Southeast Asia predicted to impel the market growth over the upcoming period. Furthermore, easy availability of raw materials together with less strict laws related to VOC emissions compared to other regions such as Europe and North America offers immense growth opportunities to uplift the market growth in the years to come.

In January 2025, Kansai Nerolac Paints Ltd (KNPL), a key player in India's paint industry, announced its plan to invest ?98 crore to enhance its production capacity at its Hosur facility in Tamil Nadu. As a subsidiary of Kansai Paint Co Ltd, Japan, the ?7,393-crore company expects strong growth in the Indian paint market, driven by the rising urbanization and industrialization.

- According to the Infrastructure Industry Report published in February 2025, in the Union Budget 2025-26, capital investment outlay for infrastructure has been increased to Rs. 11.21 lakh crore (US$ 128.64 billion), which would be 3.1% of GDP.

China's Industrial and Urban Expansion

China holds a leading position in the global market, fueled by rapid urbanization, significant infrastructure development, and a booming manufacturing sector. The "Made in China 2025" strategy also encourages advanced coating technologies and environmentally friendly building standards, promoting a shift towards water-based solutions and increased R&D investment.

Germany: Innovation in Green Automotive Coatings

Germany's market is primarily driven by its strong automotive and industrial sectors, alongside increasing construction activity. The market is shifting towards sustainable solutions, with significant demand for waterborne and powder coatings, driven by the EU Green Deal and strict national eco-labels. Innovations in smart and self-healing coatings are also gaining traction.

Colouring The Future: Expanding Infrastructure Drives North America

North America is expected to grow significantly in the paints and coatings market during the forecast period, due to expanding infrastructure, which is increasing the demand. At the same time, the growing automotive industry and technological advancements are also increasing their use and driving their innovation to meet the growing environmental regulations. Moreover, the growing government initiatives and disposable incomes are also contributing to their enhanced growth, promoting market growth.

U.S. Coatings Market: A Sustainable Shift

The U.S. market is expanding, driven by a surge in both residential and commercial construction and remodeling projects. A major trend is the rising demand for eco-friendly and low-VOC (volatile organic compound) products, influenced by stringent environmental regulations and consumer preferences for healthier options.

Vibrant Growth: Urbanization Fuels South America

South America is expected to grow significantly in the paints and coatings market during the forecast period, due to the rapid urbanization, which is increasing the demand for commercial paints and coatings. At the same time, the growing automotive sector is also increasing its demand for vehicle coating, where the growing awareness is also increasing its use for decorating homes and offices. Additionally, the industries are developing durable and corrosion-resistant coatings, promoting the market growth.

Brazilian Color Surge

Brazil's market is experiencing strong growth, fueled by expansion in the construction, automotive, and industrial sectors. Increasing demand for decorative paints in residential and commercial buildings is a major driver, alongside rising consumer interest in sustainable and eco-friendly products. Rapid urbanization and government housing initiatives like "Minha Casa Minha Vida" are boosting demand across the country.

Why is Europe Considered the Second-Largest Market for Paints & Coatings?

Europe holds the second largest position and accounted for more than 28% of value share out of the global revenue in the year 2024. Growing the construction activities across various countries, such as the Netherlands, the U.K., Hungary, Germany, Sweden, Poland, and Ireland anticipated to augment the demand for paints & coatings over the forthcoming time period. Increased funding from the European Union (EU) coupled with supportive policies that include tax breaks, subsidies, and incentives taken by governments of various European countries propel the growth of the construction industry within the region.

40% of total EU energy consumption is used by the building sector. 36% of total EU greenhouse gas emissions come from buildings. The European Commission has announced a Renovation Wave to improve the energy performance of buildings across the EU. The goal is to double renovation rates by 2030 and ensure these lead to better energy- and resource efficiency. This means that by 2030, 35 million buildings could be renovated, creating up to 160,000 new green jobs in the construction sector.

What Potentiates the Paints and Coatings Market in the Middle East & Africa?

The market in the Middle East & Africa is being driven by rapid urbanization, industrial growth, and increasing infrastructure and construction projects across the region. Rising demand for decorative, protective, and specialty coatings in residential, commercial, and industrial sectors further fuels market expansion. Additionally, investments in sustainable and high-performance coatings, along with growing awareness of quality standards and aesthetic trends, are strengthening the market's growth prospects.

Saudi Arabia Market Analysis

Saudi Arabia is the major contributor to the Middle East & Africa paints and coatings market due to its robust construction and infrastructure development, booming real estate sector, and large-scale industrial projects. The country's government-led initiatives in urban development, Vision 2030 projects, and investments in manufacturing and energy sectors are driving high demand for both decorative and industrial coatings. Additionally, the presence of well-established local and international coatings manufacturers ensures supply availability and market growth.

Behind the Colours: Paints and Coatings Value Chain Analysis

- Feedstock Procurement: The feedstock procurement of paint and coating involves the acquisition of essential raw materials, solvents, and various performance-enhancing additives.

Key players: BASF SE, Meghmani Organics Ltd, allnex, Heubach GmbH. - Quality Testing and Certification: Evaluation of physical, chemical, and performance in compliance with the set standards is involved in the quality testing and certifications of paints and coatings.

Key players: SGS SA, Bureau Veritas SA, ASTM International, Smither. - Regulatory Compliance and Safety Monitoring: The regulatory compliance and safety monitoring of the paints and coatings focuses on adherence to the stringent government regulations.

Key players: SGS SA, Bureau Veritas SA, Chemwatch, Sphera.

The value chain of the paints and coatings market consists of raw material suppliers, manufacturers, distribution channels, and end-use industries. The major raw materials required for manufacturing paints and coatings are pigments, resins, solvents, extenders, and additives. Pigments provide color, corrosion resistance, and mechanical strength to paints and coatings; additives such as thickeners, ultraviolet stabilizers, and anti-foaming agents are used in the manufacturing process of paints and coatings; key resins used in paint and coating formulations include acrylic, epoxy, polyurethane, polyester, and alkyd; and solvents are used to control and define the viscosity and drying qualities of the final products.

These raw materials primarily rely on the feedstock derived from oil and natural gas, which results in price volatility. As a result, key raw material suppliers operate through predefined agreements with paint and coating manufacturers.

The first stage of the value chain includes raw material suppliers for paints and coatings. Kamsons Chemicals Pvt. Ltd., Mitsubishi Chemicals Corporation, Adhesives Technology Corporation (ATC), Gellner Industrial LLC, and MegaChem (UK) Ltd. are some of the key raw material suppliers in the global paints and coatings market.

Acrylate and methacrylate are the major raw materials used to produce acrylic resins. Companies such as Evonik Industries AG, Macro Polymers, Dow, Inc., and Kamsons Chemicals Pvt. Ltd. are engaged in the production of acrylic resins. Solvents such as butyl acetate & xylene, pigments, and additives are added to acrylic resins to produce acrylic-based paints and coatings. Arkema S.A., the Sherwin-Williams Company, and Akzo Nobel N.V. are some of the companies engaged in producing acrylic-based paints and coatings.

Bisphenol-A, epichlorohydrin, and phenols are some of the major raw materials used to produce epoxy resins. Huntsman International LLC, Aditya Birla Chemicals, and Hexion, Inc. are engaged in manufacturing epoxy resins. Several additives, solvents, and pigments such as anti-corrosives are added to epoxy resins to produce epoxy-based paints and coatings. PPG Industries, Inc. and RPM International, Inc. are the major companies offering epoxy-based paints and coatings.

Isocyanate and polyol are the major raw materials used to produce polyurethane resins. M.P. Dyechem and Bond Polymers International are among the companies engaged in offering polyurethane resins. Color pigments, additives, primers, and extenders are further added to polyurethane resins to produce polyurethane coatings. Axalta Coating Systems, LLC, The Sherwin-Williams Company, and Hindustan Coatings are involved in offering polyurethane paints and coatings.

Isophthalic acid, phthalic anhydride, maleic anhydride, and glycols , such as propylene glycol, diethylene glycol, and monoethylene glycol are the major raw materials used to produce polyester resins. Arkema S.A., Tough Color Resins Pvt. Ltd., and Karna Paints are some of the manufacturers engaged in producing polyester resins. Additives such as flow & leveling agents, pigments, and solvents are added to polyester resins to produce polyester-based paints and coatings. Akzo Nobel N.V. and Amco Polymers offer polyester coatings.

Polyols and dicarboxylic acid are the major raw materials used to produce alkyd resins. Macro Polymers, Uniform Synthetics, and Mobile Rosin Oil are some of the companies offering alkyd resin. Several types of additives and pigments are added to produce alkyd-based paints and coatings. The Sherwin-Williams Company and Jotun A/S are the major companies involved in producing alkyd coatings.

The second stage of the value chain includes paints and coatings manufacturers. Akzo Nobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, Jotun A/S, Hempel A/S, Nippon Paint Holdings Co., Ltd. and Axalta Coating Systems, LLC are some of the leading manufacturers operating in the global paints and coatings market. Companies such as Akzo Nobel N.V., PPG Industries, Inc., and The SherwinWilliams Company are integrated across the value chain, which gives them operational flexibility to respond rapidly to events such as the actions of competitors and fluctuations in consumer demand. Therefore, the companies involved in the production of raw materials and final products save a lot on cost since the materials required are available in-house.

The third stage of the value chain includes distributors. Manufacturers of paints and coatings distribute finished products through direct and indirect channels. Companies may distribute their products through third-party vendors, distributors, and wholesalers. Product manufacturers form alliances and strategic business partnerships with distributors & suppliers to ensure the marketing and distribution of their products. In addition, RADKA International s.r.o., Metalife Solutions, Kortec, Parker James Protective Coatings Ltd., and Rawlins Paints are some of the distributors operating in the global market.

The final product is used in oil & gas, aerospace, general industry, marine, automotive, power generation, and mining among various other end-use industries. Companies including Lockheed Martin Corporation, United Technologies Corporation, Airbus SE, and The Boeing Company are some of the major end users of paints and coatings. The rising need for the protection of equipment, devices, and machine components in the aforementioned industries is expected to increase the consumption of paints and coatings over the forecast period.

Paints and Coatings Market Key Players' Offering

|

Companies |

Headquarters |

Products |

|

The Sherwin-Williams Company |

U.S. |

Sherwin-will |

|

U.S. |

PPG ENVIROCRON, DYRUP |

|

|

Netherlands |

DULUX, Interpon |

|

|

Axalta Coating Systems, LLC

|

U.S. |

Axlta NextJet, Alesta AM |

|

Jotun

|

Norway |

Jotacote Universal S120, Hull performance solutions |

Other Major Key Players

- RPM International Inc.

- Henkel AG & Company, KGaA

- BASF SE

- Kansai Paint Co., Ltd.

- Hempel A/S

- Nippon Paint Holdings Co., Ltd.

- Sika AG

- Beckers Group

- 3M

- The Chemours Company

Recent Developments

- In January 2025, AkzoNobel unveiled its plan to its employee representatives and its employees in France that includes a €22 million investment to establish the Montataire site as a flagship for decorative paint production.

- In July 2024, Asian Paints unveiled its expansion plan of its Mysuru plant, doubling its production capacity with an investment of Rs 13.50 billion. This strategic move aims to meet the rising demand for paints and coatings in India, spurred by the rapid growth in the housing and infrastructure sectors. The expansion project at the Mysuru plant will increase its annual production capacity from 300,000 kiloliters to 600,000 kiloliters.

- In March 2025, Evonik's Coating Additives business unit announced a strategic partnership with and Nippon Paint China. The agreement combines Evonik's expertise in high-performance additive solutions with Nippon Paint China's market leadership in the coatings industry. The collaboration will focus on creating next-generation products to meet consumers' growing demand for environmentally friendly solutions.

- In December 2024, the biggest institutional investor in the nation, LIC (Life Insurance Corporation of India), raised its ownership stake in Asian Paints to 7%. On December 10, 2024, this was disclosed in an exchange filing. After open market acquisitions between January 1 and December 9, 2024, LIC's share increased from 6.6% at the end of the September quarter to 7.01%. At an average price of ?2,891.25 per share, the insurer purchased 1.93 crore more shares, increasing its total holdings to 6.72 crore shares.

- In February 2024, with the introduction of Birla Opus, Grasim Industries, a division of the Aditya Birla Group, joins the paint industry, escalating rivalry in the decorative paints market. In order to become a successful No. 2 player, Grasim plans to double its paint investment to Rs 10,000 crore in FY23. Over the next five years, the Indian paint and coatings market is anticipated to reach a value of Rs 1 lakh crore.

Segments Covered in the Report

By Material

- Polyester

- Acrylic

- Alkyd

- Epoxy

- Polyurethane

- Others

By Product

- Solvent-borne Coatings

- Waterborne Coatings

- Powder Coatings

- High Solids/Radiation Curing

- Others (Specialty Coatings)

By Application

- Non-Architectural

- Wood

- Automotive & Transportation

- General Industrial

- Protective

- Marine

- Others

- Architectural & Decorative

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Get a Sample

Get a Sample

Table Of Content

Table Of Content