What is the Anti-corrosion Coatings Market Size?

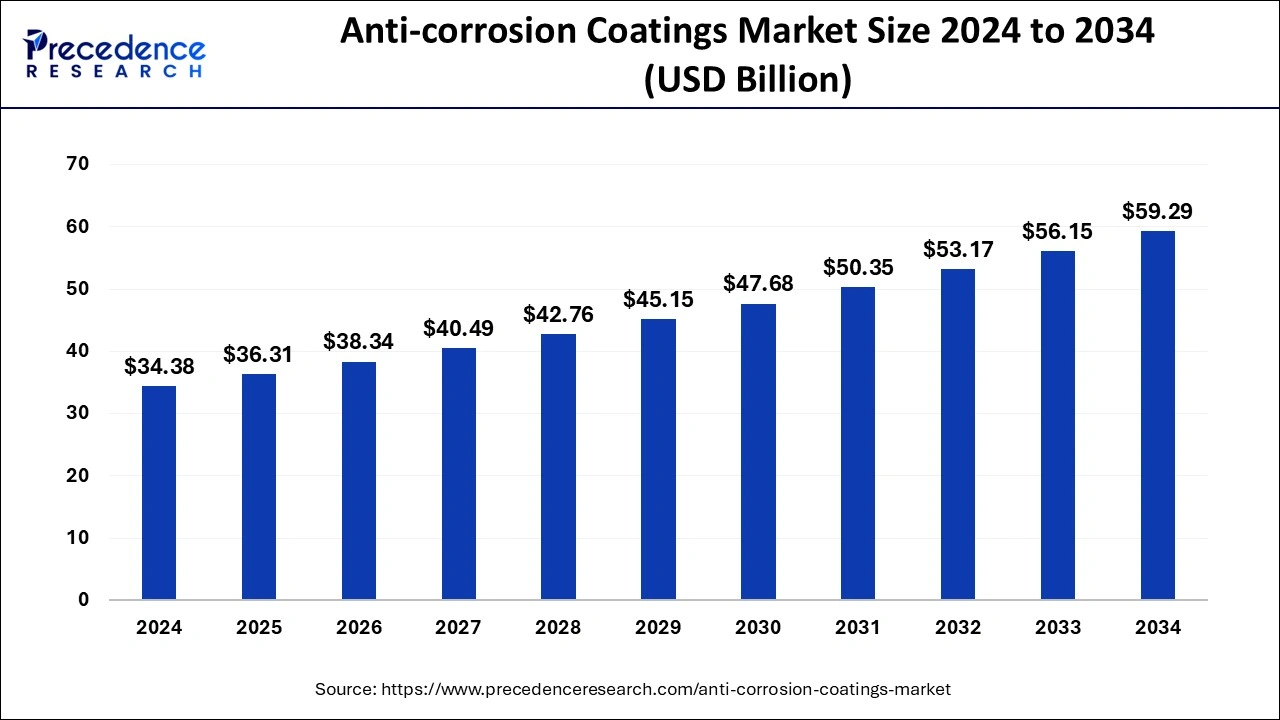

The global anti-corrosion coatings market size is calculated at USD 36.31 billion in 2025 and is predicted to increase from USD 38.34 billion in 2026 to approximately USD 59.29 billion by 2034, expanding at a CAGR of 5.60% from 2025 to 2034.

Anti-corrosion Coatings Market Key Takeaways

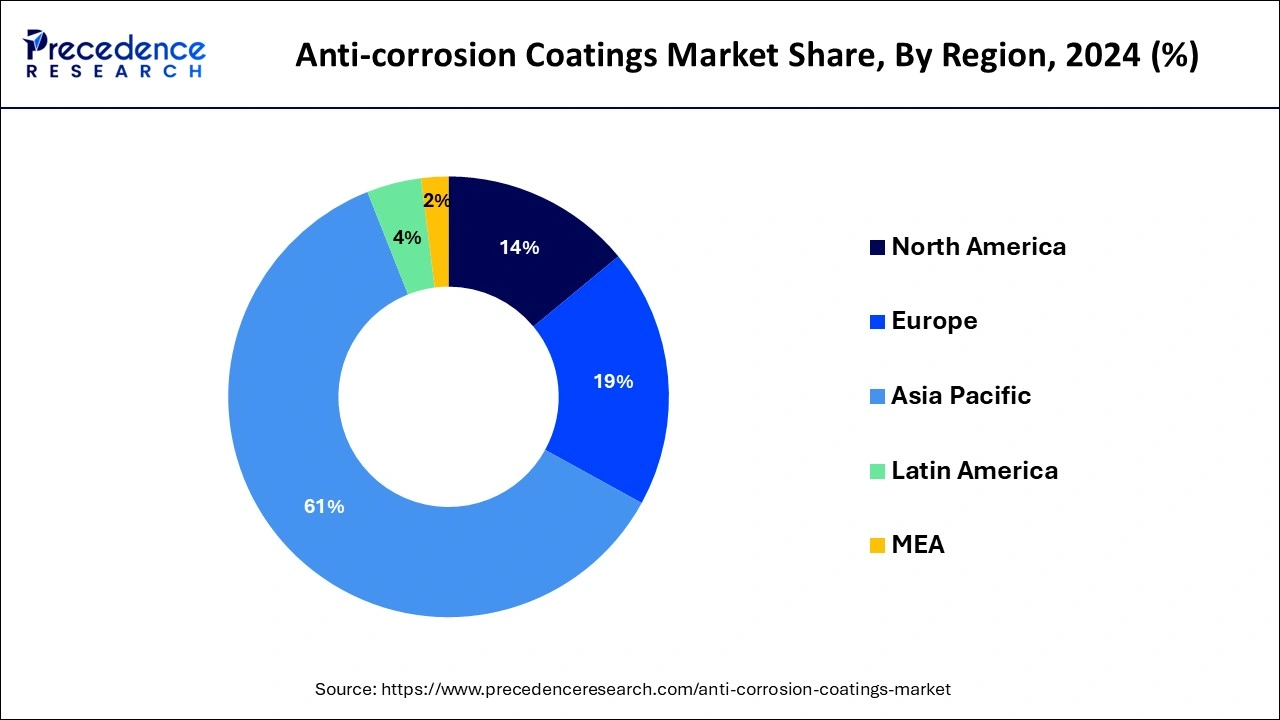

- Asia Pacific led the global market with the largest market share of 61%in 2024.

- By Type, the solvent-based technology segment had the biggest market share in 2024.

- By End-User, the oil & gas segment has held the largest revenue share in 2024.

- By Material, the acrylic material segment has held the highest market share in 2024.

Anti-corrosion Coatings Market Overview: The Market Snapshot

Anti-corrosion coatings are crucial tool for preventing challenges of rust across several industries. This type of coating finds application under several areas including automobiles tunnels, bridges, and protection of structures in few of the toughest environments. Anti-corrosion coatings have become an inevitability for businesses to defend the enormous investments they make in terms of property, money, and protection of workforces. These coatings are employed extensively in sectors like oil and gas, marine, petrochemical, power generation, infrastructure, and others.

Anti-corrosion Coatings Market Growth Factors

- Escalating requirement for thin-walled durable metallic components in the engineering of lightweight products

- Development of oil and gas exploration operations in North America and Asia-pacific

- Power plants anticipated to deliver development outlook to high-performance anti-corrosion coatings

Anti-Corrosion Coatings Market Outlook: Emerging Trends

- Industry Growth Overview: Strict environmental regulations, growing awareness, and growing demand are driving the industrial growth in the market.

- Major Investors: Large chemical corporations, institutional shareholders, and venture capital firms are the major investors in the market.

- Startup Ecosystem: The startup ecosystem is focusing on the use of nanotechnology and advanced chemistry to develop low or zero-VOC and eco-friendly formulations.

Market Scope

| Report Highlights | Details |

| Market Size in 2026 | USD 38.34 Billion |

| Market Size in 2025 | USD 36.31Billion |

| Market Size by 2034 | USD 59.29 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.60% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Material, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Type Insights

Solvent-Based Technology Segment Recorded Prime Market Share in 2024

The solvent-based technology segment led the global anti-corrosion coatings market in 2024. This high market stake is responsible to the intensifying demand for manufacturing machines, industrial tanks, pipes, chemical storage tanks, ballast tanks, gas ducts, smoke stacks and cooling towers. Furthermore, solvent-based corrosion protection coating needs low drying time, displays humidity, enhanced temperature, and abrasion resistance.

End-User Insights

Oil and Gas Application Sector Foretold to Emerge as Dominant Segment during Estimate Period

Anti-corrosion coating finds usage in care homes, hospitals, and drop-in centers for the product such as handles, floors, beds, ceiling paints and walls. Among all, oil & gas application segment dominated the overall market in 2024. This high market cut is credited to the high importance and widespread practice of corrosion protection coating in this application segment. Further, the anti-corrosion coating reduces the risk of microbes and expands surface finish and abrasion resistance.

Material Insights

Acrylic Material Segment is Projected to Govern the Anti-corrosion Coatings Market Revenue

Out of different material segment covered in the report, acrylic material segment conquered the market in 2024. This high share is credited to outstanding properties offered by these materials including resistance to oxidation and weathering. Acrylic coatings are principally water-based, which bid comfort of handling and improved performance in a extensive range of areas such as roof coating, wall coating, and less cost in comparison with other materials

Regional Insights

Asia Pacific Anti-Corrosion Coatings Market Size and Growth 2025 to 2034

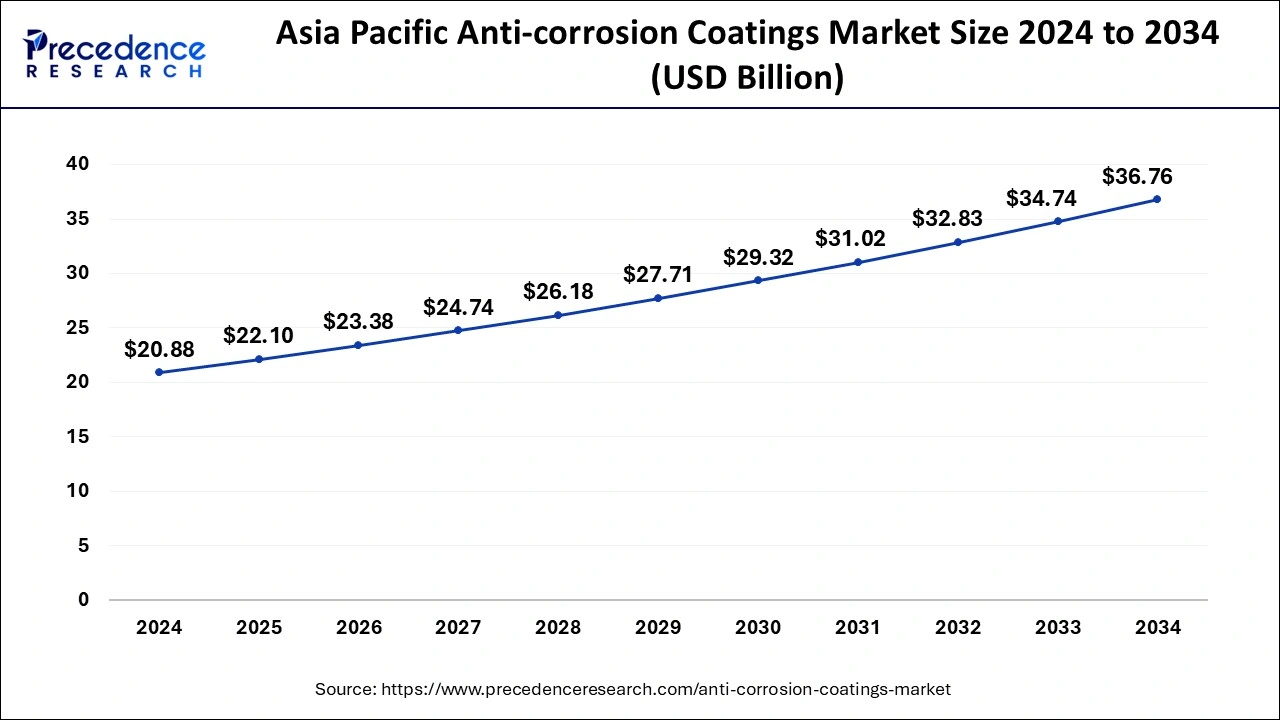

The Asia Pacific anti-corrosion coatings market size is evaluated at USD 22.10 billion in 2025 and is predicted to be worth around USD 36.76 billion by 2034, rising at a CAGR of 5.80% from 2025 to 2034.

Asia Pacific has held the largest market share in 2024. Augmented investments in the marine, construction, and energy sectors in India and China are responsible for changing industry tendencies, which is projected to stimulate the growth of anti-corrosion coatings market. China is the largest user of anti-corrosion coatings across the world. This is mainly due to the increasing energy demand and the necessity of maintenance in the transportation sector.

North America region is estimated to expand the fastest CAGR between 2025 and 2034. In the past few years, the U.S. has exceeded both Saudi Arabia and Russia as the world's leading producers of natural gas and oil. As the installation of pipelines upsurges, so does the risk of corrosion which emphasizes the necessity for pipeline protection. As per, National Association of Corrosion Engineers, global cost of corrosion was around USD 2.5 trillion in 2016. If the industry endures its upward path, the influence of corroded steel pipelines on the financial data is anticipated to increase.

Expanding Industries Sparks Growth in Europe

Europe is expected to grow significantly in the anti-corrosion coatings market during the forecast period, due to industrial expansion and infrastructure revitalisation. At the same time the presence of stringent regulations, the companies are investing and developing advanced anticorrosion coating solutions for protecting of enhancing the life of the products. They are also developing sustainable and eco-friendly corporate solutions.

Advanced Industries Boost UK Market

The presence of well-developed industries is increasing the use of anticorrosive coatings in the UK. The growing infrastructure backed by investment is utilizing these coatings to protect the power plants, bridges, etc, from corrosion, where the government and technological innovations are enhancing the safety of patients and affordability.

Infrastructure Bloom Powers South America

South America is expected to grow in the anti-corrosion coatings market during the forecast period, due to growing infrastructure development, to protect them from aging and environmental conditions. Mining operations are also increasing their use to protect their equipment. Additionally, nanocoating, or self-healing coating technologies, are also being developed by the companies.

Large Industries Drive Brazil

The presence of large industries in Brazil is increasing the use of anti-corrosive coatings. They are widely used in the mining, automotive, and marine sectors. At the same time, the growing suitability trends and innovations are driving the development of their various alternatives

Decoding Anti-Corrosion Coating: Value Chain Analysis

- Feedstock Procurement

The feedstock procurement of anti-corrosion coating includes sourcing essential chemical components and performance additives from major chemical suppliers.

Key players: Toray Industries, Mitsubishi Chemical, SABIC. - Chemical Synthesis and Processing

Reactions to polymerize the monomers and performance additives are involved in the chemical synthesis and processing of anti-corrosion coatings.

Key players: BASF SE, PPG Industries, Akzo Nobel N.V. - Regulatory Compliance and Safety Monitoring

The regulatory compliance and safety monitoring of anti-corrosion coating focuses on performance and safety testing.

Key players: AMPP, ASTM International, UL Solutions, SGS.

The Market Leaders: Key Players' Offering

- Akzo Nobel N.V.: International brand products and the Sigma Coating brand are offered by the company.

- Axalta Coating Systems, LLC: The company is providing specialized liquid and powder coatings.

- Hempel A/S: The company offers a wide range of water-based and low VOC coatings.

- Jotun: Products like Barrier, Jotacote, Hardtop, and Pilot are provided by the company.

- PPG Industries, Inc.: The company offers products like the Amerlock family and PPG Hi-Temp 1027 HD.

Major Market Segments Covered

By Type

- Water-based

- Solvent-based

- Powder

- Others

By End-User

- Building & Construction

- Oil & Gas

- Marine

- Aerospace and Defense

- Automotive & Rail

- Others

By Material

- Polyurethane

- Epoxy

- Acrylic

- Alkyd

- Zinc

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- United Kingdom

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting