What is the Epoxy Resin Market Size?

The global epoxy resin market size accounted for USD 12.33 billion in 2025 and is predicted to increase from USD 13.11 billion in 2026 to approximately USD 21.22 billion by 2035, expanding at a CAGR of 5.58% from 2026 to 2035.

Market Highlights

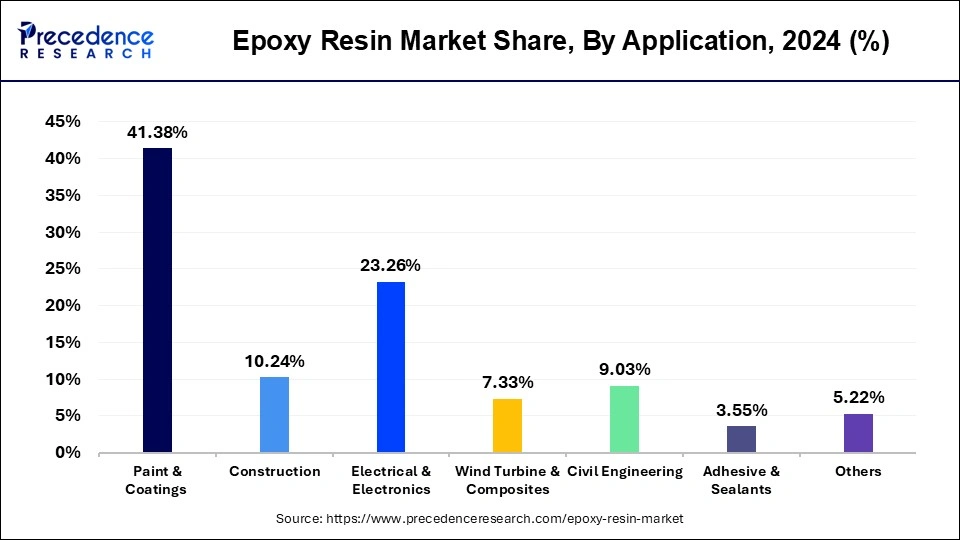

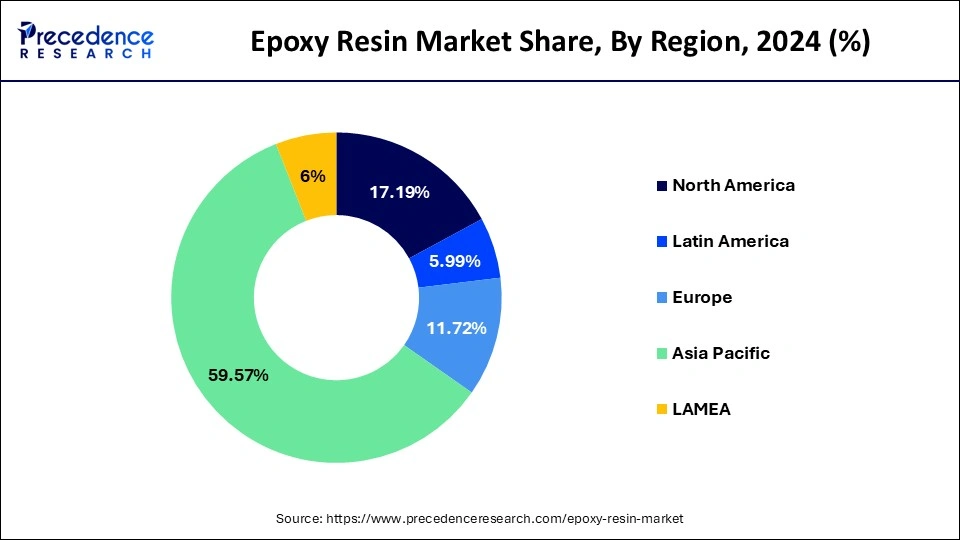

- Asia Pacific accounted for the largest market share of 59.81% in 2025.

- By application, the paints and coatings application segment contributed the biggest market share of 41.50% in 2025.

- By application, the adhesives & sealants epoxy resin segment is growing at a CAGR of 5.60% from 2026 to 2035.

- By raw material, the DGBEA (Bisphenol A and ECH) segment held the major market share of 36.33% in 2025.

- By technology, the solvent cut epoxy segment captured the biggest market share of 29.93% in 2025.

- By sales channel, the direct company sale segment is estimated held the biggest market share of 32.18% in 2025.

- By end use, the consumer goods (including sporting equipment) segment generated the largest market share of 46.93% of in 2025.

Market Overview

Epoxy resin is the thermosetting polymer created by the copolymerizing the epoxide with another molecule which has two hydroxyl groups. It's mostly employed in non-reinforced applications such paints and varnishes, adhesives, and composites. Lightweight composite materials are now being used by car makers to address the requirement for improved design freedom, flexibility, high strength, and decreased vehicle weight. Epoxy resins have grown in popularity across end-use sectors ranging as of coating to the composites due to their superior physical, chemical, and mechanical qualities. These resins have an excellent adhesion to the wide range of the materials, making them certain excellent choice for their production of adhesives and sealants.

Special epoxies have it with higher heat resistance and endurance which plays an important role in the high-end application like wind turbines and composites manufacture. Leading firms are growing tremendously throughout the Middle East and Africa, where the regional epoxy marketplaces are the best performing. Sika AG, for example, finished the epoxy factory in Qatar and plans to start operations in April 2021.

The company wants to capitalize on expected sales for epoxy-based adhesives and flooring in Qatari construction and infrastructure developments with this investment. Such market leaders' initiatives are projected to strengthen the supply chain and lay the groundwork for market development over the forecast period. The bulk of epoxies are produced by the core reactions of the Bisphenol-A with epichlorohydrin (ECH).

AI in the Market

The artificial intelligence phenomenon is disrupting the epoxy resins market and providing further impetus for the development of smarter products and efficiencies in operations, including sustainability. In product innovations, it speeds up formulation design by predicting resin performance characteristics such as strength, viscosity, and thermal stability, thus reducing random lab experiments. Machine learning maximizes the component ratios to targets like flame retardancy or durability. On the manufacturing side, AI gives smarter process controls that deliver consistent quality with minimal wastage.

Maintenance in a predictive fashion manages the elimination of production downtime and improvement in operational reliability. For sustainability, AI shall promote the development of bio-based and waterborne epoxy systems that maintain alignment with tightening environmental regulations. Supply chain forecasting with AI supports more efficient demand planning and logistics. Also, market intelligence provided by AI gives companies foresight about customer preferences and further agility to quickly respond with customized solutions. AI in general gives the ability to epoxy resin manufacturers to cut costs, improve product performance, and respond to markets with agility and innovation.

Epoxy Resin Market Growth Factors

Furthermore, the very demand for epoxy resins for aerospace sectors has expanded rapidly for the construction of aircraft in which panels and helicopter, in which rotor blades. The lightweight and durability of epoxy resin, as well as its high heat with pressure tolerance, make it perfect for usage in a aircraft sector, which drives growth of the worldwide epoxy resin market. All of these reasons are projected to boost the further growth of this epoxy resin market in aerospace sector during the forecast period.

Epoxy resins, they are also used to shield solar panels from rapid temperature fluctuations. Epoxies are reasonably priced, simple to apply, and require minimal work. Because of their great creep resistance and tensile strength, epoxy thermosets are used to make the blades more robust. The use of epoxy resins mixed with various toughening agent on the wind turbine blades has yielded many favorable results considered in terms of making those blades corrosion resistant also fatigue-proof, resulting in increasing demand for epoxy resins from the wind energy sector.

Epoxy resins aid in the creation of numerous coating qualities, including strength, durability, and chemical resistance. Their quick-drying, toughness, great adhesion, rapid curing, abrasion resistance, and excellent water resistance make it appropriate for protecting metals and other surfaces. The expanding construction sector is anticipated to help the paints and coatings business develop. In Europe, the German government announced a plan to build around 1.5 million housing units by the end of 2021. Similarly, rising building activity in countries such as Russia, France, and the United Kingdom is likely to propel the epoxy resins market forward.

The report estimates that 21.8 million light commercial vehicles, heavy buses, and trucks as well will be built globally in 2020. As a result, the increasing manufacture of lightweight and commercial vehicles are likely to increase the overall market for epoxy resins utilized in a automotive coatings sector. Epoxy coatings are used like the primers for corrosion protection in those of automotive, marine, and aerospace sectors. The use of epoxy coatings is likely to increase further as requirement from the electric vehicle (EV), marine, and aerospace sectors are on the rises. These factors are projected to have a substantial influence on demand for epoxy resins in the paints and coatings, impacting the positive growth of the epoxy resins market all the way through the forecast period.

Bio-based epoxies were developed to reduce the environmental impact of crude oil resins. Biomaterials which including lignin, vegetable oil, rosin, tannin, and so on replace a portion of the petrochemical products, ranging from 20% to 50%. These materials eliminate this need BPA, which is toxic and therefore must be dealt with caution. Bio-based resins have several uses, including paints, adhesive, composite, and many others.

Entropy Resins, Greenpoxy, and Resin Studies Bio Epoxy, for example, have commercially manufactured bio-based resins that include 20-50 percent bio-based components, according on the epoxy system. Because of the rising need for durability in epoxy end-use sectors, the opportunity for bio-based products can help to grow over the forecast period. Epoxy resins manufacturers are increasing output capacity to grow and capitalize on the revenue prospects in the aviation and construction industries. To fulfill the demanding demands of clients and consumers in the aviation and construction sectors, they are developing in paints, coatings, and adhesives. This is obvious since epoxy resins improve the durability of coating and paint compositions.

Furthermore, there is a rising need in the aviation and construction industry for paint and coating that can survive adverse weather and temperature conditions. Such needs are fueling the expansion of the epoxy resins market, moreover epoxy resins are accepted for their better mechanical strength and hardiness to harsh temperatures.

- Growing demand from the aerospace and automotive industries due to epoxy resin's lightweight, long durability, and high strength.

- Wind energy sector adds to demand as epoxy composites are used for building turbine blades that have a fatigue resistance and are strong enough.

- Used increasingly in paints, coatings, and adhesives that fall under construction and infrastructure.

- An alternative green bio-epoxy is believed to be coming to reduce reliance on petrochemicals.

- Due to being resistant to chemicals, mechanically strong, and easily handled to form composites, electronics, and protective coatings, there exists a wide domain of industrial applications for them.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 12.33 Billion |

| Market Size in 2026 | USD 13.11 Billion |

| Market Size by 2035 | USD 21.22Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.58% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Raw Material, Application, Technology, Sales Channel, End User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segments Insights

Application Insights

In 2025, the paint and coating application category led the market, accounting for much more than 41.50% of total revenue. Epoxy resin-based paints and coatings are widely utilized in residential housing constructions, maritime industries, automobiles, and sewerage systems due to their outstanding resistance to stains, fractures, temperature extremes, scorching, and solvents, among others. They have the great anti-corrosions performance and also low amount of Volatile Organic Compound (VOCs). inner and exterior surfaces of commercial, housing, institutional, and the industrial buildings are coated with epoxy resin-based paint and coating.

These adhesives and sealants not just to increase the aesthetic attractiveness of surfaces, and yet also preserve them from hot conditions and Ultraviolet rays, avoiding peeling, fading, and breaking. Emerging regions such as Asia Pacific, the Middle East, and Africa are seeing significant growth in quasi businesses such as IT, telecommunications, and retail, which is increasing consumption for coatings and adhesives. Likewise, continued industrialization, expanding government infrastructure expenditure, and rising Foreign Investments (FDI), notably in Asia Pacific, are anticipated to fuel the growth for epoxy resin-based paints and coatings throughout the projected period.

Raw Material Insights

The DGBEA (Bisphenol A and ECH) segment led the market in 2025. DGBEA epoxy resins offer excellent versatility and performance across a wide range of applications. They exhibit high mechanical strength, chemical resistance, adhesion, and durability, making them ideal for various end-use industries such as construction, automotive, electronics, aerospace, and coatings. DGBEA epoxy resins can be formulated and customized to meet specific performance criteria and application requirements. Manufacturers can adjust the molecular weight, functionality, cross-linking density, and other parameters to tailor the properties of epoxy resin formulations for different end uses, enhancing their versatility and market appeal.

Technology Insights

The solvent cut epoxy segment dominated the market in 2025. The addition of solvents to epoxy resin formulations improves their workability, allowing for better flow, wetting, and penetration into substrates. This facilitates smooth surface coverage and adhesion, resulting in high-quality finishes and strong bonds in various applications. Solvent-cut epoxy resins typically exhibit faster cure times compared to solvent-free formulations. The presence of solvents accelerates the curing process by promoting molecular mobility and facilitating cross-linking reactions between epoxy molecules and curing agents. This enables rapid production cycles and shorter lead times in manufacturing processes.

Global Epoxy Resin Market, By Technology, 2022-2024 (USD Million)

| By Technology | 2022 | 2023 | 2024 |

| Solvent Cut Epoxy | 3,028.0 | 3,237.1 | 3,457.7 |

| Liquid Epoxy | 2,469.7 | 2,637.6 | 2,814.5 |

| Waterborne Epoxy | 2,150.7 | 2,287.7 | 2,431.4 |

| Others | 2,530.6 | 2,697.7 | 2,873.4 |

Sales Channel Insights

The direct company sale segment held the dominating share of the market in 2025. Direct sales enable epoxy resin manufacturers to offer customized solutions tailored to the specific requirements of customers. By engaging directly with customers, companies can better understand their needs, preferences, and project specifications, allowing them to provide tailored epoxy resin formulations, technical support, and value-added services. Direct company sales ensure that customers receive epoxy resin products directly from the manufacturer, minimizing the risk of product tampering, contamination, or quality issues associated with intermediaries or third-party distributors. This direct supply chain ensures product authenticity, quality assurance, and adherence to industry standards and specifications.

Global Epoxy Resin Market, By Sales Channel, 2022-2024 (USD Million)

| By Sales Channel | 2022 | 2023 | 2024 |

| Direct Company Sale | 3,295.4 | 3,508.9 | 3,733.1 |

| Direct Import | 1,520.2 | 1,623.5 | 1,732.5 |

| Distributors & Traders | 3,010.4 | 3,221.4 | 3,444.4 |

| Retailers | 2,353.0 | 2,506.1 | 2,667.1 |

End User Insights

The consumer goods segment held the largest share of the market in 2025. Epoxy resins are widely utilized in the manufacture of adhesives and sealants for bonding and sealing a wide range of consumer goods, including electronics, appliances, automotive parts, and construction materials. Their strong bonding strength, moisture resistance, and temperature stability make them ideal for assembly and repair applications. Epoxy resins are essential components in the production of composite materials used in consumer goods such as aerospace components, sporting equipment, automotive parts, and recreational products.

They are combined with reinforcing fibers or fillers to create lightweight, high-strength composites that offer superior mechanical properties and design flexibility.

Regional Insights

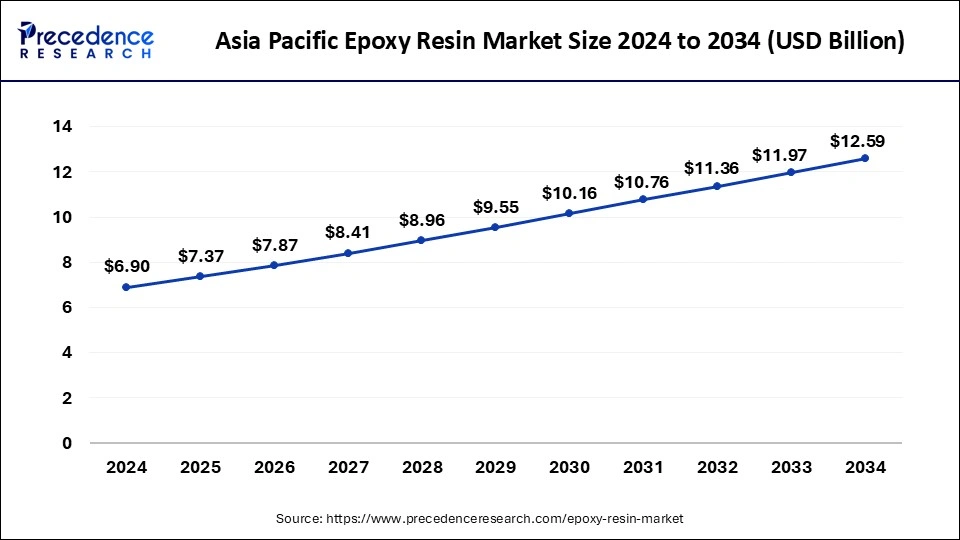

What is the Asia Pacific Epoxy Resin Market Size and Growth from 2026 to 2035?

The Asia Pacific epoxy resin market size is valued at USD 7.37 billion in 2025 and is expected to be worth USD 13.20 billion by 2035, with a solid CAGR of 6% from 2026 to 2035.

Attributed to the prevalence of large-scale manufacturers and the widespread access to raw materials, Asia Pacific accounted for the biggest volumes and market share in the global market in 2025. With favorable end-use industry growth in China, India, and South East Asian countries, the region is likely to lead this market during the forecast period. China is the world's biggest epoxies user.

The paint and coatings industry in the nation is well-established, and the majority of epoxy-based coatings are employed due to their excellent qualities. Furthermore, the rapidly growing composites, construction, and automotive sectors are growing significantly for long-lasting epoxies. India is likely to undergo rapid improvement in the foreseeable future as a result of expanding industrialization. Furthermore, countries like as South Korea and Japan hold a substantial portion of the regional market due to a very well epoxy supply chains and manufacturers.

In Europe, automobile, renewable power, and composites are driving the growth of higher and lower cured epoxy resins. Automotive part innovations, increased need for green chemicals in construction operations, and a booming green economy are just a few of the factors boosting epoxies demand in the area.

North America's increased digitization is driving higher demand for electrical and electronic products. To reduce costs and improve performance, these systems use long-lasting and trustworthy epoxy-based components. Furthermore, growing governmental and non-governmental infrastructure direct investment provides significant opportunities for market development. The good growth of the food and beverage sector is setting the stage for solutions such as metals container coatings.

China has the world's largest electronics manufacturing base and competes fiercely with established upstream producers such as South Korea, Singapore, and Taiwan. Electronic devices such as smartphones, OLED TVs, tablets, among others, have seen the most demand rise in the consumer electronics area of the industry. With rising middle-class disposable incomes, demand for electronic devices is expected to rise gradually in the future, propelling the industry under consideration. In India, the government is pushing for massive residential constructions in the next years. India has a USD 1400 billion infrastructure investment budget, with 24 percent going toward renewable energy, 19 percent going toward roads and highways, 16% going toward urban infrastructure, and 13 percent going toward railroads. Till June 2021, 2,734 of the total 5,956 Smart Cities Mission projects have been completed. As a result, expansion in the residential category is expected to boost the Asia-Pacific epoxy resins market.

Evolving Epoxy Resin Market of the United States

The United States epoxy resin market is witnessing a spur demand, fueled by a convergence of factors that span multiple sectors. The construction sector is a prominent factor in the risen demand for epoxy resins in the United States. Epoxy resins are widely used in construction materials, including coatings, adhesives, and sealants. Aerospace and defense companies of the United States need high-performance materials, including adhesives, coatings, and aircraft ingredients. These industries make significant utilization of epoxy resins, which are well-known for their mechanical strength and lightweight nature.

Epoxy Resin Market Companies

- 3M

- Aditya Birla Management Corp. Pvt. Ltd.

- Atul Ltd

- BASF SE

- Solvay

- Huntsman International LLC

- Kukdo Chemical Co., Ltd.

- Olin Corp.

- Sika AG

- Nan Ya Plastics Corp.

- Jiangsu Sanmu Group Co., Ltd.

- Jubail Chemical Industries LLC

- China Petrochemical & Chemical Corp. (SINOPEC)

- Hexion

- Kolon Industries, Inc.

- Techstorm

- NAGASE & Co., Ltd.

Recent Developments

- In March 2025, BASF and Sika collaborated to create a novel amine building block for curing epoxy resins, which is now offered commercially under BASF's Baxxodur EC 151 label. This recent advancement is especially noteworthy for flooring uses, such as in manufacturing facilities, warehouses, and assembly areas, as well as parking structures. Baxxodur EC 151 provides epoxy resin flooring solutions with low viscosity and excellent flow characteristics.

- In February 2025, Superior Materials became the new distributor for Westlake Epoxy in the Northeastern, Mid-Atlantic, and Southeastern regions of the United States. The collaboration was commenced on February 1, 2025. In the new partnership, Superior Materials will take on the role of distributing Westlake Epoxy's EPON™ resins, EPI-REZ™ water-based resins, EPIKURE™ curing agents, and HELOXY™ functional modifiers.

- In February 2025, the board of directors at the Japanese chemical giant Asahi Kasei formally approved a resolution declaring that it will absorb its wholly-owned subsidiary Asahi Kasei Epoxy Corporation into its parent company via an absorption merger. The merger strategy will formally commence on April 1, 2026.

Segments Covered in the Report

By Raw Material

- DGBEA (Bisphenol A and ECH)

- DGBEF (Bisphenol F and ECH)

- Novolac (Formaldehyde and Phenols)

- Aliphatic (Aliphatic Alcohols)

- Glycidylamine (Aromatic Amines and ECH)

- Other

By Application

- Paint & Coatings

- Construction

- Electrical & Electronics

- Wind Turbine & Composites

- Civil Engineering

- Adhesive & Sealants

- Others

By Technology

- Solvent Cut Epoxy

- Liquid Epoxy

- Waterborne Epoxy

- Others

By Sales Channel

- Direct Company Sale

- Direct Import

- Distributors & Traders

- Retailers

By End User

- Building & construction

- Automotive, large & heavy vehicles & railroads

- Aerospace

- Consumer goods (including sporting equipment)

- General industrial

- Wind power

- Marine

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting