What is the Resin Market Size?

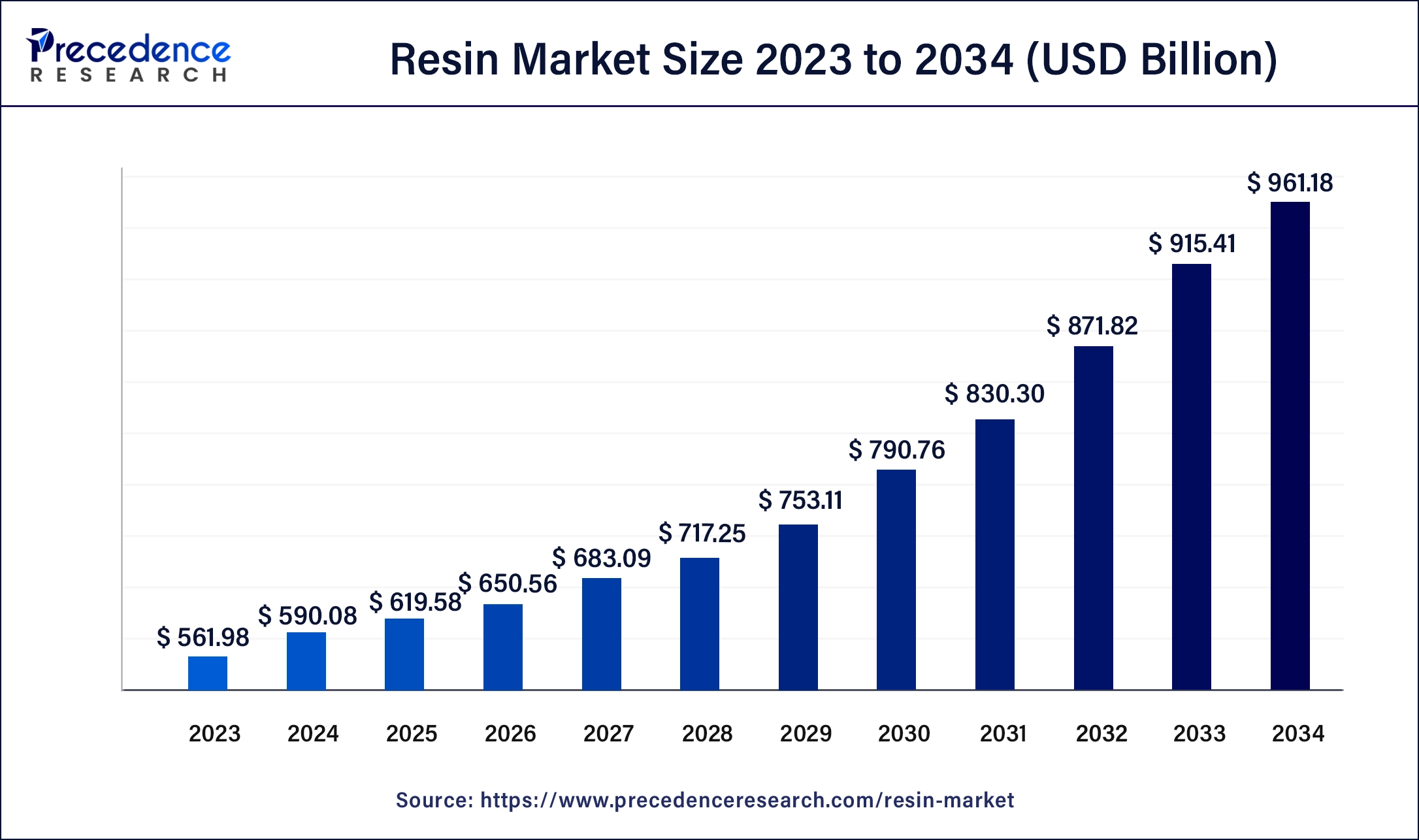

The global resin market size is calculated at USD 619.58 billion in 2025 and is predicted to increase from USD 650.56 billion in 2026 to approximately USD 961.18 billion by 2034, expanding at a CAGR of 5% from 2025 to 2034.

Resin Market Key Takeaways

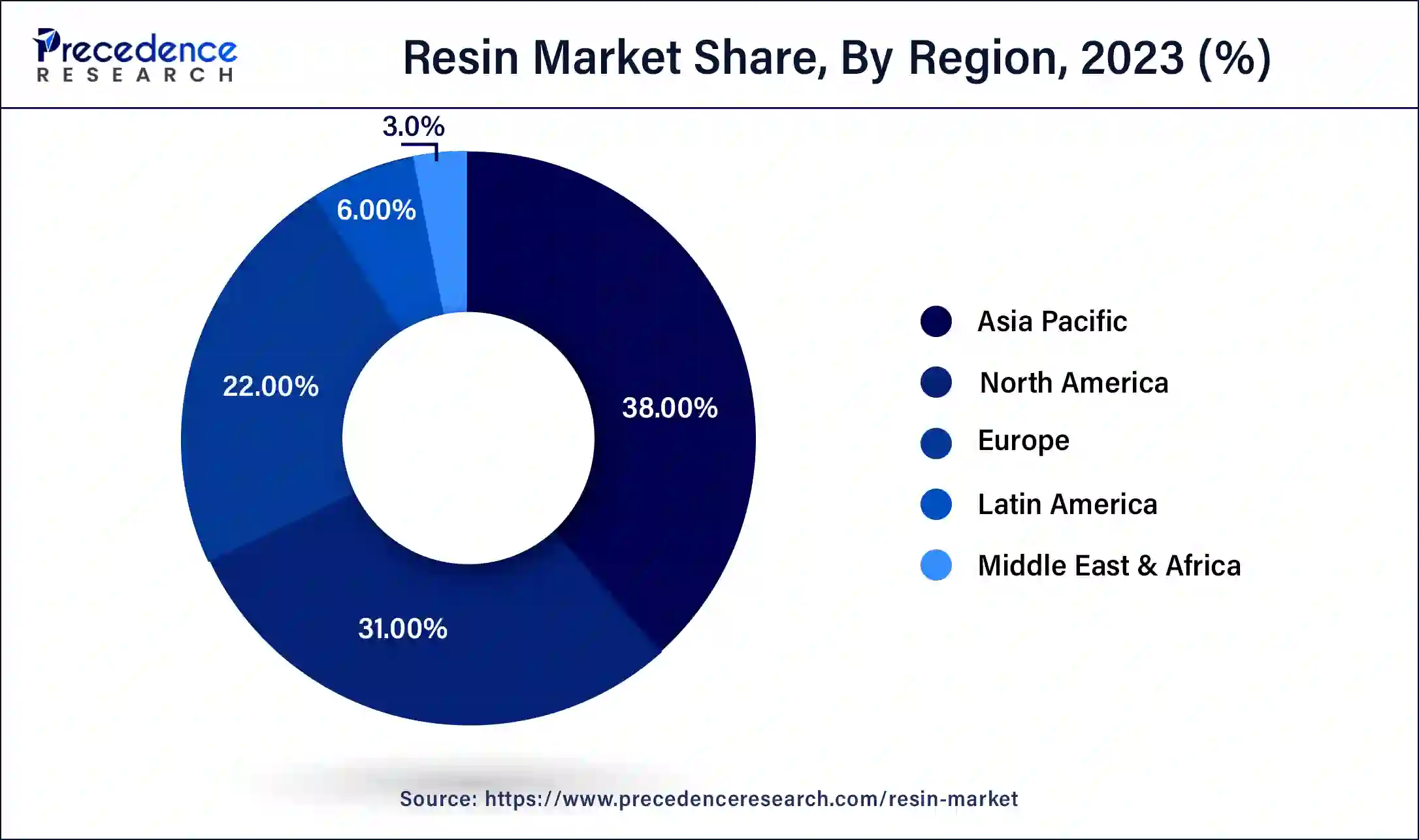

- Asia-Pacific contributed the highest market share of 38% in 2024.

- North America is estimated to expand at the fastest CAGR between 2025 and 2034.

- By type, the polyethylene segment has held the largest market share of 41% in 2024.

- By type, the polyethylene terephthalate segment is anticipated to grow at a remarkable CAGR of 8.3% between 2025 and 2034.

- By end-use industry, the packaging segment generated the highest revenue share of 43% in 2024.

- By end-use industry, the electrical & electronics segment is expected to expand at the fastest CAGR of 8.2% over the projected period.

Market Overview

Resin can be derived from natural sources, such as plant exudates (e.g., tree sap), or they can be synthesized through chemical processes, as in the case of synthetic resins. Its properties may differ widely depending on their composition and intended use. Natural resins have been used for centuries in various applications, while synthetic resins have become increasingly vital in modern industry due to their versatility and controllable properties.

The resin market is a significant component of the global chemical and materials industry, and its growth and trends can be indicative of broader economic and technological developments. Resin is a broad and versatile class of natural or synthetic organic compounds that are typically solid or highly viscous substances, often with an amorphous or glassy appearance. Its ability to become harden & rigid and may exhibit a glossy or translucent surface when subjected to various chemical or physical processes and plays a crucial role in various manufacturing sectors, such as automotive, construction, packaging, and consumer goods.

Resin Market Outlook

- Industry Growth Overview:The resin market is expected to grow at a robust rate between 2025 and 2034, driven by increasing demand for engineering plastics, epoxy resins, and unsaturated polyester resins across various end-use sectors. The automotive industry is adopting lightweight, high-strength polymers to improve fuel efficiency, while the electronics industry relies on high-performance resins to produce circuit boards, connectors, and insulation materials. Moreover, there is an increase in investments in 3D printing and additive manufacturing, which boosts demand for high-quality resins used to produce prototypes and final parts.

- Sustainability Trends:Sustainability is becoming a key factor in the resin industry, with a noticeable move toward bio-based and recyclable polymers. Major resin producers like BASF, Arkema, and SABIC are increasing their R&D efforts to develop resins with lower carbon footprints and improved recyclability. Regulatory requirements, especially in the European Union and North America, are encouraging the development of green resins and eco-friendly formulations.

- Global Expansion:Resin manufacturers are strategically expanding operations to meet demands in emerging regions and streamline supply chains. The main focus areas include Southeast Asia, India, and Latin America, where the automotive, construction, and packaging industries are seeing rising consumption. Companies are setting up new production facilities, increasing capacities, and establishing local research and development centers to cater to local preferences and reduce logistics costs. Additionally, LyondellBasell and Covestro are boosting their polymer production capacity in the Asia-Pacific to supply the growing demand for polyolefins and engineering resins.

- Major Investors:Major investors in the resin market include large chemical and petrochemical corporations, such as BASF SE, Dow Inc., SABIC, LyondellBasell Industries N.V., and ExxonMobil Chemical Company, which reinvest profits to expand production capacity, diversify resin offerings (thermoplastics, thermosets, bio-based resins), and enhance global supply chains. Their investments fuel research and development of innovative, high-performance, and sustainable resins that support adoption across automotive, packaging, construction, electronics, and other major end-use industries, thereby driving overall market expansion.

- Startup Ecosystem:The startup ecosystem in the market is expanding rapidly, with new companies focusing on sustainable, high-performance, and specialized polymer solutions. Startups are creating bio-based resins from renewable feedstocks, recyclable polymer formulations, and advanced engineering plastics used in aerospace, automotive, and electronics industries. Origin Materials (U.S.), Avantium (Netherlands), and Futerro (Belgium) are all attracting venture capital and government grants to increase sustainable resin production, further boosting the market.

Resin Market Growth Factors

- Increasing demand for plastics: As one of the primary uses of resins, the growing demand for plastics in various industries, including packaging, automotive, construction, and consumer goods, drives the resin market. It offers lightweight and durable materials, as well as the replacement of traditional materials with plastics, that contributes to the growth of the market.

- Advancements in resin technology: Ongoing research and development efforts to improve resin formulations, enhance their performance characteristics, and develop eco-friendly and sustainable options are driving growth. Innovations in resin technology can lead to new applications and expanded market opportunities.

- Construction and building sector: Resins are widely used in construction for adhesives, sealants, and coatings. Its growth is driven by urbanization, infrastructure development, and renovation projects. Therefore, it provides opportunities for the resin market.

- Automotive industry: Resins are used in automotive components, including lightweight composites, adhesives, and coatings. These factors further help in growth of the automotive industry and contributes to increased demand for resins.

- Packaging industry: Resins play a significant role in the packaging industry, where lightweight and durable materials are essential. E-commerce and the food & beverage sector are key drivers for the growth in the packaging market. This way it further provides opportunities for the resins market.

- Aerospace and defense: Resins are used in composites for aircraft and military equipment. The expansion of the aerospace and defense sector, particularly for lightweight and high-performance materials, stimulates demand for resins.

- Renewable energy and electronics: Resins are used in various components of renewable energy systems and electronic devices. The growth of renewable energy sources and the electronics industry can lead to increased resin demand.

- Consumer goods and appliances: Resins are used in the production of a wide range of consumer goods, from appliances to electronics. Changing consumer preferences and rising disposable incomes can drive market growth in this sector.

- Environmental regulations: Increasing environmental awareness and regulations aimed at reducing the use of hazardous materials can create opportunities for eco-friendly and sustainable resin alternatives.

- Healthcare and medical devices: Resins are used in medical devices and healthcare products. The growing healthcare sector, especially in the context of an aging population, can drive demand for specialized medical-grade resins.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5% |

| Market Size in 2025 | USD 619.58 Billion |

| Market Size in 2026 | USD 650.56 Billion |

| Market Size by 2034 | USD 961.18 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type and By End-use Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Increasing use of plastics

Plastics have become ubiquitous in various industries due to their versatility, cost-effectiveness, and durability. This pervasive presence of plastics is intrinsically linked to the resin market because resins are the fundamental building blocks of plastic materials. Several sectors such as packaging and plastics provide durable, lightweight, and cost-efficient solutions.

The surge of e-commerce and the rising demand for efficient and sustainable packaging options have led to an increase in the use of plastic materials that has further drive demand for resins. Similarly, the automotive industry has observed a mounting reliance on plastics to decrease vehicle weight and increase fuel efficiency. The resins are used to manufacture numerous automotive components, comprising adhesives, lightweight composites, and coatings.

Moreover, construction and infrastructure projects operate resins for coatings, adhesives and sealants, this demand is closely tied to the construction industry's expansion driven by urbanization and infrastructure development. The increasing demand for resins in various industries or sectors will further drive demand for the resins market.

The versatility of resins in replying to the distinctive requirements of these various industries makes them a vital component in the growing demand for plastic-based products. As industries continue to seek cost-effective, lightweight, and environmentally sustainable solutions, the use of plastics and resins is expected to rise, further propelling the growth of the resin market.

Restraint

Increasing environmental awareness

Environmental concerns, coupled with regulatory pressures, are shifting the focus towards sustainable and eco-friendly alternatives, which may disrupt traditional resin consumption patterns. Push for reduced plastic usage and the drive to mitigate plastic pollution is one of the primary factors restraining the demand for the resin market. Consumers are gradually seeking products and packaging that are recyclable, biodegradable, and less harmful to the environment. This shift in consumer behavior has driven various industries to discover substitutes to traditional resins, such as bio-based resins and compostable materials. Thus, the demand for conventional resins, particularly single-use plastics, may decline.

Furthermore, environmental regulations are also becoming more stringent. Governments and international bodies are imposing restrictions on the use of certain types of resins, particularly those that are non-recyclable or pose environmental risks. For instance, in March 2023, according to the environmental protection agency, eastman chemical resins Inc. will pay a penalty worth $2.4 million to resolve alleged environmental violations at its manufacturing facility. Manufacturers are under pressure to meet these regulations, which can necessitate costly reformulations of resin products and reduce their market appeal.

Moreover, recycling initiatives and the circular economy principles encourage the use of recycled resins, diverting demand away from new resin production. As recycling infrastructure improves and the quality of recycled resins increases, businesses are likely to favor these sustainable options. The resin market, in response, is evolving towards eco-friendly solutions.

Manufacturers are investing in research and development to create biodegradable and recycled resin alternatives, while also working on improving the recyclability of traditional resins. While these environmental constraints pose challenges, they also present opportunities for the resin market to innovate and adapt to meet the demands of a more environmentally conscious world.

Opportunity

Development and adoption of biodegradable and sustainable resins

The development and adoption of biodegradable and sustainable resins present a transformative opportunity for the resins market, driven by the growing global emphasis on environmental responsibility and sustainability. These innovative resins, often derived from renewable sources, offer several key advantages, making them a compelling choice for both businesses and consumers. Biodegradable and sustainable resins address the pressing issue of plastic pollution. With traditional plastics contributing to long-lasting environmental harm, these eco-friendly alternatives break down naturally over time, significantly reducing the burden on landfills and oceans.

The desire to mitigate such harm has fueled widespread interest and demand for these resins. Regulatory support further bolsters this opportunity. Governments and international organizations are introducing policies and regulations to limit the use of non-sustainable plastics. These regulations create a favorable environment for the development and adoption of biodegradable resins, as they align with the broader goal of environmental protection.

Consumer sentiment plays a pivotal role as well. The modern consumer is increasingly eco-conscious, actively seeking products and packaging that reflect their environmental values. Biodegradable and sustainable resins cater to this demand, offering a tangible way for companies to demonstrate their commitment to eco-friendly practices and win over environmentally conscious consumers. For instance, in August 2023, DIC Corporation launched environment-friendly waterborne polyurethane resins of HYDRAN GP series. These new resins decrease greenhouse gas emissions and unstable organic compounds (VOCs).

Moreover, the adoption of these resins is not limited to specific industries. They have applications in diverse sectors, from packaging and consumer goods to agriculture and healthcare. This versatility broadens the market's scope and potential, creating opportunities for resin manufacturers and suppliers to diversify their product offerings and target new customer segments. Thus, the development and adoption of biodegradable and sustainable resins represent a pivotal shift in the resins market, offering a pathway to ecological responsibility, regulatory compliance, and heightened consumer appeal. Companies that seize this opportunity can position themselves as leaders in a more sustainable and environmentally conscious future.

- In December 2024, Symphony Environmental launched biodegradable resin for the plastics industry. The company says its new resin reduces the fossil content of plastic and can be recycled, but biodegrades within months if it escapes into the natural environment. NbR comprises 20 percent non-fossil natural compounds and is suitable for making a wide variety of packaging, carrier bags, and garbage bags.

Segment Insights

Type Insights

In 2024, the polyethylene segment had the highest market share of 41% on the basis of the type. Polyethylene is one of the most widely used plastics. It comes in various forms, such as HDPE (high-density polyethylene) and LDPE (low-density polyethylene), and is employed in applications like packaging, pipes, and plastic bags.

The polyethylene terephthalate (PET) segment is anticipated to expand at a CAGR of 8.3% over the projected period. This is due to PET being a versatile resin commonly used for the production of beverage bottles, food packaging, synthetic fibers, and various consumer goods. Its properties include transparency, lightweight, and excellent gas barrier properties.

End-use Industry Insights

In2024, the packaging segment had the highest market share of 43% on the basis of the end-use industry. The packaging industry is a significant consumer of resins. Resins are used to manufacture a wide range of packaging materials, such as plastic bottles, containers, films, and closures, ensuring product protection, shelf life, and transportation efficiency.

The electrical & electronics segment is anticipated to expand fastest over the projected period at a CAGR of 8.2%. The electrical and electronics industry relies on resins for encapsulating and insulating electronic components, circuit boards, and connectors. Resins are essential for protecting electronics from moisture, heat, and other environmental factors.

Regional Insights

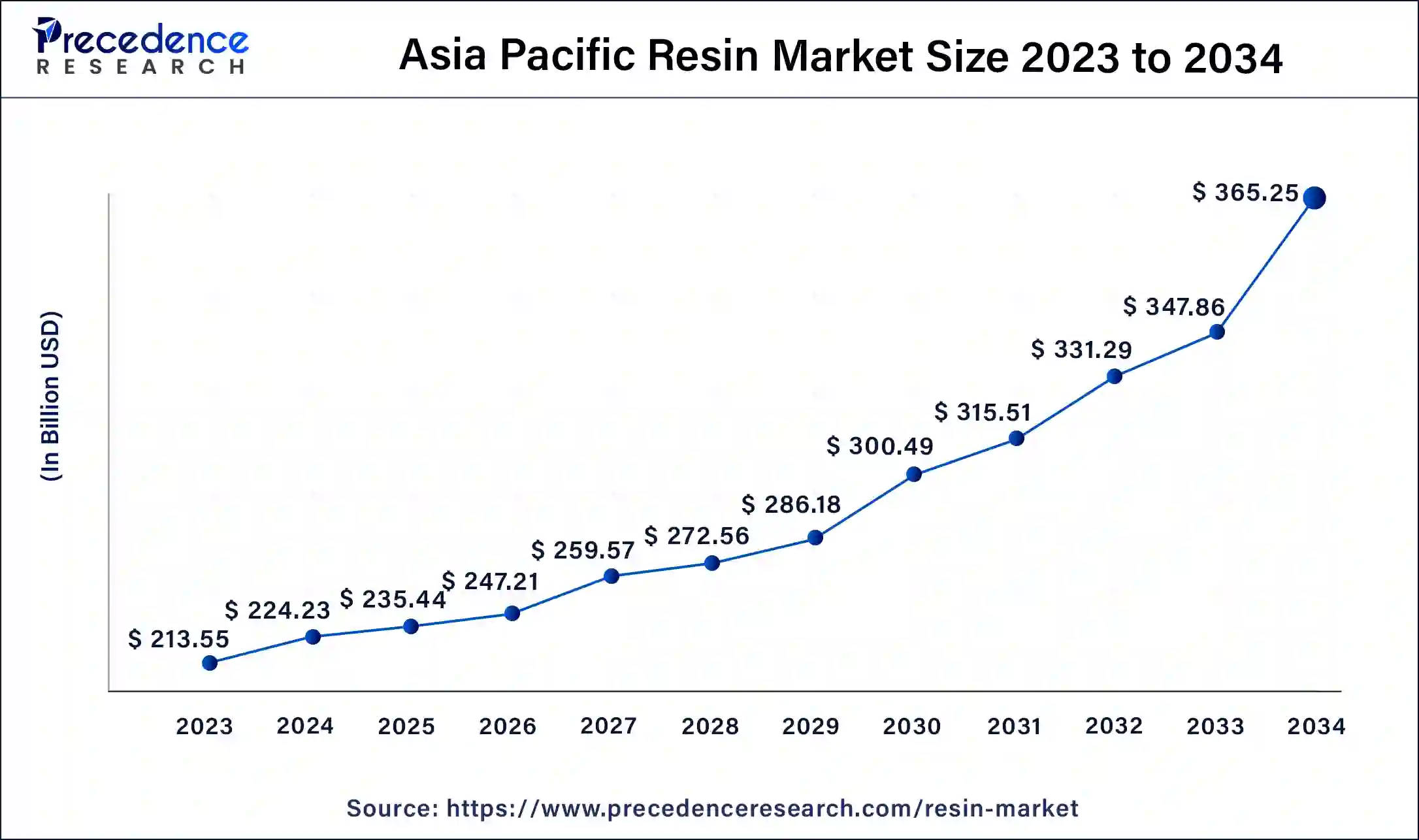

Asia Pacific Resin Market Size and Growth 2025 to 2034

The Asia Pacific resin market size is estimated at USD 235.44 billion in 2025 and is predicted to be worth around USD 365.25 billion by 2034, at a CAGR of 5.10% from 2025 to 2034.

Asia-Pacific has held the largest revenue share of 38% in 2024. The packaging sector, including the production of plastic bottles, containers, and flexible packaging, was a major consumer of resins in the Asia-Pacific region. The demand for convenient and lightweight packaging materials continued to rise. Therefore, Asia-Pacific played a pivotal role in the global resin market due to its significant manufacturing capacity, diverse industries, and the presence of emerging economies.

- In March 2025, Thermax collaborated with Brazil-based OCQ to establish a new company in India. Thermax will hold a majority stake of 51 percent, and OCQ will own 49 percent. The joint venture will produce acrylic resins, helping both companies grow their global presence in the chemicals market.

China Resin Market Trends

China is a major contributor to the market in Asia Pacific due to rapid industrialization, urbanization, and expanding end-use sectors. Automotive, electronics, packaging, and construction industries are driving demand for polyethylene, polypropylene, epoxy, and unsaturated polyester resins. The market growth is projected to be further driven by high demand for sustainable, high-performance resins in electric cars and consumer electronics. The country also hosts extensive petrochemical and polymer production facilities, which contribute to market growth.

What Makes North America the Fastest-Growing Region in the Resin Market?

North America is estimated to observe the fastest expansion. This is due to the growing emphasis on sustainable and environmentally friendly resins in North America, driven by increasing environmental awareness and regulatory measures. The development and adoption of biodegradable and recycled resins drive demand for the resin market across the region.

- In March 2025, Mallinda Inc., a global developer of vitrimer resin systems, announced the commercial launch of Vitrimax Versatile Hot Melt (VHM) resin, a vitrimer-based composite resin system. According to the company, this technology combines the optimal mechanical properties of thermosets with the processing flexibility of thermoplastics.

U.S. Resin Market Trends

The U.S. is a major player in the North American market. The U.S. market is driven by strong demand in the automotive, aerospace, electronics, and construction industries. Growth is fueled by the increasing adoption of electric vehicles and renewable energy, as well as the use of lightweight engineering plastics and epoxy resins. Additionally, the U.S. is expected to sustain steady demand growth, supported by the expanding industrial sector and rising demand for high-performance polymers across various applications.

What Potentiates the Growth of the Resin Market in Europe?

The market's growth in Europe is mainly due to its stringent environmental regulations. These regulations have a substantial impact on the resin market, encouraging the development and use of eco-friendly and sustainable resins. Moreover, the automotive and aerospace industries utilized resins for light weighting and performance enhancements. Resins were employed in various components, including interior materials and composites for aircraft. Thus, these factors further drive demand for the resin market across the region.

Germany Resin Market Trends

Germany leads the market, driven by growing demand for resin in automotive, electronics, and industrial sectors. The strict EU environmental laws are also expected to drive the demand for bio-based and recyclable resins. The growing use of light- and energy-resistant materials in the automotive and construction industries is expected to drive demand for epoxy, polyester, and polycarbonate resins.

How is the Opportunistic Rise of Latin America in the Resin Market?

Latin America is expected to experience an opportunistic rise in the market, supported by increasing industrial production and expanding automotive and construction sectors. There is high demand for polyethylene, polypropylene, and polyester resins, especially in Brazil, Mexico, and Argentina, due to a large industrial base. Furthermore, the innovation of bio-based resins and environmentally compliant production processes is likely to contribute to regional market growth.

Brazil Resin Market Trends

Brazil is considered a major player in the Latin American market. The market in Brazil is driven by growth in the automotive, construction, packaging, and consumer goods industries. The increased use of polyethylene, polypropylene, and polyester resins in packaging and industrial applications also drives market growth. The country also boasts a well-developed chemical production infrastructure and state-of-the-art manufacturing facilities, which enhance the availability and quality of the resin products, thereby driving market growth.

What Opportunities Exist in the Middle East & Africa for the Resin Market?

The Middle East & Africa (MEA) offers significant market opportunities, driven by abundant petrochemical feedstock and expanding industrial applications. Saudi Arabia, the UAE, and South Africa are key countries contributing to regional demand, due to their expanding construction, automotive, and packaging industries. Moreover, the rapid industrialization and infrastructure development across the region are likely to support market growth.

Saudi Arabia Resin Market Trends

Saudi Arabia is a major contributor to the Latin American resin market, as one of the world's largest producers and exporters of petrochemical-based resins, supplying significant volumes of polyethylene, polypropylene, and other polymers to Latin American manufacturers. Its competitive production costs, large-scale petrochemical infrastructure, and strong trade links with countries such as Brazil, Mexico, and Argentina make Saudi Arabia a key external supplier to the region's packaging, construction, automotive, and consumer goods industries.

Resin Market – Value Chain Analysis

1. Raw Material Sourcing

The production of resins begins with the procurement of primary feedstocks such as crude oil, natural gas derivatives, and monomers like ethylene, propylene, styrene, and vinyl acetate. These raw materials form the foundation for various resin types, including polyethylene, polypropylene, epoxy, and unsaturated polyester resins.

- Key Players: SABIC, LyondellBasell, ExxonMobil, INEOS, Dow Inc.

2. Monomer & Intermediate Production

Raw feedstocks are chemically processed into monomers or intermediates that serve as building blocks for polymerization. This step ensures high-purity intermediates essential for consistent resin quality.

- Key Players: Mitsui Chemicals, Mitsubishi Chemical, Arkema, BASF, Sumitomo Chemical

3. Polymerization & Resin Manufacturing

Monomers are polymerized and compounded to produce a range of resins with specific properties tailored for applications in the automotive, construction, electronics, and packaging industries.

- Key Players: Toray Group, Teijin Limited, Radici Group, Hexion, Tosoh Corporation

4. Formulation & Additives Integration

Resins are enhanced with additives such as stabilizers, flame retardants, colorants, and fillers to improve performance characteristics like heat resistance, durability, UV stability, and mechanical strength.

- Key Players: Clariant, Covestro, Solvay, Sika AG

5. Distribution & End-User Applications

Finished resin products are distributed to manufacturers across sectors like automotive, electrical & electronics, construction, and consumer goods for final product fabrication.

- Key Players: Arkema, BASF, DuPont, Nova Chemicals, LyondellBasell

Resin Market Companies

- Arkema (France): Arkema is a leading specialty materials and chemicals company, offering high-performance resins for automotive, construction, and electronics applications.

- BASF SE (Germany): BASF produces a wide range of resins, including engineering plastics, polyurethanes, and coatings, serving diverse industries worldwide.

- DuPont (U.S.): DuPont provides advanced polymer and resin solutions, focusing on high-performance applications in automotive, electronics, and industrial sectors.

- Mitsubishi Engineering-Plastics Corporation (Japan): This company specializes in high-performance engineering plastics and resins for industrial and consumer applications.

- Mitsui Chemicals (Japan): Mitsui Chemicals develops resins and polymers for packaging, automotive, healthcare, and electronics markets.

- Nova Chemicals (Canada): Nova Chemicals offers polyethylene and other resin products for packaging, consumer goods, and industrial applications.

- Invista (U.S.): Invista manufactures polymer resins and nylon solutions used in textiles, automotive components, and engineering plastics.

- LyondellBasell (Netherlands): LyondellBasell produces polyolefin resins and specialty polymers for packaging, automotive, and construction applications.

- Qenos (Australia): Qenos supplies polyethylene resins and innovative polymer solutions for flexible packaging, pipes, and industrial applications.

- INEOS Holdings Ltd. (U.K.): INEOS is a major producer of resins and petrochemical derivatives for automotive, construction, and industrial markets.

- Teijin Limited (Japan): Teijin specializes in high-performance resins and polymers for automotive, electronics, and healthcare sectors.

- Tosoh Corporation (Japan): Tosoh develops resins and specialty polymers for electronics, industrial applications, and packaging.

- Toray Group (Japan): Toray provides advanced resin materials and engineering plastics for aerospace, automotive, and electronics industries.

- Hexion (U.S.): Hexion offers thermoset and epoxy resins used in coatings, adhesives, composites, and construction materials.

- Radici Group (Italy): Radici Group manufactures engineering plastics and specialty resins for automotive, textile, and industrial applications.

- SABIC (Saudi Arabia): SABIC produces a wide range of polyolefin and engineering resins for packaging, automotive, and construction industries.

- Repsol (Spain): Repsol supplies high-quality resins and polymers for industrial applications, including coatings, adhesives, and packaging.

- Sumitomo Chemical Co. Ltd. (Japan): Sumitomo develops advanced resins and polymers for electronics, automotive, and industrial sectors.

Recent Developments

- In June 2024, Ecolab announced that its Purolite resin business, together with Repligen Corporation, had commercially launched Purolite's DurA Cycle, a protein A chromatography resin for large-scale purification processes. This new affinity resin is being introduced at the BIO International Convention, held from June 3 to 6 in San Diego.

- In October 2024, polySpectra, a 3D printing materials producer, launched its latest product, Cyclic Olefin Resin (COR) Zero, through a Kickstarter campaign. With this launch, the company is offering consumers a manufacturing-grade material that can be used with affordable resin 3D printers.

- In April 2025, Waterline Renewal Technologies, a leader in innovative pipeline rehabilitation solutions, announced the introduction of LightRay High-Temperature UV Resin, a new high-performance UV-cured in-place pipe (CIPP) resin specifically designed for high-temperature applications.

- November 2023: Raise3D launched its new DF2 Solution. With this, the company marked its debut in photopolymer resin 3D printing and expanded its portfolio of professional and industrial 3D printing.

- November 2023: Lubrizol and Grasim Industries Limited, launched a 100,000 metric-ton CPVC resin plant in Vilayat, Gujarat. The project helps in catering mounting CPVC demand in India and neighboring countries such as Indonesia, Nepal, and Bangladesh.

- September 2023: Montachem partnered with Loliware to launch seaweed based resins into European market.

Segments Covered in the Report

By Type

- Polycarbonate

- Polyurethane

- Polyvinyl Chloride

- Acrylonitrile Butadiene Styrene

- Polystyrene

- Polypropylene

- Polyethylene Terephthalate

- Polyethylene

- Polyamide

- Others

By End-use Industry

- Automotive & Transportation

- Building & Construction

- Packaging

- Agriculture

- Consumer Goods/Lifestyle

- Electrical & Electronics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting