Specialty Polystyrene Resin Market Size and Forecast 2025 to 2034

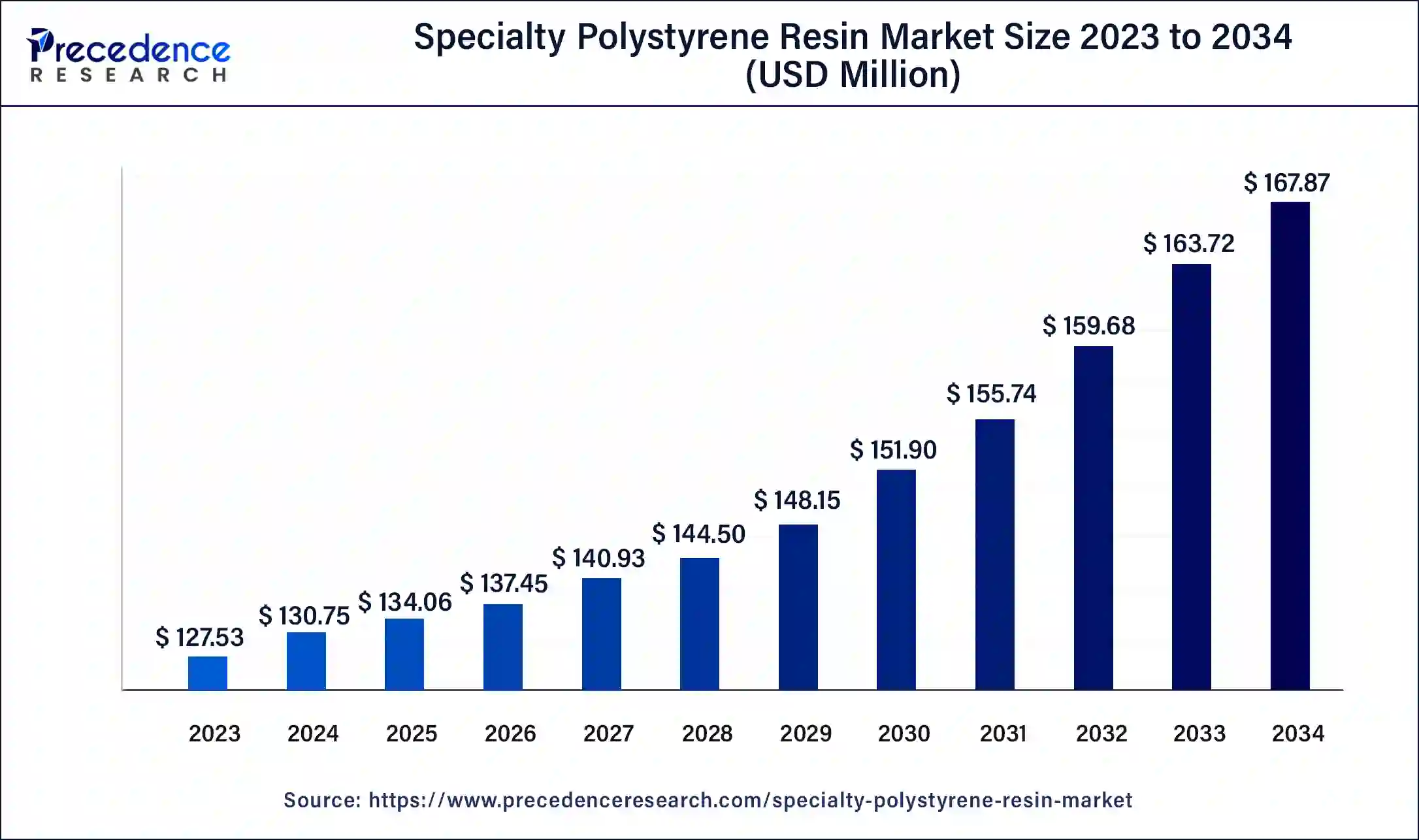

The global specialty polystyrene resin market size was estimated at USD 130.75 million in 2024 and is predicted to increase from USD 134.06 million in 2025 to approximately USD 167.87 million by 2034, expanding at a CAGR of 2.53% from 2025 to 2034. Rising usage of eco-friendly polystyrene by end-use industries to reduce greenhouse gas emissions is the key factor driving the growth of the specialty polystyrene resin market

Specialty Polystyrene Resin Market Key Takeaways

- In terms of revenue, the global specialty polystyrene resin market was valued at USD 130.75 million in 2024.

- It is projected to reach USD 167.87 million by 2034.

- The market is expected to grow at a CAGR of 2.53% from 2025 to 2034.

- Asia Pacific dominated the specialty polystyrene resin market in 2024.

- North America is expected to show the fastest growth in the market over the studied period.

- By function, the protection segment dominated the market in 2024.

- By function, the durability segment is expected to grow at the fastest rate in the market over the forecast period.

- By application, the protective packaging segment led the market in 2024 and is expected to grow rapidly during the forecast period.

- By end-use industry, in 2023, the packaging segment dominated the market and is anticipated to grow further over the projected period.

Market Overview

Specialty polystyrenes are the kind of polystyrenes that are designed for high-performance applications. These are fabricated with special additives and raw materials using innovative production techniques and improved properties. Specialty polystyrenes are a combination of less dense cells, and their cross-linked behavior gives them a better strength-to-weight ratio than polystyrene. The specialty polystyrene resin market products are utilized in different industries like automotive & transportation, building & construction, electrical & electronics, and others.

Role of AI in the specialty polystyrene resin market

AI particularly manages resin drying airflows and helps save energy in the specialty polystyrene resin market. AI-driven logic increases airflow through each active hopper plotted on changes in bulk flow and temperature. When the material at the bottom achieves the proper temperature, the Optimizer logic adjusts the airflow incrementally to match the actual processing rates along with the material drying requirements. Furthermore, AI-driven logic can dial back and rebalance the flows for unused hoppers, too.

- In January 2023, Ai Build, a SaaS company developing AI-based software for additive manufacturing, announced the introduction of ‘Talk to AiSync' NLP for additive manufacturing. This NLP or Natural Language Processing system will be able to operate similarly to a generative pre-trained transformer (GPT), giving a 3D printer slicing instructions.

Specialty Polystyrene Resin Market Growth Factors

- Rapid growth in the automobile sector is expected to fuel market growth shortly.

- Growing demand for its application in thermal insulation systems can boost market growth further.

- The rising demand for specialty polystyrene resins from medical laboratories and pharmaceuticals is anticipated to fuel market growth.

- Growing demand for packaged and ready-to-cook foods can propel market growth further.

- Market players' increasing R&D activities will likely contribute to market expansion shortly.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 167.87 Million |

| Market Size in 2024 | USD 134.06 Million |

| Market Size in 2024 | USD 130.75 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 2.53% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Function, Application, End-use Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing use of styrene polymers

The expansion of specialty polystyrene resin in the medical industry is mainly driven by the rising utilization of styrene polymers as PVC alternatives. Styrenic polymers are used primarily in the healthcare field to manufacture lightweight and high-performance medical devices. Additionally, the growing use of these polymers in the automotive industry is one of the key factors driving the growth of the market over the forecast period.

- In May 2024, Sabic collaborated with Kraton for certified renewable butadiene to produce certified renewable styrenic block copolymers. The new collaboration with Kraton will deliver certified renewable butadiene from Sabic's Trucircle portfolio for use in Kraton's certified renewable styrenic block copolymers (SBC).

Restraints

Strict quality requirements

Complying with strict quality needs raises the complexity and cost of the production process of the specialty polystyrene resin market application, particularly in the electronic and automotive sectors. Moreover, investments in quality control and technology are important to meet these criteria.

Opportunity

Development of sustainable and biodegradable materials

The focus on developing sustainable and environmentally friendly products generates a wide range of opportunities for the development of special biodegradable products in the specialty polystyrene resin market. These products can fulfill the increasing need for environmentally friendly options for several applications. Furthermore, major market players are investing in biodegradable alternatives such as polystyrene. This investment is meant to decrease the environmental impact of plastics.

- In February 2024, global packaging solutions provider SEE developed the first biobased, industrial compostable tray for protein packaging that has been successfully tested to meet the demands of existing food processing equipment. SEE's new CRYOVAC brand compostable overwrap tray is made from biobased, food-contact grade resin, which is USDA-certified as having 54% biobased content chemically derived from renewable wood cellulose.

Function Insights

The protection segment dominated the specialty polystyrene resin market in 2024. The dominance of the segment can be attributed to the increasing use of polystyrene to protect products or components from shock, handling, and damage during transportation. Protection can also be found in packaging materials, including corner doors, foam insulation, and fixtures. The protection can safeguard fragile items and valuables from loss during delivery and handling.

The durability segment is expected to grow at the fastest rate in the specialty polystyrene resin market over the forecast period. This is because the durability of the material stabilizes and minimizes the impact of changes in products to increase their shelf life which is necessary for the long-term suitability of products. Additionally, durability offers maximum impact resistance to products which can affect their quality positively.

Application Insights

The protective packaging segment led the specialty polystyrene resin market in 2024 and is expected to grow rapidly during the forecast period. The growth and dominance of this segment can be linked to the increasing demand for sustainable and efficient packaging solutions to meet consumer demand. Furthermore, increasing e-commerce coupled with the growing application of protective packaging solutions in various end-user industries is propelling segment growth further.

- In February 2022, Pregis launched carbon-neutral film for protective packaging. Pregis, based in the Netherlands, is bringing its sustainability focus to protective packaging with a new carbon-neutral air-cushioning film called Renew Zero. The polyethylene film is currently only available in Europe.

End-use Industry Insights

The packaging segment dominated the specialty polystyrene resin market in 2024 and is anticipated to grow further over the projected period. The dominance of the segment can be credited to the increasing trend toward sustainable and recyclable packaging. Furthermore, some companies are now manufacturing specialty polystyrene resins from post-consumer recycled polystyrene. These resins also have special properties that are similar to traditional resins, but they don't have hazardous environmental impacts.

- In June 2023, France-based polymer manufacturer TotalEnergies commercially launched its new high-density polyethylene (HDPE) resin that can be used for tethered cap applications. The new solution is named HDPE 20HD07, and features improved mechanical and organoleptic properties. It uses less material than its market reference while providing a similar technical cap performance.

Regional Insights

Asia Pacific dominated the specialty polystyrene resin market in 2023. This growth can be attributed to the raised integration and connectivity in the region's developing nations. Furthermore, the ongoing emergence of new automotive, pharmaceutical, and packaging industries can strengthen this growth further. Also, the rising utilization of plastic packaging in several countries will contribute to the market.

North America is expected to show the fastest growth in the market over the studied period. This is because North America has a good consumer base for the specialty polystyrene resin market. This resin is popular due to its properties, such as flexibility and versatility. Moreover, there is a growth in online shopping, rising demand for effective protective products, and a desire for environmentally friendly and sustainable packaging solutions.

- In January 2024, Midland, Michigan-based Dow Chemical Co. partnered with RKW Group, a German manufacturer of polyolefin-based films, to launch two new grades of resins under Dow's Revoloop recycled plastic resin product offering, including a resin with up to 100 percent postconsumer recycled (PCR) plastic. The two new grades of Revoloop resins are approved for nonfood contact packaging applications.

Specialty Polystyrene Resin Market Companies

- Sumitomo Chemical

- Toray Industries

- Mitsubishi Chemical Corporation

- Asahi Kasei

- Formosa Plastics Coporation

- ExxonMobil

- China Petrochemical Corporation

- BASF

- TotalEnergies

- Sinopec

- LG Chem

- Braskem

- SABIC

- Styron

- INEOS Styrolution

Recent Developments

- In September 2023, R-Hybrid, the first commercial cup made from recycled polystyrene, will be presented at Plast by FLO Group and Versalis.

- In September 2022, SABIC made Conventus Polymers, LLC, an authorized distributor across North America for its high-performance engineering thermoplastics. Conventus is reputed for its technical proficiency and strong relationships with OEMs in energy, water management, healthcare, electrical and electronics, and other important industries. The company joins Chase Plastic, Nexeo, and Amco Polymers as official distributors of SABIC's line of specialty materials.

- In August 2022, Kraton Corporation and Formosa Petrochemical Corporation acquired a joint venture of HSBC in Mailiao, Taiwan. This project will increase the capacity of the current facility by 30%. Upon completion of this expansion project, Kraton will be able to offer all its SEBS and SEPS products in crumbs and pellet form to customers in Asia using Kraton's most up-to-date technology.

- In March 2022, BASF grew its selection of graphitic expandable polystyrene (EPS) granulate by launching Neopor F5 McycledTM. This cutting-edge solution integrates 10% recycled material and is suitable for multiple construction uses, particularly for insulating building facades. By utilizing extrusion technology, the company has enhanced the durability and insulation capabilities of its products.

Segments Covered in the Report

By Function

- Protection

- Durability

- Insulation

- Cushioning

- Others

By Application

- Protective Packaging

- Building and Construction

- Automotive and Transportation

- Electrical and Electronics

- Healthcare

By End-use Industry

- Packaging

- Electronics

- Automotive

- Construction

- Healthcare

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting