What is the Specialty Polymer Market Size?

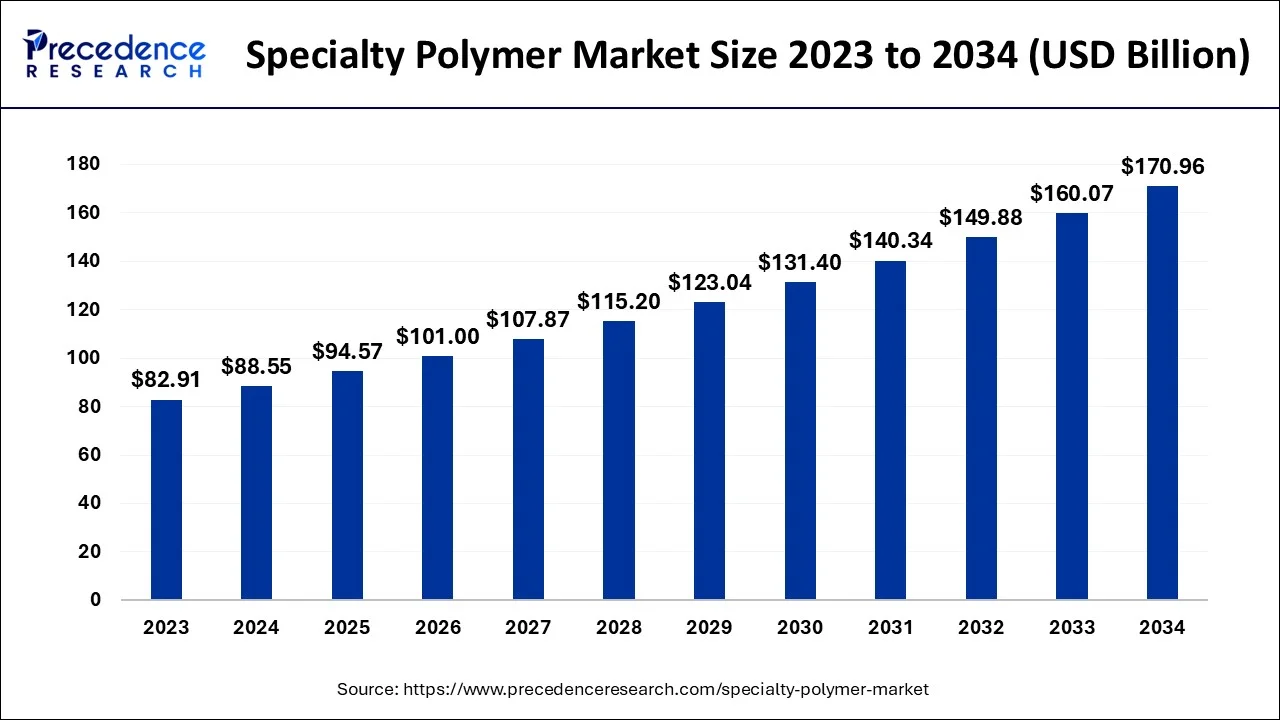

The global specialty polymer market size is calculated at USD 94.57 billion in 2025 and is predicted to increase from USD 101 billion in 2026 to approximately USD 181.38 billion by 2035, expanding at a CAGR of 6.73% from 2026 to 2035.

Specialty Polymer Market Key Takeaways

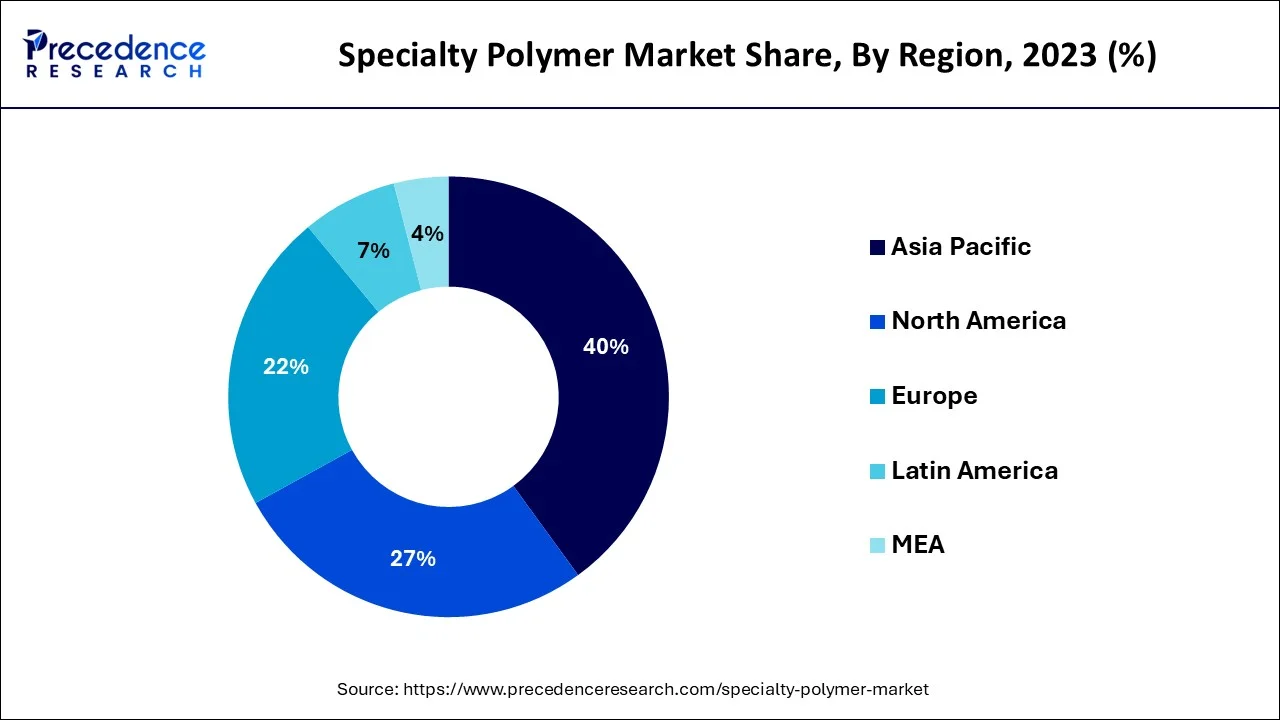

- Asia Pacific dominated the nitric acid market with a share of 40 in 2025

- In 2023, By type, the elastomers segment held the greatest market share.

- By end use, the automotive segment is growing at a CAGR of 8.9%.

- More than 80% of businesses in the automobile and allied industries claim that the coronavirus will directly affect their 2025 sales.

Market Overview

The expansion of the electronics and construction industries is anticipated to increase demand for specialty polymers globally. The demand for high-performance polymers in specialized settings is also expected to increase throughout the projected period due to their enhanced endurance limit, electrical insulation, corrosion resistance, resistance to wear, and thermal stability. However, it is anticipated that price volatility for the raw ingredients used to make specialized polymers would be a major market restraint. The difficulty for the companies in the specialty polymers market is to keep up with the changes and alter their products in line with the constantly shifting demands of the end-use industries and technical breakthroughs in the application sectors. Given the aforementioned nature of the sector, there may be tremendous growth prospects for the market in the next years.

In order to provide polymers with the appropriate qualities for improved performance, specialty polymers are employed as polymeric additives. These are now utilized in lower amounts but are priced more for the customer. Construction, electronics, pharmaceuticals, and the automotive sectors are just a few of the many fields in which specialty polymers may be employed. In 2013, the demand for specialized polymers was mostly driven by the construction and electronics industries, which are also predicted to develop at the quickest rates going forward. A new trend in the market for specialty polymers is the customization of goods to meet the needs of a particular application as opposed to improving the overall product features. To generate possibilities in the specialty polymers market throughout the course of the forecast period, businesses should integrate digitally linked processes and concentrate on operational efficiency, supply source diversification, and cost control. Understanding and assessing the specialty polymers market landscape is complicated by the uneven recovery in various end markets and regions.

Specialty Polymer Market Growth Factors

The demand for the specialty polymer market is expected to increase due to growing industrial and construction projects with high standards of design and an emphasis on developing dependable and lasting buildings to prevent early repairs. One of the key reasons propelling the growth of the specialty polymer market is the rising awareness among multiple industries regarding such polymers that give great performance in challenging conditions without impairing particular activities.

Market Outlook

- Industry Growth Overview: The specialty polymer market is rapidly expanding, driven by high-performance applications, technological innovations, and growing demand across automotive, healthcare, and electronics industries.

- Global Expansion:The market is growing worldwide due to increasing demand from industries such as automotive, electronics, and healthcare, which require high-performance, lightweight, and durable materials. Emerging regions offer immense growth opportunities, driven by the rising adoption of sustainable and biodegradable polymers and expanding applications in packaging, construction, and renewable energy sectors.

- Major Investors: Major investors in the market include large chemical companies, private equity firms, and government-backed innovation funds, such as Dow, BASF, LyondellBasell, SABIC, and Covestro. They contribute by funding research and development of advanced polymer formulations, expanding production capacities, establishing global supply chains, and supporting sustainable and high-performance polymer applications across industries, which accelerates market growth and adoption.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 94.57Billion |

| Market Size in 2026 | USD 101 Billion |

| Market Size by 2035 | USD 181.38Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.73% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered |

By Type,By End Use |

| Regions Covered |

North America,Europe,Asia-Pacific,Latin America,Middle East & Africa |

MarketDynamics

Key Market Drivers

- Expansion of the aerospace sector - The worldwide market will grow by the aerospace sector, which is expanding primarily in North America as well as Europe. Due to their numerous engineering designable benefits, these materials are frequently used in aerospace applications. These benefits include precise strength characteristics that result in weight savings of 20–40%, the potential for quick process cycles, the capacity to match required dimensional stability, less thermal expansion, and superior fatigue compared to other materials like metals and ceramics. These polymers are the material of choice for many aircraft applications. Such a material may be designed to provide great strength with relatively low weight, resistance to corrosion, and long-term durability under the worst environmental conditions.

- The construction industry's growing demand - When it comes to the usage of these materials in the construction sector, specialty polymers are becoming a crucial component. The adoption of these construction polymers in the construction of walls and flooring with the greatest strength is a result of their technical, design, and structural benefits. The range of applications for construction polymers has expanded as a result of developments in construction technology. Large chemical corporations are gravitating toward the building polymer industry because of cost-effective production, manageable profit margins, and relatively simple raw material procurement. During the anticipated term, this aspect will fuel the market's expansion.

Key Market Challenges

- High cost as well as complex fabrication of specialty polymers - Specialty polymers are relatively expensive. Its production is a difficult procedure that calls for cutting-edge technology. Cost also varies based on a variety of circumstances, including the state of the market. Also, the next drawback is a complicated fabrication. The material is sometimes destroyed when impacted since it is not as essential as its substitutes. An object's internal structure can dissolve even though its outside remains intact. High repair costs are another negative. These variables will limit market expansion within the anticipated time frame.

Key Market Opportunities

- The rise in the automotive sector - Due to the global expansion of the automobile industry, the market is anticipated to soar in the upcoming years. The International Organization of Motor Vehicle Manufacturers said that 91.7 million automobiles were produced in the year 2019. In the upcoming years, it is anticipated that the growing demand for hybrid, electric, but also lightweight cars will play a significant role in the market's overall growth. The need for lightweight automobiles is being driven by the rising requirement for pollution reductions and fuel economy. Materials that improve the design, functionality, and manufacturability of machined and moulded components are in high demand from engineers and vehicle manufacturers. In a hybrid, electric, and plug-in hybrid automobiles, the magnet wire insulation and slot liners have been improved by a special mix of several types of modern polymers. Several businesses have started offering specialty, cutting-edge, and high-performance polymers for their clients in recent years. For instance, one of the market's major companies, Solvay, offers specialty polymers to improve the downscaling of transmissions and the efficiency of powertrains, electrification, and weight reduction. In the upcoming years, these developments are predicted to accelerate market expansion.

Segment Insights

Type Insights

In 2025, the specialty polymers market's elastomers category held the greatest market share. Elastomers are polymers with both viscosity and elasticity, and as a result, they are referred to as viscoelasticity. The weak intermolecular forces that hold the molecules of elastomers together cause them to typically have low Young's modulus, high yield strength, or high failure strain. They take on the special ability to recover their former size and shape after being greatly stretched. The sector of elastomers with the biggest share was natural rubber. The elastomers that can be found naturally are those made of natural rubber.

The substance that makes it up is latex, a milky white liquid that falls from the peel of tropical and subtropical trees. It is made up of solid particles floating in the liquid. The primary locations for this latex rubber are Brazil, India, Indonesia, Malaysia, and Sri Lanka. The natural rubber has been a useful material in engineering for a long time since it can withstand abuse while still carrying out essential tasks. High tensile and tear strength are combined with exceptional fatigue resistance in natural rubber. For dynamic or static engineering applications like tires, printer rollers, agitators, and other parts that will frequently come into touch with abrasive surfaces or other harmful materials, natural rubber is the perfect polymer due to its properties. During the anticipated term, this aspect will fuel the market's expansion.

End Use Insights

In 2025, the automotive industry was the main market for specialty polymers, rising at a CAGR of 8.9%. Automobile applications for specialty polymer materials have seen a significant surge, and these uses are expected to continue growing. The low weight and generally improved qualities of the polymers are the main reasons why they are making their way deep within the majority of applications. The average penetration of specialty polymers worldwide is 120 kg/vehicle, whereas the average penetration of plastics in India is 60 kg/vehicle. Vehicles employ a broad range of polymers. The fundamental purposes of such extensive usage of specialty polymer materials in automobiles determine the aesthetics, usefulness, economy, and low fuel consumption of the vehicles.

Concerns have changed from supply-side manufacturing problems to diminished business as the virus has expanded throughout the world. The major industrialized economies most impacted include South Korea, Italy, and Japan. As a result, 80 percent of businesses in the automobile and allied industries claim that the coronavirus will directly affect their 2021 sales. 78% of businesses lack the personnel necessary to staff a full manufacturing line. The global auto supply chain is related to China to a greater than 80% extent. China's vehicle sales fell by more than 18% in January 2020. According to the China Passenger Car Association (CPCA), sales for the first two months of 2020 may have decreased by at least 40%. Global automakers will be impacted by production deficits brought on by China's supply chain interruptions this year, but once things have returned to normal, the market will increase steadily during the projected period.

Regional Insights

Asia Pacific Specialty Polymer Market Size and Growth 2026 to 2035

The Asia Pacific specialty polymer market size is exhibited at USD 37.83 billion in 2025 and is projected to be worth around USD 73.70 billion by 2035, growing at a CAGR of 6.9% from 2026 to 2035.

What Made Asia Pacific the Dominant Region in the Specialty Polymer Market?

Asia Pacific has emerged as the dominant region in the specialty polymer market due to rapid industrialization, large-scale manufacturing activity, and strong demand from end-use industries such as automotive, electronics, construction, and packaging. The region benefits from cost-efficient production, abundant raw material availability, and a robust supply chain ecosystem, particularly in countries like China, India, Japan, and South Korea. Additionally, rising investments in infrastructure, electric vehicles, renewable energy, and advanced materials have further accelerated specialty polymer consumption across Asia Pacific.

India Specialty Polymer Market Analysis

India's market is expanding due to rapid industrialization, growth in construction and electronics sectors, and rising demand for high-performance, durable materials. Increased adoption in automotive, pharmaceuticals, and packaging industries, along with government initiatives supporting manufacturing and innovation, further accelerate market growth. Trends toward customization and advancements in polymer formulations are also propelling the market forward.

India's market is also driven by rapid industrialization, expanding construction and electronics sectors, and rising demand for high-performance, durable materials. Growing adoption across the automotive, pharmaceutical, and packaging industries, along with government initiatives supporting manufacturing and innovation, further boost market growth.

What Potentiates the Growth of the Market in North America?

North America's specialty polymer market is expanding due to strong demand from the electronics, automotive, and construction sectors, fueled by technological progress and the need for high-performance, durable materials. Increased R&D investments, the adoption of advanced polymer formulations, and a focus on lightweight, corrosion-resistant, and thermally stable materials all support market growth across the region.

U.S. Specialty Polymer Market Analysis

The market in the U.S. is expanding due to growing adoption across the healthcare, packaging, and renewable energy sectors. Increasing demand for polymers with enhanced chemical resistance, flexibility, and performance in extreme conditions, combined with innovations in polymer blends and composites, is driving market growth. Government incentives and sustainability initiatives also support the sector's rapid development.

A Notably Growing Region

Europe is expected to grow at a notable rate in the market due to rising demand for lightweight, high-performance, and durable materials in the automotive, aerospace, and electronics sectors. Emphasis on sustainable and recyclable polymers, technological innovations, and government regulations promoting energy-efficient and eco-friendly materials further drive growth. Increased industrial production and customization trends for specialized applications also support market expansion across the region.

UK Specialty Polymers Market Analysis

The market in the UK is growing due to rising demand from the automotive, construction, and electronics industries for high-performance, corrosion-resistant, and lightweight materials. Technological advances, focus on sustainable and recyclable polymers, and rising use of customized polymer solutions for specific applications further fuel growth. Strong industrial activity and government support for innovation also contribute to market expansion.

How is the Opportunistic Rise of Latin America in the Market?

Latin America is experiencing an opportunistic rise in the specialty polymer market due to increasing industrialization, urbanization, and demand from automotive, packaging, and construction sectors. The region benefits from abundant raw materials, lower manufacturing costs, and growing investments in polymer production and technology. Additionally, supportive government policies and trade partnerships are accelerating market adoption and attracting global players to expand their footprint in the region.

What Opportunities Exist in the Middle East & Africa (MEA)?

The Middle East & Africa (MEA) offers significant opportunities in the specialty polymer market due to rising industrialization, infrastructure development, and growth in sectors like automotive, packaging, and construction. The region's abundant raw materials, low production costs, and increasing investment in polymer manufacturing and technology further support market expansion. Additionally, government initiatives promoting sustainable materials and partnerships with global polymer producers create avenues for innovation and increased adoption.

Value Chain Analysis

Feedstock Procurement

Feedstock procurement for specialty polymers centers on sourcing vital monomers and chemical intermediates from petrochemical, bio-based, or recycled materials. Main priorities include stabilizing prices, securing supply chains, and meeting sustainability standards.

- Key Players: LyondellBasell, SABIC, Dow Chemical, BASF

Chemical Synthesis and Processing

Chemical synthesis of specialty polymers involves designing custom macromolecules by linking monomers through controlled polymerization techniques to achieve specific properties like strength, flexibility, or biocompatibility. These polymers are then processed using methods such as extrusion, molding, or 3D printing to produce final products for specialized applications.

- Key Players: BASF, Dow Chemical, SABIC, LyondellBasell

Packaging and Labelling

Specialty polymers require customized packaging to preserve product integrity and performance, especially in automotive, medical, and semiconductor industries. Packaging solutions safeguard the material and ensure dependable use in specialized environments.

- Key Players: Sealed Air Corporation, Berry Global, Amcor, Mondi Group

Specialty Polymer MarketPlayers

- 3M:Provides specialty polymers, adhesives, coatings, and high-performance materials for automotive, electronics, healthcare, and industrial applications, emphasizing durability, chemical resistance, and innovation.

- Clariant: Offers advanced polymer solutions, custom formulations, and specialty materials for the industrial, medical, and electronics sectors, with a focus on high-performance and application-specific requirements.

- Solvay Group: Delivers specialty polymers, high-performance materials, and engineered solutions for aerospace, automotive, electronics, and healthcare applications, focusing on lightweight, durable, and chemically resistant products.

- BASF: Supplies a broad range of specialty polymers, additives, and high-performance materials for automotive, construction, electronics, and packaging industries, emphasizing sustainability and product innovation.

Other Major Key Players

- Arkema Group

- Evonik Industries

- Croda International Plc

- Specialty Polymers Inc.

- PolyOne Corporation

- The Dow Chemical Company

Recent Developments

- In June 2025, Indorama Ventures, a leading specialty co-polyester producer, signed a strategic distribution agreement with PolySource, appointing it as an authorized distributor of specialty PET and PEN polymers across North America and key global markets under its CPET segment. (Source: indoramaventures.com)

- In May 2025, DKSH announced the acquisition of APN Plastics, a specialty polymers distributor in Australia and Malaysia, enhancing DKSH Performance Materials' market presence and client base in the region. (Source: dksh.com)

- SK Capital Partners LP purchased Baker Hughes' specialty polymer businessin July 2020. "The specialty polymer company is a pioneer in the development of innovative polymerization technology," claims Mario Toukan, Managing Director of SK Capital. The firm sees tremendous growth potential in the continued development of useful, problem-solving products that overcome difficulties and provide great value to clients.

- In June 2021, Necicolor S.p.a, a significant thermoplastics distributor, was acquired by Nexeo Plastics, one of the biggest distributors of thermoplastic resin and a subsidiary of GPD Companies Inc. Nevicolor offers its clients top-notch polymers made in part from recycled resources. Customers of Nexeo Plastics in Europe would have access to specialty polymers, custom-made compounds, recycled materials, and lab services as a result of this purchase. In the upcoming years, this development is anticipated to have a significant influence on the market.

Segments Covered in the Report

By Type

- Elastomers (Natural rubber, Polyurethanes, Polybutadiene, Silicone, Neoprene)

- Thermosets polymers

- Thermoplastic polymers

- Composites polymer

- Electroluminescent polymers

- Biodegradable polymers

- Liquid crystal polymers

- conducting polymers

- Others

By End Use

- Automotive

- Building and Construction

- Adhesives and Sealants

- Electrical and Electronics

- Medical, Aerospace

- Marine

- Other

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting