What is the Elastomers Market Size?

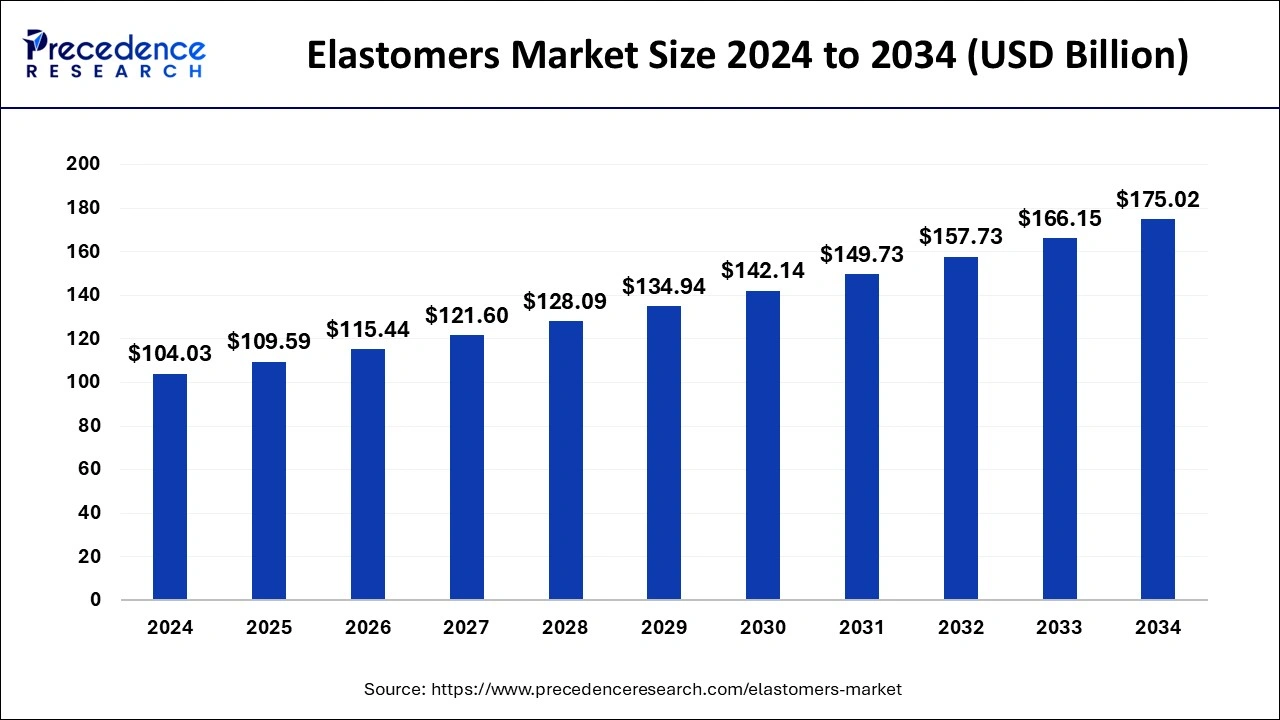

The global elastomers market size is calculated at USD 104.03 billion in 2025 and is predicted to increase from USD 109.59 billion in 2026 to approximately USD 175.02 billion by 2034, expanding at a CAGR of 5.34% from 2025 to 2034. A rise in construction and infrastructure development, especially in Asia Pacific is leading to high demand in the elastomers market.

Elastomers Market Key Takeaways

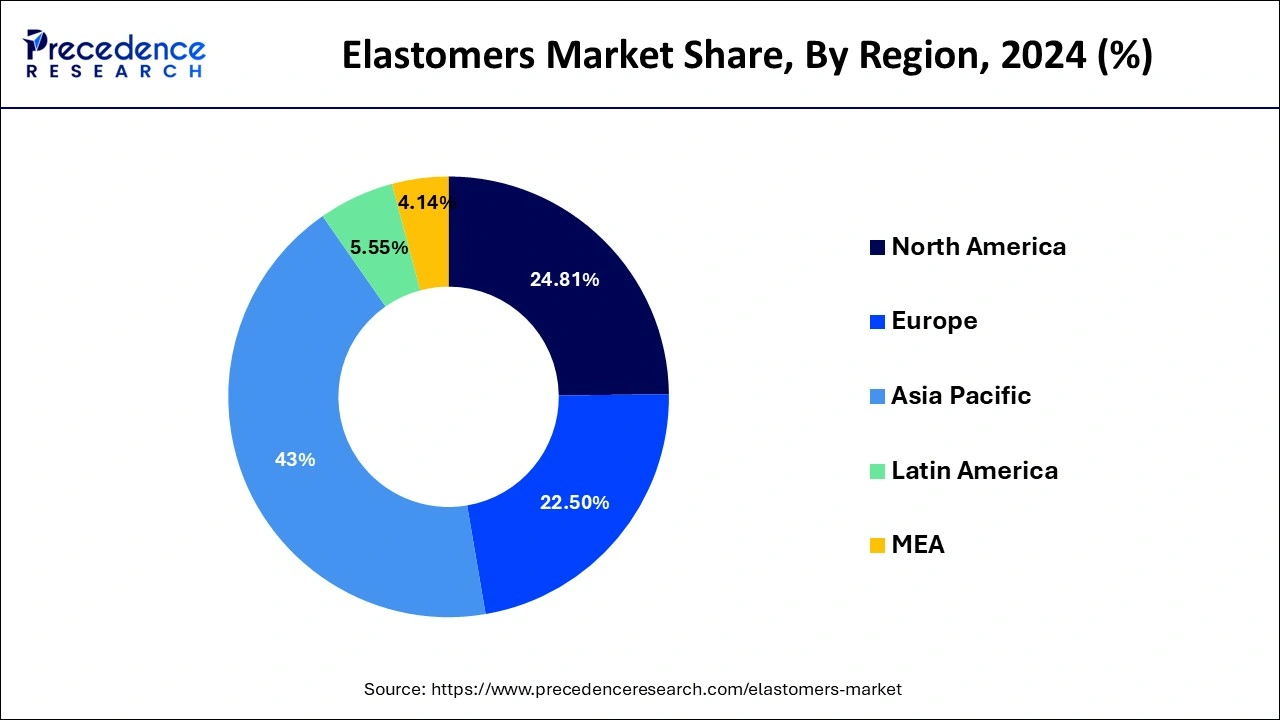

- Asia Pacific dominated the global market with the largest market share of 43% in 2024.

- North America is projected to expand at the notable CAGR during the forecast period.

- By product, the thermosets segment contributed the highest market share in 2024.

- By product, the thermoplastic segments is estimated to be the fastest-growing segment during the forecast period.

- By application , the automotive segment captured the biggest market share in 2024.

What are Elastomers?

The elastomers market is mainly driven by increasing demand in the automotive, healthcare, and consumer goods industries, where flexibility, resilience, and durability are crucial. Growth is also boosted by greater adoption in sustainable materials, electric vehicles, and 3D printing applications. Elastomers are polymers with viscoelastic properties, meaning they combine the viscosity of liquids with the elasticity of rubber. They can stretch significantly under stress and return to their original shape once the stress is relieved. This unique trait makes them essential for manufacturing seals, gaskets, tires, and medical devices. Advances in technology and bio-based elastomer innovations further improve their performance and environmental friendliness.

How is AI Changing Elastomers?

AI integration is transforming the elastomers market by improving material formulation, manufacturing efficiency, and product performance. Using predictive analytics, artificial intelligence (AI) can develop elastomer compounds with greater durability, elasticity, and environmental resistance, reducing the need for trial-and-error in R&D. Machine learning models enable real-time quality monitoring during production, cutting down waste and defects. AI-powered simulations speed up innovation in bio-based and recyclable elastomers, supporting sustainability goals. Furthermore, AI improves supply chain management and demand forecasting, helping producers respond quickly to market changes. Overall, AI promotes smarter, faster, and more sustainable elastomer manufacturing, driving technological progress and competitive advantages across industries.

Elastomers Market Growth Factors

- The demand for elastomers is increasing for the heating, ventilation and air conditioning industry. The demand for elastomers is increasing for producing the construction industry materials like the coatings, tubes, adhesives and all the other materials are driving the market growth.

- Advancements in the automotive industry and increased car builds are increasing the consumption of elastomers. Thermoset rubber is a type of elastomer which is used in automotive tires.

- Due to the properties like ease of processing, greater design freedom, versatility, ability to be recycled and lightweight the thermoplastic elastomers will be widely used in the transportation industry as well as the automotive industry.

- The use of high-performance thermoplastic elastomers provides an advantage of design and strength which could be comparable with the steel it also helps in reducing the overall weight and reducing the greenhouse gas emission.

Market Outlook

- Industry Growth Overview: The elastomers market is experiencing steady growth driven by rising demand in the automotive, construction, and healthcare industries. Advancements in bio-based and recyclable elastomers, along with increasing adoption of lightweight materials, are further boosting innovation, sustainability, and global market expansion.

- Sustainability Trends: Sustainability trends in the elastomers market focus on developing bio-based and recyclable materials, reducing carbon emissions, and promoting circular economy practices. Companies are investing in green chemistry, renewable feedstocks, and energy-efficient manufacturing to enhance environmental responsibility and long-term material sustainability.

- Global Expansion:The global expansion of the elastomers market is driven by increasing industrialization, infrastructure growth, and rising demand for high-performance materials across automotive, healthcare, and consumer goods sectors. Emerging economies in Asia-Pacific and Latin America are becoming key manufacturing hubs, fueling international trade and technological collaboration in elastomer production.

- Major investors:Major investors in the elastomers market include global leaders such as Dow, BASF, Covestro, and ExxonMobil, as well as private equity firms focused on sustainable materials. Their investments target R&D in bio-based elastomers, recycling technologies, and advanced polymer innovation to enhance market competitiveness and eco-efficiency.

- Startup Ecosystem:The startup ecosystem in the market is rapidly evolving, focusing on sustainable material innovation, bio-based polymer development, and smart elastomer technologies. Emerging companies are leveraging AI, nanotechnology, and green chemistry to improve performance, recyclability, and circularity, attracting collaborations and funding from major chemical corporations and venture capital investors.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 175.02 Billion |

| Market Size in 2026 | USD 115.44 Billion |

| Market Size in 2025 | USD 109.59 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.34% |

| Largest Market | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Type, Application, Process, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Product Insights

The thermosets segment had the largest market share till the recent years and the thermoset segment shall have the highest growth during the forecast period. This product has application in various industries. It helps in enhancing the integrity of the product map and improve the mechanical properties of the product. Thermosets are extremely resistant towards chemicals as well as heat. Thermostats are extremely cost effective materials which are used in the manufacturing of sealed products as they have great resistance to deformation.

The thermoplastic elastomer segment shall also have a good growth during the forecast period. Thermoplastic elastomers are extremely tough, flexible and they offer superior electrical properties. The performance of the thermoplastic elastomers is exceptionally good even in extremely low temperatures. This product has high tensile property and it can withstand abrasion and tear. Thermoplastic elastomers are costly as compared to the thermoset elastomers.

Application Insights

The automotive segment had the largest application of elastomers. There is an increased demand for elastomers in the automotive segment. The rapid increase in the demand for automobiles and stringent government regulation which are preventing the toxic emissions are creating growth opportunities for the elastomers across the globe. Many major market players are making use of elastomers in order to reduce the product weight and the product size. As there are stringent government rules for the reduction of carbon emission and reducing fuel consumption these factors are expected to drive the market growth period the medical segment is also expected to be the fastest growing segment during the forecast period.

Thermoplastic elastomers have properties like high insulation and molding they have great usage in medical field. They are used in the manufacturing of medical gaskets and stoppers. Thermoplastic elastomers are able to fit in all sorts of gaps as they are extremely flexible so this helps in creating a larger demand for these products. Elastomers has great application in the automotive industry. It is used in door handles, rocker panels, dashboards, vibrating damping pads, rear windows, interiors, wipers, gear knobs, body seals etc. As the passengers vehicle provide a better value for money the there is an increased demand for passenger vehicles in the market. The growth of passenger cars was supported by the demand in countries like Russia Brazil and China.

Furthermore, the sale of elastomer across the medical industry registers significant growth mainly because of its unique and variable properties, that includes low-temperature flexibility, fungus resistance, acid/base resistance, tensile strength, excellent hydrolytic stability, fluid resistance, excellent translucency, and easy sterilization. In accordance to these properties, elastomer is has witnessed diverse range of applications across the medical field, that includes gas supply, drug patches, medical bags, drug delivery, chest drainage, wound dressing, surgical instruments, peristaltic pump catheters, needleless syringes, valves, stoppers, ventilation bags, bottles,and vial caps. Elastomers are increasingly preferred owing to their recycling capability along with its cost effectiveness nature over conventional materials that were already being used across the market since long time for example latex, silicone, and PVC. Application of elastomers across the medical sector has registered high demand across the developed nations of North America coupled with Western Europe. In addition, the demand for the same expected to increase at a rapid pace in the developing countries such as Asia-Pacific during the upcoming years.

Asia Pacific Elastomers Market Size and Growth 2025 to 2034

The Asia Pacific elastomers market size was exhibited at USD 47.12 billion in 2025 and is projected to be worth around USD 76.13 billion by 2034, growing at a CAGR of 5.46% from 2025 to 2034.

Asia Pacific region dominates the growth of the elastomers market. As is an increasing demand for automatic production across the nations the market is expected to grow. Increased production of automotives in Thailand China India and Indonesia are driving the market growth period rapid industrialization and rapid urbanization in these developing nations is driving the manufacturing industries as well as the construction industries in this region.

China dominates the Asia Pacific elastomers market as a critical hub of automotive manufacturing and a large player in construction. Government programs targeting increased industrial manufacturing such as the "Made in China 2025" commitments, focused on both increasing industrial development and increasing domestic manufacturing self-reliance, has directly increased elastomer demand as a high-performance material. China's newly developed ecosystems for medical device manufacturing, in addition, also creates demand for thermoplastic elastomers. R&D investment by local firms, such as Sinopec's bio-based elastomer development, creates value for China as a large, expendable consumer of elastomers but also as an exporter of specialty elastomer products as well.

The growing construction and manufacturing industries are creating a demand for elastomers. Many original equipment manufacturers are shifting their basis to the markets that have low operational cost. By reducing the cost of manufacturing they're also escalating the demand for various passenger cars. This creates or demand for elastomers.

What Makes North America the Fastest-Growing Market for Elastomers?

North America is projected to expand at a notable CAGR during the forecast period. Elastomers will expand drastically throughout North America during the forecast period because sustainability initiatives and environmental development rules become more stringent. The region speeds up the implementation of bio-based and environmentally friendly elastomers because it needs to fulfill stricter emission guidelines and satisfy consumers who seek eco-friendly materials. A well-developed supply network serves as a strong pillars that support expanding elastomer industries.

The elastomers market in the United States functions as the leading segment across North America. A strong automotive sector drives the leading position in the market because it needs durable yet fuel-efficient materials. The U.S.-based manufacturing innovation drives quality improvements and decreases production expenses, which establishes domestic producers as global market leaders.

The United States maintains a leadership role in the North America elastomers market due largely to strong automotive, aerospace and medical sectors. By offering lightweight, high-performance materials, elastomers have quickly been adopted by EV manufacturing and medical device manufacturers. Recent developments such as the U.S. Infrastructure Investment and Jobs Act has continued to spur demand for long-lasting and durable construction materials (synthetic rubber, thermoplastic elastomers, etc.), while recent collaborations between OEMs and raw material manufacturers have streamlined domestic supply chains, which puts the U.S. in a unique position to become an integral player in the North American elastomer manufacturing and development landscape.

What are the Major Factors Supporting the Growth of the European Elastomers Market?

The European elastomer market is guided by stringent environmental regulations and policies that are driving demand for bio-based and recyclable elastomers, including in automotive applications for lightweight solutions and EVs in the sustainable mobility arena. It is often noted that Germany is leading the charge on sustainable elastomers in Europe, supported by a strong chemical and manufacturing industry. For example, German firms like BASF and Covestro are innovating recyclable elastomer formulations. In addition to market dynamics, the European Union (EU) is committed to sustainable product development as part of the EU Green Deal and is now positioning Europe for advancement as a regulator and innovator in sustainable elastomers.

What Potentiates the Growth of the Latin America Elastomers Market?

The Latin America elastomers market is driven by robust growth in sectors like automotive, footwear, and construction, especially in countries such as Brazil, where major vehicle and tire manufacturing hubs are located and continually expanding. The region's natural rubber base and increasing petrochemical capacity provide raw material advantages that reduce import dependence, while emerging applications in medical-grade, thermoplastic elastomers (TPEs), and sustainable/recycled elastomers are opening new high-value market segments. In Brazil specifically, increased investment in renewables, infrastructure, and consumer goods manufacturing is boosting elastomer demand in both traditional uses (tires, seals, hoses) and newer ones (medical devices, eco-friendly materials), making it the fastest-growing country in the region.

What Factors Drive the Growth of the Elastomers Market in the Middle East and Africa?

The Middle East & Africa elastomers market is gaining momentum due to large-scale oil and gas operations, major infrastructure and urban development projects, and rapid growth in the automotive and construction industries. These sectors heavily depend on elastomer materials for seals, hoses, coatings, and structural parts. For example, Saudi Arabia has become a key market, supported by its integrated petrochemical supply chain (with companies like SABIC and Saudi Aramco) and major projects such as NEOM city and the Red Sea Development, which boost demand for high-performance elastomers in industrial, automotive, and infrastructure uses. Sustainability trends, including bio-based and recycled elastomers for building materials and tires, are also opening new growth opportunities in the region.

Value Chain Analysis

- Feedstock Procurement - Feedstock procurement involves sourcing natural rubber, petrochemical monomers, and renewable bio-based raw materials. The focus is on ensuring supply stability, cost efficiency, and sustainability through responsible sourcing and local partnerships.

- Chemical Synthesis and Processing - In this stage, raw materials undergo polymerization, compounding, and vulcanization to create elastomers with desired mechanical, thermal, and chemical properties. Advanced technologies like AI-assisted process optimization and automation enhance efficiency and quality control.

- Waste Management and Recycling - Waste generated during elastomer production and post-use is managed through mechanical recycling, devulcanization, and pyrolysis processes. Companies focus on circular economy practices to reduce landfill waste and improve sustainability.

- Regulatory Compliance and Safety Monitoring - Products are evaluated for environmental, health, and safety compliance through standardized testing and certifications. Continuous monitoring ensures compliance with regional chemical safety, emissions, and waste management regulations.

Elastomers Market Companies

- BASF SE (Germany): BASF produces high-performance elastomeric materials such as Elastollan TPU, offering wear & abrasion resistance and low temperature flexibility across industrial, automotive, and cable applications.

- E. I. du Pont de Nemours and Company (U.S.): DuPont provides specialty elastomers, such as MULTIFLEX™ thermoplastic elastomers, that serve demanding automotive exterior and interior applications by combining design flexibility with recyclability and performance.

- Lanxess AG (Germany): Lanxess's High Performance Elastomers unit manufactures specialty rubbers such as Baypren, Thermban HNBR, and Perbunan NBR, used in automotive, oil & gas, and electrical industries while also launching sustainable cast elastomer systems like Adiprene Green.

- The Dow Chemical Company (U.S.): Dow is a global leader in polyolefin elastomers (POEs) such as ENGAGE™, delivering materials that blend rubber-like flexibility with plastic processability for automotive, infrastructure, and packaging, with a strong push into renewable feedstock elastomer alternatives.

- JSR Corporation (Japan): JSR historically offered a wide portfolio of synthetic rubbers and thermoplastic elastomers, especially SSBR for fuel-efficient tires, before transferring the elastomers business to focus on advanced materials.

Latest Announcement by Industry Leaders

- In March 2024, groundbreaking polyolefin elastomer (POE) based artificial leather or eco-friendly leather substitute, marking its debute in the global automotive seating market was launched by Dow. Dow's Asia Pacific commercial vice president, Bambang Candra expressed excitement about introducing this innovative solution, which extends beyond automotive applications to sporting goods, furniture, fashion, and accessories. With a focus on sustainability and performance, the company aims to forge partnerships to explore new possibilities and cater to evolving market demands, offering brands cost-effective options that prioritise product appearance and customer experience.

Recent Developments

- In April 2025, BASF introduced its Elastollan FC grade TPU designed for medical tubes and conveyor belts, showcased at CHINAPLAS 2025. The new TPU offers enhanced flexibility, chemical resistance, and biocompatibility. Its Shanghai facility is now GMP-qualified, meeting global medical standards. Source: BASF

- In April 2025, Momentive Performance Materials, Inc. launched HARMONIE NatuVelGel, a 100% naturally derived elastomer gel formulated for skincare and color cosmetics applications. It enhances sensory performance and sustainability in personal care formulations, reflecting the growing demand for eco-friendly elastomers. Source: Momentive

- In May 2025, Elkem expanded its SILCOLEASE recycled silicone range with two new low-carbon elastomers designed for release liner applications. These innovations aim to lower environmental footprints and improve circular material usage in industrial production. Source: Elkem

- In November 2024, a line of thermoplastic elastomers made from marine waste plastics was launched by a global supplier of innovative elastomer materials, Audia Elastomers.

- In February 2024, LANXESS India expanded Rhenodiv production plant in Jhagadia. This milestone demonstrates lANXESS's dedication to environmental responsibility, process safety, sustainability, and innovation in tyre and elastomer manufacture.

- In February 2023, Kuraray Co., Ltd. announced that it plans to bring its new isoprene production facility in Thailand online in a phased start-up operation. It is expected that the new Thai factory will enable the isoprene-related industry to grow by establishing a global supply system and meeting the growing world demand for isoprene-related products.

- In March 2024, Dow launched a new polyolefin elastomer (POE) based alternative for use in the automotive industry to reflect the industry's change toward animal-free products. This exciting development, made in conjunction with HIUV Materials Technology, provides softness, color retention during aging, dampening to aging and low temperatures, and a lighter weight than PVC leather.

- In March 2023, Borealis presented its new branded line of circular elastomers and plastomers, called Renewable. Also, Borealis' Renewable products will be produced at its Geleen plant in the Netherlands from renewable feedstock to respond to the growing demand for sustainable materials while maintaining performance.

Segments Covered in the Report

By Product

- Thermoplastics

- Styrenic Block Copolymers (TPS)

- Polyolefin Blends (TPO)

- Thermoplastic Polyurethanes (TPU)

- Elastomeric Alloys (TPV)

- Other Thermoplastic Elastomers

- Thermosets

- Carboxylated Nitriles (XNBR)

- Hydrogenated Nitrile (HNBR)

- Nitrile Rubber (NBR)

- Ethylene Propylene (EPR)

- Fluorocarbon Elastomers (FKM)

By Type

- General Purpose

- Styrene-butadiene Rubber(SBR)

- Poly-butadiene rubber (BR)

- Polyisoprene (PIR)

- Natural rubber (SR)

- Synthetic Rubber(SR)

- Specialty Elastomers

- Nitrile rubber (NBR)

- Butyl Rubber (IIR)

- Silicone Rubber

- Fluorocarbon Elastomers

- PU (Thermoset)

- Thermoplastic Elastomer

- Polyamide Elastomers

- Polypropylene Elastomer

- Olefin Elastomers (TPO)

- Others

By Application

- Consumer goods

- Medical

- Industrial

- Automotive

- Sports

- Electronics

By Process

- Extrusion

- Injection Moulding

- Blow Moulding

- Compression Moulding

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting