What is the Polystyrene Market Size?

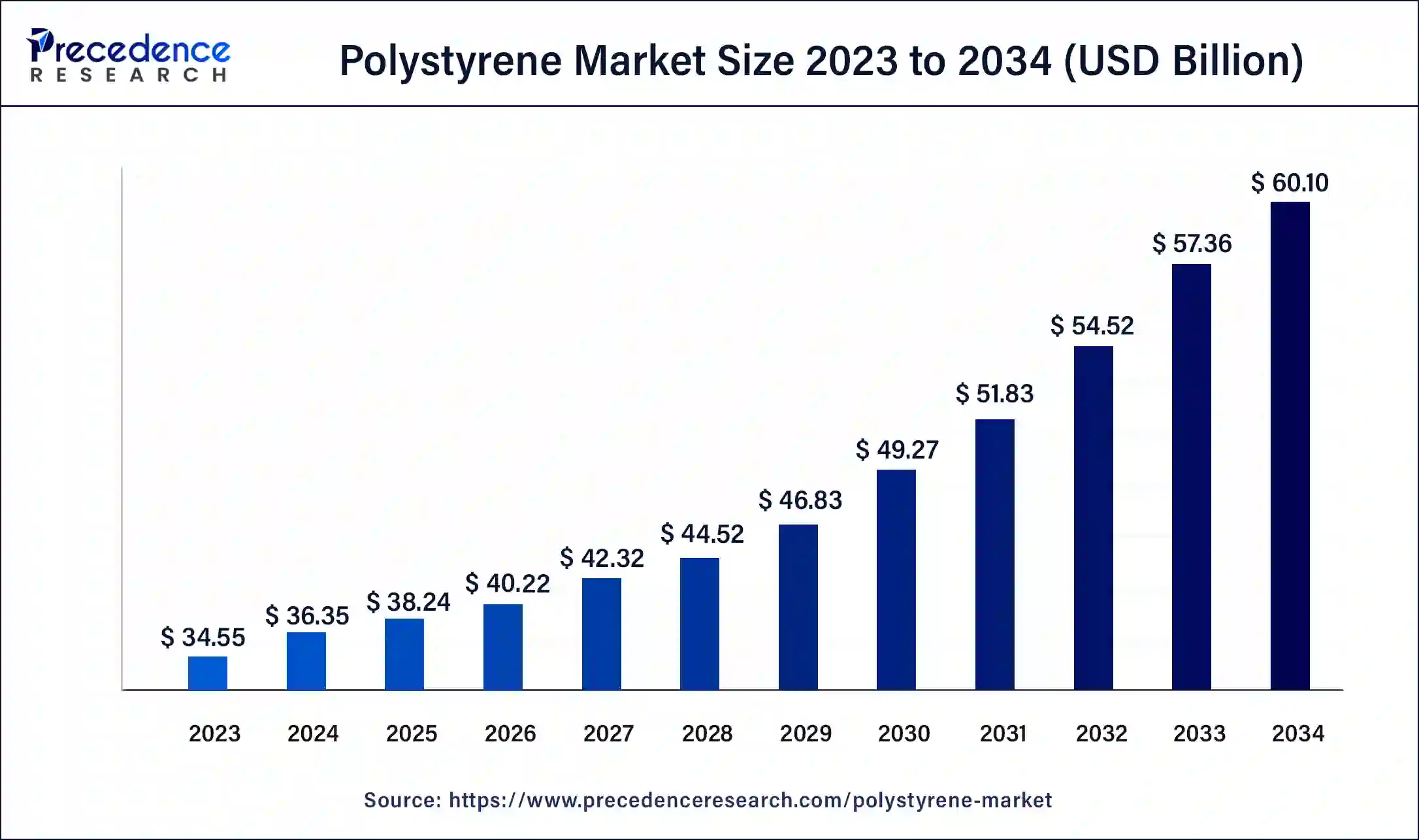

The global polystyrene market size is calculated at USD 38.24 billion in 2025 and is predicted to increase from USD 40.22 billion in 2026 to approximately USD 60.10 billion by 2034, expanding at a CAGR of 5.16% from 2025 to 2034.

Polystyrene MarketKey Takeaways

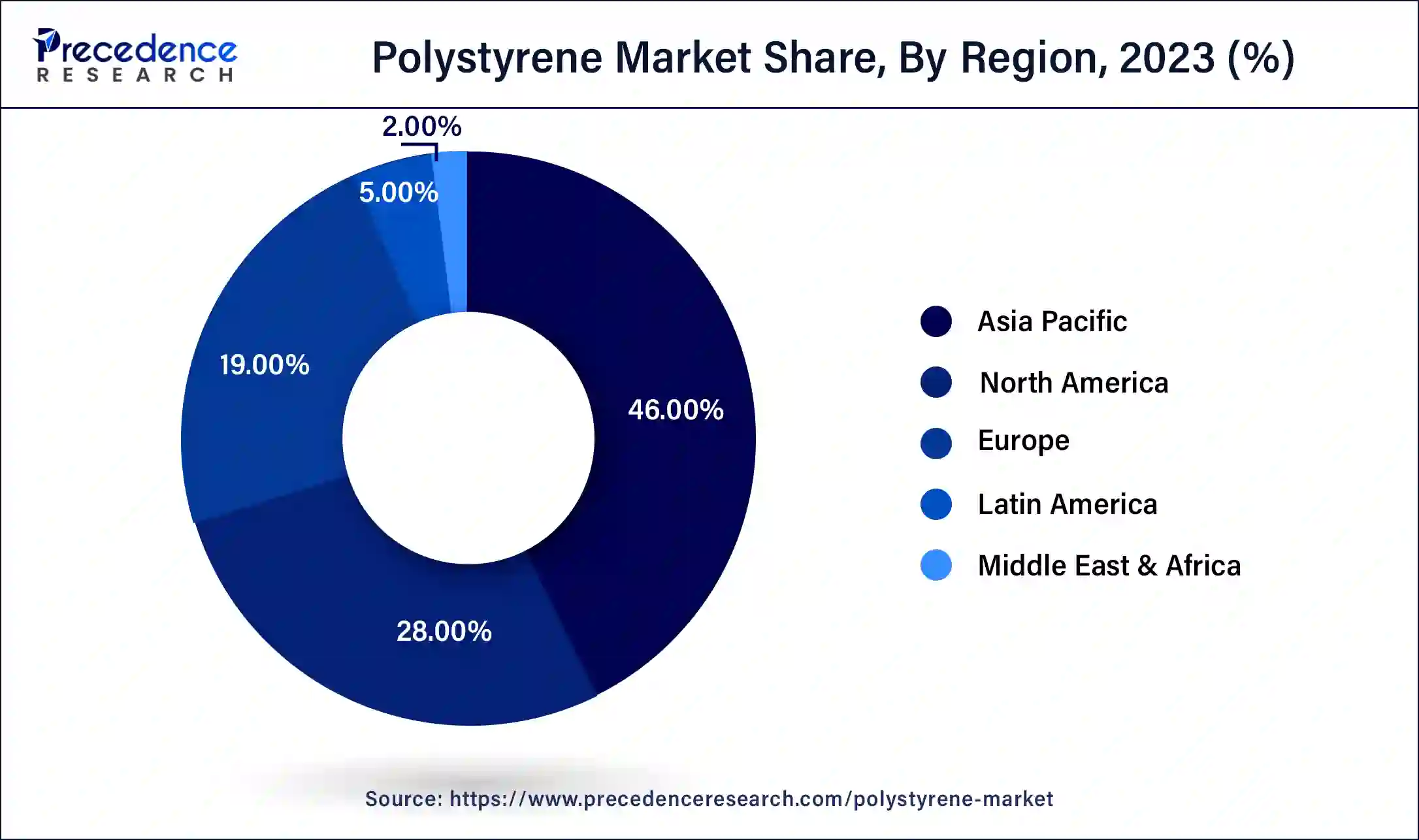

- Asia-Pacific contributed more than 46% of revenue share in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

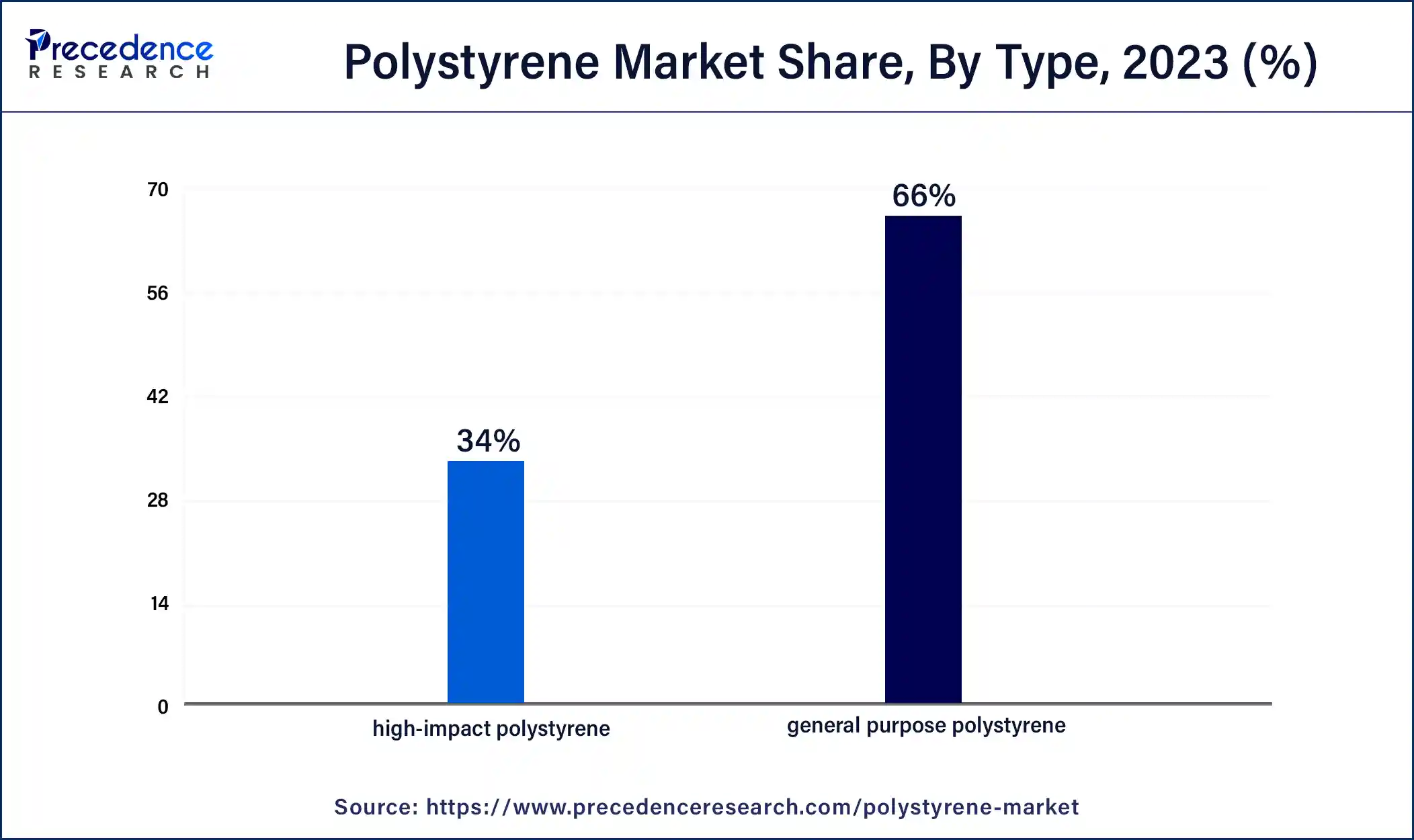

- By type, the general purpose polystyrene {GPPS} segment has held the largest market share of 66% in 2024.

- By type, the high impact polystyrene {HIPS} segment is anticipated to grow at a remarkable CAGR of 1% between 2025 and 2034.

- By application, the packaging segment generated over 35% of revenue share in 2024.

- By application, the automotive segment is expected to expand at the fastest CAGR over the projected period.

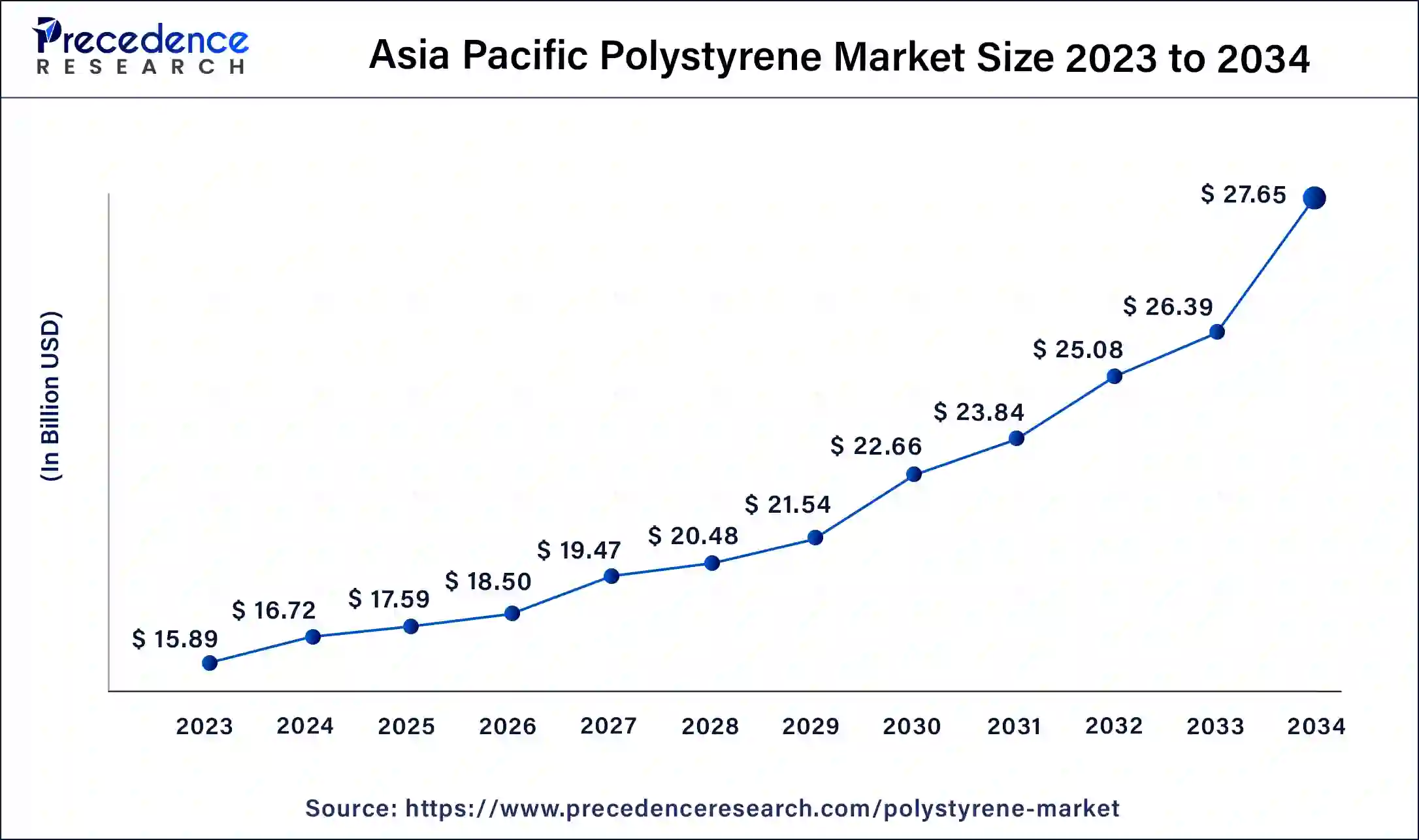

Asia Pacific Polystyrene Market Size and Growth 2025 To 2034

The Asia Pacific polystyrene market size was valued at USD 17.59 billion in 2025 and is expected to be worth around USD 27.65 billion by 2034, at a CAGR of 5.30% from 2025 to 2034.

Asia-Pacific has held the largest revenue share 46% in 2024. Asia-Pacific commands a significant share in the polystyrene market due to rapid industrialization, robust construction activities, and a thriving manufacturing sector in countries like China and India. The region's increasing population and urbanization contribute to the demand for packaging andconstruction materials, where polystyrene finds extensive use. Additionally, a burgeoning consumer goods market further propels the need for polystyrene in packaging applications. The availability of raw materials and a supportive regulatory environment for the plastics industry also contribute to Asia-Pacific's dominant position in the polystyrene market.

North America is estimated to observe the fastest expansion. North America commands significant growth in the polystyrene market due to robust industrial activities, a flourishing packaging sector, and increased demand in construction applications. The region's advanced infrastructure, coupled with a strong presence of key market players, further contributes to its dominance. Additionally, the growing focus on sustainable practices and stringent environmental regulations in North America has led to increased adoption of bio-based and recyclable polystyrene, aligning with the evolving preferences of environmentally conscious consumers and bolstering the market growth in the region.

Market Overview

Polystyrene, a flexible man-made material, is widely used in various industries for its light weight, stiffness, and insulation capabilities. Its formation involves linking styrene units through a process called polymerization, resulting in a thermoplastic substance with diverse applications. One popular form, expanded polystyrene (EPS), is particularly valued for its use in packaging, insulation, and disposable foam products, owing to its cost-effectiveness, buoyancy, and excellent thermal insulation.

Yet, environmental concerns have emerged due to polystyrene's inability to break down naturally, leading to pollution and posing challenges in waste management. There is a growing push for sustainable alternatives and improved recycling efforts. Despite these concerns, the material remains indispensable in industries where its specific qualities address practical needs, sparking ongoing discussions about finding a balance between its applications and environmental impact.

Packaging Laws 2025- Affecting the Polystyrene Market

- Since January 1, 2025, Oregon's SB 543 law has prohibited food vendors from serving food in polystyrene foam containers and selling or distributing foam packing peanuts, as well as packaging that intentionally contains PFAS.

- under a law that also bans plastic beverage stirrers in Rhode Island, restaurants and food service establishments are banned from processing, preparing, selling, or providing food or drinks in disposable food containers made from polystyrene foam.

- 1 under a 2023 update that also applies to single-service plastic coffee stirrers, cocktail picks, or sandwich picks, Delaware's Restaurants and other food service establishments will be banned from providing polystyrene foam containers for ready-to-eat food or beverages beginning July 1, 2025.

- In New York City, hotels with 50 or more rooms are banned from offering small plastic bottles of personal care products like shampoo and conditioner starting January 1, 2025. This prohibition will extend to smaller hotels on January 1, 2026.

Polystyrene Market Growth Factors

- Packaging Industry Expansion: The growing demand for lightweight and durable packaging solutions is a key driver for the polystyrene market, especially in food packaging and consumer goods.

- Construction Sector Surge: Increased construction activities, particularly in emerging economies, fuel the demand for insulation materials like expanded polystyrene (EPS) in buildings.

- Automotive Applications: The automotive industry's need for lightweight materials to enhance fuel efficiency and reduce emissions drives the use of polystyrene in various automotive components.

- Rising Disposable Income: Higher disposable incomes contribute to increased consumer spending on packaged goods, leading to a surge in the demand for polystyrene packaging.

- Technological Advancements: Ongoing advancements in polystyrene production technologies contribute to improved product quality and manufacturing efficiency, fostering market growth.

- E-commerce Boom: The rapid growth of e-commerce amplifies the need for secure and lightweight packaging solutions, benefiting the polystyrene market.

- Urbanization Trends: Urbanization and population growth drive the construction industry, boosting the demand for polystyrene-based insulation materials in residential and commercial buildings.

- Globalization of Trade: The increasing global trade of goods amplifies the demand for durable and cost-effective packaging, benefiting the polystyrene market.

- Consumer Electronics: The expanding consumer electronics market utilizes polystyrene for its protective packaging qualities, safeguarding delicate electronic components during transportation.

- Medical Packaging Needs: Polystyrene's sterile and lightweight properties make it a preferred choice for medical packaging, contributing to market growth.

- Environmental Concerns: The search for environmentally friendly alternatives to traditional packaging materials creates opportunities for biodegradable and recyclable polystyrene products.

- Foodservice Industry Growth: The thriving foodservice sector, particularly the demand for takeaway and delivery services, drives the use of polystyrene containers and packaging.

- Increased Investments in Infrastructure: Government investments in infrastructure projects globally boost the consumption of polystyrene-based construction materials.

- Innovative Product Designs: Continuous innovation in product design and development enhances the versatility of polystyrene, expanding its applications across industries.

- Consumer Preference for Convenience: The convenience offered by lightweight and easily disposable polystyrene products aligns with evolving consumer preferences, driving market growth.

- Stringent Building Regulations: Increasing emphasis on energy-efficient and environmentally friendly construction practices fuels the adoption of polystyrene insulation materials.

- Automotive Light weighing Initiatives: Ongoing initiatives in the automotive industry to reduce vehicle weight for fuel efficiency propel the demand for polystyrene-based lightweight materials.

- Growing Pharmaceutical Sector: The pharmaceutical industry's need for safe and contamination-resistant packaging supports the use of polystyrene in pharmaceutical products.

- Eco-Friendly Initiatives: Companies focusing on sustainable practices and eco-friendly materials explore the development of bio-based and recyclable polystyrene options.

- Infrastructure Development in Emerging Markets: Infrastructure development projects in emerging markets drive the consumption of polystyrene-based construction materials, contributing to market expansion.

- Kumho Petrochemicals Ltd. annual revenue for 2022 was $6.16B and annual revenue for 2021 was $7.29B.

Market Scope

| Report Coverage | Details |

| Market Size in 2026 | USD 40.22 Billion |

| Market Size in 2025 | USD 38.24 billion |

| Market Size by 2034 | USD 60.10 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.16% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Packaging industry demand and construction industry growth

The demand for polystyrene experiences a substantial uptick driven by the packaging and construction industries. In packaging, polystyrene's lightweight, durable, and cost-effective attributes make it a preferred choice. As the packaging sector constantly seeks innovative materials to meet evolving consumer and logistical needs, polystyrene emerges as a reliable solution due to its capacity to offer secure and lightweight packaging solutions. Its adaptability in creating various packaging forms, combined with its protective qualities, aligns seamlessly with the dynamic requirements of the packaging industry, leading to an increased market demand.

Concurrently, the expansion of the construction industry significantly boosts the need for polystyrene, particularly in the form of expanded polystyrene (EPS). Renowned for its excellent thermal insulation properties, EPS finds widespread application in construction for insulation purposes. With urbanization and infrastructure projects thriving globally, the demand for efficient and cost-effective insulation materials propels the uptake of polystyrene in the construction sector, contributing substantially to the overall market demand for polystyrene products.

Restraint

Regulatory scrutiny and recycling challenges

The growth of the polystyrene market is constrained by two significant factors: regulatory scrutiny and recycling challenges. Heightened environmental concerns have led to increased regulatory scrutiny, resulting in stringent regulations on the use and disposal of polystyrene. Government measures aimed at reducing single-use plastics and promoting sustainable alternatives impact the market by limiting the scope of polystyrene applications.

Additionally, recycling challenges pose obstacles to market expansion. While there are efforts to promote polystyrene recycling, the logistical complexities and economic viability of recycling processes remain significant hurdles. The collection, sorting, and recycling of polystyrene materials present challenges that slow down the adoption of recycling practices, contributing to the overall restraint on the growth of the polystyrene market in the face of evolving environmental and regulatory landscapes.

Opportunity

Bio-based polystyrene

Bio-based polystyrene is bringing fresh opportunities to the polystyrene market by offering a sustainable alternative. Unlike traditional polystyrene, this type is crafted from renewable sources like agricultural leftovers or bio-based materials, steering away from reliance on fossil fuels. This not only lessens its impact on the environment but also champions a more eco-friendly lifecycle for the product. Bio-based polystyrene tackles worries about the environmental effects of conventional polystyrene and caters to the rising desire for packaging solutions that prioritize our planet.

As rules and consumer choices increasingly favor sustainability, bio-based polystyrene emerges as an inventive solution, paving the way for the market to expand and take the lead in the industry. Collaborations between manufacturers, biotech companies, and policymakers play a pivotal role in advancing research, production, and the widespread adoption of bio-based polystyrene, positioning it as a crucial element in shaping the future of the polystyrene market.

Type Insights

In 2024, the general purpose polystyrene (GPPS) segment had the highest market share of 66% based on the type. General Purpose Polystyrene (GPPS) is a versatile segment in the polystyrene market, known for its clarity, rigidity, and cost-effectiveness. Widely used in packaging, disposables, and consumer goods, GPPS meets diverse industry needs. Current trends in the GPPS segment involve innovations in production technologies to enhance material properties, increased demand from the packaging industry due to its excellent optical clarity, and a focus on developing sustainable formulations to address environmental concerns, aligning with the broader industry shift toward more eco-friendly materials.

The high-impact polystyrene segment is anticipated to expand at a significant CAGR of 1% during the projected period. High-impact polystyrene (HIPS) is a segment within the polystyrene market known for its toughness and impact resistance. It is a versatile thermoplastic commonly used in packaging, consumer electronics, and household goods. Recent trends in the HIPS segment involve an increased demand for sustainable options, leading to innovations in recyclable and bio-based HIPS products. Additionally, advancements in manufacturing technologies contribute to the development of HIPS with enhanced properties, meeting the evolving needs of industries seeking durable and environmentally conscious materials.

Application Insights

According to the application, the packaging segment has held a 35% revenue share in 2024. In the realm of the polystyrene market, the packaging segment revolves around using polystyrene materials for crafting efficient and affordable packaging solutions. This encompasses creating lightweight and sturdy packaging for diverse industries like food, electronics, and consumer goods. An observable trend in polystyrene packaging is the growing emphasis on sustainability.

The industry is witnessing a surge in demand for eco-friendly alternatives, leading to the development of innovative bio-based polystyrene packaging. This evolution aligns with the broader push towards environmentally conscious practices and caters to the increasing consumer preference for sustainable packaging choices.

The automotive segment is anticipated to expand fastest over the projected period. In the polystyrene market, the automotive segment refers to the application of polystyrene in various components within the automotive industry, such as interior trims, insulation, and lightweight structural elements. A prevailing trend in this sector is the increasing focus on light weighting to enhance fuel efficiency and reduce emissions. Polystyrene, with its lightweight properties and versatility, is gaining traction as a material of choice for automotive manufacturers aiming to achieve these objectives while maintaining structural integrity and safety standards.

Product type Insights

The general-purpose polystyrene (GPPS) segment held the largest share of 66.00% in the 2024 global polystyrene market. The GPPS is a visible, cost-effective and rigid polymer holding the highest position in the market. It's counted as one of the effective product types, especially proving excellence for applications mandating seamless processing and clarity. It's a crucial component to consider in the vast global polystyrene sector.

Its high insulation properties and strong presence in the European market, with the growing demand and need, have captured the attention of many industries like healthcare, packaging and more in this market.

The high-impact polystyrene (HIPS) segment is expected to grow at a CAGR of 5.20% during the forecast period. The HIPS is a differentiated and defined form of GPPS that plays an important role in the global polystyrene market. With the integration of polybutadiene rubber additives, HIPs have achieved an improvement in rigidity, durability and have double the strength of the impact. Its seamless process and cost-effective strategy have gained traction and fuelled the development with its simple and easy accessibility.

Form Insights

The foamed segment held the largest share of 59.10% in the 2024 global polystyrene market. The foamed polystyrene in its extensive ejected (XPS) and EPS forms has ruled the market with its appealing appearance and excellent physical properties. The foamed form holds lightweight, protective and insulating properties. Since its dramatic discovery in the 1940s till the date has seen improvement in the development process. The development is fuelled by applications in packaging and construction.

The sheets and films segment is expected to grow at a CAGR of 5.00% during the forecast period. These sheets and films polystyrene plays a major role in the global polystyrene market. This form has largely been used by electronics, construction and packaging companies. Due to the growing concern for environmental regulations and heavy competition from other alternatives, the segment has shifted to equip creativity in recycling technologies and sustainable practices.

Manufacturing Process Insights

The suspension polymerisation segment held the largest share of 71.40% in the 2024 global polystyrene market. The segment is leading due to its superior purity polymer beads production for numerous applications, involving EPS and HIPS. This manufacturing method has the highest benefit than any other method. Though the development and advancement have marked a convincing line to prove its reach in various other specific uses and improve its efficiency.

The mass (bulk) polymerisation segment is expected to grow at a CAGR of 4.80% during the forecast period. The segment has been an essential factor of global polystyrene production (PS), which over time has emerged as a highly efficient, consistent system. A system that generates high-impact PS (HIPS) and general-purpose PS (GPPS). The versatility, purity, production of HIPS and GPPS and cost-effectiveness promote mass polymerisation manufacturing process.

End-use industry Insights

The packaging segment held the largest share of 33.00% in the 2024 global polystyrene market. The packaging market is the only huge consumer and client of polystyrene production. With its advances and diverse applications, the segment pushes the global polystyrene industry to innovate sustainably. With the growing demand for sustainably produced products, the need for sustainable packaging has accelerated.

Following this, the polystyrene sector has to focus on the quality, performance and materials cost-effectiveness while maintaining environmental regulations to retain the position in the packaging industry.

The healthcare segment is expected to grow at a CAGR of 5.70% during the forecast period. The segment depends on polystyrene for several crucial applications, as polystyrene provides clarity, ease, cost-effectiveness and durability of sterilisation. With the continuous use of polystyrene in every process, aligning with the operational value and requirements healthcare sector has accelerated the alliance with the polystyrene provider and companies largely. As it safeguards the devices, medicines and other equipment as it signifies sustainable use in the hygiene-concerned area.

Distribution Channel Insights

The direct sales segment held the largest share of 54.60% in the 2024 global polystyrene market. The direct sales department manages and maintains valuable, longstanding partnerships with the leading manufacturing clients. The segment is getting used to the accelerated demand for sustainable solutions and rising competition. The sales development is backed by a sharp focus on eco-friendly, sustainable product innovations, smart collaborations and expansion in the market.

The online retail segment is expected to grow at a CAGR of 6.20% during the forecast period. With the rapid growth in e-commerce, online retail has steadily sped up and gained a position in the global polystyrene market. The segment is attracting many industries due to the demand for an innovative approach and impressive change, and trends in different markets. The segment is leading with the development and crucial role in packaging applications that fuel demand for expanded polystyrene (EPS).

Polystyrene Market Companies

- INEOS Styrolution

- TotalEnergies

- Dow Chemical Company

- SABIC

- BASF SE

- LG Chem

- Chevron Phillips Chemical Company

- Synthos S.A.

- Versalis S.p.A.

- Formosa Chemicals & Fibre Corp.

- Trinseo

- Nova Chemicals Corporation

- Chi Mei Corporation

- Supreme Petrochem Ltd.

- Americas Styrenics LL

Recent Developments

- In February 2025, Trinseo launched its transparent recycled polystyrene resin with dissolution technology for food-contact applications. The product is used in dairy containers, food trays, and hot/cold drink cups, and is the first transparent dissolution recycled polystyrene (rPS) in the European market compliant with EU Regulation 2022/1616.

- In January 2025, a new polystyrene mechanical recycling solution for food contact quality of INEOS Styrolution, the global leader in styrenics, has been selected as a finalist at the 2025 Plastics Recycling Awards Europe in the category “Product Technology Innovation of the year”.

- In January 2025, Ineos Styrolution, a Germany-based styrenics producer, completed its first project using mechanically recycled polystyrene (rPS) in yogurt cups.

- In January 2025, The Plastics Industry Association (PLASTICS), Washington, created Polystyrene Recycling Alliance (PSRA), a collaborative effort designed to unite the polystyrene (PS) and expandable polystyrene (EPS) industries together with a diverse group of stakeholders from brands, converters and recyclers to achieve the goal of gaining “widely recyclable status” for PS.

- In April 2021, INEOS Styrolution, Recycling Technologies, and Trinseo collaboratively established commercial polystyrene recycling plants in Europe, with Recycling Technologies serving as the technology partner. This expansion marked a significant step toward addressing environmental concerns by integrating advanced recycling solutions into the polystyrene production process.

Segments Covered in the Report

By Product Type (Revenue and Volume)

- General Purpose Polystyrene (GPPS)

- High Impact Polystyrene (HIPS)

- Expandable Polystyrene (EPS)

- Extruded Polystyrene (XPS)

- Polystyrene Copolymers

- Acrylonitrile Butadiene Styrene (ABS)

- Styrene Acrylonitrile (SAN)

- Styrene-Butadiene (SB)

- Others

- Syndiotactic Polystyrene (SPS)

- Biodegradable/Modified Polystyrene

By Form

- Solid

- Foamed

- Expanded (EPS)

- Extruded (XPS)

- Pellets/Granules

- Sheets & Films

- Blocks

By Manufacturing Process

- Suspension Polymerization

- Emulsion Polymerization

- Solution Polymerization

- Mass (Bulk) Polymerisation

By End-Use Industry

- Packaging

- Construction

- Automotive & Transportation

- Electrical & Electronics

- Healthcare

- Consumer Goods & Appliances

- Industrial

- Agriculture

- Others

By Distribution Channel

- Direct Sales

- Distributors/Wholesalers

- Online Retail

- Speciality Chemical Suppliers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content