What is the Expanded Polystyrene Market Size?

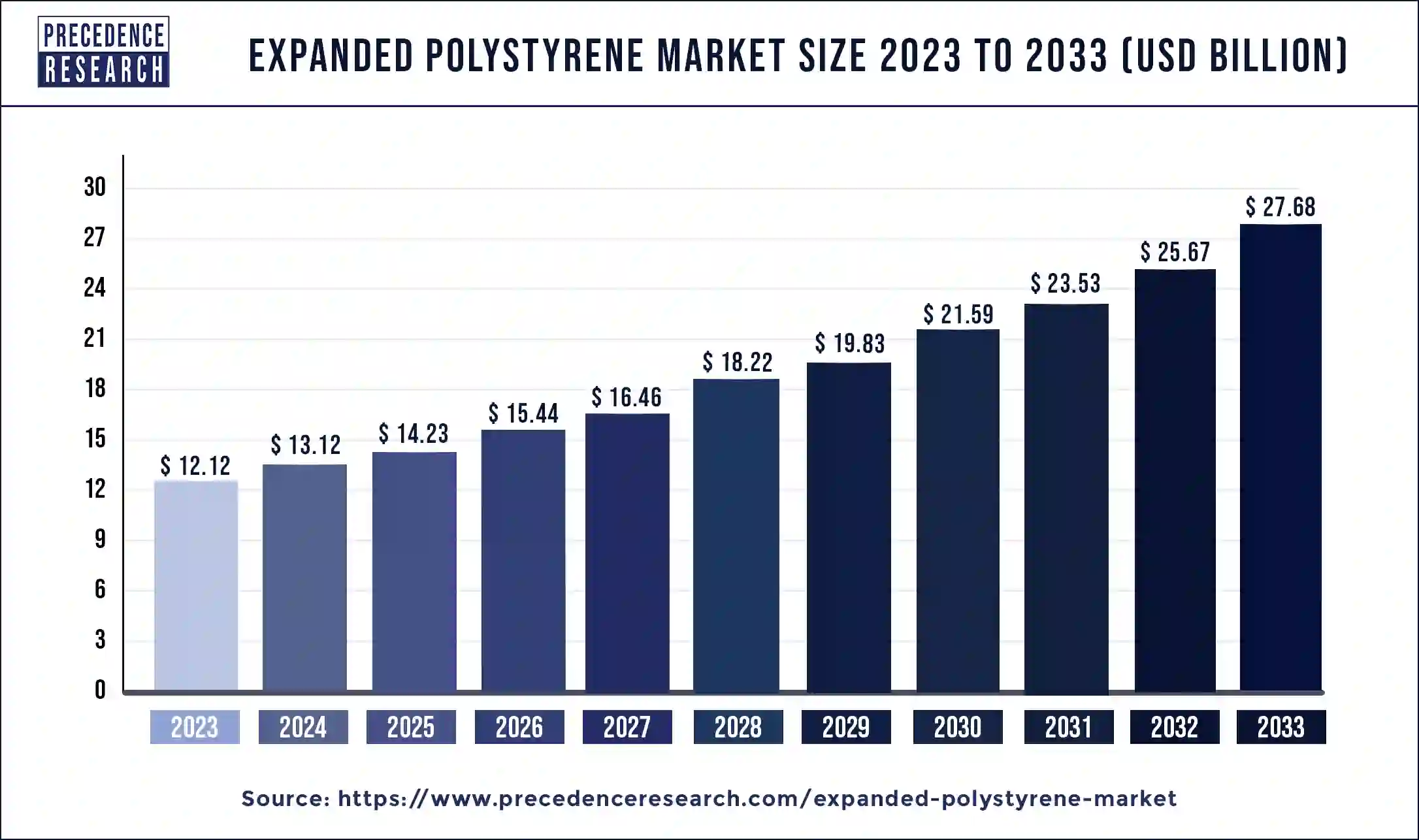

The global expanded polystyrene market size is exhibited at USD 14.23 billion in 2025 and is projected to hit around USD31.8 billion by 2035, registering a CAGR of 8.37% during the forecast period from 2026 to 2035

Market Highlights

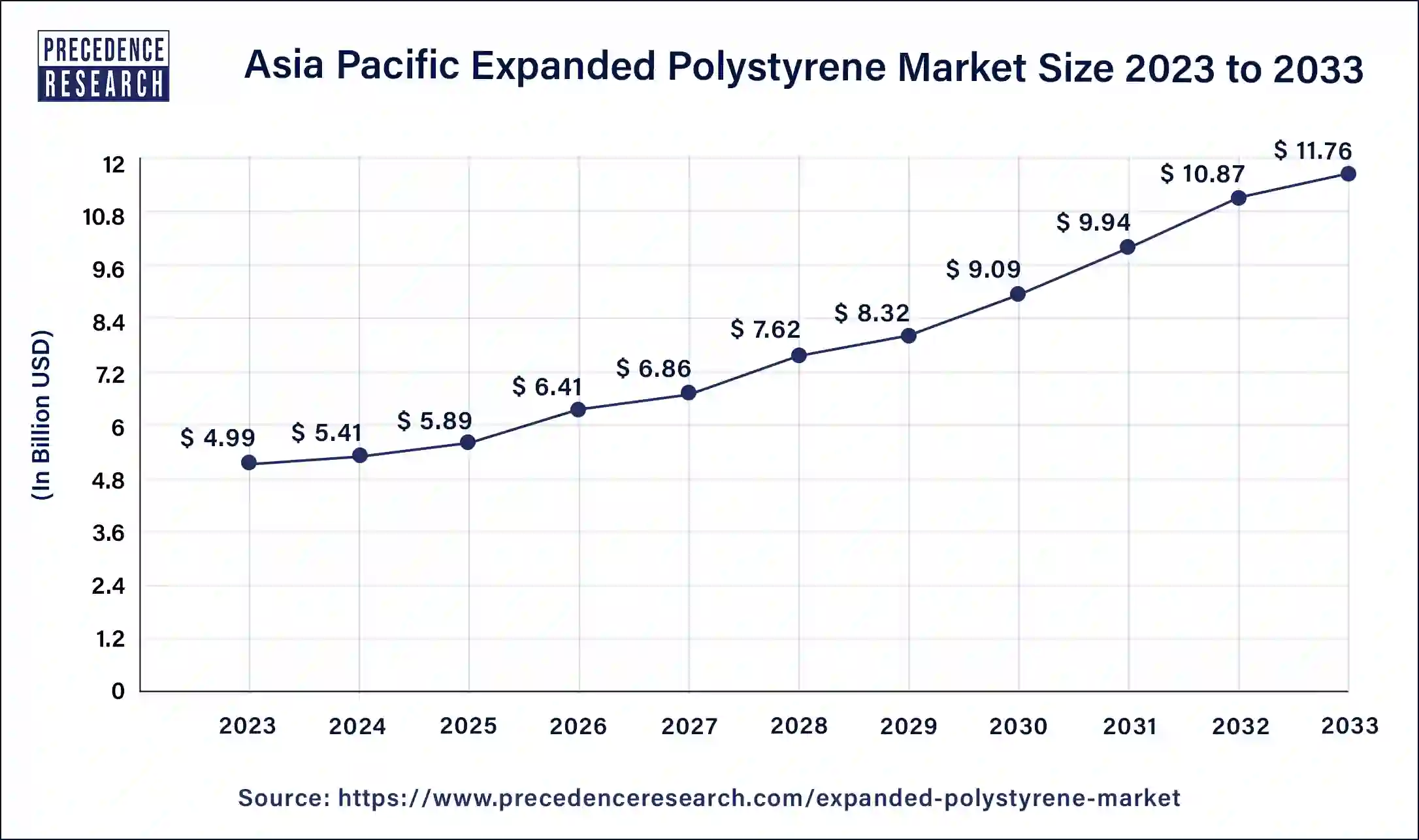

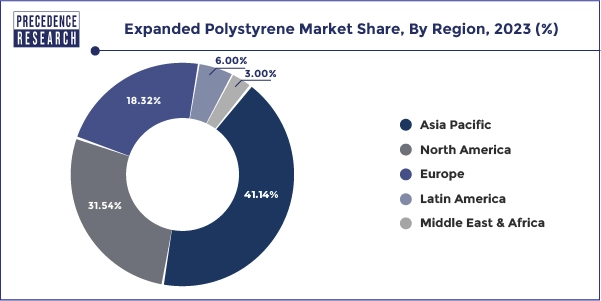

- Asia Pacific contributed more than 41.14% of revenue share in 2025.

- North America is estimated to expand the fastest CAGR between 2026 and 2035.

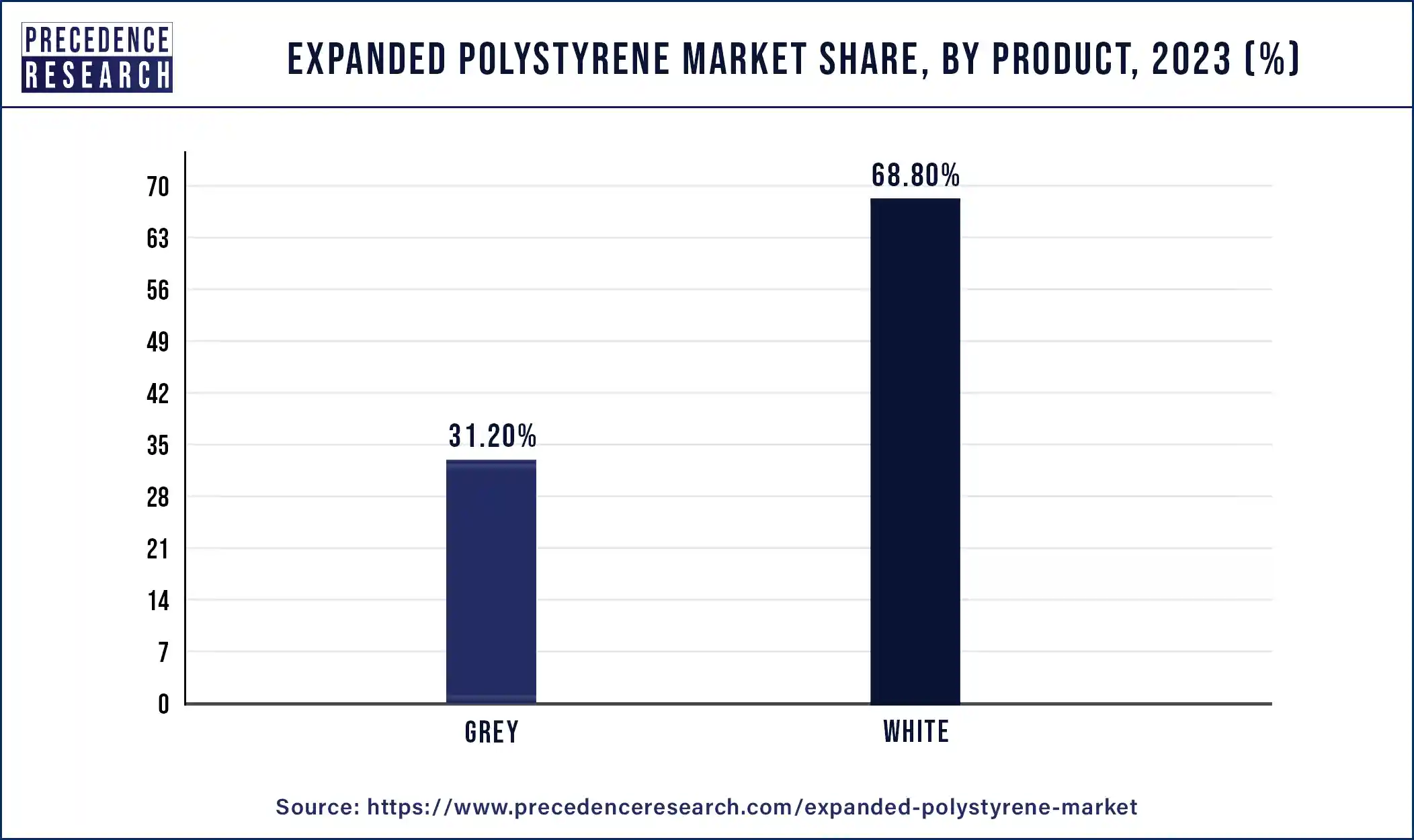

- By product, the white segment has held the largest market share of 68.80% in 2025.

- By product, the grey segment is anticipated to grow at a remarkable CAGR of 9.2% between 2026 and 2035 .

- By application, the construction segment generated over 34% of revenue share in 2025.

- By application, the packaging segment is expected to expand at the fastest CAGR over the projected period.

What is Expanded Polystyrene?

Expanded polystyrene (EPS) is a lightweight and rigid cellular plastic material derived from the polymerization of styrene. It is commonly known as foam or Styrofoam, a trademarked term owned by Dow Chemical Company. EPS is created by expanding polystyrene beads using steam, which causes them to fuse together and create a closed-cell structure. This structure gives EPS its characteristic insulating properties, making it an excellent choice for various applications.

EPS is widely used in packaging, construction, and insulation due to its low thermal conductivity, affordability, and versatility. In construction, EPS is employed as insulation material for walls, roofs, and foundations, providing effective thermal resistance and energy efficiency. In packaging, its lightweight nature and shock-absorbing qualities make it ideal for protecting fragile items during transportation. While EPS has numerous practical applications, its environmental impact has raised concerns, as it is not easily biodegradable. Efforts are being made to promote recycling and sustainable disposal methods to mitigate these environmental concerns associated with EPS usage.

Growth Factors

- Growing construction projects worldwide drive the demand for Expanded Polystyrene (EPS) in insulation and building applications.

- The expanding e-commerce sector and demand for lightweight packaging solutions fuel the growth of EPS as a protective and insulating material.

- Ongoing research and development in EPS production processes lead to improved efficiency, cost-effectiveness, and expanded application possibilities.

- Stringent regulations promoting energy-efficient construction boost the adoption of EPS insulation materials.

- The automotive industry's focus on lightweight materials for fuel efficiency creates opportunities for EPS in vehicle components.

- Global urbanization trends and infrastructure development projects drive the use of EPS in construction for its insulation and structural properties.

- The increasing demand for electronic devices contributes to the growth of EPS in protective packaging for fragile goods.

- The need for temperature-sensitive transport and storage in the pharmaceutical and food industries increases the demand for EPS in cold chain logistics.

- The shift towards eco-friendly materials benefits EPS, as it is recyclable and can be used in sustainable packaging solutions.

- Ongoing innovations, such as shape molding and specialty EPS products, expand the range of applications for this versatile material.

- EPS's thermal insulation properties make it popular for food service applications, such as disposable containers and cups.

- A rebound in manufacturing activities globally positively impacts the demand for EPS in industrial packaging and components.

- Improvements in EPS recycling technologies address environmental concerns, making it a more sustainable choice.

- Government investments in infrastructure projects create a steady demand for EPS in construction and insulation.

- The aftermarket demand for replacement parts and accessories contributes to the growth of EPS in automotive applications.

- EPS is increasingly used in horticulture for its lightweight, insulating, and moisture-resistant properties in seed trays and containers.

Market Outlook

- Industry Growth Overview: The expanded polystyrene market is experiencing significant growth as EPS is a lightweight material with good insulation characteristics, offering advantages like better mechanical strength, electrical properties, dimensional stability, weathering, and aging resistance

- Global Expansion: The expanded polystyrene market is experiencing significant global expansion, driven by major customers from the construction, packaging, appliances, and consumer electronics industries. North America is dominant in the market, as there is progressive infrastructure for long-distance delivery.

- Major investors: The major investors in the expanded polystyrene market are largely the massive chemical and petrochemical corporations that produce the raw material. It includes BASF SE, SABIC, and many others.

How is AI Influencing the Expanded Polystyrene Industry?

Artificial Intelligenceand automation are reconsidering the expandable polystyrene industry by optimizing production processes and even minimizing energy consumption. Automated manufacturing systems equipped with AI-based controls enable real-time monitoring of polymer growth and molding operations, decreasing material waste and enhancing throughput. AI algorithms can determine vast datasets from numerous sources, including online reviews, social media, and customer interactions, in real time, uncovering trends along with sentiments that would be nearly impossible to detect manually.

Expanded Polystyrene Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 14.23 Billion |

| Market Size in 2026 | USD 15.44 Billion |

| Market Size by 2035 | USD 31.8 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.37% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product and By Application, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing awareness of energy efficiency and rising e-commerce activities

The increasing awareness of energy efficiency in construction practices has become a significant driver for the expanded polystyrenes market. Stringent regulations and a growing consciousness of environmental sustainability have led to a surge in demand for EPS as a thermal insulation material. Its lightweight and insulating properties make EPS a preferred choice for builders seeking energy-efficient solutions in residential, commercial, and industrial structures.

Simultaneously, the rising tide of e-commerce activities has propelled the demand for EPS in the packaging industry. With the exponential growth of online shopping, there is a heightened need for secure and lightweight packaging materials to protect goods during transportation. EPS, known for its shock-absorbing characteristics and cost-effectiveness, has become a go-to material for packaging fragile items, reinforcing its pivotal role in sustaining the burgeoning e-commerce market. As a result, the dual forces of energy efficiency awareness and the e-commerce boom synergistically contribute to the expanding market demand for expanded polystyrene.

Restraint

Recycling challenges

Recycling challenges pose a significant restraint on the growth of the expanded polystyrenes market. While EPS is technically recyclable, the lack of a widespread and efficient recycling infrastructure impedes its sustainable lifecycle. The lightweight and voluminous nature of EPS make collection and transportation for recycling economically challenging. Additionally, the cost-effectiveness of recycling operations is influenced by the demand for recycled EPS, which can be inconsistent. Limited awareness and access to EPS recycling facilities further contribute to the challenge.

The perception that EPS recycling is difficult and economically unviable hampers its overall sustainability profile. As environmental concerns intensify and recycling becomes a focal point in waste management, addressing these challenges is crucial for the EPS market to align with evolving regulatory standards and consumer expectations for environmentally responsible materials. Developing efficient and cost-effective recycling solutions will be instrumental in mitigating these constraints and fostering the sustainable growth of the EPS market.

Opportunity

Green innovations

Green innovations are pivotal in creating opportunities within the expanded polystyrenes market. The development of environmentally friendly EPS variants, such as bio-based or recycled content, aligns with the growing demand for sustainable materials. Companies investing in green innovations can differentiate themselves in the market, meeting consumer expectations and regulatory requirements for reduced environmental impact. These eco-friendly EPS options offer a compelling proposition for industries seeking sustainable solutions, contributing to the market's expansion.

As sustainability becomes a central focus across various sectors, including packaging and construction, the adoption of green EPS variants presents a strategic advantage. Furthermore, such innovations position EPS manufacturers to participate actively in circular economy initiatives, addressing concerns about plastic waste and supporting a more sustainable and responsible approach to material usage. Overall, green innovations not only open new avenues for growth in the EPS market but also contribute to the industry's positive environmental impact.

Segment Insights

Product Insights

In 2025, the white segment had the highest market share of 68.80% based on the product. The segment in the expanded polystyrenes market refers to EPS products with a characteristic white color, often used in construction and packaging applications. This segment is witnessing a trend towards increased demand in the construction sector, driven by the growing need for energy-efficient insulation materials. The white EPS products are favored for their thermal insulation properties and versatility in diverse construction applications. As sustainability gains importance, there is also a trend towards developing eco-friendly white EPS variants, addressing environmental concerns and aligning with green building practices.

The grey segment is anticipated to expand at a significant CAGR of 9.2% during the projected period. In the expanded polystyrene (EPS) market, the "grey" segment refers to EPS with a graphite additive, enhancing its insulation properties. The addition of graphite particles enhances thermal performance by reflecting and absorbing radiant heat. This variant, often referred to as "grey EPS" or "graphite EPS," is gaining popularity in the construction industry due to its improved insulation efficiency. As energy efficiency becomes a priority in building design, the grey EPS segment is witnessing a rising trend, particularly in applications requiring enhanced thermal insulation for walls, roofs, and foundations.

Application Insights

According to the application, the construction segment has held 34% revenue share in 2023. The construction segment in the expanded polystyrenes market refers to the utilization of EPS in building and infrastructure applications. EPS is widely employed for thermal insulation in walls, roofs, and foundations due to its lightweight and excellent insulating properties.

A significant trend in this segment involves the increasing adoption of EPS as a sustainable and energy-efficient construction material. Stringent energy codes and regulations globally have driven the demand for EPS insulation solutions, contributing to its prominence in the construction industry as a preferred choice for enhancing building energy performance.

The packaging segment is anticipated to expand fastest over the projected period. In the expanded polystyrenes market, the packaging segment refers to the use of EPS in various packaging applications. EPS is widely employed for its lightweight, shock-absorbing properties, making it an ideal material for protective packaging.

In recent trends, there is an increased demand for EPS in e-commerce packaging, where its effectiveness in safeguarding fragile items during transportation is particularly valuable. Additionally, the packaging segment sees growth in sustainable packaging solutions, with a focus on recyclability and eco-friendly alternatives, aligning with broader industry efforts towards environmental responsibility.

Regional Insights

Asia Pacific Expanded Polystyrene Market Size and Growth 2026 to 2035

The Asia Pacific expanded polystyrene market size is valued at USD 5.89 billion in 2025 and is expected to reach USD13.56 billion by 2035, growing at a CAGR of 8.7% from 2026 to 2035.

Asia Pacific has held the largest revenue share of 41.14% in 2023. Asia Pacific dominates the expanded polystyrenes market due to robust industrial and construction activities. The region's rapid urbanization, infrastructure development, and expanding manufacturing sectors drive significant demand for EPS in insulation, packaging, and diverse applications. Additionally, the booming e-commerce industry in countries like China and India fuels the need for lightweight and protective packaging, further enhancing EPS consumption. The continuous economic growth, coupled with favorable government policies, positions Asia-Pacific as a major contributor to the overall market share and growth of the EPS industry.

China Expanded Polystyrene Market Trends

In China, with increasing levels of urbanization and an increasing economy, total building energy use in China is increasing. China's low-carbon city pilot guideline is an efficient way of encouraging green building development and lowering these emissions. In 2024, China produced nearly 30% of the world's vehicles, making it a major automotive manufacturer, which increases the demand for expanded polystyrene.

North America: Robust industrialization

North America is estimated to observe the fastest expansion. North America holds a significant growth in the expanded polystyrenes market due to robust demand in the construction and packaging industries. The region's emphasis on energy-efficient construction, driven by stringent regulations, boosts EPS applications. Additionally, the thriving e-commerce sector fuels the need for lightweight and protective packaging, further contributing to EPS market dominance. Ongoing innovation and a strong focus on sustainability in packaging practices reinforce North America's key role, making it a major player in the EPS market.

U.S. Expanded Polystyrene Market Trends

The United States is experiencing a surge in construction activity and, increase in spending on infrastructure projects, which eventually increases the demand for expanded polystyrene. E-commerce created a tremendous market opportunity for defensive packaging, as many more products had to be packaged as individual parcels rather than as products in a greater box on a pallet, which drives the growth of the market.

Europe: Increasing demand for energy

Europe is experiencing significant growth in the market, as the EU needs a 16% in energy use by 2030, increasing to 20–22% by 2035, with 55% of savings to come from the worst-performing 43% of homes. EPS insulation provides a practical, affordable solution to support meeting these binding targets in Europe.

The UK Expanded Polystyrene Market Trends

In the UK, packaging and construction sustained to drive demand due to expanded polystyrene's lightweight, protective, and insulated properties. EPS provides a good balance of performance and reduced cost, making it attractive for large-scale projects in logistics and construction.

Latin America Expands: Rising Demand Fuels the Expanded Polystyrene Industry

Latin America's market shows notable growth during the forecast period. It is driven by the expansion in residential and infrastructure projects, mainly for energy-efficient buildings, which creates a strong need for expanded polystyrene insulation. There is a requirement for insulated food containers along with packaging to maintain freshness, which boosts consumption in the foodservice industry.

Brazil Expanded Polystyrene Market Trends

Brazil's market is experiencing notable expansion due to the increasing need from various industries such as construction, packaging, and electronics. The market is anticipated to expand steadily over the next numerous years, driven by both local and international consumption patterns, together with innovations in product manufacturing and recycling technologies.

From Packaging to Insulation: Expanded Polystyrene Demand Surges Across MEA

MEA's market shows a rapid growth rate during the forecast period. It is driven primarily by massive infrastructure investments, the demand for energy-efficient building solutions, and even a rapidly expanding cold chain logistics sector. The demand to transport vaccines, pharmaceutical products, and fresh food across the region demands reliable, temperature-controlled packaging. Expanded polystyrene is the preferred alternative for its thermal insulation properties.

Kuwait Expanded Polystyrene Market Trends

Kuwait's market is primarily driven by rapid urbanization, a rising construction sector, and the increasing need for energy-efficient building insulation materials. Expanded polystyrene is a lightweight and rigid plastic foam with strong thermal insulation properties, which has widespread applications in construction, packaging, and cold chain logistics.

Value Chain Analysis for the Expanded Polystyrene Market

- Feedstock Procurement

It revolves around sourcing petrochemical-origin raw materials, primarily styrene monomer and even a blowing agent, via a highly integrated, cost-sensitive supply chain.

Key Players: INEOS Styrolution Group GmbH, SABIC, TotalEnergies SE - Chemical Synthesis and Processing

It includes synthesizing polystyrene via polymerization, impregnating it with a blowing agent to create expandable beads, and then utilizing steam to foam and mold these beads into desired shapes.

Key Players: TotalEnergies SE, Ravago, Versalis S.p.A. - Compound Formulation and Blending

It operates by strategically mixing virgin polystyrene resin with additives and also blowing agents to create "expandable" beads and by blending in recycled materials to improve performance, enhance insulation, and meet expense or sustainability targets.

Key Players: Synthos S.A., Kaneka Corporation, NOVA Chemicals Corporation

SWOT Analysis - Expanded Polystyrene Market

Drivers:

• Expanded polystyrene is extremely versatile; it can be used to protect, package, transport, and preserve sensitive products and equipment in comprehensive safety.

• EPS boasts exceptional thermal insulation properties, which significantly improve energy efficiency and reduce heating and cooling expenses.

• Expanded polystyrene (EPS) is a building material equipped for upgrading the building's plan and mechanical integrity

Restraints:

• Expanded polystyrene does not biodegrade. These tiny pieces become brittle and break down further into microplastics.

• Expanded polystyrene simply becomes pollution. It is problematic to collect and persist in the environment indefinitely.

Opportunity:

• Graphite-driven EPS is an ecological material that not only enhances energy efficiency but also provides a sustainable choice for insulation, lowering the carbon footprint of buildings.

• Cellulose-based material, which is a supportable replacement for traditional expanded polystyrene (EPS) products. This biobased extra for foam-molded EPS is made from cellulose-driven materials instead of fossil fuels and has noteworthy environmental benefits.

Threat:

• Expanded polystyrene has been connected to cancer and other adverse health impacts. EPS contains the chemical styrene, which is classified as a credible human carcinogen.

• Prolonged polystyrene is problematic and expensive to recycle.

Expanded Polystyrene Market Companies

- BASF SE

- Kaneka Corporation

- Synthos S.A.

- TotalEnergies

- SABIC

- SUNPOR Kunststoff GmbH

- Flint Hills Resources

- PJSC SIBUR Holding

- Nova Chemicals Corporation

- Alpek S.A.B. de C.V.

- Saudi Basic Industries Corporation (SABIC)

- ACH Foam Technologies

- StyroChem

- BEWiSynbra Group AB

- Brødrene Hartmann A/S

Recent Developments

- In August 2025, INEOS Styrolution launched its recent circular packaging breakthrough, sour cream cups made with 30% recycled polystyrene, available in ALDI SÜD stores across Germany since the beginning of this year.

- In October 2024, Engineered Foam Products Ltd, a leading UK manufacturer of expanded foam, is pleased to announce the acquisition of Springvale EPS Ltd, creating the largest expanded polystyrene (EPS) and expanded polypropylene (EPP) manufacturer in the UK. ( (Source: https://www.engineeredfoamproducts.com)

- In July 2022, Venture Polymers and Aurora Manufacturing, two U.K. recyclers, have been acquired by Belgian plastics company Ravago Manufacturing.

Segments Covered in the Report

By Product

- White

- Grey

By Application

- Construction

- Packaging

- Automotive

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting