What is the Packaging Material Market Size?

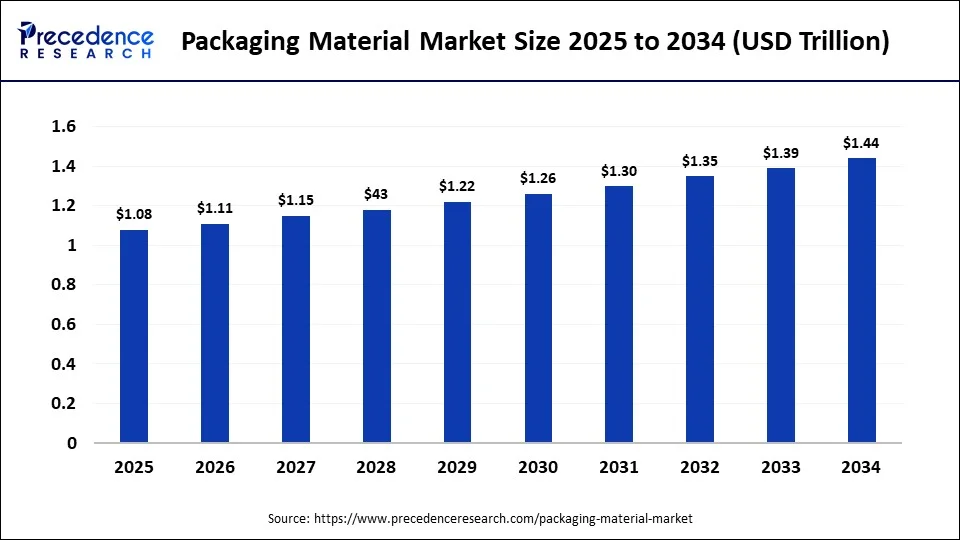

The global packaging material market size was valued at USD 1.08 trillion in 2025, accounted for USD 1.11 trillion in 2026, and is expected to reach around USD 1.44 trillion by 2034, expanding at a CAGR of 3.2% from 2025 to 2034. The expansion of end-users across the globe along with new product innovation for packaging purposes are observed to boost the growth of the packaging material market during the forecast period.

Market Highlights

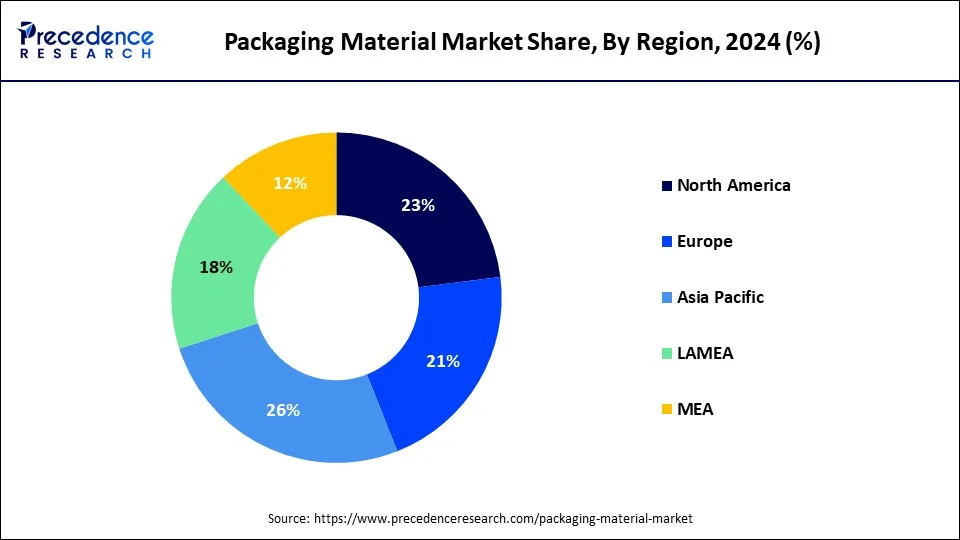

- Asia Pacific led the global market with the highest market share of 26% in 2024.

- By Material, the paper segment is projected to dominate the global market over the forecast period.

- By Material, the rigid plastic segment generated a remarkable market share in 2024.

- By Product, the bottles segment led the market in 2024.

- By End-user, the food and beverages segment dominated the global market in 2024.

- By End-user, the household products segment is predicted to hold a significant market share.

Market Size and Forecast

- Market Size in 2025: USD 1.08 Billion

- Market Size in 2026: USD1.11 Billion

- Forecasted Market Size by 2034: USD1.44 Billion

- CAGR (2025-2034): 3.2%

- Largest Market in 2024: Asia Pacific

Market Overview

The packaging material market is a dynamic and rapidly growing industry that is critical in protecting and preserving various products during transportation, storage, and sale. Packaging materials are used in a wide range of applications, including food and beverage packaging, pharmaceutical packaging, personal care packaging, industrial packaging, and more.

The market's growth is driven by multiple regulations and standards set by governments and industry bodies for the packaging material industries and manufacturers. Regulations promoting the use of recyclable or reusable packaging materials, restrictions on single-use plastics, and food safety and hygiene requirements can shape the demand for packaging materials.

For instance, in July 2022, India banned the use of single-use plastic to curb the pollution caused by plastic packaging and wrapping. This step by the Indian government is expected to boost the production of sustainable packaging materials in the upcoming years, which subsequently promote the market's growth.

Packaging Material Market Growth Factors

The growth of the packaging material market is driven by the rising e-commerce industry worldwide. The booming e-commerce industry requires specialized packaging materials to ensure the safe and efficient shipping of products. Packaging materials designed for e-commerce, such as protective packaging, void fill materials, and returnable packaging, can offer significant growth opportunities for businesses catering to the e-commerce market.

With increasing awareness about environmental concerns, there is a growing demand for sustainable and eco-friendly packaging materials. Businesses that offer packaging materials made from renewable, biodegradable, and compostable materials are expected to witness a significant increase during the projected timeframe.

Technological advancement in packaging material innovation is another significant driving factor for the growth of the packaging material market. Advances in technology can drive innovation in the packaging material market. For example, developing new materials, coatings, and printing techniques can lead to improved packaging performance, durability, and aesthetics, driving adoption in the market.

In February 2023, the global leader in beverage products, Coco-Cola, announced that the company aims to launch the minute maid range of fruit-based drinks, especially for the Indian market. The new carton development for fruit-based drinks is described as a seamless package in unique shapes. The company will utilize Direct Injection Moulding Concept Technology for the latest innovative packaging solution, ensuring a great pouring experience with an easy grip.

Improvements in the efficiency of the packaging supply chain, such as advancements in logistics, transportation, and warehousing, are observed to impact the market in a positive way. Efficient supply chain management can lead to cost savings, reduced waste, and improved delivery times, which can influence the choice of packaging materials. Economic factors such as GDP growth, disposable income, and consumer spending patterns are driving the growth of the packaging material market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.08 Trillion |

| Market Size in 2026 | USD 1.11 Trillion |

| Market Size by 2034 | USD 1.44 Trillion |

| Growth Rate from 2025 to 2034 | CAGR of 3.2% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Product, End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising e-commerce food delivery industry

The rise of e-commerce and online food delivery services has revolutionized the food industry, creating new opportunities and challenges for packaging. Food products ordered online require packaging that can withstand the rigors of transportation, protect the products from damage and heat, and maintain their freshness until they reach the consumer's doorstep. This has led to the development of specialized packaging materials for e-commerce and online food delivery, such as insulated packaging, tamper-evident packaging, and sustainable packaging that can be easily recycled. The growth of the food industry's e-commerce and online food delivery segments drives the demand for these specialized packaging materials, leading to the development of the packaging material market.

In addition, many e-commerce businesses focus on utilizing recyclable and sustainable packaging solutions; this is predicted to drive the market's growth. For instance, in April 2022, India's largest food delivery partner, Zomato, stated that it would be using 100% plastic-neutral packaging onwards by setting up a target to deliver more than ten crore orders in sustainable packaging.

Restraint

Environmental concerns

Rising environmental concerns are observed to act as a significant restraint on the growth of the packaging material market by limiting market players from developing new materials. Increasing awareness and concern about environmental issues such as plastic pollution, deforestation, and climate change has increased the demand for sustainable packaging materials. Traditional packaging materials that are not eco-friendly, such as single-use plastics or non-recyclable materials, may face limitations regarding consumer acceptance, regulatory compliance, and market demand, which can impact their growth prospects.

Governments and regulatory bodies around the world are imposing stricter regulations and standards on packaging materials to promote environmental sustainability. These regulations may include restrictions on the use of certain materials, such as plastic bags or polystyrene packaging, or requirements for recycling or composability. Compliance with these regulations may be challenging for traditional packaging materials that do not meet the sustainability criteria, leading to potential restraints in the market.

Opportunity

Rising demand for customized packaging

Customized packaging creates a unique brand identity for companies; by using such packaging solutions, companies focus on their brand recognition. Factors such as competitive advantages, improved business scope, favorable outcomes, changing consumer preferences, and increasing focus on sustainability through packaging have boosted the demand for customized packaging solutions across the globe. Customized packaging that caters to the specific needs of various industries, such as food and beverage, healthcare, and e-commerce, can be a lucrative opportunity, as businesses require innovative packaging solutions. Especially, rising e-commerce business activities are supporting the demand for customized packaging. Companies that offer packaging materials that are tailored to meet the specific requirements of different industries can attract niche markets and create a loyal customer base.

Segments Insights

Material Type Insights

Due to the rising consumer preferences for paper bags, pouches, and other packaging forms, the paper segment is expected to dominate the global sustainable packaging market during the forecast timeframe. Given the growing environmental concerns, many clothing brands, packaged food product companies, and other end-users are focusing on promising sustainable packaging.

In 2022, the plastic segment held a significant market share; the segment grew steadily during the analysis period. The increasing production of recycled plastic material for multiple end-users, particularly pharmaceutical applications, is expected to drive segment growth during the forecast period. Furthermore, because of its low cost and lightweight properties, plastic is used as sustainable packaging.

During the forecast period, the glass segment remains the most promising segment in the packaging material market. Sustainable glass packaging is becoming increasingly popular due to its environmental benefits, health and safety benefits, durability, attractive appearance, and purchaser interest in environmentally conscious packaging options. The producers of alcoholic and non-alcoholic beverages are expected to contribute the most to the segment's growth.

Product Insights

The bottles segment dominated the global glass packaging market in 2024 and will continue to do so during the forecast period. The segment's progress has been facilitated by the design flexibility and durability of bottles. In addition, rising demand for recycled material from the food and beverage industries is expected to keep the bottles segment expanding during the forecast period.

Another factor considered for the growth of the bottle segment is rising disposable income; as disposable income rises, consumers are more likely to purchase premium products that are often packaged in glass bottles, such as high-end wine, spirits, and cosmetics.

The box segment shows a promising growth during the forecast period, the rise of online shopping businesses that require lightweight packaging solutions for easy transportation is expected to propel the growth of box segment. Moreover, boxes can be easily designed and recycled, the rising environmental concerns are expected to support the growth of box segment.

End-User Insights

The food and beverages segment dominated the market in 2024; the segment will continue its dominance throughout the forecast period. The emerging online food industry that requires branding and marketing along with safe food transportation is fueling the demand for packaging materials in the food and beverage industry. Moreover, the combination of factors such as the need for protection, preservation, and regulatory requirements in the food industry are observed to boost the segment's growth.

The household products segment is expected to hold a significant market share. The Covid pandemic has forced the population to adopt multiple sanitization methods, which resulted in increased demand for household products. The enormous demand for household products boosted the demand for cardboard and plastic packaging. The increased demand in recent years for cleaning and hygiene-based products even forced several market players to develop innovative solutions for packaging specially designed for household products.

For instance, in February 2023, Total Energies and EcoLabs announced their collaboration to introduce post-consumer recycled plastic into post-consumer recycled into primary packaging for highly concentrated cleaning products in order to deliver sustainable packaging solutions.

Regional Insights

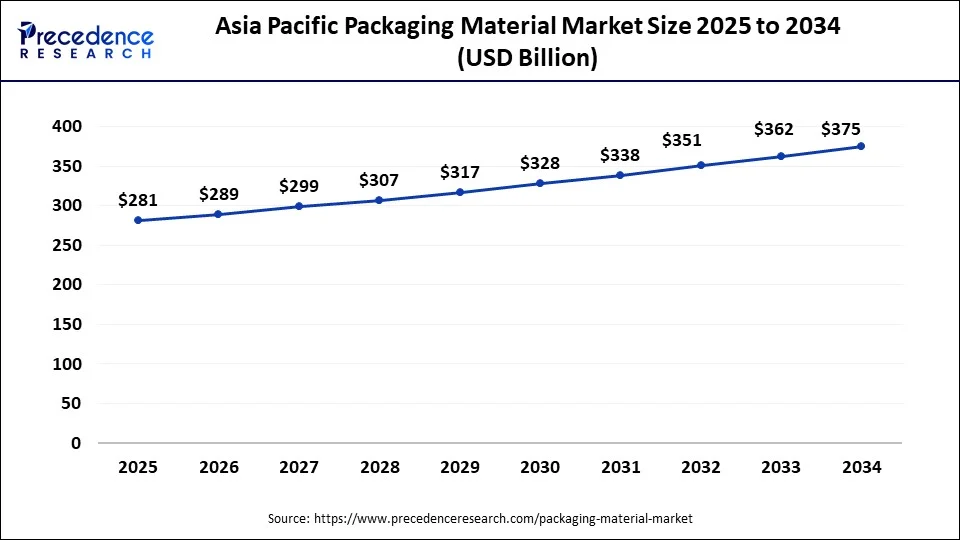

Asia Pacific Packaging Material Market Size and Growth 2025 to 2034

The Asia Pacific packaging material market size is estimated at USD 281 billion in 2025 and is predicted to be worth around USD 375 billion by 2034, at a CAGR of 3.4% from 2025 to 2034.

Asia Pacific is expected to dominate the packaging material market during the forecast period. The fastest market growth in Asia Pacific is promoted by the higher plastic consumption in numerous industries. Rising urbanization and industrialization in developing countries of Asia Pacific are demanding innovative packaging solutions; this is intended to boost the market's growth during the forecast period. Moreover, the availability of low-cost supplies needed in financially viable packaging solutions continues to drive market growth in Asia Pacific. China is the Asia Pacific region's largest market for packaging solutions, which is followed by Japan, India, and South Korea.

The North American packaging material market is mature and highly competitive, with the United States and Canada being the key markets. The demand for sustainable packaging materials, such as bioplastics and recycled materials, is increasing due to growing environmental concerns. In addition, stringent regulations on packaging materials, including recyclability and composability requirements, are influencing the market dynamics in North America.

Europe is another significant market for packaging materials, with countries such as Germany, France, and the United Kingdom leading the industry. The European packaging material market is driven by factors such as increasing consumer awareness of sustainability, stringent regulations on single-use plastics, and a growing demand for convenience packaging. The focus on recyclable and renewable packaging materials and innovative packaging designs and technologies is shaping the market landscape in Europe.

Packaging Material Market Companies

- Amcor

- Ball Corporation

- Crown Holdings

- International Paper

- Reynolds Group

- Mondi

- Stora Enso

- WestRock

- Bemis

Recent Developments

- In February 2023, Cruz Foam announced the launch of new sustainable packaging material in the form of foam packaging material. The new packaging solution aims to ship fragile and temperature sensitive goods. The Cruz Foam aims to replace bubble wrap, bubble mailers, and other plastic packaging solutions.

- In March 2023, Stora Enso announced the launch of recyclable fiber-based material for food services paper lids, ‘Cupforma Natura Aqua+'; according to Stora Enso, the new packaging material is sturdy, lightweight, and can withstand hot beverages.

- In February 2023, ITC and Bonnysa announced their collaboration to launch a new packaging solution in the form of a lid for the carton of its grated tomato range. The new packaging lid is made from bio-based polypropylene that helps in reducing carbon emissions while guaranteeing the sustainability of raw materials.

Segments Covered in the Report

By Material

- Paper

- Cardboard

- Rigid plastic

- Flexible plastic

- Wood

- Textile

- Glass

- Metal

By Product

- Bag

- Pouch

- Box

- Bottles

- Cans and Jars

- Containers

- Wraps

- Drums

- IBCs

By End-User

- Food & Beverage

- Healthcare

- Household products

- Chemicals

- Cosmetics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting