What is the Thermoformed Plastics Market Size?

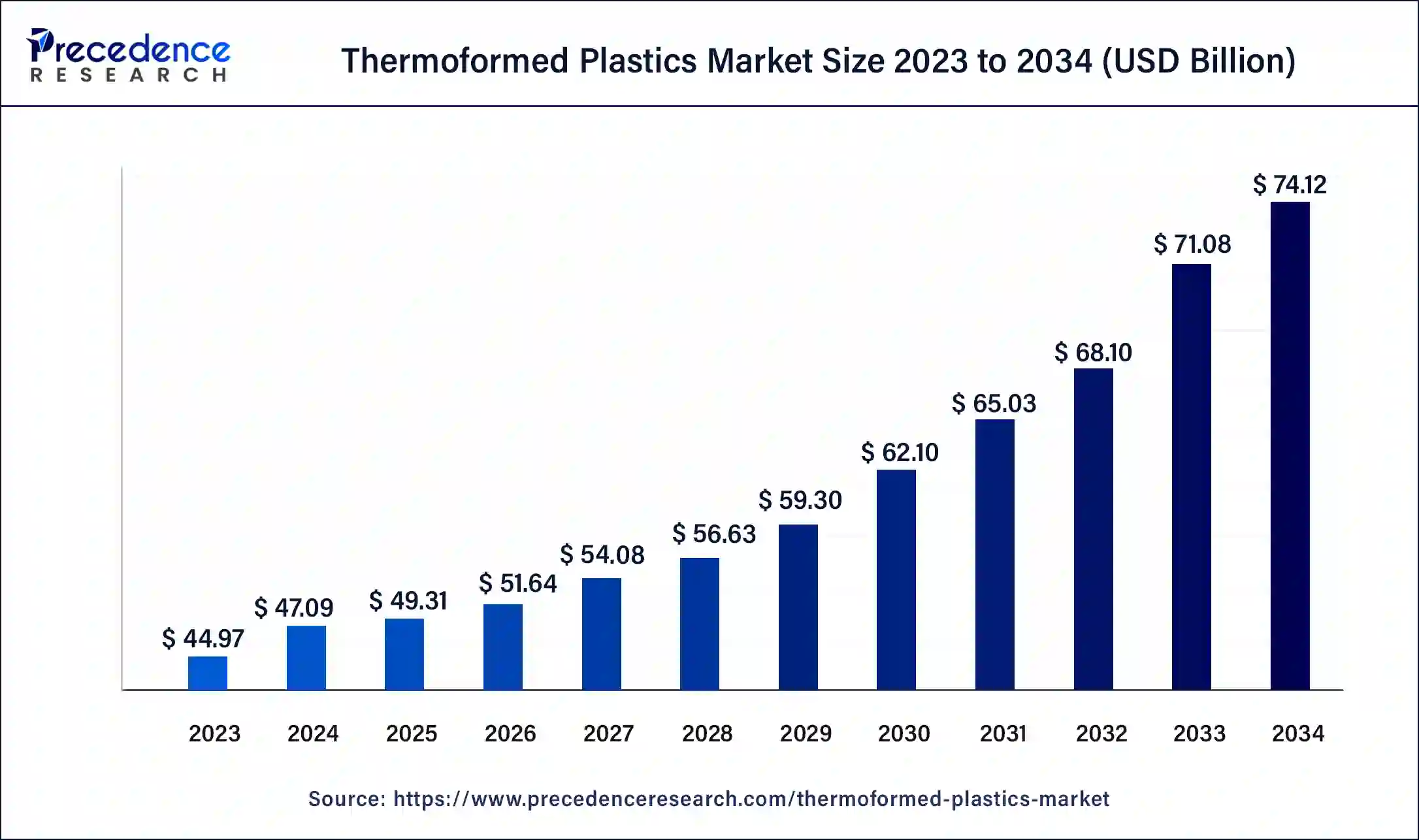

The global thermoformed plastics market size is calculated at USD 49.31 billion in 2025 and is predicted to increase from USD 51.64 billion in 2026 to approximately USD 77.12 billion by 2035, expanding at a CAGR of 4.57% from 2026 to 2035.

Thermoformed Plastics Market Key Takeaways

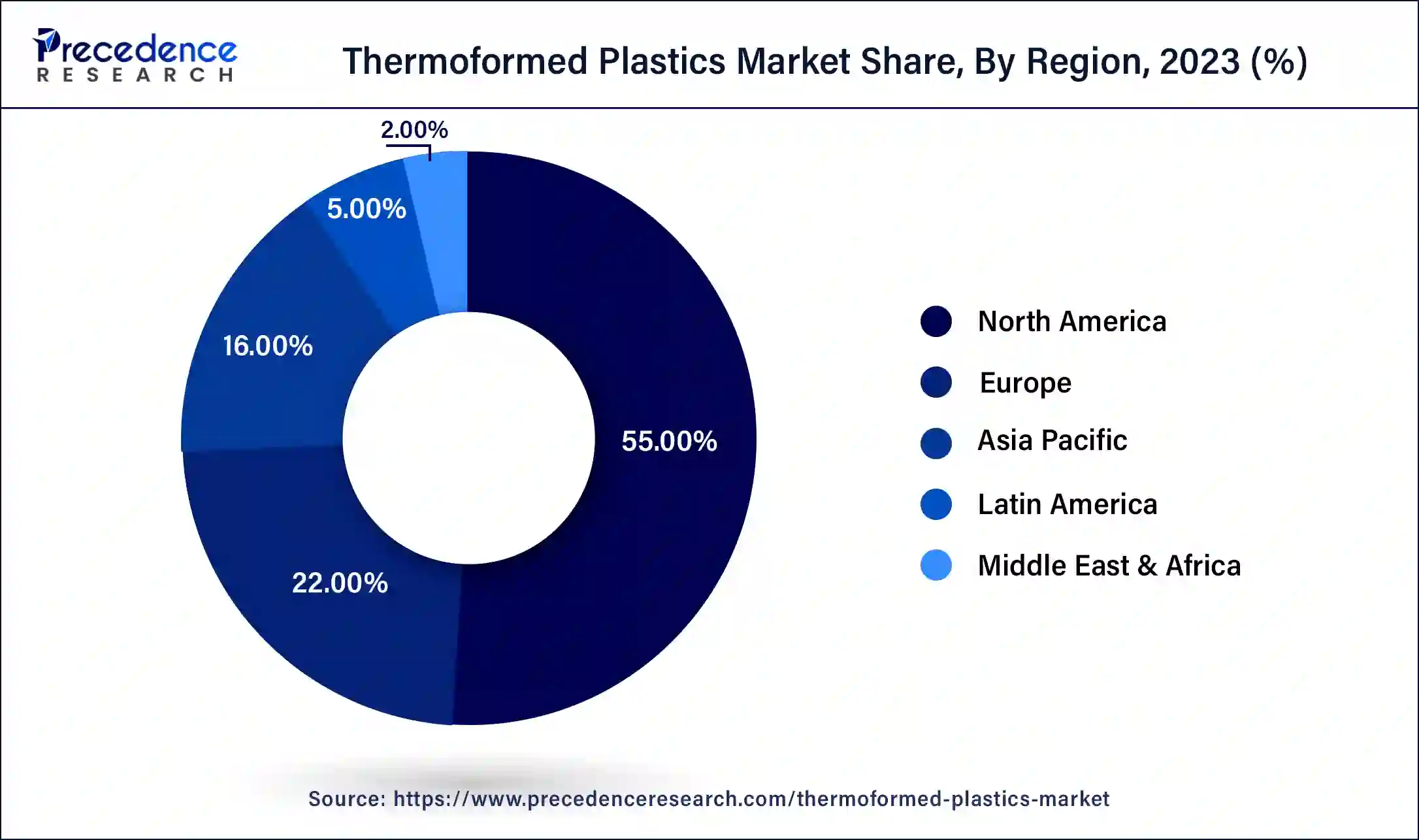

- North America region has captured 55% market share in 2025.

- By product, the polypropylene segment has reached its highest revenue share of 22% in 2025.

- By process, the thin-gauge thermoformed plastic segment has reached more than 36% revenue share in 2025.

- By application, the food packaging segment has accounted for 43% revenue share in 2023.

How will the Thermoformed Plastics Market's Overview Specify the Market's Potential Value?

As the thermoformed plastics are lightweight, they are widely used to produce vehicles which are lightweight durable and provide strength. Increased regulations by the government and the growing demand for the automotive's is creating a great demand for light vehicle usage and the thermoform plastics shall benefit from this demand. The use of all a tiled raw material in the thermoformed plastics may sometime hinder the growth of the market as it is costly. Thermoform plastics also find usage in four packaging. Does an increasing demand for packaged milk, carbonated drinks, packaged mineral water and packaged fruit juice. Many consumers are moving from unpacked products to the packed food items which is propelling the growth of the thermoform plastics market. This factor is expected to create good growth for this product during the forecast period. An increase in the convenience stores, supermarkets and hypermarkets are also helping in the growth of the food packaging industry.

Artificial Intelligence: The Next Growth Catalyst in Thermoformed Plastics

AI is transforming the thermoformed plastics industry by enabling real-time process optimization, which significantly reduces material waste and energy consumption. Machine learning algorithms and IoT sensors continuously monitor temperature, pressure, and cooling cycles, allowing for automated adjustments that ensure high-quality, consistent output while reducing downtime.

In terms of quality control, computer vision systems are replacing manual inspection to instantly detect microscopic defects, such as wall thickness variations and wrinkles, at high speeds.

Major Trends of the Thermoformed Plastics Market:

- Strategic Transition to Sustainable Feedstocks: Manufacturers are aggressively pivoting toward rPET and bio-based polymers like PLA to align with stringent ESG mandates and evolving consumer expectations. This shift focuses on maximizing post-consumer recycled (PCR) content to mitigate environmental footprints and ensure long-term regulatory compliance.

- Standardization of Mono-Material Architectures: There is a significant industry-wide movement toward "Design for Recycling" (DfR), arranging mono-material PET and PP constructions over complex multi-layer laminates. This streamlined material approach facilitates seamless integration into existing waste streams, significantly enhancing the recyclability of end-market products.

- Deployment of Industry 4.0 and Smart Automation: The integration of AI-driven defect detection, IoT telemetry, and robotics into thermoforming lines is optimizing production throughput and material utilization. These digital transformation initiatives are critical for reducing scrap rates, lowering energy intensity, and ensuring high-precision output in high-volume manufacturing environments.

- Optimization via Advanced Lightweighting (Down-Gauging): Investment in sophisticated tooling and material science is enabling the production of high-strength, thin-walled packaging.

Market Outlook

- Start-up Ecosystem:The startup space has noteworthy opportunities to grab as the market is initiating certain valuable shifts and integration into the global market, adhering to regulatory compliance. The integration of Industry 4. New technologies and a shift towards sustainable materials are paving ways for new intellectual approaches and skills to enter the market to excel in development and impact.

- Industry growth overview:The industry growth is built on technological advancement, sustainability focus and cost-effectiveness. With the growing and changing demand for sustainability and specific variants, most of the industries seek thermoformed plastics and other suitable solutions to meet the demand and growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 77.12 Billion |

| Market Size in 2025 | USD 49.31 Billion |

| Market Size in 2026 | USD 51.64 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.57% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Process, Based on Thickness, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Insights

The polypropylene segment has dominated the market in the recent years period it had a revenue share of about 22% till the last year. This product is expected to dominate the market during the forecast period. The most commonly used resins in thermoformed plastic production is polystyrene, polypropylene and polyethylene. a polypropylene is a thermoplastic polymer which is widely used in the food packaging products like the trees, margarine tubs, cups, disposable products, beverage glasses, sandwich packs, microwave containers. As there are many advantages of polymethyl methacrylate like light transmission high surface hardness and a good service life the segment is expected to grow well during the forecast period. New to growing innovations and product developments over the years across developed as well as developing nations and the investments in PMMA have created a demand in the Middle Eastern region.

Process Insights

The thin gorge thermoformed plastic segment has dominated the market in terms of revenue till the year 2025. The thin gorge thermoform plastic segment is expected to remain the largest segment during the forecast period. Thermoformed plastics are manufactured with the help of hot air techniques, radiant techniques and contact techniques. There's an increasing demand for the thin gorge thermoformed plastics for the medical device packaging trays and it is anticipated to try the market growth during the forecast period. The thick gauge Thermoforms are rigid and sturdy. This thick gorge thermoformed plastics are used in rear bumpers and front bumper. They are also used in the interior trim components of the heavy truck industry. This material is used in treadmills and weights. thank God thermal forms are also used as engine cover in the construction equipment industry.

The plug assist forming segment is the fastest growing during the forecast period. It has application in food packaging which is projected to boost the market growth of this segment. In order to have a uniform wall thickness the packaging materials use this product. The use of the thick gorge thermal forms helps in protecting the product which is within the packaging.

Application Insights

On the basis of application, the food packaging segment was leading the market in recent years period these plastics are widely used in the food industry for the packaging of vegetables, fruits, confectionery products, fish, poultry, meat, and other prepared meals. Food packaging requires extremely good quality packaging material that protects the food from moisture bacteria and older. Their demand in the food industry is extremely high as it inhibits any growth of bacteria or pathogens.

Thermoformed packaging is also used in the medical and healthcare sector as it has a range of material that enhance the appearance of the other products. In the healthcare and medical sector the packaging products are medical devices, procedure trays, medical trays, protective packaging and pharmaceutical packaging.

Regional Insights

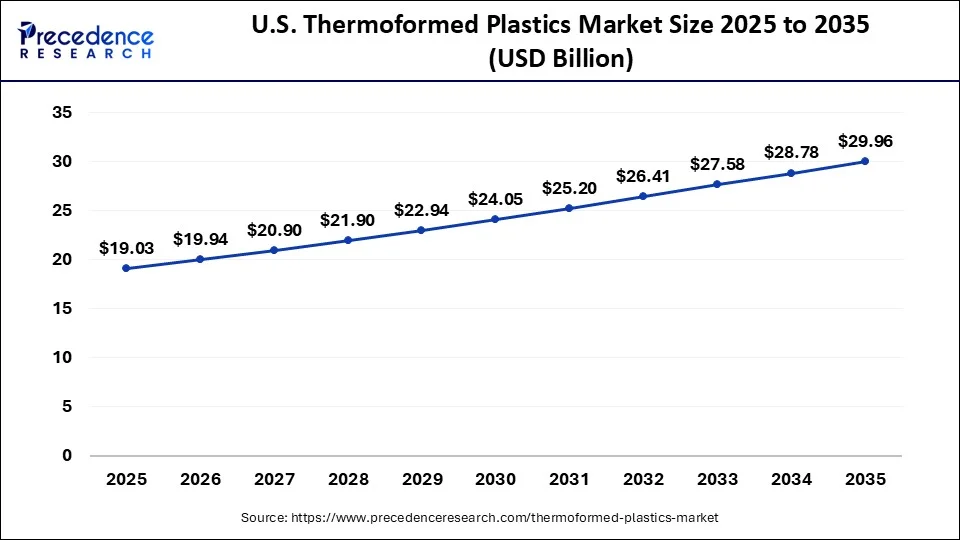

The global thermoformed plastics market size was valued at USD 19.03 billion in 2025 and is expected to be worth around USD 29.96 billion by 2035, expanding at a CAGR of 4.64% from 2026 to 2035.

What Made North America the Dominant Region in the Thermoformed Plastics Market?

North American region has dominated the market growth in terms of revenue till the year 2025. It had shown a growth of 54.2% in the past period due to increased industrialization and advancements in the packaging industry the North American region is projected to drive the regional market growth for these thermoformed plastics during the forecast period. Increase in the number of manufacturers and the suppliers of the thermoform plastic products in the North American region is expected to drive the growth of the industry. US is an important market for the thermoforming plastic followed by Canada.

U.S. Thermoformed Plastics Market Analysis

In the U.S., the market is expanding due to trends such as sustainability and material innovation, with manufacturers increasingly adopting recyclable, bio-based materials and eco-friendly solutions to meet environmental regulations and consumer demand. In July 2024, the U.S. government announced plans and programs to tackle local and global plastic pollution and waste, including a ban on single-use plastics. The U.S. government launched a national strategy to reduce plastic pollution, boosting demand for thermoformed plastics.

The Asia Pacific region is also expected to be the fastest growing regional market during the forecast period. Many emerging economies in the Asia Pacific region like China and India have been seeing a strong economic growth in the recent years. China happens to be the largest producer and supplier of thermoform plastics equipment. Due to an increase in the per capita income, there is a growth in the disposable income and there is rapid urbanization in this region which is driving the growth of the market. The demand for automotive's and subsequent demand for lightweight components is also driving the growth of the market. In order to improve the efficiency of vehicles the thermoformed plastics are used.

The thermoforming process involves the fabrication of plastic sheets with the use of heat. Plastic sheets are heated in order to convert them into a bendable form which can be molded to acquire the desired shape depending upon the customer's specifications. With the use of heavy gouge process thermoformed plastics are used as a metal replacement. Thermoformed plastics used as metal replacements have applications in industries related to transportation, aerospace, medical devices, kiosks and industrial equipment.

Thermoformed plastics are used in the manufacturing of the diagnostic systems, medical plants and accessories in the medical industry the thermoforming procedure. Thermoform plastics are also used in pharmaceutical industry for the products like prefilled syringes, medical electronics, pharmaceutical bottles. It is also used for capsules and tablet packaging in the pharmaceutical industry.

India Thermoformed Plastics Market Analysis

India is a major contributor to the market within Asia Pacific. There is a strong focus on sustainability and material innovation. Manufacturers are increasingly adopting recyclable, biodegradable, and eco‑friendly polymers to meet rising environmental and regulatory pressures. India is dedicated to building a greener economy and cutting down on plastic use. In March 2024, the Ministry of Environment, Forest, and Climate Change (MOEFCC) introduced an amendment to the plastic waste management rules.

Europe is expected to grow at a notable rate in the market in the upcoming period. This is mainly due to stringent environmental regulations and strong sustainability initiatives that drive demand for recyclable, biodegradable, and circular‑economy‑aligned thermoformed packaging solutions. In February 2025, the European Commission reported that the new EU regulation encourages the use of sustainable packaging. In June 2025, the new European project called BioPackMan was launched to transform biodegradable packaging.

Europe's advancement in this market for this year is attributed to the transformational shift towards precision engineering, smart manufacturing technologies and circular economy models. The advancements are determined by the strict regulations, such as the EU Single-Use Plastics Directive, as the market is leaving the traditional polystyrene behind and adopting bio-based and recyclable alternatives. This manufacturer is working hard to meet the sustainability target. Alongside the R&D sector, all are aiming for biobased thermoforming substrates and compostable films to coordinate with the European Green Deal.

Europe's Thermoformed Plastics Market Trends

Europe's convincing and inspiring material and sustainability trends regarding this market are bioplastic integration, mono-material engineering, and recycled content dominance. Above all, Industry 4. O and modernised manufacturing have paved the way for advancement and development in this market. The unification of AI-powered vision systems for in-line inspection is implicated for reducing waste and improving accuracy in high-speed production. Manufacturers' efforts to prioritise and implement rPP and rPET, along with charging on Eco-modulated EPR fees in countries such as Poland, are an excellent move to ease the recycling of mono-materials.

The market in Latin America is driven by growing demand for cost‑effective packaging solutions in the expanding food and beverage, retail, and consumer goods sectors, where lightweight, durable thermoformed packs support convenience and protection needs. The International Finance Corporation (IFC) invested in America Embalagens, the leading manufacturer of rigid plastic packaging, to promote circular economy solutions in Brazil. Additionally, investment in sustainable and recyclable materials are contributing to market growth across the region.

Latin America's contribution to this market to date is the innovations' sustainable shift. The region has largely equipped bio-based and recyclable PET plastics in their respective industries to promote sustainability. Within the region, Brazil is a major contributor, as it has elevated the production of renewable polyethylene from sugarcane, and Colombia executed the rigorous regulations to mitigate single-use plastics with key companies that promises 75% of recyclable packaging by 2030.

Latin America's Thermoformed Plastics Market Trends

Latin America's trend in this market is the PCR content, automation and technological advancement. The rapid trend of in-line digital printing on thermoformed trays that enables 2D DataMatrix codes for tracking, tracing and serialisation compliance has long benefitted the pharmaceutical sector. Alongside, the heavy-gauge thermoforming has extended in the lithium-ion batteries, and Electric Vehicles (EV) market due to the need for components as the new specialised facilities need specialized solution in the operations.

The Middle East & Africa (MEA) presents significant opportunities for the market, fueled by increasing consumer goods demand, expansion in the food and beverage industry, and growth in the healthcare and pharmaceutical sectors. In September 2025, the Middle East and Africa launched plastics recycling awards to promote the circular economy and recognize recycling machinery, leadership, and sustainable plastic packaging. There is also growing interest in sustainable and recyclable materials and advanced thermoforming technologies, as companies and regulators alike push for eco‑friendly solutions and improved production efficiency, supporting market growth.

Value Chain Analysis

- Raw Materials Procurement: This stage includes producers of base thermoplastic resins such as polypropylene (PP), polyethylene (PE), polystyrene (PS) and advanced materials that are sold to thermoforming converters for use in sheet and film production.

Key Players: SABIC, LyondellBasell Industries N.V., Formosa Plastics, BASF SE, Exxon Mobil Corp, Eastman Chemical Company. - Thermoformed Product Manufacturers: This critical stage is where final thermoformed items, such as trays, clamshells, containers and specialized packaging, are produced.

Key Players:Pactiv LLC, Sonoco Products Company, Genpak LLC, Placon Corporation, Anchor Packaging, Berry Global Inc., and Brentwood Industries. - Distributors & Logistics: After manufacturing, distributors and supply chain partners handle warehousing, inventory management, and transportation to deliver thermoformed products efficiently to customers across sectors.

Thermoformed Plastics Market Companies

- Pactiv LLC,: A leader in food packaging, the company utilizes high-speed thermoforming to produce a vast range of containers and trays for the foodservice and retail sectors.

- Greiner Packaging GmbH,:This Swiss-based manufacturer specializes in "K3" cardboard-plastic combinations and thin-walled thermoformed containers for the dairy and food industries.

- Dongguan Ditai Plastic Products Co., Ltd: As a major Chinese manufacturer, they provide large-scale vacuum forming and pressure forming services for industrial components and consumer electronics packaging. They contribute to the market through cost-effective, high-volume production of custom-engineered heavy-gauge thermoformed parts.

- Genpak LLC: The company focuses on the development of high-quality thermoformed food containers, including its Earthsmart line made from renewable resources. Their contribution lies in advancing microwaveable and cold-storage-safe thermoformed designs that meet the evolving needs of the "to-go" food market.

- Sonoco Products Company: Sonoco utilizes thermoforming primarily for retail display packaging and medical device trays through its sophisticated global supply chain.

- CM Packaging: This European specialist focuses on high-precision thermoforming for the food and pharmaceutical markets, producing specialized tins and plastic containers.

Other Major Key Players

- Brentwood,

- Industries,

- Palram Americas Ltd.,

- Placon Corporation,

- Anchor Packaging LLC

Recent Developments

- In October 2025, Amcor launched new thermoformed trays and rollstock made from Amorphous Polyethylene Terephthalate (APET), offering a cost-effective and more sustainable alternative to Polyethylene Terephthalate Glycol (PETG).

(Source:packagingeurope.com) - In January 2024,Genpak introduced a new packaging line free of added per- and polyfluoroalkyl substances.

(Source:packagingreporter.com) - Fabri-Kal Is a leading provider of custom thermoformed packaging solutions. In January 2020 it collaborated with the Michigan Department of Environment. This collaboration will be helpful put double the recycling rate of the packaging products in the coming years period

- An amount of 10 million euro was invested by Papacks in Arnstadt mill in Germany. This production unit will be able to produce good quality of molded paper fiber with the use of thermoforming process.

Segments Covered in the Report

By ProductÂ

- Polymethyl Methacrylate (PMMA)

- Bio-degradable polymers

- Polyethylene (PE)

- Poly Vinyl Chloride (PVC)

- High Impact Polystyrene (HIPS)

- Polystyrene (PS)

- Polypropylene (PP)

By ProcessÂ

- Plug Assist Forming

- Thick Gauge Thermoforming

- Thin Gauge Thermoforming

- Vacuum Snapback

By Based on Thickness

- Thin Gauge

- Thick Gauge

By ApplicationÂ

- Automotive

- Construction

- Healthcare & Medical

- Food Packaging

- Electrical & Electronics

- Consumer Goods & Appliances

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting