What is the Transparent Plastics Market Size?

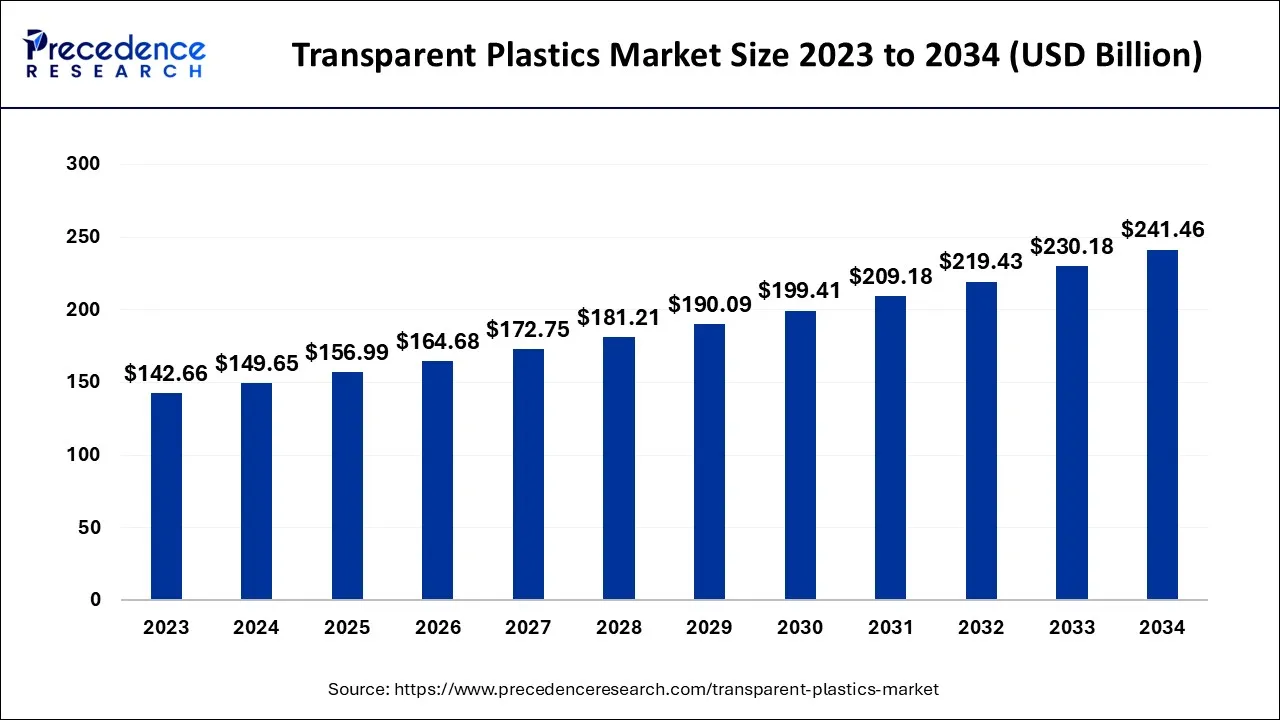

The global transparent plastics market is valued at USD 156.99 billion in 2025 and predicted to increase from USD 164.68 billion in 2026 to approximately USD 241.46 billion by 2034, expanding at a CAGR of 4.90% over the forecast period from 2025 to 2034

Transparent Plastics Market Key Takeaways

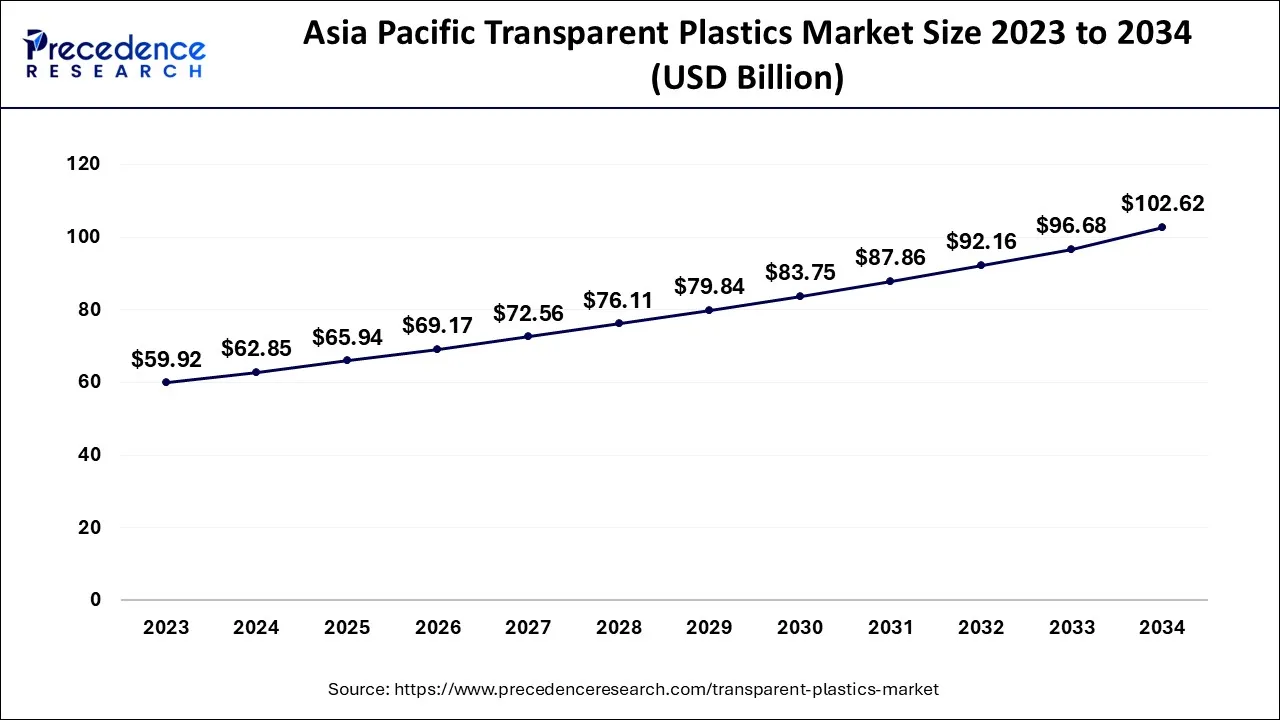

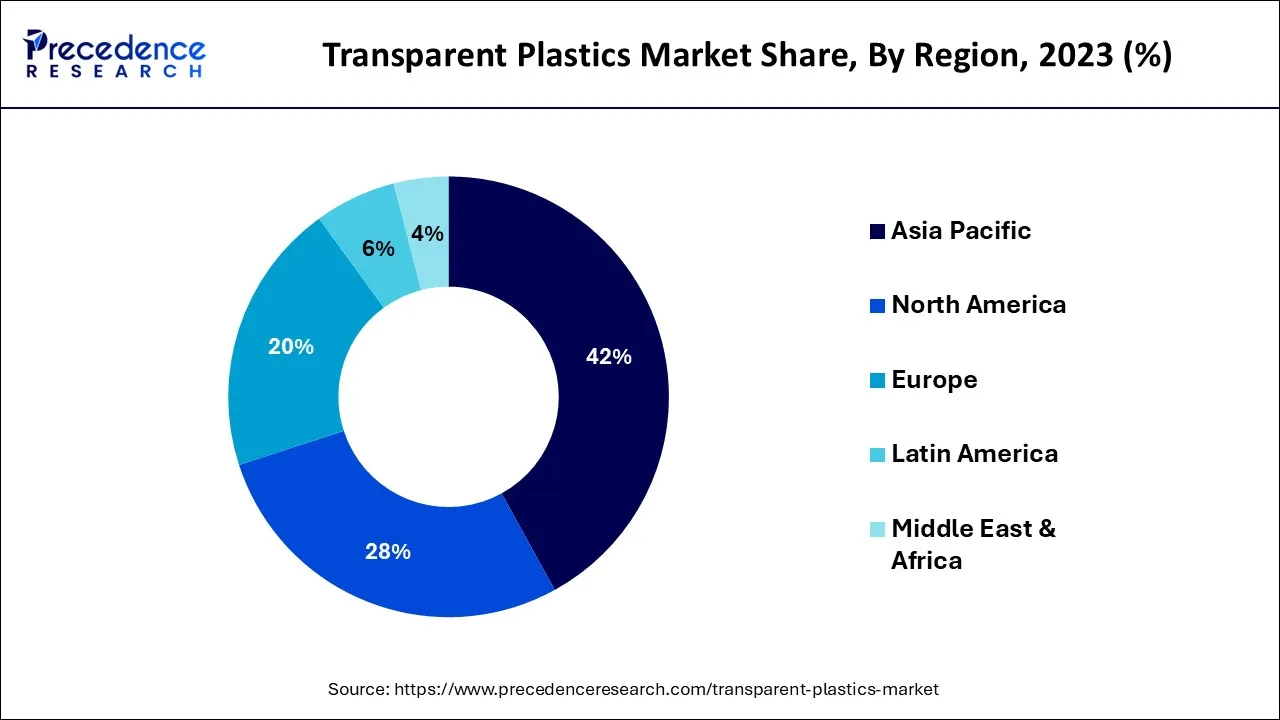

- Asia Pacific region accounted highest revenue share of over 42% in 2024.

- Asia Pacific market is growing at a CAGR of 6.8% over the forecast period.

- By end users, the packaging segment is expected to grow at a CAGR of 6.4% from 2025 to 2034.

- By form, the rigid segment is growing at a CAGR of 6.6% over the forecast period.

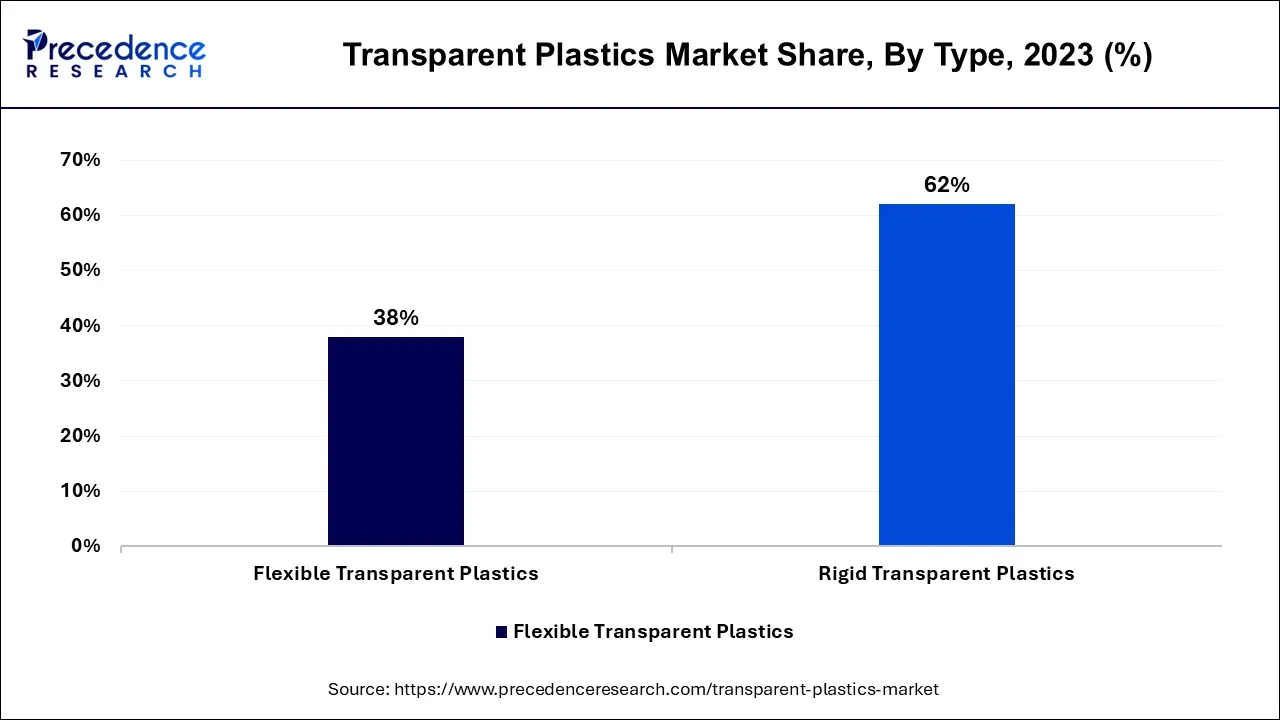

- The rigid segment accounted for 62.5% revenue share in 2024.

Market Overview

The global market for transparent plastic is anticipated to grow during the projected period as a result of increased demand from end-use sectors including construction, automobile, and consumer products. Additionally, it is anticipated that the worldwide transparent plastic market would grow due to the prolonged shelf-life of packaged food items and the ease of customizing. In addition, rising demand for transparent plastic is predicted to support the expansion of the global transparent plastics market in emerging nations like China and India, where it is widely utilized for food and beverage packaging.

- On 6 January 2025, All India Plastic Manufacturers Association (AIPMA) urged the government to introduce a production-linked incentive scheme for the plastics sector to enhance global competitiveness. They also recommended reducing GST to nil for plastic waste and recycling machinery, lowering GST on recycled plastic granules, and purchasing recycling equipment.

What Is Fueling the Rapid Demand for Transparent Plastics Globally?

The transparent plastics industry is gaining momentum as industries are increasingly selecting lightweight, strong, and visually clear materials, catalyzed by the use in operational packaging in packaging, automotive, electronics, and medical products. The increase in consumer preference for product visibility to improve aesthetics, as well as improvements in polymer chemistry, have allowed manufacturers to enhance clarity, UV resistance, and impact strength.

The improvement of polycarbonate, acrylic, and PET materials will expand their uses in retail packaging, opto-electronics, and construction applications. Sustainable initiatives coupled with advanced/modular recycling technologies are shaping and improving various products.

Transparent Plastics Market Growth Factors

Compared to other materials like glass and metal, plastic has the benefit of being lighter. Plastics are widely used in many end-use sectors because of their strength, beauty, performance, and ease of handling. Due to their great energy efficiency, aesthetics, design, flexibility, and cost-effectiveness, plastics are replacing conventional materials like glass in building applications including the construction of windows and frames. For instance, the windows use polycarbonate material. Plastics have a low thermal conductivity, which lowers heating and cooling costs while providing protection from severe weather. Transparent plastics are also proven to be more lucrative than other materials in the packaging business.

Market Outlook

- Industry Growth Overview: The transparent plastics market is poised for continued growth, as lightweight materials, enhanced safety provisions, and high visibility of products continue to be prioritized by industry sector development. The continued development and increasing application in end-uses related to packaging, automotive, and healthcare will maintain and spur product innovation, along with more diversification in materials.

- Sustainability trends: Sustainable transparent plastics will gain momentum as manufacturers increase recycling, move to bio-based resins, and incorporate circular design approaches across their portfolios. The emergence of recycled PET, the development of bio-based and biodegradable plastics, as well as low-carbon production activities will drive efforts in each of the sectors related to the market.

- Global Expansion: Higher levels of capital investment within Asia-Pacific, North America, and Latin America are allowing manufacturers to expand capacity to satisfy growing industrial capacity in each of these domains. Mergers and acquisitions, strategic alliances, and technology upgrades will be necessary to remain globally competitive and deliver new or advanced products.

- Startup Ecosystem: Start-ups will allow for the introduction of transparent bio-plastics, advanced recycling technologies, and innovations in packaging. The developments in low-carbon materials, smart additives, and circular systems will continue to support the development of products for the next generations of products and impact the development of industry standards

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 241.46 Billion |

| Market Size in 2025 | USD 156.99 Billion |

| Market Size in 2026 | USD 164.68 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.9% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Polymer Type, Form, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

- Increasing adoption by end-use industries - End-use industries are using transparent plastics more frequently since they are lighter than other materials like glass and metal. Plastics are becoming more and more popular across a range of end-use sectors because to their strength, beauty, performance, and ease of handling. In architecture and construction, plastics are displacing conventional materials like glass. In the manufacture of windows and frames, plastics are replacing glass because they provide superior energy efficiency, design flexibility, aesthetics, and cost effectiveness. For instance, windows are made of polycarbonate plastic. Transparent, lightweight, and shatterproof polycarbonate is a popular material. Plastics have a low thermal conductivity, which lowers heating and cooling expenses while yet providing protection from adverse weather.

- Increasing Electric Vehicles in automotive production - In the automotive sector, transparent plastic is frequently used for packaging and in vehicle parts. These applications have seen an increase in recent years, and they have a propensity to continue growing when compared to other materials used in autos. Transparent plastics are preferred over other materials for use in electric vehicles because they are comparatively less fuel-hungry, lightweight, affordable, and easy to manufacture. Every year, particularly more lately, the manufacturing of cars, mostly electric vehicles, has increased globally. Despite a pandemic, the international energy agency (IEA) reports that electric cars made up roughly 1% of worldwide automotive stock and 2.6% of global auto sales in 2019. This is a 40% year-over-year gain. EVs and the automotive industry have shown to be resilient in the face of a worldwide crisis, supporting the market need for transparent plastics as the automotive sector quickly moves towards lightweight materials for usage in electric cars.

Challenges

- Stringent Government regulations: Regarding the use of transparent plastics, several nations have created their own sets of regulations and laws. For instance, the Nigerian house members outlawed the importation, use, and manufacture of plastic bags in the nation in May 2019. Taiwan revealed its plan to outlaw petroleum-based plastics in stores in 2018. The plan calls for a comprehensive ban on petroleum-based bags by 2030, followed by price increases starting in 2025 and 2020. Thailand adopted a road map in 2019 for cutting back on trash plastics by 2030. As part of the plan, the government planned to outlaw cups, plastic bags smaller than 35 microns, and even plastic straws by 2020. This will encourage more people to use bioplastics as these items are needed by stores, supermarkets, and shop vendors. As a result, nearly 127 nations have passed legislation to control the use of common plastics. The use of plastics is thus prohibited or subject to regulations, which significantly slows the market's expansion.

Key Market Opportunities

- Growing demand for transparent plastics in healthcare and pharmaceuticals - Since it is used to make many practical items like medical equipment, implants, pharmaceutical consumables, and packaging materials like medication bottles, syringes, and others, the need for transparent plastics from the pharmaceutical industry and healthcare facilities is always on the rise. Because of their great performance characteristics, such as low density, simple recycling, various processability, and most importantly cost-effectiveness, transparent polymers like polyethylene terephthalate are employed in numerous applications. The transparent plastics business is rising thanks to increased investment in healthcare and pharmaceuticals. For instance, the Indian Brand Equity Foundation (IBEF) estimates that the Indian healthcare market will reach US$372 billion by 2022, driven by rising income, improved health awareness, lifestyle diseases, and increased access to insurance. Additionally, the Australian government announced that it will invest US$1.3 billion in a plan to grow the pharmaceutical and medical industries in order to usher in a new era of better health care. Thus, the market for transparent plastics is growing significantly due to all of the aforementioned aspects.

- Demand for Biodegradable Plastics is growing exponentially - The market for biodegradable plastics is expected to be dominated in the future by clear biodegradable polymers that can be disposed of right in landfills. One of the major areas that is expected to offer excellent prospects for bio-based plastics is food and beverage packaging.

Type Insights

The flexible transparent plastics market is anticipated to expand at a rapid CAGR over the next years. In this area, polytetrafluoroethylene (PTFE) is the substance that works well. Flexible packaging is coveted for its affordability, sustainability, use, and beauty.

This type of packaging also has the advantage of allowing textual information, such as product instructions, to be printed on the label. Additionally, PTFE is an affordable alternative for a variety of sectors, including oil and gas, chemical processing, industrial, electrical/electronic, and construction.

- On 16 December 2024, UFlex Limited, India's largest integrated flexible packaging and solutions company, showcased a range of post-consumer-grade PCR Films with up to 30-50% recycled PET content at the Plastics Recycling Show India. The company also commissioned a new PET post-consumer recycling site in Egypt, enhancing its recycling infrastructure. UFlex is gearing up to meet the Indian government-mandated plastic recycling guidelines starting April 2025, which envisage 10% recycled content in packaging for flexibles and 30% for rigid plastics.

Application Insights

The packaging and films category, which in 2023 held a sizeable portion of the transparent plastics market, is anticipated to expand at a CAGR of 7.5% from 2025 to 2034. Due to the majority of customer demands, the packaging and film sectors are quickly moving toward lightweight, transparent, and durable materials. As a result, there is an increasing need forpolyethylene terephthalate films and sheets since they have these qualities and are relatively affordable. Transparent polymers like polyethylene terephthalate films are mostly replacing conventional films because they are safer, more cost-effective for food packaging, and stronger across a wider range of temperatures. According to the Ministry of Economy, Trade, and Industry of Japan, polyethylene films and sheets totaled 2.4 million metric tons of processed plastic in 2020. This significant production volume demonstrates the rising demand for and consumption of plastic films as well as the wide range of packaging uses in the automotive, food and beverage, chemical, pharmaceutical, and other sectors.

As a result, throughout the forecast period, the packaging and films sector will be the largest and fastest-growing section within the application segmentation of the market. During the projected period, the aforementioned reasons are anticipated to fuel demand and market expansion for transparent plastics.

Polymer Type Insights

The majority of the transparent plastics market in 2024 belonged to polyethylene terephthalate (PET), which has received approval from the Food and Drug Administration in several nations and numerous other health-safety organizations worldwide for its suitability for contact with food and drinks. PET, also known as polyethylene terephthalate, is becoming the material of choice for packaging foods and drinks across the world because of its distinctive qualities, which include clarity, good barrier characteristics, ease of handling, low weight, safety, and recycling.

PET, an affordable thermoplastic polymer with exceptional mechanical, thermal, chemical, and high tensile qualities, is made of polyethylene terephthalate. For the production of water bottles, fibers, films, and soft drink containers, it is the most extensively used transparent material. They are widely utilized in a variety of sectors, including electrical and electronic, building and construction, automotive, and medical. Additionally, the most recycled plastic in the world is polyethylene terephthalate (PET). The market for transparent plastics is dominated by polyethylene terephthalate due to the aforementioned characteristics.

Form Insights

In 2024, the rigid category controlled a large portion of the transparent plastics market. T Since rigid clear plastics are excellent for usage in a variety of applications thanks to their advantageous characteristics including the nature of the mix, physical features, and simplicity of consumption, the rigid plastics market is anticipated to maintain its dominance during the projected period. Because of their affordability, sustainability, beauty, and rigidity, rigid transparent polymers are favoured. These translucent polymers also have the benefit of enabling the labeling of textual information, such as product instructions. Thus, it is anticipated that the rigid segment would rule the transparent plastics market throughout the projected period as a result of all the aforementioned aspects.

Regional Insights

Asia Pacific Transparent Plastics Market Size and Growth 2025 to 2034

The Asia Pacific transparent plastics market size is accounted for USD 65.94 billion in 2025 and is projected to be worth around USD 102.62 billion by 2034, poised to grow at a CAGR of 5.02% from 2025 to 2034

During the forecast period, the Asia-Pacific region is anticipated to lead the market. The explosive demand for transparent plastics from major end-use industries including construction, packaging, electronics, and automotive, among others, is responsible for this region's rise. The expansion of these end-user businesses fuels the need for transparent plastics by driving up industrialization while also upgrading consumer lifestyles and per capita income. Through innovation, sustainable change, reasonable pricing, and sales execution techniques, businesses in this region are quickly adjusting to this changing landscape and generating attractive revenues. Therefore, as a result of the aforementioned reasons, this region is anticipated to hold a large market share for transparent plastics throughout the projected period.

North America is Experiencing Growth in Sustainability and Technological Innovation

North America holds a strong competitive position in the transparent plastics market, partly due to advanced technologies and regulatory challenges. U.S.-based companies, in 2025, report increasingly using chemical recycling methods to achieve local circular economy targets. Medical device and pharmaceutical packaging use of transparent plastics is also growing due to higher hygienic expectations. Also, the recent rebound of homebuilding in the U.S. is creating demand for polycarbonate and acrylic sheet for windows and interior use, and Canada's automotive sector is experiencing increased use in cold-weather-proofed parts.

North America: North America Surges Ahead in Transparent Plastics Growth

North America is showing the fastest growth in the transparent plastics market, fueled by strong policy support for recycling and a rapid shift to sustainable materials. Demand is soaring from the packaging, healthcare, and consumer goods sectors, where high-quality clear polymers are critical. The region is also scaling up its chemical-recycling infrastructure, bolstering the adoption of recycled transparent plastics. Additionally, innovation in bio based transparent resins and investments in next generation polymers are further accelerating North America's market momentum.

U.S. Transparent Plastic Market Trends

In the U.S., the market is being driven by growing demand in packaging, especially for food, beverage, and personal care products that benefit from clear, recyclable materials. Lightweight, high clarity engineered polymers like polycarbonate and PMMA are increasingly used in automotive glazing and consumer electronics for their strength and design flexibility. In the healthcare sector, transparent plastics are seeing strong growth in devices, diagnostic cartridges, and medical packaging due to their optical clarity and sterility compatibility.

Europe Grows Fastest in Transparent Plastics Marketplace

Europe is truly progressing in the transparent plastics industry as the region experiences strong incentives from its environmental policies and increasing demand for sustainable materials. In 2023, the region recycled over 12,400 kilotons of plastic, which demonstrates the region's commitment to fulfilling its circular economy ambitions. Germany leads the fastest way as its infrastructure to recycle plastics is still world-class and increasing regulations incentivize using recycled materials in packaging, automotive, and construction industries. Other technological innovations, such as AI-powered sorting systems, improve recycling efficiency so that transparent recycled plastics are now more feasible in many industries than previously possible.

What Is Driving Growth in the Transparent Plastics Market in Europe?

Europe is an established market for transparent plastics due to existing resilience via rigorous quality standards and industrial infrastructure, as well as developing demand by industries engaged in automotive lightweighting. The countries of Europe are also initiating high-performance transparent polymers for packaging, building panels, and glazing for energy efficiency.

Meanwhile, initiatives and regulatory developments for recycling and circular plastics are positively having an impact on the demand for materials such as PET and polycarbonate. Enterprises like Covestro and BASF, innovators in advanced formulations, are evidencing how Europe continues to develop and influence global pathways for materials and sustainability.

What Is Driving Demand for Transparent Plastics in Latin America?

The market of Latin America appears to be one of the more promising growth markets globally, as consumer goods, food packaging, and healthcare-related sectors rely on value-driven transparent polymers. The expansion of retail and e-commerce in the region is increasing the use of clear PET bottles, blister packs, private-label, and clear films for protective packaging.

In order to drive value, manufacturers continue to replace composites in construction and automotive with durable transparent plastic. The growing interest of global players and increased domestic manufacturing capacity are also driving market potential in the region.

How Does the Transparent Plastic Value Chain Support Global Manufacturing?

The transparent plastics value chain incorporates raw material sourcing, polymer manufacturing, compounding, processing, and distribution to end uses. The main manufacturers of resins, including SABIC, Covestro, and Eastman Chemical, produce high-quality plastics that are manufactured into sheets, films, bottles, and molded parts.

- Engineered High-Purity Resins: Leading manufacturers such as SABIC and Covestro manufacture "high-purity" engineered polymers that have high clarity, UV-stability, and strength, assuring the performance capabilities required in demanding applications.

- Processing & Manufacturing Efficiencies: Producers can manufacture films, bottles, and components out of resins using injection molding, extrusion, and blow-molding technologies to help meet demanding specifications.

- Distribution & End-use Applicability: Transparent plastics have relevance in packaging, medical, automotive, and construction markets, and with continued innovation, companies such as Eastman Chemical can help meet needs in a custom manner

Transparent Plastics Market Companies

- EI. Du Pont De Nemours and Company

- Dow Chemical Company

- Lyondellbasell Industries

- Holdings B.V.

- SABIC, Covestro

- BASF SE

- INEOS

- PPG Industries

- Evonik Industries AG

- LANXESS AG

Recent Developments

- In May 2024, Aviation thermoplastics giant Sekisui Kydex, revealed the results of a collaboration with KRD Luftfahrttechnik, a manufacturer of transparent plastics. Ben Smalley, director of business development for Sekisui Kydex, stated, “We are excited to share this collaboration, which has helped further develop our translucent product offering.”

- In March 2025, Time Technoplast Ltd., in collaboration with Dow, launched the "Smart Can" technology, a lightweight, flexible packaging solution aimed at reducing raw material usage and offering a higher product-to-package ratio. This innovation is part of Time Technoplast's sustainability initiative to provide functional and sustainable packaging solutions for a wide range of applications.

- On 28 February 2025, Researchers from IIT Roorkee introduced Kodo millet-based edible cups, utilizing guar gum and hibiscus powder to enhance structural integrity and biodegradability. This innovation offers a sustainable alternative to conventional plastic packaging, aiming to reduce plastic waste and promote environmental sustainability.

- On 18 March 2025, UFlex presented a range of packaging solutions at the Aahar 2025 exhibition in New Delhi, including packaging with recycled content for easier recyclability and advanced security features to enhance brand protection. The company also presented solutions to meet diverse needs, such as zip pouch bags designed to enhance consumer convenience, while 4D WPP slider bags and 3D retort center-seal packs offered brands a competitive edge by improving shelf appeal and strengthening first impressions

- During the COVID-19 epidemic, DuPont has been supplying community organizations and individuals making face shields to safeguard the hospital and care facility employees in Tees Valley with supplies. DuPont manufactured polyester films and coatings in 2021 from its factory in Teesside.

- Dow revealed additional material options for its Asia-Pacific plastics range in 2021. Products and applications in sustainable growth, mobility, Industry 4.0, healthcare, and consumer experience are among the new materials that have been presented.

New Developments in Transparent Plastics: Smart Glass and Recycling

Recent developments in transparent plastics have made a significant impact in various fields. One development is smart glass, which can go from transparent to opaque. Smart glass is being used in car design—for example, the Volkswagen ID.7, as it offers some privacy away from other traffic, while being energy efficient. Equally, the automotive sector is adopting recycled polycarbonate (PC) material for transparent headlamp covers. Companies are championing the modular and recyclability of PC headlamps, which reduce assembly steps, space, costs, and CO? emissions.

Segments covered in the report

By Type

- Rigid

- Flexible

By Application

- Packaging

- Building & Construction

- Electrical & Electronics

- Automotive

- Consumer Goods

- Healthcare

- Others (Aerospace, Agriculture)

By Polymer Type

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Polystyrene (PS)

- Polycarbonate (PC)

- Polymethyl Methacrylate (PMMA)

- Others (Polyamide, ABS & SAN, Polyethylene, TPU)

By Form

- Rigid Transparent Plastics

- Flexible Transparent Plastics

By Region

- North America

- Europe

- Asia-Pacific,

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content