Plastics in Consumer Electronics Market Size and Forecast 2025 to 2034

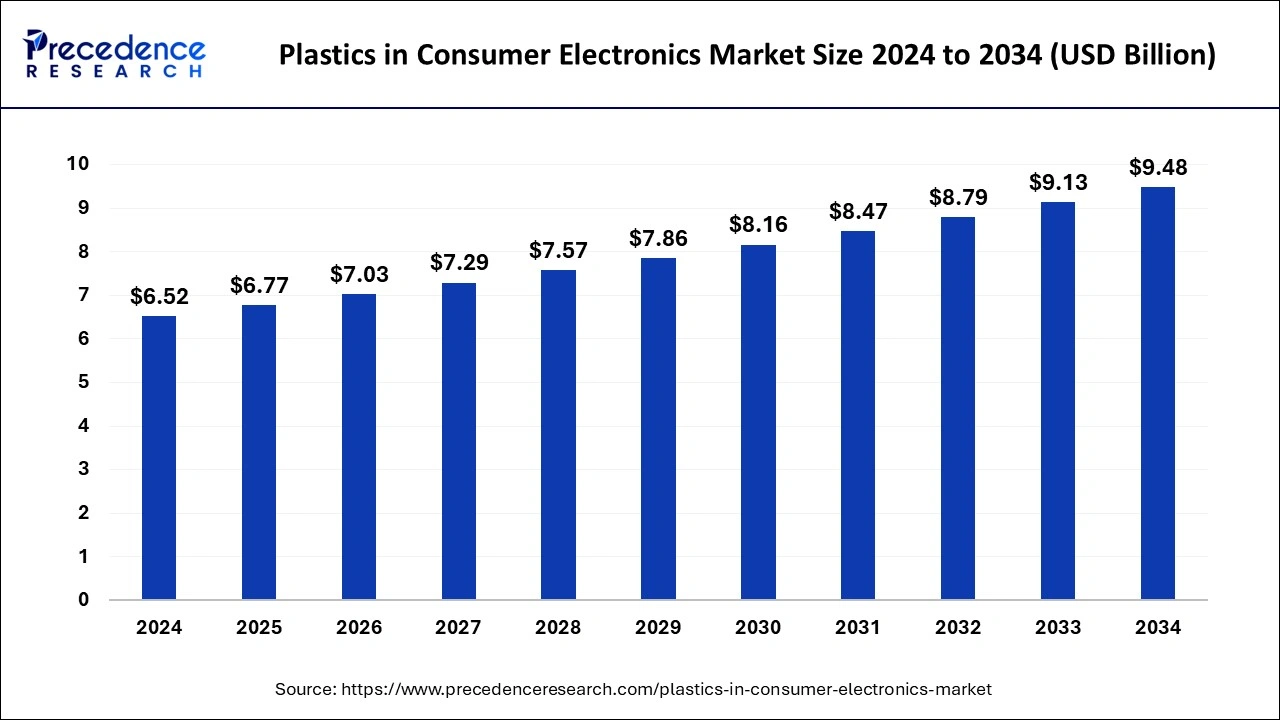

The global plastics in consumer electronics market size accounted for USD 6.52 billion in 2024 and is expected to exceed around USD 9.48 billion by 2034, growing at a CAGR of 3.81% from 2025 to 2034. The plastics in consumer electronics market growth is attributed to the increasing demand for advanced, lightweight, and durable plastic materials in a wide range of consumer electronic applications.

Plastics in Consumer Electronics Market Key Takeaways

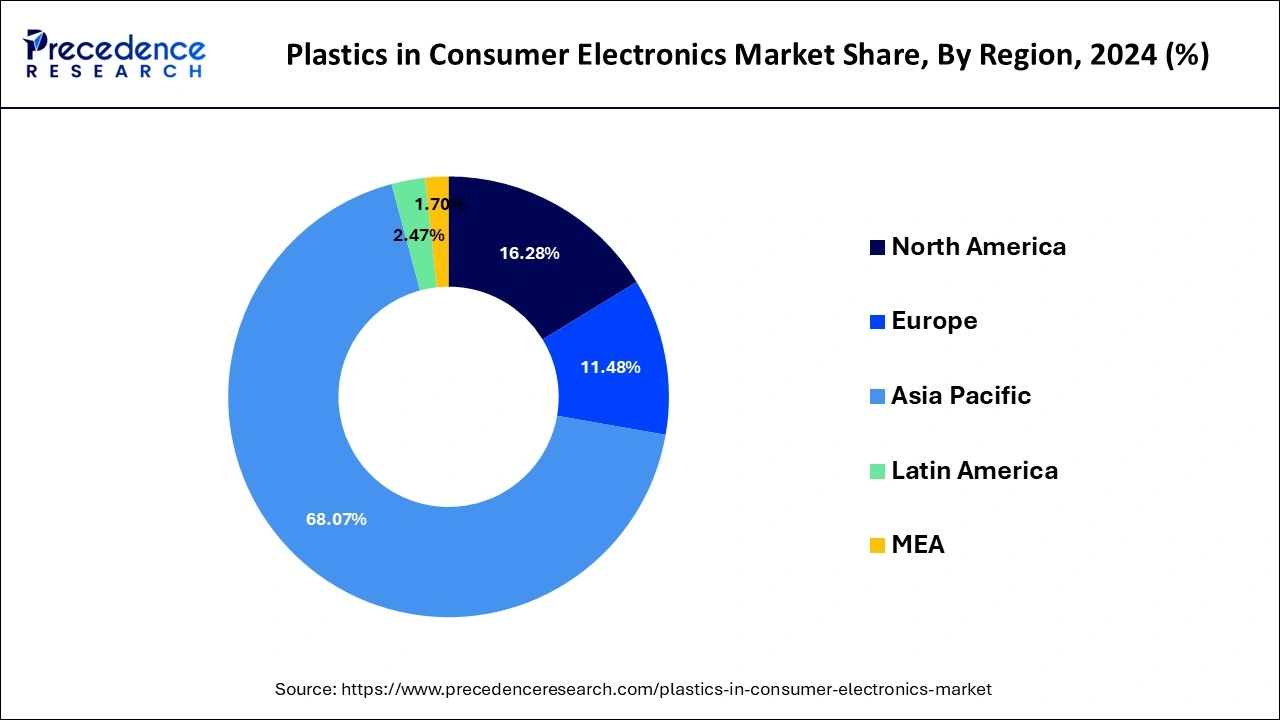

- Asia Pacific dominated the global plastics in consumer electronics market with the largest market share of 68.07% in 2024.

- North America is anticipated to grow at the fastest CAGR during the forecast period.

- By product, the polyamide segment held a dominant presence in the market in 2024.

- By product, the liquid crystal polymer segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- By application, the mobile phone bodies segment accounted for a considerable share of the market in 2024.

- By application, the wearables segment is anticipated to grow with the highest CAGR in the market during the studied years.

Impact of Artificial Intelligence (AI) on the Plastics in Consumer Electronics Market

Artificial intelligence strategies are used to combine voice control, predictive actions, and energy-saving technologies into the plastics in consumer electronics market in an effort to make them more attractive to customers from the IT sector. AI enhances the capability of real-time data processing so that manufacturers enhance their real-time supply chain and minimize the loss of products in the course of production. With predictive modeling, markets, and customer trends are accurately estimated so that organizations offer products that fit into the market demands. Furthermore, dynamic automation through AI cuts production costs and speeds up the availability of fresh solutions, thereby increasing competitiveness in this dynamic industry.

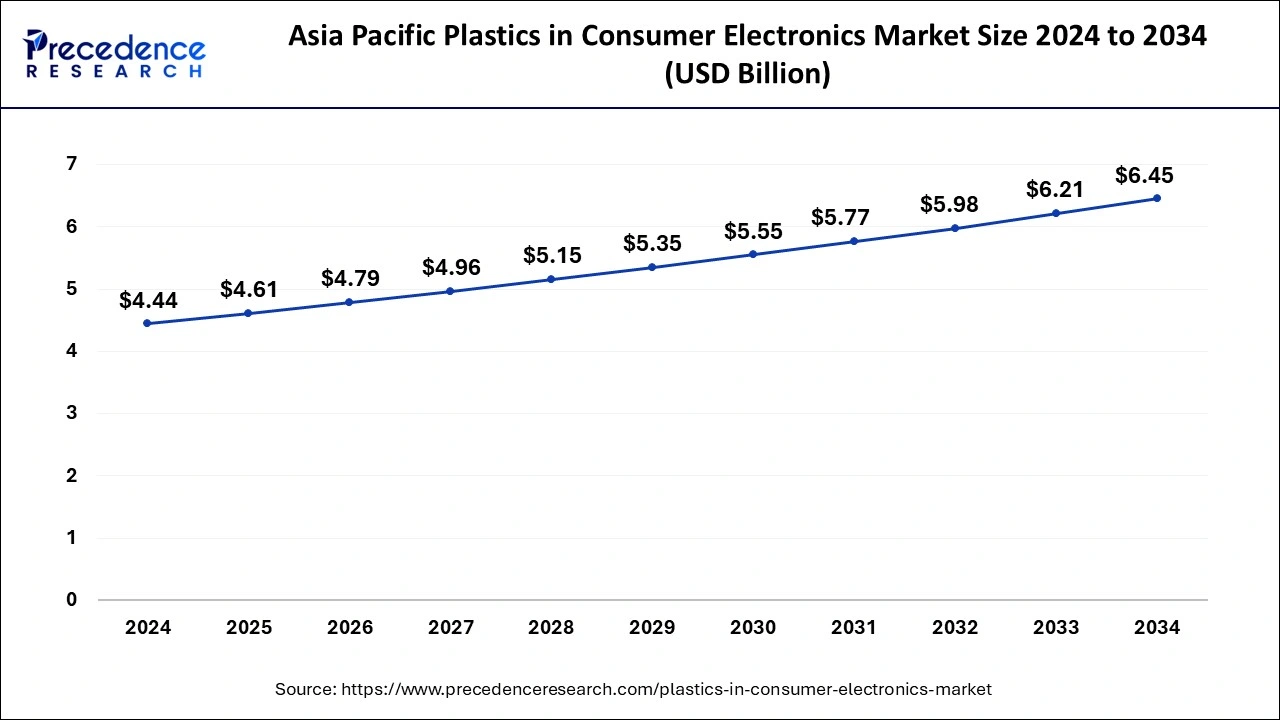

Asia Pacific Plastics in Consumer Electronics Market Size and Growth 2025 to 2034

The Asia Pacific plastics in consumer electronics market size was exhibited at USD 4.44 billion in 2024 and is projected to be worth around USD 6.45 billion by 2034, growing at a CAGR of 3.83% from 2025 to 2034.

Asia Pacific dominated the global plastics in consumer electronics market in 2024, owing to the fast-growing electronics manufacturing industries in China, Japan, South Korea, and India. The region continues to be an important manufacturer of consumer electronics, with cheap labor, a technological edge, and electronics manufacturing giants.

China occupies a particularly important position in the plastics in consumer electronics market, as it is the largest supplier of consumer electronics in the world, including smartphones, tablets, and other portable electronics that use copious amounts of plastics. The electronics industry is a leading industry in China. Furthermore, an increased disposable income among consumers and an emerging need for electronic devices in emerging countries such as India and Southeast Asian countries drive market growth in this region.

- According to the ITA, electronics exports from China will cross USD 250 billion in 2023.

North America is anticipated to grow at the fastest rate in the plastics in consumer electronics market during the forecast period due to developments in technology and the trend in which people use electronics in products such as healthcare products, automobiles, and consumer electronics, among others.

The U.S. plastics in consumer electronics market is driving this North America's growth due to the significant advancements in high-tech electronics, including mobile phones, notebooks, smart wearables, and smart home gadgets. It was reported that the U.S. Environmental Protection Agency (EPA) has set new goals to cut down the usage of plastics with an aim to use and promote the use of recyclable and biodegradable plastics in manufacturing, which is expected to drive the utilization of sustainable technologies in the durables industry.

Market Overview

The demand for strong and lightweight materials in the plastics in consumer electronics market is rapidly growing in the automotive and consumer electronics industries. Polycarbonate, polycarbonate/acrylonitrile butadiene styrene, thermoplastic elastomers, and polyamide are common in the manufacturing of TV frames, laptop monitor encompassing, LCD panels, portable hand-held devices, wearables, mobile phone bodies, and appliances due to features such as flexibility, durability, and chemical and heat resistance.

- According to the 2023 report by the University of Minnesota, changes in material technology have fuelled the need for new and improved plastic material that would increase the efficiency of power-saving electronics. This trend is premised on the fact that there is a steady increase in demand for these materials in the global market. Furthermore, smart gadgets, wearable devices, smartphones, and smart home devices are leading to the high utilization of Grade 1-PLA by the consumer electronics industry.

Plastics in Consumer Electronics Market Growth Factors

- Increasing demand for miniaturized electronics drives the need for lightweight and durable plastics.

- Growing emphasis on energy efficiency in electronics boosts demand for advanced plastic materials.

- The rising popularity of electric vehicles (EVs) increases the use of plastics in automotive electronics.

- Advancements in 5G technology enhance the need for specialized plastic components in communication devices.

- Surge in smart home device adoption fuels the requirement for high-performance plastics in the plastics in consumer electronics market.

- Growing consumer preference for customizable and ergonomic electronics drives innovation in plastic designs.

- Rising government regulations around electronic waste recycling encourage the adoption of recyclable plastics.

Market Scope

| Report Coverage | Details |

| Market Size by 2024 | USD 6.52 Billion |

| Market Size in 2025 | USD 6.77 Billion |

| Market Size in 2034 | USD 9.48 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.81% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand for lightweight and durable plastics in consumer electronics

Growing request for lightweight and high-durability materials is expected to drive the plastics in consumer electronics market in the coming years. Durability without adding extra weight is the choice of materials that manufacturers focus on to make portable products. Plastics provide strength while being light and portable, and this makes them appropriate for smartphones, laptops, and pocket-friendly devices. Furthermore, workability is an advantage that plastics possess over other materials because they allow for the formation of diverse and comfortable forms that lead to improved design and tool differentiation in the market.

- According to the 2024 report by the World Economic Forum, mobile phones have become nearly universal, with over 5.4 billion people globally holding at least one mobile subscription, as reported by GSMA.

Restraint

Stringent environmental regulations

Stringent environmental regulations on plastic production and disposal are anticipated to restrain the plastics in consumer electronics market expansion. National and international governments and regulatory authorities have put measures in place to control the use of plastics. Furthermore, the increase in consumers' cognizance of the environmental threat posed by plastics increases pressure on firms to seek green substitutes, although these are not as cheap or elastic as plastics.

The 2024 EU Single-Use Plastics Directive (SUPD) seeks to mitigate the environmental impact of plastic waste by banning items such as single-use plastic cutlery, plates, and cups, among other disposable products. These policies bring about high manufacturing costs since the manufacturers are required to use sustainable materials or develop recycling ways. Adherence to these regulations also causes program timeliness in production.

Opportunity

High demand for sustainable plastic solutions in eco-friendly electronics

High demand for sustainable plastic solutions is expected to create significant opportunities for the eco-friendly plastics in consumer electronics market. Manufacturers want to adopt readily recycled and biodegradable plastics to meet current world trends and customers' expectations. Traditional biodegradable plastics are short-complexed by various drawbacks.

PHA present themselves as less harsh solutions with comparable efficiency. Governments and NGOs offer tax credits and grants for these materials to ensure that investments set for the production of sustainable products are improved. Furthermore, the continued incorporation of sustainable policies inside the consumer electronics industry indicates vast-scale prospects for advancements.

- According to the 2024 report by the U.S. National Science Foundation, USD 9.5 million has been allocated to support multidisciplinary initiatives aimed at accelerating the development of safe, sustainable, and high-value polymers for commercial applications.

Product Insights

The polyamide segment held a dominant presence in the plastics in consumer electronics market in 2024 due to its mechanical properties, which include high strength, impact resistance, and heat resistance. It is capable of being designed in different types, and it is transparent and light, which has made it the most-used product for the creation of long-lasting and good-looking electrical devices. The need for polycarbonate is likely to continue to be high primarily, as the material is very critical in the creation of high-performance, portable electronic products.

- According to the 2023 report published by the NIH, polycarbonate (PC), a type of engineering plastic, is noted for its exceptional mechanical strength and toughness. This makes it suitable for consumer electronics such as smartphones, laptops, and optical discs.

The liquid crystal polymer segment is expected to grow at the fastest rate in the plastics in consumer electronics market during the forecast period of 2025 to 2034, owing to its great mechanical and thermal properties, which endear it to high-performance applications in small and compact electronic devices. Due to its dimensional stability and electrical insulation, it has found a wide application in connectors, antennas, and microelectronic devices, especially as 5G technology increases. Additionally, demand for LCP is expected to rise as electronics shrink and require high-frequency, low-attenuation materials, positioning it as vital for future consumer electronic devices.

Application Insights

The mobile phone bodies segment accounted for a considerable share of the plastics in consumer electronics market in 2024, owing to the growing need for smartphones, the lightweight yet highly durable material known as plastics is ideal for use in the construction of the phone body. Polycarbonate, ABS, and polyamide are most popular in custom design for mobile phone casings because of their strength, impact, and design properties. Moreover, the rise in demand for consumer goods in emerging markets is the foremost driver of this increase in production.

The wearables segment is anticipated to grow with the highest CAGR in the plastics in consumer electronics market during the studied years, owing to the rising demand for health and fitness, fitness monitors, and the installation of intelligent circuitry in wearables such as smartwatches and fitness bands. Thermoplastic elastomer (TPE), polycarbonate, and soft rubber, among other materials, are widely used for the fabrication of wearables because of their flexibility, durability, and comfort. Furthermore, the integration of wearables into daily health management is expected to further fuel market growth, thus increasing the need for durable and eco-friendly plastic solutions.

The U.S. National Institutes of Health (NIH) 2024 report that millions of Americans leave for school or work each day wearing devices that count their steps, check their heart rates, and help them stay fit. The next generation of “wearables,” used by individuals in partnership with their healthcare providers, might be able to monitor vital signs, blood oxygen levels, and a wide variety of other measures of personal health.

Plastics in Consumer Electronics Market Companies

- Trinseo S.A.

- Covestro AG

- Celanese Corp.

- SABIC

- Lotte Chemical Corp.

- LG Chem

- Mitsubishi Chemical Corp.

- SAMSUNG SDI Co., Ltd.

- Koninklijke DSM N.V.

- Qingdao Gon Science & Technology Co., Ltd.

Latest Announcements by Industry Leaders

- November 2024 – Grownet

- CEO – Dhanish Goyal

- Announcement - Grownet, a pioneer in polymer industry innovation and sustainable technologies, has secured a patent for its groundbreaking Sandsplash System. "This patent is a milestone in sustainable technology," stated Dhanish Goyal, Founder and CEO of Grownet. "The Sandsplash System transforms polymer cleaning by eliminating the need for water and chemicals, enhancing the quality of cleaned polymers. We are proud to contribute to global environmental goals and collaborate with organizations that share our vision for a sustainable and cleaner future.

Recent Developments

- In September 2024, AkzoNobel developed a professional-grade series of coatings that enhance the reliability and efficiency of using recycled plastics in consumer electronics. These innovative coatings, designed for products such as computers, mobile phones, and household appliances, offer long-lasting protection and are specifically tailored for items made from post-consumer recycled (PCR) plastics.

- In May 2022, SABIC introduced LNP™ ELCRIN™ WF0061BiQ resin, a groundbreaking material that utilizes ocean-bound polyethylene terephthalate (PET) bottles as a feedstock for chemical upcycling into polybutylene terephthalate (PBT) resin, advancing sustainable material innovation.

- In November 2023, SMX (Security Matters) PLC announced the planned launch of a revolutionary plastic cycle token, set for release in Q2 2024. This initiative aims to establish a reliable, ethical digital credit platform in response to the global challenge of recycling, with only an estimated 9% of plastic recycled globally (OECD, 2022). This platform seeks to capitalize on the significant market potential for recyclable plastics credits, addressing a growing demand in the circular economy.

Segments Covered in the Report

By Product

- Bio-Based Polycarbonate

- Liquid Crystal Polymer (LCP)

- Polyamide (PA)

- Polycarbonate (PC)

- Polycarbonate/Acrylonitrile Butadiene Styrene (PC/ABS) Glass Filled Resin

- Thermoplastic Elastomers (TPE)

By Application

- Appliances and White Goods

- Laptop Monitor Enclosures

- LCD Panels

- Mobile Phone Bodies

- Portable Hand-held Devices

- TV Frames

- Wearables

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content