Thermoplastic Elastomer Market Size and Forecast 2026 to 2035

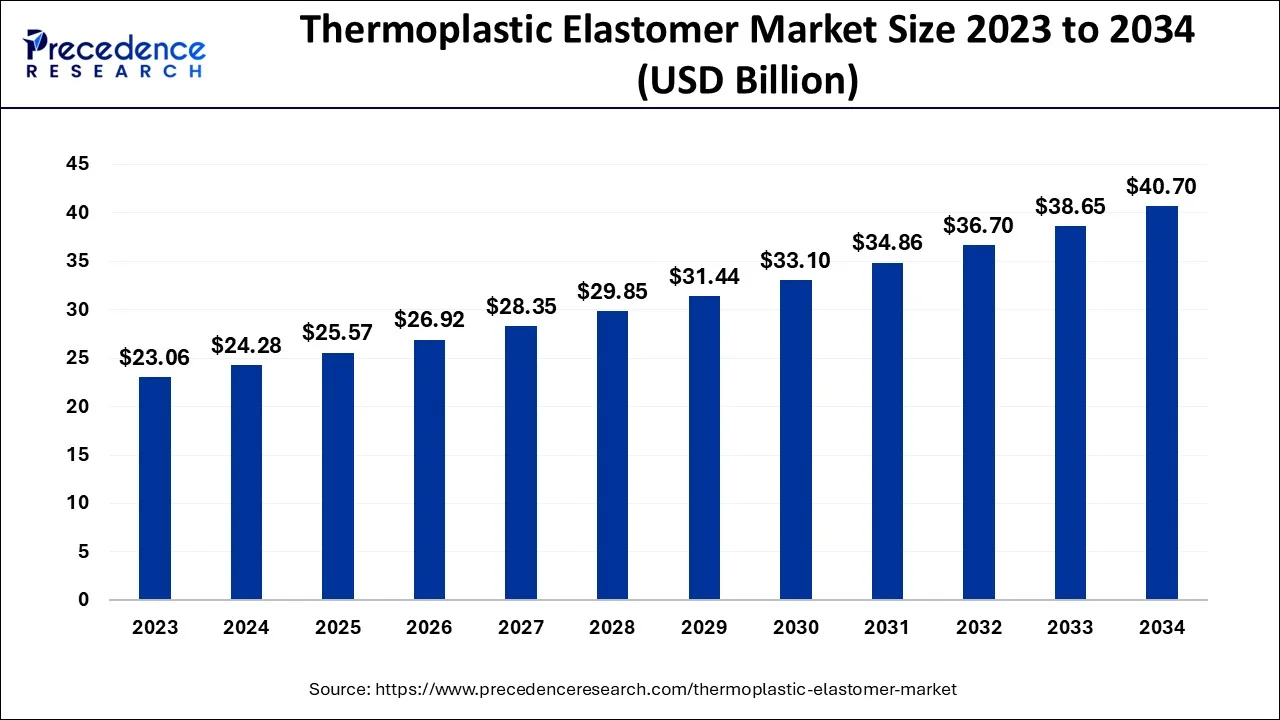

The global thermoplastic elastomer market size is valued at USD 25.57 billion in 2025 and is predicted to increase from USD 26.92 billion in 2026 to approximately USD 42.68 billion by 2035, expanding at a CAGR of 5.26% from 2026 to 2035.

Thermoplastic Elastomer Market Key Takeaways

- In 2023, By geography, the North America region has captured the highest revenue share.

- In 2023, The Asia Pacific region held the second-largest revenue share.

- In 2023, By type, the thermoplastic vulcanizates segment is projected to have the largest market share.

- In 2023, By application, the automotive segment is expected to have the biggest revenue share.

Market Overview

Thermoplastic elastomers also referred to as plastic wrap, saran wrap, food wrap, and stretch film, are thin transparent plastic films that adhere to each other and to surfaces, and are commonly used to wrap food in containers. High-quality food wrap films made of thermoplastic elastomers keep food fresh, shield it from bugs and microbial contamination, and lengthen its shelf life to lower the risk of food waste. Combining thermoplastic and elastomeric polymers results in thermoplastic elastomers. Many different industries, including the automotive, medical, construction, and packaging sectors, use thermoplastic elastomers. It can be stretched two or three times its original size due to its elastomeric properties, which make it flexible and soft. The most common place that thermoplastic elastomers are used in consumer goods is in headphones as a thin, translucent, flexible material. TPE can also be used to create sealing rings and bottle cap liners.

The thermoplastic elastomer helps improve fuel efficiency in automotive applications by reducing vehicle weight and density by swapping out traditional parts inside and outside the car. Regulating bodies in many different countries have enacted a number of strict regulations in an effort to lessen the negative effects of carbon emissions and greenhouse gases (GHG) on the environment and human health. The need for TPE in the external, interior, sealing systems, and under-the-hood components are also anticipated to increase as a result of the rapidly expanding vehicle markets. Demand for safe, affordable, lightweight MUV/SUV models with excellent fuel efficiency and a focus on comfort and aesthetics is driving the growth of applications in the automobile industry.

Thermoplastic Elastomer Market Growth Factors

According to estimates, the market will increase as more end-user industries, including those in the automotive, building and construction, home appliances, electrical and electronics, medical, adhesives, sealants and coatings, HVAC, footwear, and others, embrace thermoplastic elastomers. Thermoplastic elastomers are widely used in the healthcare sector to produce, among other things, surgical tool grips, catheters, drug delivery tubes, and other implants.

- The growing demand from the automotive industry

- Increasing disposable income

Thermoplastic Elastomer Market Outlook

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 25.57 Billion |

| Market Size in 2026 | USD 26.92 Billion |

| Market Size by 2035 | USD 42.68 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.26% |

| Largest Market | North America |

| Second Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered |

|

| Regions Covered |

|

Market Dynamics

Key Market Drivers

- Increasing demand for thermoplastic elastomers made from biomaterials - Thermoplastic elastomers created from sustainable bio-based materials, such as starches, microbiota, and plant oils, are frequently used as an alternative to traditional polymers made from petroleum-based resources. Polymers, plasticizers, fillers, or additives are examples of renewable upstream raw materials that can be used to produce bio-based elastomer content. The market for thermoplastic elastomers made from bio-based materials is anticipated to grow rapidly over the forecast period. The business for thermoplastic elastomers made from bio-based materials is being driven by the rise in their use across a variety of end-user industries. The market for bio-based thermoplastic elastomers is also being driven by strict emission regulations. The market prognosis for bio-based thermoplastic elastomers is expected to be significantly influenced by a potential COVID-19 rebound as well as the growing acceptance of electric vehicles. Furthermore, the business of bio-based thermoplastic elastomers is anticipated to advance due to strict emission rules and standards in industrialized nations. Additionally, the growth of the bio-based TPE market is anticipated to be supported by the growing demand for medicinal elastomers as a result of advancements in the thermoplastic elastomer sector globally.

- Growing knowledge of their benefits - The market will continue to rise as more people become aware of the benefits of thermoplastic elastomers, such as their excellent performance characteristics like cleanliness, flexibility, shock absorption, chemical, weather, and thermal resistance, easy sterilization, and dimensional stability. The market will rise as thermoplastic elastomers gain popularity due to their eco-friendliness, low production energy costs, and simplicity in processing, recycling, and molding. The market for thermoplastic elastomers will continue to expand at a rapid clip due to the increase in building and infrastructure development activities. The market value will increase due to the explosive use of thermoplastic elastomers in electric vehicles.

Key Market Challenges

- Replacement of the intra-thermoplastic elastomer - The market offers numerous thermoplastic elastomers that are differentiated based on cost and performance standards. A certain type of thermoplastic elastomer is utilized depending on the profit margins of the applications. The increasing trend of simplifying the challenging selection process when choosing a particular type due to the growing emphasis on specific kinds and their capacity to serve a variety of functions is posing a threat to the market for alternative thermoplastic elastomers. This situation has reduced the cost and boosted the adaptability of one type of thermoplastic elastomer. The main offender in this situation is the automotive sector, which is substituting less expensive and less significant thermoplastic vulcanizates with thermoplastic elastomers. Over the projection, PVC and thermoplastic polyurethane films are expected to overtake thermoplastic polyolefin in automotive applications.

Key Market Opportunities

- The need for bio-based thermoplastic elastomers is increasing - Biobased thermoplastic elastomers are made from renewable resources like vegetable oils and fatty acids. It offers properties that are comparable to or even better than those of traditional thermoplastic elastomers for sectors like footwear, sporting goods, and electronics. The development of biobased thermoplastic elastomers reduces the use of non-renewable resources and improves the material's biodegradability. The development and commercialization of biobased thermoplastic elastomers are providing new opportunities for thermoplastic elastomer manufacturers. Additionally, many manufacturers of synthetic thermoplastic elastomers have shifted their focus to the development of durable, ecologically friendly products.

Thermoplastic Elastomer Market Segment Insights

Type Insights

On the basis of type, the thermoplastic vulcanizates segment is expected to have the largest market share in 2025. The market share is projected to belong to the Thermoplastic Vulcanizates category. They are able to reuse and recycle production refuse and waste, which explains the causes. Ethylene propylene diene monomer (EPDM)/polypropylene thermoplastic vulcanizate is the most used form of thermoplastic vulcanizates (TPV).

Application Insights

On the basis of application, the automotive segment is expected to have the highest revenue share in 2025. In the foreseeable time, the Automotive segment is expected to have the greatest CAGR. Exterior filler panels, wipers, rocker panels, body seals, automotive gaskets, door & window handles, and vibration-damping pads are all made of thermoplastic elastomers.

Thermoplastic Elastomer Market Value Chain Analysis

The value chain begins with sourcing key raw materials such as styrene, olefins, and other polymer components, which are essential for producing TPEs with desired flexibility, strength, and thermal stability.

Key Players: BASF, LANXESS, Kuraray

Raw materials are compounded to form TPEs, combining thermoplastic and elastomeric segments to achieve dual-phase structures that allow melt-processability and rubber-like flexibility, enabling various manufacturing techniques.

Key Players: ExxonMobil, Dow, Kraton Polymers

TPEs are shaped into functional components or packaging solutions using prototyping methods such as 3D printing and small-batch injection molding, enabling evaluation of texture, elasticity, chemical resistance, and durability before full-scale production.

Key Players: Covestro, MCP Elastomers, Teknor Apex

Finished TPE products are distributed through global supply chains to manufacturers, wholesalers, and retailers, ensuring timely delivery to industries including automotive, healthcare, packaging, and consumer goods.

Key Players: McMaster-Carr, Alibaba, Wacker Chemie AG

Thermoplastic Elastomer Market Companies

- Advanced Elastomer Systems L.P.

- Arkema S.A

- BASF SE

- LyondellBasell Industries

- TSRC Corporation

- Yantai Wanhua Polyurethane Co. Ltd.

- Bayer MaterialScience LLC

- China Petroleum & Chemical Corporation

- Dynasol Elastomers LLC

- Nippon Polyurethane Industry Company Ltd.

- Avient Corporation

- Teknor APEX Company

- Huntsman Corporation

- Kraton Polymers LLC

- LG Chemicals

Recent Developments

- In January 2020 �BASF purchased the non-European PA6.6 business of Solvay, which included Butachimie's 50% ownership of the manufacturing of adiponitrile (ADN). The deal cost $1.53 billion in US dollars. By integrating cutting-edge and well-known products like Technyl, the acquisition will bolster BASF's polyamide capabilities.

Thermoplastic Elastomer MarketSegments Covered in the Report

By Type

- Thermoplastic Polyurethane (TPU)

- Styrenic Block Copolymer (TPE-S)

- Thermoplastic Vulcanizates

- Thermoplastic Copolyester

- Elastomeric Alloys (TPE-V or TPV)

- Others

By Application

- Automotive

- Footwear

- Wires & Cables

- Building & Construction

- Others

By Material

- Poly Styrenes

- Poly Olefins

- Poly Ether Imides

- Poly Urethanes

- Poly Esters

- Poly Amides

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content