What is Ethylene Market Size?

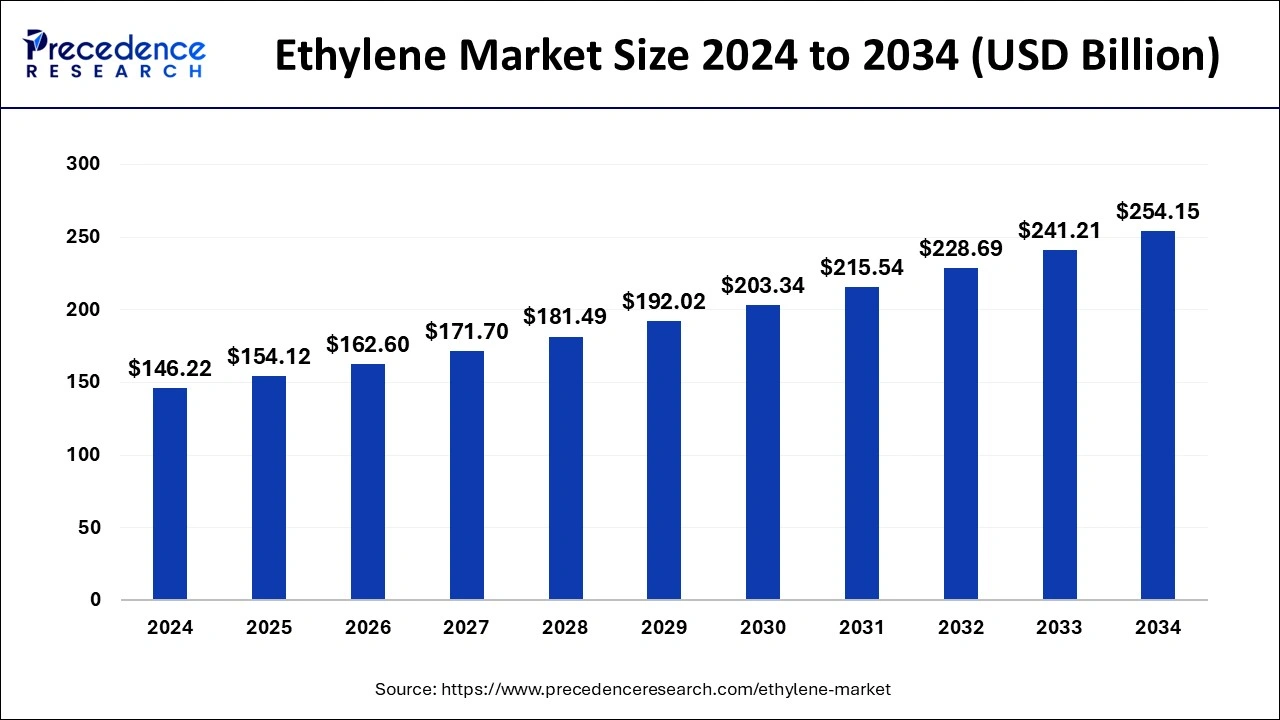

The global ethylene market size is exhibited at USD 154.12 billion in 2025 and it is projected to surpass around USD 254.15 billion by 2034, anticipated to reach a registered CAGR of 5.68% during the forecast period 2025 to 2034.

Market Highlights

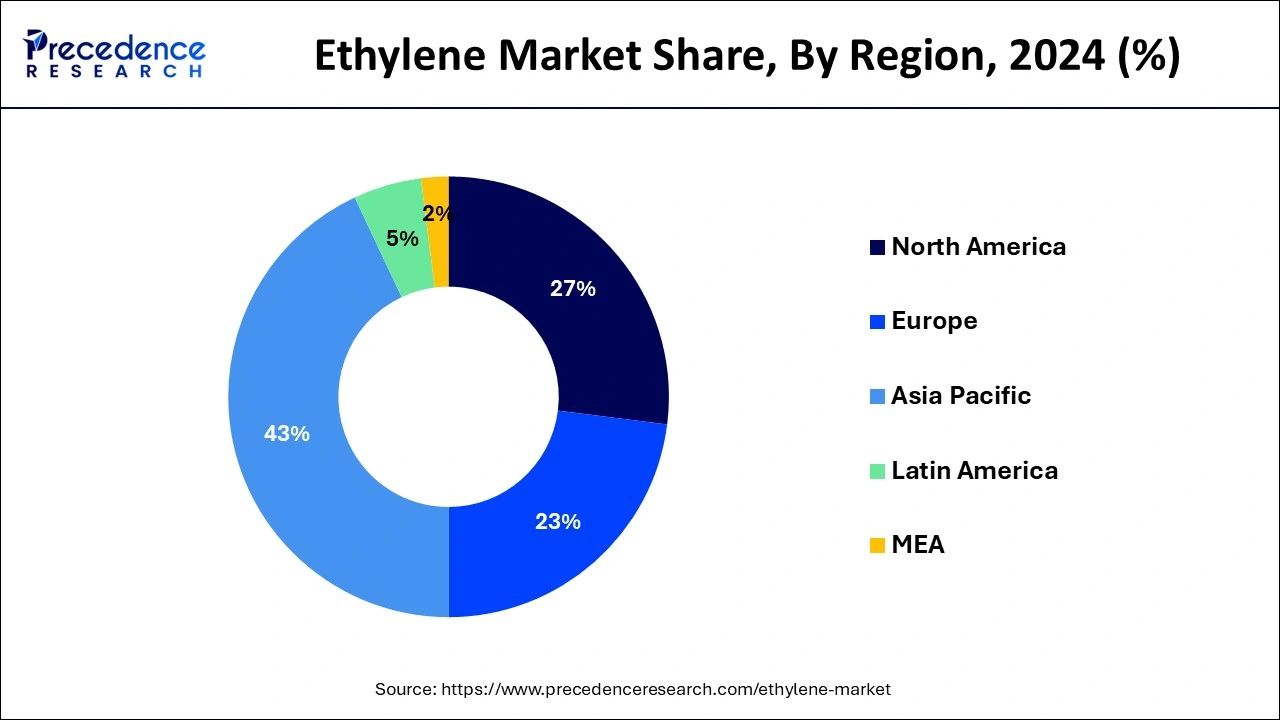

- The Asia-Pacific region has contributed the highest revenue share of around 43% in 2024.

- By application, the polyethylene segment has captured a 57% revenue share in 2024.

- By end use, the packaging industry has accounted for 51.8% of revenue share in 2024.

What is ethylene?

The size of the ethylene market will increase through 2023 as a result of rising expenditures meant to increase the production capacity for gas. The widespread use of ethylene in sectors including packaging, buildings, and automobiles will further increase demand for ethylene internationally. The demand for ethylene has increased globally, but mainly in the Asia-Pacific area due to the increasing number of goods made using various types of polyethylene, such as linear low-density polyethylene and high-density polyethylene. It is projected that the rapidly shifting consumer preference toward bio-based products will have an impact on the expansion of the ethylene industry. As a result, the demand for processed food and beverages has increased, acting as a major factor favoring the market's growth over the anticipated period. This is related to the sudden increase in spending on infrastructure and construction improvement, in addition to the increase in the number of people employed globally. Furthermore, it is projected that price fluctuations for ethylene will restrict growth.

Ethylene Market Growth Factors

Lightweight plastics are growing in popularity due to increased consumer convenience, creating new opportunities for small- as well as large-scale cosmetic companies. Consumer awareness of the many types and forms of plastic products will contribute to further business expansion. As lightweight plastic products gain popularity in the construction and automotive industries, demand is rising. Companies that produce ethylene are concentrating more on lightweight as well as high-quality packaging to provide consumers with greater alternatives.

Ethylene Market Outlook

- Industry Growth Overview: From 2025 to 2030, ethylene demand is projected to grow substantially, led by the production of polyethylene, ethylene oxide, and ethylene dichloride. The highest growth will occur in the Asia-Pacific due to growth in the packaging, construction, and automotive sectors.

- Global Expansion:As demand increases and producers look to maximize access to feedstocks, major producers globally are increasing capacity in Asia, the Middle East, and North America. Saudi Aramco and SABIC have recently announced new ethylene crackers to service these markets in the region.

- Significant Investors: Ethylene's predictability and downstream integration appeal to strategic and financial investors. Investments continue from firms such as Blackstone and CVC, as well as regional petrochemical funds, behind increasing positions in the ethylene supply chain and downstream derivatives.

- Startups Ecosystem: Startups are emerging in metabolically-engineered bio-ethylene, catalytic process innovation, and carbon capture for their enhanced production of ethylene. Companies like Newlight Technologies (USA) and Global Bioenergies (France) are attracting attention from venture capitalists (VCs) to provide sustainable solutions to the ethylene sector.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 154.12 Billion |

| Market Size in 2026 | USD 162.60 Billion |

| Market Size by 2034 | USD 254.15 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.68% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Source, By Feedstock, By Application, By End-Use, and By Sales Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

- Rise in demand for ethylene derivatives - Because of the growing use of ethylene derivatives as well as a modest expansion into new applications, the ethylene market is becoming more and more dependent on increases in global GDP. Major market players are investing, growing, and using a variety of methods to increase their manufacturing capacity and extend their market share. Additionally, the growing emphasis on circular economy and ecological solutions led to the creation of creative methods for ethylene development. For example, on September 9, 2021, Braskem and SCG Chemicals signed an MOU for collaborative investment in the manufacture of bio-polyethylene using ethylene produced from renewable sources. Companies will be able to produce twice as many bio-based products thanks to this investment.

- Demand for ethylene in the packaging industry - The packaging industry's increasing need for ethylene in form of polyvinyl chloride and polyethylene is also anticipated to provide profitable growth potential for the industry. An increasing trend has been observed in the demand for plastic used in packaging, including sacks and bags, as well as various types of packaging, polyethylene bottles and jars, and containers. The rise in ethylene oxide consumption is also probably going to affect the growth of the market.

Key Market Challenges

- Strict government regulations - Because it is flammable and carcinogenic, ethylene poses a threat to the environment. When exposed, it is quite explosive and can make people feel faint, woozy, and unconscious. Environmental protection laws are being implemented in a number of nations, which will put a burden on ethylene-producing businesses. Additionally, governments everywhere are outlawing single-use plastics to reduce plastic waste. For instance, China declared in January 2020 that it will outlaw single-use plastics to encourage recycling and eco-friendly packaging. The output limitations imposed would impede the market's expansion.

Key Market Opportunities

Rising rapid industrialization and urbanization

- In emerging nations, the demand for packaging materials based on ethylene is increasing dramatically as a result of rising urbanization and industrialization. Additionally, the market for ethylene is expanding since ethane is utilized as a raw ingredient in both auto and electrical products, which is driving demand in APAC nations like China and India. The middle class is predicted to grow in emerging nations over the next several years, which will increase demand for vehicles and electronics in such nations. As a result, the growing demand for gas from end-use industries will create new opportunities for market participants to expand.

Increase in adoption of bio-based green polyethylene compounds

- Companies that produce ethylene are engaging in initiatives to create green polyethylene compounds based on biomaterials. These polymers are just as versatile as chemically manufactured plastic and are simpler to make while using less energy. Following the fashion, Braskem, a Brazilian biopolymer manufacturer, collaborated with the Danish toy manufacturer LEGO Group to provide it with I'm green polyethylene. I'm green polyethylene is a plastic derived from sugarcane that is completely recyclable and lowers greenhouse gas emissions.

Segment Insights

Source Insights

Throughout the projected period, the natural gas category is anticipated to have a considerably quicker revenue CAGR. The adoption of new extraction techniques, such as horizontal drilling and hydraulic fracturing, has led to easier extraction of natural gas, also known as shale gas, trapped in low permeability rock formations. As a result, natural gas availability has increased significantly over the past few years. Natural gas is now one of the main energy and feedstock sources on the market as a result of price reductions brought about by its availability.

Feedstock Insights

Throughout the projected period, the naphtha segment is anticipated to post a considerably quicker revenue CAGR. It may also be broken down into three other categories: light naphtha, heavy naphtha, and full-range naphtha, which combines light and heavy naphtha. It is one of the most often utilized feedstocks in the petroleum sector and is also employed in the production of fertilizers. By synthesizing ammonia, it is also utilized to create fertilizers or public gas. Currently, naphtha steam cracking is nearly entirely used to create ethylene. Pyrolysis Gasoline (PG), mixed-C4, ethylene, and propylene are just a few of the petroleum feedstock that may be produced from naphtha using this technique.

Application Insights

The market category for ethylene oxide had the highest CAGR growth share in 2024. It is a gas that is used to sterilize a wide range of application areas in the medical industry, including bespoke procedure packs, wound care dressings, multi-lumen tubing products, constructed complicated devices, and catheters. Because of its low-temperature parameter, ethylene oxide sterilization is one of the most effective sterilizing techniques and can be used effectively on a variety of materials.

It thoroughly penetrates the surfaces of the devices. In addition, the product is a significant chemical made mostly from the catalytic oxidation of ethylene. A wide range of chemicals, including ethoxylates, ethylene glycols, glycol ethers, ethanolamine, polyethylene glycol, and polyether polyols, may be produced using it as a chemical intermediary.

End-Use Insights

The worldwide market has been divided into categories for automotive, building and construction, packaging, textiles, agrochemicals, and others based on end-use. In 2023, the packaging category had the greatest revenue share worldwide. The market for the packaging product will be largely driven by increased consumption of consumables made of polyethylene, rising PET fiber, bottle, and packaging demand, and rising demands for Polyvinyl Chloride (PVC) used in pipe and construction applications. One of the most common polymers utilized in this industry is polyethylene. The product may be used to create flexible and soft films for packaging and storage needs. It provides basic packaging plastics with a significantly lower softening point, which lowers processing energy costs. Additionally, ethylene vinyl acetate is a copolymer of vinyl acetate, and because it has more anti-blocking chemicals than polyethylene, it is frequently used in food packaging as a shrinkage film. The demand for ethylene would thus increase throughout the predicted period as a result of the vast range of applications for it and its derivatives in packaging.

Regional Insights

Asia Pacific Ethylene Market Size and Growth 2025 To 2034

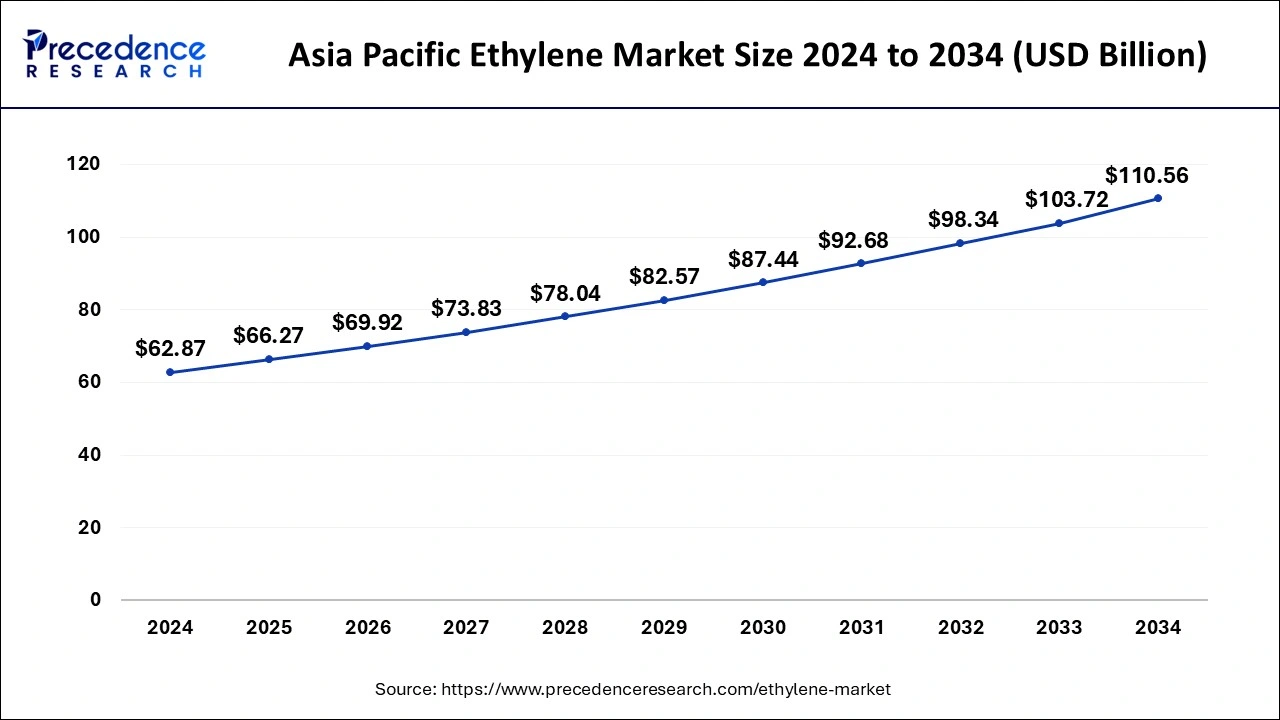

The Asia Pacific ethylene market size reached USD 66.27 billion in 2025 and is anticipated to be worth around USD 110.56 billion by 2034, poised to grow at a CAGR of 5.81% from 2025 to 2034.

Asia Pacific Title: Asia Pacific's Ethylene Ascendancy

The Asia-Pacific accounted for 43% revenue share in 2024. Positive economic and demographic trends, rising demand for petrochemical derivatives, and other factors have all contributed to the market's revenue growth. The availability of conventional feedstock and the rising expansion capacities of industry participants are additional significant variables boosting market revenue development. The need for ethylene-based derivatives in end-use sectors including packaging, automotive, and construction dominates this industry. Due to the expansion of the manufacturing sector in nations like China, India, and Japan, the region will continue to dominate the worldwide market over the projection period.

China Ethylene Market Trends

China is set to account for a significant share of global ethylene supply, surpassing many established producers. Domestic demand, while slowing in sectors like construction and automotive, remains substantial, supporting steady consumption and downstream integration into polymers and chemicals. Additionally, Chinese producers are increasingly targeting higher-value derivatives and export markets to maintain profitability amid oversupply and global margin pressures, further solidifying country's position

North America had a 27% revenue share in 2024 and is anticipated to grow at a quicker CAGR than the rest of the world over the projected period. The United States demand for ethylene is anticipated to rise as a result of expanding shale oil output, strong automotive sales, an uptick in building activity, and a booming flexible packaging sector. In addition, the expansion of the region's ethylene production, increased demand for plastics and basic chemicals, and technological developments will all contribute to an increase in market revenue.

The third-largest revenue share in 2023 came from Europe. Public and private investment in this region has increased as a result of Europe's ongoing growth in the construction and packaging sectors. The growth engine for the European construction sector may also change from end-use industries like packaging, construction, and automotive, among others. Product demand in this area is being driven by rising spending on residential, non-residential, and civil engineering operations in many European Union (EU) countries, including Germany, the U.K., and France, among others.

U.S. Ethylene Market Trends

The U.S. dominates the global market through its abundant feedstock availability, particularly shale gas, which provides a cost advantage for ethylene production. Large-scale, integrated petrochemical complexes across Texas and Louisiana enable high-volume production and downstream integration into polyethylene, ethylene oxide, and other derivatives. Strong domestic demand from packaging, automotive, construction, and consumer goods sectors sustains production, while exports to Latin America and Asia expand the US influence globally.

Germany Ethylene Market Trends

Germany maintains a prominent position in the global market due to its highly developed chemical and petrochemical industry, combined with a strategic location at the heart of Europe, which enables easy access to both regional and international markets. The country benefits from advanced petrochemical infrastructure, integrated production facilities, and highly efficient manufacturing processes, allowing for large-scale production of ethylene and its derivatives, including polyethylene, ethylene oxide, ethylene glycol, and specialty chemicals.

Latin America - New Energy, New Ethylene Horizons

Significant growth in Latin America's ethylene market was due to increased development of the packaging, automotive, and construction industries. Consequently, new opportunities arose as Brazil and Latin America began building new ethylene facilities while recycling and downstream derivative opportunities were also developing to meet local industrial demand. While demand remains steady, oversupply risks and constrained downstream growth are curbing value expansion, some projections indicate declines in market value from current levels.

Brazil Ethylene Market Trends

Brazil accounted for the largest share of the Latin American ethylene market due to greater-scale polyethylene production and significant industrial growth. Ultimately, further investment in bio-ethylene generation would create unprecedented opportunities in sustainable production. This growth is largely driven by increasing demand for polyethylene and other ethylene based derivatives, particularly in packaging, construction, automotive, and other industrial applications.

Middle East & Africa - Ethylene Expansion from Desert to Demand

Significant growth in the Middle East & Africa ethylene market was the result of good access to abundant feedstock and increased industrialization. In addition, new opportunities existed in new cracker plants, export-based production, and new downstream chemicals for local and international markets. While the region benefits from abundant low cost feedstocks (notably in countries such as Saudi Arabia, UAE and Iran), demand remains relatively weak due to less diversified downstream industries and slower industrial expansion. Additionally, the MEA market faces structural challenges including flattening exports, increasing imports in some markets, and margin pressures from global competitors.

Saudi Arabia Ethylene Market Trends

Saudi Arabia accounted for the largest share of the region's ethylene market, due to extensive petrochemical complexes and inexpensive feedstock. Investment in new downstream products reinforced Saudi Arabia's desire to enhance its global positioning. Saudi Arabia remains one of the world's largest ethylene producers, with a strong base of ethane cracker and naphtha cracker infrastructure, placing it among the top global producers.

Ethylene Market Companies

|

Company |

About |

|

BASF SE |

BASF SE was established in 1865. It produces sustainable chemicals and materials that develop lighter, efficient vehicle parts, providing transportation options and reducing carbon output. |

|

Chevron Phillips Chemical Company, LLC |

Chevron Phillips Chemical Company, LLC was incorporated in 2000. It creates advanced plastics and chemicals utilized in electric vehicles, light-weight designs and fuel-efficient structures to contribute to greener vehicle options. |

|

Exxon Mobil Corporation |

Exxon Mobil Corporation was created in 1999. It invests in low-emission fuels, biofuels and enhancement lubricants, all of which provide improved efficiencies in vehicle performance, providing enhanced vehicle options and reduce the effects on the environment. |

Recent Developments

- Exxon Mobil Corporation said on November 8 that it will establish a chemical manufacturing complex in Huizhou, Guangdong Province, China.

- The Dow Chemical Company announced on October 6 that it would construct the world's first ethylene and derivatives facility with net-zero carbon emissions.

Segments Covered in the Report

By Source

- Coal

- Natural Gas

- Hydrocarbon Steam Cracking

By Feedstock

- Naphtha

- Ethane

- Propane

- Butane

- Others

By Application

- Polyethylene

- High-density Polyethylene (HDPE)

- Linear Low-density Polyethylene (LLDPE)

- Low Density Polyethylene (LDPE)

- Ethylene Oxide

- Ethyl Benzene

- Ethylene Dichloride

- Others

By End-Use

- Building & Construction

- Automotive

- Textiles

- Packaging

- Agrochemicals

- Others

By Sales Channel

- Direct Company Sale

- Direct Import

- Distributors & Traders

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content