What is the Ethylene Vinyl Acetate Market Size?

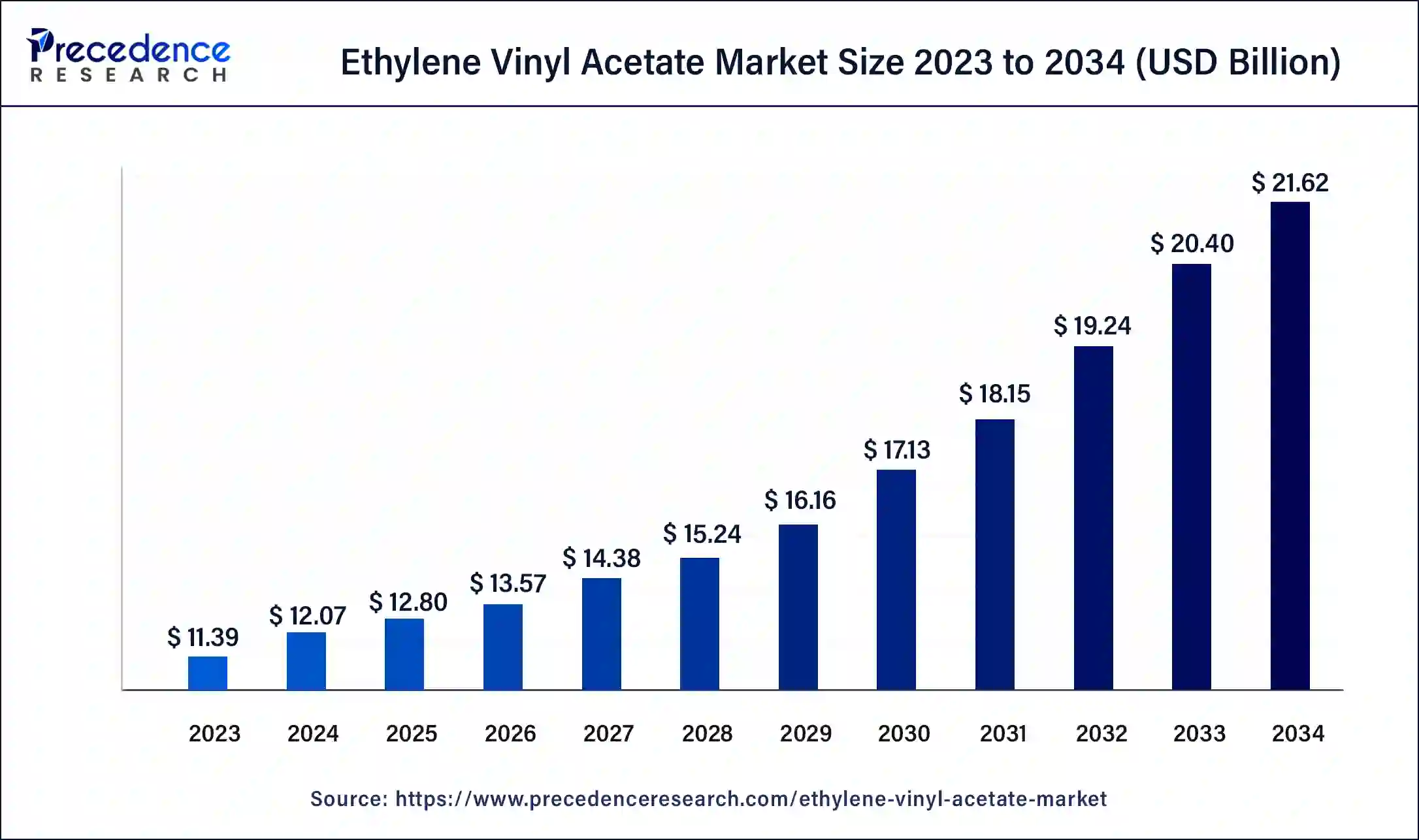

The global ethylene vinyl acetate market size is valued at USD 12.80 billion in 2025 and is predicted to increase from USD 13.57 billion in 2026 to approximately USD 21.62 billion by 2034, growing at a healthy CAGR of 6% between 2025 and 2034.

Ethylene Vinyl Acetate Market Key Takeaways

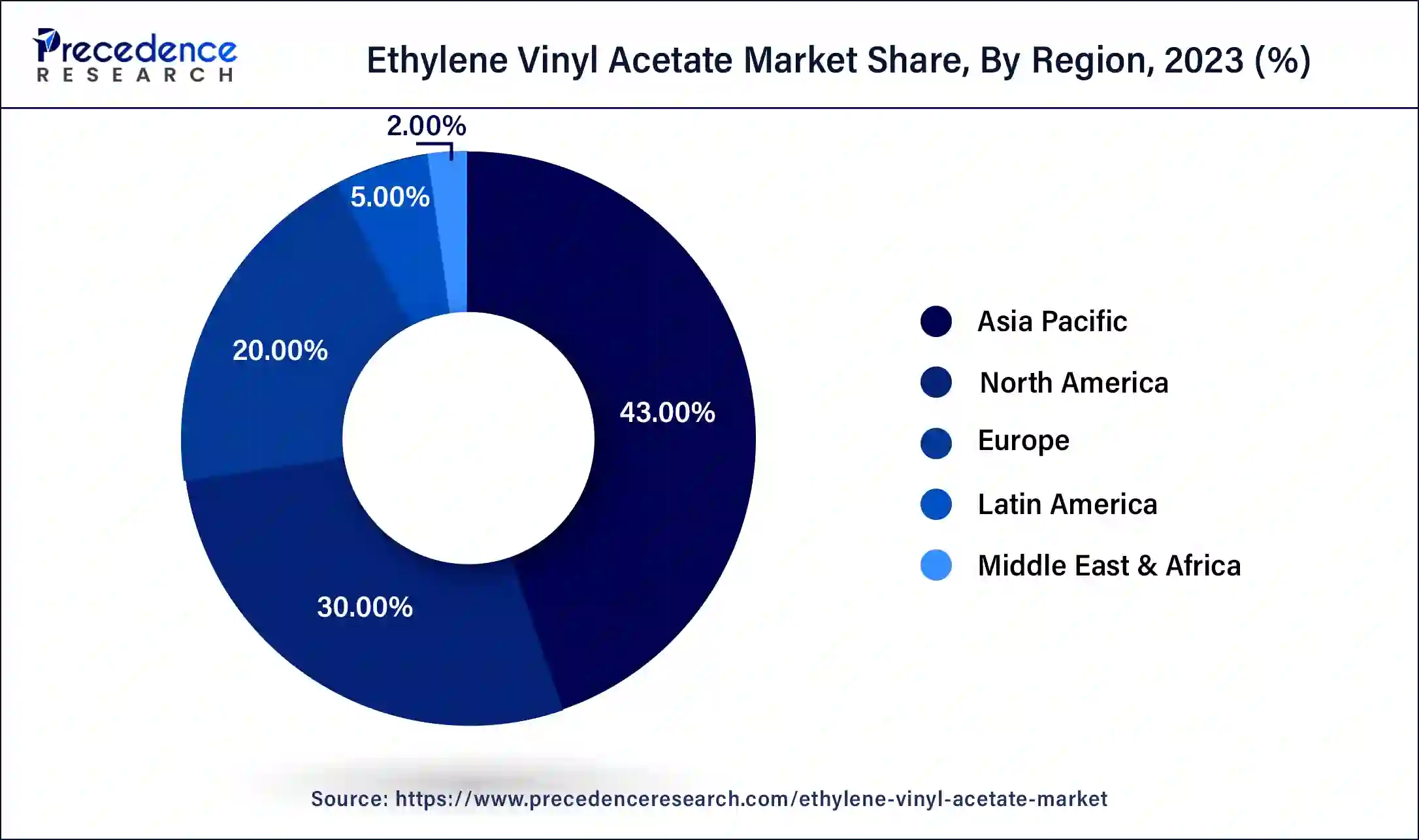

- Asia Pacific contributed more than 43% of revenue share in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

- By grade, the medium density segment has held the largest market share of 41% in 2024.

- By grade, the high-density segment is anticipated to grow at a remarkable CAGR of 7.2% between 2025 and 2034.

- By application, the adhesives segment generated over 35% of revenue share in 2024.

- By application, the films segment is expected to expand at the fastest CAGR over the projected period.

Strategic Overview of the Global Ethylene Vinyl Acetate Industry

Ethylene vinyl acetate (EVA) is a flexible and durable copolymer formed by combining ethylene and vinyl acetate. This versatile material finds widespread application across industries due to its elastic nature and varied properties, determined by the proportion of vinyl acetate in its composition. EVA is commonly utilized in the production of foam-based products like shoe soles, athletic padding, and packaging materials.

Its lightweight character, excellent shock absorption, and resistance to UV rays make it an ideal choice for these purposes. Beyond foams, EVA is employed in the creation of films, wires, cables, adhesives, and molded products. Its unique blend of flexibility at low temperatures and resilience at high temperatures contributes to its extensive use in the industrial, consumer, and medical sectors. EVA stands out for its adaptability, cost-effectiveness, and eco-friendly profile as a recyclable material, solidifying its pivotal role in contemporary manufacturing practices.

Artificial Intelligence: The Next Growth Catalyst in Ethylene Vinyl Acetate

AI is significantly impacting the ethylene vinyl acetate market by driving significant improvements in manufacturing efficiency, quality control, and sustainability. Through the implementation of AI and machine learning algorithms, manufacturers can optimize production parameters in real time, leading to reduced waste, lower energy consumption, and increased yields. AI-powered systems also enable predictive maintenance and real-time quality monitoring, minimizing costly downtime and ensuring product consistency. Additionally, AI accelerates the discovery of sustainable and bio-based material alternatives, aligning with the industry's growing focus on eco-friendly solutions and circular economy principles.

Ethylene Vinyl Acetate Market Growth Factors

- The growing demand for comfortable and lightweight shoes, particularly in the athletic and casual footwear segments, is a significant driver for EVA market growth.

- EVA's versatility in packaging foams and materials contributes to its expanding use in various industries, driven by the rising need for protective and sustainable packaging solutions.

- The construction sector's growth, especially in emerging economies, fuels the demand for EVA in applications such as sealants, adhesives, and insulation materials.

- EVA's use in automotive interiors, including headliners and door panels, is increasing with the growing global automotive industry.

- EVA's biocompatibility and flexibility make it a preferred material in the production of medical devices, contributing to the market's growth.

- The solar energy sector utilizes EVA for encapsulating photovoltaic cells in solar panels, aligning with the expanding renewable energy market.

- EVA's protective and cushioning properties make it valuable in the packaging of electronic devices, supporting its growth in tandem with the electronics industry.

- EVA is increasingly used in textiles for enhancing properties such as flexibility, weather resistance, and durability, contributing to its market expansion.

- EVA films find applications in agriculture, solar panels, and laminated glass, witnessing increased demand due to their optical, thermal, and mechanical properties.

- The popularity of sports and leisure activities drives the demand for EVA in products like yoga mats, flotation devices, and protective gear.

- EVA's usage in furniture manufacturing, particularly in cushions and padding, is growing in response to the expanding furniture market.

- EVA's softness and safety features contribute to its use in the production of toys, supporting its market growth.

- EVA's ease of use and versatility make it a preferred material for do-it-yourself (DIY) projects, fostering its demand among hobbyists and DIY enthusiasts.

- The fashion industry utilizes EVA in accessories like bags, belts, and hats, capitalizing on its lightweight and customizable nature.

- EVA's thermal stability and lightweight characteristics contribute to its use in aerospace applications, including interior components and insulation materials.

- EVA's moldability and customizable features cater to the rising demand for personalized and unique packaging solutions across industries.

- EVA's compatibility with healthcare standards and its role in sterile packaging contribute to its growth in the healthcare packaging sector.

Market Outlook

- Market Growth Overview: The Ethylene Vinyl Acetate market is expected to grow significantly between 2025 and 2034, driven by the strong demand from the solar energy, footwear, and packaging industries. Key growth drivers include technological innovation, a push for sustainable bio-based alternatives, and increasing application in the automotive and medical sectors.

- Sustainability Trends: Sustainability trends involve the enhanced recyclability and circular economy practices, sustainable manufacturing processes, and a focus on creating EVA products with improved properties that support sustainability goals in end-user applications.

- Major Investors: Major investors in the market include Vanguard and BlackRock, ExxonMobil, LyondellBasell, and Celanese.

- Startup Economy: The startup economy in the market is focused on bio-based and circular solutions, waste-to-value innovation, and process optimization and automation.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6% |

| Market Size in 2025 | USD 12.80 Billion |

| Market Size in 2026 | USD 13.57Billion |

| Market Size by 2034 | USD 21.62 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Grade, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Expanding packaging applications and construction sector growth

The ethylene vinyl acetate market experiences a significant surge in demand due to expanding applications in packaging and the growth of the construction sector. In packaging, EVA's versatility as a material for foams and protective packaging solutions responds to the increasing demand for sustainable and efficient packaging across diverse industries. The lightweight and durable nature of EVA makes it ideal for ensuring product safety during transportation, thus driving its adoption in various packaging applications.

Simultaneously, the construction sector's expansion contributes to the heightened demand for EVA, particularly in sealants, adhesives, and insulation materials. The flexibility and adhesive properties of EVA make it valuable in construction applications, meeting the evolving needs of the industry. As construction activities grow globally, so does the utilization of EVA in enhancing the performance and durability of construction materials, further fueling the market demand for ethylene vinyl acetate.

Restraints

Volatility in raw material prices

The volatility in raw material prices significantly restrains the growth of the ethylene vinyl acetate market. EVA production relies on ethylene and vinyl acetate monomers, and fluctuations in their prices directly impact manufacturing costs. Rapid and unpredictable changes in raw material prices make it challenging for EVA producers to establish stable pricing structures and can lead to reduced profit margins. This volatility also hampers long-term planning and investment decisions within the industry, affecting overall market growth.

Moreover, the sensitivity of EVA prices to changes in ethylene and vinyl acetate costs can create uncertainties for both manufacturers and end-users, influencing purchasing decisions. As a result, the EVA market is not only exposed to the economic factors affecting raw material prices but also to the inherent challenges associated with managing this volatility, making it essential for industry participants to implement effective risk management strategies to mitigate the impact on market dynamics.

Opportunities

Rising demand in the renewable energy sector

The ethylene vinyl acetate market is experiencing significant opportunities through the increasing demand in the renewable energy sector, specifically in solar technology. EVA plays a pivotal role in encapsulating photovoltaic modules within solar panels. As the global focus on sustainable energy solutions intensifies, there is a growing requirement for advanced materials that can enhance the longevity and effectiveness of solar panels. EVA's distinctive attributes, including flexibility, lightweight properties, and resilience to environmental elements, position it as an optimal material for the encapsulation of photovoltaic modules.

With the ongoing expansion of renewable energy initiatives and continual advancements in solar technologies, the demand for EVA in the production and enhancement of solar panels is poised to escalate. This presents a noteworthy opportunity for the EVA market to contribute to the progression and efficacy of renewable energy solutions, aligning with worldwide efforts for a cleaner and more sustainable future.

Grade Insights

The medium-density segment had the highest market share of 41% in 2024. In the ethylene vinyl acetate market, the medium density segment refers to EVA products with a moderate vinyl acetate content. These grades offer a balanced combination of flexibility, durability, and cost-effectiveness, making them suitable for various applications. Trends in the medium-density EVA segment include increased utilization in footwear production, particularly for midsole components, as well as growth in the packaging industry where these grades find applications in foam sheets and protective packaging materials. The medium-density segment is characterized by its adaptability and widespread use across diverse industries.

The high-density segment is anticipated to expand at a significant CAGR of 7.2% during the projected period. In the ethylene vinyl acetate market, the high-density segment refers to EVA products with a higher proportion of vinyl acetate content. These grades exhibit enhanced properties such as increased toughness, better elasticity, and improved chemical resistance compared to lower-density counterparts.

Trends in the high-density segment include growing demand for these specialized EVA grades in industries like automotive, where their superior properties find application in components requiring durability and resilience. Additionally, advancements in high-density EVA formulations cater to evolving needs in the packaging, construction, and industrial sectors.

Application Insights

According to the application, the adhesives has held 35% revenue share in 2024. Within the ethylene vinyl acetate market, the adhesives segment pertains to the incorporation of EVA in adhesive formulations. EVA's outstanding adhesive characteristics, combined with its flexibility, position it as a favored option in construction, packaging, and automotive applications. A notable trend in this segment involves the ongoing innovation of EVA-based adhesives to meet changing performance expectations, particularly in response to the need for more robust, sustainable, and environmentally conscious bonding solutions across diverse industries.

The film segment is anticipated to expand fastest over the projected period. In the ethylene vinyl acetate market, the films segment refers to the production and utilization of EVA films. These films find applications across various industries, including agriculture, solar panels, and laminated glass. In recent trends, there is a growing preference for EVA films in the packaging industry due to their favorable optical, thermal, and mechanical properties. Additionally, EVA films are witnessing increased demand in the solar energy sector for encapsulating photovoltaic cells, reflecting a trend toward sustainable and efficient energy solutions.

Regional Insights

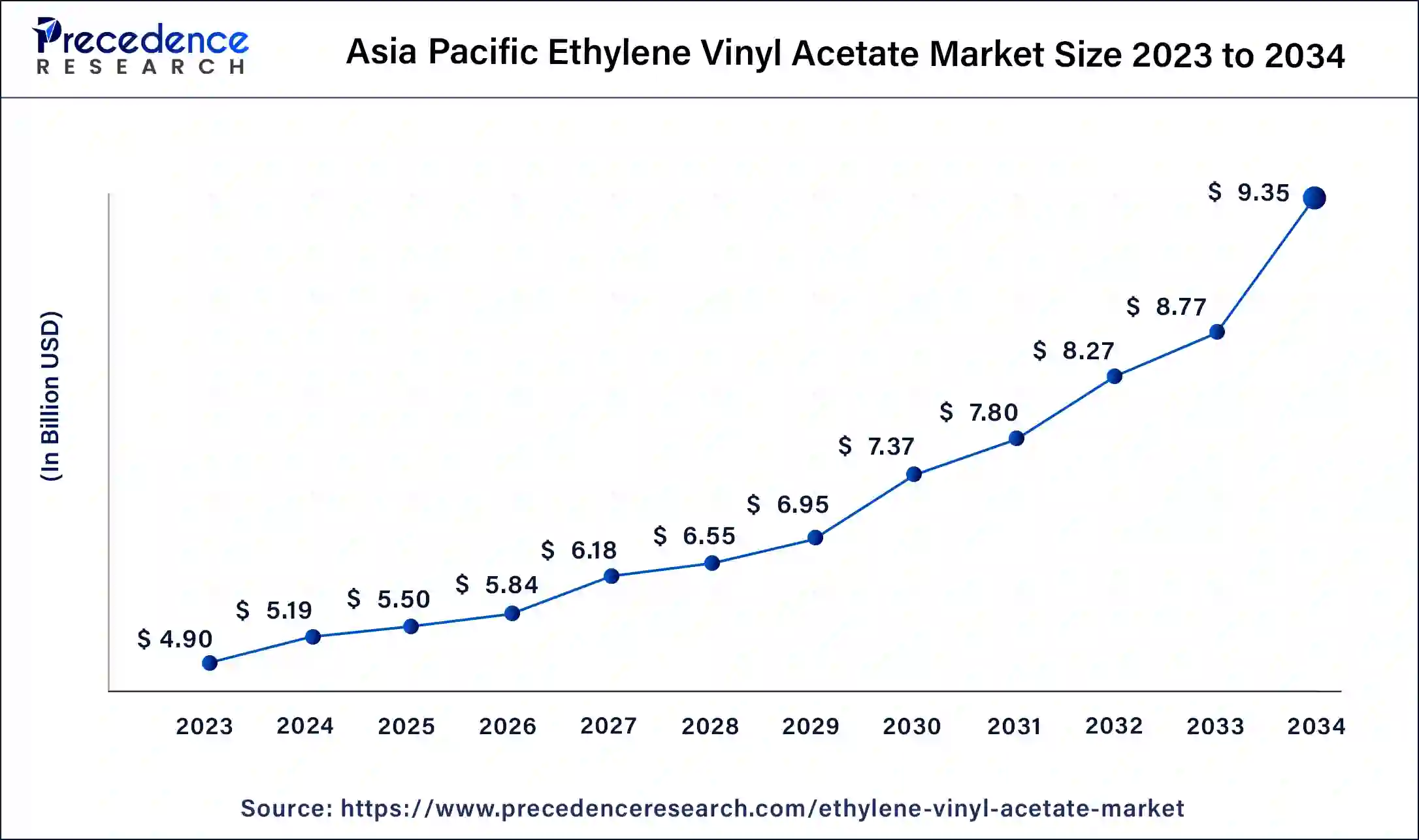

Asia Pacific Ethylene Vinyl Acetate Market Size and Growth 2025 To 2034

The Asia Pacific ethylene vinyl acetate market size is valued at USD 5.19 billion in 2025 and is expected to reach USD 9.35 billion by 2034, at a CAGR of 6.06% from 2024 to 2034.

Asia Pacific has held the largest revenue share of 43% in 2024. Asia Pacific holds a major share in the ethylene vinyl acetate market due to robust industrial growth and widespread applications across diverse sectors. The region's burgeoning manufacturing industries, particularly in China and India, drive substantial demand for EVA in footwear, packaging, construction, and automotive applications. Additionally, the increased focus on renewable energy projects in countries like China contributes to the growing utilization of EVA in the solar energy sector. The region's economic dynamism, coupled with its expanding end-use industries, solidifies Asia-Pacific's prominent position in the EVA market.

China's massive demand for solar panels and the footwear industry. Intensive domestic competition, fueled by expanded production capacity, is shaping the market and influencing pricing. Additionally, increasing environmental concerns are pushing manufacturers toward more sustainable and bio-based alternatives.

North America is estimated to observe the fastest expansion. North America holds a major share in the ethylene vinyl acetate market due to several factors. The region benefits from a robust demand for EVA in industries such as footwear, packaging, and automotive manufacturing. Additionally, the presence of key market players, technological advancements, and a well-established infrastructure contribute to the dominance of North America. The region's focus on sustainability and innovation further propels the demand for EVA in applications such as solar energy and medical devices, solidifying its significant market share in the EVA industry.

The U.S ethylene vinyl acetate market is driven by the robust demand from the expanding solar energy and packaging sectors. Key trends involve a strong push towards sustainable, bio-based alternatives and technological innovations to enhance product performance. The automotive and medical industries are also increasing their adoption of specialized EVA grades.

Germany's ethylene vinyl acetate market is rising, with government incentives for solar installations and the need for durable, high-performance encapsulation firms. The shift towards sustainable & bio-based EVA, increasing demand for automotive & healthcare sectors, and market leans towards higher-value EVA grades with superior properties, such as enhanced UV resistance and chemical stability, for demanding applications in construction, automotive, and specialized packaging.

Ethylene Vinyl Acetate Market Value Chain Analysis

- Raw Material Procurement and Production: This initial stage involves sourcing the primary feedstocks.

Key Players: ExxonMobil Chemical, LyondellBasell Industries N.V., and SABIC. - EVA Manufacturing and Polymerization: In this central stage, the raw materials are chemically combined through polymerization processes to produce various grades of EVA with differing vinyl acetate content.

Key Players: DuPont (now part of Celanese in this segment), Versalis S.p.A., and LG Chem. - Conversion and Fabrication: This downstream stage involves transforming the EVA resins and compounds into intermediate or final products using processes like extrusion, injection molding, and foaming.

Key players: Mitsui Chemicals

Ethylene Vinyl Acetate Market Companies

- DuPont

DuPont is a key innovator in the EVA market, historically providing a wide portfolio of specialty polymers for various applications, including medical devices and solar encapsulation. - ExxonMobil Corporation

ExxonMobil is a major global manufacturer of EVA, with a strong presence in packaging and solar segments due to its extensive production capacity. The company focuses on developing a wide range of EVA grades to meet the needs of various industrial applications. - Hanwha Total Petrochemical Co., Ltd.

Hanwha Total is a leading producer of EVA, particularly known for its specialized, high-value grades used in photovoltaic (PV) solar cell encapsulation. - LyondellBasell Industries N.V.

LyondellBasell is a major global chemical company and a leading producer of polyolefins, including EVA, with a wide product portfolio. The company contributes by supplying a broad range of EVA grades for applications from hot melt adhesives to footwear and foam products. - Arkema SA

Arkema is a specialty chemicals and advanced materials company that contributes to the EVA market with a focus on high-performance polymers. - Braskem S.A.

Braskem is the largest petrochemical company in Latin America and a key player in the EVA market, known for its focus on sustainable and bio-based polymers. The company is investing in bio-EVA production from renewable sources like sugarcane to address the growing demand for eco-friendly materials. - Celanese Corporation

Celanese is a major producer of chemical raw materials, including vinyl acetate monomer (VAM), which is a key feedstock for EVA production. - Sumitomo Chemical Co., Ltd.

Sumitomo Chemical contributes to the market through its diversified petrochemicals business, producing a range of EVA grades for various applications. The company focuses on specialized, flame-retardant EVA grades for demanding applications like automotive interiors and electronics. - Formosa Plastics Corporation

Formosa Plastics is a large producer of petrochemicals and resins, including EVA, with a significant presence in the Asia-Pacific market. The company contributes by investing in new production facilities to meet regional demand for EVA in applications like footwear and films. - Sinopec Corporation

As one of China's largest chemical companies, Sinopec is a major producer of ethylene and EVA resins, providing a substantial supply to the domestic market. The company's large production capacity is critical for supporting China's massive manufacturing sector and growing demand for photovoltaic and footwear applications. - Tosoh Corporation

Tosoh is a Japanese chemical company that produces EVA and other specialty polymers for a wide range of industrial applications. The company contributes to the market by supplying various EVA grades used in hot-melt adhesives, films, and foaming products. - Saudi Basic Industries Corporation (SABIC)

SABIC is one of the world's largest petrochemical companies and a major producer of polyethylene, including EVA. The company provides a large-scale, cost-effective supply of EVA resins to global markets, primarily serving sectors like packaging and solar. - LG Chem Ltd.

LG Chem is a prominent South Korean chemical company that manufactures a variety of EVA copolymers, including grades for specialized applications. The company is also innovating in sustainable solutions, having launched new bio-based EVA lines to target green packaging and photovoltaics. - Westlake Chemical Corporation

Westlake Chemical is a North American producer of petrochemicals, including ethylene, a key feedstock for EVA. The company contributes to the market's supply chain by ensuring a stable and cost-effective source of essential raw materials for EVA manufacturers. - Repsol S.A.

Repsol is a global energy and petrochemical company that produces a range of polyolefins, including EVA. The company contributes to the European market by providing EVA grades used in applications like solar panel encapsulation and footwear.

Recent Developments

- In June 2023, PetroChina Guangxi Petrochemical Company revealed its adoption of LyondellBasell's polyethylene technology at its Qinzhou City facility in Guangxi, China. The utilization of LyondellBasell's Lupotech process technology is geared toward the production of primarily low-density polyethylene (LDPE) with ethylene vinyl acetate copolymers (EVA).

- In February 2023, Celanese Corporation successfully concluded an ultra-low capital project aimed at repurposing existing manufacturing and infrastructure assets at its Edmonton, Alberta facility. This strategic initiative led to a noteworthy 35% increase in the facility's ethylene vinyl acetate (EVA) capacity, showcasing Celanese's commitment to expanding and optimizing its EVA production capabilities. These developments underscore the dynamic nature of the ethylene vinyl acetate market, with key players making strategic moves to enhance their production capacities and technological capabilities.

Segments Covered in the Report

By Grade

- Low Density

- Medium Density

- High Density

By Application

- Films

- Adhesives

- Foams

- Solar Cell Encapsulation

- Other Applications

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content