What is the Vinyl Flooring Market Size?

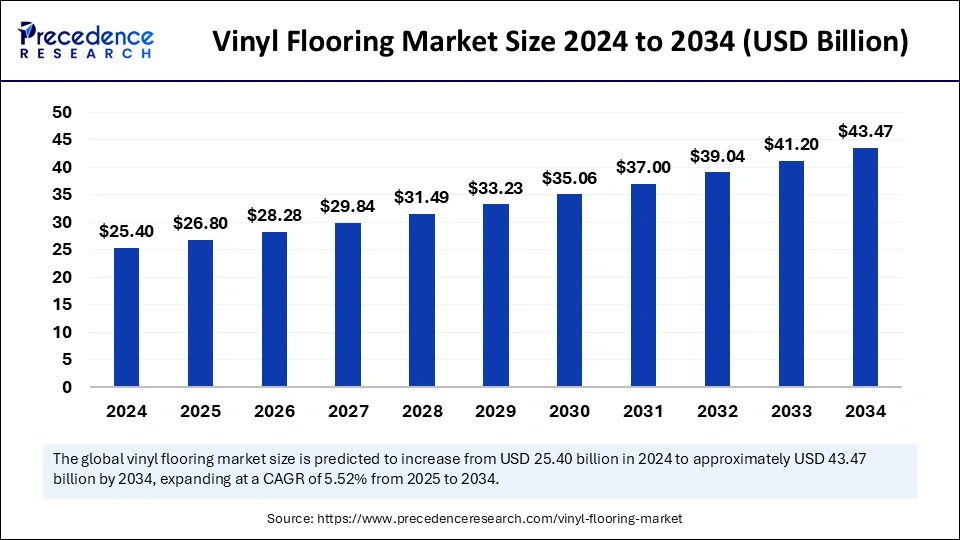

The global vinyl flooring market size accounted for USD 26.80 billion in 2025 and is predicted to increase from USD 28.28 billion in 2026 to approximately USD 45.67 billion by 2035, expanding at a CAGR of 5.48% from 2026 to 2035. Increasing construction activities, rising consumer preference for aesthetically appealing and durable materials, increasing demand for cost-effective flooring solutions, and growing popularity for luxury vinyl tiles flooring are expected to drive the growth of the global vinyl flooring market

Vinyl Flooring MarketKey Takeaways

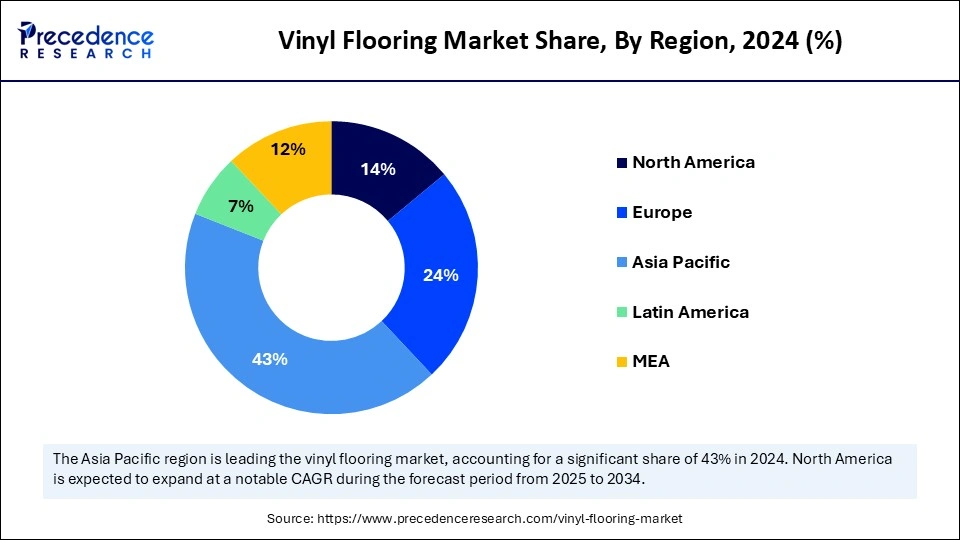

- Asia Pacific led the vinyl flooring market with the largest market share of 43% in 2025.

- North America is expected to grow at a notable CAGR 13.9% during the forecast period.

- By product, the luxury vinyl tiles segment accounted for the major market share of 65% in 2025.

- By product, the vinyl sheets segment is expected to grow at a significant CAGR of 3.35% during the forecast period.

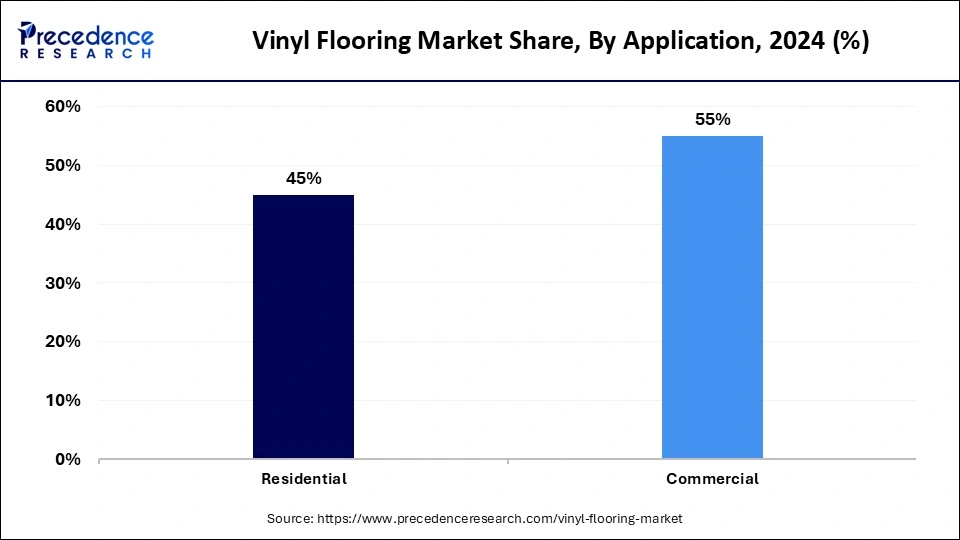

- By application, the commercial segment accounted for the highest market share of 54.34% in 2025.

- By application, the residential segment is seen to grow at a notable rate of growth during the forecast period.

Market overview

Vinyl flooring is a type of versatile and resilient flooring material made from polyvinyl chloride. Vinyl flooring offers several advantages, such as easy installation, low-maintenance nature, and high durability. It is available in various forms, including luxury vinyl tiles, vinyl sheets, and vinyl tiles, which cater to dynamic consumer preferences for construction applications related to residential and commercial projects. The use of vinyl flooring can enhance interior looks, aesthetics, and comfort underfoot in several residential and commercial spaces.

Vinyl Flooring Market Growth Factors

- Growing population coupled with the increase in per capita income are expected to contribute to the overall growth of the vinyl flooring market during the forecast period.

- The expansion of enhanced offices and workspaces, along with increasing consumer lifestyles, are anticipated to create significant demand for vinyl flooring, accelerating the market's expansion.

- The rising demand for Luxury vinyl tiles (LVT) is expected to promote the vinyl flooring market growth in the coming years. Luxury vinyl tiles (LVT) are becoming increasingly popular, particularly in the developing nations, offering greater design flexibility and a realistic look as well as imitate natural materials like wood and stone.

- The rising popularity of modern interior designs is expected to boost the market's expansion in the upcoming years.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 45.67 Billion |

| Market Size in 2025 | USD 26.80 Billion |

| Market Size in 2026 | USD 28.28 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.48% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising construction and renovation activities

The increasing construction activities around the world are expected to drive the growth of the vinyl flooring market in the upcoming years. Vinyl flooring is easy to install, moisture-resistant, affordable, low maintenance cost, and more durable than other flooring solutions. It can mimic natural materials such as stone and wood, making it a popular choice in the construction industry.

Additionally, several prominent manufacturers are increasingly investing to develop customized product solutions in a wide variety of colors, patterns, design textures, and dimensions, which are propelling the product penetration in the construction sector. The increasing need for renovation and construction of residential places, including apartments, family-homes, and condominiums along with the rising demand for vinyl flooring from schools, healthcare facilities, and several public buildings are anticipated to fuel the expansion of the market in the coming years.

Restraint

Fluctuations in Raw Material Prices

The volatility in raw material prices is anticipated to hamper the growth of the market. Fluctuations in raw material prices can adversely impact the overall cost of the vinyl flooring as well as the profitability of manufacturers as they find it difficult to pass on the increased costs to potential customers due to severe competitive pressures. Such factors may restrict the expansion of the global vinyl flooring market.

Opportunity

Rising focus on sustainability and eco-friendly solutions

The increasing focus on sustainability and eco-friendly solutions is projected to offer lucrative opportunities to the vinyl flooring market during the forecast period. Manufacturers are increasingly using recycled materials and reducing VOC emissions as eco-friendly innovations are gaining significant popularity among environmentally conscious consumers. These innovations align with stringent environmental regulations and are attractive for green building certifications like LEED, making vinyl flooring the preferred option for sustainable projects.

In addition, the rising advancements in digital printing technology can enhance the aesthetic appeal of vinyl flooring. Digital printing technology allows for the creation of very intricate designs and lifelike textures. This advancement caters to residential, commercial, and industrial sectors for personalized aesthetics, bolstering the growth of the market during the forecast period.

Segment Insights

Product insights

The luxury vinyl tiles segment accounted for the dominating share in 2025 owing to the rising investments in construction and renovation activities. The growth of the segment is majorly driven by the increasingly popularity of Luxury vinyl tiles (LVT) among consumers for residential and commercial applications owing to its affordability, ease of installation, durability, and water resistance properties. Luxury vinyl tiles (LVT) are also gradually replacing industry staples including solid wood flooring, engineered wood flooring, and porcelain. LVTs can significantly reduce replacement cost and material wastage as well as align with environmental and sustainability objectives. This flooring type is highly preferred in commercial sectors such as retail, offices, hospitals, educational buildings, and others.

- In July 2024, Interface, a global leader in flooring solutions and sustainability, held the Middle East launch of its latest Etched & Threaded carpet tiles and Earthen Forms luxury vinyl tiles (LVT) collections with an exclusive multimedia event in Dubai. Hosted at the innovative venue Lifesize Plans Dubai, in media partnership with Design Middle East magazine and Intelier, the event provided an immersive experience for several interior design studios in the region, showcasing Interface's latest offerings in a truly interactive and engaging setting.

On the other hand, the vinyl sheets segment is expected to witness a significant growth rate during the forecast period. Vinyl sheet flooring offers a variety of benefits, such as being easy to install, durable, and stress-free to clean. To meet the diverse customers' needs, manufacturers are offering color and texture customization to match any décor. These sheets are increasingly being adopted among customers as a substitute for natural stone flooring, hardwood flooring, ceramic tiles, and others. Vinyl sheet flooring is becoming a preferred choice for many businesses and commercial spaces like offices, schools, and hospitals.

Application insights

The commercial segment accounted for the dominant share in 2025 owing to the rising demand for vinyl flooring in commercial settings such as residences, retail, offices, shopping malls, hotels, and others. Vinyl flooring can be used in areas with heavy foot traffic, which has led to an increase in the demand for vinyl flooring for commercial uses. Vinyl flooring offers features like easy cleaning, slip & water resistance, and stylish designs are expected to accelerate the adoption of the products in commercial applications.

On the other hand, the residential segment is expected to grow at a notable rate in global vinyl flooring market over the forecast period. The residential application segment includes apartments, residential buildings, complexes, and houses. In the residential applications, vinyl floorings are widely used due to their low cost, long-lasting, ease of installation, and resistance to water, stains, and dirt. This flooring is available in various patterns, colors, and sizes, making it a preferred choice to create patterns resembling natural stone or wood.

Vinyl flooring is either waterproof or water-resistant, which makes it highly durable against spills, wet feet, and other moisture exposure. This characteristic of vinyl is an excellent choice for areas like kitchens, bathrooms, and other spaces that frequently encounter wetness. Moreover, the surge in the number of single-family houses in developing nations, rising urbanization, and the growing disposable income of consumers are anticipated to propel the product demand in the residential segment during the forecast period.

- In many developing countries in Asia and Africa, Blackstone has invested significantly in the Indian real estate sector. Blackstone further seeks to invest an additional $22 billion (1.7 lakh crore) by 2030.

Regional Insights

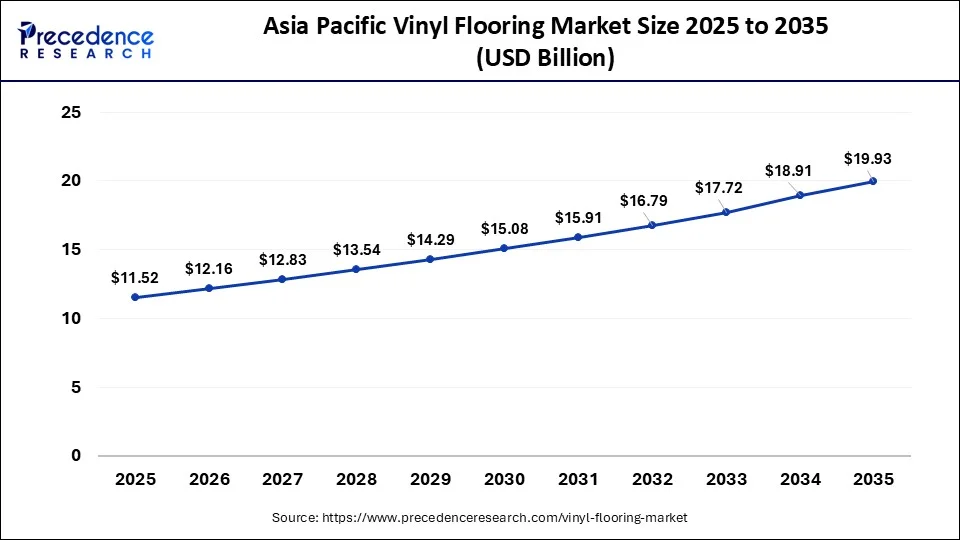

What is the Asia Pacific Vinyl Flooring Market Size?

The Asia Pacific vinyl flooring market size was exhibited at USD 11.52 billion in 2025 and is projected to be worth around USD 19.93 billion by 2035, growing at a CAGR of 5.63% from 2026 to 2035.

Asia Pacific held the largest share in the vinyl flooring market in 2025. The region growth is mainly attributed to the increasing standard of living along with the rising population that offers a great potential for infrastructural development and new housing demand, which significantly fuels the market growth in this region. The rise in building and construction trends to develop modern architectural structures, spurring the demand for vinyl flooring in the region. Additionally, increasing investments in the construction of single-family homes, apartments, complexes, shopping malls, offices, and other commercial spaces are positively influencing the growth of the vinyl flooring market in the region.

- In 2021, as per the Kensho calculations, residential real estate witnessed net new investments of worth €10.8 billion ($12.22 billion). Thus, the high income of people and growing real estate sector drive the construction materials market growth in Japan drastically.

- In March 2022, according to the India Report Indian Real Estate's ESG landscape and its progress to a sustainable future, in India the past 5 years have seen a pronounced push towards green buildings; the period saw a 37% increase in the supply of certified buildings, with the addition of ~ 78 million sq. ft. of certified stock, compared with the previous five years (2012-2016). Moreover, developers are now seeking nationally and internationally.

On the other hand, North America is observed to grow at the fastest rate during the forecast period. The growth of the region is driven by the presence of a well-established service industry, expansion of the construction sector, rapid technological advancement and product innovation, rising urbanization, increasing disposable income, surge in the number of single-family houses, and an increase in the number of MNCs operating in the region. In addition, the supportive government initiatives to develop social infrastructure across the region is expected to drive the regional market's growth.

- In 2023, total construction spending reached $1.98 trillion, marking a 7.4% increase from the previous year. There are approximately 745,000 construction businesses in the U.S. as of 2023.

- The states of California, Florida, and New York boast the largest number of construction businesses in the U.S., with approximately 85,000, 65,000, and 50,000 businesses respectively. As of 2023, the number of construction businesses in the U.S. has risen to around 745,000.

What are the Advancements in the Vinyl Flooring Market in Europe?

Europe is experiencing significant growth in the market. This is due to the increasing number of manufacturers and suppliers who are focusing on providing cost-effective, low-maintenance, durable, and eco-friendly flooring solutions. In addition to that, rising urbanization efforts coupled with changing consumer lifestyles focusing on home decor are expected to open up new opportunities. Countries like Germany, France, and the UK are leading players.

Germany Vinyl Flooring Market Trends: The country is witnessing a surging demand for insulation and flooring solutions in the construction industry, which is boosting market growth. The country is also expected to witness a rise in the demand for vinyl flooring due to the increased availability of innovative construction solutions and easy installation techniques.

What are the Key Trends in the Vinyl Flooring Industry in Latin America?

Latin America is expected to witness substantial growth in the market. Factors like rapid urbanization and increasing infrastructure development are driving demand for modern, durable, and cost-effective flooring solutions across various residential, commercial, and institutional sectors. The region is also witnessing a growing awareness of sustainable and eco-friendly building materials. Manufacturers are also increasingly offering recyclable and other advanced options that align with building certifications.

Brazil Vinyl Flooring Market Trends: The country has a robust commercial real estate sector, including a good retail, hospitality, and healthcare infrastructure, which contributes to a high demand for vinyl flooring. There is rapid development in the region, driven by urban housing developments and renovation projects, particularly in metropolitan areas.

How is the Middle East and Africa Region Growing in the Vinyl Flooring Industry?

The Middle East and Africa are expected to witness steady growth in the market. This growth is due to the region's continuous urban development efforts and infrastructure upgradation projects, which are directly influencing the demand for vinyl flooring. It is widely used in new commercial buildings, public institutions, and residential housing projects. Manufacturers in the region are also coming up with advanced vinyl flooring that is integrated with smart sensors and anti-microbial coatings. These advancements and innovations are propelling the market further.

Saudi Arabia Vinyl Flooring Market Trends: An increase in construction projects, a rising demand for affordable flooring solutions, advanced manufacturing capabilities, and the expanding adoption of innovative vinyl flooring products are some of the major factors boosting market potential in the country.

Vinyl Flooring Market Companies

- Congol,

- eum Corporation

- Novalis Innovative Flooring

- Gerflor

- CBC Co., Ltd.

- Armstrong Flooring, Inc.

- Forbo Flooring Systems

- Mohawk Industries, Inc.

- Berkshire Hathaway Inc.

- Tarkett S.A.

- Mannington Mills, Inc.

Recent Developments

- In September 2024, The Southern African Vinyls Association (SAVA) announced its plans to launch of an industry-wide vinyl floor recycling and recovery programme. This groundbreaking initiative, modelled after the successful Australian ResiLoop programme, aims to revolutionise the way vinyl flooring waste is managed, promoting sustainability and environmental responsibility across the industry.

- In November 2024, Danube Home, a key furnishing retailer in UAE unveiled its latest collection of flooring solutions for homes, outdoors, and commercial spaces including laminate, vinyl, engineered wood, and luxury vinyl tiles (LVT), designed to cater to diverse tastes and budgets.

- In October 2022, Rehau introduced eco-friendly flooring solutions. Raufloor Neostein rigid core vinyl tile (RCVT) is for households with children, pets, and people who are hyper-sensitive to allergens.

In January 2025, Nox Corporation, a luxury vinyl tile (LVT) flooring producer, has signed a Memorandum of Understanding (MoU) with BASF Corporation, a global chemical company, to reduce virgin fossil use and enhance resource circularity in the flooring industry. This collaboration focuses on integrating BASF's ChemCycling program into Nox production processes, aiming to introduce circular plasticizers derived from recycled mixed plastic waste.

Segments covered in the report

By Product

- Vinyl Sheets

- Vinyl Tiles

- Luxury Vinyl Tiles

By Application

- Residential

- Commercial

By Region

- North America

- Europe

- Latin America

- Asia Pacific

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content