Ethylene Glycols Market Size and Forecast 2025 to 2034

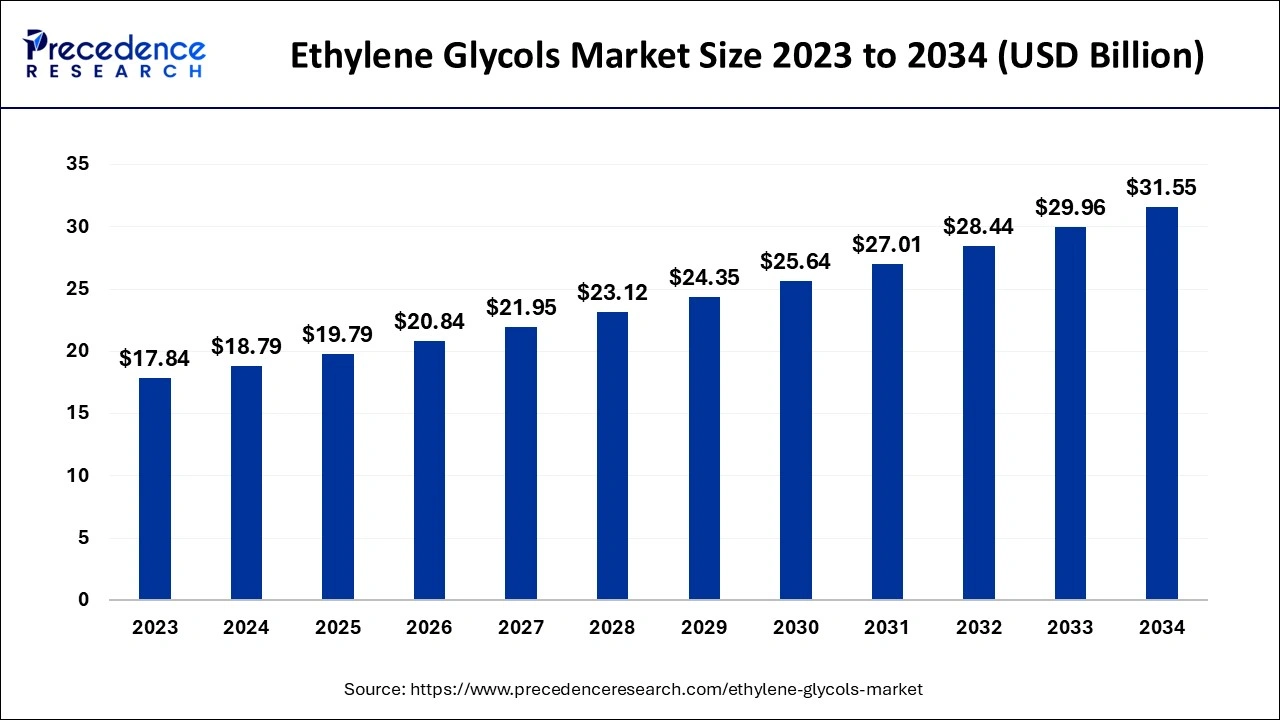

The global ethylene glycols market size was estimated at USD 18.79 billion in 2024 and is predicted to increase from USD 19.79 billion in 2025 to approximately USD 31.55 billion by 2034, expanding at a CAGR of 5.32% from 2025 to 2034. Increasing demand for ethylene glycols from the textile and automotive industries is the key factor driving the growth of the Ethylene Glycols market. Also, growing PET resin production along with the renewable energy initiatives can fuel market growth further.

Ethylene Glycols Market Key Takeaways

- In terms of revenue, the global ethylene glycols market was valued at USD 18.79 billion in 2024.

- It is projected to reach USD 31.55billion by 2034.

- The market is expected to grow at a CAGR of 5.32% from 2025 to 2034.

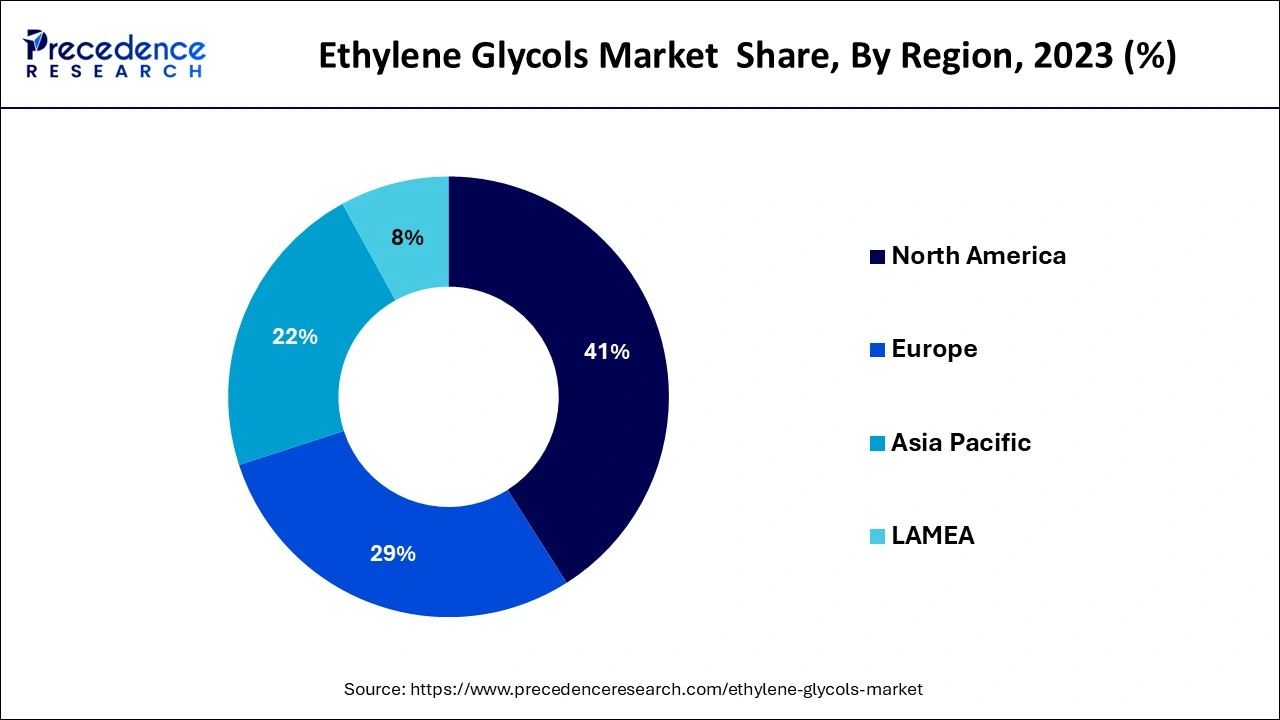

- North America dominated the ethylene glycols market with the largest market share of 41% in 2024.

- Asia Pacific is expected to grow at a CAGR of 4.52% over the projected period.

- By derivative type, the triethylene glycol (TEG) derivative segment contributed the highest market share of 42% in 2024.

- By derivative type, the monoethylene Glycol (MEG) derivative segment is anticipated to grow at a notable CAGR of 4.52% over the forecast period.

- By application, The PET application segment accounted for the biggest market share of 45% in 2024.

- By application, the polyester fibers segment is expected to grow a CAGR of 4.11% over the projected period.

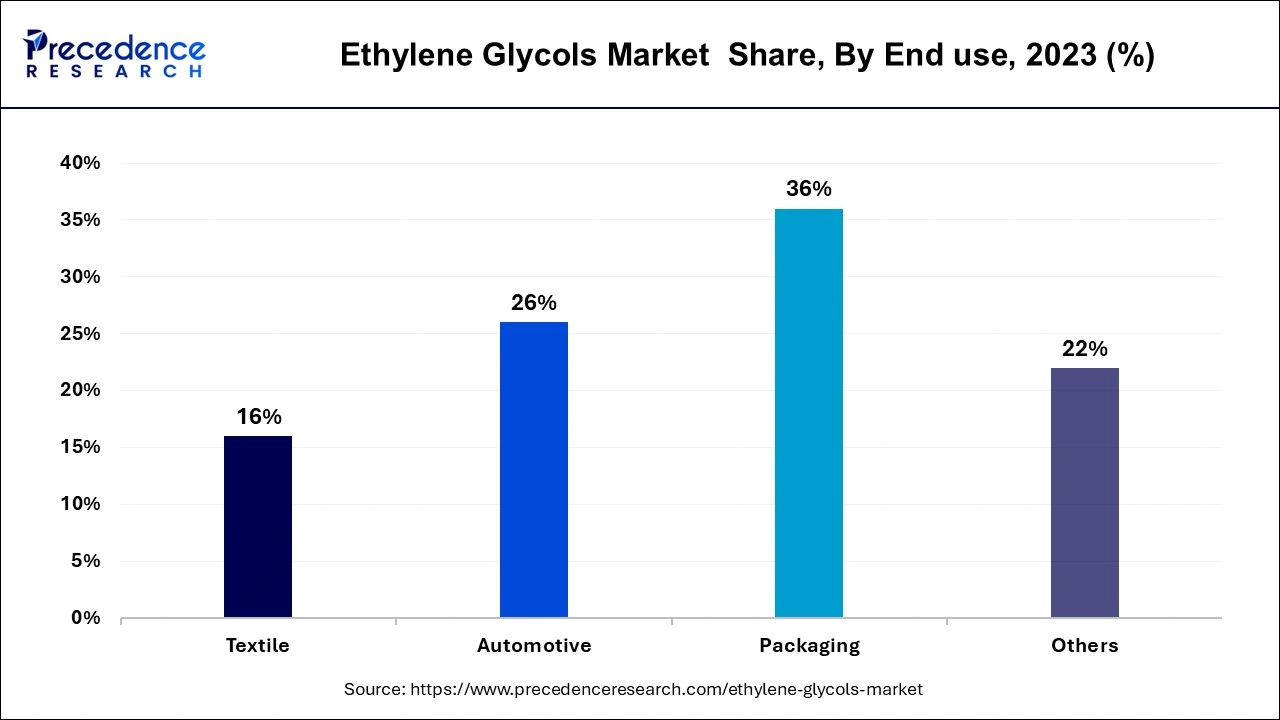

- By end use, the packaging segment has held the major 36% market share of 36% in 2024.

- By end use, the automotive segment is projected to grow at a significant CAGR of 4.21% over the studied period.

Impact of AI on the Ethylene Glycols Market

Artificial intelligence (AI) is making a significant impact on the Ethylene Glycols market. Guided process optimization and predictive maintenance are improving operational efficiencies and decreasing overall production costs. Furthermore, AI streamlines the production process, leading to consistent quality and higher productivity of ethylene glycol products, and also enhances the sustainability of the manufacturing process.

U.S. Ethylene Glycols Market Size and Growth 2025 to 2034

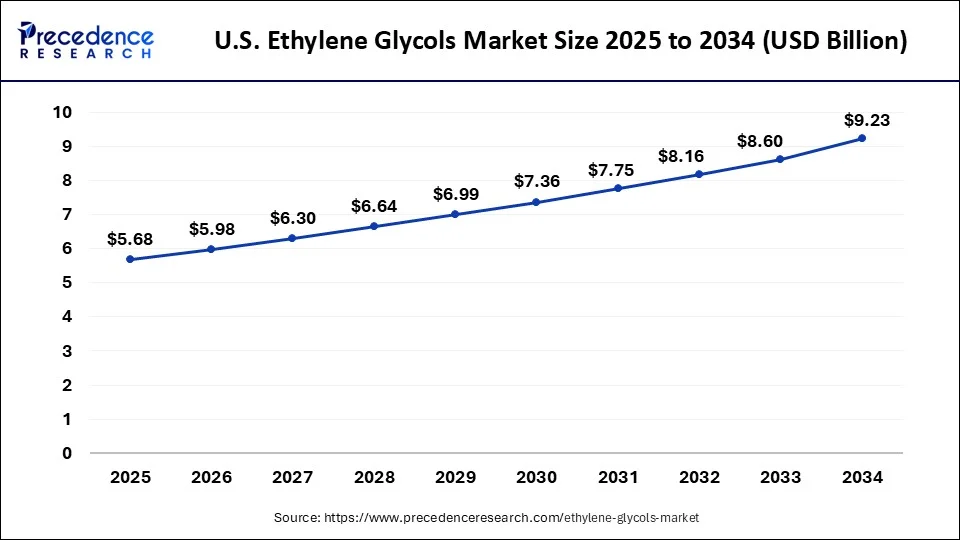

The U.S. ethylene glycols market size is exhibited at USD 7.70 billion in 2024 and is anticipated to be worth around USD 13.09 billion by 2034, growing at a CAGR of 5.43% from 2024 to 2034.

North America dominated the Ethylene Glycols market in 2024. The dominance of the region can be attributed to the increasing demand for packaged goods and the surge in industries like paints. The region is also a hub for major automotive players, which can create a positive outlook on the market. Furthermore, the region is led by major market players like Exxon Mobil Corp, Dow Chemicals, and LyondellBasell Industries, which have a wide presence and experience in the regional market.

- In June 2024, Hyosung TNC announced that it had entered a partnership with Ambercycle, a California-based company specializing in recycling waste clothing and waste fabric into polyester raw materials. This strategic collaboration aims to target the global eco-friendly market by manufacturing recycled fiber from resource regeneration.

Asia Pacific is expected to show the fastest growth in the Ethylene Glycols market over the projected period. The growth of the region can be linked to the rapid urbanization, and industrialization in the region along with the increasing utilization of ethylene glycol from end-user industries such as textiles, automotive, and others. Moreover, because of growing consumption and demand for MEG, most manufacturers are increasing their manufacturing capacity in the region.

Market Overview

Ethylene glycol is an organic compound that is utilized as a raw material in the manufacturing of polyester fiber. It is also used as a coolant in the vehicle engine. Polyester fiber can act as a heat transfer agent. The combination of ethylene glycol and water offers the advantages of preventing corrosion, resistance to certain bacteria, and acid degradation. In addition, MEG-based PET is utilized in the production of drinking water bottles, food packages, and carbonated drinks.

Top Five Exporters of Woven Fabrics of Polyester Staple Fibers

| Reporter | Trade Value 1000 USD | Quantity |

| China | 175,608.47 | 11,692,400 |

| European Union | 79,965.23 | 3,118,090 |

| Turkey | 41,444.91 | 1,501,630 |

| India | 36,067.36 | 1,200,410 |

| Portugal | 35,489.59 | 1,136,600 |

Ethylene Glycols Market Growth Factors

- Increasing adoption of polyester fibers among MEG manufacturers is expected to boost the Ethylene Glycols market growth further.

- The growing use of Polyethylene Terephthalate in the packaging industry is another factor propelling the market growth throughout the forecast period.

- Rising demand for personal protective care like face masks and disinfectants will likely contribute to market expansion further.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 31.55 Billion |

| Market Size in 2024 | USD 18.79 Billion |

| Market Size in 2025 | USD 19.79 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.32% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Derivative Type, Application, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Dynamics

Driver

Increasing demand for non-ionic surfactants

Ethylene glycol is an important element in the production of non-ionic surfactants, which are necessary for different products such as emulsifiers, detergents, and wetting agents. Non-ionic surfactants, because of their non-reactive nature and stability, are preferred in various consumer products. Additionally, the increasing disposable income of consumers, growing awareness about hygiene, and increasing urbanization led to the creation of new and enhanced formulations.

- In October 2024, Chinese researchers made substantial developments in sustainable chemical production by developing a bio-based technology for manufacturing ethylene glycol (EG), with a yearly capacity of 1,000 metric tonnes. This achievement marks a key step forward in China's green revolution in its chemical industry.

- In April 2024, Arxada introduced Geomuse, manufactured specifically to fulfill modern formulator demands and consumer demands. Geomulse is a new line of versatile, non-ionic emulsifiers and surfactants based on a naturally extracted and customizable polyglycerol ester chemistry.

Restraint

Lack of global regulations

The lack of regulations governing ethylene glycol production and application across the globe can impact market growth negatively. The regulations and laws governing the use of ethylene glycol are changing in every country. However, companies find it difficult to deal with these national laws and mandates. This can lower the investment in the Ethylene Glycols market.

Opportunity

Growing utilization of ethylene glycol in polyester and PET resin production

The increasing need for ethylene glycol in polyester manufacturing is the key factor boosting the Ethylene Glycols market growth. Polyester is widely utilized in the textile industry because of its wrinkle resistance, durability, and affordability. Furthermore, the increasing consumption of packaged goods is fuelled by rising urbanization and changes in consumer lifestyles, driving the demand for PET and enabling its strong presence in the market.

- In March 2024, H&M Group and Vargas Holding unveiled Syre, the latest venture to scale textile-to-textile recycled polyester. He co-founded a venture, also backed by TPG Rise Climate, meant to scale textile-to-textile recycling of polyester and contribute to a more sustainable textile industry.

- In June 2024, France's Arkema launches sustainable powder coating with recycled PET. This new technology involved in the manufacturing process will empower end markets to better respond to growing societal expectations to preserve resources and decrease climate impact.

Derivative Type Insights

The Triethylene Glycol (TEG) derivative segment led the global Ethylene Glycols market in 2024. The dominance of the segment can be attributed to the increasing use of TEG in different industries, such as chemical production, plastics, and natural gas processing, because of its unique properties. In addition, its high boiling point, low volatility, and moisturizing controlling properties make it a primary choice for applications like hygroscopic processes. And natural gas dehydration.

The Monoethylene Glycol (MEG) derivative segment is anticipated to grow at the fastest rate in the Ethylene Glycols market over the forecast period. The growth of the segment can be linked to the increased manufacturing of polyethylene terephthalate, which is produced from mono-ethylene glycol. However, MEG is the primary base material in the textile industry for producing polyester, which is utilized in different applications, including upholstery, clothing, and carpets, because of its desirable properties, like superior strength, durability, and resistance to shrinking.

- In October 2022, Braskem and Sojitz, a Japan-oriented global trading company, declared the launch of Sustainea, which will manufacture and market bioMEG (mono ethylene glycol) and bioMPG (mono propylene glycol).

Application Insights

The PET application segment dominated the Ethylene Glycols market. The dominance of the segment can be credited to the growing use of PET (polyethylene terephthalate) in packaging materials, particularly in the food and beverage (F&B) industry. The requirement for PET is propelled by the increasing consumption of packaged foods across the globe, which is fuelled by urbanization and the convenience offered by packaged food.

- In August 2023, Carbios entered a Letter of Intent (LOI) with SASA to launch a New PET Depolymerization Plant in Turkey. Moreover, This LOI highlights a potential partnership where SASA would acquire a license for CARBIOS' cutting-edge PET recycling technology.

The Polyester fibers segment is anticipated to grow at the fastest rate in the Ethylene Glycols market over the projected period. The growth of the segment is due to various e characteristics offered by this fiber such as durability, high strength, and resistance. These properties make them a prime choice for numerous applications. Furthermore, polyester fibers are more cost-effective than natural fibers, including cotton or wool, which improves their overall value proposition.

- In December 2023, The LYCRA Company, a key innovator in fiber and technology solutions for the personal care and apparel industries, launched a new product called LYCRA FiT400 fiber for knits. LYCRA FiT400 fiber is made from 60% recycled PET and 14.4% bio-derived resources, and it is GRS-certified.

End use Insights

The packaging segment led the global Ethylene Glycols market in 2024. This is because the consumer goods market has witnessed a substantial surge due to changes in consumer lifestyles. Which in turn results in increasing demand for PET packaging options. Ethylene glycol is also a main element in the manufacturing of PET resins that are utilized in packaging applications like containers, bottles, and films.

The automotive segment is estimated to grow at a significant rate in the Ethylene Glycols market over the studied period. The growth of the segment can be driven by the increasing use of ethylene glycol as an antifreeze in automobile cooling systems which is necessary for maintaining engine functions and overall longevity. Additionally, ethylene glycol is utilized in the aerospace industry for crafting lucrative solutions for aircraft.

Ethylene Glycols Market Companies

- Reliance Industries Ltd. (India)

- Huntsman Corporation (US)

- SABIC (Saudi Arabia)

- BASF SE (Germany)

- Kuwait Petroleum Corporation (Kuwait)

- AkzoNobel (Netherlands)

- Clariant (Switzerland)

- Formosa Plastics Group (Taiwan)

- Exxon Mobil Corp. (US)

- Ineos Oxide (UK)

- Ultrapar Participacoes Sa (Brazil)

- LyondellBasell Industries (Netherlands)

- Honam Petrochemical Corporation (South Korea)

Recent Developments

- In March 2024, Dow Inc. announced its investment plan to grow ethylene derivatives capacity in the U.S., such as carbonate solvents, an essential raw material for lithium-ion batteries.

- In January 2024, SABIC made the last investment decision for the SABIC Fujian Petrochemical Complex in China, which is a mixed-feed steam cracker anticipated to produce up to 1.8 million tons of ethylene yearly.

Segments Covered in the Report

By Derivative Type

- Monoethylene Glycol (Meg)

- Diethylene Glycol (Deg)

- Triethylene Glycol (Teg)

By Application

- Polyester Fibers

- Pet

- Antifreeze and Coolants

- Films

- Others

By End use

- Textile

- Automotive

- Packaging

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting