What is the Polyester Fiber Market Size?

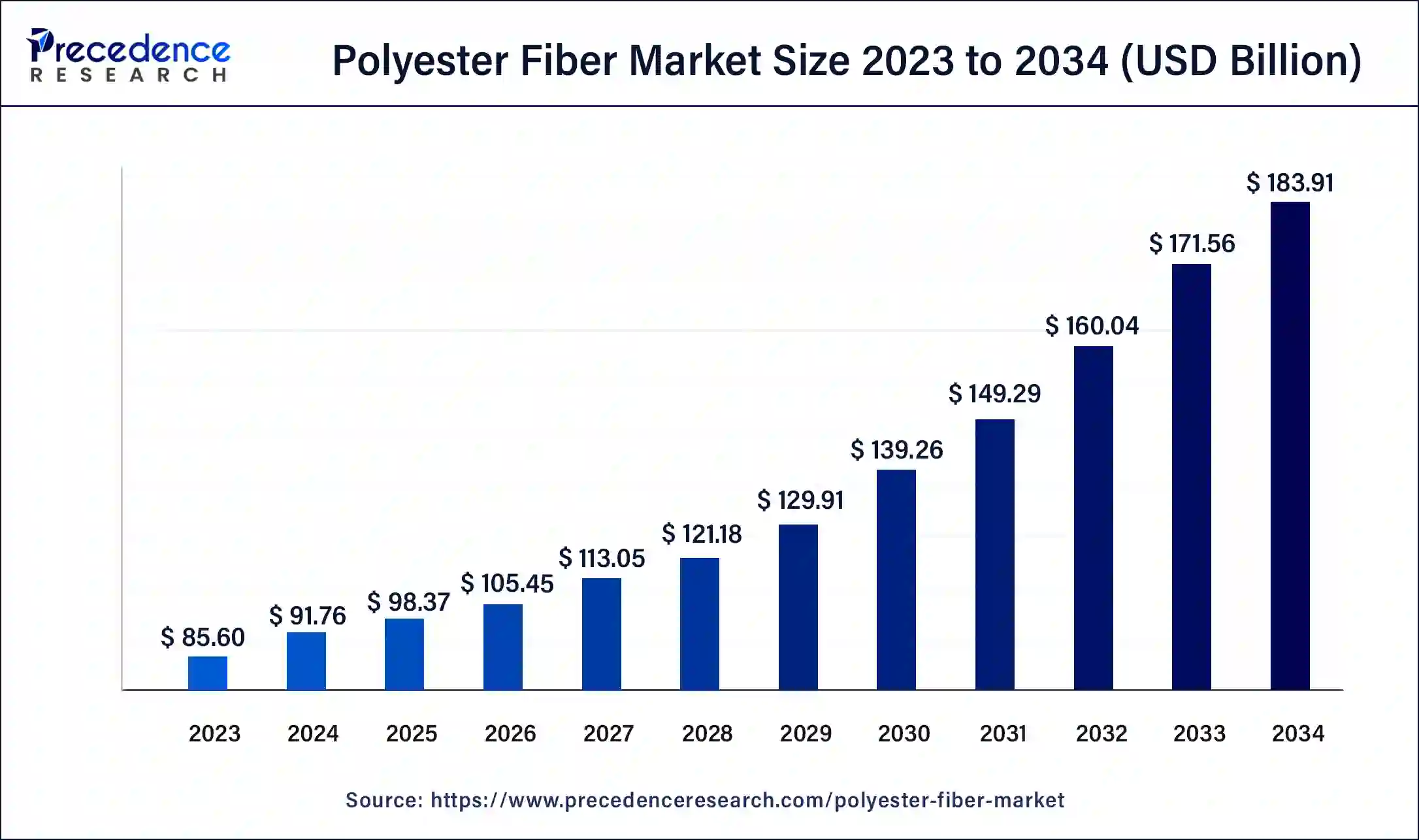

The global polyester fiber market size is accounted at USD 98.37 billion in 2025 and predicted to increase from USD 105.45 billion in 2026 to approximately USD 195.7 billion by 2035, expanding at a CAGR of 7.12% over the forecast period 2026 to 2035

Market Highlights

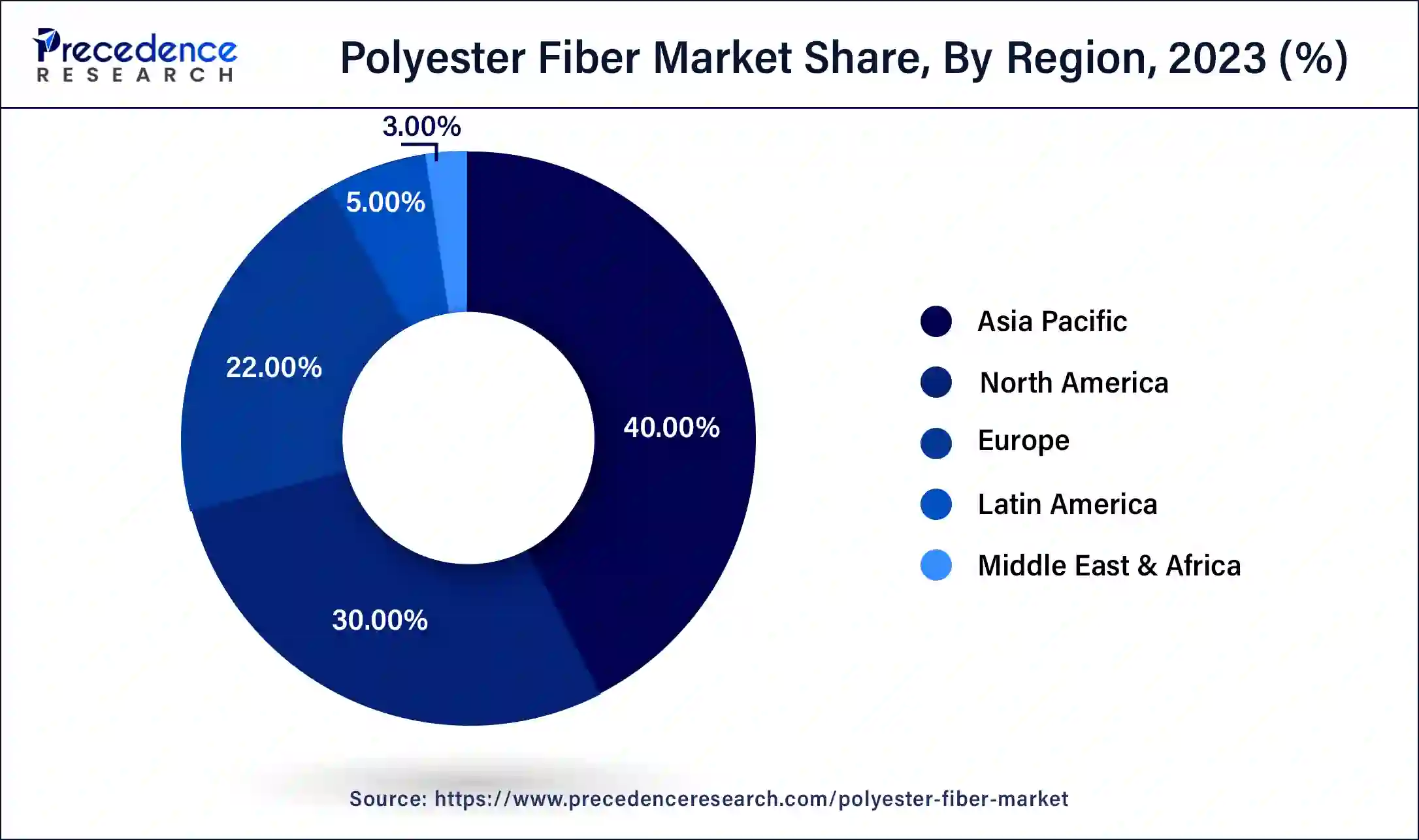

- Asia Pacific contributed more than 40% of revenue share in 2025.

- North America is estimated to expand the fastest CAGR between 2026 to 2035

- By form, the solid segment has held the largest market share of 56% in 2025.

- By form, the hollow segment is anticipated to grow at a remarkable CAGR of 7.8% between 2026 to 2035

- By grade, the polyethylene terephthalate (pet) polyester segment generated over 72% of revenue share in 2025.

- By grade, the PCDT polyester segment is expected to expand at the fastest CAGR over the projected period.

- By product type, the polyester filament yarn (pfy) segment generated over 70% of revenue share in 2025.

- By product type, the polyester staple fiber (psf) segment is expected to expand at the fastest CAGR over the projected period.

- By application, the textile segment generated over 28% of revenue share in 2025.

- By application, the automotive segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

Polyester fiber is a synthetic textile material renowned for its versatility and widespread use in the fashion and textile industry. Crafted from extended polymer chains sourced from petrochemicals, it has earned acclaim for its cost-efficient appeal, rendering it a favored selection in the realms of fashion, home decor, and industrial applications. Polyester's resistance to shrinking, stretching, and fading ensures the longevity of products made with this material.

It can be easily blended with other fibers to enhance specific qualities, such as strength or moisture-wicking abilities. Moreover, polyester's recyclability aligns with sustainability goals in the textile industry. Its affordability, coupled with its impressive performance, renders polyester fiber an enduring choice for an array of applications, from athletic apparel to upholstery.

Polyester fiber demand is increasing globally for many reasons. Increasing global demand and acceptance of recycled polyester have further led to increased opportunities in polyester fiber products because they have proven to have many applications (i.e., textiles, clothing, automobiles, industrial fabrics). The increase in global polyester fiber demand is mainly due to the availability of inexpensive polyester fiber products, but increasing demand for wrinkle-resistant fabrics and easy-care fabrics has also helped drive this market growth for most major manufacturers like Toray Industries, Reliance Industries, and Indorama Ventures.

How is AI Influencing the Polyester Fiber Industry?

Artificial intelligence algorithms monitor machinery, like spinning machines and looms, to forecast equipment failures before they occur, decreasing downtime by up to 25%. Further, AI-powered, near-infrared (NIR) sensors, along with robotics, are used to automatically detect, classify, and even separate PET bottles and textiles by fiber composition, significantly enhancing the efficiency of recycling streams. AI determines massive, real-time datasets from social media and e-commerce to forecast upcoming trends in colors, fabrics, and even prints, reducing the risk of unsold inventory.

Technological Advancement

The technological advancement of the polyester fiber market features microfibers, smart sensors, and specialization. Smart sensors and AI technology are used in the manufacturing process, integrating polyester fiber production. The microfibers' advancement provides unique and fine properties for applications such as technical textiles and apparel. This improves and enhances the production of microfibers.

The specialization is initiated by research institutions and startups to add variety and new techniques in the process to gain recognition in the polyester fiber market, mainly in applications such as technical fabrics and smart sensors. The technologies and innovations also support sustainable manufacturing to minimize environmental impact.

Polyester Fiber Market Growth Factors

- Increasing environmental consciousness is driving the demand for sustainable polyester fibers made from recycled materials.

- Ongoing innovations in polyester production processes, such as bio-based polyester, are fueling market growth.

- A booming fashion industry, particularly in emerging markets, is boosting the demand for polyester fibers in clothing production.

- Polyester's moisture-wicking properties are fueling its use in activewear, contributing to market expansion.

- Polyester's durability and affordability make it a preferred choice in the home furnishings sector, driving market growth.

- Increased demand for lightweight and durable materials in the automotive industry is propelling polyester fiber consumption.

- The use of polyester geotextiles in infrastructure projects is contributing to market growth due to their strength and durability.

- Polyester fibers are being utilized in the medical sector for products like surgical gowns and drapes, aiding market expansion.

- The versatility of polyester in nonwoven applications, like hygiene products and filters, is driving market growth.

- Polyester's resistance to chemicals is making it a preferred choice in industrial applications.

- Polyester's lightweight and moisture-wicking properties make it a top choice for sportswear and outdoor gear, fueling market expansion.

- The use of polyester in packaging materials, such as PET bottles, is driving market growth.

- Expanding global trade of textile products is increasing the demand for polyester fibers in international markets.

- Polyester's comfortable wear and long-lasting properties are driving its adoption in various consumer goods.

- Polyester fibers are being utilized in the medical sector for products like surgical gowns and drapes, aiding market expansion.

- The versatility of polyester in nonwoven applications, like hygiene products and filters, is driving market growth.

Market Outlook

- Industry Growth Overview: Expect to see robust product growth in the polyester fiber segment across apparel, automotive, home furnishing, and industry sectors. Continued growth of the polyester fiber segment will be driven by an increase in global demand for synthetic fibers (either) synthetic fiber products.

- Sustainability Trends: The use of recycled polyester (rPET), bio-based PET, and low-carbon manufacturing processes is expected to increase in popularity and acceptance rapidly in the near future. Many major polyester manufacturers are moving towards the development of circular textile systems and are continuing to implement closed-loop recycling systems.

- Global Expansion: The expansion of manufacturers (as noted above) will be facilitated by the rapid growth in textile exports from these sectors, as well as the anticipated modernization or upgrading of machinery and equipment to support manufacturing modernization and the growth of the market demand for polyester fiber products.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 98.37 Billion |

| Market Size in 2026 | USD 105.45 Billion |

| Market Size by 2035 | USD 195.7 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.12% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Form, Grade, Product Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Activewear & sportswear and geotextiles

Activewear and sportswear are significant drivers of demand in the polyester fiber market. Polyester's unique properties, such as moisture-wicking capabilities and durability, make it a top choice for these sectors. In activewear, polyester fibers provide wearers with comfort during physical activities by efficiently wicking away sweat and moisture. As the global enthusiasm for fitness and sports continues to grow, the demand for activewear and sportswear, often featuring polyester components, is experiencing a notable surge. This trend is prompting manufacturers to diversify their offerings of polyester-based athletic attire, thereby further stimulating market expansion.

On the other hand, geotextiles hold a critical role in construction and infrastructure projects. Polyester's durability and strength render it a prime material for geotextiles, which are indispensable in tasks related to soil stabilization, erosion control, and drainage. With increasing urbanization and ongoing infrastructure development on a global scale, the need for geotextiles is on the upswing. Polyester-based geotextiles offer a cost-effective and enduring solution for civil engineering endeavors, thus propelling market growth as construction activities continue to proliferate across regions.

Restraint

Competition from natural fibers and flammability

Competition from natural fibers and flammability concerns present notable restraints on the growth of the polyester fiber market. Natural fibers, including cotton, wool, and hemp, have gained traction due to their eco-friendly and biodegradable characteristics. This surge in demand for sustainable and natural textile alternatives poses a challenge to the dominance of polyester fibers in the market. Consumers, driven by environmental consciousness, are increasingly opting for clothing and products made from these natural fibers, causing a shift in market preferences.

Moreover, the flammability of polyester is a prominent obstacle. Polyester is exceptionally susceptible to catching fire, which raises safety issues, particularly in products like children's sleepwear and upholstery. To comply with rigorous safety regulations, flame retardant chemicals must be incorporated, but this can alter the fundamental characteristics of polyester and impact its cost-efficiency.

This necessitates a careful balance between safety and performance considerations to ensure that polyester remains a viable choice in applications where fire safety is paramount. These measures aim to mitigate the fire risk but can impact the material's performance, limiting its market share in applications that prioritize safety and fire resistance. Thus, addressing flammability concerns is essential for sustaining the growth of the polyester fiber market.

Opportunity

Smart textiles

Smart textiles are creating opportunities in the polyester fiber market. Smart textiles, incorporating advanced materials and technologies, offer unique functionalities such as conductive, sensing, and interactive properties. Polyester's compatibility with these technologies makes it an ideal choice for producing smart textiles. These textiles find applications in diverse sectors, including wearable technology, healthcare, sports, and military, offering growth prospects for the polyester fiber market. As the demand for smart textiles continues to rise, polyester can play a pivotal role in meeting these technological advancements.

Segment Insights

Form Insights

In 2025, the solid segment had the highest market share of 56% on the basis of the form. In the polyester fiber market, the solid segment pertains to polyester fibers in their traditional, non-hollow form. Solid polyester fibers are solid throughout their cross-section, offering robustness and durability. Recent trends in this segment reflect the demand for sustainable and recycled solid polyester fibers, aligning with eco-conscious consumers' preferences. The use of solid polyester fibers in fashion, home textiles, and nonwoven applications is on the rise due to their strength and colorfastness, contributing to the continued growth of this segment in the global textile industry.

The hollow segment is anticipated to expand at a significant CAGR of 7.8% during the projected period. The hollow segment in the polyester fiber market refers to fibers with a unique hollow or partially hollow cross-sectional structure. This design creates air pockets within the fiber, resulting in enhanced insulation properties and reduced weight compared to solid polyester fibers. Trends in the hollow segment of the polyester fiber market include a growing preference for these fibers in the production of lightweight and thermally efficient textiles. They are commonly used in outdoor clothing, bedding, and technical textiles. With a rising demand for comfort and performance in various applications, hollow polyester fibers continue to gain popularity for their insulating capabilities and reduced environmental impact due to decreased material usage.

Grade Insights

According to the grade, the polyethylene terephthalate (pet) polyester segment has held 72% revenue share in 2025. The PET (Polyethylene Terephthalate) polyester segment within the polyester fiber market represents a high-grade category of polyester fibers, celebrated for their exceptional strength, resilience, and resistance to environmental factors. Recent market trends highlight the notable expansion of the PET polyester segment, primarily fueled by the rising demand for sustainable and environmentally friendly textile solutions.

The market has witnessed a surge in the use of recycled PET polyester, aligning with the global emphasis on sustainability. Additionally, the PET polyester segment benefits from its versatility, finding applications in activewear, sportswear, home textiles, and nonwoven products, driven by consumers' preference for durable and high-performance materials in these domains.

The PCDT polyester segment is anticipated to expand fastest over the projected period. In the polyester fiber market, the PCDT polyester segment pertains to fibers crafted from poly-1, 4-cyclohexylene-dimethylene terephthalate, a premium polyester material. These PCDT polyester fibers are celebrated for their robustness, longevity, and resilience against environmental factors, rendering them ideal for diverse applications.

In recent trends, PCDT polyester has gained attention due to its compatibility with eco-friendly production processes, meeting the growing demand for sustainable textiles. Additionally, its versatility and superior properties have positioned it favorably in sectors like technical textiles, automotive components, and geotextiles, contributing to its growth and prominence in the market.

Product Type Insights

In 2025, the polyester filament yarn (PFY) segment had the highest market share of 70% on the basis of the product type. Polyester filament yarn (PFY) is a key product segment within the polyester fiber market. PFY consists of long, continuous strands of polyester fibers, known for their high strength, durability, and smooth texture. Trends in the PFY segment include a growing demand for the fine denier PFY, suitable for lightweight and high-performance textiles.

Additionally, the rise of sustainable and recycled PFY is gaining momentum in response to environmental concerns. PFY is increasingly used in various applications, including apparel, home textiles, and industrial fabrics, reflecting its versatility and the evolving demands of consumers seeking both performance and sustainability in their textile products.

The polyester staple fiber (PSF) segment is anticipated to expand fastest over the projected period. Polyester staple fiber (PSF) is a crucial segment in the polyester fiber market, known for its short and discrete fibers. It's a versatile material used in various applications, including textiles, nonwovens, and filling materials. One notable trend in the PSF segment is the growing demand for recycled PSF, driven by sustainability concerns. Manufacturers are increasingly focusing on eco-friendly PSF production to reduce the environmental impact. Additionally, the PSF segment is witnessing innovations in flame-resistant and moisture wicking PSF variants, catering to diverse industries, from fashion to automotive, and enhancing its appeal in the market.

Application Insights

In 2025, the textile segment had the highest market share of 28% on the basis of the application. In the polyester fiber market, the textile segment primarily encompasses the production of a wide range of textile products, including clothing, home furnishings, and industrial textiles. It is the largest application sector for polyester fibers. Trends in this segment reflect the demand for sustainable and high-performance textiles. Eco-friendly polyester, made from recycled materials or bio-based sources, is gaining popularity.

Additionally, the textile industry is witnessing a surge in smart textiles that incorporate technology into fabrics, offering features like moisture-wicking and antimicrobial properties. These innovations cater to evolving consumer preferences for comfort, sustainability, and functionality in textile products.

The automotive segment is anticipated to expand fastest over the projected period. Within the polyester fiber market, the automotive segment pertains to the utilization of polyester fibers in various aspects of the automotive industry, including the creation of car interiors, upholstery, and certain exterior components. A notable trend in this domain involves the growing need for lightweight and long-lasting materials in the automotive sector. Polyester fibers align with these demands, contributing to reduced vehicle weight, better fuel efficiency, and improved overall performance. As the automotive industry continues to prioritize these characteristics, the polyester fiber market stands to benefit from the persisting trend toward lighter and more durable materials in car production.

Regional Insights

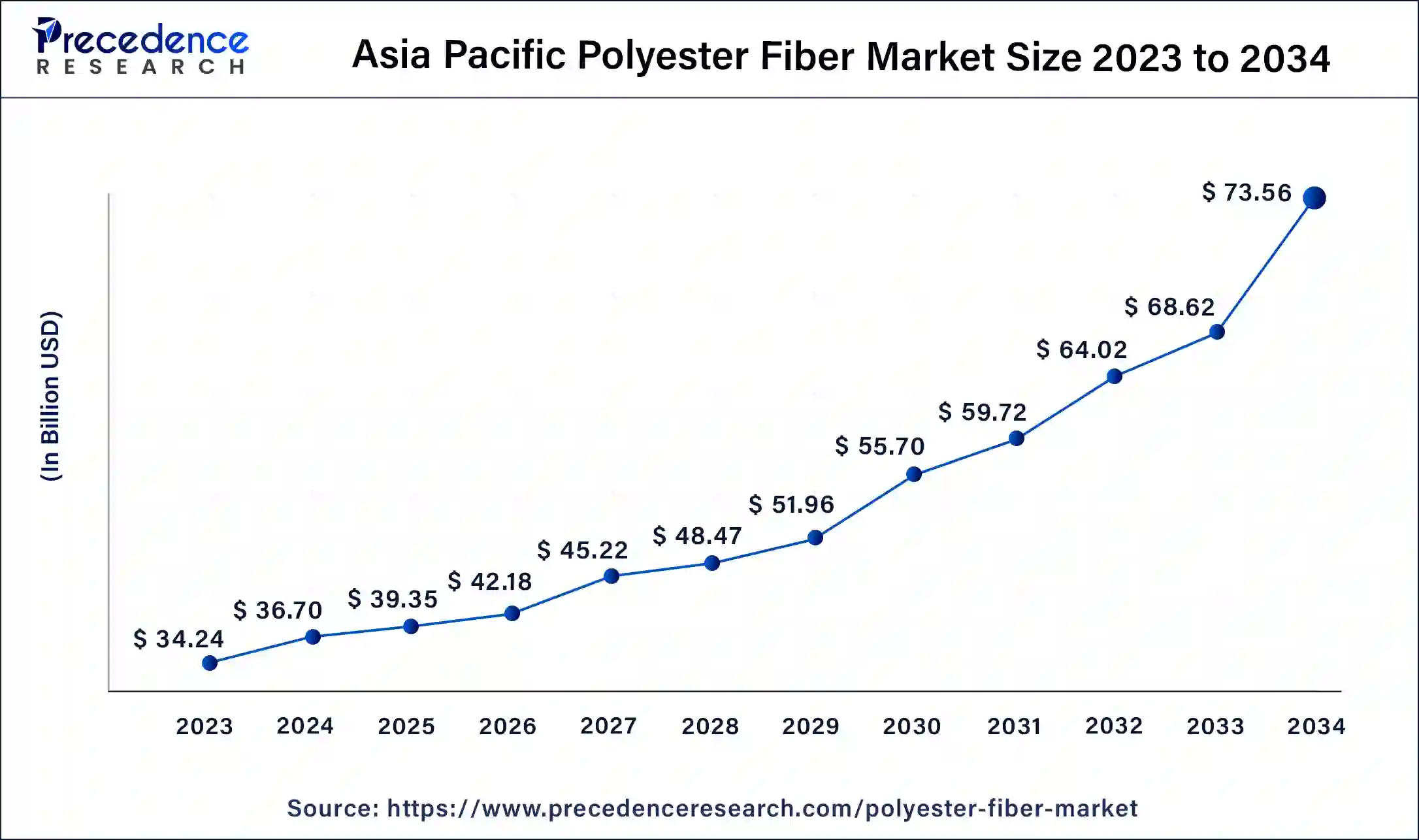

Asia Pacific Polyester Fiber Market Size and Growth 2026 to 2035

The Asia Pacific polyester fiber market size is exhibited at USD 39.35 billion in 2025 and is projected to be worth around USD 78.27 billion by 2035, poised to grow at a CAGR of 7.12% from 2026 to 2035

Asia-Pacific has held the largest revenue share of 40% in 2025. Asia-Pacific commands a significant share in the polyester fiber market due to several factors. The region's robust textile industry, rapid urbanization, and a burgeoning middle-class population have fueled the demand for affordable and versatile polyester textiles.

Moreover, Asia-Pacific's manufacturing capabilities and cost-effective production processes make it a hub for polyester fiber production. With a focus on sustainability and the increasing popularity of sportswear and activewear, the region continues to be a key driver of market growth. The presence of established textile manufacturers and a growing focus on innovation further solidify Asia-Pacific's dominance in the polyester fiber market.

Currently, Asia Pacific is dominating the polyester fiber market. Within the region, China holds the largest market share. The rapid growth in industrialization and synthetic textiles contributes to the development of the market in the region. The demand for the polyester fiber in the automotive and home furnishing industries is leveraging the market's growth factor eventually. The government's initiative and strategy to popularize synthetic textiles is increasing the demand for new businesses approaching this market.

North America is estimated to observe the fastest expansion. North America commands significant growth in the polyester fiber market due to a confluence of factors. The region boasts a robust textile and automotive industry, where polyester fibers are extensively used for their durability and cost-efficiency. Additionally, the growing emphasis on sustainability and the adoption of recycled polyester fibers align with the eco-conscious consumer base.

North America's well-established recycling infrastructure and increasing demand for sustainable textiles contribute to its prominent position in the market. With diverse applications in clothing, home furnishings, and industrial sectors, North America continues to play a pivotal role in shaping the polyester fiber market landscape.

North America: U.S. Polyester Fiber Market Trends

The U.S. market continues to grow steadily, driven by strong demand across apparel, home furnishings, automotive interiors, and industrial textiles. Rising interest in sustainability has boosted the adoption of recycled polyester (rPET), especially in clothing and upholstery, as consumers and brands shift toward eco-friendly and circular-economy materials. Demand in home textiles, carpets, curtains, bedding, and upholstery remains robust thanks to renovation trends and growth in housing and refurbishment activity.

Is Polyester Fiber Use Increasing in the Latin Americas?

Applications of polyester fiber are steadily growing throughout the Latin American countries because of an increase in demand for polyester fiber due to the apparel manufacturing business, sporting apparel, and home decor. In addition to this growth in polyester fiber throughput in Latin America, some countries like Brazil, Mexico, and Argentina continue to make substantial investments into the modernization of their textile enterprises, creating a strong need for high-performance synthetic fiber products throughout Latin America.

In addition to investment into textile modernization, the expansion of the retail industry, increasing urbanization, and inexpensive polyester products continue to provide for additional growth in sales to Latin America.

Is Europe Shaping the Future of Polyester Fiber Innovations?

Europe has established itself as a leader in polyester fiber innovation through stringent compliance with sustainability regulations and has achieved very high rates of use and acceptance of recycled PET based fibers. Continued strong demand for polyester fibers continues to exist in the established high fashion business, the automotive textiles sector, and the development of many technical applications.

The successful development of advanced manufacturing technologies continues to support the strong growth of the polyester fiber market in Europe. Countries like Germany, Italy, and France are continuing to drive innovation in this space, with continued investment in technologies that support circular economy initiatives.

Italy Market Trends

This is due to the increasing need for versatile and even cost-effective fibers in the textile and apparel industry, which is driving the acceptance of polyester fiber. Polyester fibers provide excellent strength, durability, along with resistance to wrinkles and shrinking, making them ideal for numerous textile applications. Additionally, the expansion of the fashion and home textile sectors, driven by growing user spending and changing lifestyle trends, is driving the need for polyester fiber utilized in clothing, upholstery, and home furnishings.

Impact of Innovation on Polyester Fiber Demand in MEA

MEA's market shows fast growth during the forecast period. It is driven by increasing need across multiple end-use sectors, including automotive, textiles, construction, and packaging. The region's growing population, increasing disposable incomes, and even expanding industrial base underpin a robust need trajectory.

Saudi Arabia Polyester Fiber Market Trends

In Saudi Arabia, with rising environmental concerns, many producers are adopting fibers to reduce plastic waste and carbon footprints. Polyester-based composites are gaining traction in the automotive and aerospace industries due to their lightweight and durability. Industries like sportswear, medical textiles, and protective clothing are demanding high-performance polyester fibers with improved functionality.

How does the Polyester Fiber Value Chain Look in 2025?

The value chain for polyester fibers includes raw materials procurement, polymerizing the fibers, producing the fibers, distributing the fibers, and manufacturing the finished product utilizing the fibers. The major polyester fiber manufacturers (Indorama Ventures, Reliance Industries, and Toray Industries) play an integral role in integrating their supply chains to maximize manufacturing efficiencies, drive technology innovation, and continue to expand the value chain offerings of polyester fibers to the market.

- Raw Materials and Polymerization: Through their global supply channels, major polyester fiber manufacturers provide global customers with consistent access to PTA and MEG to support polyester fiber manufacturing processes. The manufacturing facility integration of major polyester fiber manufacturers minimizes their costs and stabilizes the availability of PTA and MEG.

- Fiber Manufacturing and Quality Improvements: Several companies are implementing advanced spinning technologies in the technical manufacturing sector to enhance fiber performance characteristics such as strength, luster, and dye/absorption of the fibers.

- Transportation, Branding, and End-User Application: The expansion of distribution networks within the textile, fashion, and industrial segments has provided these stakeholders with significantly improved access to high-performance polyester fiber products with competitive pricing and expedited delivery.

Top Companies in the Polyester Fiber Market and Their Offerings

- Toray Industries: Toray Industries provides a comprehensive, vertically integrated range of products along with technologies for the polyester fiber industry, thus spanning from raw materials to processed textiles for apparel as well as industrial applications.

- Huvis Corporation: Huvis Corporation's portfolio involves high-value-added staple fibers, super fibers (Aramid, PPS), filament yarns, and eco-friendly options such as biodegradable polyester utilized in automotive, hygiene, and even clothing applications.

- Tongkun Group: Tongkun Group is a major Chinese producer offering a comprehensive, integrated range of polyester fiber products, thus, specializing in over 1,000 kinds of civil filament yarns.

- Zhejiang Hengyi Group: Zhejiang Hengyi Group functions a highly integrated supply chain, producing raw materials such as PTA and supplying specialized, differentiated polyester yarns for various applications in apparel and industrial textiles.

Other Polyester Fiber Market Companies

- Reliance Industries

- Indorama Ventures

- China Petroleum & Chemical Corporation (Sinopec)

- Nan Ya Plastics Corporation

- Teijin Limited

- Bombay Dyeing

- SRF Limited

- Märkische Faser

- Alpek S.A.B. de C.V.

- Far Eastern New Century Corporation

- Asahi Kasei Corporation

Recent Developments

- In May 2025, Egypt-oriental weavers launched a new polyester yarn dyeing unit at oriental weavers international, in the 10th Ramadan area, with EGP 50 million in total investments. (Source - https://www.zawya.com)

- In May 2025, HUGO BOSS introduced Novapoly innovative recycled polyester yarn co-developed with the company's suppliers, Jiaren Chemical Recycling and NBC LLC. The eco-friendly environmental concept is contributing the most to the polyester fiber market. (Source - https://group.hugoboss.com)

- In January 2025, CARBIOS figured out polyester fiber-to-fiber recycling. The green biotech company CARBIOS will take the synthetic fiber and put it back in another garment. The study to achieve sustainability in the market has raised the expectation of new ideas and innovation in the market. (Source - https://www.waste360.com)

- In March 2023, Reliance Industries successfully finalized its acquisition of Sintex Industries. This significant milestone came one year after receiving approval from banks and just a month after the National Company Law Tribunal (NCLT) greenlit the transaction.

- In January 2023, Stein Fibers Ltd. made a strategic move by acquiring the Fibertex Corporation. This acquisition was aimed at enhancing its product portfolio, allowing the company to provide better services to its customers. These corporate developments showcase the dynamic nature of the business world, with companies continuously seeking opportunities for growth and expansion through strategic acquisitions.

Segments Covered in the Report

By Form

- Solid

- Hollow

By Grade

- Polyethylene terephthalate (PET) Polyester

- PCDT Polyester

By Product Type

- Polyester Filament Yarn (PFY)

- Polyester Staple Fiber (PSF)

By Application

- Automotive

- Home Furnishing

- Textile

- Filtration

- Construction

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting