Low Melting Fiber Market Size and Forecast 2026 to 2035

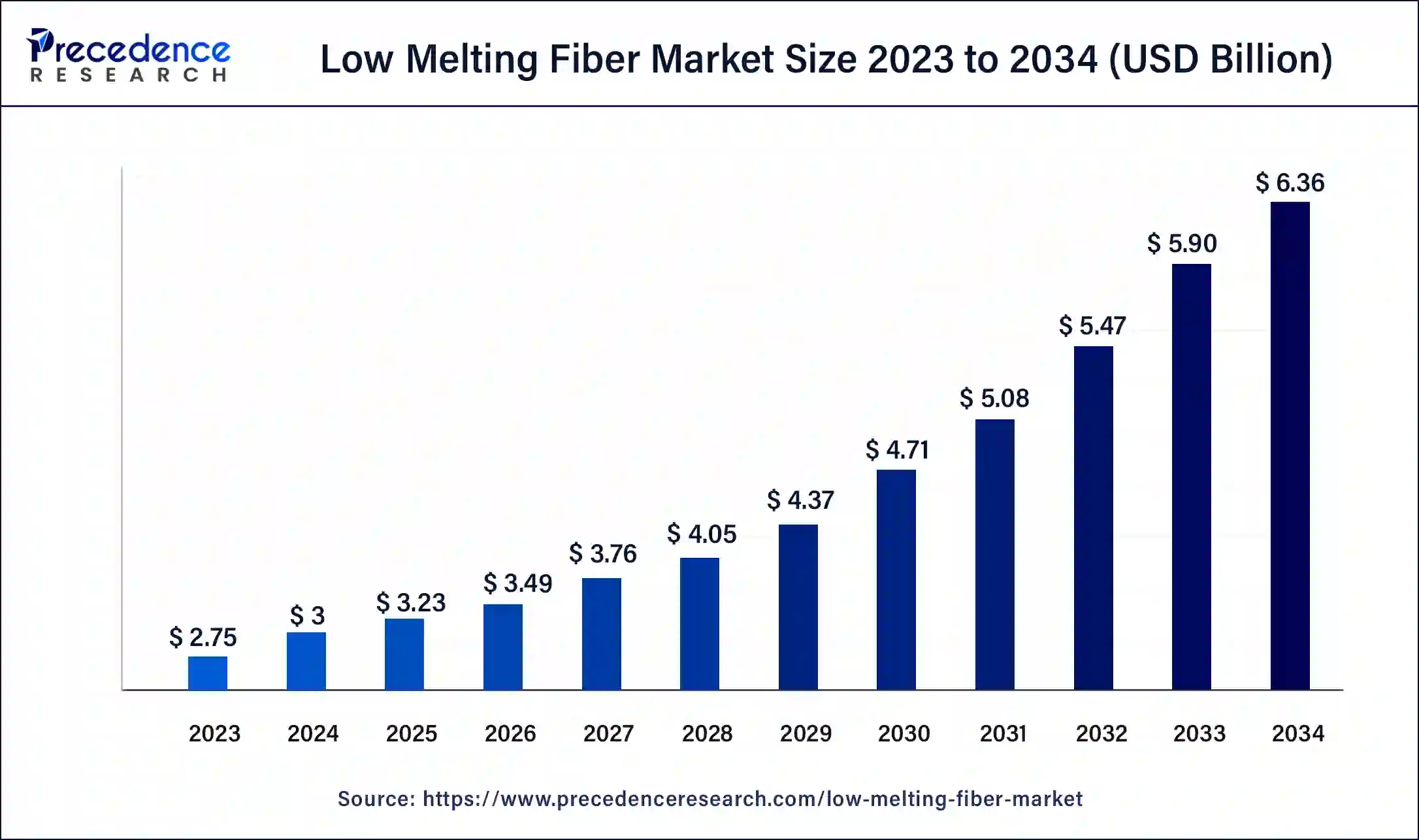

The global low melting fiber market size is accounted at USD 3.23 billion in 2025 and predicted to increase from USD 3.49 billion in 2026 to approximately USD 6.80 billion by 2035, representing a CAGR of 7.73% from 2026 to 2035.

Low Melting Fiber Market Key Takeaways

- Asia Pacific led the global market with the highest market share in 2025.

- By application, the mattress segment has held the largest market share in 2025.

What is the Low Melting Fiber Market?

Low-melting fiber is produced by spinning ordinary polyester and modified polyester. This low-melting fiber can be melted at temperatures ranging between 900 C to 2200 C. This type of fiber is suitable for applications requiring hot-melt adhesion and thermal bonding. Low melting fiber provides outstanding bonding properties. Thus, it can be used with other fibers. The increasing need for nonwoven textiles and increasing adoption in the apparel sector contribute to the market growth. Additionally, growing awareness and preference for sustainable materials and the rising demand for lightweight materials are further anticipated to boost the growth of the market during the forecast period.

How is AI contributing to the Low-Melting Fiber Market?

The application of artificial intelligence in long-term care facilities, such as through predictive analytics, remote monitoring, and automated support systems, results in a significant increase in operational efficiency. AI once more amplifies patient safety through the use of fall prediction, mood tracking, medication reminders, and crisis forecasting. By the same token, the application of AI-powered virtual assistants in the caregiving process also comes with a number of advantages, including decreased caregiver burden, enhanced staffing, streamlined documentation, and automated scheduling.

Low Melting Fiber Market Growth Factors

- The upsurge in population along with growing rate of urbanization has positive inference on the home furnishings sector in the U.S.

- Rising demand automotive industry and for bedding accelerates the demand for low-melting fiber

- Strategic partnerships by the key players operating in the global market in order to strengthen the market position.

Low Melting Fiber Market Outlook

Increased usage in textiles, automotive, and construction prop up the demand for low-melting-point fibers and the development of novel materials.

The green production of low-melting fibers that are eco-friendly is influenced by the usage of recycled materials, less energy consumption in processing, and the use of greener chemical bonds.

The global demand for low-melting fibers is rising, with Asia-Pacific being the major center, and the world's different sectors adopting the fibers more and more.

Huvis, Toray Industries, Teijin, and Nan Ya Plastics are the four that not only by investment and product development made innovation worldwide but also increased the competitiveness of materials on a global scale.

New companies are coming up with concepts that lead to the introduction of sustainable fiber chemistry, which in turn facilitates the development of green production methods and hence, speeds up the technology evolution in the market.

Market Scope

| Report Highlights | Details |

| Market Size in 2026 | USD 3.49 billion |

| Market Size in 2025 | USD 3.23 billion |

| Market Size by 2035 | USD 6.80 billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.73% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Dynamics

Driver

Increasing demand for mattresses

Low-melting fiber is used to produce comfortable mattresses, as it has more effective properties than its alternatives, such as cotton, wood, and others. Additionally, there is a significant increase in mattress demand in various sectors, such as education, corporate, commercial, hospital, and others, thus driving the demand for low-melting fiber. Moreover, low-melting fiber is used in nonwoven fabrics and automotive textiles. Thus, the rising demand from the automotive and textile industries further drives the market.

- For instance, Fibbo mattress is India's first hygienic low melting fiber mattress. Fibbo mattress pillows, bed, and travel accessories are sold online in Odhi.IN with matching wood and steel costs.

Restraint

Disposal and recycling issues

While low-melting fibers are beneficial in terms of biodegradability and recycling, their appropriate disposable and recycling require specific procedures and facilities, which may create challenges. Additionally, fluctuations in raw materials costs, such as polypropylene and polyester, may impact manufacturing costs, thus hindering the growth of the market.

Opportunity

Rising demand for recycled low-melting fibers

The demand for recycled low-melting fibers is increasing due to the growing awareness about environmental sustainability. Moreover, the rapid shift of consumers toward more sustainable clothing is a major contributor to the increasing demand for recycled low-melting fibers. Thus, key players are focusing on manufacturing recycled fibers to innovate and compete in the market. For instance,

- In January 2024, British design studio Layer collaborated with Chinese start-up Mazzu to design sustainable mattresses.

Low Melting Fiber Market Segment Insights

Application Insights

The mattress segment accounted for the largest market share in 2023. The increasing demand for mattresses in several sectors, such as commercial buildings, residential buildings, hostels, restaurants, and hospitals contributed to the segmental growth. Additionally, mattress made with low-melting fiber provides greater comfort and resistance to bed bug plagues.

Regional Insights

Asia pacific dominated the market with the largest share in 2023. The market dominance is mainly attributed to the increasing demand for low-melting fibers in various industries, such as the automotive, construction, and bedding. The rising industrialization in emerging countries, such as India, China, and Japan, along with the rapid expansion of the construction, textile, and automotive industries contributed to the regional market growth.

The market in Asia Pacific is anticipated to expand at the fastest growth rate during the projection period. This growth is primarily attributed to the rising demand for lightweight materials. Furthermore, the rising demand for low-melting fibers in the textile and construction industries propels the market.

Low Melting Fiber Market Regional Insights

The Asia-Pacific is at the forefront, along with the low-melting fibers market, which is driven by the strong industrial demand and the robust textile and automotive sectors. The upward trend is mainly due to the competitive production advantages and growing demand for nonwoven fabrics in hygiene and bedding applications.

China has a significant role in the regional market characterized by its extensive manufacturing capacity and well-thought-out industrial policies. Habits in automotive interiors and nonwoven materials create the growth of the market, with producers concentrating on fibers that are low-cost fibers and their export activities getting bigger.

North America is a region that is steadily developing, with the most significant demand coming from the bedding, construction, and automotive industries. Consumers' preference for sustainability stimulates the use of low-melting fibers as a substitute for chemical adhesives, and there is a growing interest in eco-friendly manufacturing practices.

Demand in the U.S. is considerably high as it is mainly driven by the bedding, insulation, and lightweight automotive components market. The development of the advanced mattress materials market is supported by the research into bio-based and high-performance fiber alternatives, which has been the case for the sustainable building materials market.

Europe keeps a steady demand that is supported by strict environmental regulations that promote the use of sustainable and adhesive-free materials. Filtration, medical textiles, and automotive applications are the areas where growth is the most noticeable, and the innovations are the strongest in terms of eco-friendly solutions.

Germany's market is powered by the industrial and automotive sectors, which are concentrating on high-end textile technology. The focus on innovation and compliance has led to the development of high-performance, eco-friendly fibers and partnerships in closed-loop recycling.

Low Melting FiberMarket Value Chain Analysis

Sourcing the basic ingredients consisting of polymers and monomers needed for the fiber-making process.

Key Players: Reliance Industries, SABIC, Dow Inc., and Tongkun Group

Changing the chemical structure of the feed into polymers suitable for the production of fibers.

Key Players: Zhejiang Hengyi Group, Shenghong, and Indorama Ventures

Resin polymers mixed with additives to deliver the required properties of performance.

Key Players: Clariant AG, Lubrizol Corporation

Fiber's inspection and regulations before giving a nod to formal approval.

Key players: SGS, Intertek, TÜV SÜD, and Bureau Veritas

Safe fibers and accurate product labels come with the proper packing.

Key Players: Berry Global Group, Inc., ALPLA

Low Melting Fiber Market Companies

- Huvis

- Taekwang

- Toray Chemical Korea

- Hickory Springs

- Ningbo Dafa

- Yangzhou Tianfulong

- Nan Ya Plastics

- XiangLu Chemical Fibers

Recent Developments

- In August 2024, a leading innovator in recycled and synthetic yarn, UNIFI, Inc. announced the launch of two new products made from textile waste, making its circular REPREVE providing the largest portfolio of regenerated performance polyester.

- In September 2025, AGY and A+ Composites will present ultra-lightweight thermoplastic UD tapes at CAMX 2025, featuring AGY's lightweight S2 Glass roving combined with LM-PAEK and PEI resins, competing for a CAMX Innovation Award.

Low Melting Fiber Market Segment Covered in Report

By Type

- Melting Point ≤130

- Melting Point >130

By Application

- Mattress

- Car molding

- Padding

- Bedding

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- United Kingdom

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting