Abaca Fiber Market Size and Forecast 2025 to 2034

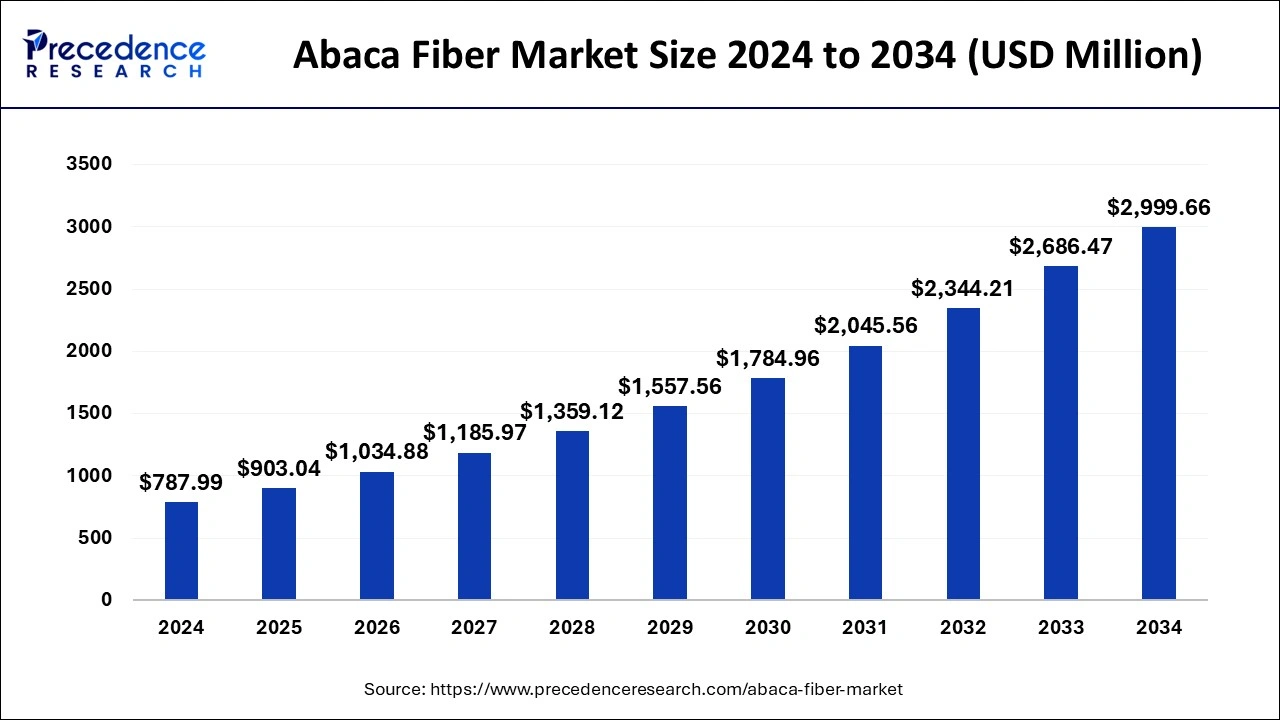

The global abaca fiber market size was accounted for USD 787.99 million in 2024 and is anticipated to reach around USD 2,999.66 million by 2034, growing at a CAGR of 14.30% from 2025 to 2034. Sustainability is driving the growth of the abaca fiber market.

Abaca Fiber Market Key Takeaways

- The global abaca fiber market was valued at USD 787.99 million in 2024.

- It is projected to reach USD 2,999.66 million by 2034.

- The abaca fiber market is expected to grow at a CAGR of 14.30% from 2025 to 2034.

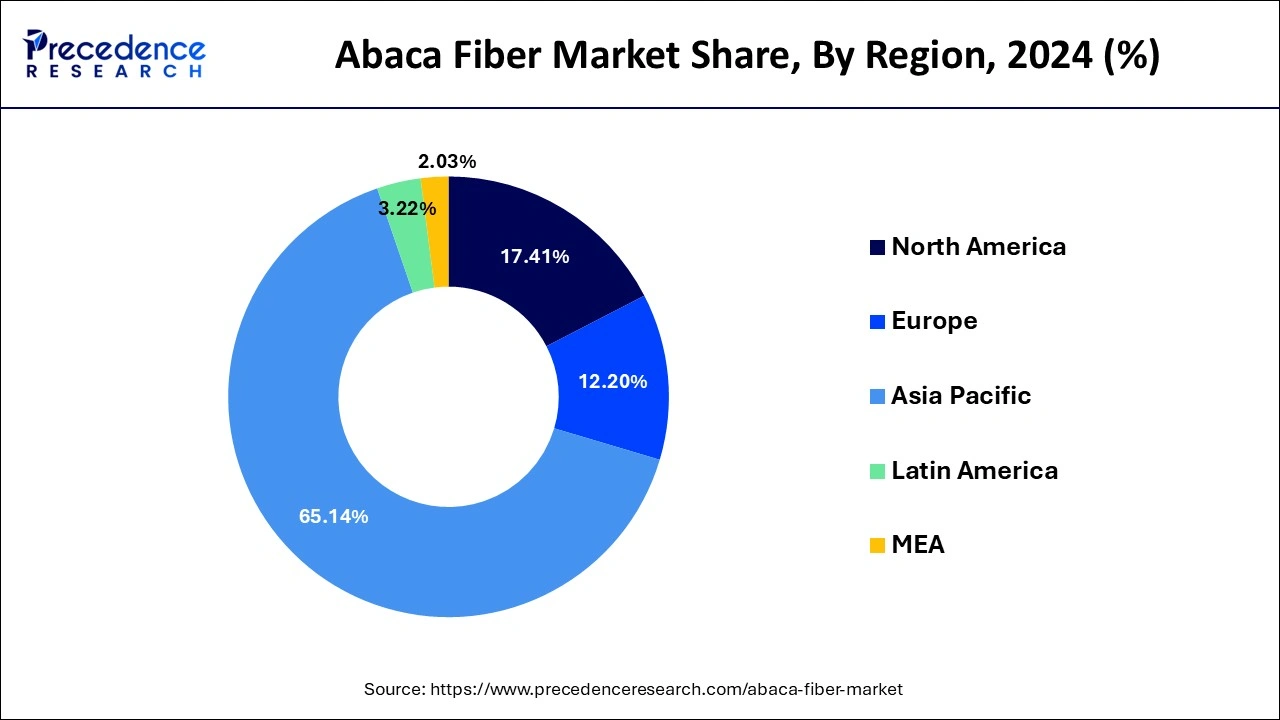

- Asia Pacific dominated the global market with the largest market share of 40% in 2024.

- Europe is projected to expand at the notable CAGR during the forecast period.

- By product, the paper and pulp segment contributed the highest market share in 2024.

- By product, the textile segments is estimated to be the fastest-growing segment during the forecast period.

Integration of AI in the Abaca Fibers

The market for abaca fiber is undergoing a change thanks to automation and artificial intelligence (AI), which are increasing manufacturing efficiency and quality control. Cutting manufacturing costs and waste, advanced AI algorithms optimize the processing of abaca fibers. Higher accuracy and consistency in pulp quality are made possible by automation in harvesting and processing facilities. Additionally, improved supply chain management is made possible by predictive analytics and data-driven decision-making, which enables businesses to react quickly to shifts in the market. It is anticipated that when the industry implements these technologies, operational efficiency will rise dramatically, which will eventually benefit market expansion and sustainability initiatives.

Asia Pacific Abaca Fiber Market Size and Growth 2025 to 2034

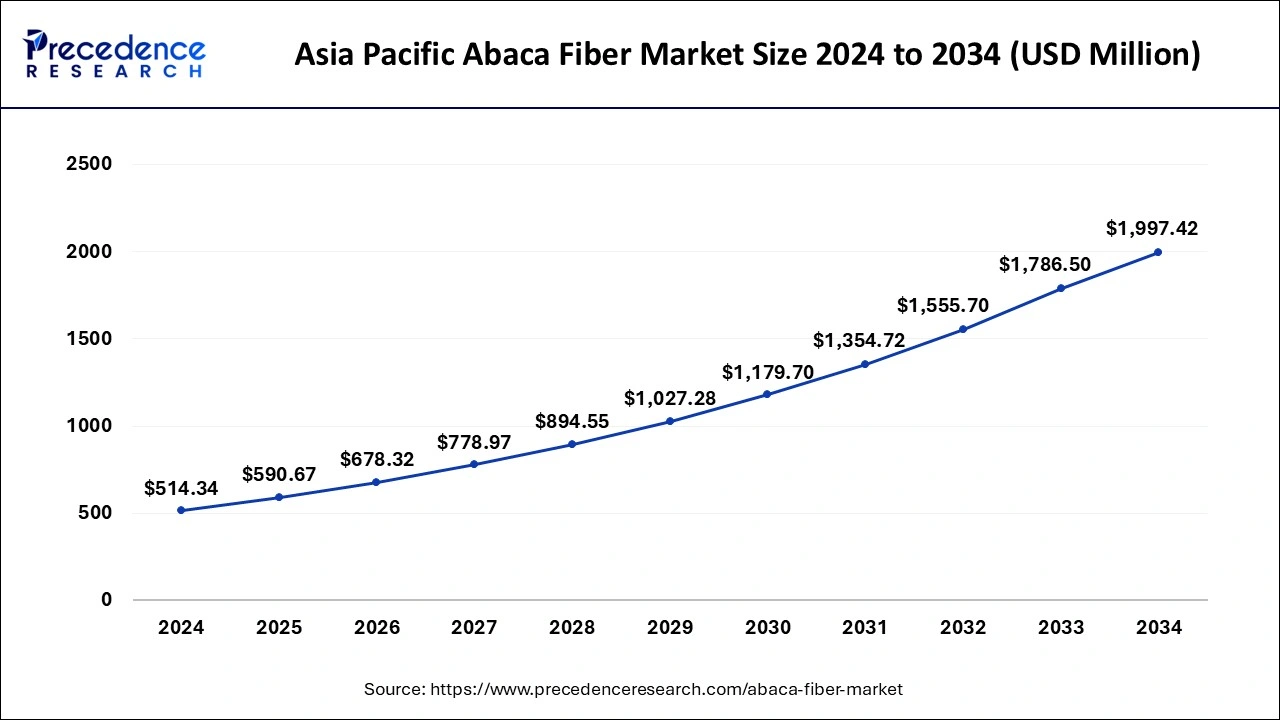

The Asia Pacific abaca fiber market size was exhibited at USD 514.34 million in 2024 and is projected to be worth around USD 1,997.42 million by 2034, growing at a CAGR of x% from 2025 to 2034.

Due to the increasing use of these fibers in a variety of end-use industries, automotive, specialty paper, including healthcare, handicraft, and textile, as well as their strong mechanical properties, long length, durability, and sustainability, Asia Pacific dominated the industry and accounted for the highest revenue share of around 65.14% in 2024.

With the Philippines holding a market share of more than 85% worldwide,the region is the most significant worldwide supplier of abaca fibers. Public spending in Japan and the Philippines to support abaca cultivation practices and boost fiber manufacturing capacity is also anticipated to positively impact market expansion in the future.

Due to the increasing use of fibers in numerous application industries, such as automotive, beverages and food, and specialty papers, due to their high mechanical strength, flexibility, durability, and long length, the market in Europe is anticipated to experience a remarkable revenue-based CAGR of 14.9% from 2024 to 2033.

Additionally, it is anticipated that the expansion of the fiber market will be aided by the European nations' beneficial trade policies for importing abaca and other natural fibers. Major German auto manufacturers are using abaca fibers for automotive parts like headliners, trunk components, rear cargo shelves, and thermal insulation to lighten the weight of the entire vehicle and improve fuel economy.

North America is expected to grow significantly in the abaca fiber market during the forecast period. The demand for the use of abaca fiber in North America is growing due to the increasing use in packaging as well as in the textile industry. Additionally, its use in the development of filter papers and tea bags is also increasing. At the same time, its use in the development of automotive interiors is also growing. Hence, all these developments are enhancing the use of abaca fiber. Thus, this promotes the market growth.

Market Overview

The market is anticipated to be driven by the quickly expanding use of abaca fiber in the expanding pulp and paper industry for products like disposable tea and coffee bags, disposable medical and food papers, and cigarette filter papers.

Because of the product's superior high mechanical strength and long fiber length resistance to salt-water damage, there has been a rise in the need for it in recent years in the manufacture of curtains, paper, clothing, screens, and furnishings. This requirement is anticipated to continue driving market growth. In addition, the market is expected to expand as more people worldwide adopt products.

As natural fibers are increasingly used in the production of cars, the use of abaca fibers, mainly in the automotive industry, is also expanding. In the automotive industry, these fibers are used in various applications, such as filler material for bolster and exterior semi-structure components and interior trip parts to replace glass fiber in reinforced plastic elements.

Because abaca fibers are becoming more widely used in various industries, including medical fabric, automotive, paper, and handicraft industries, demand for them has increased globally in recent years. Low productivity, though, has been present in the market and hasn't been sufficient to meet demand.

Over the projected period, the pulp and paper sector is predicted to dominate all other application segments. Abaca fiber specialty papers are thin and have high tensile strength. Abaca fibers are preferred by businesses in the paper and pulp industry for uses like tea bags, currency, large sausage casings, security papers, and cigarette and filter papers because of these qualities.

Due to the growing demand for natural fibers, the abaca fiber industry is anticipated to grow in importance over the forecast period. Throughout the forecast period, consumers' demand for abaca fiber will be driven by superior quality and strength.

Abaca Fiber Market Growth Factors

- Sustainability and eco-friendliness: Natural, biodegradable, and renewable abaca fiber is a resource that is kind to the environment. The demand for abaca fiber has grown as more people and businesses look for eco-friendly substitutes for synthetic materials.

- High strength and durability: Due to its high strength and durability, abaca fiber is an excellent choice for products like ropes, twines, and other cordage that must be strong and resilient. This has increased the demand for abaca fiber in the transportation, construction, and maritime sectors.

- Unique properties and characteristics: Abaca fiber is desirable for specialty paper products, textiles, and luxury goods due to its distinctive qualities, including luster, texture, and flexibility. As a result, abaca fiber is now more in demand in high-end clothing, specialty paper, and other luxury markets.

Market trends

- In March 2025, in Sitio Panangan, Barangay Lower Tungawan, a facility worth Php1,275,680.00, for Abaca fiber processing and organic fertilizer production was launched by Sirawai Plywood and Lumber Corporation (SPLC) – Agro Industrial Multi-Purpose Cooperative. Moreover, to provide sustainable livelihood opportunities to the local farmers, modernize abaca fiber processing, and improve productivity will be the main goals of the initiative that is funded by the Department of Trade and Industry (DTI)-9, Shared Service Facilities (SSF) project.

- In May 2025, to help the abaca (Manila hemp) farms recover from destructive diseases that have affected them over several years inCatanduanes, a project with P2 million was announced by the Philippine Fiber Industry Development Authority (PhilFida). At the same time, it was stated to the Philippine Information Agency that this project was initiated in the villages of Sagrada and Pedro Vera, along with a budget of P500,000 in the first quarter of 2025, by the head of PhilFida, Robert Lusuegro. Furthermore, with the use of the remaining P1.5 million budget, this project will be expanded to four new areas, which are Soboc, Villa Aurora, Barangays Mabini, and Tinago, within a year.

(Source: https://pia.gov.ph/)

(Source: https://pia.gov.ph/ )

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 903.04 Million |

| Market Size by 2034 | USD 2,999.66 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.30% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Abaca Fiber Market Dynamics

Drivers

The growth and demand for abaca fiber in various applications are being fueled by several market factors. Among some of the key factors are:

- Sustainability and eco-friendliness: Natural, biodegradable, and renewable abaca fiber is a resource that is kind to the environment. The demand for abaca fiber has grown as more people and businesses look for eco-friendly substitutes for synthetic materials.

- High strength and durability: Due to its high strength and durability, abaca fiber is an excellent choice for products like ropes, twines, and another cordage that must be strong and resilient. This has increased the demand for abaca fiber in the transportation, construction, and maritime sectors.

- Unique properties and characteristics: Abaca fiber is desirable for specialty paper products, textiles, and luxury goods due to its distinctive qualities, including luster, texture, and flexibility. As a result, abaca fiber is now more in demand in high-end clothing, specialty paper, and other luxury markets.

- Growing demand for specialty paper products: Teabags, money paper, filter paper, and other specialty paper goods are made with abaca fiber. Abaca fiber demand and the need for these goods are anticipated to rise.

- Government support: Many governments of abaca-producing nations, including the Philippines, offer support for the growth of the abaca industry. This covers funding and subsidies for abaca farmers and producers, as well as research and development. The market for abaca fiber has grown thanks to this support.

Various industries and applications comprise a broad range of market drivers for abaca fiber. The demand for strong, long-lasting, and distinctive materials is expected to increase as consumers and businesses emphasize sustainability and eco-friendliness. The abaca fiber market is predicted to grow and prosper.

Restraint

- Limited availability: The small scale of its production restrains abaca fiber's marketability. This is because abaca plantations are mainly found in the Philippines and other Southeast Asian nations, which restricts the supply and production of abaca fiber.

- Competition from synthetic fibers: Abaca fiber can be produced more cheaply and efficiently than synthetic fibers like nylon and polyester. Due to their increased use and popularity in numerous applications, the demand for abaca fiber has decreased.

- Labor-intensive production: Abaca fiber is more expensive than synthetic fibers because it requires a labor-intensive production process, and this restricts its application to mass-produced goods and lowers its marketability.

Opportunity

- Sustainable and eco-friendly: Abaca fiber is a sustainable, biodegradable material that can be composted. Abaca fiber can be used in a greater variety of products as consumer demand for eco-friendly and sustainable goods rises.

- High-strength and durability: Abaca fiber is renowned for its strength and durability, making it the perfect material for ropes, twines, and other cordage that must be strong and resilient.

- Niche markets: Because of its distinct texture, durability, and luster, abaca fiber has found niche markets in the fashion and luxury industries. Abaca fiber producers now have a chance to go after premium textile and fashion markets.

- Growing demand for specialty paper products: Producing specialty papers like filter paper, currency paper, and tea bags uses abaca fiber. There is potential for abaca fiber to be used more frequently in these applications as the demand for these goods increases.

- Government support: Abaca-producing nations' governments, like those in the Philippines, support the growth of the abaca industry. This includes funding and subsidies for abaca farmers and producers, as well as research and development, which can help to increase the market for abaca fiber.

The market opportunities for abaca fiber are wide-ranging and cover a variety of sectors and uses. Abaca fiber is poised to take a more significant role in the global fiber market as more businesses and consumers look for eco-friendly and sustainable alternatives to synthetic materials.

Product Insights

The paper and pulp product segment dominated the industry with more than 83% revenue growth in 2024. This explains the increased need for non-wood fibers as raw materials for specialty paper applications. The superior strength-to-weight ratio of specialty paper made with abaca fiber makes it highly functional for making money, tea bags, and security papers.

To properly understand the yield of pulp, the characteristics of pulping, and the quality of abaca fibers, development activities, and active research are taking place. The findings from the study results can provide an accurate depiction of the potential and uses of abaca fibers for the manufacture of paper and pulp.

Due to the growing popularity of advanced biomaterials in fashion textiles, the textile product segment is also anticipated to experience a substantial operating income CAGR of 12.3% over the projected period. The most recent fashion in interior decorating techniques for commercial and residential spaces is also anticipated to increase the requirement for abaca fiber in the textile industry.

Environmental issues have compelled several industry executives to concentrate on creating "green" products over the last few years. Industries now use biomaterials in their production technologies to achieve sustainability goals. Abaca fibers are expected to see growth opportunities in the textile industry because of the growing need for advanced, sustainable fibers.

Abaca Fiber Market Companies

- M.A.P. Enterprises

- DGL Global Ventures LLC

- Specialty Pulp Manufacturing, Inc. (SPMI)

- Yzen Handicraft Export Trading

- Terranova Papers

- Ching Bee Trading Corporation

- Sellinrail International Trading Compan

- Peral Enterprises

Recent Developments

- In December 2024, according to the Bangko Sentral ng Pilipinas (BSP), 70 to 90 million pieces of the P500, P100, and P50 denominations of its first Philippine polymer (FPP) banknote series will be distributed in restricted amounts beginning today. The central bank made it clear that there are no intentions to phase out paper currency, which will still be manufactured from abaca fiber.

- In April 2024, Abaca is the "breakthrough zero plastic" shoe made with next-generation biomaterials, according to the UK-based sustainable shoe company Purified. After four years of development, the natural shoe was created with the intention of enriching the soil at the end of its life.

Segments Covered in the Report

By Product

- Pulp & Paper

- Cordage

- Textile

- Fiber Craft

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting