What is Surfactants Market Size?

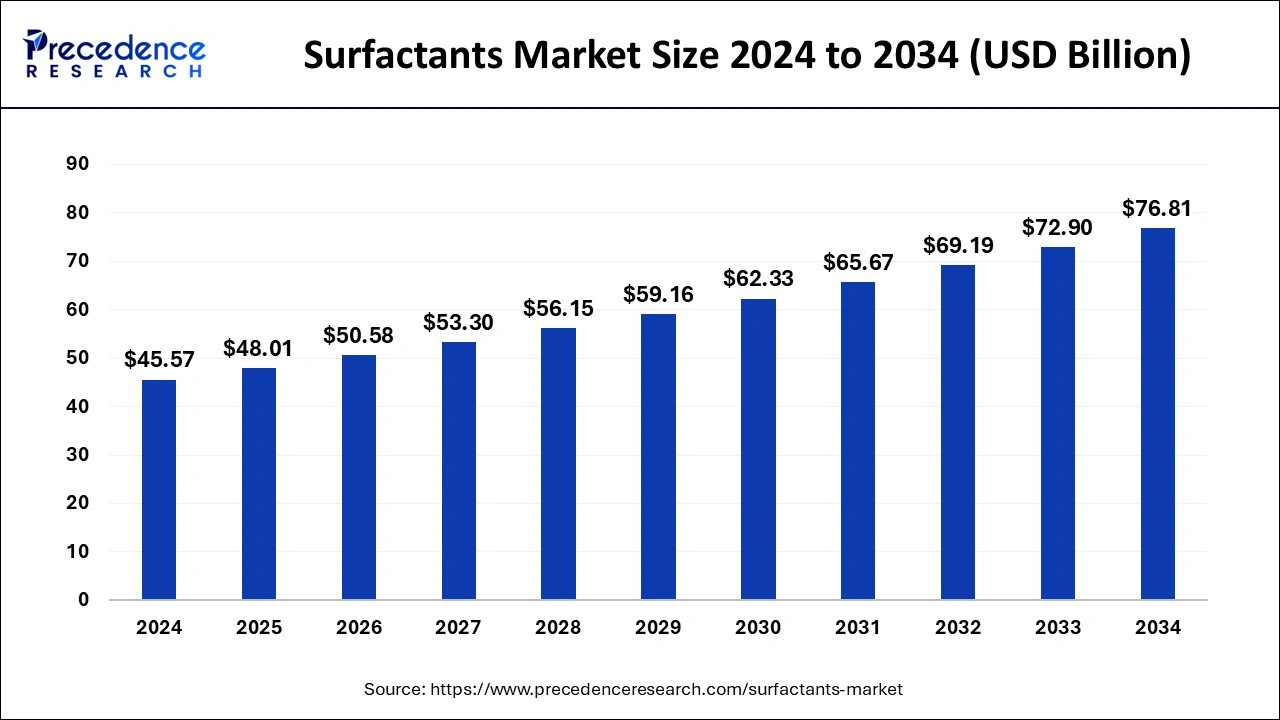

The global surfactants market size is estimated at USD 48.01 billion in 2025 and is anticipated to reach around USD 76.81 billion by 2034, expanding at a CAGR of 5.36% from 2025 to 2034. The growth of the surfactants market is driven by the increasing demand from various industries such as personal care, chemical, and pharmaceuticals. These industries use surfactants as emulsifiers and foaming agents.

Market Highlights

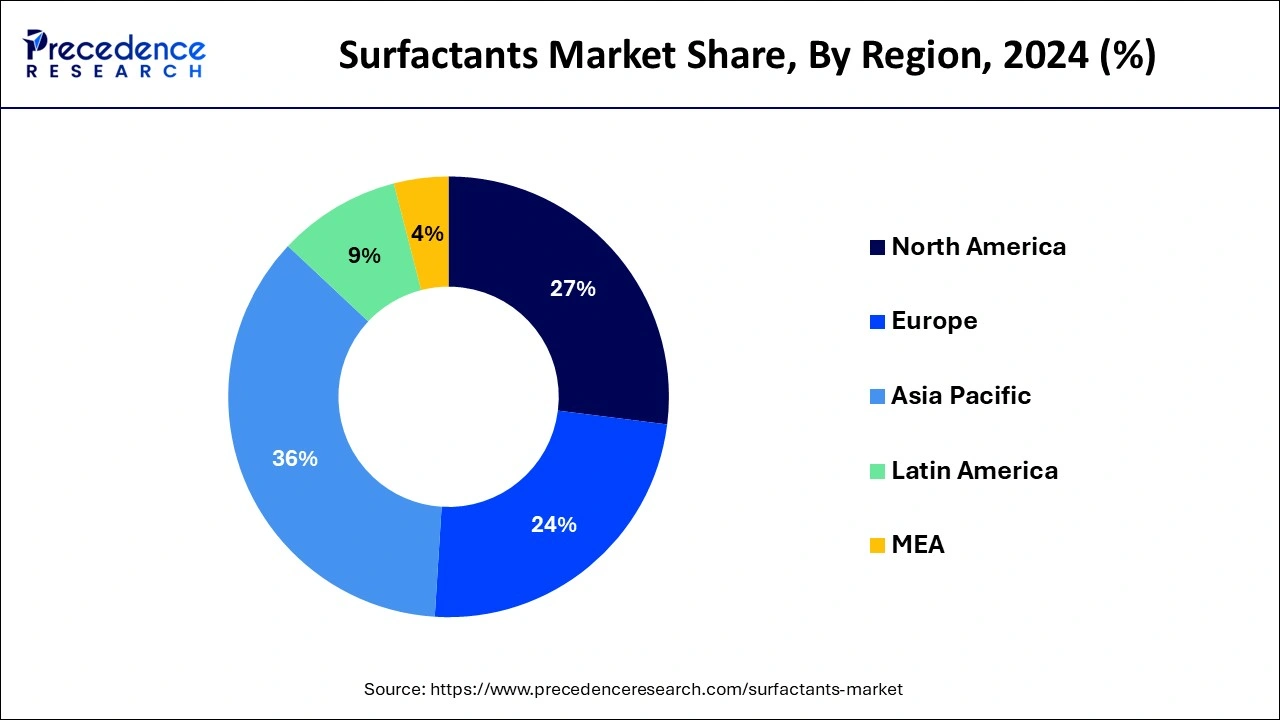

- Asia Pacific dominated the global market with the largest market share of 36% in 2024.

- North America is projected to expand at the notable CAGR during the forecast period.

- By type, the anionic surfactants segment contributed the highest market share in 2024.

- By applications, the home care segment captured the biggest market share in 2024.

Market Size and Forecast

- Market Size in 2025: USD 48.01 Billion

- Market Size in 2026: USD 50.58 Billion

- Forecasted Market Size by 2034: USD 76.81 Billion

- CAGR (2025-2034): 5.36%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Artificial Intelligence: The Next Growth Catalyst in Surfactants

Artificial Intelligenceis transforming various industries across the globe, and the surfactant industry is no exception. AI is rapidly being used in the production processes of surfactants to improve their sustainability and effectiveness. AI helps in the development and design of new surfactant molecules. By using AI algorithms, researchers can predict the behavior and properties of new surfactants before they are synthesized. AI analyzes the vast amount of data generated during production processes and identifies areas for improvement by detecting errors, which further increases production output.

Strategic Overview of the Global Surfactants Industry

COVID-19 had a great impact on the market and the product witnessed a short decline in the demand. But post pandemic, the demand has grown significantly. Surfactants are the chemical compounds which have low surface tension. They are used in home as well as in personal care and textile industry. They are widely also in food and beverages industry. The various industries where the surfactants are used to is expected to have a great growth during the forecast. As the demand shall rise for the textiles or food and beverage industry the markets for surfactants is also expected to grow. Surfactants play a very important role in the cleaning agents. They are used for wetting, washing and emulsifying and also used as lubricants for shaving creams. Due to an increased awareness regarding a high living style and maintenance of hygiene, the market for surfactants is expected to progress during the forecast.surfactants are used in the production of many FMCG products and so the demand for these surfactants shall keep growing through the forecast period.

Market Trends

- Growing demand from various industries such as agrochemicals, personal care, cleaning products, and industrial applications drives the growth of the market.

- Technological advancement in the production and applications, along with innovation in the synthesis process and the use of bio-surfactants, drives the demand and fuel the growth.

- Rise in use of bio-based surfactants and increasing focus on sustainability drives the use of environmentally friendly products, which in turn increases the demand for production.

- Rising demand from the agricultural sector for applications like crop protection and fertilizer fuels the growth of the market, and growing regional demand for industrial growth.

Surfactants Market Growth Factors

- With the growing production of personal care products, there is a high adoption of surfactants in the personal care industry. Surfactants are used in the formulation of skincare and hair care products due to their cleansing and foaming properties.

- Surfactants are used in the production of agrochemicals, such as pesticides and fertilizers. They help agrochemicals stick to plant stems and leaves for a longer period, reducing the need for frequent reapplications.

- Surfactants are also used in industrial as well as household cleaning applications due to their ability to disperse, wet, and emulsify.

- There is a high demand for biosurfactants due to their low toxicity, which further boosts the growth of the market.

- The rising demand for biosurfactants in the pharmaceutical and food & beverages industries fuels the growth of the market.

Market Outlook

- Market Growth Overview: The surfactants market is expected to grow significantly between 2025 and 2034, driven by the rising awareness of cleanliness and personal hygiene, expansion of the consumer goods industry, increasing environmental concers and regulatory pressures are pushing manufacturers.

- Sustainability Trends: Sustainability trends focus on stringent regulations and eco-conscious consumer demand. Manufacturers are adopting green chemistry principles and supply chain transparency to ensure ethical sourcing and environmentally friendly production processes.

- Major Investors:Major investors in the market include BlackRock, The Vanguard Group, State Street Global Advisors, J.P. Morgan Asset Management, Goldman Sachs Asset Management, and BNP Paribas Asset Management.

- Startup Economy: The startup economy in the market is focused on push for green chemistry and specialization in niche applications, these ventures leverage innovative production methods like microbial fermentation.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 48.01 Billion |

| Market Size in 2026 | USD 50.58 Billion |

| Market Size by 2034 | USD 76.81 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.36% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Origin, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising area of application and increasing R&D

Surfactants play a crucial role in a range of consumer products, ranging from personal care items like shampoos, conditioners, and skincare products to household cleaners and laundry detergents. The growing global population and increased disposable incomes are significantly driving up the demand for these essential products. In response to this heightened demand, ongoing research and development in surfactant chemistry fosters the innovation of new products with enhanced performance and efficiency. Innovations in this field may include the formulation of surfactants that require lower concentrations to achieve the same cleaning power or those that provide a better user experience, such as improved texture and feel in personal care products.

Restraint

Price Fluctuation

Surfactants often derive from petroleum-based materials, which are subject to price fluctuations influenced by geopolitical events and global economic conditions. These instabilities can lead to significant variations in production costs, consequently affecting the overall profitability of companies operating within the surfactants market. Furthermore, the surfactant industry is characterized by fierce competition, with numerous players, ranging from large multinational corporations to smaller regional companies, vying for market share. This competitive landscape can put additional pressure on prices and profit margins as companies strive to differentiate their products in a crowded marketplace.

Opportunity

Increasing demand for biosurfactants

The increasing consumer demand for sustainable and eco-friendly products is creating substantial opportunities for the development of biosurfactants. These surfactants, derived from renewable resources such as plants and microorganisms, offer a more sustainable alternative to traditional petroleum-based options. In addition to their environmental benefits, biobased surfactants can often be tailored to meet specific application needs, making them highly desirable in various sectors. As consumers become more environmentally conscious, companies that invest in the development of novel surfactant solutions are poised to gain a significant competitive advantage. The ability to offer customizable properties that enhance product performance and sustainability will likely become a key differentiator in the market.

Segment Insights

Type Insights

On the basis of the type, the anionic based surfactant had a major market share till the year 2022 and it is expected to grow during the forecast period owing to the low cost and easy availability of this type of product. It is a widely used variety of product in many applications in many nations. Other than increased awareness regarding the various hygiene and cleaning agents, the market is expected to grow during the forecast. The anionic segment will have the largest market share due to its qualities like solubilizing and emulsification. An ever growing demand for linear alkyl benzene which is used in various detergents and cleaning products, the anionic segment is expected to grow. Aanions helps in creating foam when it is mixed with the base hence it is in great demand.

Non ionic's are used in various emulsifying oils, as they are low foaming. Cationic's have a positive charge that makes them useful in fabric softeners. They have a very major use in disinfectants, as they have antimicrobial agents. Amphoterics have used in shampoo and cosmetic products due to the qualities that they have. Improved lifestyle and increase in the disposable income has created a demand for the surfactants in the cosmetic industry. Hence, the hydrophilic segment is also expected to grow.

Application Insights

Surfactants have applications in personal care, home care industries, textiles. It is used in the production of plastics, agrochemicals, foods and beverages. The home care segment had the largest application in the recent years and in the future the Home care application is expected to grow. Surfactants are extensively used in various products like laundry detergent, dishwashing detergents, soaps, carpet cleaners and for various other types of products. It is also used in home care in products that are useful in removing oil dirt, unwanted particles from the fabrics or any other surfaces that have oil dirt. The foods and beverages industry uses surfactantsas the treating agents for food services. They also use as antioxidants for food formulations. It also has antimicrobial properties, which help in protecting against the food pathogens and hence the market in the food and beverages sector will also grow owing to these factors.

Regional Insights

Asia Pacific Surfactants Market Size and Growth 2025 to 2034

The Asia Pacific surfactants market size is exhibited at USD 17.28 billion in 2025 and is projected to be worth around USD 28.04 billion by 2034, growing at a CAGR of 5.50% from 2025 to 2034.

The Asia Pacific region is also expectedto lead the market. Asia Pacific market was valued at a US$ 15.80 billion in 2020. Increasing demand for home care and personal care products in developing nations like India, Japan and China, the Asia Pacific market is expected to grow. Due to a low manufacturing cost and labor cost in the Asia Pacific region, the demand is expected to grow. The European market is also experiencing market growth as an increase in the demand for personal care and home care products. Due to a great fashion industry in Europe, there's a rise in cosmetics and textile industriesthereby increasing the demand forsurfactants.

China Surfactants Trends

China is rapid urbanization and rising incomes, home and personal care remain the dominant and fastest-growing application segments, with increasing demand for mild and high-performance products.

The North American region is expected to have the largest share in the global surfactant market as it has had in the recent years. The market is expected to grow during the forecastdue toan increase in demand. There's an increase in the biobased surfactants in the North American regionand also there is a demand forraw material from countries such as Malaysia and Thailand.

U.S. Surfactants Market Trends:

The U.S. significant shift towards sustainable, eco-friendly surfactants, influenced by environmental concerns and a focus on clean-label products. Technological innovation and strategic collaborations are accelerating the launch of advanced biobased surfactants for various applications.

How is Europe Rising in the Surfactants Market?

Europe's market is propelled by the commitment to sustainability, stringent environmental regulations, and a demand for bio-based solutions. The region benefits from a mature chemical industry and a strong innovation ecosystem that fosters research into eco-friendly alternatives to traditional petroleum-based surfactants.

United Kingdom Surfactants Trends:

The U.K. strong demand from the personal care and home care sectors, alongside a significant trend towards sustainable, bio-based products. Heightened consumer awareness of environmental impacts is accelerating the adoption of biodegradable surfactants

How is Latin America Rising in the Surfactants Market?

Latin America is growing preference for sustainable, bio-based surfactants, mirroring global environmental trends. The region's strong agro-based and oil and gas industries also provide substantial demand for specialized surfactants.

Brazil Surfactants Trends:

Brazil contribute to a strong demand from home care, personal care, and industrial sectors like agriculture and oil & gas. The primary trend is a rapid shift towards sustainable, bio-based surfactants, leveraging the country's abundant natural resources and growing environmental consciousness.

How is the Middle East & Africa driving the Surfactants Market?

The Middle East and Africa growth is driven by robust demand from the region's expansive oil and gas industry and increasing consumer awareness of health and hygiene in rapidly urbanizing areas. Government-led initiatives and increasing environmental consciousness are accelerating the shift towards sustainable, bio-based surfactants.

Saudi Arabia Surfactants Trends

The high disposable incomes, a high industrial demand from the oil and gas sector and increased consumer focus on hygiene. The shift towards bio-based and biodegradable options, driven by new government regulations mandating sustainability. An increasing push for environmentally responsible and high-concentration product solutions.

Surfactants Market Value Chain Analysis

Raw Material Sourcing

This initial stage involves procuring the primary feedstocks for surfactant production, which can be either petrochemical-based (e.g., ethylene oxide, benzene) or bio-based (e.g., palm kernel oil, coconut oil, animal fats). The availability, cost, and sustainability of these raw materials are critical factors influencing the entire value chain. Key players are typically large chemical companies, petrochemical giants, and agricultural cooperatives.

Key Players: SABIC (Saudi Basic Industries Corp.), BASF SE, Dow Inc., Shell Plc., and major agricultural raw material suppliers.

Manufacturing

At this core stage, the raw materials are processed through complex chemical reactions like sulfation, ethoxylation, and amination to produce intermediate surfactants. These intermediates are then converted into finished surfactant products, such as linear alkylbenzene sulfonates (LAS), fatty alcohol ethoxylates, and biosurfactants. Companies in this stage focus on process efficiency, innovation, and large-scale production.

Key Players: Stepan Company, Sasol Ltd., Evonik Industries AG, Solvay S.A., Clariant AG, and Croda International Plc.

Formulation and Application Development

In this stage, manufacturers and specialized formulators develop customized surfactant blends for specific end-use applications, optimizing for performance, cost, and biodegradability. This includes creating specialized formulas for household detergents, personal care products, industrial cleaners, and agrochemicals. The stage is highly dependent on R&D and application expertise.

Key Players: Ecolab Inc., Procter & Gamble (P&G), Unilever, and specialized formulation companies.

Distribution and Sales

The finished surfactant products and formulations are distributed to end-use industries and consumer product manufacturers through direct sales, distributors, and bulk chemical providers. The distribution network must manage logistics efficiently, particularly for hazardous or specialized products, to ensure timely and reliable delivery. This stage includes global distributors and regional specialists.

Key Players: Brenntag SE, Univar Solutions Inc.

Surfactants Market Companies

- Nouryon: Nouryon is a key player providing essential performance chemicals, including surfactants used across various industries like personal care, cleaning, and agriculture. They focus on delivering innovative, sustainable solutions that enhance product performance and meet specific customer needs globally.

- Evonik Industries AG: Evonik specializes in manufacturing a wide range of specialty surfactants, particularly bio-based and mild options, which are in high demand for the personal care and high-end home care markets. Their focus on sustainability and green chemistry provides unique solutions tailored for eco-friendly product development.

- Kao Corporation: Kao is a major Japanese chemical and cosmetics company that produces a diverse portfolio of surfactants primarily for its own consumer products (personal care and home care) and other industrial applications. They contribute through extensive R&D, focusing on performance, safety, and addressing specific regional market demands.

- BASF SE: As one of the world's largest chemical producers, BASF manufactures a vast array of surfactants that serve a broad range of industries, including agriculture, personal care, home care, and industrial applications. Their global scale and extensive R&D capabilities allow them to provide high-volume and specialty surfactant solutions to manufacturers worldwide.

- Stepan Company: Stepan is a leading manufacturer of specialty and intermediate chemicals, with a significant focus on producing primary and secondary surfactants for consumer and industrial cleaning products. They are a core supplier to many global cleaning product brands, offering a wide variety of cost-effective and high-performance solutions.

- Solvay: Solvay, now part of Syensqo, provides a wide range of specialty surfactants and functional polymers designed for demanding applications in personal care, agriculture, and industrial markets. They contribute through innovation in high-performance and sustainable formulations that address complex formulation challenges.

- El Dupont De Nemours & Co (DuPont): DuPont contributes to the market through its expertise in specialty materials and ingredients, including sustainable surfactants and other functional chemicals for personal care, nutrition, and industrial applications. Their focus on science-based solutions and innovation helps in developing effective and environmentally conscious products.

- Clariant AG: Clariant is a specialty chemical company offering innovative and sustainable surfactants for various applications, particularly in personal care, mining, and industrial sectors. They focus on providing high-performance, eco-friendly, and cost-effective solutions that meet stringent safety and environmental regulations.

Recent Developments

- In May 2025, Pilot Chemical Co., in collaboration with Novvi LLC, launched a biobased surfactant in North America. Pilot is the sole sulfonator and distributor of Novvi CalCare. The partnership aims at increasing supply chain management and also bringing innovation in technology and products. Combining Novvi's sustainable feedstocks with Pilot's sulfonation expertise, the partnership targets the household, I&I, and personal care markets. (Source: https://www.chemanalyst.com)

- In October 2024, AmphiStar Belgian start-up, launched a range of waste-based biosurfactants aimed at the personal and home care markets. The raw materials are sourced from local, organic biowaste and side streams from agri-food processing, The AmphiCare and AmphiClean ranges were produced using microbial fermentation. Using a production method similar to processes used to brew beer, the company's range of microbial surfactants is produced from locally-sourced waste and side-streams from the agri-food industry, such as supermarket food waste. (Source: https://www.ofimagazine.com)

- In January 2025, Galaxy Surfactants Ltd Performance surfactants and specialty care ingredients manufacturer, launched a three-year farmer empowerment project as part of its CSR initiative. The project aims to increase farmer incomes through sustainable agricultural practices and market linkages, improve soil health using advanced technologies like hydrogels and composting, enhance crop water management and irrigation efficiency, and reduce the usage of harmful fertilizers and insecticides in agriculture by promoting eco-friendly practices. (Source: https://thecsruniverse.com)

- In January 2024, Bionema Group launched Soil-Jet BSP100. By enhancing the effectiveness of biologicals and agrochemicals, this biodegradable surfactant is poised to redefine agriculture.

- In February 2023, Pangaea Biosciences Ltd. launched a new plant-based surfactant formulation technology to preserve soil health. These surfactants, when sprinkled on the plants, destroy bacteria and fungus in the soil, thereby enhancing soil health.

- In September 2023, Dow launched EcoSense 2470 Surfactant, providing consumers with a sustainable solution to reach their formulation targets by harnessing innovative carbon capture technology for the household care industry. This surfactant contributes to a circular carbon economy without sacrificing performance.

Segments Covered in the Report

By Type

- Anionic Surfactants

- Linear alkyl benzene

- Fatty alcohol ether sulfates

- Fatty alcohol sulfates

- Sulfosuccinates

- Others

- Non-ionic Surfactants

- Fatty Alcohol Ethoxylates (FAE)

- Alkyl Phenol Ethoxylates (APE)

- Others

- Cationic Surfactants

- Amphoteric Surfactants

- Others

By Origin

- Synthetic Surfactants

- Bio-based Surfactants

- Chemically Synthesized Bio-based Surfactants

- Biosurfactants

By Application

- Home Care

- Personal Care

- Oilfield Chemicals

- Food & Beverage

- Agrochemicals

- Textiles

- Plastics

- Industrial & Institutional Cleaning

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting