What is the Fluorinated Surfactants Market Size?

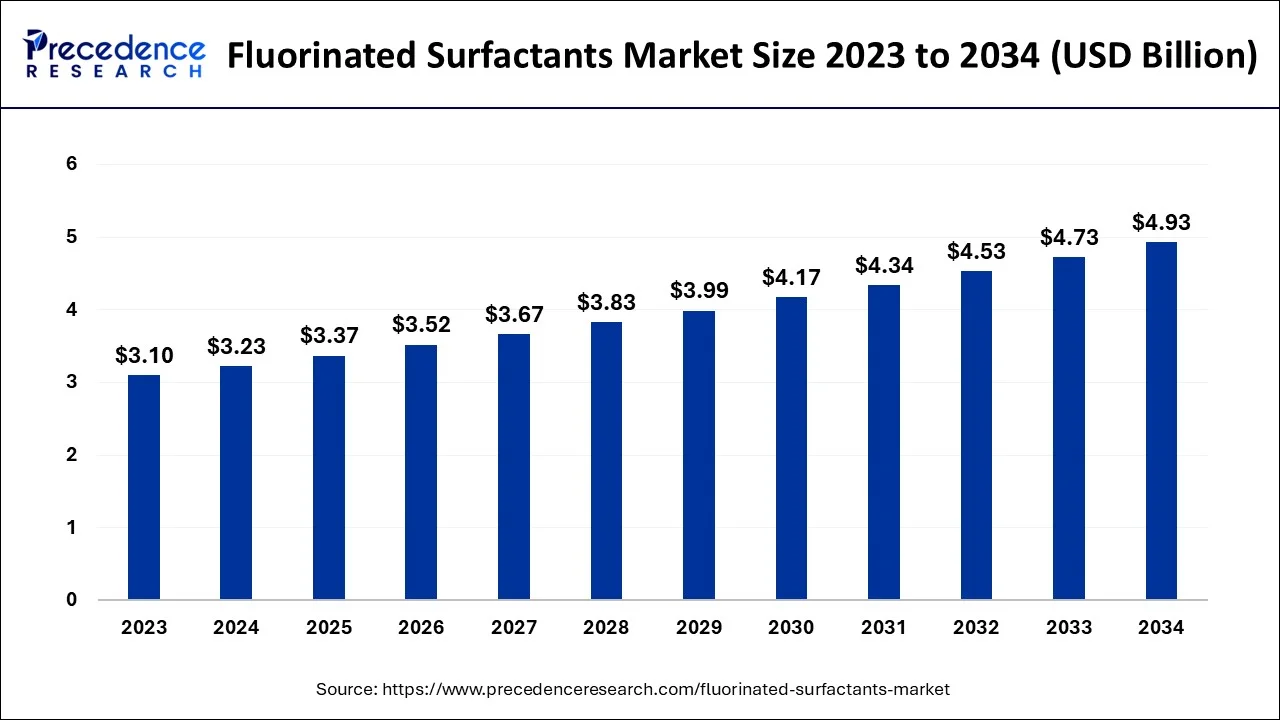

The global fluorinated surfactants market size is valued at USD 3.37 billion in 2025 and is predicted to increase from USD 3.52 billion in 2026 to approximately USD 5.13 billion by 2035, expanding at a CAGR of 4.29% from 2026 to 2035.

What are the Extensive Advances in the Fluorinated Surfactants?

Fluorinated surfactants are special types of chemicals that have been gaining popularity due to their ability to help liquids mix better. They contain something called fluorine, which gives them unique characteristics like being able to reduce the tension on a liquid's surface, making it easier for different liquids or liquids and solids to blend together. Recently, there has been a lot of attention on protecting the environment and being more sustainable. Because of this, there is a growing demand for fluorinated surfactants that have less of an impact on the environment and are less harmful to living things.

Fluorinated surfactants are used in many different industries because they can do a lot of different things. They are found in things like coatings for surfaces, fabrics, oil and gas production, electronics, and even firefighting foams. These industries are growing, which means there is more need for fluorinated surfactants.

One of the reasons why fluorinated surfactants are in demand is because they are used to make advanced materials like fluoropolymers. These materials have special properties that make them resistant to chemicals and prevent things from sticking to them. Because of this, they are used in things like cars, electronics, and buildings. As the demand for these advanced materials increases, so does the need for fluorinated surfactants.

Industries like electronics, aerospace, and automotive require materials that can handle extreme conditions and still perform well. Fluorinated surfactants have properties that make them suitable for these demanding applications. They can withstand high temperatures and repel water, which makes them valuable for meeting these performance requirements.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.37 Billion |

| Market Size by 2035 | USD 5.13 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.29% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, End-Users, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamic

Drivers

Environmental regulations and sustainability: Increasing environmental regulations and the growing emphasis on sustainability have driven the demand for more eco-friendly alternatives. Fluorinated surfactants with lower environmental impact and reduced toxicity are sought after as replacements for older, less environmentally friendly surfactants. Also, it has wide applications in various industries, including coatings, textiles, oil and gas, electronics, and firefighting foams. Additionally, the growing demand for advanced materials in sectors such as automotive, electronics, and construction fuels the demand for fluorinated surfactants. Also, Ongoing research and development efforts focused on improving the properties and performance of fluorinated surfactants contribute to market growth.

Market Restraints

High cost: Fluorinated surfactants can be more expensive compared to conventional surfactants. The complex manufacturing processes, specialized raw materials, and the costs associated with meeting regulatory requirements contribute to their higher price. The higher cost can be a deterrent for some industries or applications, especially in price-sensitive markets. Also, Regulatory restrictions or bans on certain fluorinated surfactants can limit their use in certain applications or regions. Apart from this, some fluorinated compounds are sourced from specific regions or have limited production capacities, which can impact the overall supply chain and availability of fluorinated surfactants. Additionally, Public perception and concerns about the potential environmental and health impacts of fluorinated compounds can lead to a preference for alternative surfactants.

Opportunity

Advanced material demand: The growing demand for advanced materials, such as fluoropolymers, in sectors like automotive, electronics, and construction, presents opportunities for fluorinated surfactants. Fluorinated surfactants play a crucial role in the production of these high-performance materials. As industries continue to seek materials with exceptional chemical resistance, nonstick properties, and durability, the demand for fluorinated surfactants is likely to increase. Also, there is an opportunity for manufacturers to develop customized fluorinated surfactant solutions to meet specific customer requirements.

Additionally, Industries such as renewable energy, energy storage, and water treatment could benefit from the properties of fluorinated surfactants. Research and development efforts in these areas can help identify novel applications and expand the market potential for fluorinated surfactants.

Type Insights

Non-ionic fluorinated surfactants are a type of surfactant that doesn't have an electric charge. They are very versatile and can be used in many different products. These surfactants are compatible with various formulations and find applications in industries like coatings, textiles, personal care products, and cleaning agents. Also, Anionic fluorinated surfactants, on the other hand, have a negative charge. They are commonly used in industrial settings for their ability to create emulsions and disperse substances effectively. Apart from this, Cationic fluorinated surfactants have a positive charge. They are often used in personal care products like shampoos and fabric softeners. These surfactants are great at wetting surfaces and can even have antimicrobial properties. On the other hand, Amphoteric fluorinated surfactants are unique because they can act as either anionic or cationic depending on the pH of the system. They work well in a wide range of pH levels and are often used in personal care products like shampoos and skin cleansers.

Application Insights

Fluorinated surfactants play a vital role in the coatings and paints industry by improving the way coatings spread and stick to surfaces. They make it easier for the coating to cover a surface evenly, ensuring better adhesion and durability. Also, In the textile industry, fluorinated surfactants are used to treat fabrics, providing them with enhanced resistance to stains, water, and oil. These treatments create a shield on the fabric surface that prevents liquids and stains from seeping in. Additionally, for firefighting purposes, fluorinated surfactants are essential in producing foams used in Class B fire suppression systems. These surfactants help create a foam blanket that covers flammable liquid surfaces, preventing the release of flammable vapors and suppressing the fire effectively. Secondly, In the oil and gas industry, fluorinated surfactants are added to drilling fluids, hydraulic fracturing fluids, and oil spill dispersants. They help reduce friction, improve fluid flow, and enhance the recovery of oil.

End Users Insights

Fluorinated surfactants are widely used in different industries. They play a significant role in the paints and coatings industry, where they help improve the way coatings spread and stick to surfaces. In the textile industry, fluorinated surfactants are used to make fabrics more resistant to stains, water, and oil. They also find application in the firefighting industry, where they help create foams that suppress fires by covering flammable liquid surfaces.

The oil and gas industry uses fluorinated surfactants in drilling and oil spill cleanup processes. Additionally, they are used in personal care products like shampoos and toothpaste to enhance foaming and spreadability. Fluorinated surfactants also have various applications in electronics manufacturing and other industries that require surface tension reduction and modification.

Regional Insights

How did North America Dominate the Fluorinated Surfactants Market in 2024?

North America encompasses countries like the United States and Canada. This region has a significant market for fluorinated surfactants due to the presence of key industries such as paints and coatings, textiles, oil and gas, and personal care. The demand for fluorinated surfactants is driven by the growing emphasis on sustainability and performance in these industries. Talking about Europe includes countries like Germany, the United Kingdom, France, and Italy. This region is a major consumer of fluorinated surfactants, particularly in industries such as automotive, coatings, textiles, and personal care.

Developing Economies and Demand are Driving the Asia Pacific

Asia Pacific is experiencing rapid growth in the market for fluorinated surfactants. This is mainly due to the presence of emerging economies like China, India, and Japan. Industries such as textiles, coatings, electronics, and personal care in the region have a strong demand for fluorinated surfactants. Latin America, including countries like Brazil, Mexico, and Argentina, has a smaller but growing market for fluorinated surfactants.

The Middle East and Africa region has a growing market for fluorinated surfactants, primarily driven by the oil and gas industry. Countries like Saudi Arabia and the United Arab Emirates have significant demand for fluorinated surfactants as additives in drilling fluids and hydraulic fracturing fluids.

Canada Fluorinated Surfactants Market Trends

Such as a "Toxic" Designation, a proposed order was published on March 8, 2025, to include the class of PFAS (exempting fluoropolymers) to the list of toxic substances under the Canadian Environmental Protection Act, 1999 (CEPA), which allows the government to showcase risk management solutions. Regulatory pressures, including the classification of most PFAS as toxic, are phasing out high risk uses and encouraging safer alternatives. Public concern over environmental persistence and health risks is boosting innovation in fluorine free and low-impact surfactants.

China Fluorinated Surfactants Market Trends

Day by day, many Chinese research institutions are actively emerging novel, safer fluorinated surfactants. Domestic production and exports are expanding to meet industrial needs. Environmental concerns and PFAS regulations are pushing innovation toward greener, sustainable alternatives. Overall, the market combines strong industrial demand with emerging sustainability pressures. For instance, the synthesis and characterization of a series of biofriendly, short-chain zwitterionic fluorosurfactants, which were particularly developed for firefighting foams, where high performance is necessary, and options are limited.

UAE Fluorinated Surfactants Market Trends

Mainly, Tricore Surfactants Technologies FZC is a UAE-based manufacturer of anionic surfactants for agro-industries, emphasising high-performance CABS (Coconut Amido Propyl Hydroxy Sulfaine) and adhering to global QHSE (Quality, Health, Safety, and Environment) policies. Rising sustainability concerns are encouraging interest in environmentally compliant and lower-impact fluorinated surfactant formulations, as global and regional regulatory expectations evolve.

Fluorinated Surfactants Market- Value Chain Analysis

- Feedstock Procurement

This primarily covers receiving specific fluorinated raw materials and intermediates, like Perfluoroalkylsulfonyl fluoride (POSF) and sulfonyl chlorides, and finally processing them into finished products.

Key Players: The Chemours Company, 3M, Daikin Industries Ltd., etc. - Chemical Synthesis and Processing

The market comprises multi-step reactions, which use radical telomerization, fluorination, and functional group transformations (etherification, hydrolysis, oxidation) to develop molecules with a robust perfluorinated chain and a hydrophilic head.

Key Players: AGC Inc., Daikin, Solvay, etc. - Regulatory Compliance and Safety Monitoring

Firstly, these chemicals are subject to the global regulations and further focus on phasing out long-chain PFAS and controlling their elimination into the environment.

Key Players: Freyr Solutions, UL Solutions, Intertek, etc.

Top Companies in the Fluorinated Surfactants Market & Their Offerings:

- Nouryon- Currently, they are emphasising sustainable, bio-based, and non-fluorinated surfactants.

- Daikin- Most significant offerings include UNIDYNE water and oil repellents, and DAISAVE fluorinated liquids.

- ChemGuard- This company specialises in an immersive line of short-chain, telomer-based fluorosurfactants.

- OMNOVA Solutions Inc.- It explored fluorinated surfactants under the PolyFox brand name.

- Kawaken Fine Chemicals Co. Ltd- A firm widely offers amino acid-based, amphoteric, and non-ionic surfactants for personal care and industrial use.

Fluorinated Surfactants Market Companies

- Nouryon

- Daikin

- ChemGuard

- OMNOVA Solutions Inc.

- Kawaken Fine Chemicals Co. Ltd

- MAFLON SPA

- The Chemours Company

- AgcSeimi Chemical Co. Ltd.

- DIC Corporation

- Dynax

- Innovative Chemical Technologies Inc.

- 3M

Recent Developments

- In March 2023, DuPont announced that it would invest €30 million in a new research and development center for fluorinated surfactants in Germany. The company plans to use the funds to develop new products and applications for fluorinated surfactants.

- In January 2023, Nouryon acquired Stepan's fluorochemicals business. This acquisition gave Nouryon a significant market share in the fluorinated surfactants market and expanded Nouryon's product portfolio.

- In February 2022, Daikin expands fluorinated surfactants production capacity in China - Daikin Industries announced that it has expanded the production capacity of its fluorinated surfactants plant in China. The expansion will increase the plant's production capacity by 50%.

- On January 10, 2022, 3M launched a new fluorinated surfactant for use in personal care products - 3M announced that it has launched a new fluorinated surfactant for use in personal care products. The new surfactant is said to be more effective at cleaning and moisturizing skin than traditional surfactants.

Segments Covered in the Report

By Type

- Non-Ionic

- Anionic

- Cationic

- Amphoteric

By Application

- Paints & Coatings

- Adhesives

- Sealants

- Caulks

- Waxes & Polishes

- Polymers

- Foamers

- Inks

- Others

By End-Users

- Construction & Architecture

- Automotive

- Consumer Goods

- Oilfields

- Electronics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting