What is the Cosmetic Chemicals Market Size?

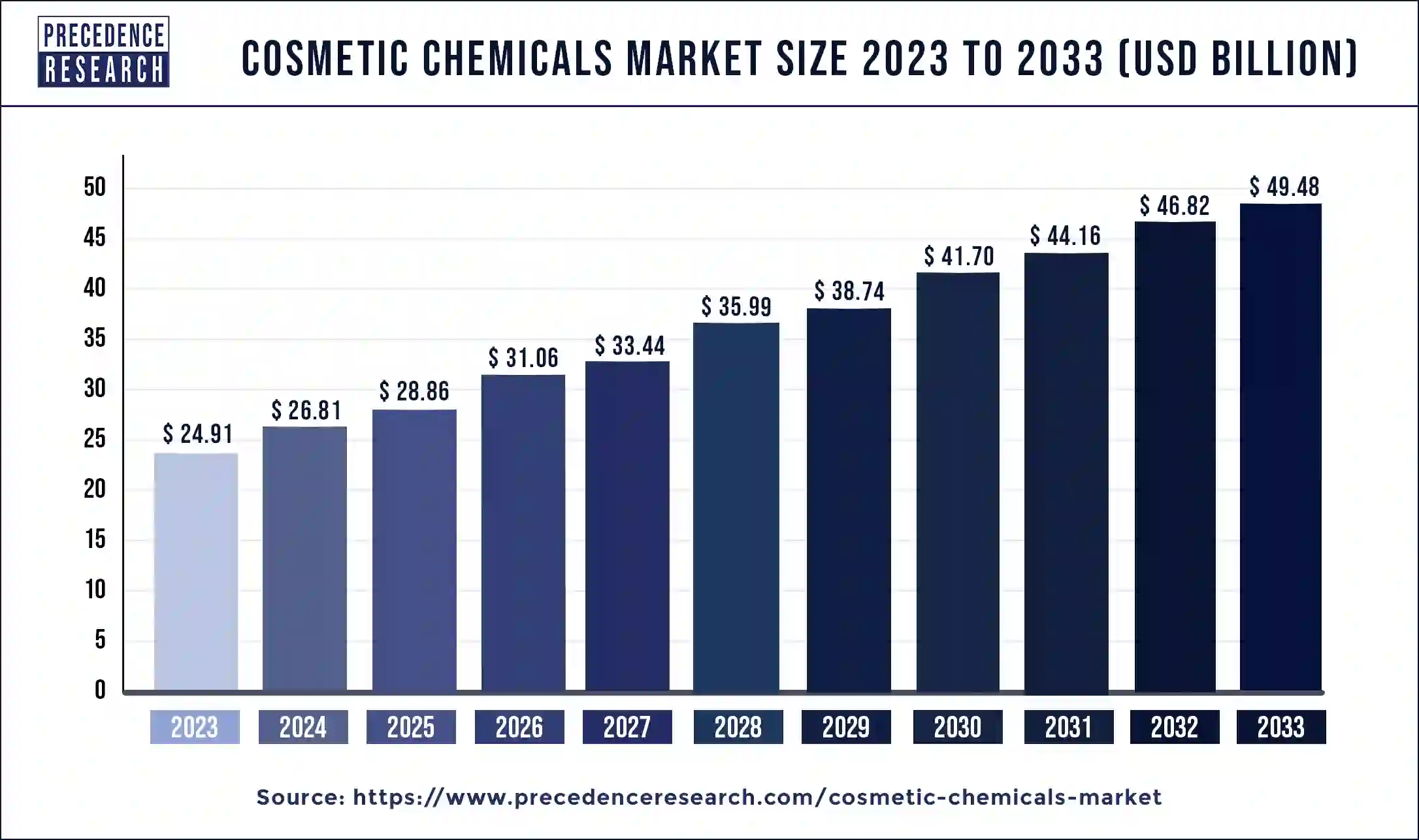

The global cosmetic chemicals market size is valued at USD 26.81 billion in 2025 and is predicted to increase from USD 28.86 billion in 2026 to approximately USD 52.14 billion by 2035, expanding at a CAGR of 6.88% from 2026 to 2035.

Market Highlights

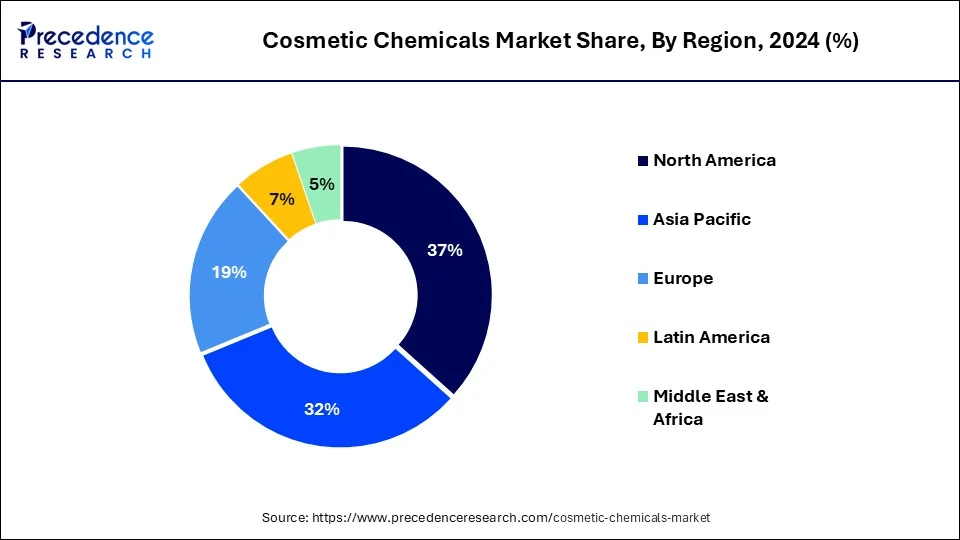

- North America dominated the cannabis beverages market, holding the largest share of 37% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By product type, the emollients and moisturizers segment contributed the highest share 2025.

- By product type, the preservatives segment is growing at a strong CAGR between 2026 and 2035.

- By application, the skin care segment captured the highest market share in 2025.

- By application, the hair care segment is poised to grow at a healthy CAGR between 2026 and 2035.

Market Overview

A variety of chemical substances from synthetic sources make up cosmetic chemicals. They are the primary components utilised in the creation of cosmetic or personal care products. Colorants, surfactants, emollients, preservatives rheology control agents are just a few of the cosmetic chemicals that are often present in cosmetic products. The increasing desire for cosmetic products created with natural ingredients and consumer willingness to pay more for premium items are driving the market for cosmetic chemicals.

Emulsifiers, preservatives, thickeners, moisturisers, colours, and perfumes are a few of the components that are frequently used in cosmetics. They can be created artificially or naturally. Additionally, synthetic compounds can be made from natural resources like petroleum or bio-based materials. However, because of the complex synthesis process they go through and the use of derived reagents and catalysts, these chemicals are referred to be synthetic. Products made from plants, minerals, animals, and microbes all seem to be examples of natural commodities. There are around 1500 chemical units recognised as cosmetic chemicals worldwide.

Among the most common ingredients used in cosmetics are thickening agents, carrier powders, pigments, colorants, preservatives, film formers, emollients, and moisturisers. The cosmetic industry is fragmented because a huge number of suppliers offer a wide range of natural and inorganic chemicals, which are essential components. Nevertheless, a significant share of the market's commerce in cosmetic chemicals is controlled by twenty or more large worldwide businesses.

What is the Role of AI in the Cosmetics Chemicals Market?

The role of artificial intelligence in skincare extends to improving real-time skin monitoring. AI-based applications use computer vision and facial recognition technologies to evaluate essential skin features like blemishes, hydration, texture, and pigmentation. Companies use AI to analyze individual skin profiles and create custom skincare products. By providing data like, skin type, concerns, and environmental factors, AI algorithms can design products tailored to the user's unique needs.

AI detects and removes acne, pimples, and dark spots with price, while maintaining natural skin texture. AI improves product lifecycle management by providing data driven insights throughout the entire lifecycle of a product, from development to retirement. AI tools can predict maintenance needs, improve product performance, and manage product data across many stages.

Cosmetic Chemicals Market Growth Factors

- Rising consumer demand for skin care and anti-aging cosmetics will fuel the market for cosmetic chemicals

- Rising demand for cosmetic products made with natural components and consumers' desire to spend money on high-end goods

- increasing demand for Ultra-violent absorbent lotions for self-care

- rising working female population

- Rising disposable income

- Rising customer base

- Improving lifestyle

Additionally, during the aforementioned projection period, the market for cosmetic chemicals will have several potential prospects due to the booming demand for innovative beauty products and rising consumer spending on branded organic toiletries.

The desire to enhance one's look and increasing disposable earnings in emerging countries like India and China are the main factors driving the worldwide market for cosmetic chemicals. The rapidly growing fashion and entertainment industries in developed and emerging countries like the U.S., France, and South Korea have also increased consumer demand for cosmetics, which is expected to eventually fuel demand for cosmetic chemicals in the near future. Additionally, it is anticipated that throughout the projected period, demand for cosmetic chemicals would increase due to the growing number of working women in major businesses and international firms as well as their high consumption of beauty products.

One of the key elements influencing the cosmetic business is the rising demand from ethnic communities for beauty products that are catered to their demands. In addition, it is anticipated that ageing baby boomers would have more awareness of and desire for personal care products, which will raise demand for cosmetic chemicals. However, the worldwide market for cosmetic chemicals may experience a growth slowdown due to the growing desire for natural substances. Major firms must also follow rules and laws specific to their sector.

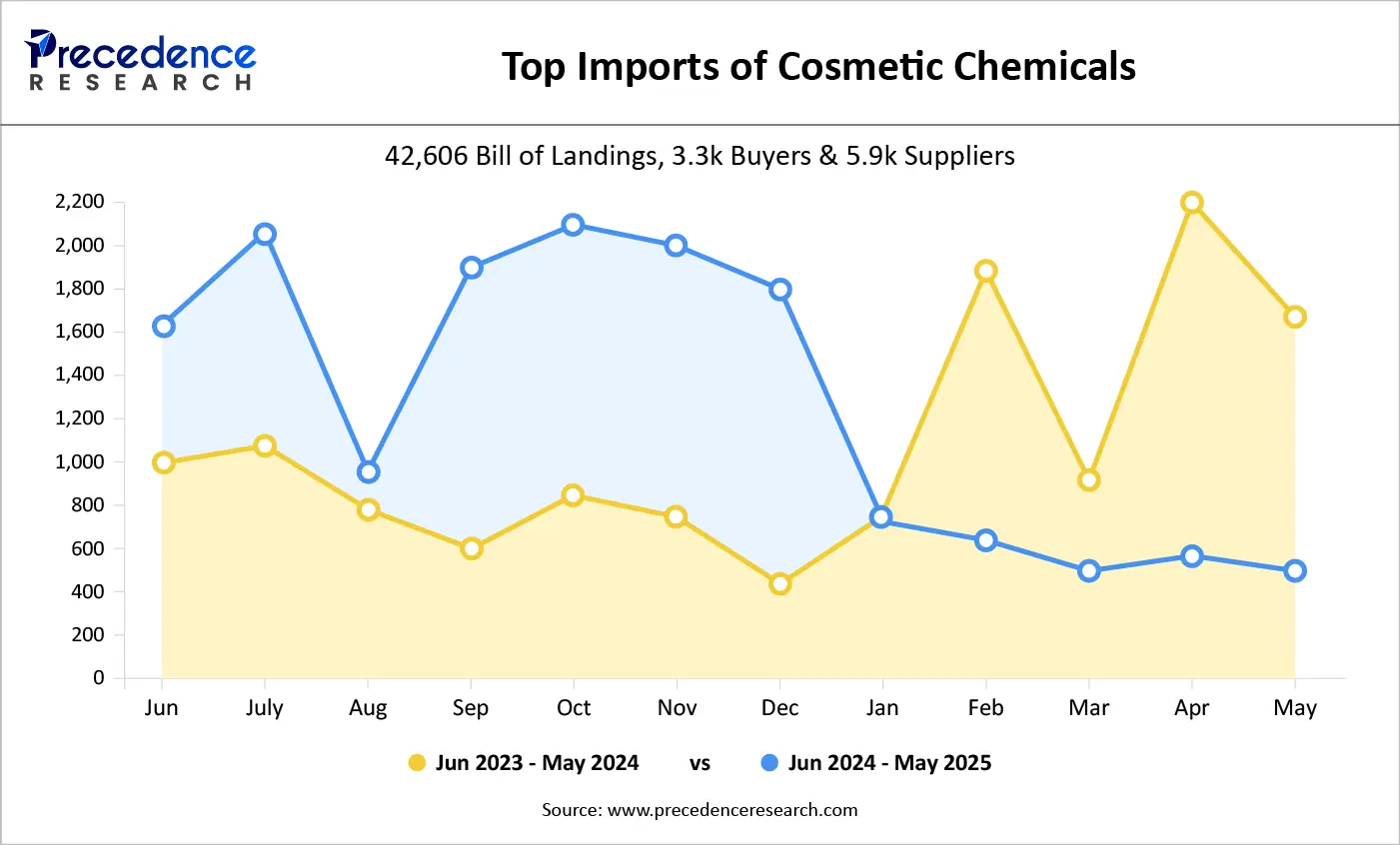

The chart will compare the volume of monthly import shipments of cosmetic chemicals in two consecutive years giving the performance of the years on years. It compares June 2023-May 2024 (green line) and June 2024-May 2025 (black line) based on 42,606 bills of lading with approximately 3.3k buyers and 5.9k suppliers, which is a wide and dynamic trade base.

The preceding period (Jun 2023-May 2024) has moderate changes, with shipments decreasing towards the end of the year and then increasing drastically between January and April, which can be explained by post-holiday demand recovery and the end-of-year restock. Conversely, the later period (Jun 2024-May 2025) shows that the highest volumes of shipments are made in mid-year, with peaks in September October, and then a significant decrease in January onwards. This dispersion indicates a change in the timing of imports, with the demand in the latest year seemingly being front-loaded. In general, the diagram represents seasonality, fluctuating procurement strategies and shifting demand cycles in the cosmetic chemicals import market.

Overall, the diagram highlights clear seasonality and a shift in procurement behaviour, suggesting that cosmetic chemical importers are adjusting sourcing strategies in response to market conditions, inventory planning, and downstream demand from the cosmetics and personal care industry.

Market Trends

- Expanding personal care and beauty products

- Rising demand for anti-aging products

- Increasing demand for natural ingredients

- Rising digital transformation and advanced technologies

Report Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 26.81 Billion |

| Market Size in 2026 | USD 28.86 Billion |

| Market Size by 2035 | USD 52.14 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.88% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Application, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand for natural ingredients:

The benefits of using natural ingredients in cosmetic chemicals include affordable, eco-friendly, effectiveness, skin friendly, natural nutritious, and safe. Natural cosmetics derive their strength from ingredients that come directly from nature. Rich in vitamins, essential nutrients, and antioxidants, these ingredients help to nourish, protect, and balance the skin. Natural ingredients use can safely test and try different herbs, reduced risk of side effects, natural healing, and cost cost-effective and accessible.

Restraint

Side effects of premium ingredients:

Allergies and skin irritability are frequent adverse effects of many cosmetics. Specific colorants, fragrances, and preservatives are chemicals that can cause reactions ranging from minor redness and itching to severe allergic reactions. Endocrine disruptors are some of the substances found in cosmetics. The beauty industry impacts our environment in many ways. Now a days practices can produce harmful microplastics, hurt wildlife, damage oceans, and deplete natural resources. There is also a risk of indiscriminate use, adverse effects, prolonged chemical exposure, allergic reactions, and higher risk of intoxication.

Opportunity

Digitalization in cosmetic industry:

Digitalization offers enormous potential for improvement. The benefits include more satisfied customers, time savings, and reduced errors. Digitalization benefits also include saving time, materials or storage space, improving access times to information or the possibility of obtaining it from different places, without the need to be physically located in a particular place. Sustainability is a growing priority in digital transformation, with many chemical companies adopting digital tools to achieve environmental goals.

Product Type Insights

The emollients & moisturizers segment held a dominant presence in the cosmetic chemicals market in 2024.

- In February 2025, first ever moisturiser Olay Super Cream with SPF-30 in a glass jar was launched by Olay. This moisturizer hydrates, smooths, firms, brightens, and protects the skin and its in a luxe glass jar.

Olay Launches First-Ever Moisturizer in a Glass Jar - Beauty Packaging

The preservatives segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- In May 2023, natural, preservative free skincare was launched by TARAMAR. TARAMAR, an award-winning beauty brand from Iceland is driven by powerful organic and wild handpicked ingredients from the Icelandic nature in formulas that are 100% toxic free and technically edible.

Game changing beauty! - TARAMAR Launches Natural, Preservative Free Skincare - TARAMAR

Global Cosmetic Chemicals Market, By Product Type, 2022 – 2024 (USD Million)

| Product Type | 2022 | 2023 | 2024 |

| Surfactants | 6,668.2 | 7,194.8 | 7,194.8 |

| Emollients & Moisturizers | 6,812.6 | 7,391.3 | 8,012.7 |

| Film-Formers | 2,676.4 | 2,884.6 | 3,108.6 |

| Colorants & Pigments | 1,283.8 | 1,371.0 | 1,371.0 |

| Preservatives | 902.5 | 969.7 | 1,041.8 |

| Emulsifying & Thickening Agents | 1,132.9 | 1,220.0 | 1,313.6 |

| Single-Use Additives | 700.3 | 752.6 | 808.6 |

| Others | 2,964.8 | 3,127.8 | 3,302.7 |

Application Insights

The skin care segment underwent a notable in the cosmetic chemicals market during 2024.

- In April 2025, Zenakine, a biotech-based cosmetic active ingredient designed to bridge the connection between skin quality and overall well-being was introduced by Croda Beauty Actives.

The hair care segment will gain a significant share of the market over the studied period of 2025 to 2034.

- In March 2025, 34 new products across hair, body, and men's care were launched by newly independent Suave Brands Company.

Suave Launches 34 New Products Across Hair, Body, and Men's Care - Beauty Packaging

Global Cosmetic Chemicals Market, By Application, 2022 – 2024 (USD million)

| Application | 2022 | 2023 | 2024 |

| Skin Care | 8,052.6 | 8,713.1 | 9,427.1 |

| Hair Care | 6,057.4 | 6,537.7 | 7,055.6 |

| Makeup | 3,323.0 | 3,561.5 | 3,816.6 |

| Oral Care | 2,564.6 | 2,737.1 | 2,920.7 |

| Fragrances | 1,905.5 | 2,046.5 | 2,197.8 |

| Others | 1,238.7 | 1,315.9 | 1,396.6 |

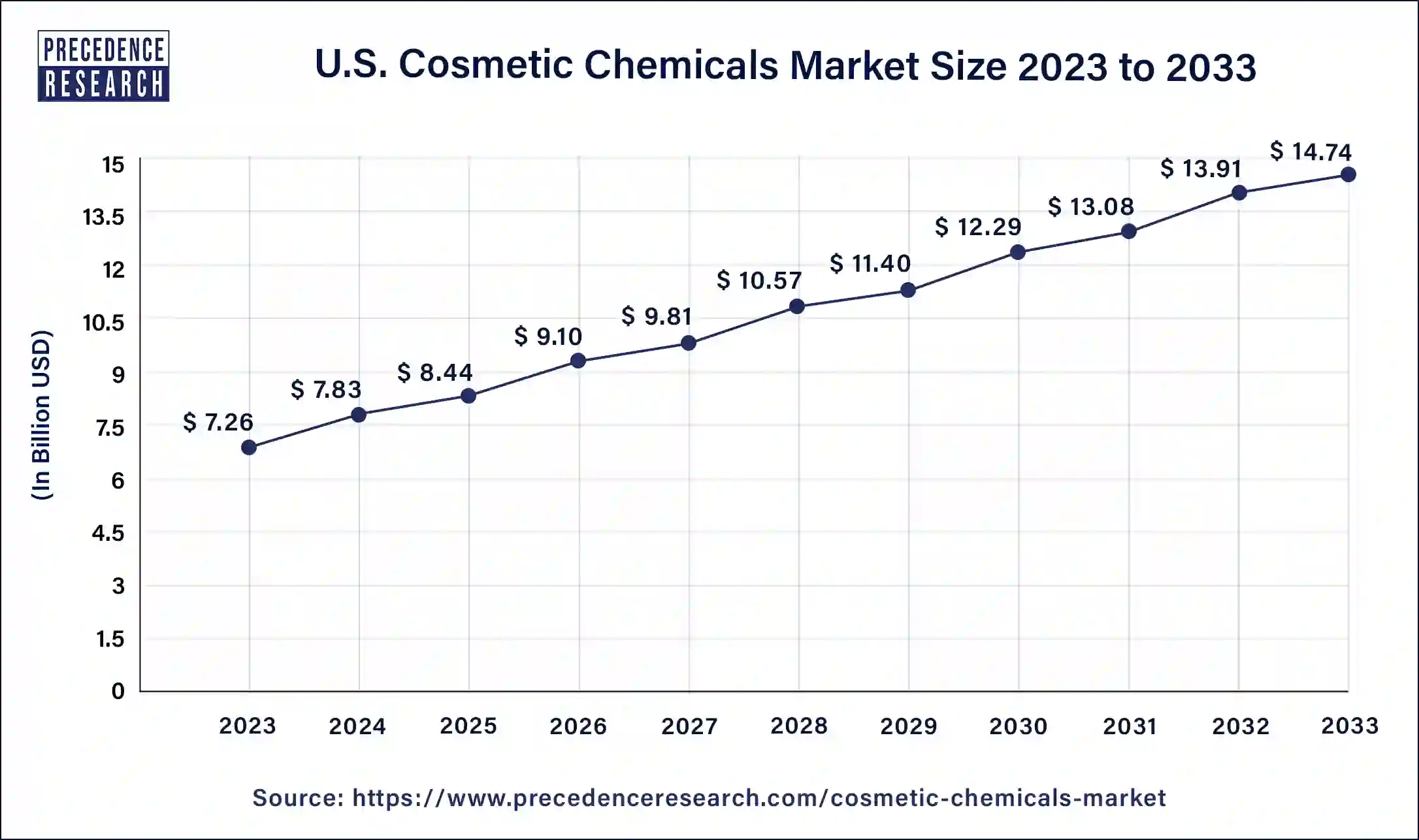

U.S. Cosmetic Chemicals Market Size and Growth 2026 to 2035

The U.S. cosmetic chemicals market size was valued at USD 7.83 billion in 2025, and it is expected to surpass around USD 15.57 billion by 2035 with a CAGR of 7.12% from 2026 to 2035.

Due to the area's high demand for the cosmetic product, North America is anticipated to have the greatest shareholder by geographic region. Every year brings new heights for the cosmetic and personal care industries in the United States. Manufacturers in the country are using an integrated approach rather than seeing personal care products under the categories of health and beauty. Many market participants are concentrating on boosting the entry of biotechnology, pharmaceutical, and food ingredient firms into the beauty sector, which will lead to the release of cutting-edge goods. Men in the nation use an average of six personal care items each day, compared to 12 for women. In addition, a 2021 poll of the clique community in the United States revealed that 63% of women saw skin care as an investment in their wellbeing.

Additionally, there is a rise in demand for skincare products among consumers as a result of increased knowledge of the importance of skin health and skin care. Globally rising demand for face creams, sunscreens, and body lotions is anticipated to fuel the expansion of the cosmetic chemicals industry. Major businesses in the cosmetic chemicals sector are now concentrating more on the creation of cutting-edge skin care products. Additionally, a shift in consumer preference toward goods made from natural sources and generated from organic materials is anticipated to fuel the expansion of the cosmetic chemicals market. Some businesses source the majority of their chemicals from plants, such as camelina, polyphenols, and marine sources including collagen, algae, and insects. Many brand-new, smaller firms have also entered the market in an effort to benefit from the sector's ongoing success. Additionally, the market is expanding as a result of increasing investments in skincare product R&D.

The market for cosmetic chemicals in Asia-Pacific is anticipated to expand at the quickest rate. Asia-Pacific consumers' demand for cosmetic chemicals is rising as a result of skin care applications.

Global demand for cosmetic chemicals is rising as a result of the fast rise in buying power in nations like India and China. Asia Pacific is anticipated to use cosmetic chemicals the most in the near future. In the upcoming years, Southeast Asia, which encompasses Thailand, Malaysia, Indonesia, Vietnam, and Singapore, is anticipated to have fast growth.

The market for cosmetic chemicals in Europe is anticipated to increase by 5.28% CAGR between 2026 and 2035 as a result of ongoing R&D expenditures, rising individual disposable income and purchasing power, and growing consumer desire for cosmetics made with natural components.

North America held the largest share of the cosmetic chemicals market during the forecast period.

- In June 2025, the launch of Esmeri CC1N10, a high performance, readily biodegradable cellulose ester micro-powder for color cosmetics was announced by Eastman, a global specialty materials company. Sourced from sustainably managed forests, Esmeri is designed to meet stringent EU regulations for synthetic polymer microparticles that fully biodegrade and do not persist in the environment.

US' Eastman launches Esmeri CC1N10 for colour cosmetic - AlchemPro

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

- In September 2024, the opening of first facility for cosmetic ingredients in Chennai, located in Tamil Nadu, India was announced by Symrise. The state-of-the-art manufacturing site will blend a wide range of high-quality ingredients for the Indian Market. It represents an important milestone in Symrise's growth strategy in the Asia Pacific region.

Symrise Cosmetic Ingredients inaugurates manufacturing facility in Chennai, India - Symrise

Key Market Developments

- In January 2020, BASF SE introduced new skincare active ingredients and displayed its actives portfolio, which includes Inolixir, bioactive compounds for cosmetic applications, Hydagen Aquaporin, and Hydrasensyl Glucan. Hydagen Aquaporin, Hydrasensyl Glucan, and Inolixir were created as skin moisturisers, while Hydrasensyl Glucan helps to create healthy skin and provides a calming sensation.

Key Market Players

- SOLVAY SA

- Croda International PLC

- Evonik Industries AG

- Stepan Company

- Symrise

- Ashland Inc

- Dow

- Givaudan

- Eastman Chemical Company

- Lonza Group

- Lanxess

- The Dow Chemical Company

- BASF SE

- P&G Chemicals

- Bayer AG.

- Cargill Incorporated

Recent Developments

- In December 2024, the successful launch of new Beauty ColLABoration House near Los Angeles, marking a new era in cosmetic innovation was announced by Lucas Meyer Cosmetics by Clariant.

(Source:https://www.clariant.com ) - In April 2025, a portfolio of natural based ingredients with three new products for personal care solutions while not compromising on performance Verdessence Maize, a natural styling polymer, Lamesoft OP Plus, a wax based opacifier dispersion, and Dehyton PK45 GA/RA, a betaine derived from Rainforest Alliance Certified coconut oil was launched by BASF.

BASF launches natural-based innovations for personal care at in-cosmetics Global 2025

Segments Covered in the Report

By Product type

- Surfactants

- Emollients & Moisturizers

- Film-Formers

- Colorants & Pigments

- Preservatives

- Emulsifying & Thickening Agents

- Single-Use Additives

- Others

By Application

- Skin Care

- Hair Care

- Makeup

- Oral Care

- Fragrances

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content