What is the Cosmetic Pigments Market Size?

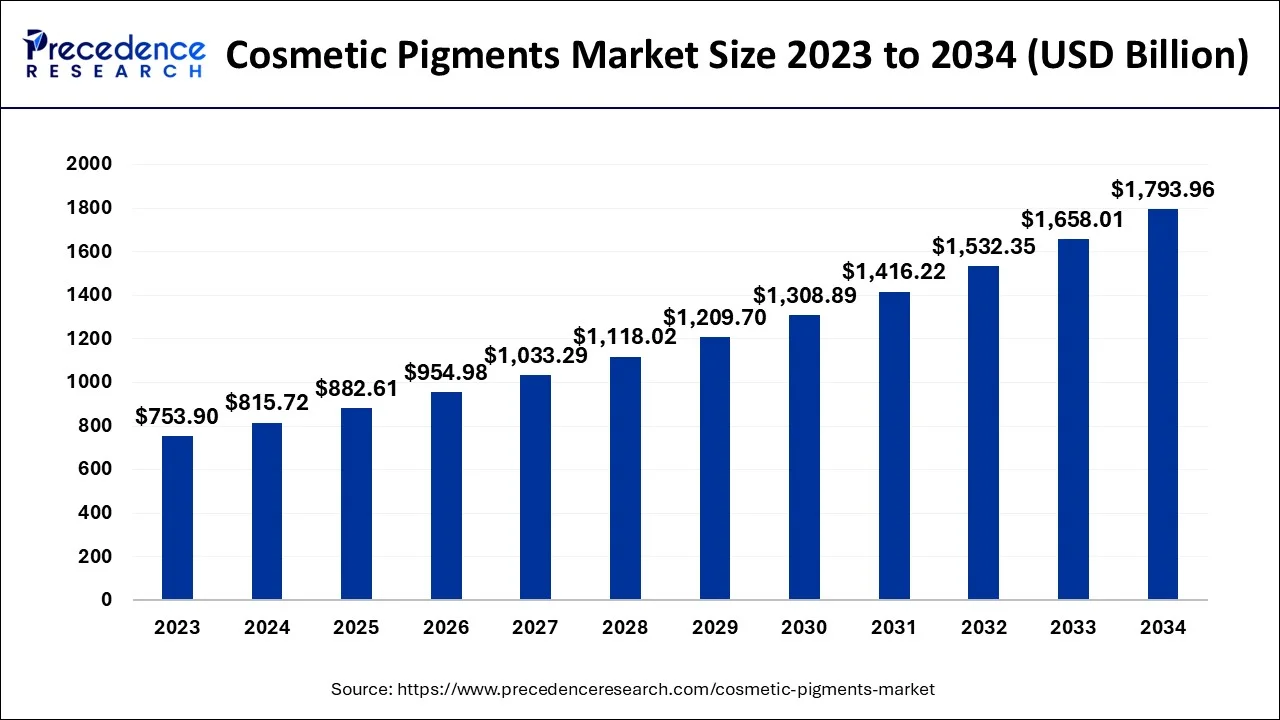

The global cosmetic pigments market size is estimated at USD 882.61 billion in 2025 and is predicted to increase from USD 954.98 billion in 2026 to approximately USD 1,923.05 billion by 2035, expanding at a CAGR of 8.10% from 2026 to 2035.

Cosmetic Pigments Market Key Takeaways

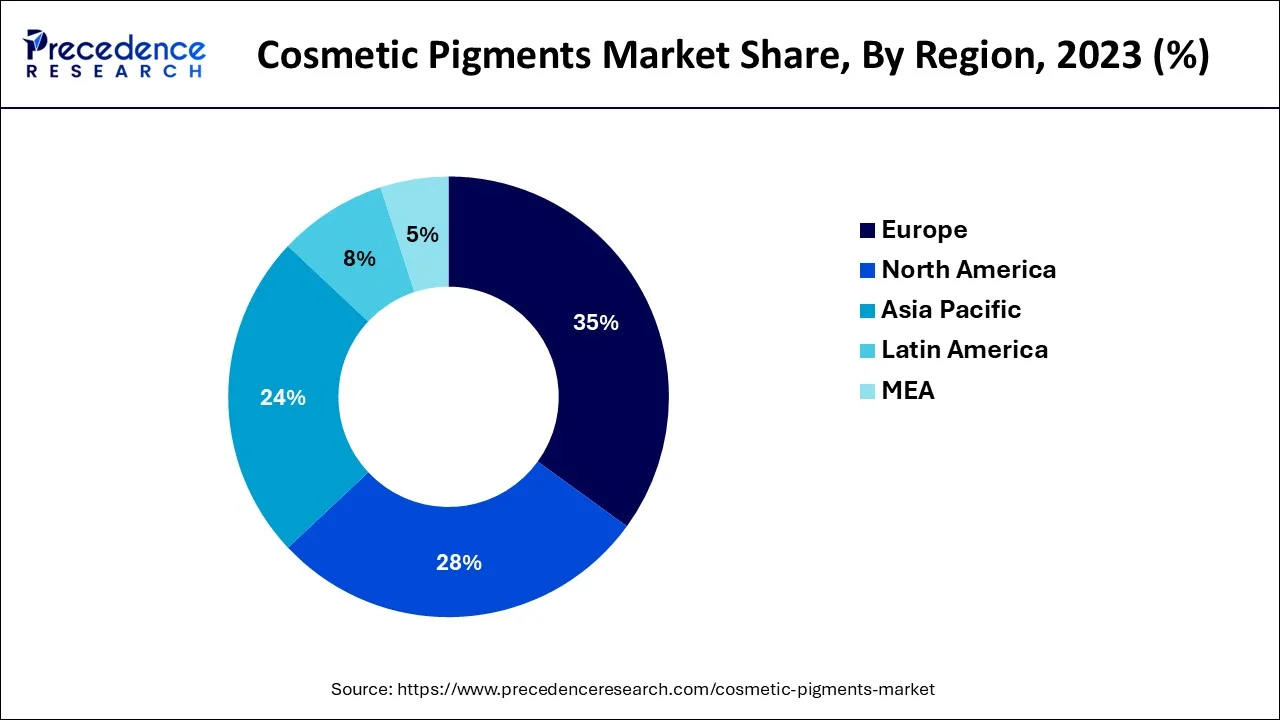

- The Europe region contributed 35% of the revenue share in 2025.

- By elemental composition, the inorganic pigments segment has contributed the highest revenue share in 2025.

- By application, the facial makeup segment has captured the largest market share in 2025.

- By geography, Europe accounted largest market share in 2025.

What is the Cosmetic Pigment?

A colored substance that is insoluble in water or almost insoluble in water is referred to as a pigment. In contrast to dyes, which are typically organic substances, pigments are inorganic substances. Lapis lazuli, ochre, and charcoal are a few examples of ancient and modern pigments. Cosmetic pigments add a variety of colors, textures, and looks to cosmetic products. Cosmetic pigments come in a variety of hues, as well as white pigments, metallic tones, and other substances. They are used to create personal care items like skincare, nail polish, hair color, and lip care.

Based on their chemical makeup, cosmetic pigments are separated into two categories: organic pigments and inorganic pigments. Carbon chains make up organic pigments, giving them a brighter hue than inorganic pigments. A variety of inorganic pigments with different chemical compositions, including iron oxides, ultramarines, chromium dioxides, white pigments, and others, are employed in the formulation of cosmetic products. Black, red, and yellow is the three colors of iron oxide. These can be found in blushers, face powders, and liquid foundations. Cosmetics frequently contain white pigments like titanium oxide and zinc oxide. These pigments are incredibly light, heat-resistant, and have great covering power. Ultramarines are flat, powerful, matte pigments with vivid colors that are manufactured to a high level of perfection and adhere to all cosmetic standards. Among the cosmetic items that contain them are lipsticks, correctives, foundations, and colored eye shadows. They are crucial in the creation of cosmetics.

The market is being driven by both the efficient and excellent qualities of cosmetic pigments, as well as the rapid expansion of specialized applications using them globally.

How is AI contributing to the Cosmetic Pigments Industry?

AI remarkably propels the development cycle of cosmetic pigments to formulate design, stability prediction of pigment, processing efficiency optimization, virtual try-on facilitation, shade matching accuracy enhancement, eco-friendly pigment discovery support, personalization enrichment, waste material reduction, and safety validation fortification.

Cosmetic Pigments Market Growth Factors

Cosmetic pigments have a sheen, shimmer, and shine that is bright and brilliant. These pigments are made up of colored, colorless, or fluorescent particles. They could be finely powdered organic or inorganic substances. Typically, they are insoluble and unaffected by the chemically integrated medium. They can be found in many different items, including nail paint, lip products, eye products, and facial makeup. Cosmetic pigments, particularly pearlescent pigments, are used in facial cosmetics to cover imperfections and uneven skin tone.

- The growing demand for high-performance pigment.

- Increasing disposable income.

Market Outlook

- Industry Growth Overview: The increasing demand is mainly caused by the factors of awareness of the consumers, various preferences in terms of shades, and the continuous innovations of new cosmetic products.

- Sustainability Trends: The whole industry will witness a lot of changes as natural pigments, ethical sourcing, cleaner formulations, and environmentally responsible manufacturing will be the main concerns of the industry.

- Global Expansion: The demand for advanced cosmetic pigments in North America and Europe will continue, while the market in Asia-Pacific will be the main contributor to the global growth of this sector.

- Major Investors: The Focus of Innovation-driven Pigment Investments is Envisaged as a Joint Venture among the Investors: Sudarshan Chemical, Sun Chemical, Clariant, Merck, BASF, DIC Corporation, and Sensient Cosmetic Technologies.

- Startup Ecosystem: Unexpectedly, startups will be able to secure funding through AI personalization, skin analysis technologies, and clean beauty pigment innovations.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 882.61Billion |

| Market Size by 2035 | USD 1,923.05 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.10% |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered |

|

| Regions Covered |

|

Market Dynamics

Key Market Drivers

- Escalating need for high-performance pigment - Global need for high-performance and specialty pigments is what is driving the market for cosmetic pigments. The growing demand for cosmetic pigments in personal care products will also have a significant impact on the market's expansion. In addition, the expanding fashion and entertainment sectors are a key element boosting the market for cosmetic pigments. Additionally, the market forces that will further accelerate the expansion of the cosmetic pigments market are the fast-expanding demand for organic pigments. The increasing emphasis of manufacturers on the adoption of cutting-edge technology is another important factor that will moderate the growth rate of the cosmetic pigment market.

- An increase in available funds and a change in lifestyle - The market for cosmetic pigments will experience a slower rate of growth due to changing lifestyles and rising disposable income. As growing economies like China, India, and Brazil see an increase in their GDP, so do their standards of living. The demand for beauty and personal care products is expanding sharply as a result of rising income levels and altering lifestyles brought on by urbanization.

Key Market Challenges

- Maintaining the quality of the pigments - The market for cosmetic pigments is growing as a result of the rising demand for color cosmetic products, but there are still a number of limitations that business participants must deal with. The main challenge that producers of cosmetic pigments have is maintaining the quality of pigments for mass-market products like nail paints, lip colors, and eye makeup items. It is necessary to evaluate a raw material's quality before using it to create cosmetic pigments. The mass-produced, high-grade color cosmetics for the mass market are occasionally of poor quality. The value of the cosmetic pigment used has a significant impact on the demand for these expensive goods. Cosmetic pigment manufacturers and processors are required to use only the best pigments.

Key Market Opportunities

- Increasing sustainable and environmentally safe pigments for cosmetics - Even now, cosmetics still contain substances that contain dangerous compounds. These substances could be harmful to human health and are anticipated to raise the risk of health issues. As a result of growing public interest and market shifts in the markets for cosmetic pigments, cosmetics producers are searching for more natural and environmentally friendly cosmetic emulsifiers. For instance, there is a considerable demand for environmentally friendly, sustainably produced organic pigments. As a result, manufacturing firms are investing in the green market and implementing eco-friendly technologies. Throughout the forecast period, there is likely to be a considerable opportunity for market participants in the cosmetic pigments sector due to the rising demand for cosmetic pigments created with natural and organic components that are derived from renewable raw materials.

Segment Insights

Elemental Composition Insights

On the basis of elemental composition, the inorganic pigments segment accounted highest revenue share in 2022. White opaque inorganic pigments are used to brighten and opacify other colors by adding opaqueness to them. These pigments' color intensity is less intense than that of organic pigments. As a result of its widespread use in all cosmetic pigment applications, inorganic pigments like titanium dioxide are in high demand, fueling the expansion of the cosmetic pigments market in this sector.

Throughout the projection period, it is anticipated that the organic pigments segment will expand significantly. Through the projection period, it is anticipated that rising consumer preferences for the usage of dark and vivid colors, notably in nail polish, eyelashes, and lipsticks, together with the low environmental effect, will fuel the demand for the product.

Application Insights

On the basis of application, the facial makeup segment has generated the largest market share in 2022. The market for this application is anticipated to be driven by escalating demand for foundations and face powders, which are basic makeup items. Face makeup dominates the market for cosmetic pigments. Cosmetic pigments used in facial cosmetics products including foundation, blushers, and powders are brightened by titanium dioxide.

Regional Insights

What is the Europe Cosmetic Pigments Market Size?

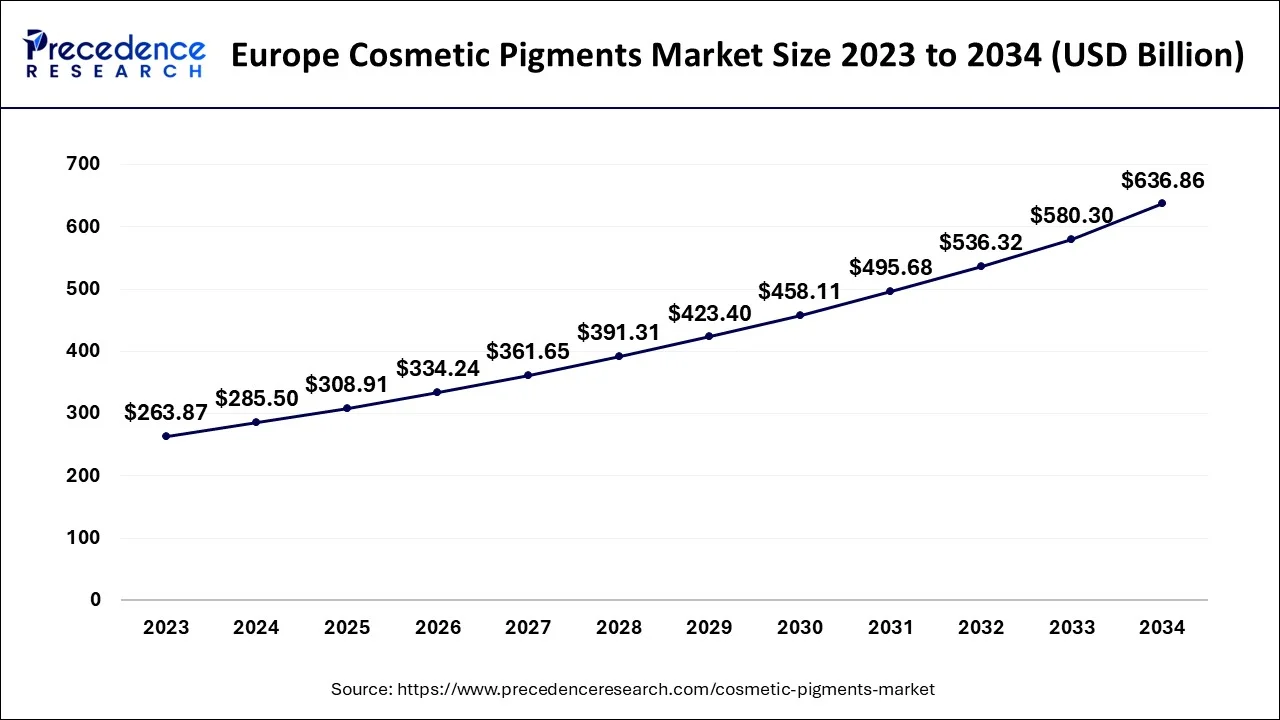

The Europe cosmetic pigments market size is estimated at USD 308.91 billion in 2025 and is expected to be worth around USD 685.03 billion by 2035, rising at a CAGR of 8.29% from 2026 to 2035.

On the basis of geography, Europe has garnered the highest market share in 2023. The market for cosmetic pigments in Europe is expanding as a result of rising urbanization, a greater awareness of personal grooming, and the value of looking presentable, as well as worldwide trends like resource concern, individualization, and digitization. With a share of about 35% in 2023, Europe led the market as a whole. Over 20,000 businesses, mostly in Italy, Spain, and France, operate on the wholesale side of the cosmetics industry in Europe. A Cosmetics Europe survey indicated that 88% of people find it difficult to live without cosmetics, 33% of women find it impossible to live without foundation or concealer, 25% of men find it difficult to live without aftershave, and the market for cosmetics pigment is growing as a result.

In Asia Pacific, the market for cosmetic pigments is divided into China, Japan, India, South Korea, and the Rest of Asia Pacific. Due to rising personal affluence, the Asia Pacific cosmetics and personal care market is expanding quickly. The market for cosmetic pigments in this region is being driven by changing lifestyles and the desire for high-quality cosmetic and personal care products.

How is North America Performing in the Cosmetic Pigments Market?

North America is expected to grow at a significant rate during the forecast period. The rise of the North American market can be explained by the need to use clean beauty, awareness of safety, the influence of social media, and good research on pigment. It is also helpful in the direct accessibility of high-performance, natural, and organic color solutions that are highly underpinned by the robust research ecosystem and quick technology adoption.

U.S. Cosmetic Pigments Market Trends

The US cosmetic pigments market is strengthened by the superior research, implementation of clean beauty, and digital innovation. The brand's core values of the brands include safe and high-performance pigments, inclusion of a broad range of shades, and sustainable sourcing and AI-assisted personalization, which is also supported by informed purchasers and product discovery through influencers.

Value Chain Analysis of the Cosmetic Pigments Market

- Feedstock Procurement: This is the initial step in the process, which entails the identification of reliable suppliers who will supply the raw materials and ingredients used in the manufacture of cosmetic pigments.

Key players: BASF SE, Dow Inc., SABIC, ExxonMobil Chemical - Chemical Synthesis and Processing: It occurs in the stage where the raw materials are converted to pigment compounds under regulated chemical reactions and processing activities.

Key Players: Mitsubishi Chemical Corporation, Anupam Rasayan - Compound Formulation and Blending: The pigments, binders, and additives are combined in a highly specific manner to achieve the desired cosmetic color performance.

Key players: Estée Lauder, L'Oréal, Procter & Gamble (P&G), Coty Inc. - Quality Testing and Certification: Pigments are given a rigorous testing process in which their safety, regulatory, and quality requirements are put into test and certified.

Key players: Intertek Group plc, SGS S.A., Bureau Veritas, Eurofins Scientific - Cosmetic Pigment Packaging and Labelling: Pigments are packaged safely with appropriate branding, precautionary instructions, and instructions for compliance with the laws.

Key players: Amcor plc, Berry Global Group, Inc., Sonoco Products Company

Cosmetic Pigments Market Companies

- Geotech: The company specializes in pearlescent, glitter, and carbon black pigments that are not only good-looking but also eco-friendly and have no microplastic content; the latter is their major selling point in the color cosmetics segment.

- Eckart: The company is on a mission to market and develop metallic and pearlescent pigments that would provide the spark, glow, and finish characteristic of premium quality.

- BASF: The company is the source of organic, inorganic, and effect pigments, offering cutting-edge and eco-friendly equipment in the area of coloring in cosmetics.

Other Major Key Players

- Lanxess

- Venator

- Nihon Koken Kogyo

- Ferro Corporation

- Dayglo Color

- Elemental Srl

- Kolortek

- Sandream Impact

- Chem India Pigments

- Yipin Pigments

- Sun Chemical

- Toyal

- Kuncai Europe

- Kobo Products

- Sensient Cosmetic Technologies

- Merck

- Vibfast Pigments

- Neelikon

- Miyoshi Kasei

Recent Developments

- In May 2025, Eckart's SYNCRYSTAL Platinum, a mineral-based pigment, offers intense metallic effects without aluminum, suitable for water-based formulations. Safe for lips, eyes, and nails, it enables diverse metallic shades like silver, pink, blue, and green.

(Source: https://www.globalcosmeticsnews.com ) - In February 2025, Ronaflux pigments are a unique innovation in personal care, offering high performance without color dilution. Easy to process and stable, they enhance color intensity for various cosmetic applications, marking a significant advancement in pigment technology.

(Source: https://cosmeticsbusiness.com ) - In June 2019 –Leading chemical solutions provider BASF formed a strategic alliance with UK-based start-up siHealth Ltd to market satellite and optronic products with a scientific foundation to the global personal care market. The collaboration should speed up BASF's goods while also enabling new technological advancements in the personal care sector.

Segments Covered in the Report

By Elemental Composition

- Inorganic Pigments

- Organic Pigments

By Application

- Facial Makeup

- Eye Makeup

- Lip Products

- Nail Products

- Hair Color Products

- Special effect & Special Purpose Products

- Others

By Type

- Special Effect Pigments

- Surface Treated Pigments

- Nano Pigments

- Natural Colorants

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting