What is Cosmetic Ingredients Market Size?

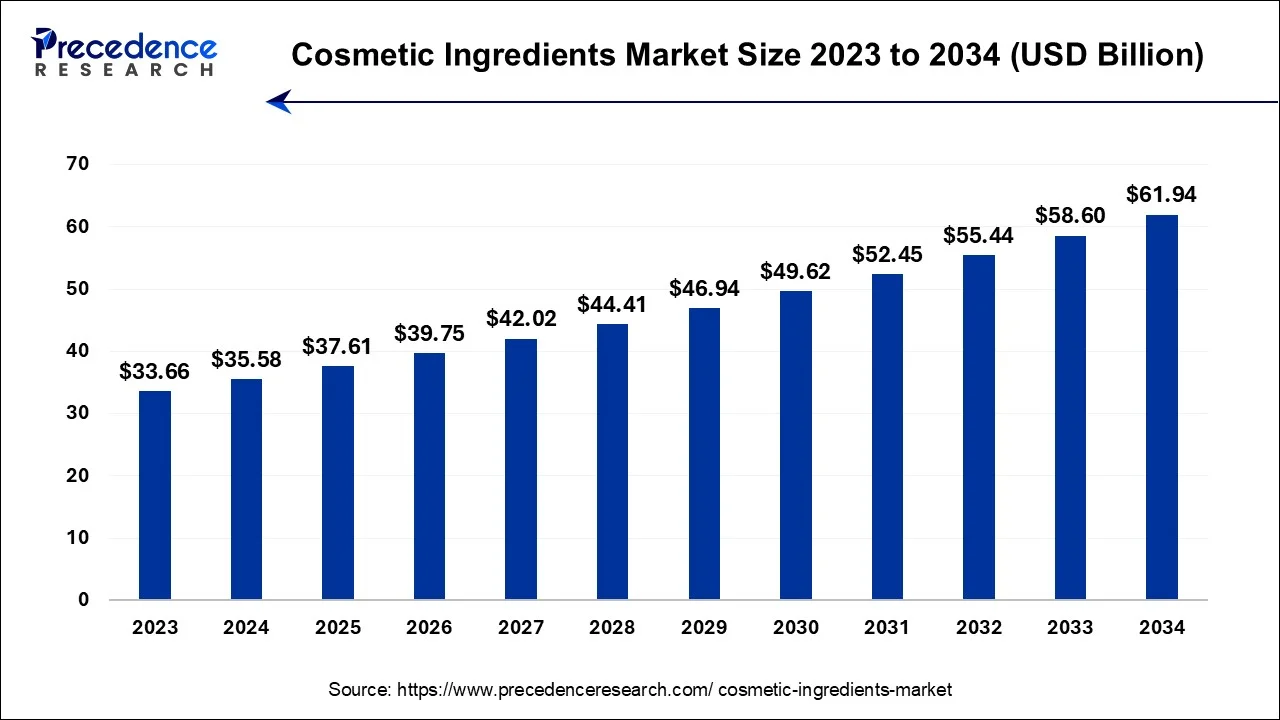

The global cosmetic ingredients market size accounted for USD 37.61 billion in 2025 and is anticipated to reach around USD 65.16 billion by 2035, expanding at a CAGR of 5.65% between 2026 to 2035.

Market Highlights

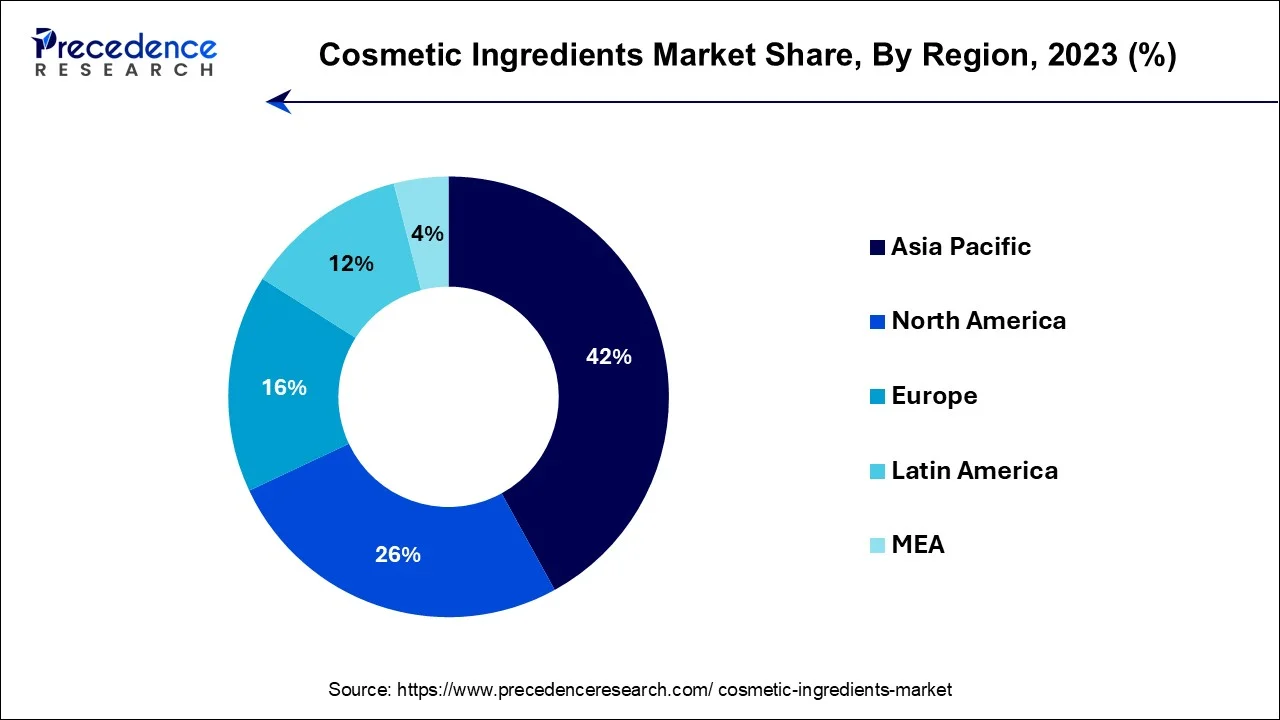

- Asia Pacific led the market in 2025 with the largest share.

- The North America is projected to host the fastest-growing market in the coming years.

- By ingredient type, the natural segment held a dominant presence in the market in 2025.

- By ingredient type, the synthetic segment is expected to grow at the fastest rate in the market during the forecast period of 2026 to 2035.

- By product type, the surfactant segment accounted for a considerable share of the market in 2025.

- By product type, the botanical extract segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By functionality, in 2025, the cleaning agents & foamers segment led the global market.

- By functionality, the moisturizing segment is projected to expand rapidly in the market in the coming years.

- By end-user, the skin care segment dominated the global market in 2025.

- By end-user, the oral care segment is projected to grow at the fastest rate in the market in the future years.

Market Overview

Cosmetic ingredients are the elements that go into the creation of cosmetic goods like body lotions, eyeliners, lipsticks, moisturizers, and lotions with sunscreen. Water, moisturizers, preservatives, emulsifiers, thickeners, lubricants, pigments, and perfumes are some of the substances used in cosmetics. Ingredients for cosmetics can be created synthetically or obtained from natural sources like items derived from plants. They are utilized to give cosmetic products anti-oxidant, anti-inflammatory, thickening, and moisturizing characteristics.

They are additionally employed to improve the texture and appearance of cosmetic goods. Green cosmetics that are beneficial to the environment have been developed as a result of growing awareness of clean-label cosmetic goods. Manufacturers of cosmetic ingredients work hard to develop new products and components while also conducting considerable research and development in order to satisfy consumer demands. Asia Pacific is predicted to have the highest demand for products made with organic components, which will in turn significantly fuel the expansion of the global cosmetics ingredients market over the course of the next five to six years.

Nowadays, customers choose to use fully natural and herbal personal care and cosmetic products because they don't include any dangerous chemicals that could hurt their skin. Major producers and players in the worldwide cosmetic ingredients market have taken notice of the growing demand for herbal cosmetic products and are progressively developing new lines of herbal components, mostly in developed regions like North America and Europe.

Cosmetic Ingredients Market Growth Factors

- Rising demand for vegan and cruelty-free products is driving innovation in ingredient sourcing and formulation.

- Increasing focus on personal grooming and self-care routines among consumers is boosting the usage of cosmetic ingredients.

- Advancements in biotechnology are leading to the development of sustainable and effective ingredients in cosmetics.

- Growing popularity of online retail channels is facilitating greater access to a wider range of cosmetic ingredients and products.

- Regulatory support for organic and natural formulations is encouraging manufacturers to adopt cleaner ingredient standards.

- Expanding consumer awareness of clean beauty trends is driving demand for products free from harmful chemicals.

- Rising disposable incomes in emerging markets are enabling consumers to spend more on premium cosmetic products and ingredients.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 37.61 Billion |

| Market Size in 2026 | USD 39.75 Billion |

| Market Size by 2035 | USD 65.16 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.65% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

- Increase in product introductions and consumer awareness - The necessity to meet consumer demand has prompted cosmetics firms to create new product lines in response to rapid urbanization and growing consumer interest in natural ingredients. For instance, Quench Botanic announced the introduction of four new skincare products in May 2022, each of which has Birch juice as its main ingredient. Additionally, Mug Guard, a facial sunscreen that lessens the look of wrinkles and skin discoloration, was launched in June 2022, according to a statement from the sun-care company Dune. In addition, Olay asserts that three new body-washing products with vitamin B3 complex were announced by the company in April 2020. Such product launches will assist the expansion of the cosmetic ingredients market throughout the forecast period by enabling the effective use of natural cosmetic ingredients in the cosmetics and personal care sector to develop a variety of product lines in skincare and body care.

- Promotional programs for oral care products - In addition to skincare and body care, cosmetic ingredients are quite useful in oral care products like toothpaste and gel for their cleansing properties. The rising prevalence of the periodontal disease has prompted businesses to launch campaigns to promote and make oral care products easily accessible. For instance, Proctor & Gamble started a campaign in January 2021 with the goal of enabling 2 billion people to develop good dental hygiene practices. Additionally, in May 2021, EPL and Unilever collaborated on a sustainable project that would make it possible for people to easily get Unilever's oral care products. The initiatives will boost both demand for and production of oral care products, which will accelerate the use of cosmetic ingredients in their manufacture and favorably affect the development of the cosmetic ingredients market throughout the course of the forecast year.

Challenges

- Hazardous effect - Both cancer and chapped skin can develop from synthetic or chemical cosmetic ingredients that are particularly harmful to human skin, such as sodium lauryl sulfate, propylene glycol, and methyl. Governmental organizations have established a few regulations to stop these damaging skin effects. For instance, the National Industrial Chemicals Notification and Assessment Scheme of the Australian Government restrict the use of chemicals in cosmetics. Additionally, the Cosmetic Directive of the EU forbids the use of specific synthetic cosmetic components in cosmetics. Such laws could restrict the use of synthetic components in cosmetics and personal care products, which could hinder the industry's expansion and limit the market size for cosmetic ingredients over the projection period.

Opportunity

Rising middle-class population

The market for cosmetic ingredients is expected to benefit greatly from the growing middle class in emerging economies, particularly in the Asia Pacific. According to the European Commission, the global middle class now represents over half of the world's population, growing from 1.8 billion in 2009 to 4 billion by 2021, and is projected to reach 5.3 billion by 2030. This surge in the middle class is expected to drive demand for premium personal care and cosmetic products, fuelling the growth of cosmetic ingredients. Additionally, reports from the World Bank indicate that the Asia Pacific region alone is home to nearly 54% of the global middle class, and the rising disposable incomes in countries like China, India, and Indonesia are leading to increased consumer spending on beauty and personal care products. Furthermore, urbanization trends and a preference for natural, eco-friendly products are likely to further drive the market's expansion, presenting significant growth opportunities for manufacturers in the coming years.

Segment Insights

Ingredient Type Insights

The synthetic segment is expected to grow at the fastest rate in the cosmetic ingredients market during the forecasting period, due to its availability, low cost and relatively stable in store formulations. They provide manufacturers with stability in the performance of the products and are longer lasting compared to naturally occurring compounds such as, preservatives, emulsifiers, and surfactants. Additionally, the increasing utilization of superior technologies in creating synthetic cosmetic products such as peptide and polymer from laboratory formations is also expected fuel the market.

Product Type Insights

The surfactants segment held the largest share in the cosmetic ingredients market during the forecasting period, due to their cleaning, foaming, and emulsifying abilities that are used widely in products such as shampoos body washes and facial cleaners. This is mainly due to the increasing consumers' attention to the dual role of cosmetic products, cleaning and moisturizing. They also point to the growth in consumer awareness of personal hygiene coupled by growth in per capita products consumption in developing countries. Moreover, transition to mild and plant-derived surfactants have risen significantly due to the rising concern for environment friendly and skin-kind ingredients.

The botanical extracts segment is projected to grow at the fastest rate in the market in the coming years, owing to the increasing shift towards natural and organic products. These extracts are obtained from plants and are acidic in nature, and useful for their antioxidant, anti-inflammatory and skin soothing properties. This makes them ideal for products used on problematic, mature or sensitive skin. Furthemore, the Current trends in wellness or ‘clean' and ‘green beauty' have prompted manufacturers to include plant actives into their formulations, thus fuelling the segment in the coming years.

Functionality Insights

The cleansing agents & foamers segment dominated the cosmetic ingredients market, due to the rising demands for skin treatment and personal care products. People turning to skincare routines and washing their faces frequently coupled with increasing preference towards multi-use cleansing products, these ingredients have found a place. The population in urban areas is growing and overall, consumers' expenditure on personal care products is higher, which in return has created demands for these cleansing agents. Sulfate-free and natural surfactant has become another segment contributing to the industry growth due to increasing consumer concerns for mild products. Additionally, the increasing needs for efficient and mild cleaning agents further boosts the segment.

The moisturizing segment is projected to grow at the fastest rate in the cosmetic ingredients market in the coming years, owing to the growing awareness toward hydration and anti-aging property in the skin care segment. This awareness is specifically expected to be driven among the population in the dryer climate regions of the world hence the need for more moisturizing ingredients. Moreover, the growing trend of product innovation, especially in the development of new products with active ingredients including hyaluronic acid, ceramides and glycerin which are known to have intense moisturizing properties, further propelling the segment.

End-user Insights

The oral care segment is projected to grow at the fastest rate in the market during the forecast years, owing to the periodontal diseases have been on the rise, and the general population's awareness of dental care has expanded. People are getting more conscious about the relation between oral health and general health, creating increased spending on superior oral hygiene products having added benefits such as activated charcoal, probiotics, and natural whitening formulas. Moreover, global companies including Proctor & Gamble and Unilever are also contributing towards facilitating and educating the community about better oral health.

Regional Insights

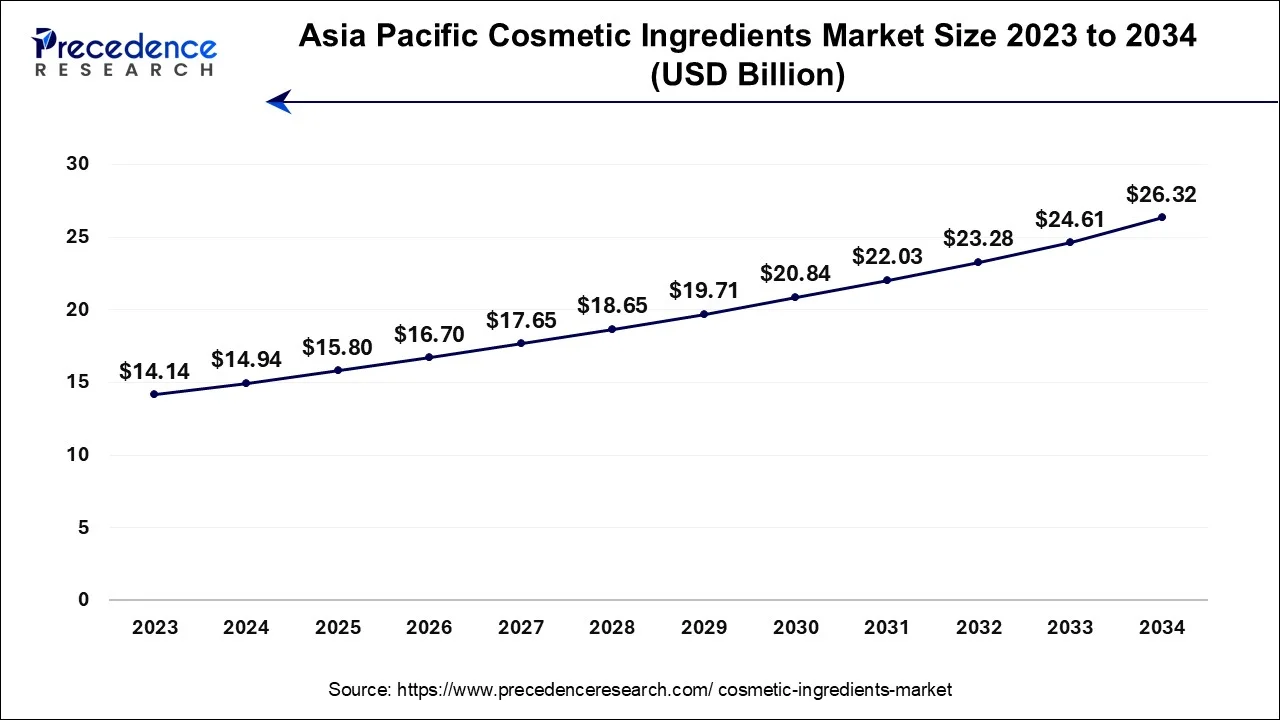

Asia Pacific Cosmetic Ingredients Market Size and Growth 2026 to 2035

The Asia Pacific cosmetic ingredients market size is estimated at USD 15.80 billion in 2025 and is expected to be worth around USD 27.77 billion by 2035, expanding at a CAGR of 5.8% between 2026 to 2035.

Asia-Pacific has captured the larget share of the cosmetic ingredients market in 2025. The region has seen a considerable increase in the use of beauty care goods, particularly skincare, as a result of the quick change in consumer lifestyle and the rising popularity of natural cosmetics. According to a statement made by L'Oréal, the company's active cosmetic product sales in China increased by 13.4% in Q1 2022 compared to Q1 2021. The demand for cosmetic components serving as emulsifiers and preservatives in the area is being driven by the rising cosmetic product consumption in key Asia-Pacific nations like China, which will boost the market for cosmetic ingredients during the forecast period.

Additionally, the rising investment by key market players to strengthen their position in the region is anticipated to fuel the cosmetic ingredients market expansion in the region during the forecast period. For instance, in September 2025, Symrise proudly announced the opening of its first facility for cosmetic ingredients in Chennai, India. The state-of-the-art manufacturing site covers a total area of 1,788 square meters. It marks a crucial milestone in Symrise's growth strategy and will strengthen the company's position in Asia Pacific.

North America is expected to grow rapidly. The region is witnessing such expansion due to a combination of factors such as rising demand for anti-aging and beauty products, rising expansion of the e-commerce industry, rising focus on the development of new cosmetic ingredients, and growing consumer preference for natural and eco-friendly cosmetic ingredients. The strong presence of prominent cosmetic brands, coupled with the high disposable income of North American consumers, accelerates the region's growth in the cosmetic ingredients market in the coming years.

Moreover, the rising adoption of key market strategies by the key market players to such as acquisition and collaboration, is anticipated to propel the regional growth in the coming years. For instance, in March 2025, the Robertet Group, global leader in natural raw materials, announced a collaboration with Phenix en Provence, a pioneer in the development of upcycled ingredients. The partnership aims to combine their vision of sustainable innovation by developing new natural active ingredients for the cosmetics industry.

Cosmetic Ingredients Market Companies

- Clariant AG

- Solvay S.A.

- BASF SE

- Dow Chemical Company

- Eastman Chemical Company

- Croda International PLC

- Estee Lauder Company

- Ashland Global Specialty Chemicals

- Lonza Group Ltd.

- Wacker Chemie AG

Recent Developments

- In April 2025, Univar Solutions Brasil Ltda, a leading solutions provider to users of specialty ingredients and chemicals, announced that its Ingredients and Specialties (I+S) division's achievement as the sole distributor of Phenbiox's cosmetic ingredients in Brazil. The partnership with Phenbiox brings plant-derived cosmetic active and extract innovations to Univar Solutions' beauty care customers in Brazil.

- In March 2025, a UK-based fragrance house unveiled two new captive ingredients, Aromalide and Sandalwave, designed exclusively for CPL's perfumers. These innovative additions aim to strengthen the company's position in the fragrance industry.

- In September 2024, DSM-Firmenich, a Swiss-Dutch nutrition, health, and beauty firm, announced its plan to invest over USD 100 million in India, intending to expand its business and make India an export base for ingredients. The company expects India to be among its top three global markets in the next 5 years.

Segments Covered in the Report

By Ingredient Type

- Synthetic

- Natural

By Product Type

- Surfactant

- Emollient

- Polymer

- Oleo-chemical

- Botanical Extract

- Rheology Modifier

- Preservatives

- Antioxidant

- Emulsifier & Stabilizer

- Others

By Functionality

- Cleansing Agents & Foamers

- Aroma

- Moisturizing

- Specialty

- Others

By End Use

- Skin Care

- Oral Care

- Hair Care

- Body Care

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting