What is the Emulsifiers Market Size?

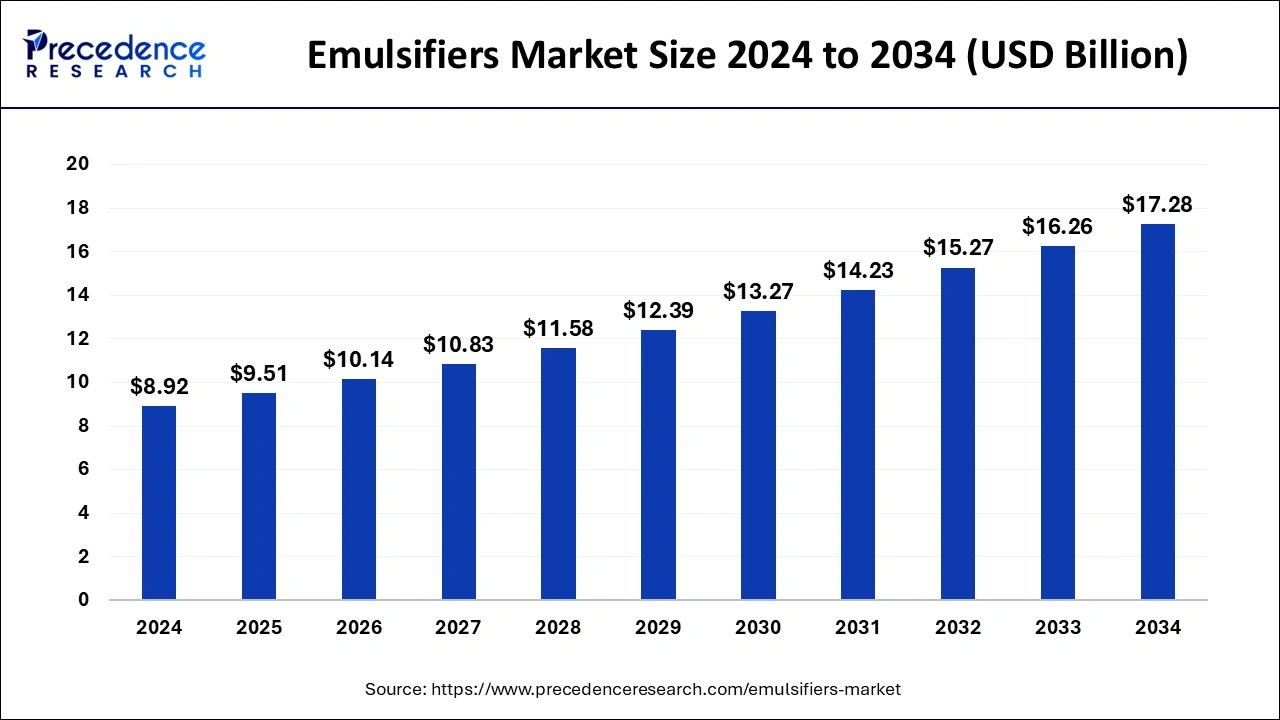

The global emulsifiers market size is calculated at USD 9.51 billion in 2025 and is predicted to increase from USD 10.14 billion in 2026 to approximately USD 18.28 billion by 2035, expanding at a CAGR of 6.75% from 2026 to 2035.

Emulsifiers Market Key Takeaways

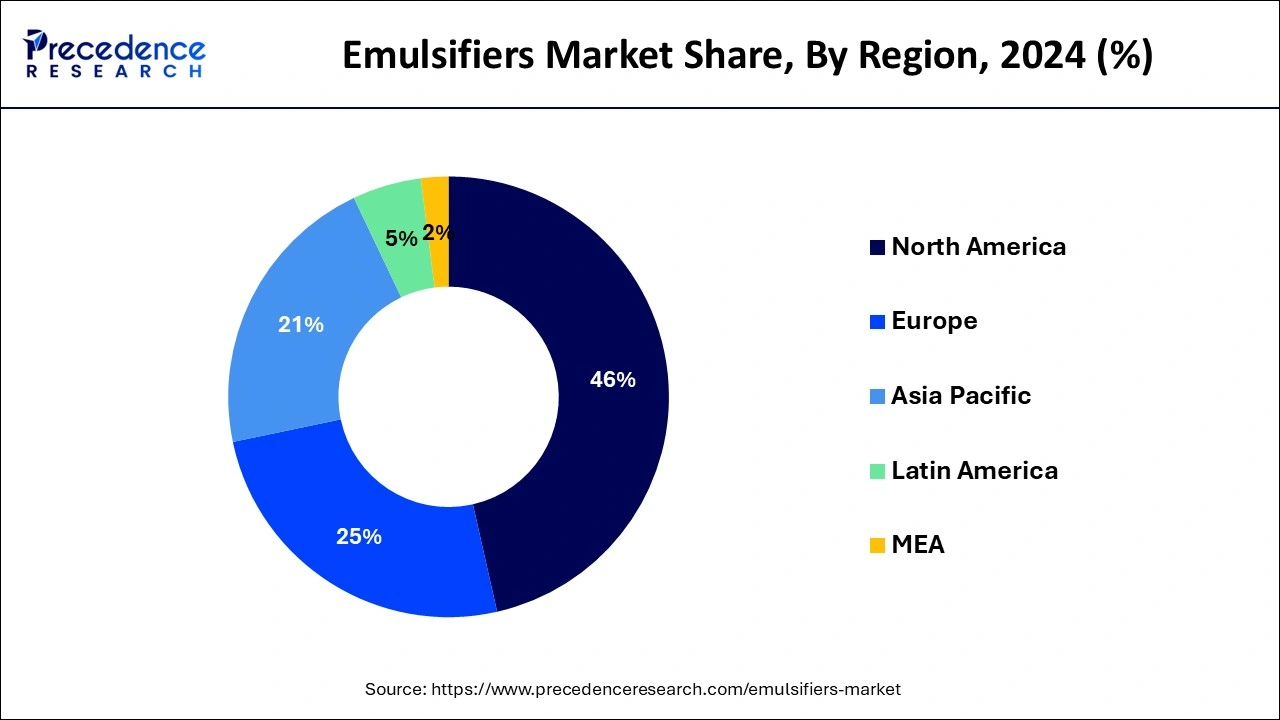

- North America led the global market with the highest market share of 46% in 2025.

- Asia-Pacific is predicted to be the fastest-growing CAGR from 2026 to 2035.

- By product, the mono and di-glycerides segment is predicted to grow at a significant CAGR from 2026 to 2035.

- By application, the baking segment is expected to expand at a remarkable CAGR between 2025 and 2035.

Market Overview

Emulsions combine two or more unblendable constituents that use external agents known as emulsifiers to get a firm kinetic state. They have broad applications in the food & beverages, cosmetic, and pharmaceutical industries. Oil companies are surveying oilfields to understand the endorsement of digitalized remedies to boost production ability. Some companies, like ABB and CGG, are taking part in exploring both onshore and offshore oil reservoirs.

70% of the earth's oil and gas is obtained from onshore sites, and the remaining 30% is from offshore oil deposits. The exploration of the onshore oil sector has been widespread, and most corporations have surveyed the bulk of onshore oilfields. The North American market is anticipated to grow at a higher CAGR between 2025- 2034. A notable number of bitumen emulsions is required to upkeep and repair these roads, increasing the need for emulsifiers. The United States government's new road construction scheme will also support the expansion of the bitumen emulsifiers industry.

Emulsifiers Market Growth Factors

Between 2025 and 2034, North America is expected to account for 50% of the international non-GMO protein market. In the decade, the cosmetics market has modified entirely. Customers quest for organic products with condensed ingredient lists and organic certification. Cosmetics formulators are researching to swap certain ingredients, for instance, obtained from petroleum or poisoned into the atmosphere, with natural and non-polluting remedies. Consumers believe in having more transparency and responsibility from brands that must reformulate or establish beauty goods.

Gellant gum business giants' investment will rise dramatically. It is a vegan thickener added to foods to create and retain a desired consistency and further added to various foods as an emulsifier and stabilizer. It is said to be an efficient food stabilizer.

The fast growth in urban development and the general population, particularly in evolving economies, is predicted to create a high need for the food emulsifier market. Ice cream is the only food designed, formulated, constructed, stored, circulated, and sold to be eaten and frozen. And this can be protected by managing the behavior of water and fat where the stabilizers and emulsifiers come into action. Numerous non-GMO soy protein applications in various industries are expected to increase demand.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 6.75% |

| Market Size in 2025 | USD 9.51 Billion |

| Market Size in 2026 | USD 10.14 Billion |

| Market Size by 2035 | USD 18.28 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product, By Source, and By Applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand for antibiotic-free meat replacement and the anticipated introduction of animal feeding initiatives are set to help increase demand. Growing user awareness of the health benefits of functional foods is significant to favorable trends in soy protein hydrolysate needs worldwide.

Restraints

High cost and government support

Fluctuations or volatility in the expense of raw materials and machinery apparatus pose a significant hazard to the market's growth. Furthermore, the uneven accessibility of raw materials at one location degrades the market's growth. The presence of alternatives at an affordable range will further derail the market growth rate. Increased financing from the federal government for R&D proficiencies is also strengthening the market's growth. R&D functions targeted towards sustainable development will ensure optimal and sensible use of resources, hence improving the market value.

Increasing health and environmental problems

Emulsifiers' increasing health and environmental problems are predicted to restrain the market, and the health hazards could force people to shy away from products consisting of emulsifiers. Specific proof has been found that dietary emulsifiers affect gut health by impairing intestinal barrier tasks, thus probably growing the incidence of inflammatory bowel disease and metabolic syndrome, which badly affects the human race. Thereby, the associated health problems could restrain the emulsifiers market in the future.

Opportunities

Global population growth is anticipated to be among the significant emulsifier market drivers. A population increase boosts the need for various foods, beverages, and other goods, driving the condition for emulsifiers. According to a study, the international food market is predicted to reach 60%-100% by 2050. In addition to protecting crops from pests, these mixtures raise crop yield and production. Natural gums are at the prominence of the trends in the cosmetics market.

Their adaptability can help replace multiple additives usually used for different roles and helps simplify formulas awaited by customers looking for better products. According to Lucie Birchler, a cosmetic expert in the R&D team of Alland & Robert, "the properties of natural gums are manifold: they can therefore be used to great advantage as emulsifiers, texturing agents, tightening agents, technological aids, film-forming agents, suspension agents, and sensory improvers."

Over the past two decades, the upsurge in the consumption of oil and petroleum products across the globe has been highly uncertain. The suspense illustrates the need and supply of petroleum-oil products, which push oil and gas production or derivation of new oil wells on a global scale.

Segment Insights

Product Insights

Based on products, mono-, di-glycerides & derivatives are widely consumed for manufacturing dairy and bakery items, which include ice creams, cakes, bread, and margarine. Due to its widespread use in the bakery industry, mono-, di-glycerides & derivatives product is expected to grow at a remarkable CAGR from 2025 to 2034. Stearoyl lactylates are expected to provide lucrative facilities in the international market. Owing to their extensive consumption for the production of pancakes, sauces, snacks, dietary products, and cream-based alcoholic beverages has enhanced the emulsifier market. The U.S. FDA renders safe services to all these products, even the need for the same will likely grow at the highest rate over the coming years.

Source Insights

Based on the source, the emulsifier industry is divided into three categories: animal, plant, and synthetic. Plant derivatives have dominated growth over the past decade. Gellan gum, xanthan gum, agar-agar, soy lecithin, as well as other emulsifiers are popular on the market. The soy lecithin segment is anticipated to grow at the highest CAGR from 2025 to 2034. Soy lecithin is a versatile and cost-effective emulsifier that is widely used in the food industry.

It is used in many products, such as chocolate, margarine, salad dressings, baked goods, and ice cream. In the pharmaceutical industry, soy lecithin is used as a coating agent for tablets, as well as in creams and ointments. In the cosmetic industry, it is used as an emollient and a skin conditioning agent.

Application Insights

The application segregates it into food & beverages, pharmaceuticals, personal care & cosmetics. In 2025, the most significant segmental market proportion was used in the food & beverages industry. The food sphere has experienced progress over the years, and in the modern world, favored by growing knowledge of food and its components along with the endorsement of technology by R&D method to find more ingredients to the end-production of food goods, the industry has identified a drastic alteration in the last couple of years.

Although some naturally sourced emulsifiers have existed for decades, market players have operated to draw up artificially enhanced emulsifiers that can offer additional advantages. By application, the baking and confectionery sector is predicted to increase at a considerable CAGR from 2025- 2034.

The requirement for innovative baked food products, notably gluten-free and with demonstrated prolonged shelf life, is one of the significant trends leading to the development of the bakery area. In addition, rising customer standard for nutritious and fibrous biscuits are an alternative trending feature of the food emulsifier market. These cases will likely upsurge the intake of natural ingredients, particularly emulsifiers, in the following couple of years.

Regional Insights

What is the U.S. Emulsifiers Market Size?

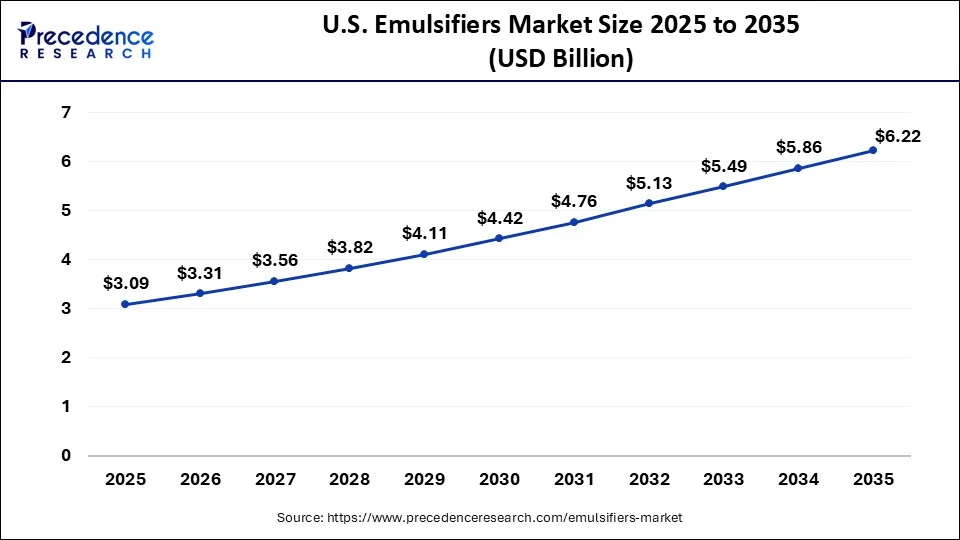

The U.S. emulsifiers market size was estimated at USD 3.09 billion in 2025 and is projected to surpass around USD 6.22 billion by 2035 at a CAGR of 7.25% from 2026 to 2035.

North America dominated the market worldwide in 2025. This is attributed to the substantial existence of food & beverages, pharmaceutical,cosmetics, and paints & oils firms in North America, which raise the need for emulsifiers. For instance, In 2022, food technology enterprise Benson Hill Inc. united forces with Denofa, a top Scandinavian protein maker, to encourage sustainable soy protein constituents in the Northern European aquafeed sector.

U.S. Emulsifiers Market Analysis

The U.S. consumer population is highly aware of personal care and prefers clean-label, natural, low-fat, and reduced-calorie food products. The U.S. FDA is committed to advancing a transparent and robust chemical-review program to maintain a safe and healthy food supply. In March 2024, the U.S. Department of Energy (DOE) announced $1.2 billion in funds for refining and chemicals companies to decarbonize manufacturing. All these factors contribute to the market in the U.S.

Rapid urbanization, advancement in modern farming mode, an increasing need for eco-friendly goods, and government help for crop production in the region are expected to push the regional market throughout the forecast time.

What Makes Asia Pacific the Fastest-Growing Region in the Emulsifiers Market?

Asia-Pacific was the central region in the emulsifiers market in 2025 and is projected to be the fastest-expanding territory in the projection period. The increased revenue could conduct advancement in Asia-Pacific in cosmetics in South Korea, which is one of the substantial providers of skincare and makeup goods with clients and consumers worldwide.

India Emulsifiers Market Trends

The market in India is growing, driven by the rapid expansion of the food & beverages sector. Technological innovations such as enzyme-assisted synthesis, microencapsulation, and AI-driven formulation tools also contribute to market growth. Government initiatives supporting food processing and chemical manufacturing also drive the market in India.

Why is Europe Considered a Notably Growing Region in the Emulsifiers Market?

Europe is expected to grow at a notable rate in the market, fueled by the expansion of plant-based alternatives, rising demand for clean-label and natural ingredients, and stringent regulatory frameworks promoting eco-friendly and safe products. Evolving EU food regulations reflect growing consumer expectations for sustainability, safety, and transparency, driving food businesses to adopt natural and innovative ingredient solutions.

What Drives the Emulsifiers Market in Latin America?

Latin America is expected to grow at a significant rate in the market, driven by the increasing adoption of processed and convenience foods and growing industrial and pharmaceutical demand for emulsifiers in advanced drug delivery systems. In October 2025, Palsgaard Brazil launched Emulpals cake mix emulsifiers, offering an innovative alternative to trans and saturated fats and highlighting the region's focus on healthier and functional ingredient solutions.

How is the Opportunistic Rise of the Middle East & Africa in the Emulsifiers Market?

The Middle East & Africa (MEA) is witnessing an opportunistic rise in the emulsifiers market due to growing consumer demand for packaged foods, ready-to-eat meals, and personal care products. Increasing local refining investments and the expansion of cosmetics, skincare, and hair care industries are driving demand for functional emulsifiers. Additionally, government-backed projects and foreign investments, such as funding from the UK Export Finance, are strengthening regional infrastructure and supporting market growth opportunities.

Emulsifiers Market Companies

- Arkema

- Eastman Chemical Company

- The Lubrizol Corporation

- Clariant

- LANXESS

- Lonza

- Stepan Company

- DSM

- Corbion

- Estelle Chemicals Pvt. Ltd.

- ADM

- Dow

- DuPont

- Cargill, Incorporated

- Kerry Group plc.

- Ingredion Incorporated

- Evonik Industries AG

- BASF SE

- Solvay

- Akzo Nobel N.V.

Recent Developments

- In 2022, the formation of a novel extrusion manufacturing plant in Serbia was reported by ADM, a global leader in human and animal nutrition. This occurred less than a period after ADM purchased SojaProtein, a European supplier of non-GMO soy components.

- In 2022, the launching of silver and gold metallic toners for the Cheetah 2.0 Series by Xeikon rendered printers and converters a competitive advantage, offering firms the possibility to add value. This considerable progress in digital foiling results from Xeikon's innovation approach, which highlights establishing more long-lasting, cost-effective, and application-particular solutions.

- In August 2021, Infineum, a UK-based specialty chemical business, signed a deal to obtain the ISCA UK emulsifiers business cell for an unrevealed amount. The agreement ensures ISCA UK's formulation proficiency and the ISCAMUL emulsifier hallmark. This acquisition constitutes Infineum's return to the emulsion explosive substance sector, where its current proficiency can be utilized to better serve existing and potential new customers.

- In Sep 2020, The Brazilian cell of U.S. commodities dealer Cargill built a new establishment to produce pectin, a fruit by-product used in jams, dairy products, beverages, and confectionery.

- In July 2020, Indian Oil Corporation advertised establishing a joint enterprise with Total, a French petroleum firm. This joint venture aims to manufacture and trade high-quality bitumen by-products and comparable specialty products for road construction deeds. This joint venture is expected to boost the market share of both partnering companies.

Segments Covered in the Report

By Product

- Lecithin

- Mono and Di-Glycerides

- Stearyl Lactylates

- Sorbitan Esters

- Polyglycerol Esters

- Other Products

By Source

- Animal

- Plant

- Synthetic

By Applications

- Food Emulsifiers

- Dairy

- Bakery

- Meat

- Others (Mayonnaise, Cheese)

- Cosmetics & Personal Care

- Creams & Lotions

- Makeup Components

- Personal Hygiene

- Oilfields Chemicals

- Drilling fluids

- Wetting fluids

- Gelling fluids

- Pharmaceutical

- Creams & Gels

- Medicines

- Agrochemicals

- Seed Coating

- Crop Protection

- Others (Paints & Polymers, Oil spill dispersants, Household)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting