What is the Food Emulsifiers Market Size?

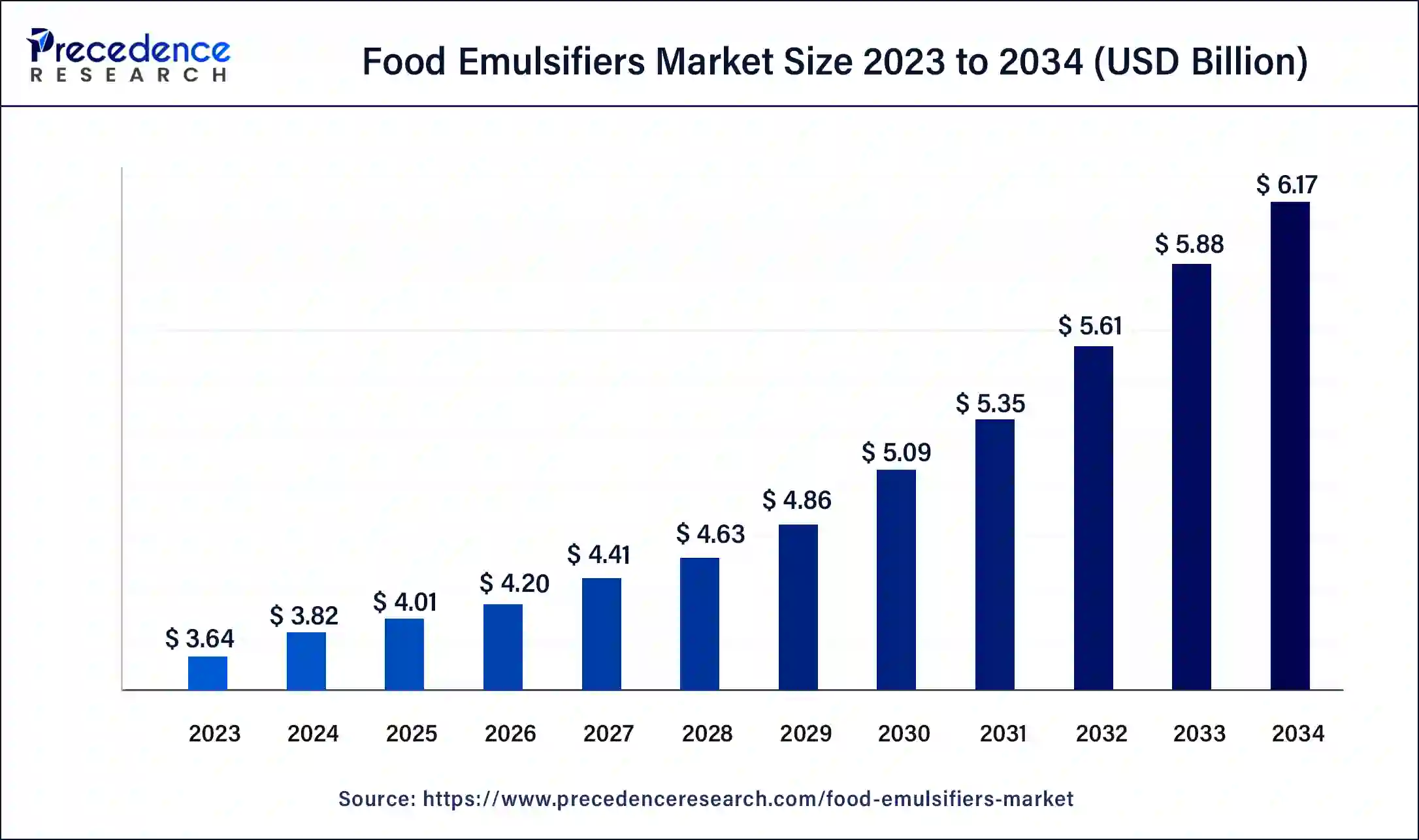

The global food emulsifiers market size was valued at USD 4.01billion in 2025, and is anticipated to hit around USD 4.20 billion by 2026, and is expected to be worth around USD 6.45 billion by 2035, at a CAGR of 4.87% from 2026 to 2035. Food emulsifiers improve texture and flavor, prevent separation in mayonnaise-like products, preserve processed food items, and improve flavor and aroma.

Food Emulsifiers Market Key Takeaways

- In terms of revenue, the market is valued at $4.01billion in 2025.

- It is projected to reach $6.45billion by 2035.

- The market is expected to grow at a CAGR of 4.87% from 2026 to 2035.

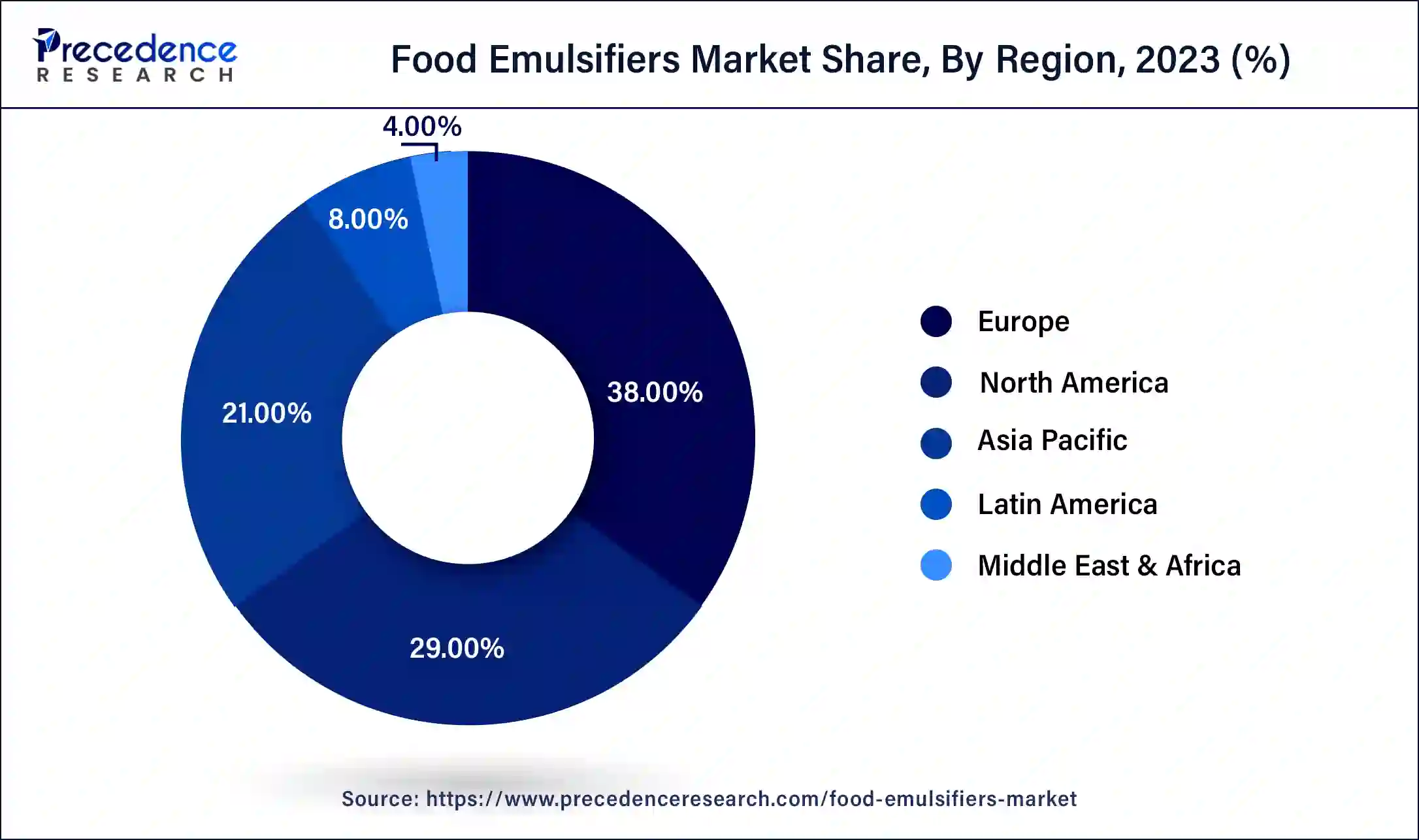

- Europe dominated the food emulsifiers market with the largest market share of 38% in 2025.

- Asia Pacific is estimated to be the fastest-growing during the forecast period of 2026 to 2035.

- By product, the mono-, di-glycerides & derivatives segment dominated the market in 2025.

- By product, the stearoyl lactylates segment is expected to grow significantly during the forecast period.

- By application, the bakery & confectionery segment dominated the food emulsifiers market in 2025.

- By application, the convenience foods segment is anticipated to grow significantly during the forecast period.

What are the Food Emulsifiers?

The food emulsifiers market refers to food emulsifier providers that are used to food and beverages to create consistent and smooth textures in foods that may otherwise normally coagulate or separate, like ice cream or mayonnaise. The food emulsifier is a substance that helps blend 2 ingredients together that do not generally mix like water and oil. Food emulsifiers are used in processed foods to help prevent the separation of water and oil components, increase their shelf life, and give them a smooth texture. Examples of food emulsifier products include sorbitan esters, stearoyl lactylates, lecithin, mono-, di-glycerides & derivatives, etc. These factors help to the growth of the market.

How is AI Changing the Food Emulsifiers?

AI is transforming the food industry, including the use of food emulsifiers. The benefits of AI in the food industry include improving traceability and visibility in the supply chain and ensuring that emulsifiers are sourced and delivered effectively. It can help develop emulsifiers modified to specific dietary preferences and needs, improve the nutritional profile of food products, and perform predictive maintenance. AI algorithms can improve the mixing and formulation processes of emulsifiers, increasing production efficiency and reducing waste; AI can analyze and monitor the production process in real-time and ensure emulsifiers are constantly produced to high-quality standards. This helps in maintaining the texture and stability of food products.

- In May 2024, a first-of-its-kind marketplace and discovery platform for proteins allows companies in many industries to use their machine learning (ML) and artificial intelligence (AI) capabilities to identify and test proteins from sweeteners and high-intensity sweeteners was launched by California-based startup Shiru.

Market Trends

- The increasing use of emulsifiers in foods industry to improve texture and improve their shelf life increasing the demand for the market.

- The growing demand from consumers for the integration of plant-based products in the diet increases the production of eco-friendly emulsifiers which increases the demand for the product.

- The increasing demand for functional foods and nutraceuticals uses natural food emulsifiers, which drives the demand by health-conscious consumers.

- The driving use of clean label and demand for natural emulsifiers increases the demand and is a growing trend in the market.

Food Emulsifiers Market Growth Factors

- The benefits of food emulsifiers include sometimes reduction of fat content and improved flavor & aroma to improve taste in chocolates.

- It also helps to extend shelf life and maintain freshness, enhanced texture, and stability, which helps the growth of the food emulsifiers market.

- Food emulsifiers are used in a high range of food products. Their applications include crystal modification, aerated foods like creamers, and cake batters, which are complex emulsions.

- Food emulsifiers can react with proteins in many foods and starch complexing, which helps the growth of the market.

Market Outlook

- Industry Growth Overview: The food emulsifiers market is growing due tp increase in processed food, which contributes to the emulsifier demand due to better stability, texture, and shelf performance.

- Sustainability Trends: Bio-based sourcing and enzymatic processing are given a high priority in the development of ingredients that have a low impact.

- Major Investors: Cargill, Archer Daniels Midland, Kerry Group, Corbion, Ingredion, BASF, and increase research.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 6.45Billion |

| Market Size in 2025 | USD 4.01 Billion |

| Market Size in 2026 | USD 4.20 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.87% |

| Largest Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for bakery and confectionary applications

The increasing demand for bakery and confectionary applications contributes to the growth of the market. Emulsifiers are used in a wide range of food applications, such as bakery and confectionery applications. Emulsifiers may be used to assimilate water and fat in ice cream, making a smooth texture. They can also enhance the shelf life and texture of vinegar, mix oil, and baked goods uniformly in mayonnaise and salad dressing. In lubrication, crystal modification, aerated foods like creamers and cake batters are complex emulsions. These factors help the growth of the food emulsifiers market.

Restraint

Downsides of food emulsifiers

The downsides of food emulsifiers include rising gut permeability and harm to the gut microbiome called leaky gut. A leaky gut allows bacteria to proceed from the gut wall into the bloodstream. Develop widespread inflammation, change mat metabolism, developing bowel syndromes such as colitis in rats, unequal gut microbes in mice, and the source is inflammation and weight gain. Cause obesity-related conditions like liver, type-2 diabetes, and cardiovascular diseases. High costs are linked with the emulsifier extraction from natural sources. These factors can restrict the growth of the food emulsifiers market.

Opportunity

Increasing investment in research and development

The increasing investment in research and development contributes to the growth of the market. Moving beyond the quick sips of emulsified drinks and jumping into sustained studies. Increasing high use of natural alternatives like Pickering stabilizers which are organic-based solid particles may support emulsions, biosurfactants, proteins and polysaccharides, saponins extracted from plants that have emulsifying properties, and phospholipids natural molecules found in soybeans and egg yolks may stabilize emulsions.

Segment Insights

Product Insights

The mono and di-glycerides & derivatives segment dominated the food emulsifiers market in 2025. The benefits of mono and di-glycerides & derivatives include these are generally classified as emulsifiers that enable for contribute to the overall product stability, help products to dissolve easily, keep ingredients dispersed, control crystallization, reduce stickiness, prevent separation and smooth mixing of ingredients. It is also considered a fat and lipid source.

The industrial applications include puff pastry, cake, and cream kinds of margarine. The mono and di-glycerides & derivatives create and stabilize emulsions in many food products like ice cream, margarine, salad dressings, and mayonnaise. These factors help the growth of the mono and di-glycerides & derivatives segment and contribute to the growth of the market.

The stearoyl lactylates segment is expected to grow significantly during the forecast period. Primarily, stearoyl lactylates are used to emulsify and stabilize properties in cosmetics and food. In food, stearoyl lactylates mix oil and water together and are highly used as crumb softeners and dough strengtheners in bakeries. When stearoyl lactylates are mixed with saturated and distilled mono glycerol, they are stable in food systems. These stearoyl lactylates work well for applications such as texturing and aerating low-fat foods.

Stearoyl lactylates have broad applications in pet food, mostarda di frutta, minced and diced canned meats, dietic foods, chewing gums, gravies, sauces, snack dips, dehydrated potatoes, cream liqueurs, creamers, powdered beverage mixes, sugar confectionaries, toppings, puddings, fillings, icings, desserts, instant rice, kinds of pasta, cereals, waffles, pancakes, and baked cooks. These factors help the growth of the stearoyl lactylates segment and contribute to the growth of the food emulsifiers market.

Application Insights

The bakery & confectionery segment dominated the food emulsifiers market in 2025. Emulsifiers like polysorbate 60, calcium stearoyl lactylates (CSL), sodium stearoyl lactylates (SSL), DATEM (Diacetyl Tartaric Acid Esters of Monoglycerides), mono- and di-glycerides, and lecithin. These are used in meat products, plant or vegetable-based artificial whipped cream, candies, and chocolate, preventing precipitation and stability of ice cream, fermented foods, etc. Food emulsifiers help to maintain the hydrophilic-lipophilic balance. These factors help to the growth of the bakery & confectionery segment and contribute to the growth of the market.

The convenience foods segment is anticipated to grow significantly during the forecast period. Emulsifiers such as vinegar and oil are used in foods to help stabilize mixtures that may generally be naturally separated. The use of food emulsifiers in the food industries provides a high range of benefits, including reduced fat content in some products, improved flavor & aroma, raised freshness & shelf life, and increased stability and texture in food products. These factors help to grow the convenience foods segment and contribute to the growth of the food emulsifiers market.

Regional Insights

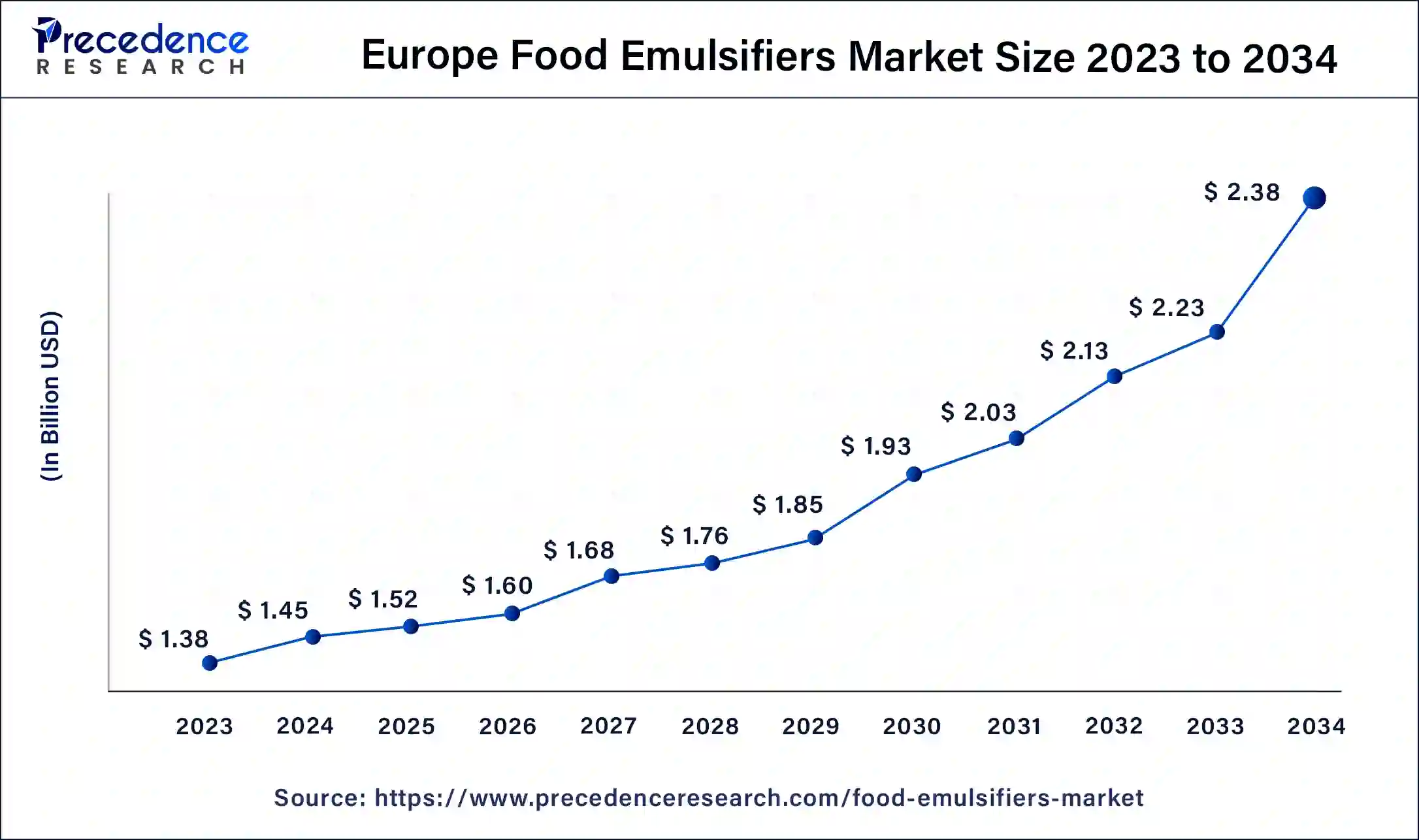

What is the Europe Food Emulsifiers Market Size?

The Europe food emulsifiers market size is exhibited at USD 1.52 billion in 2025 and is projected to be worth around USD 2.50 billion by 2035, poised to grow at a CAGR of 5.10% from 2026 to 2035.

Europe dominated the food emulsifiers market in 2025. Industrial expansion in France, Germany, and Eastern European countries contribute to the growth of the market in the European region. European region people demand food emulsifying agents, including sorbitan esters and stearoyl lactylates, for dairy and bakery applications, which contribute to the growth of the market. The alcoholic beverages production sector, increasing foreign investment, and rapid expansion contribute to the growth of the market. In March 2024, according to a report, European natural products still hold a high growth potential, including foods and supplements, which help the growth of the market.

Germany Food Emulsifiers Market Trends

Germany functions as a primary processing center that provides specialty organic-certified emulsifiers for the industry. The bakery and confectionery industry creates strong market demand for products. The research centers on developing vegan products together with gluten-free food options. The food manufacturing sector enhances its production process through high-shear processing technology and an automated system.

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2026 to 2035. The expanding consumer base for the food & beverage sector and rapid development contribute to the growth of the food emulsifiers market in the Asia Pacific region. China and India contribute to the growth of the market in the Asia Pacific region. The increasing popularity of veganism, rapid urbanization, and increasing demand for premium products and convenience foods contribute to the growth of the market.

- In October 2023, in milk and milk products, the addition of protein binders and any other ingredients was not permitted, as clarified by the FSSAI (Food Safety and Standards Authority of India). It will help to ensure that only pure products are sold in the market, and the dairy industries can use only emulsifiers that are FSSAI-specified.

China Food Emulsifiers Market Trends

Urbanization, combined with increased demand for convenience products, drives rapid expansion in China. Manufacturers show a growing preference to use natural emulsifiers. The food industry uses high volumes of sustainable production processes, which include baked goods, noodles, and confectionery items, together with sustainable bio-based extraction methods for domestic production growth.

What Are the Driving Factors of The Food Emulsifiers Industry in North America?

North America is expected to grow at a significant rate during the forecast period because it has an established food processing system combined with a high demand for processed food products. The choice of ingredients depends on clean-label requirements, which lead to the use of organic and natural emulsifiers. The food industry implements advanced manufacturing methods together with new product development for bakery products, dairy items, and ready-to-eat meals.

U.S. Food Emulsifiers Market Trends

The U.S. uses clean-label reformulation together with allergen-safe ingredient sourcing to establish its leadership position. The market shows increasing demand for sunflower-based and pea-based emulsifiers. The plant-based market growth, together with emulsifier innovation in bakery and frozen foods, creates better stability, texture, and shelf life according to current product development

Value Chain Analysis of the Food Emulsifiers Market

- Raw Material Procurement: Sourcing of sustainable and traceable oilseeds or animal fats that comply with purity, compliance, and functional performance specifications.

Key players: Archer Daniels Midland (ADM), Cargill, Wilmar International - Processing and Preservation: Refining, esterification, and distillation convert the raw materials to stable and high-grade emulsifiers.

Key Players: Cargill, BASF SE, Kerry Group, Palsgaard A/S, Corbion - Quality Testing and Certification: There is laboratory testing, purity of products, HLB balance, compliance, and congruency with regulations and international food safety standards.

Key players: Eurofins Scientific, SGS, Intertek, Equinox Labs - Packaging and Branding: Protective packaging helps prevent oxidation, and branding helps to convey the specifications, application suitability, and compliance credentials.

Key players: Amcor, Mondi, Sealed Air Corporation, Berry Global - Cold Chain Logistics and Storage of food Emulsifiers-Storage, which is temperature-controlled, maintains the chemical integrity and eliminates degradation of functionality.

Key players: Kuehne + Nagel, DHL Supply Chain, Americold Logistics

Food Emulsifiers Markets Top 27 Companies

- Ingredion Incorporated: Offers clean-label emulsifiers that are vegetable-based, such as chickpea-based solutions, to facilitate sustainable formulations and the transformation in consumer preference towards healthy habits.

- Kerry Group Plc.: Offers sustainable emulsifiers such as acacia-based Puremul, which responds to the sustainability agenda and sustainable supply chain needs.

- Cargill Incorporated: Provides various systems of emulsifiers like PowerBake stabilizers, which help in the improvement of the functions of a bakery, as well as help to align the performance and consumer quality expectations.

Other Major Key Players

- E.I. du Pont Nemours and Company (U.S.)

- Archer Daniels Midland Company (U.S.)

- Dupont Nutrition and Biosciences

- Lace nor Emul

- RIKEN VITAMIN Co.

- Estelle Chemicals Pvt. Ltd.

- LECICO GmbH

- Palsgaard A/S

- Vantage Food

- Kemin Industries

- FSSAI

- ABITEC

- Foodchem International Corporation

- Tate & Lyle

- Lonza (Switzerland)

- The Lubrizol Corporation (U.S.)

- Stepan Company (U.S.)

- Solvay S.A. (Belgium)

- Akzonobel N.V. (The Netherlands)

- Koninklijke DSM N.V. (The Netherlands)

- Clariant (Switzerland)

- BASF SE (Germany)

- DowDuPont (U.S.)

- Evonic Industries AG (Germany)

Recent developments

- In February 2025, LBB Specialties (LBBS), a leader in specialty chemicals and ingredient distribution in North America, announced a new partnership with Kerry Group, a world-leading taste and nutrition partner for the food, beverage, and pharmaceutical markets with innovative, sustainable specialty ingredients for the Personal Care industry. This is especially for its new line of emollients, emulsifiers, and fermentation-derived actives specifically designed for skin care, personal care, and cosmetics.(Source:https://www.prnewswire.com)

- In March 2025, Antarctica Equipment, a leader in temperature-controlled food display solutions, in collaboration with Valmar has launched Valmix 20. It is an advanced emulsifier which is of high-quality texture, which is used for gelato, ice cream, sorbets, sauces, high viscosity preparations, and toppings. it also has superior stability, texture, and efficiency. (Source: https://nuffoodsspectrum.in)

Segments Covered in the Report

By Product

- Mono-, di-glycerides & Derivatives

- Lecithin

- Stearoyls Lactylates

- Sorbitan Esters

- Others

By Application

- Bakery & Confectionary

- Convenience Foods

- Meat Products

- Dairy Products

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content