What is the Baking Ingredients Market Size?

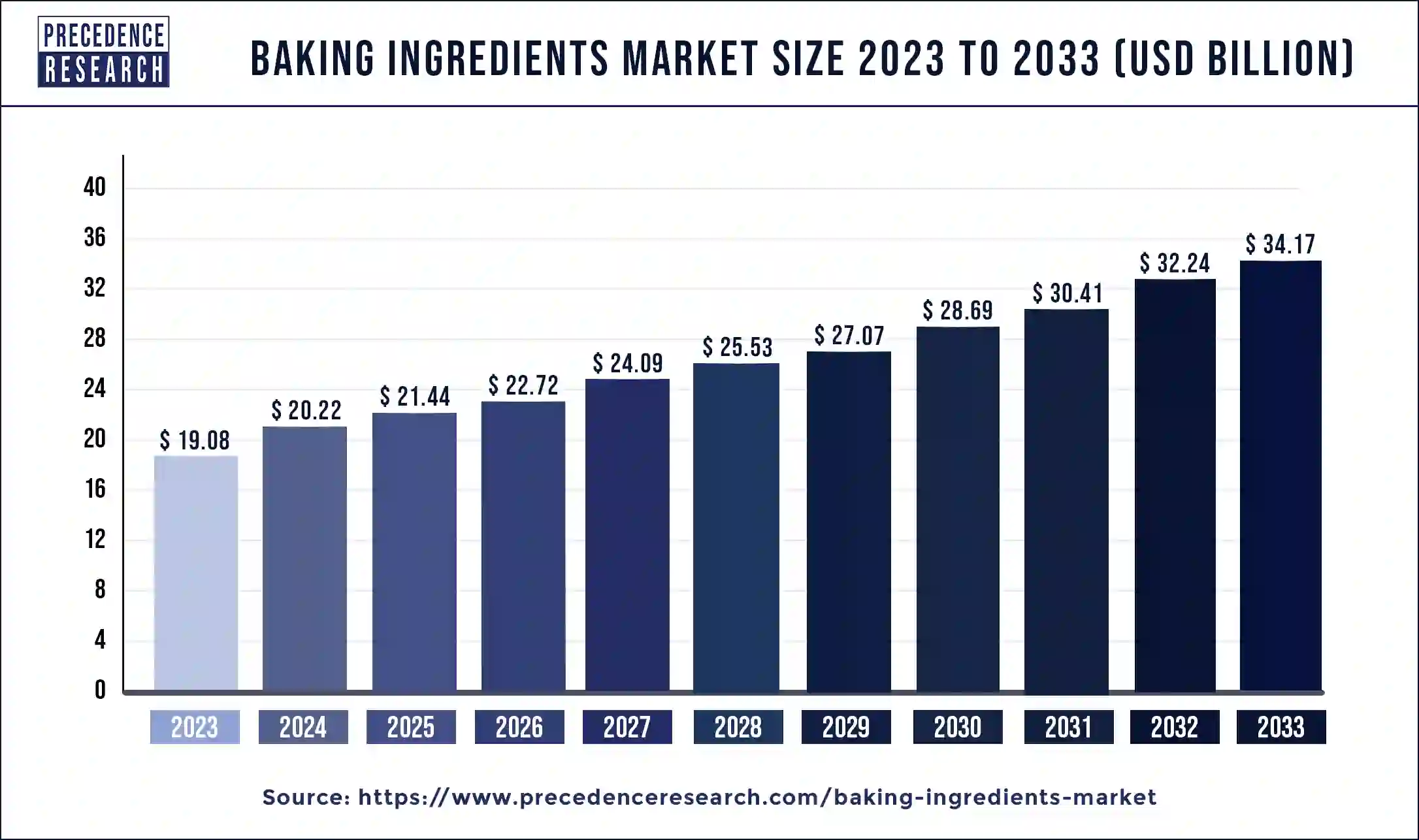

The global baking ingredients market size is USD 21.44 billion in 2025, accounted for USD 22.72 billion in 2026, and is expected to reach around USD 37.94 billion by 2035, expanding at a CAGR of 5.87% from 2026 to 2035.

Market Highlights

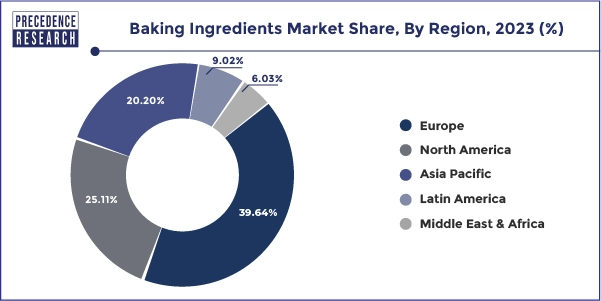

- Europe region accounted for the highest revenue share 39.64% in 2025.

- North America region accounted for 25.11% revenue share in 2025.

- By type, the dry baking mix segment generated a revenue share of around 18.5% in 2025.

- By application, the bread segment hit the highest revenue share of 70% in 2025.

- By type, the dry baking mix was valued at USD 2,491.6 million in 2025 at a CAGR of 5.8% over the forecast period.

- By application, the bread segment reached USD 8,956.7 million in 2025 and registered growth at a CAGR of 5.6% in the coming years.

Strategic Overview of the Global Baking Ingredients Industry

Baking ingredients are foods that help maintain freshness, sweetness and flavor; improved shelf life; and increased protein content in baked goods. These commodities are available in various grades in the market and are considered the major source of human nutrition in the world. Baking ingredients have been used since ancient times and are of prime importance today because nothing can be baked without them. The choice of ingredients and preparations determines the taste and texture of the cooked food product. Demand for products, such as bread and biscuits, is growing at a remarkable rate and is expected to provide lucrative growth opportunities for the growth of the global ingredients market in the coming years. In the mature baking ingredient markets in North America and Europe, the demand for ingredients that are healthy and contain little or no artificial ingredients is growing massively.

The novel coronavirus/COVID-19 pandemic has had a significant impact on the entire food and beverage industry, of which the baking industry is a part. This pandemic has resulted in production shutdowns and disruptions in supply chain also affecting the economy.

In early 2020, sales of disinfectants, paper goods, toilet paper, and hand sanitizers, were in high demand. Edible products, such as meat products, bread, and many other shops went bankrupt because of an insufficient supply of cakes and many bakeries closed due to lack of manpower. The disruption of the logistics facilities due to the lockdown created more problems in the market as consumers did not receive the quality products, which negatively affected the market. But in some regions the demand experienced spike. The Covid-19 lockdowns imposed in various countries led to a surge in demand for baking ingredients such as cocoa powder, baking soda, and other spices, as consumers stuck at home have actively switched to baking. Bakery raw material manufacturers and retailers such as Cargill (USA) and Kerry Group Plc (Ireland) report that sales of these products have increased significantly since the blockade compared to the same period last year. With the recent influx of international cafes and bakery chains, dining on the go is becoming more and more popular.

Another factor that also affects the market is the lack of availability of raw materials, so the production of products is not suitable. Manufacturers of baking ingredients also face similar problems, such as labor shortages, supply chain disruptions, and unavailability of raw materials. Due to these issues, small bakers in the unorganized segment are most affected. However, over time, the government began to allow shops to reopen. Demand for bakery products, especially bread and other products, has increased, as they are essential products, used in the daily diet, mainly for breakfast and evening snack. As a result, demand for bakery products increased from households. On the other hand, the catering sector faces a market decline for bakery products which are considered as one of the fastidious products of the catering sector.

Growth in the frozen bakery product market is also expected to boost consumption of baking ingredients during the forecast period. The increasing acceptance of frozen baked goods is due to factors such as convenience, speed of cooking, availability of products, and low cost. The growth of the bakery ingredient market is also supported by increasing demand from coffee shops and large and small grocery chains. Frozen bakery products are expected to have potential demand in emerging markets such as India and China due to rising disposable income and the increasing population purchasing power parity (PPP) of these countries.

Artificial Intelligence: The Next Growth Catalyst in Baking Ingredients

Artificial Intelligence is significantly transforming the baking ingredients industry by streamlining operations, fostering rapid innovation, and meeting complex consumer demands. It accelerates the development of healthier, plant-based, and gluten-free recipes by analyzing vast datasets on ingredient interactions and consumer preferences.

Through predictive analytics, AI optimizes supply chains, enabling precise demand forecasting and efficient inventory management that dramatically reduces food waste. Furthermore, AI-powered systems enhance quality control and food safety via automated, real-time monitoring of production lines.

Market Outlook

- Industry Growth Overview: The baking ingredients market is expected to experience rapid growth between 2025 and 2034, driven by shifting consumer preferences toward convenient bakery products, premium artisan offerings, and clean-label or functional ingredients that enhance taste, texture, and shelf-life. Growth is further supported by increasing urbanization in emerging regions, supply chain pressures that encourage innovation, and advances in ingredient technologies.

- Global Expansion: The market is expanding worldwide, driven by rising demand for artisanal and convenience baked goods, cross-border ingredient innovations, expanded distribution networks, and growing adoption of clean-label and functional formulations across emerging and mature markets. There is significant potential for market growth in emerging regions due to rapid urbanization, rising disposable incomes, expanding retail and foodservice sectors, and growing demand for convenient, affordable, and Western-style bakery products.

- Major investors: Major investors in the market include large ingredient and food-processing firms such as Associated British Foods plc, Cargill Incorporated, Kerry Group plc, and Tate & Lyle PLC. These firms are investing heavily in emulsifiers, enzymes, and clean-label solutions to drive growth in the bakery sector.

- Startup Ecosystem: The startup ecosystem in the market is thriving, with emerging companies exploring sustainability, clean-label and functional solutions, AI/IoT-driven production systems, and ingredient traceability innovations.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 21.44 Billion |

| Market Size in 2026 | USD 22.72 Billion |

| Market Size by 2035 | USD 37.94 Billion |

| Growth Rate from 2025 to 2035 | CAGR of 5.87% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, Application, and Form, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

Baking powder and mixes is the major segment in the baking ingredients industry. Baking powder is a mixture of carbonate and a weak acid. Bases and acids are prevented from prematurely reacting by including a buffer such as corn starch. Baking powder is mainly used to add volume as well as to lighten the texture of baked goods.

Baking mix is a complex, ready-to-use mixture of dry baking ingredients used to make breads, cakes, waffles, pizza dough, cookies and muffins. Baking mix ingredients can include flour, baking powder, bread flour, sugar, baking soda, and salt, depending on the type of food.

Preparation powder is a special dry matter treatment device that is a combination of carbonate or bicarbonate and a helpless caustic alkali. The base and caustic alkali prevent premature reaction by including pillow lava cornstarch. The prepared powder is used to expand the volume of the heated product and brighten the surface. The swelling of the damp compound drains the rise.

Application Insights

By application, bread has the largest share of baking ingredients. Bread is one of the oldest human staple foods. Breads and baked goods are widely consumed as part of the traditional diet and are an important source of food energy. Bread is also a good source of carbohydrates, protein and vitamins B and E, and is increasingly consumed around the world. However, this requirement applies to whole wheat products. The reason is that the population is sensitive to a healthy diet that minimizes income from carbohydrates, fats, and cholesterol in their meals and maximizes income from complex carbohydrates, fiber, and plant proteins. A 2010 European Commission study found the European bakery industry to be 32 million tones across 27 EU countries. There is more and more demand for breads than ever before with the development of whole wheat breads, of which oat and bran are increasingly popular in European countries. There is also a trend towards increased production of sliced and packaged bread in a number of countries in Europe, including Germany and France.

Bread and baking ingredients are usually consumed as part of a normal diet and are an important source of dietary energy. Bread is also a source of sugar, protein, vitamins B and E and is being consumed more and more around the world. Anyway, this interest is in the whole grain article. The explanation is that good nutritional awareness minimizes the content of carbohydrates, fats and cholesterol in the diet and increases complex levels of starch, dietary fiber and plant-based proteins.

Form Insights

Dry Ingredients hold the largest share of baking ingredients by form. Dry ingredients are not measured accurately due to the nature of many dry ingredients. To accurately measure dry ingredients, it is essential to use a set of measuring cups. The increase in the quality of supermarket and commercial bakery products along with a number of artisan bakeries in Asian countries has led to an increase in demand for wet and dry baking ingredients.

Regional Insights

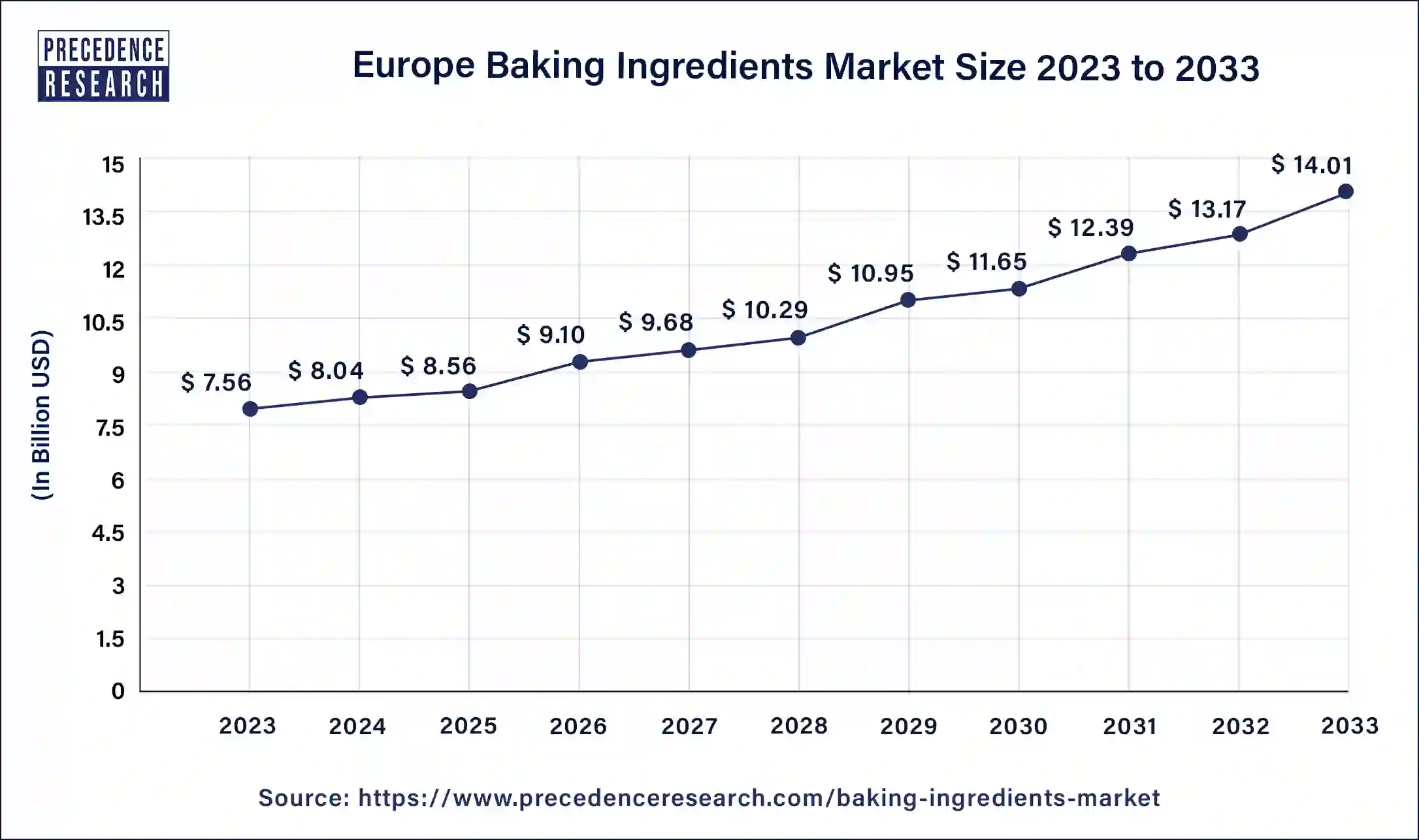

Europe Baking Ingredients Market Size and Growth 2026 to 2035

The Europe baking ingredients market size is estimated at USD 8.56 billion in 2025 and is predicted to be worth around USD 15.61 billion by 2035, at a CAGR of 6.19% from 2026 to 2035.

What Made Europe the Dominant Region in the Baking Ingredients Market?

Europe dominates the baking ingredients market with the largest share in 2024 due to its long-established bakery culture, high consumption of bread, pastries, and confectionery products, and strong presence of leading bakery manufacturers. The region has a well-developed food processing industry supported by advanced technologies and strict quality and safety regulations, which drive demand for high-quality and clean-label ingredients. Additionally, rising consumer interest in artisanal, organic, and functional bakery products further boosts market growth. Continuous innovation by ingredient suppliers and strong retail penetration also contribute to Europe's leadership in the global market.

Germany Baking Ingredients Market Analysis

Germany is a major contributor to the European market, supported by its strong bakery tradition and high per capita consumption of bread and baked goods. The country's advanced food processing industry and demand for premium, clean-label, and innovative baking ingredients further drive market growth. Additionally, the presence of leading bakery manufacturers and a well-established retail network reinforces Germany's dominant role in the region.

Why is North America Considered the Second-Largest Market?

North America is the second-largest market for baking ingredients, holding a significant share in 2024. This is mainly due to high consumer demand for convenience bakery products, snacks, and specialty baked goods. The region benefits from a well-developed food processing industry, strong retail and e-commerce channels, and growing interest in clean-label, functional, and artisanal ingredients. Additionally, innovation in baking technologies and changing consumer lifestyles continue to drive market growth across the U.S. and Canada.

North America's Top Notch Advancement's in the Baking Ingredients Sector.

North America's advancement in this sector measures the wavelength of the clean labels, a primary pitch to nutritional fortification, and the tech support. These innovations bifurcates the certain protein fusions into new launches to promote protein in this sector. The promotion of key nutrients for survival enhances the baking.

What Potentiates the Growth of the Latin American Baking Ingredients Market?

In Latin America, the growth of the baking ingredients market is driven by rising disposable incomes and urbanization, which lead consumers to choose premium and convenience bakery products. Additionally, the growing Western lifestyle and changing eating habits are supporting market growth. Brazil leads the market in the region, supported by widespread consumption of baked goods and a robust home-baking culture. The expansion of the retail and e-commerce networks is increasing the availability of premium, health-oriented, and convenience formulations.

How Big is the Opportunity for the Baking Ingredients Market in the Middle East and Africa?

The Middle East and Africa (MEA) offer immense opportunities for the market due to rising disposable incomes, expanding urban lifestyles, and increasing demand for convenience and premium baked goods. Growth in commercial bakeries and tourism is also opening up doors for market expansion. Improving retail infrastructure and investing in foodservice continue to unlock substantial opportunities across the region. The UAE leads the market due to its affluent, urbanized population, thriving café and artisanal bakery culture, robust e-commerce and modern retail networks, strong demand for health-focused, clean-label ingredients, and status as a regional hub for foodservice and luxury consumer goods.

Canada Baking Ingredients Market Trends

Canada's heart of the trend is its alternative flours, functional grains, and ancient & heirloom grains. The rising fitness enthusiasts and health-conscious consumers are the target population for the region to practice, follow, and promote the baking ingredients sector at one stroke with its land's richness. The apt platform for keeping up with the trend is to deliver unmatched flavors and nutritional benefits.

The wheat-free and gluten-free alternatives, such as teff, amaranth, quinoa, chia, and rice, are the real healthy essence for the global population. Natural sweeteners and trending rich flavors like matcha, mango, and pistachio are taking all the spotlight at the bakeries, and relevant shops providing the same.

Brazil Baking Ingredients Market Trends

Brazil's digestive-based consumable alternative is aligned best with the interest and demand for prebiotics and enzymes. The tropical fruits/paste, regional lavish flavors, and artisanal yeast are an honor of the region that redefines trends with more confidence than ever before. The coconut flakes and Guava paste, also known as goiabada in its regional language plays a major role in the intensified sweet products such as Bombocado and Bolo de Rolo.

The rich ingredients such as pistachio, acai, and cupuacu are used as a desired filling for pastries and are unified with the artisanal baked products. Apart from this, the ready-to-use mixture and frozen doughs are a quick preservation of the bakery ingredients' growth.

Africa Baking Ingredients Market Trends

Africa's trends are its valuable crops, securing healthy and nutritious baking, especially for pastries and tarts. The use of millet, cassava, and sorghum as an additive to wheat flour normalises the use of these rich indigenous grains in the regional baking ingredients sector.

The dry mixes for home bakers are turning out to be a personal joy or a business for many start-ups, either concentrating on the ingredients or the way of utilisation to bring new ideas to the taste buds.

Value Chain Analysis

- Raw Material Procurement

Raw materials such as flour, oils, emulsifiers, enzymes, sweeteners, preservatives, and dairy derivatives are obtained from agricultural producers and global suppliers through long-term contracts to ensure quality and a reliable supply.

Key Players: Cargill, Archer Daniels Midland (ADM), DuPont, Associated British Foods, Wilmar International. - Processing and Preservation

Raw materials go through processing, blending, enzymatic treatment, fermentation, and stabilization to produce baking ingredients with ideal texture, shelf-life, performance, and safety.

Key Players: Kerry Group, Tate & Lyle, DSM-Firmenich, Corbion, BASF, Ingredion. - Retail Sales and Marketing

Finished baking ingredients are distributed through B2B industrial supply, retail outlets, e-commerce platforms, and food-service channels using promotional campaigns, partnerships with bakeries, and customer-education programs.

Key Players: Walmart, Carrefour, Amazon, Metro AG, Tesco, Sysco, and US Foods. - Waste Management and Recycling

Manufacturing by-products, expired goods, and packaging waste are handled through recycling, composting organic scraps, circular packaging initiatives, and energy-efficient disposal programs.

Key Players: Veolia, SUEZ, Waste Management Inc., Clean Harbors, TerraCycle.

Top Companies in the Baking Ingredients Market & Their Offerings

- Kerry Group plc: Kerry provides taste & nutrition solutions geared toward bakery applications, including emulsifiers, dairy-based systems and flavour blends adapted for artisan and industrial bakers. Their focus also includes clean-label, health & wellness bakery formats, reflecting consumer trends toward “recognisable ingredients.”

- Archer Daniels Midland Company (ADM): ADM offers milled ingredients, sweeteners, baking mixes & bases, and fillings and icings for the food & beverage industry, making it a major supplier to bakery channels. Its broad global scale (many plants, global sourcing) gives it strong supply-chain presence in baking ingredients.

- Cargill, Incorporated: Cargill supplies key baking-industry raw materials such as cocoa, oils, sweeteners and soy-based ingredients, geared toward bakery and confectionery markets. The company emphasises sustainability and global reach, relevant in bakery-ingredients sourcing and manufacturing.

- Associated British Foods plc (AB Foods): AB Foods is active in the ingredients arena (emulsifiers, enzymes, sugar, baker's yeast) for bakery applications, via its ingredient divisions. Their integrated sugar, yeast and ingredient operations give them a vertical advantage in the baking-ingredients value chain.

- AAK AB: AAK specialises in specialty fats and blends, laminating fats, and shortenings tailored for bakery applications (margarines, flaked shortenings, hardstocks) and adds value via formulation expertise. Their “value-added solutions” span bakery, confectionery, dairy and foodservice which strengthens their baking-ingredients footprint.

- Corbion N.V.: Corbion focuses on functional enzyme blends, lactic-acid derivatives and emulsifiers designed for high-speed, automated bakery production systems. Their specialization positions them well in upgrade and automation-driven bakery ingredient trends (e.g., texture enhancement, shelf-life).

Other Major Key Players

- British Bakels

- IFF

- Dawn Food Products, Inc.

- Koninklijke DSM N.V.

Recent Developments

- In January 2025, GoodMills Innovation introduced GoWell Tasty Protein, a blend of fava beans, yellow peas, sunflower seeds, and wheat. These innovative solutions are designed to seamlessly add protein to bakery products without affecting flavor. (https://www.goodmillsinnovation.com)

- In June 2024, Fooditive Group introduced a new plant-derived sweetener called Keto-Fructose, sourced from apples and pears via fermentation. This launch closely resembles sugar's taste profile and is being evaluated for widespread use. (https://www.nutritionaloutlook.com)

Segments covered in the Report

By Type

- Emulsifiers

- Enzymes

- Starch

- Fiber

- Oils, fats, and shortenings

- Baking powder and mixes

- Preservatives

- Colors & flavors

- Leavening agents

- Others

By Application

- Bread

- Sweet Bakery

By Form

- Dry

- Liquid

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting