What is the Nutraceutical Ingredients Market Size?

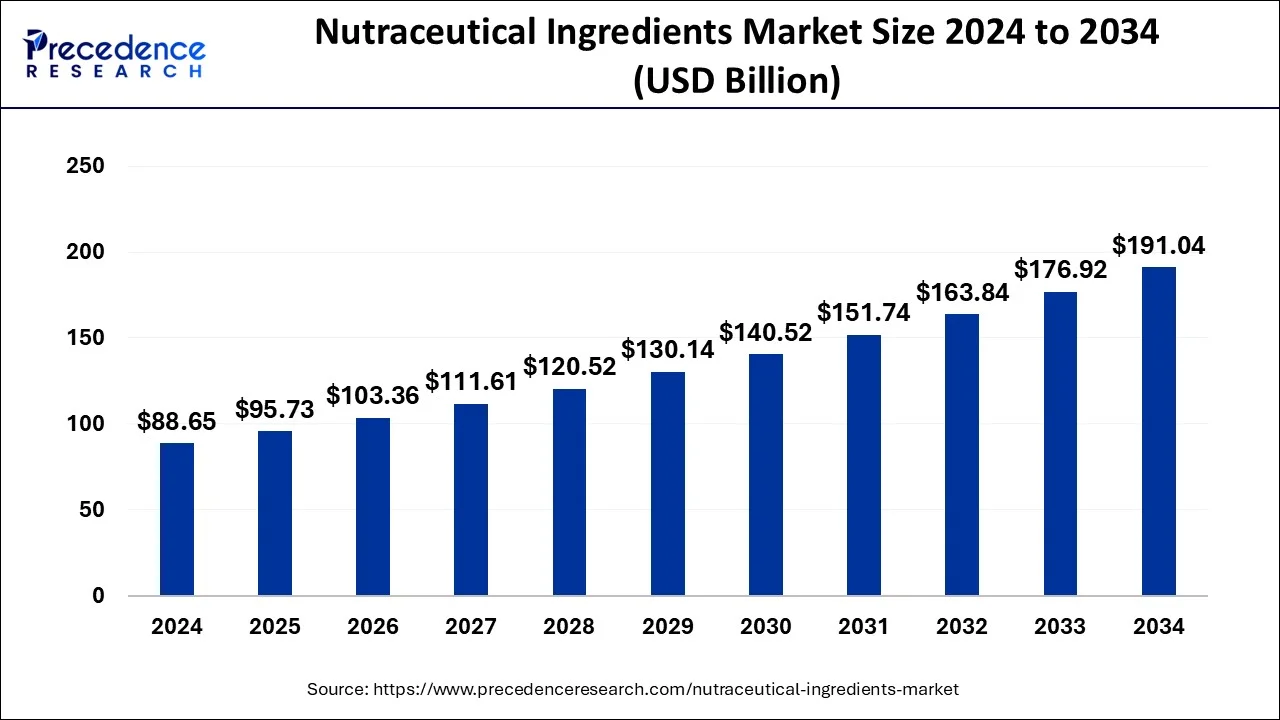

The global nutraceutical ingredients market size is accounted at USD 95.73 billion in 2025 and predicted to increase from USD 103.36 billion in 2026 to approximately USD 191.04 billion by 2034, expanding at a CAGR of 7.98% from 2025 to 2034.

Market Highlights

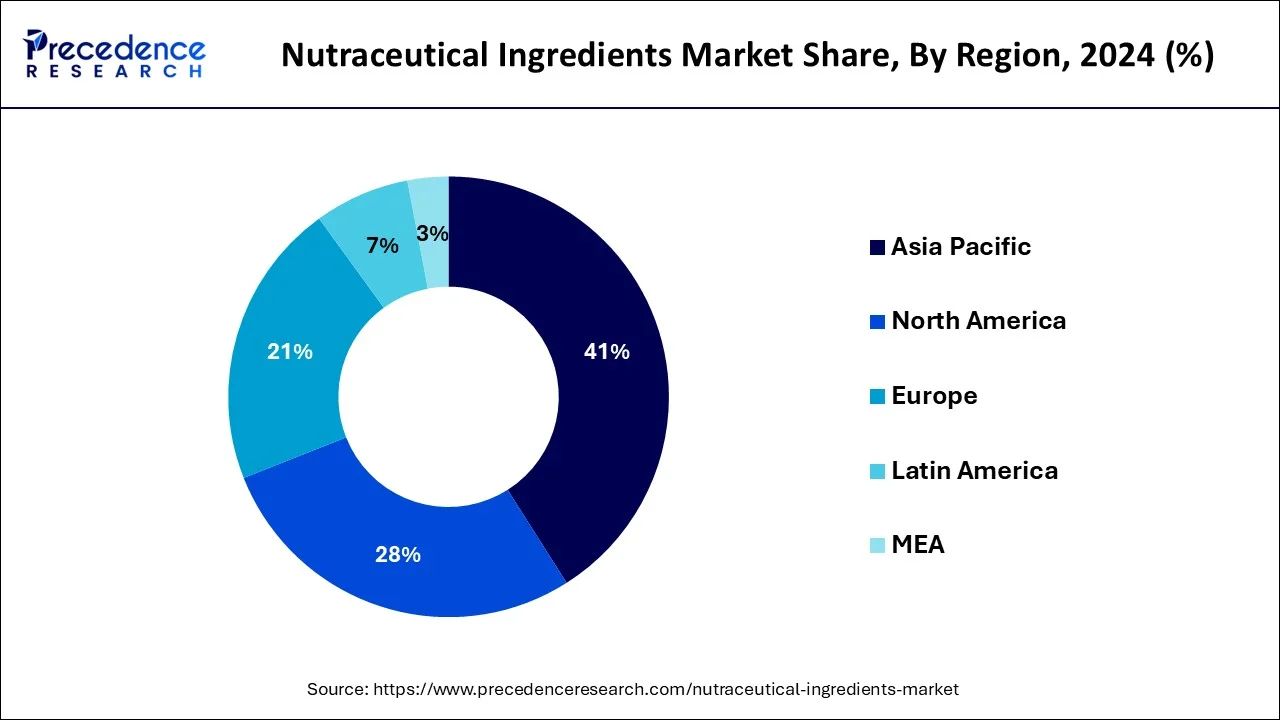

- By region, Asia Pacific dominated the nutraceutical ingredients market with share of 41% in 2024.

- By region, North America region is expected to grow rapidly in the nutraceutical ingredients market over the forecast period.

- By type, the proteins and amino acids segment dominated the market with the largest share in 2024.

- By type, the probiotics segment is expected to grow rapidly over the forecast period.

- By application, the food segment dominated the market accounting the largest share in 2024.

- By application, the dietary supplement segment is expected to grow rapidly over the forecast period.

- By form, the dry form segment dominated the market with the largest share in 2024.

Market Overview: Strategic Overview of the Global Nutraceutical Ingredients Industry

The rising demand for nutraceutical ingredients driven by the increased use of dietary supplements, functional foods and beverages, pharmaceuticals as well as in pet food is fuelling the growth of this market. Furthermore, the growing awareness about preventive healthcare, increased R&D for innovations in nutraceuticals, rising industrial collaborations and acquisition for large scale manufacturing with streamlined workflows along with the rising support from government bodies and regulatory agencies is expanding the market for the nutraceutical ingredients market.

Artificial Intelligence: The Next Growth Catalyst in Nutraceutical Ingredients

The integration of artificial intelligence AI in nutraceutical ingredients is driving the market growth by aiding in discovery of ingredients and product development processes. Furthermore, AI can help to create products tailored to specific individual needs, for achieving regulatory compliance, in maintaining quality control by streamlining daily operations and enhance sustainability of the nutraceutical ingredients.

Nutraceutical ingredients Market Growth Factors

- Demand for personalized nutrition.

- Rising awareness on benefits of nutraceuticals among consumers.

- Research and development by major market players for creating novel products.

- Growing applications of nutraceuticals in preventive healthcare and chronic disease management.

- Increased involvement of major pharmaceutical and nutraceutical industries.

- Rising disposable incomes.

Market Outlook:

- Market Growth Overview: The nutraceutical ingredients market is expected to grow significantly between 2025 and 2034, driven by rising health consciousness, the rise in chronic diseases, technological advancement, and growing demand for natural plant-based products.

- Sustainability Trends: Sustainability trends involve clean label and transparency, a shift to plant-based and bio-based ingredients, and eco-friendly manufacturing and the circular economy.

- Major Investors: Major investors in the market include The Vanguard Group, Breakthrough Energy Ventures, B Capital Group, Fireside Ventures, and Ajinomoto Co.

- Startup Economy: The startup economy is focused on sustainable and ethical sourcing, plant-based alternative proteins, and biotechnology and fermentation.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 95.73 Billion |

| Market Size in 2026 | USD 103.36 Billion |

| Market Size by 2034 | USD 191.04 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.98% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Health Benefits, Form, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Nutraceutical components, frequently obtained from food sources, offer health advantages that surpass essential nutrition. These components are utilized in functional foods, dietary supplements, drinks, and cosmetics to boost overall health, avoid illnesses, and promote well-being. The growing appetite for natural, organic, and plant-based products is a major factor fueling the swift growth of this market. Advancements in technology, especially in ingredient sourcing and processing, are also propelling the nutraceutical ingredients market. The advancement of new extraction methods, like supercritical fluid extraction and enzymatic processing, enables companies to acquire high-quality, bioactive compounds from natural sources more effectively and at reduced costs. The initiatives taken by governments globally to encourage its utilization are a crucial element propelling the expansion of the worldwide market for nutraceutical components. This has helped to increase awareness and enhance their accessibility. This has also driven the expansion of the worldwide nutraceutical ingredients market. Moreover, the worldwide market is being driven by the growing advancements in the healthcare sector.

Restraint

Availability of Counterfeit and Adulterated Ingredients

With the increased use of nutraceutical ingredients in manufacturing industries for developing nutraceuticals the concern regarding product quality and safety hampers the market growth. The supply of adulterated and counterfeit raw materials for nutraceutical manufacturing can potentially harm the consumer's health thereby creating the demand for effective methods for quality control and production of these nutraceutical ingredients adhering to strict regulations.

Opportunity

Demand for Personalized Nutrition Formulations

The demand for personalized nutraceuticals tailored to the specific needs of the individual is expected to drive the market growth in future. Furthermore, the development of advanced digital platforms providing personalized ideas for customers in developing novel products and the rising investments of nutraceutical supplements developing industries is driving the market.

Segment Insights

TypeInsights

Based on type, the proteins and amino acids segment dominated the market with the largest share in 2024. The market growth of this segment can be attributed various applications associated with use of proteins and amino acids such as for supporting immune function, in promoting muscle growth and recovery, enhancing gut health, maintaining blood sugar and for providing necessary nutrients for overall health of the consumers.

The probiotics segment is expected to grow rapidly over the forecast period. Probiotics are widely used by consumers for preventing food sensitivities, lactose intolerance, promoting gut health and also in food packaging materials for controlling growth of pathogens. The advancements in research tools for identifying potential probiotic strains, use of nucleotide sequencing technology for identifying previously unknown microbes, gene editing technologies, microencapsulation of probiotic bacteria for enhancing viability and developing sophisticated formulations with target selectivity of probiotics using nanotechnology are the factors expected to promote market growth of this segment over the forecast period.

Application Insights

The food segment dominated the market accounting the largest share in 2024. The increased use of nutraceutical ingredients for functional foods proving numerous health benefits are driving the market. The various applications of nutraceutical ingredients in functional foods such as prebiotics and probiotics, carotenoids, encapsulation systems and designer foods are promoting the market dominance of this segment.

The dietary supplement segment is predicted to grow rapidly during the forecast period. The increased focus on personalized nutrition, ongoing research for managing and treating chronic diseases, utilization of advanced computing and data analysis tools for understanding dietary needs and rising consumer interest in consumption of dietary supplements for improving health are the factors expected to drive the market growth of this segment over the forecast period.

Form Insights

The dry form segment dominated the market with the largest share in 2024. The preference and extensive use of dry form nutraceuticals available in the form of powders, tablets and capsules among consumers due to their convenience, stability and ability to precisely blend in various formulations is boosting the market for this segment. Additionally, the recent advancements such as enzyme-assisted extraction for effective bioactive compound isolation, targeted delivery through nanofabricated delivery systems, improved encapsulation techniques for protecting sensitive ingredients and spray drying for developing high stability fine powders aiming to enhance the efficacy and bioavailability of dry form nutraceutical ingredients is expected to fuel the market growth of this segment.

Health Benefits Insights

Nutrition segment dominated the market with the largest share. Consumers are becoming more conscious of the connection between nutrition and health, prompting them to look for foods and supplements that offer additional health benefits. There is an increasing focus on preventive healthcare, as consumers seek nutraceutical components to sustain ideal health and possibly lower the risk of illness. This growth path is propelled by the escalating consumer desire for health-boosting and functional food items, spurred by the growing prevalence of chronic illnesses like obesity, diabetes, and heart conditions.

Weight management segment is observed to grow at the fastest rate during the forecast period. The growing worldwide obesity rates have led to a notable rise in the demand for weight loss supplement components. With the rising awareness of the health dangers linked to obesity, more people are driven to tackle their weight concerns to enhance their overall health and lower the chances of obesity-related illnesses like heart disease, diabetes, and hypertension. These supplements appeal to health-conscious individuals looking for holistic wellness solutions by including botanical extracts, vitamins, and minerals derived from natural sources.

Regional Analysis

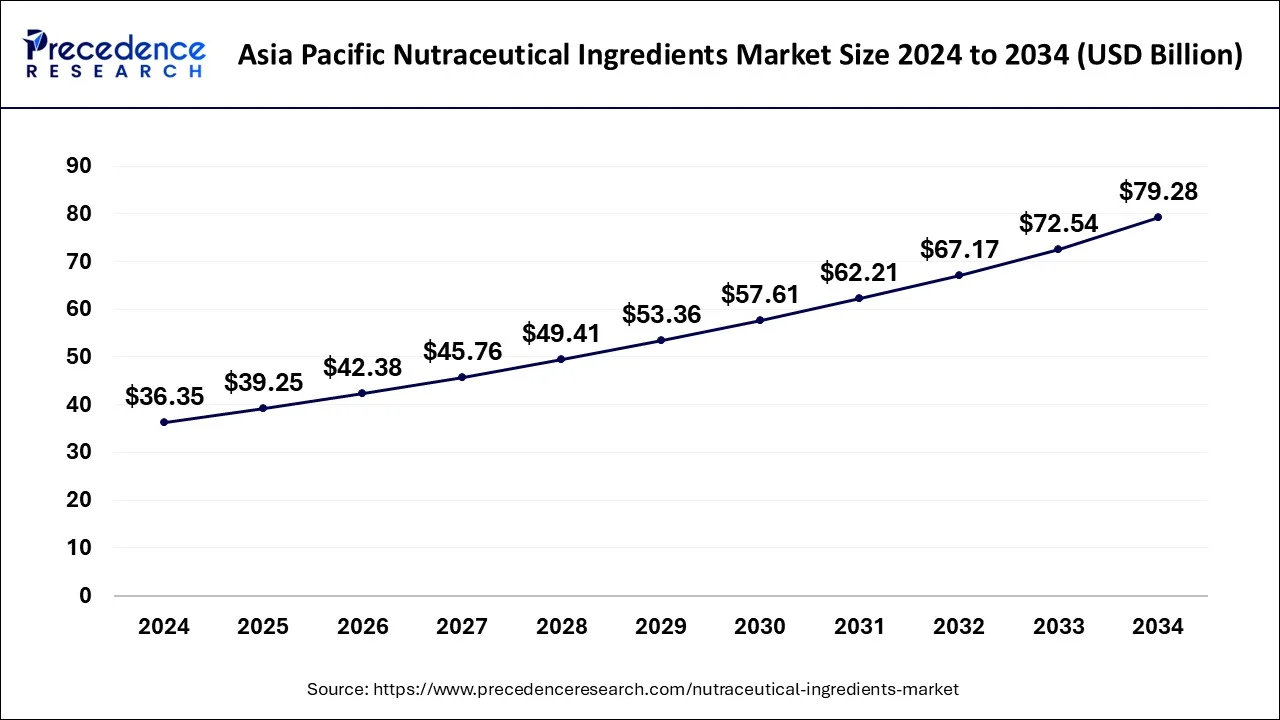

Asia Pacific Nutraceutical Ingredients Market Size and Growth 2025 to 2034

The Asia Pacific nutraceutical ingredients market size is evaluated at USD 39.25 billion in 2025 and is predicted to be worth around USD 79.28 billion by 2034, rising at a CAGR of 8.11% from 2025 to 2034.

How is Asia-Pacific leading the Nutraceutical Ingredients Market?

The nutraceutical ingredients market is primarily dominated by the Asia-Pacific region, thanks to the increasing number of consumers, better health awareness, and the shift towards preventive healthcare. The region's emphasis on functional foods and traditional herbal-based ingredients, especially in the case of the developing economies, is the major factor behind the strong market growth. The great adoption of modern wellness trends, digital retail, and personalized nutrition is among the factors that continue to keep the region strong across several consumer segments.

Owing to rise in anti-aging properties, the rising demand for nutraceutical products has led Asia Pacific to become a prominent region in the industry.Due to the involvement of major pharmaceuticals and food & beverage producers, the North America has seen substantial growth in the past few years. Growing consumer spending on health and wellness goods is likely to be a key factor driving the growth of industry in economies such as the Middle East & Africa and Asia Pacific due to changing lifestyles and increasing disposable income.

The high mortality rates, along with growing consumer awareness of health-focused products and the increase in chronic illnesses, are boosting the market share of nutraceuticals in the Asia Pacific. Heart diseases, diabetes, and cancer rank as leading causes of death that boost the intake of nutraceuticals in the Asia Pacific region. Different government programs and non-profit groups are conducting awareness campaigns regarding the significance of a nutritious diet to combat illnesses. These organizations are expected to boost the growth of the nutraceuticals market in the Asia Pacific during the forecast period.

An essential factor for market expansion is the increasing health consciousness among Indian consumers, especially after the pandemic, resulting in a more preventive attitude toward well-being instead of waiting for treatment. The swift urbanization in India and the shift towards sedentary living accelerate market expansion, leading to nutritional disparities. This has greatly increased the need for supplements and functional foods, particularly among younger urban groups such as millennials and Gen Z.

At the same time, there is a marked consumer inclination towards natural, plant-based, and Ayurveda-influenced nutraceuticals, driven by worries about the side effects of synthetic drugs and a preference for clean-label offerings. The North American area possesses the capability to utilize nutraceutical components and is anticipated to have a significant influence in the worldwide market. This is due to the rise of chronic illnesses caused by a busy lifestyle and greater consumer awareness regarding the health advantages of nutraceutical components. Consumers in the United States are mindful of calorie intake, resulting in the popularity of low-calorie and low-fat foods in both the US and Canada. Moreover, as consumers recognize the health advantages of prebiotics and their importance in weight control, the need for nutraceutical-derived products rises. North America exhibits the greatest prevalence of obesity, thereby increasing the demand for nutraceutical components.

Sales of nutraceutical ingredients in the United States are expected to rise at a CAGR of 7.2%, fueled by a growing consumer emphasis on preventive health and individualized nutrition. The trend of plant-based and organic nutraceuticals is driving market expansion. Key companies such as Cargill, ADM, and DuPont are consistently broadening their offerings to align with the changing needs for health and wellness items. The increasing trend of clean-label products and sports nutrition, especially protein supplements, are important factors influencing the market. Digital grocery and e-commerce platforms are broadening availability of nutraceuticals, enhancing market reach.

UK Nutraceutical Ingredients Market Trends

The industries in the UK are focusing on the development of new nutraceuticals, which increases the demand for nutraceutical ingredients. This, in turn, results in new collaborations where advanced technologies are being used to enhance the production as well as the quality of the nutraceuticals.

Germany Nutraceutical Ingredients Market Trends

The growing awareness about health in Germany is increasing the use of nutraceuticals. Furthermore, for the development of personalized nutrition solutions, the use of nutraceutical ingredients is rising.

China Nutraceutical Ingredients Market Trends

The active government behind China's nutraceutical ingredients market, the nation's legacy of traditional herbal medicine, and the health-conscious society are the three main factors that together make the country a strategic market for nutraceuticals. China's urbanization and the rise of functional foods are the two main trends driving the market. The surging demand, coupled with the production of local ingredients and advancements in technologies, made China a significant player both as a major consumer of and supplier to the global nutraceutical industry.

How is North America performing in the Nutraceutical Ingredients Market?

North America is still hailed as the leading market due to its high health consciousness and an already established supplement sector. Consumers prefer natural, clean-label, and organic ingredients, which in turn stimulates the demand for functional and fortified foods. The presence of highly developed manufacturing facilities, continuous innovation, and increased focus on preventive wellness propel the market growth further, particularly in the U.S. and Canada.

United States Nutraceutical Ingredients Market Analysis

The United States is still the largest and most powerful market for nutraceutical ingredients, where wellness and preventive health are the main themes. The increasing interest in personalized nutrition, functional beverages, and clean-label ingredients drives the growth of the industry. The strong R&D activity and the consumer focus on healthy aging and immune support still continue to determine the product innovation and demand patterns.

What are the driving factors of the Nutraceutical Ingredients Market in Europe?

The European nutraceutical market rides high on innovation, scientific research, and consumer trust in quality assured products. The market's demand for vegan, plant-based, and specialty diet-friendly ingredients goes hand in hand with the region's sustainability focus. Moreover, the aging population, especially in Western European countries, continues to be a major driver of the demand for health-promoting and functional ingredients that comply with the strict safety regulations.

Key Companies & Market Share Insights

The global Nutraceutical Ingredients market seeks intense competition among the market players owing to rapid changing consumer preference. Further, the industry participants are prominently adopting growth strategies that include partnership, collaboration, merger & acquisition, and many others to maintain their competitive edge in the global market. Apart from this, they invest prominently in the R&D activity for new product development & advancements. India, which accounted for almost 31.5 percent of the market share in 2019, totally drives the Asia Pacific market for nutraceutical ingredients. Due to evolving lifestyles and dietary habits and rising knowledge of nutritious ingredients, the country is also projected to be the fastest-growing country in the region.

Value Chain Analysis

- Raw Material Procurement (Farms, Fisheries, etc.): The process of selecting the best quality botanical, marine, or agricultural raw materials, which are the basis for nutraceutical formulations.

Key Players: Cargill, Archer Daniels Midland (ADM), Associated British Foods plc - Processing and Preservation: Changing the natural ingredients into stable, bioavailable forms by using extraction, encapsulation, and preservation techniques to keep their efficacy.

Key Players: Cargill, ADM, BASF, DSM-Firmenich - Quality Testing and Certification: A series of strict laboratory tests is done along with obtaining certifications to make sure of purity, strength, and following the global safety standards.

Key Players: Eurofins, Intertek, SGS, and ITC Labs - Packaging and Branding: Creating durable, informative, and eco-friendly packaging that preserves product quality and, at the same time, helps brand recognition.

Key players: Amcor PLC, Berry Global Inc., WestRock Company - Cold Chain Logistics and Storage: Safe transportation and storage with controlled temperature are provided to avoid the degradation of ingredients and to keep them stable during the shelf life.

Key players: DHL Supply Chain and CEVA Logistics - Waste Management and Recycling: The company adopts eco-friendly measures to cut down on waste and encourages recycling throughout the production and packaging processes.

Key Players: Waste Management Inc., Eco Recycling Ltd

Top Companies in the Nutraceutical Ingredients Market & Their Offerings:

- Kraft Heinz Company: Kraft Heinz is primarily an end-user that incorporates or reformulates its packaged food products with health-promoting components to align with global nutrition targets and consumer health trends.

- GlaxoSmithKline (GSK): While primarily a pharmaceutical and vaccine company, GSK historically contributed through its former consumer healthcare nutrition products like Horlicks and Boost before divesting them to Unilever.

- Amway: Amway is a major participant through its globally recognized Nutrilite brand, which offers a wide range of vitamins, dietary supplements, and herbal remedies.

- Abbott: Abbott is a significant player in the adult and pediatric nutrition segments, using nutraceutical ingredients in its market-leading brands such as Ensure, Glucerna, and PediaSure.

- Kellogg's: Kellogg's is primarily an end-user of nutraceutical ingredients, incorporating fibers, proteins, and micronutrients into its functional foods like cereals and snack bars to appeal to health-conscious consumers.

- Danone: Danone contributes significantly through its specialized nutrition portfolio, including Early Life Nutrition brands (Aptamil, Nutrilon) and Medical Nutrition products via its Nutricia division.

- Cargill Inc.: Cargill is a major supplier of bulk nutraceutical ingredients to the food, beverage, and dietary supplement industries.

- Nestlé: Nestlé participates through its Health Science business and nutrition portfolio, which focuses on science-based consumer care and medical nutrition products (e.g., Boost, Vital Proteins).

- Archer Daniels Midland (ADM): ADM is a key supplier in the nutraceutical ingredients market, excelling in the provision of plant-based proteins, fibers, and specialty ingredients derived from agricultural processing.

- DSM: DSM-Firmenich is a global science-based company operating in health, nutrition, and materials businesses, providing a wide range of essential vitamins, nutrients, and other health-enhancing ingredients to the market.

- BASF: As a leading chemical company, BASF is a major producer and supplier of a broad portfolio of high-quality ingredients for the human and animal nutrition markets.

- PepsiCo: PepsiCo is an end-user in the market, incorporating nutraceutical ingredients into its product lines to offer healthier options and functional beverages to consumers.

- General Mills: General Mills, a major food manufacturer, incorporates nutraceutical ingredients into its various consumer food products, particularly cereals and yogurts, to enhance nutritional value. The company acts as an end-user, utilizing ingredients like fiber, probiotics, and whole grains to meet consumer demand for functional foods.

- Aker BioMarine: Aker BioMarine is a specialized supplier of krill-based ingredients, specifically Omega-3 fatty acids (EPA and DHA) for the nutraceutical and aquaculture industries. They contribute to the market by providing a sustainable and highly bioavailable source of healthy fats.

- Procter & Gamble (P&G): P&G is involved in the health and wellness sector through brands that may incorporate some nutraceutical components in products like Vicks or Metamucil.

- Johnson & Johnson: J&J's primary contribution is in the pharmaceutical and medical device sectors, and its involvement in the pure nutraceutical ingredients market is minimal compared to the other listed companies.

Market Breakthroughs in Nutraceutical Ingredients Market

- In May 2025, 31 new Stock Keeping Units (SKUs) in the Business-to-Consumer (B2C) nutraceuticals pace were launched by Mangalam Global Enterprise Limited (MGEL), which is a part of the Mangalam Group, which is well known for its niche agri-products entity. The presence of this company in the wellness and health sector will be solidified with this expansion. The deficiencies in the modern lifestyle and diet can be overcome with the diverse range of nutritional supplements and cold-pressed oils, which are provided to the users with nutrients. (Source: https://www.business-standard.com)

- In May 2025, StemPets™ was launched and announced by the Stemtech Corporation, which is the global leader in Human stem cell nutrition science and nutraceutical innovation. This product was launched for pets. This revolutionary new supplement will be available for orders from June 2025 in the U.S., whereas it will be launched soon in Mexico. (Source: https://www.pharmiweb.com)

Latest Announcements by Industry Leaders

- In December 2024, two awards were presented to Nutralab Canada Corp at the 2024 Global Corporate Excellence Awards by Business World Magazine in recognition of company's almost 30-year dedication for innovation, quality and excellence in the nutraceutical sector. Dr. Peter Ou, CEO and Chief Scientific Officer of Nutralab Canada Corp said, “Nutralab's journey is built on a commitment to integrity, innovation, and quality. These awards reflect the dedication of our entire team and reinforce our mission to deliver industry-leading solutions that improve public health.”

- In December 2024, MaxScientific Inc., a global leader in the field of aging and longevity intervention decalred the launch of Revigorator G5, a next-generation nutraceutical integrating NAD+, senolytics and autophagy activators. Brandon West, Senior Product Manager at MaxScientific said, “By partnering with leading research institutions around the globe and investing in basic and translational research, we have successfully developed a groundbreaking nutraceutical that targets multiple aging mechanisms at the cellular level. By combining the most advanced aging intervention technologies available, Revigorator G5 delivers the most comprehensive approach for longevity optimization and cellular rejuvenation.”

Recent Developments

- In December 2024, Metabolic Maintenance, a leader in high-quality, physician-formulated nutritional supplements announced the launch of its latest nootropic supplement MetaMIND which is a nutraceutical particularly designed for supporting attention and learning, working memory and for boosting mental performance. The supplement is available in capsule and gummy forms.

- In December 2024, IMCD China, a global leading distribution partner and formulator of speciality chemicals and ingredients declared the signing of an agreement for acquiring the business of the food and nutraceutical ingredient distributor, Daoqin Biological Technology which will the strengthen IMCD's presence on China's life science market. The deal is expected to close in Q2 2025.

Segments Covered in the Report

By Type

- Probiotic

- Proteins and amino acids

- Phytochemical & plant extracts

- Fibers & specialty carbohydrates

- Omega 3 fatty acids

- Vitamins

- Prebiotic

- Carotenoids

- Minerals

- Others

By Application

- Food

- Beverages

- Personal care

- Animal nutrition

- Dietary supplements

By Health Benefits

- Cognitive health

- Gut health

- Heart health

- Bone health

- Immunity

- Nutrition

- Weigh management

- Others

By Form

- Dry

- liquid

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content